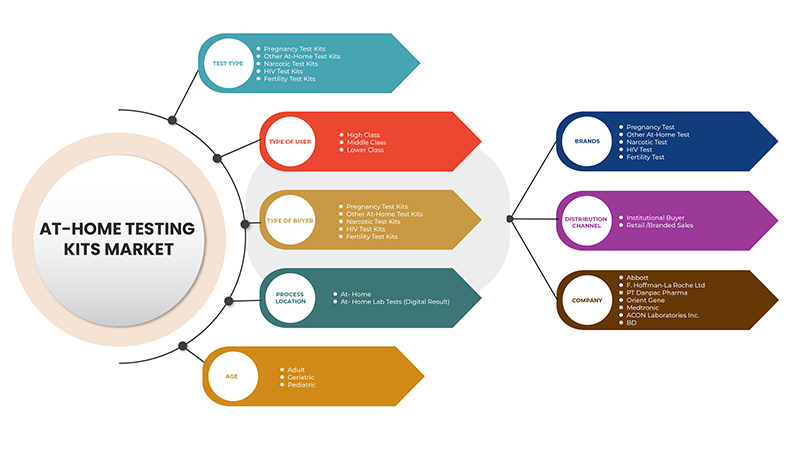

Indonesia At-home Testing Kits Market, By Test Type (Pregnancy Test Kits, Other At-Home Test Kits, Narcotic Test Kits, HIV Test Kits & Fertility Test Kits), Type of User (High Class, Middle Class & Lower Class), Type of Buyer (Pregnancy Test Kits, Other At-Home Test Kits, Narcotic Test Kits, HIV Test Kits & Fertility Test Kits), Process Location (At-Home & At-Home Lab Tests (Digital Results), Age (Adult, Geriatric & Pediatric), Brands (Pregnancy Test, Other At-Home Test, Narcotic Test, HIV Test, and Fertility Test), Distribution Channel (Institutional Buyer & Retail/Branded Sales) Industry Trends and Forecast to 2029.

Indonesia Market Analysis and Insights

At-home testing kits mean testing instruments that help a person perform tests at home and give them rapid results in a minute. It also includes health monitoring equipment to continuously check and control the health of diabetic patients. At-home tests are very convenient to perform with comfort at home and are available at a very affordable rate.

Self-tests are usually the advanced versions of rapid, point-of-care test kits that were originally designed for healthcare professionals and can be performed by the common person. Their processes, packaging, and instructions have been simplified to guide the person through the steps of taking a test. Various at-home test kits are available including HIV tests, pregnancy tests, diabetes, ovulation test, and infectious diseases such as malaria, COVID-19, and others. For performing these rapid at-home tests, blood, urine, and oral fluid can be taken as a sample

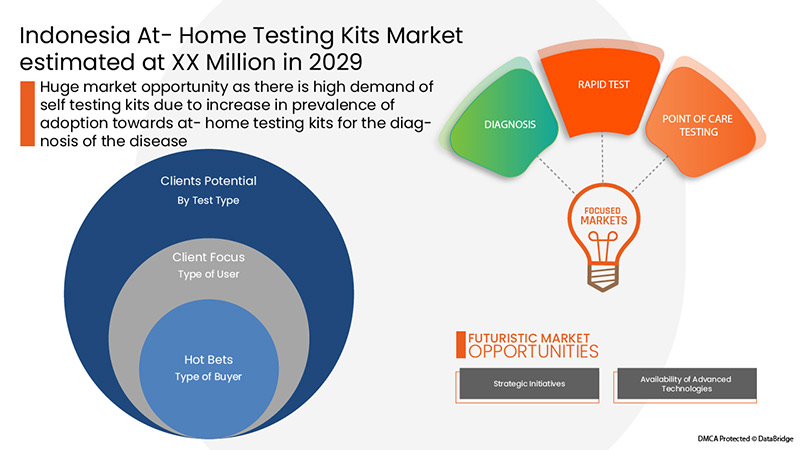

Indonesia at-home testing kits market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 4.6% in the forecast period of 2022 to 2029 and is expected to reach IDR 16, 81,367.36 million by 2029 from IDR 10, 13,289.31 million in 2021.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 |

|

Quantitative Units |

Revenue in IDR Million |

|

Segments Covered |

By Test Type (Pregnancy Test Kits, Other At-Home Test Kits, Narcotic Test Kits, HIV Test Kits & Fertility Test Kits), Type of User (High Class, Middle Class & Lower Class ), Type of Buyer (Pregnancy Test Kits, Other At-Home Test Kits, Narcotic Test Kits, HIV Test Kits & Fertility Test Kits), Process Location (At-Home & At-Home Lab Tests (Digital Results), Age (Adult, Geriatric & Pediatric), Brands (Pregnancy Test, Other At-Home Test, Narcotic Test, HIV Test & Fertility Test), Distribution Channel (Institutional Buyer & Retail/Branded Sales) |

|

Countries Covered |

Indonesia |

|

Market Players Covered |

Las principales empresas que operan en el mercado son Abbott, PT. Danpac Pharma, Orient Gene, Siemens Healthcare GmbH, Medtronic, BD, B. Braun Melsungen AG, Quidel Corporation, NIPRO, F. Hoffmann-La Roche Ltd., bioMérieux SA, EGENS GROUP, DKT INTERNATIONAL, Clearblue (una filial de SPD Swiss Precision Diagnostics GmbH) y ACON Laboratories, Inc., entre otras. |

Dinámica del mercado de los kits de prueba para el hogar

Conductores

- Creciente adopción de kits de autodiagnóstico

A medida que ha aumentado la conciencia sobre varios productos, este comportamiento ha cambiado y se ha convertido en una tendencia. Hoy en día, las personas prefieren hacerse las pruebas básicas con kits de prueba en casa antes de visitar a un médico. Esto se ha vuelto aún más prominente debido a esta pandemia, ya que las personas están adoptando más kits de prueba de autoayuda debido a varias restricciones vigentes. Ha resultado ser una bendición disfrazada tanto para los hospitales como para los pacientes, ya que los hospitales ya están sobrecargados y pueden concentrarse completamente en los pacientes con COVID-19, y los pacientes pueden ahorrar grandes costos de visitas al médico y honorarios de medicamentos. Se ha vuelto extremadamente conveniente para los consumidores, ya que pueden conocer los resultados de sus pruebas rápidamente con solo un toque de su mano.

- Fácil disponibilidad de kits de autodiagnóstico en farmacias

Los kits de autodiagnóstico o para realizar en casa están fácilmente disponibles en las farmacias y se ha vuelto extremadamente fácil adquirirlos. Varias empresas médicas se están aventurando en este espacio, ya que fabrican rápidamente kits de autodiagnóstico. Esta amplia disponibilidad también se puede atribuir a las empresas médicas emergentes de las farmacias en línea, que hacen que la disponibilidad sea más fácil con solo hacer clic en un botón. Además, estos kits de autodiagnóstico están disponibles sin receta médica.

- Aumento de la prevalencia de enfermedades crónicas

La prevalencia de las enfermedades crónicas está aumentando rápidamente en todo el mundo. Según el Sistema de Registro de Muestras de Indonesia, las diez enfermedades más comunes detectadas en Indonesia en 2014 fueron los accidentes cerebrovasculares (21,1%), las enfermedades cardíacas (12,9%), la diabetes mellitus (6,7%), la tuberculosis (5,7%), las complicaciones de la hipertensión arterial (5,3%), las enfermedades pulmonares crónicas (4,9%), las enfermedades hepáticas (2,7%), los accidentes de tráfico (2,6%), la neumonía (2,1%) y la combinación de diarrea y gastroenteritis debido a infecciones (1,9%). Por lo tanto, la alta prevalencia de enfermedades crónicas será un factor importante para el mercado de los kits de prueba para el hogar, ya que pueden proporcionar un mejor seguimiento y diagnóstico de las enfermedades.

Oportunidades

- Advenimiento de tecnologías avanzadas

Los expertos en tecnología trabajan continuamente para mejorar los kits de pruebas rápidas para brindar resultados precisos y confiables a las personas que no son profesionales de la salud y pueden comprender los resultados de forma independiente.

Por lo tanto, las tecnologías avanzadas como la inteligencia artificial están creando oportunidades lucrativas para la industria de la salud, las empresas están incorporando tecnologías avanzadas en los kits de prueba para el hogar para hacerlos más confiables y dignos de confianza para impulsar el mercado.

Además, las iniciativas estratégicas adoptadas por los actores clave del mercado proporcionarán integridad estructural y oportunidades futuras para el mercado de kits de prueba en el hogar en el período de pronóstico de 2022 a 2029.

Restricciones/Desafíos

Sin embargo, la inexactitud de los resultados de los kits de autodiagnóstico impedirá el ritmo de crecimiento del mercado de kits de prueba para el hogar. Además, las normas y regulaciones estrictas desafiarán aún más el mercado en el período de pronóstico mencionado anteriormente.

Este informe de mercado de kits de prueba para el hogar proporciona detalles de nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de kits de prueba para el hogar, comuníquese con Data Bridge Market Research para obtener un informe de analista, nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Impacto posterior al COVID-19 en el mercado de kits de prueba para el hogar

El COVID-19 ha afectado positivamente al mercado. Los confinamientos y el aislamiento durante las pandemias complican el manejo de la enfermedad y la adherencia a la medicación. Por ello, el uso de kits de autodiagnóstico en los hogares aumentó ampliamente en la población del país. La gente utilizó a gran escala los kits de autodiagnóstico durante la pandemia en general para el diagnóstico de enfermedades y la fácil disponibilidad de dichos kits de prueba impulsó el mercado de manera positiva.

Desarrollo reciente

- En noviembre de 2020, Quidel Corporation desarrolló una prueba de diagnóstico rápido para la detección de COVID-19 y recibió la Autorización de Uso de Emergencia (EUA) de la FDA para el lanzamiento y comercialización de su Sofia 2 SARS Antigen FIA, una prueba rápida de diagnóstico en el punto de atención para COVID-19. Se utilizará para la pandemia en curso y esto ayudará a la empresa a aumentar sus ventas e ingresos.

Alcance del mercado de kits de prueba para el hogar en Indonesia

El mercado de kits de prueba para el hogar de Indonesia está segmentado por tipo de prueba, tipo de usuario, tipo de comprador, ubicación del proceso, edad, marcas y canal de distribución. El crecimiento entre estos segmentos lo ayudará a analizar los segmentos de crecimiento escaso en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de prueba

- Kits de prueba de embarazo

- Otros kits de prueba para el hogar

- Kits de prueba de narcóticos

- Kits de prueba de VIH

- Kits de prueba de fertilidad

Sobre la base del tipo de prueba, el mercado de kits de prueba para el hogar de Indonesia se segmenta en kits de prueba de embarazo, otros kits de prueba para el hogar, kits de prueba de narcóticos, kits de prueba de VIH y kits de prueba de fertilidad.

Tipo de usuario

- Clase alta

- Clase media

- Clase baja

Según el tipo de usuario, el mercado de kits de prueba para el hogar de Indonesia se segmenta en clase alta, clase media y clase baja.

Tipo de comprador

- Kits de prueba de embarazo

- Otros kits de prueba para el hogar

- Kits de prueba de narcóticos

- Kits de prueba de VIH

- Kits de prueba de fertilidad

Según el tipo de comprador, el mercado de kits de prueba para el hogar de Indonesia se segmenta en kits de prueba de embarazo, otros kits de prueba para el hogar, kits de prueba de narcóticos, kits de prueba de VIH y kits de prueba de fertilidad.

Ubicación del proceso

- En casa

- Pruebas de laboratorio en casa (resultados digitales)

Sobre la base de la ubicación del proceso, el mercado de kits de prueba para el hogar de Indonesia se segmenta en pruebas para el hogar y pruebas de laboratorio para el hogar (resultados digitales).

Edad

- Adulto

- Geriátrico

- Pediátrico

En función de la edad, el mercado de kits de prueba para el hogar de Indonesia se segmenta en adultos, geriátricos y pediátricos.

Marcas

- Prueba de embarazo

- Otras pruebas para hacer en casa

- Prueba de narcóticos

- Prueba del VIH

- Prueba de fertilidad

Sobre la base de las marcas, el mercado de kits de prueba para el hogar de Indonesia está segmentado en prueba de embarazo, otras pruebas para el hogar, prueba de narcóticos, prueba de VIH y prueba de fertilidad.

Canal de distribución

- Comprador institucional

- Ventas minoristas/de marca

Sobre la base del canal de distribución, el mercado de kits de prueba para el hogar de Indonesia está segmentado en compradores institucionales y ventas minoristas/de marca.

Análisis y perspectivas regionales del mercado de kits de prueba para el hogar

Se analiza el mercado de kits de prueba para el hogar y se proporcionan información y tendencias del tamaño del mercado por país, tipo de prueba, tipo de usuario, tipo de comprador, ubicación del proceso, edad, marcas y canal de distribución como se mencionó anteriormente.

Indonesia domina el mercado de kits de prueba para el hogar en términos de participación de mercado e ingresos de mercado y seguirá fortaleciendo su dominio durante el período de pronóstico. Esto se debe a la implementación de programas de concientización sobre los kits de prueba para el hogar y la investigación y el desarrollo de tecnologías avanzadas para los kits de prueba en la región de Indonesia que mejoran aún más el crecimiento de este mercado.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en las regulaciones del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos, como las ventas nuevas y de reemplazo, la demografía del país, la epidemiología de las enfermedades y los aranceles de importación y exportación, son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la alta competencia de las marcas locales y nacionales, y el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los kits de prueba para el hogar

El panorama competitivo del mercado de kits de prueba para el hogar proporciona detalles de los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento del producto, la amplitud y la variedad del producto y el dominio de la aplicación. Los puntos de datos proporcionados anteriormente solo están relacionados con el enfoque de las empresas en el mercado de kits de prueba para el hogar.

Entre los principales actores que operan en el mercado de kits de prueba para el hogar se encuentran Abbott, PT. Danpac Pharma, Orient Gene, Siemens Healthcare GmbH, Medtronic, BD, B. Braun Melsungen AG, Quidel Corporation, NIPRO, F. Hoffmann-La Roche Ltd., bioMérieux SA, EGENS GROUP, DKT INTERNATIONAL, Clearblue (una subsidiaria de SPD Swiss Precision Diagnostics GmbH) y ACON Laboratories, Inc., entre otros.

Metodología de la investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con tamaños de muestra grandes. Los datos del mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Aparte de esto, los modelos de datos incluyen la cuadrícula de posicionamiento de proveedores, el análisis de la línea de tiempo del mercado, la descripción general y la guía del mercado, la cuadrícula de posicionamiento de la empresa, el análisis de la participación de mercado de la empresa, los estándares de medición, el análisis global frente a regional y el análisis de la participación de los proveedores. Solicite una llamada de un analista en caso de tener más consultas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF INDONESIA AT-HOME TESTING KITS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET TYPE OF BUYER COVERAGE GRID

2.8 TEST TYPE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES

4.3 MARKET SHARE BY PLAYERS

4.3.1 INDONESIA AT-HOME TESTING KITS MARKET SIZE AND SHARE, BY PLAYERS (IDR MILLION, 2021)

4.3.2 INDONESIA AT-HOME TESTING KITS MARKET SIZE AND SHARE, BY PLAYERS (IDR MILLION, 2022)

4.3.3 INDONESIA AT-HOME TESTING KITS MARKET SIZE AND SHARE, BY PLAYERS (IDR MILLION, 2023)

4.3.4 INDONESIA AT-HOME TESTING KITS MARKET SIZE AND SHARE, BY PLAYERS (IDR MILLION, 2024)

4.3.5 INDONESIA AT-HOME TESTING KITS MARKET SIZE AND SHARE, BY PLAYERS (IDR MILLION, 2025)

4.3.6 INDONESIA AT-HOME TESTING KITS MARKET SIZE AND SHARE, BY PLAYERS (IDR MILLION, 2026)

5 INDONESIA AT- HOME TESTING KITS MARKET: REGULATIONS

5.1 REGULATION IN INDONESIA:

6 SUMMARY WRITE UP (INDONESIA)

6.1 OVERVIEW

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWING ADOPTION OF SELF-TESTING KITS

7.1.2 EASY AVAILABILITY OF SELF-TESTING KITS AT PHARMACIES

7.1.3 INCREASE IN AWARENESS ABOUT THE IMPORTANCE OF HIV DIAGNOSIS

7.1.4 INCREASING PREVALENCE OF CHRONIC DISEASES

7.2 RESTRAINTS

7.2.1 INACCURACY OF RESULTS BY SELF-TESTING KITS

7.2.2 STRINGENT GOVERNMENT REGULATIONS FOR MANUFACTURING AND DISTRIBUTION OF TESTING KITS

7.3 OPPORTUNITIES

7.3.1 ADVENT OF ADVANCED TECHNOLOGIES

7.3.2 EMERGING NEED FOR RAPID TESTING KITS FOR COVID-19 PANDEMIC

7.3.3 STRATEGIC INITIATIVES OF KEY PLAYERS

7.4 CHALLENGES

7.4.1 HIGH COMPETITION IN MEDICAL TECHNOLOGY INDUSTRY

7.4.2 REDUCTION IN RESEARCH & DEVELOPMENT BUDGETS

8 INDONESIA AT-HOME TESTING KITS MARKET, BY TEST TYPE

8.1 OVERVIEW

8.2 PREGNANCY TEST KITS

8.2.1 STRIP

8.2.2 MIDSTREAM

8.2.3 CASSETTE

8.2.4 DIP CARD

8.2.5 TEST PANEL

8.2.6 OTHERS

8.3 NARCOTIC TEST KITS

8.3.1 CASSETTE

8.3.2 DIP CARD

8.3.3 TEST PANEL

8.3.4 STRIP

8.3.5 MIDSTREAM

8.3.6 OTHERS

8.4 HIV TEST KITS

8.4.1 STRIP

8.4.2 CASSETTE

8.4.3 TEST PANEL

8.4.4 DIP CARD

8.4.5 MIDSTREAM

8.4.6 OTHERS

8.5 FERTILITY TEST KITS

8.5.1 STRIP

8.5.2 MIDSTREAM

8.5.3 CASSETTE

8.5.4 DIP CARD

8.5.5 TEST PANEL

8.5.6 OTHERS

8.6 OTHER AT-HOME TEST KITS

8.6.1 GLUCOSE TESTS

8.6.2 INFECTIOUS DISEASES TESTS

8.6.3 OTHERS

9 INDONESIA AT-HOME TESTING KITS MARKET, BY TYPE OF USER

9.1 OVERVIEW

9.2 MIDDLE CLASS

9.2.1 PREGNANCY TEST KITS

9.2.2 NARCOTIC TEST KITS

9.2.3 HIV TEST KITS

9.2.4 FERTILITY TEST KITS

9.2.5 OTHER AT-HOME TEST KITS

9.3 HIGH CLASS

9.3.1 PREGNANCY TEST KITS

9.3.2 NARCOTIC TEST KITS

9.3.3 HIV TEST KITS

9.3.4 FERTILITY TEST KITS

9.3.5 OTHER AT-HOME TEST KITS

9.4 LOW CLASS

9.4.1 PREGNANCY TEST KITS

9.4.2 NARCOTIC TEST KITS

9.4.3 HIV TEST KITS

9.4.4 FERTILITY TEST KITS

9.4.5 OTHER AT-HOME TEST KITS

10 INDONESIA AT-HOME TESTING KITS MARKET, BY TYPE OF BUYER

10.1 OVERVIEW

10.2 PREGNANCY TEST KITS

10.2.1 GOVERNMENT/INSTITUTIONAL

10.2.1.1 HOSPITAL

10.2.1.2 PUBLIC HEALTH CENTER

10.2.1.3 NON-GOVERNMENT ORGANIZATION

10.2.2 RETAIL/BRANDED

10.2.2.1 RETAIL PHARMACIES

10.2.2.2 ONLINE PHARMACIES

10.2.2.3 DRUG STORE

10.2.2.4 SUPERMARKET/HYPERMARKET

10.3 NARCOTIC TEST KITS

10.3.1 GOVERNMENT/INSTITUTIONAL

10.3.1.1 HOSPITAL

10.3.1.2 PUBLIC HEALTH CENTER

10.3.1.3 NON-GOVERNMENT ORGANIZATION

10.3.2 RETAIL/BRANDED

10.3.2.1 RETAIL PHARMACIES

10.3.2.2 ONLINE PHARMACIES

10.3.2.3 DRUG STORE

10.3.2.4 SUPERMARKET/HYPERMARKET

10.4 HIV TEST KITS

10.4.1 GOVERNMENT/INSTITUTIONAL

10.4.1.1 HOSPITAL

10.4.1.2 PUBLIC HEALTH CENTER

10.4.1.3 NON-GOVERNMENT ORGANIZATION

10.4.2 RETAIL/BRANDED

10.4.2.1 RETAIL PHARMACIES

10.4.2.2 ONLINE PHARMACIES

10.4.2.3 DRUG STORE

10.4.2.4 SUPERMARKET/HYPERMARKET

10.5 FERTILITY TEST KITS

10.5.1 GOVERNMENT/INSTITUTIONAL

10.5.1.1 HOSPITAL

10.5.1.2 PUBLIC HEALTH CENTER

10.5.1.3 NON-GOVERNMENT ORGANIZATION

10.5.2 RETAIL/BRANDED

10.5.2.1 RETAIL PHARMACIES

10.5.2.2 ONLINE PHARMACIES

10.5.2.3 DRUG STORE

10.5.2.4 SUPERMARKET/HYPERMARKET

10.6 OTHER AT-HOME TEST KITS

10.6.1 GOVERNMENT/INSTITUTIONAL

10.6.1.1 HOSPITAL

10.6.1.2 PUBLIC HEALTH CENTER

10.6.1.3 NON-GOVERNMENT ORGANIZATION

10.6.2 RETAIL/BRANDED

10.6.2.1 RETAIL PHARMACIES

10.6.2.2 ONLINE PHARMACIES

10.6.2.3 DRUG STORE

10.6.2.4 SUPERMARKET/HYPERMARKET

11 INDONESIA AT-HOME TESTING KITS MARKET, BY PROCESS LOCATION

11.1 OVERVIEW

11.2 AT-HOME

11.3 AT-HOME LAB TESTS (DIGITAL RESULT)

11.3.1 VIA E-MAILS

11.3.2 DIRECT COLLECTION OF THE REPORT FROM THE LAB

11.3.3 VIA SHORT MESSAGE SERVICE (SMS)

11.3.4 REPORT GENERATION ON MOBILE APP

11.3.5 OTHERS

12 INDONESIA AT-HOME TESTING KITS MARKET, BY AGE

12.1 OVERVIEW

12.2 ADULT

12.2.1 AT-HOME

12.2.2 AT-HOME LAB TEST (DIGITAL RESULT)

12.3 GERIATRIC

12.3.1 AT-HOME

12.3.2 AT-HOME LAB TEST (DIGITAL RESULT)

12.4 PEDIATRIC

12.4.1 AT-HOME

12.4.2 AT-HOME LAB TEST (DIGITAL RESULT)

13 INDONESIA AT-HOME TESTING KITS MARKET, BY BRANDS

13.1 OVERVIEW

13.2 PREGNANCY TEST

13.2.1 SENSITIF

13.2.2 AKURAT

13.2.3 ANDALAN

13.2.4 BLUEONE

13.2.5 OTHERS

13.3 NARCOTIC TEST

13.3.1 NARCOTEST

13.3.2 ORIENT GENE

13.3.3 EGENS

13.3.4 OTHERS

13.4 HIV TEST

13.4.1 ONE STEP

13.4.2 ORIENT GENE

13.4.3 STANDA REAGEN

13.4.4 OTHERS

13.5 FERTILITY TEST

13.5.1 OVUTEST

13.5.2 CLEARBLUE

13.5.3 ANDALAN

13.5.4 ELHA

13.5.5 OTHERS

13.6 OTHER AT-HOME TEST

14 INDONESIA AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 INSTITUTIONAL BUYER

14.2.1 HOSPITAL

14.2.2 PUBLIC HEALTH CENTER

14.2.3 NON- GOVERNMENT ORGANIZATION

14.3 RETAILS/ BRANDED SALES

14.3.1 RETAIL PHARMACIES

14.3.1.1 PREGNANCY TEST KITS

14.3.1.2 NARCOTIC TEST KITS

14.3.1.3 HIV TEST KITS

14.3.1.4 FERTILITY TEST KITS

14.3.1.5 OTHER AT-HOME TEST KITS

14.3.2 ONLINE PHARMACIES

14.3.2.1 PREGNANCY TEST KITS

14.3.2.2 NARCOTIC TEST KITS

14.3.2.3 HIV TEST KITS

14.3.2.4 FERTILITY TEST KITS

14.3.2.5 OTHER AT-HOME TEST KITS

14.3.3 DRUG STORE

14.3.3.1 PREGNANCY TEST KITS

14.3.3.2 NARCOTIC TEST KITS

14.3.3.3 HIV TEST KITS

14.3.3.4 FERTILITY TEST KITS

14.3.3.5 OTHER AT-HOME TEST KITS

14.3.4 SUPERMARKET/HYPERMARKET

14.3.4.1 PREGNANCY TEST KITS

14.3.4.2 NARCOTIC TEST KITS

14.3.4.3 HIV TEST KITS

14.3.4.4 FERTILITY TEST KITS

14.3.4.5 OTHER AT-HOME TEST KITS

15 INDONESIA AT-HOME TESTING KITS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: INDONESIA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 PT DANPAC PHARMA

17.1.1 COMPANY SNAPSHOT

17.1.2 PRODUCT PORTFOLIO

17.1.3 RECENT DEVELOPMENT

17.2 ABBOTT

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUS ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENT

17.3 ORIENT GENE

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 RECENT DEVELOPMENT

17.4 SIEMENS HEALTHCARE GMBH

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENTS

17.5 MEDTRONIC

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 ACON LABORATORIES, INC.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 B. BRAUN MELSUNGEN AG

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 BD

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUS ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 BIOMERIEUX

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUS ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT

17.1 CLEARBLUE (A SUBSIDIARY OF SWISS PRECISION DIAGNOSTICS GMBH)

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 DKT INTERNATIONAL

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 EGENS GROUP

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 F. HOFFMANN- LA ROCHE LTD

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUS ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 NIPRO

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENT

17.15 QUIDEL CORPORATION

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tablas

TABLE 1 INDONESIA AT-HOME TESTING KITS MARKET SHARE FOR PREGNANCY TEST KITS , BY PLAYERS (IDR MILLION, 2021)

TABLE 2 INDONESIA AT-HOME TESTING KITS MARKET SHARE FOR NARCOTICS TEST KITS , BY PLAYERS (IDR MILLION, 2021)

TABLE 3 INDONESIA AT-HOME TESTING KITS MARKET SHARE FOR HIV TEST KITS , BY PLAYERS (IDR MILLION, 2021)

TABLE 4 INDONESIA AT-HOME TESTING KITS MARKET SHARE FOR FERTILITY TEST KITS , BY PLAYERS (IDR MILLION, 2021)

TABLE 5 INDONESIA AT-HOME TESTING KITS MARKET SHARE FOR PREGNANCY TEST KITS , BY PLAYERS (IDR MILLION, 2022)

TABLE 6 INDONESIA AT-HOME TESTING KITS MARKET SHARE FOR NARCOTICS TEST KITS , BY PLAYERS (IDR MILLION, 2022)

TABLE 7 INDONESIA AT-HOME TESTING KITS MARKET SHARE FOR HIV TEST KITS , BY PLAYERS (IDR MILLION, 2022)

TABLE 8 INDONESIA AT-HOME TESTING KITS MARKET SHARE FOR FERTILITY TEST KITS , BY PLAYERS (IDR MILLION, 2022)

TABLE 9 INDONESIA AT-HOME TESTING KITS MARKET SHARE FOR PREGNANCY TEST KITS , BY PLAYERS (IDR MILLION, 2023)

TABLE 10 INDONESIA AT-HOME TESTING KITS MARKET SHARE FOR NARCOTICS TEST KITS , BY PLAYERS (IDR MILLION, 2023)

TABLE 11 INDONESIA AT-HOME TESTING KITS MARKET SHARE FOR HIV TEST KITS , BY PLAYERS (IDR MILLION, 2023)

TABLE 12 INDONESIA AT-HOME TESTING KITS MARKET SHARE FOR FERTILITY TEST KITS , BY PLAYERS (IDR MILLION, 2023)

TABLE 13 INDONESIA AT-HOME TESTING KITS MARKET SHARE FOR PREGNANCY TEST KITS , BY PLAYERS (IDR MILLION, 2024)

TABLE 14 INDONESIA AT-HOME TESTING KITS MARKET SHARE FOR NARCOTICS TEST KITS , BY PLAYERS (IDR MILLION, 2024)

TABLE 15 INDONESIA AT-HOME TESTING KITS MARKET SHARE FOR HIV TEST KITS , BY PLAYERS (IDR MILLION, 2024)

TABLE 16 INDONESIA AT-HOME TESTING KITS MARKET SHARE FOR FERTILITY TEST KITS , BY PLAYERS (IDR MILLION, 2024)

TABLE 17 INDONESIA AT-HOME TESTING KITS MARKET SHARE FOR PREGNANCY TEST KITS , BY PLAYERS (IDR MILLION, 2025)

TABLE 18 INDONESIA AT-HOME TESTING KITS MARKET SHARE FOR NARCOTICS TEST KITS , BY PLAYERS (IDR MILLION, 2025)

TABLE 19 INDONESIA AT-HOME TESTING KITS MARKET SHARE FOR HIV TEST KITS , BY PLAYERS (IDR MILLION, 2025)

TABLE 20 INDONESIA AT-HOME TESTING KITS MARKET SHARE FOR FERTILITY TEST KITS , BY PLAYERS (IDR MILLION, 2025)

TABLE 21 INDONESIA AT-HOME TESTING KITS MARKET SHARE FOR PREGNANCY TEST KITS , BY PLAYERS (IDR MILLION, 2026)

TABLE 22 INDONESIA AT-HOME TESTING KITS MARKET SHARE FOR NARCOTICS TEST KITS , BY PLAYERS (IDR MILLION, 2026)

TABLE 23 INDONESIA AT-HOME TESTING KITS MARKET SHARE FOR HIV TEST KITS , BY PLAYERS (IDR MILLION, 2026)

TABLE 24 INDONESIA AT-HOME TESTING KITS MARKET SHARE FOR FERTILITY TEST KITS , BY PLAYERS (IDR MILLION, 2026)

TABLE 25 INDONESIA AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2020-2029 (IDR MILLION)

TABLE 26 INDONESIA AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 27 INDONESIA PREGNANCY TEST KITS IN AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2020-2029 (IDR MILLION)

TABLE 28 INDONESIA NARCOTIC TEST KITS IN AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2020-2029 (IDR MILLION)

TABLE 29 INDONESIA HIV TEST KITS IN AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2020-2029 (IDR MILLION)

TABLE 30 INDONESIA FERTILITY TEST KITS IN AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2020-2029 (IDR MILLION)

TABLE 31 INDONESIA OTHER AT-HOME TEST KITS IN AT-HOME TESTING KITS MARKET, BY TEST TYPE, 2020-2029 (IDR MILLION)

TABLE 32 INDONESIA AT-HOME TESTING KITS MARKET, BY TYPE OF USER, 2020-2029 (IDR MILLION)

TABLE 33 INDONESIA MIDDLE CLASS IN AT-HOME TESTING KITS MARKET, BY TYPE OF USER, 2020-2029 (IDR MILLION)

TABLE 34 INDONESIA HIGH CLASS IN AT-HOME TESTING KITS MARKET, BY TYPE OF USER, 2020-2029 (IDR MILLION)

TABLE 35 INDONESIA LOW CLASS IN AT-HOME TESTING KITS MARKET, BY TYPE OF USER, 2020-2029 (IDR MILLION)

TABLE 36 INDONESIA AT-HOME TESTING KITS MARKET, BY TYPE OF BUYER, 2020-2029 (IDR MILLION)

TABLE 37 INDONESIA PREGNANCY TEST KITS IN AT-HOME TESTING KITS MARKET, BY TYPE OF BUYER, 2020-2029 (IDR MILLION)

TABLE 38 INDONESIA GOVERNMENT/INSTITUTIONAL IN AT-HOME TESTING KITS MARKET, BY TYPE OF BUYER, 2020-2029 (IDR MILLION)

TABLE 39 INDONESIA RETAIL/BRANDED IN AT-HOME TESTING KITS MARKET, BY TYPE OF BUYER, 2020-2029 (IDR MILLION)

TABLE 40 INDONESIA NARCOTIC TEST KITS IN AT-HOME TESTING KITS MARKET, BY TYPE OF BUYER, 2020-2029 (IDR MILLION)

TABLE 41 INDONESIA GOVERNMENT/INSTITUTIONAL IN AT-HOME TESTING KITS MARKET, BY TYPE OF BUYER, 2020-2029 (IDR MILLION)

TABLE 42 INDONESIA RETAIL/BRANDED IN AT-HOME TESTING KITS MARKET, BY TYPE OF BUYER, 2020-2029 (IDR MILLION)

TABLE 43 INDONESIA HIV TEST KITS IN AT-HOME TESTING KITS MARKET, BY TYPE OF BUYER, 2020-2029 (IDR MILLION)

TABLE 44 INDONESIA GOVERNMENT/INSTITUTIONAL IN AT-HOME TESTING KITS MARKET, BY TYPE OF BUYER, 2020-2029 (IDR MILLION)

TABLE 45 INDONESIA RETAIL/BRANDED IN AT-HOME TESTING KITS MARKET, BY TYPE OF BUYER, 2020-2029 (IDR MILLION)

TABLE 46 INDONESIA FERTILITY TEST KITS IN AT-HOME TESTING KITS MARKET, BY TYPE OF BUYER, 2020-2029 (IDR MILLION)

TABLE 47 INDONESIA GOVERNMENT/INSTITUTIONAL IN AT-HOME TESTING KITS MARKET, BY TYPE OF BUYER, 2020-2029 (IDR MILLION)

TABLE 48 INDONESIA RETAIL/BRANDED IN AT-HOME TESTING KITS MARKET, BY TYPE OF BUYER, 2020-2029 (IDR MILLION)

TABLE 49 INDONESIA OTHER AT-HOME TEST KITS IN AT-HOME TESTING KITS MARKET, BY TYPE OF BUYER, 2020-2029 (IDR MILLION)

TABLE 50 INDONESIA GOVERNMENT/INSTITUTIONAL IN AT-HOME TESTING KITS MARKET, BY TYPE OF BUYER, 2020-2029 (IDR MILLION)

TABLE 51 INDONESIA RETAIL/BRANDED IN AT-HOME TESTING KITS MARKET, BY TYPE OF BUYER, 2020-2029 (IDR MILLION)

TABLE 52 INDONESIA AT-HOME TESTING KITS MARKET, BY PROCESS LOCATION, 2020-2029 (IDR MILLION)

TABLE 53 INDONESIA AT-HOME LAB TESTS (DIGITAL RESULT) IN AT-HOME TESTING KITS MARKET, BY PROCESS LOCATION, 2020-2029 (IDR MILLION)

TABLE 54 INDONESIA AT-HOME TESTING KITS MARKET, BY AGE, 2020-2029 (IDR MILLION)

TABLE 55 INDONESIA ADULT IN AT-HOME TESTING KITS MARKET, BY AGE, 2020-2029 (IDR MILLION)

TABLE 56 INDONESIA GERIATRIC IN AT-HOME TESTING KITS MARKET, BY AGE, 2020-2029 (IDR MILLION)

TABLE 57 INDONESIA PEDIATRIC IN AT-HOME TESTING KITS MARKET, BY AGE, 2020-2029 (IDR MILLION)

TABLE 58 INDONESIA AT-HOME TESTING KITS MARKET, BY BRANDS, 2020-2029 (IDR MILLION)

TABLE 59 INDONESIA PREGNANCY TEST IN AT-HOME TESTING KITS MARKET, BY BRANDS, 2020-2029 (IDR MILLION)

TABLE 60 INDONESIA NARCOTIC TEST IN AT-HOME TESTING KITS MARKET, BY BRANDS, 2020-2029 (IDR MILLION)

TABLE 61 INDONESIA HIV TEST IN AT-HOME TESTING KITS MARKET, BY BRANDS, 2020-2029 (IDR MILLION)

TABLE 62 INDONESIA FERTILITY TEST IN AT-HOME TESTING KITS MARKET, BY BRANDS, 2020-2029 (IDR MILLION)

TABLE 63 INDONESIA AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (IDR MILLION)

TABLE 64 INDONESIA INSTITUTIONAL BUYER IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (IDR MILLION)

TABLE 65 INDONESIA RETAILS/ BRANDED SALES IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (IDR MILLION)

TABLE 66 INDONESIA RETAILS PHARMACIES IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (IDR MILLION)

TABLE 67 INDONESIA ONLINE PHARMACIES IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (IDR MILLION)

TABLE 68 INDONESIA DRUG STORE IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (IDR MILLION)

TABLE 69 INDONESIA SUPERMARKET/HYPERMARKET IN AT-HOME TESTING KITS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (IDR MILLION)

Lista de figuras

FIGURE 1 INDONESIA AT-HOME TESTING KITS MARKET: SEGMENTATION

FIGURE 2 INDONESIA AT-HOME TESTING KITS MARKET: DATA TRIANGULATION

FIGURE 3 INDONESIA AT-HOME TESTING KITS MARKET: DROC ANALYSIS

FIGURE 4 INDONESIA AT-HOME TESTING KITS MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 INDONESIA AT-HOME TESTING KITS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 INDONESIA AT-HOME TESTING KITS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 INDONESIA AT-HOME TESTING KITS MARKET: MARKET TYPE OF BUYER COVERAGE GRID

FIGURE 8 INDONESIA AT-HOME TESTING KITS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 INDONESIA AT-HOME TESTING KITS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 INDONESIA AT-HOME TESTING KITS MARKET: SEGMENTATION

FIGURE 11 GROWING ADOPTION OF SELF-TESTING KITS AND EASY AVAILABILITY IS EXPECTED TO DRIVE INDONESIA AT-HOME TESTING KITS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 PREGNANCY TEST KITS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF INDONESIA AT-HOME TESTING KITS MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF INDONESIA AT-HOME TESTING KITS MARKET

FIGURE 14 INDONESIA AT-HOME TESTING KITS MARKET: BY TEST TYPE, 2021

FIGURE 15 INDONESIA AT-HOME TESTING KITS MARKET: BY TEST TYPE, 2022-2029 (IDR MILLION)

FIGURE 16 INDONESIA AT-HOME TESTING KITS MARKET: BY TEST TYPE, CAGR (2022-2029)

FIGURE 17 INDONESIA AT-HOME TESTING KITS MARKET: BY TEST TYPE, LIFELINE CURVE

FIGURE 18 INDONESIA AT-HOME TESTING KITS MARKET: BY TYPE OF USER, 2021

FIGURE 19 INDONESIA AT-HOME TESTING KITS MARKET: BY TYPE OF USER, 2022-2029 (IDR MILLION)

FIGURE 20 INDONESIA AT-HOME TESTING KITS MARKET: BY TYPE OF USER, CAGR (2022-2029)

FIGURE 21 INDONESIA AT-HOME TESTING KITS MARKET: BY TYPE OF USER, LIFELINE CURVE

FIGURE 22 INDONESIA AT-HOME TESTING KITS MARKET: BY TYPE OF BUYER, 2021

FIGURE 23 INDONESIA AT-HOME TESTING KITS MARKET: BY TYPE OF BUYER, 2022-2029 (IDR MILLION)

FIGURE 24 INDONESIA AT-HOME TESTING KITS MARKET: BY TYPE OF BUYER, CAGR (2022-2029)

FIGURE 25 INDONESIA AT-HOME TESTING KITS MARKET: BY TYPE OF BUYER, LIFELINE CURVE

FIGURE 26 INDONESIA AT-HOME TESTING KITS MARKET: BY PROCESS LOCATION, 2021

FIGURE 27 INDONESIA AT-HOME TESTING KITS MARKET: BY PROCESS LOCATION, 2022-2029 (IDR MILLION)

FIGURE 28 INDONESIA AT-HOME TESTING KITS MARKET: BY PROCESS LOCATION, CAGR (2022-2029)

FIGURE 29 INDONESIA AT-HOME TESTING KITS MARKET: BY PROCESS LOCATION, LIFELINE CURVE

FIGURE 30 INDONESIA AT-HOME TESTING KITS MARKET: BY AGE, 2021

FIGURE 31 INDONESIA AT-HOME TESTING KITS MARKET: BY AGE, 2022-2029 (IDR MILLION)

FIGURE 32 INDONESIA AT-HOME TESTING KITS MARKET: BY AGE, CAGR (2022-2029)

FIGURE 33 INDONESIA AT-HOME TESTING KITS MARKET: BY AGE, LIFELINE CURVE

FIGURE 34 INDONESIA AT-HOME TESTING KITS MARKET: BY BRANDS, 2021

FIGURE 35 INDONESIA AT-HOME TESTING KITS MARKET: BY BRANDS, 2022-2029 (IDR MILLION)

FIGURE 36 INDONESIA AT-HOME TESTING KITS MARKET: BY BRANDS, CAGR (2022-2029)

FIGURE 37 INDONESIA AT-HOME TESTING KITS MARKET: BY BRANDS, LIFELINE CURVE

FIGURE 38 INDONESIA AT-HOME TESTING KITS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 39 INDONESIA AT-HOME TESTING KITS MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (IDR MILLION)

FIGURE 40 INDONESIA AT-HOME TESTING KITS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 41 INDONESIA AT-HOME TESTING KITS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 42 INDONESIA AT-HOME TESTING KITS MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.