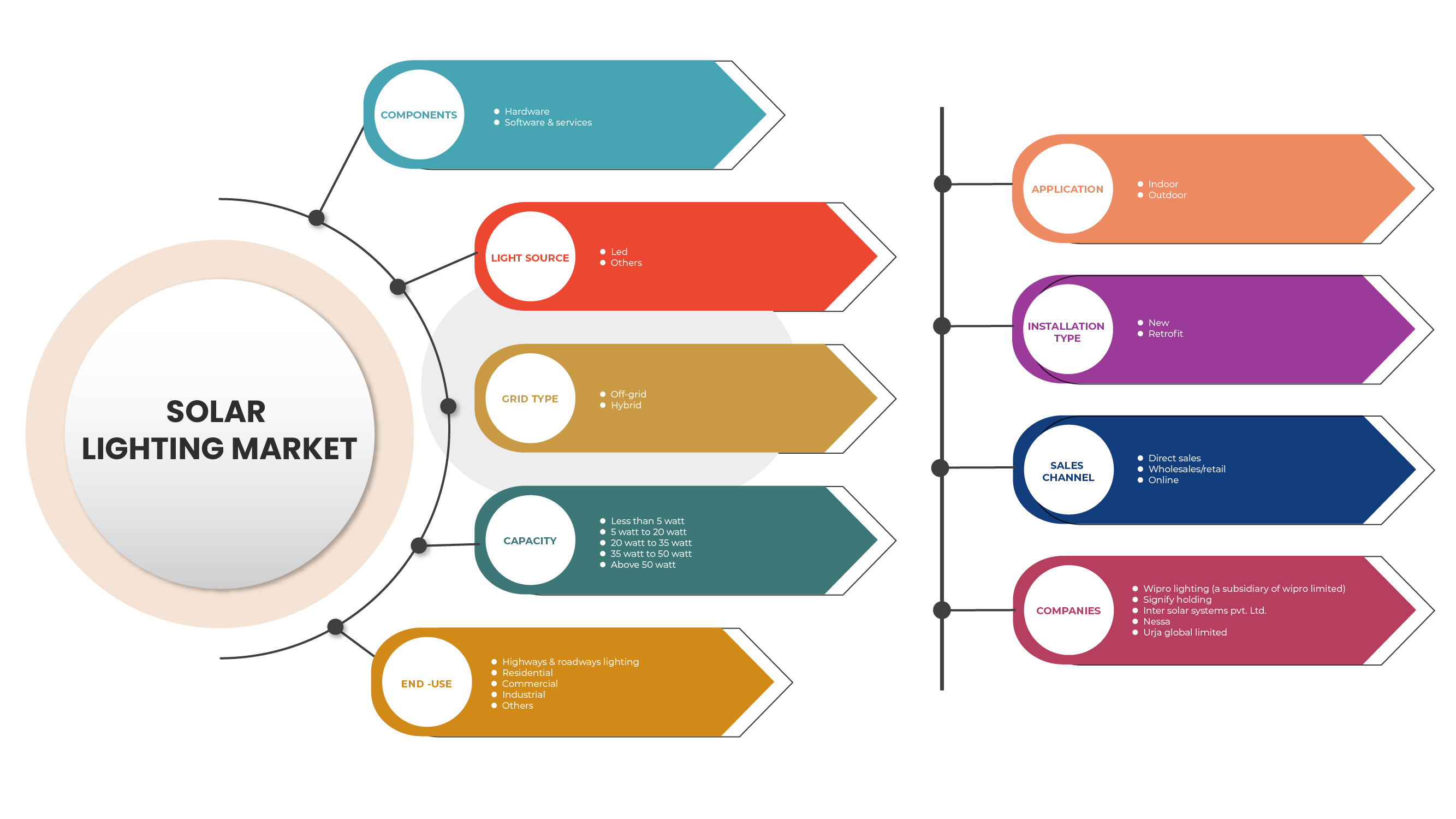

Mercado de iluminación solar en India, por componentes (hardware, software y servicios), fuente de luz (LED y otros), tipo de red (fuera de la red, híbrida ), capacidad (menos de 5 vatios, de 5 a 20 vatios, de 20 a 35 vatios, de 35 a 50 vatios y más de 50 vatios), uso final ( autopistas y carreteras, residencial, comercial, industrial y otros), aplicación ( interior , exterior), tipo de instalación (nueva, modernización ), canal de venta (venta directa, mayorista/minorista, en línea): tendencias de la industria y pronóstico hasta 2029

Análisis y tamaño del mercado

La demanda en el mercado de iluminación solar de la India está impulsada principalmente por el creciente sector de energía renovable. El creciente desarrollo de infraestructura y la creciente necesidad de sistemas de iluminación energéticamente eficientes han impulsado la demanda en el mercado indio. El aumento en el crecimiento de la tecnología LED ha creado más oportunidades para el crecimiento del mercado.

Data Bridge Market Research analiza que se espera que el mercado de iluminación solar alcance un valor de USD 650,44 millones para el año 2029, con una CAGR del 16,8% durante el período de pronóstico. El hardware representa el segmento de componentes más destacado en el mercado respectivo, ya que incluye componentes como módulos solares fotovoltaicos, baterías y accesorios de iluminación que constituyen la mayor parte del costo de la solución. El informe de mercado seleccionado por el equipo de Data Bridge Market Research incluye un análisis profundo de expertos, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y escenario de la cadena climática.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Año histórico |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Componentes (hardware, software y servicios), fuente de luz (LED y otros), tipo de red (fuera de la red, híbrida), capacidad (menos de 5 vatios, de 5 a 20 vatios, de 20 a 35 vatios, de 35 a 50 vatios y más de 50 vatios), uso final (carreteras y carreteras, residencial, comercial, industrial y otros), aplicación (interior, exterior), tipo de instalación (nueva, modernización), canal de venta (venta directa, mayorista/minorista, en línea) |

|

Países cubiertos |

India |

|

Actores del mercado cubiertos |

Corporación Renesas Electronic, Industrias Steelhacks, Iluminación Wipro, Signify Holding, Industrias Fevino LLP, GautamSolar, UM Green Pvt. Ltd., Systellar, Urja Global Limited, Inter Solar Systems, NESSA, Solmitra Power & Steel Pvt Ltd., Easy Photovoltech Private Limited, Sun World Solar Systems, Solex Energy Limited |

Definición de mercado

El sistema de iluminación solar funciona con electricidad proveniente de baterías, que se cargan mediante el uso de paneles solares fotovoltaicos. Está compuesto por una batería, un panel solar, una lámpara LED y un controlador de carga. El principio de funcionamiento del sistema de iluminación solar radica en la recolección de energía solar y su transformación en iluminación mediante el uso del efecto fotovoltaico que se utiliza en un panel fotovoltaico y un panel solar. La energía almacenada se recoge en una batería de gel recargable que se utiliza posteriormente para producir iluminación nocturna. El rápido desarrollo de la infraestructura en todos los sectores de la India está impulsando a los fabricantes locales de iluminación solar a competir y ofrecer productos de iluminación solar innovadores a precios bajos para aumentar su presencia en el mercado.

La dinámica del mercado de iluminación solar incluye:

Conductores-

- El sector de las energías renovables en crecimiento

La energía renovable se produce a partir de fuentes naturales o de recursos renovables que se renuevan constantemente. La India es el tercer mayor consumidor de electricidad del mundo, después de Estados Unidos y China. La creciente demanda de electricidad está obligando a la India a buscar nuevas formas, especialmente renovables, de producir energía, por lo que la India invierte y desarrolla constantemente su sector de energía renovable.

- Creciente desarrollo de infraestructura

El crecimiento de la infraestructura de carreteras, ferrocarriles, carreteras interiores, puertos y aviación está actuando como impulsores del mercado de iluminación solar de la India debido a los planes gubernamentales, la facilidad de instalación del alumbrado público y el mínimo mantenimiento posterior a la instalación.

- Creciente necesidad de sistemas de iluminación energéticamente eficientes

Como los productos de iluminación solar son ahora más sofisticados, con LED y microcontroladores, el usuario puede controlar el nivel de iluminación de los productos de iluminación solar, con lo que consume menos energía. Esta ventaja de los sistemas de iluminación solar y la necesidad de sistemas energéticamente eficientes actúan como impulsores del mercado de iluminación solar indio.

- Aumento del uso de linternas solares en zonas rurales

El aumento del uso de linternas solares en las zonas rurales está impulsando el crecimiento del mercado de iluminación solar de la India al brindar diversas opciones de productos de linternas solares a tasas subsidiadas.

Oportunidades-

- Aumento del crecimiento de la tecnología LED

Las luces LED han entrado masivamente en la iluminación residencial, comercial, de calles y de patios, pero aún tienen mucho camino por recorrer. El mercado indio de iluminación LED está creciendo a medida que los LED se han convertido en una corriente principal en el mercado de iluminación debido a la continua disminución de los precios de los LED en el país y a las iniciativas gubernamentales favorables, como UJALA y SLNP, que ofrecen LED a un costo subsidiado y proyectos de instalación de sistemas LED solares para farolas, respectivamente. Por lo tanto, impulsar el uso de LED como fuente de iluminación y el sector de la energía solar está brindando una oportunidad lucrativa para el crecimiento del mercado indio de iluminación solar.

- Alta presencia de población fuera de la red

La presencia de una gran población fuera de la red y los frecuentes cortes de electricidad en las zonas rurales han atraído a la población rural hacia la energía solar y esto está brindando oportunidades de crecimiento para los productos y servicios de iluminación solar de la India en las zonas rurales.

Restricciones y desafíos que enfrenta el mercado de iluminación solar

- Alta dependencia de fuentes convencionales de energía para la generación de electricidad

Esta alta dependencia del carbón y otros combustibles fósiles para la generación de electricidad ha ralentizado la transición y la adopción de energía solar, restringiendo la demanda y el crecimiento de la iluminación solar en el mercado indio.

- Falta de conciencia sobre las energías renovables

Por lo tanto, el alto costo inicial de instalación de un sistema de iluminación solar constituye un desafío importante para el crecimiento del mercado de iluminación solar en la India.

Este informe sobre el mercado de la iluminación solar proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de la iluminación solar, comuníquese con Data Bridge Market Research para obtener un informe de analista. Nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Acontecimientos recientes

- En junio de 2021, Wipro Lighting y Enlighted firmaron una alianza estratégica. En virtud de esta alianza, la empresa debía utilizar las soluciones de Internet de las cosas (IoT) de Enlighted para innovar y producir soluciones para parques solares, paneles y edificios comerciales para varios segmentos de clientes. Con este paso, la empresa pretende captar una mayor cuota de mercado en iluminación solar e iluminación comercial.

- En marzo de 2020, Signify se asoció con SRF Foundation para brindar una solución de iluminación a cinco patios de escuelas en Mewat, Haryana. A través de esta asociación, la empresa promueve su producto de iluminación solar en la India rural. La empresa tiene como objetivo impulsar las ventas de su producto solar después de esta asociación.

Alcance del mercado de iluminación solar en India

El mercado de la iluminación solar está segmentado en función de los componentes, la fuente de luz, el tipo de red, la capacidad, el uso final, la aplicación, el tipo de instalación y el canal de venta. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Componente

- Hardware

- Software y servicios

Sobre la base de los componentes, el mercado de iluminación solar de la India está segmentado en hardware, software y servicios.

Fuente de luz

- CONDUJO

- Otros

Sobre la base de la fuente de luz, el mercado de iluminación solar de la India está segmentado en LED y otros.

Tipo de cuadrícula

- Fuera de la red

- Híbrido

Sobre la base del tipo de red, el mercado de iluminación solar de la India está segmentado en fuera de la red e híbrido.

Capacidad

- Menos de 5 vatios

- De 5 vatios a 20 vatios

- De 20 vatios a 35 vatios

- De 35 vatios a 50 vatios

- Más de 50 vatios

Sobre la base de la capacidad, el mercado de iluminación solar de la India está segmentado en menos de 5 vatios, de 5 vatios a 20 vatios, de 20 vatios a 35 vatios, de 35 vatios a 50 vatios y más de 50 vatios.

Uso final

- Iluminación de carreteras y caminos

- Residencial

- Comercial

- Industrial

- Otros

Sobre la base del uso final, el mercado de iluminación solar de la India está segmentado en iluminación de carreteras y caminos, residencial, comercial, industrial y otros.

Solicitud

- Interior

- Exterior

Sobre la base de las aplicaciones, el mercado de iluminación solar de la India está segmentado en interior y exterior.

Tipo de instalación

- Nuevo

- Modernización

Según el tipo de instalación, el mercado de iluminación solar de la India se segmenta en nuevo y modernizado.

Canal de venta

- Ventas directas

- Venta al por mayor/venta al por menor

- En línea

Sobre la base del canal de ventas, el mercado de iluminación solar de la India está segmentado en ventas directas, ventas al por mayor/minoristas y en línea.

Análisis del panorama competitivo y la cuota de mercado de la iluminación solar

El panorama competitivo del mercado de la iluminación solar ofrece detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de la iluminación solar.

Algunos de los principales actores que operan en el mercado de iluminación solar son Renesas Electronic Corporation, Steelhacks Industries, Wipro Lighting, 7Signify Holding, Fevino Industries LLP, GautamSolar, UM Green Pvt. Ltd., Systellar, Urja Global Limited, Inter Solar Systems, NESSA, Solmitra Power & Steel Pvt Ltd., Easy Photovoltech Private Limited., Sun World Solar Systems y Solex Energy Limited, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF INDIA SOLAR LIGHTING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 COMPONENTS CURVE

2.11 CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PRICING ANALYSIS OF SOLAR LIGHTS IN INDIA

4.2 KEY INDUSTRY TRENDS

4.2.1 SMART SOLAR STREET AND ROADWAYS LIGHTING SYSTEMS

4.2.2 THE BATTERY INDUSTRY WILL BECOME MORE COMPETITIVE

4.3 APPLICATION OF MICROCONTROLLERS IN SOLAR LIGHTING

5 REGIONAL SUMMARY

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING RENEWABLE ENERGY SECTOR

6.1.2 RISING INFRASTRUCTURE DEVELOPMENT

6.1.3 INCREASING NEED FOR ENERGY-EFFICIENT LIGHTING SYSTEMS

6.1.4 INCREASING USE OF SOLAR LANTERNS IN RURAL AREAS

6.2 RESTRAINT

6.2.1 HIGH DEPENDENCE ON CONVENTIONAL SOURCES OF ENERGY FOR ELECTRICITY GENERATION

6.3 OPPORTUNITIES

6.3.1 GROWING GOVERNMENT INITIATIVES FOR ALTERNATE SOURCES OF ENERGY

6.3.2 HIGH PRESENCE OF OFF-GRID POPULATION

6.3.3 RISE IN GROWTH OF LED TECHNOLOGY

6.4 CHALLENGE

6.4.1 HIGH COST OF SOLAR LIGHTING SYSTEM

7 IMPACT ANALYSIS OF COVID-19 ON THE INDIA SOLAR LIGHTING MARKET

7.1 ANALYSIS OF IMPACT OF COVID-19 ON THE MARKET

7.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

7.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

7.4 IMPACT ON DEMAND

7.5 IMPACT ON SUPPLY CHAIN

7.6 IMPACT ON PRICE

7.7 CONCLUSION

8 INDIA SOLAR LIGHTING MARKET, BY COMPONENTS

8.1 OVERVIEW

8.2 HARDWARE

8.2.1 SOLAR/PV PANELS

8.2.2 LIGHTING FIXTURES

8.2.3 RECHARGEABLE BATTERY

8.2.4 MICROCONTROLLER

8.2.4.1 BY PINS

8.2.4.1.1 20 PINS TO 40 PINS

8.2.4.1.2 LESS THAN 20 PINS

8.2.4.1.3 MORE THAN 40 PINS

8.2.4.2 BY COMPONENTS

8.2.4.2.1 CPU

8.2.4.2.2 MEMORY

8.2.4.2.2.1 EMBEDDED MEMORY MICROCONTROLLER

8.2.4.2.2.2 EXTERNAL MEMORY MICROCONTROLLER

8.2.4.2.3 SERIAL PORTS

8.2.4.2.4 OTHERS

8.2.5 OTHERS

8.3 SOFTWARE & SERVICES

9 INDIA SOLAR LIGHTING MARKET, BY LIGHT SOURCE

9.1 OVERVIEW

9.2 LED

9.3 OTHERS

10 INDIA SOLAR LIGHTING MARKET, BY GRID TYPE

10.1 OVERVIEW

10.2 OFF-GRID

10.3 HYBRID

11 INDIA SOLAR LIGHTING MARKET, BY CAPACITY

11.1 OVERVIEW

11.2 5 WATT TO 20 WATT

11.3 20 WATT TO 35 WATT

11.4 35 WATT TO 50 WATT

11.5 LESS THAN 5 WATT

11.6 ABOVE 50 WATT

12 INDIA SOLAR LIGHTING MARKET, BY END USE

12.1 OVERVIEW

12.2 HIGHWAYS & ROADWAYS LIGHTING

12.2.1 NEW

12.2.2 RETROFIT

12.3 RESIDENTIAL

12.3.1 NEW

12.3.2 RETROFIT

12.4 INDUSTRIAL

12.4.1 NEW

12.4.2 RETROFIT

12.5 COMMERCIAL

12.5.1 NEW

12.5.2 RETROFIT

12.6 OTHERS

12.6.1 NEW

12.6.2 RETROFIT

13 INDIA SOLAR LIGHTING MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 OUTDOOR

13.2.1 SOLAR STREET LIGHTS

13.2.2 SOLAR GARDEN LIGHTS

13.2.2.1 SOLAR LANTERNS

13.2.2.2 SOLAR LAWN LIGHTS

13.2.2.3 SOLAR FENCE LIGHTS

13.2.2.4 SOLAR STING LIGHTS

13.2.2.5 SOLAR SIGN LIGHTS

13.2.2.6 OTHERS

13.2.3 SOLAR TRAFFIC LIGHTS

13.2.4 SOLAR PARKING LOT LIGHTS

13.2.5 SOLAR EMERGENCY LIGHTS

13.2.6 OTHERS

13.3 INDOOR

13.3.1 SOLAR DECK LIGHTS

13.3.2 SOLAR SHED LIGHTS

14 INDIA SOLAR LIGHTING MARKET, BY INSTALLATION TYPE

14.1 OVERVIEW

14.2 NEW

14.3 RETROFIT

15 INDIA SOLAR LIGHTING MARKET, BY SALES CHANNEL

15.1 OVERVIEW

15.2 DIRECT SALES

15.3 WHOLESALE/RETAIL

15.4 ONLINE

16 INDIA SOLAR LIGHTING MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: INDIA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 WIPRO LIGHTING (A SUBSIDIARY OF WIPRO LIMITED)

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCTS PORTFOLIO

18.1.4 RECENT DEVELOPMENTS

18.2 SIGNIFY HOLDING

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCTS PORTFOLIO

18.2.4 RECENT DEVELOPMENTS

18.3 INTER SOLAR SYSTEMS PVT. LTD.

18.3.1 COMPANY SNAPSHOT

18.3.2 PRODUCT PORTFOLIO

18.3.3 RECENT DEVELOPMENT

18.4 NESSA

18.4.1 COMPANY SNAPSHOT

18.4.2 PRODUCT PORTFOLIO

18.4.3 RECENT DEVELOPMENT

18.5 URJA GLOBAL LIMITED

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENT

18.6 EASY PHOTOVOLTECH PRIVATE LIMITED

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 FEVINO INDUSTRIES LLP

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCTS PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.8 GAUTAMSOLAR

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 RENESAS ELECTRONIC CORPORATION

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCTS PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 SOLEX ENERGY LIMITED

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 PRODUCT PORTFOLIO

18.10.4 RECENT DEVELOPMENT

18.11 SOLMITRA POWER & STEEL PVT LTD.

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENT

18.12 STEELHACK INDUSTRIES

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCTS PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 SUN WORLD SOLAR SYSTEMS

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 SYSTELLAR

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCTS PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 UM GREEN PVT. LTD.

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCTS PORTFOLIO

18.15.3 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

Lista de Tablas

TABLE 1 INDIA SOLAR LIGHTING MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 2 INDIA HARDWARE IN SOLAR LIGHTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 INDIA MICROCONTROLLER IN SOLAR LIGHTING MARKET, BY PINS, 2020-2029 (USD MILLION)

TABLE 4 INDIA MICROCONTROLLER IN SOLAR LIGHTING MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 5 INDIA MEMORY IN SOLAR LIGHTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 INDIA SOLAR LIGHTING MARKET, BY LIGHT SOURCE, 2020-2029 (USD MILLION)

TABLE 7 INDIA SOLAR LIGHTING MARKET, BY GRID TYPE, 2020-2029 (USD MILLION)

TABLE 8 INDIA SOLAR LIGHTING MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 9 INDIA SOLAR LIGHTING MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 10 INDIA HIGHWAYS & ROADWAYS LIGHTING IN SOLAR LIGHTING MARKET, BY INSTALLATION TYPE, 2020-2029 (USD MILLION)

TABLE 11 INDIA RESIDENTIAL IN SOLAR LIGHTING MARKET, BY INSTALLATION TYPE, 2020-2029 (USD MILLION)

TABLE 12 INDIA INDUSTRIAL IN SOLAR LIGHTING MARKET, BY INSTALLATION TYPE, 2020-2029 (USD MILLION)

TABLE 13 INDIA COMMERCIAL IN SOLAR LIGHTING MARKET, BY INSTALLATION TYPE, 2020-2029 (USD MILLION)

TABLE 14 INDIA OTHERS IN SOLAR LIGHTING MARKET, BY INSTALLATION TYPE, 2020-2029 (USD MILLION)

TABLE 15 INDIA SOLAR LIGHTING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 16 INDIA SOLAR LIGHTING MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 17 INDIA OUTDOOR IN SOLAR LIGHTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 INDIA OUTDOOR IN SOLAR LIGHTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 19 INDIA SOLAR GARDEN LIGHTS IN SOLAR LIGHTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 INDIA SOLAR GARDEN LIGHTS IN SOLAR LIGHTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 21 INDIA INDOOR IN SOLAR LIGHTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 INDIA INDOOR IN SOLAR LIGHTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 23 INDIA SOLAR LIGHTING MARKET, BY INSTALLATION TYPE, 2020-2029 (USD MILLION)

TABLE 24 INDIA SOLAR LIGHTING MARKET, BY SALES CHANNEL, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 INDIA SOLAR LIGHTING MARKET: SEGMENTATION

FIGURE 2 INDIA SOLAR LIGHTING MARKET : DATA TRIANGULATION

FIGURE 3 INDIA SOLAR LIGHTING MARKET: DROC ANALYSIS

FIGURE 4 INDIA SOLAR LIGHTING MARKET: COUNTRY MARKET ANALYSIS

FIGURE 5 INDIA SOLAR LIGHTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 INDIA SOLAR LIGHTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 INDIA SOLAR LIGHTING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 INDIA SOLAR LIGHTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 INDIA SOLAR LIGHTING MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 INDIA SOLAR LIGHTING MARKET: CHALLENGE MATRIX

FIGURE 11 INDIA SOLAR LIGHTING MARKET: SEGMENTATION

FIGURE 12 RISING INFRASTRUCTURE DEVELOPMENT IS EXPECTED TO BE A KEY DRIVER THE MARKET FOR INDIA SOLAR LIGHTING MARKETIN THE FORECAST PERIOD OF 2021 TO 2029

FIGURE 13 HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF INDIA SOLAR LIGHTING MARKETIN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINT, OPPORTUNITIES, AND CHALLENGE OF INDIA SOLAR LIGHTING MARKET

FIGURE 15 TOTAL ENERGY SUPPLY, 2019

FIGURE 16 INDIA SOLAR LIGHTING MARKET: BY COMPONENTS, 2021

FIGURE 17 INDIA SOLAR LIGHTING MARKET: BY LIGHT SOURCE, 2021

FIGURE 18 INDIA SOLAR LIGHTING MARKET: BY GRID TYPE, 2021

FIGURE 19 INDIA SOLAR LIGHTING MARKET: BY CAPACITY, 2021

FIGURE 20 INDIA SOLAR LIGHTING MARKET: BY END USE, 2021

FIGURE 21 INDIA SOLAR LIGHTING MARKET: BY APPLICATION, 2021

FIGURE 22 INDIA SOLAR LIGHTING MARKET: BY INSTALLATION TYPE, 2021

FIGURE 23 INDIA SOLAR LIGHTING MARKET: BY SALES CHANNEL, 2021

FIGURE 24 INDIA SOLAR LIGHTING MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.