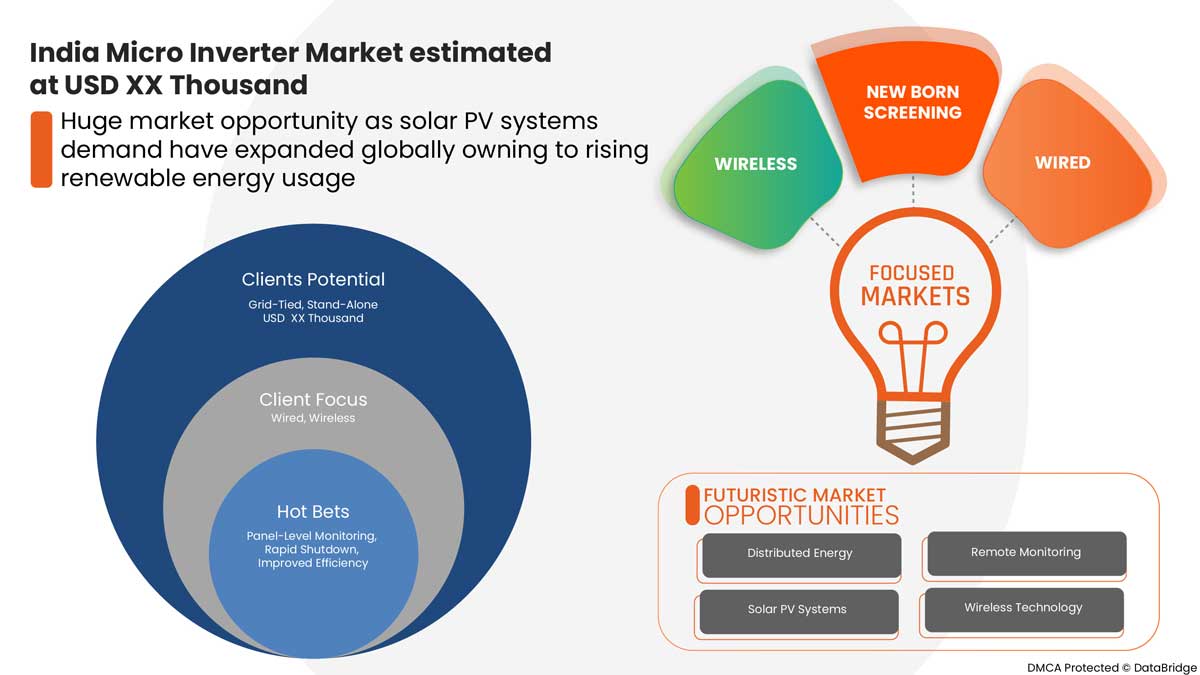

Mercado de microinversores en India, por tipo de conexión (autónomo, conectado a la red), servicio público (apagado rápido, monitoreo a nivel de panel, facilidad de expansión del sistema, instalación de múltiples ángulos, mayor durabilidad, otros (protección con clasificación IP67, electricidad)), tipo (monofásico, trifásico), oferta (hardware, software, servicios), tecnología de comunicación ( cableada , inalámbrica), potencia nominal (menos de 250 W, entre 251 W y 500 W, más de 500 W), canal de ventas (canal directo, canal indirecto), industria (residencial, comercial, plantas de energía fotovoltaica), tendencias de la industria y pronóstico hasta 2029

Análisis y tamaño del mercado

Los microinversores solares ofrecen numerosas ventajas sobre los inversores de cadena y centrales convencionales, como un alto rendimiento energético, capacidades de monitorización a nivel de módulo, ciclos de vida más prolongados, mayor seguridad, mayor flexibilidad, simplicidad y ningún punto único de fallo. Estos factores principales han aumentado la adopción de microinversores en la industria fotovoltaica en el pasado reciente. Por lo tanto, se espera que estos beneficios impulsen el crecimiento del mercado de microinversores de la India durante el período de pronóstico. Están ubicados debajo de cada panel solar y convierten la energía de corriente continua (CC) producida por un solo panel solar, a diferencia de los inversores convencionales, que se colocan a distancia del conjunto solar y pueden monitorear varios paneles solares al mismo tiempo. Esta característica permite que los microinversores funcionen de forma independiente y mejoren la eficiencia de los paneles solares.

Data Bridge Market Research analiza que se espera que el mercado de microinversores de India alcance un valor de 530.969,11 mil dólares en 2029, con una tasa compuesta anual del 16,1 % durante el período de pronóstico. El informe del mercado de microinversores también cubre en profundidad el análisis de precios, el análisis de patentes y los avances tecnológicos.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 |

|

Unidades cuantitativas |

Ingresos en miles de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Por tipo de conexión (autónoma, conectada a la red), servicio público (apagado rápido, monitoreo a nivel de panel, facilidad de expansión del sistema, instalación de múltiples ángulos, mayor durabilidad, otros (protección con clasificación IP67, electricidad)), tipo (monofásico, trifásico), oferta ( hardware , software, servicios), tecnología de comunicación (cableada, inalámbrica), potencia nominal (menos de 250 W, entre 251 W y 500 W, más de 500 W), canal de venta (canal directo, canal indirecto), industria (residencial, comercial, plantas de energía fotovoltaica) |

|

Países cubiertos |

India |

|

Actores del mercado cubiertos |

Entre otros se encuentran Infineon Technologies AG, Fchoice Solar Tech India Pvt Ltd, Nordic (India) Solutions Pvt. Ltd, SunSights Solar, UR Energy, Enphase Energy, 360 Power Products, gracerenew.com, Sun Sine Solution Private Limited, Texas Instruments Incorporated, SuratExim, Waaree Energies Ltd., SMA Solar Technology AG y P2 Power Solutions Pvt. Ltd. |

Definición de mercado

Un microinversor solar es un equipo plug-and-play que transforma la corriente continua generada por un solo módulo en corriente alterna en instalaciones fotovoltaicas . Los microinversores, a diferencia de los inversores centrales convencionales, funcionan con electrónica de potencia a nivel de módulo (MLPE), que implica la conversión de energía a nivel de módulo. Como resultado, se reducen los impactos negativos del desajuste de módulos y se mejora la eficiencia general del sistema. Los microinversores también proporcionan monitoreo a nivel de módulo , mayor flexibilidad de diseño, instalación más rápida y mayor seguridad en comparación con los inversores tradicionales. La electrónica de potencia a nivel de módulo, que utiliza seguimiento del punto de máxima potencia y microinversores y optimizadores de potencia, brinda una eficiencia significativa por encima de los sistemas convencionales (MPPT). Como resultado, se maximiza la producción de cada módulo y todo el sistema es más eficiente.

Dinámica del mercado de microinversores en India

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

Conductores

- Aumento de la demanda de energía renovable en todo el sector

La energía renovable se produce a partir de fuentes naturales o de recursos renovables que se renuevan constantemente. La India es el tercer mayor consumidor de electricidad del mundo, después de Estados Unidos y China. La creciente demanda de electricidad está obligando a la India a buscar nuevas formas, especialmente renovables, de producir energía, por lo que la India está invirtiendo y desarrollando constantemente su sector de energía renovable. La falta de una red eléctrica en una zona rural de la India y todas las iniciativas del gobierno para atraer a más consumidores de energía renovable ofrecen una oportunidad a los fabricantes locales de proporcionar paneles solares para muchas aplicaciones. Por lo tanto, el crecimiento del sector de la energía renovable en la India impulsará significativamente el mercado de microinversores.

- Aumento de instalaciones de productos solares como paneles solares en todo el país

Con el paso de los años, el número de instalaciones solares fotovoltaicas ha aumentado exponencialmente en todo el mundo. Según la hoja de ruta de la Agencia Internacional de la Energía (AIE), se espera que la capacidad solar fotovoltaica alcance los 4.600 GW en 2050, lo que equivale al 16% de la producción mundial de electricidad. Según la IRENA (Agencia Internacional de Energías Renovables), la capacidad total de energía bruta de la India se duplicará con creces, pasando de 284 gigavatios (GW) en 2015 a unos 670 GW en 2030, mientras que la generación de electricidad se triplicará con creces, pasando de 1100 teravatios-hora (TWh) al año a más de 3450 TWh al año. La energía renovable mantendrá su fuerte crecimiento en el mercado indio, alcanzando el 35% de la participación en la generación y el 60% de la capacidad de generación de energía. Esto demuestra que existe una creciente demanda de energía solar y, a medida que se conecten microinversores a cada panel solar, es probable que la demanda aumente en el futuro cercano.

Oportunidades

- La estructura integrada del microinversor está brindando oportunidades para muchos actores del mercado.

Los microinversores integrados se pueden integrar completamente en la caja de conexiones de un módulo para crear un módulo de CA más confiable y más económico. Esto, a su vez, ofrece una importante ventaja de costos para los clientes, que reemplaza la disposición convencional de la caja de conexiones. Además, los fabricantes de optimizadores de CC están incorporando esta tecnología para desarrollar dispositivos móviles integrados que se denominan módulos inteligentes.

Además, dado que los microinversores no están expuestos a cargas de potencia y calor tan altas como los inversores centrales, duran significativamente más en comparación con otros tipos. Además, los microinversores suelen tener una garantía de entre 20 y 25 años y 10 o 15 años más que los inversores centrales. Como los microinversores son muy pequeños, caben fácilmente en la parte posterior de un panel solar. Debido a su tamaño compacto y pequeño, no es necesario tener refrigeración separada como los inversores centrales.

Restricciones/Desafíos

- Mayor dependencia de fuentes convencionales de energía para la generación de electricidad

Las fuentes de energía convencionales son recursos energéticos naturales como el gas natural, el petróleo, el carbón y la energía nuclear. Se trata de fuentes de energía que se han utilizado desde la revolución industrial y la dependencia de estas fuentes es demasiado alta, ya que la infraestructura necesaria para generar electricidad utilizando estos recursos ya se ha construido y está en uso. Estas infraestructuras se han realizado con grandes inversiones de capital por parte del gobierno y las empresas y han tardado décadas en construirse. El tiempo y el capital necesarios para construir infraestructura para fuentes no convencionales son elevados y la tecnología no es fiable para generar la misma capacidad de energía que las fuentes convencionales. Esta alta dependencia de las fuentes convencionales para la generación de electricidad está actuando como un bloqueo para la transición de las fuentes convencionales a las fuentes de energía limpia.

- Estructura de diseño complicada del microinversor

Las tecnologías de microinversores se están volviendo cada vez más populares, ya que se requiere una opción de conexión a la red para sistemas fotovoltaicos de pequeña escala para recolectar energía eléctrica de corriente continua (CC) de los módulos fotovoltaicos y convertirla en corriente alterna (CA). Los microinversores constan de muchos componentes de hardware, como convertidores flyback, interruptores, filtros y otros componentes electrónicos. En cualquier sistema fotovoltaico, se conectan múltiples módulos solares en serie y en paralelo para proporcionar una salida de voltaje. Las combinaciones de estos paneles se conectan luego a un solo inversor centralizado para producir ciertos módulos de energía. Como cada inversor está ubicado independientemente debajo de un panel solar, se requiere un bus de comunicación y un sistema de monitoreo común, ya que hay un sistema de visualización integrado como en los inversores de cadena. Por lo tanto, la complicada estructura de diseño de los microinversores impone un desafío para el crecimiento del mercado.

Impacto posterior a la COVID-19 en el mercado de microinversores de India

El COVID-19 generó un gran impacto en el mercado de micro inversores, ya que casi todos los países optaron por cerrar todas las instalaciones de producción, excepto las que se dedicaban a la producción de bienes esenciales. La producción de sistemas de micro inversores se vio obstaculizada durante el confinamiento. En el escenario posterior al confinamiento, el crecimiento del mercado de micro inversores de la India se atribuye a la creciente adopción de sistemas y tecnologías solares fotovoltaicas en todas las regiones y países. La creciente demanda de energía renovable de la India es un factor importante que contribuye al crecimiento del mercado de micro inversores de la India.

Los fabricantes y proveedores de soluciones están tomando diversas decisiones estratégicas para recuperarse tras la COVID-19. Los actores están llevando a cabo múltiples actividades de investigación y desarrollo para mejorar la tecnología involucrada en el microinversor. Con esto, las empresas traerán tecnologías avanzadas al mercado. Además, las iniciativas gubernamentales relacionadas con el sistema de energía inteligente han llevado al crecimiento del mercado.

Acontecimientos recientes

- En febrero de 2022, la filial de Waaree Energies Ltd., Waaree Renewable Technologies Limited, se adjudicó el proyecto de planta de energía solar de CC de 180 MW en Tamil Nadu, India. El alcance de este proyecto incluye servicios de ingeniería, adquisición y construcción (EPC) de la planta solar.

- En abril de 2021, Enphase Energy e IBC SOLAR se asociaron para ofrecer a sus clientes aún más opciones para la planificación e instalación rápida y sencilla de sistemas solares.

Alcance del mercado de microinversores en India

El mercado de microinversores de la India está segmentado en función del tipo de conexión, la utilidad, el tipo, la oferta, la tecnología de comunicación, la potencia nominal, el canal de venta y la industria. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de conexión

- Autónomo

- Conectado a la red

Sobre la base del tipo de conexión, el mercado de microinversores de la India se segmenta en autónomos y conectados a la red.

Utilidad

- Apagado rápido

- Monitoreo a nivel de panel

- Facilidad de expansión del sistema

- Instalación de varios ángeles

- Mayor durabilidad

- Otros (protección con clasificación IP67, electricidad)

Sobre la base de la utilidad, el mercado de micro inversores de la India se ha segmentado en apagado rápido, monitoreo a nivel de panel, facilidad de expansión del sistema, instalación de múltiples ángulos, mayor durabilidad, otros protección con clasificación IP67, electricidad).

Tipo

- Monofásico

- Trifásico

Sobre la base del tipo, el mercado de micro inversores de la India se ha segmentado en monofásico y trifásico.

Ofrenda

- Hardware

- Software

- Servicios

Sobre la base de la oferta, el mercado de micro inversores de la India se ha segmentado en hardware, software y servicios.

Tecnología de la comunicación

- Cableado

- Inalámbrico

Sobre la base de la tecnología de comunicación, el mercado de micro inversores de la India se ha segmentado en cableado e inalámbrico.

Potencia nominal

- Por debajo de 250 W

- Entre 251 W y 500 W

- Más de 500 W

Sobre la base de la clasificación de potencia, el mercado de micro inversores de la India se ha segmentado en menos de 250 W, entre 251 W y 500 W, y más de 500 W.

Canal de venta

- Canal directo

- Canal indirecto

Sobre la base del canal de ventas, el mercado de micro inversores de la India está segmentado en canal directo y canal indirecto.

Industria

- Residencial

- Comercial

- Plantas de energía fotovoltaica

Sobre la base de la industria, el mercado de microinversores de la India se ha segmentado en plantas de energía residencial, comercial y fotovoltaica.

Análisis del panorama competitivo y de la cuota de mercado de los microinversores en la India

El panorama competitivo del mercado de micro inversores de la India ofrece detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en la India, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos, el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de micro inversores de la India.

Algunos de los principales actores que operan en el mercado de micro inversores de la India son Infineon Technologies AG, Fchoice Solar Tech India Pvt Ltd, Nordic (India) Solutions Pvt. Ltd, SunSights Solar, UR Energy, Enphase Energy, 360 Power Products, gracerenew.com, Sun Sine Solution Private Limited, Texas Instruments Incorporated, SuratExim, Waaree Energies Ltd., SMA Solar Technology AG y P2 Power Solutions Pvt. Ltd, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF INDIA MICRO INVERTER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 CONNECTION TYPE TIMELINE CURVE

2.9 MARKET CHALLENGE MATRIX

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 VALUE CHAIN ANALYSIS

4.2 ECOSYSTEM

4.3 TECHNOLOGY ANALYSIS

4.4 PRICING ANALYSIS

4.5 REGULATIONS

4.6 CASE STUDY

4.6.1 ENPHASE INSTALLED 7X M250 MICRO INVERTERS AND 1X ENVOY-R FOR RESIDENTIAL END USERS AS ENVIRONMENTALLY FRIENDLY SOLAR INVESTMENT

4.6.2 ENPHASE INSTALLED M215 MICRO INVERTERS FOR FAT WEST MEATS (US) COMMERCIAL PROJECT, PROVING THEM BETTER THAN DC OPTIMIZERS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN DEMAND FOR RENEWABLE ENERGY ACROSS THE SECTOR

5.1.2 INCREASE IN INSTALLATIONS OF SOLAR PRODUCTS SUCH AS SOLAR PANELS ACROSS THE COUNTRY

5.1.3 TECHNICAL ADVANTAGES OF MICRO INVERTERS OVER CONVENTIONAL SOLAR INVERTERS

5.2 RESTRAINTS

5.2.1 HIGHER INSTALLATION AND MAINTENANCE COSTS OF MICRO-INVERTERS

5.2.2 HIGHER DEPENDENCE ON CONVENTIONAL SOURCES OF ENERGY FOR ELECTRICITY GENERATION

5.3 OPPORTUNITIES

5.3.1 INCREASE IN ACQUISITION AND PARTNERSHIP AMONG VARIOUS ORGANIZATIONS

5.3.2 THE INTEGRATED STRUCTURE OF MICRO INVERTER IS PROVING OPPORTUNITIES FOR MANY MARKET PLAYERS

5.3.3 GROWING GOVERNMENT INITIATIVES FOR USING ALTERNATIVES SOURCE OF ENERGY

5.4 CHALLENGES

5.4.1 RISING ADOPTION OF DC OPTIMIZERS ACROSS THE MARKET

5.4.2 COMPLICATED DESIGN STRUCTURE OF MICRO INVERTER

6 ANALYSIS OF IMPACT OF COVID 19 ON THE MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST MARKET GROWTH

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON DEMAND, SUPPLY, AND PRICE

6.4 CONCLUSION

7 INDIA MICRO INVERTER MARKET, BY CONNECTION TYPE

7.1 OVERVIEW

7.2 GRID-TIED

7.2.1 SINGLE INPUT SINGLE OUTPUT (SISO)PLATFORM

7.2.2 MULTI INPUT SINGLE OUTPUT (MISO) PLATFORM

7.3 STAND-ALONE

7.3.1 PURE SINE WAVE

7.3.2 SQUARE WAVE

7.3.3 MODIFIED SINE WAVE

8 INDIA MICRO INVERTER MARKET, BY UTILITY

8.1 OVERVIEW

8.2 RAPID SHUTDOWN

8.3 PANEL-LEVEL MONITORING

8.4 SYSTEM EXPANSION EASE

8.5 MULTIPLE ANGEL INSTALLATION

8.6 HIGHER DURABILITY

8.7 OTHERS

9 INDIA MICRO INVERTER MARKET, BY TYPE

9.1 OVERVIEW

9.2 SINGLE PHASE

9.3 THREE PHASE

10 INDIA MICRO INVERTER MARKET, BY OFFERING

10.1 OVERVIEW

10.2 HARDWARE

10.3 SERVICES

10.4 SOFTWARE

11 INDIA MICRO INVERTER MARKET, BY COMMUNICATION TECHNOLOGY

11.1 OVERVIEW

11.2 WIRED

11.3 WIRELESS

12 INDIA MICRO INVERTER MARKET, BY POWER RATING

12.1 OVERVIEW

12.2 BETWEEN 251 & 500 W

12.3 BELOW 250 W

12.4 ABOVE 500 W

13 INDIA MICRO INVERTER MARKET, BY SALES CHANNEL

13.1 OVERVIEW

13.2 INDIRECT CHANNEL

13.3 DIRECT CHANNEL

14 INDIA MICRO INVERTER MARKET, BY INDUSTRY

14.1 OVERVIEW

14.2 RESIDENTIAL

14.2.1 INDIVIDUAL HOMES

14.2.1.1 RAPID SHUTDOWN

14.2.1.2 PANEL-LEVEL MONITORING

14.2.1.3 SYSTEM EXPANSION EASE

14.2.1.4 MULTIPLE ANGEL INSTALLATION

14.2.1.5 HIGHER DURABILITY

14.2.1.6 OTHERS

14.2.2 APARTMENTS

14.2.2.1 RAPID SHUTDOWN

14.2.2.2 PANEL-LEVEL MONITORING

14.2.2.3 SYSTEM EXPANSION EASE

14.2.2.4 MULTIPLE ANGEL INSTALLATION

14.2.2.5 HIGHER DURABILITY

14.2.2.6 OTHERS

14.2.3 SOCIETIES

14.2.3.1 RAPID SHUTDOWN

14.2.3.2 PANEL-LEVEL MONITORING

14.2.3.3 SYSTEM EXPANSION EASE

14.2.3.4 MULTIPLE ANGEL INSTALLATION

14.2.3.5 HIGHER DURABILITY

14.2.3.6 OTHERS

14.3 COMMERCIAL

14.3.1 RETAIL

14.3.1.1 RAPID SHUTDOWN

14.3.1.2 PANEL-LEVEL MONITORING

14.3.1.3 SYSTEM EXPANSION EASE

14.3.1.4 MULTIPLE ANGEL INSTALLATION

14.3.1.5 HIGHER DURABILITY

14.3.1.6 OTHERS

14.3.2 HOTELS & RESTAURANTS

14.3.2.1 RAPID SHUTDOWN

14.3.2.2 PANEL-LEVEL MONITORING

14.3.2.3 SYSTEM EXPANSION EASE

14.3.2.4 MULTIPLE ANGEL INSTALLATION

14.3.2.5 HIGHER DURABILITY

14.3.2.6 OTHERS

14.3.3 EDUCATIONAL INSTITUTIONS

14.3.3.1 RAPID SHUTDOWN

14.3.3.2 PANEL-LEVEL MONITORING

14.3.3.3 SYSTEM EXPANSION EASE

14.3.3.4 MULTIPLE ANGEL INSTALLATION

14.3.3.5 HIGHER DURABILITY

14.3.3.6 OTHERS

14.3.4 GOVERNMENT INSTITUTIONS

14.3.4.1 RAPID SHUTDOWN

14.3.4.2 PANEL-LEVEL MONITORING

14.3.4.3 SYSTEM EXPANSION EASE

14.3.4.4 MULTIPLE ANGEL INSTALLATION

14.3.4.5 HIGHER DURABILITY

14.3.4.6 OTHERS

14.3.5 HOSPITALS

14.3.5.1 RAPID SHUTDOWN

14.3.5.2 PANEL-LEVEL MONITORING

14.3.5.3 SYSTEM EXPANSION EASE

14.3.5.4 MULTIPLE ANGEL INSTALLATION

14.3.5.5 HIGHER DURABILITY

14.3.5.6 OTHERS

14.3.6 AGRICULTURE

14.3.6.1 RAPID SHUTDOWN

14.3.6.2 PANEL-LEVEL MONITORING

14.3.6.3 SYSTEM EXPANSION EASE

14.3.6.4 MULTIPLE ANGEL INSTALLATION

14.3.6.5 HIGHER DURABILITY

14.3.6.6 OTHERS

14.4 PV POWER PLANTS

14.4.1 ON-GRID

14.4.1.1 RAPID SHUTDOWN

14.4.1.2 PANEL-LEVEL MONITORING

14.4.1.3 SYSTEM EXPANSION EASE

14.4.1.4 MULTIPLE ANGEL INSTALLATION

14.4.1.5 HIGHER DURABILITY

14.4.1.6 OTHERS

14.4.2 OFF-GRID

14.4.2.1 RAPID SHUTDOWN

14.4.2.2 PANEL-LEVEL MONITORING

14.4.2.3 SYSTEM EXPANSION EASE

14.4.2.4 MULTIPLE ANGEL INSTALLATION

14.4.2.5 HIGHER DURABILITY

14.4.2.6 OTHERS

14.4.3 HYBRID

14.4.3.1 RAPID SHUTDOWN

14.4.3.2 PANEL-LEVEL MONITORING

14.4.3.3 SYSTEM EXPANSION EASE

14.4.3.4 MULTIPLE ANGEL INSTALLATION

14.4.3.5 HIGHER DURABILITY

14.4.3.6 OTHERS

15 INDIA MICRO INVERTER MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: INDIA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 ENPHASE ENERGY

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 WAAREE ENERGIES LTD.

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 RECENT DEVELOPMENTS

17.3 FCHOICE SOLAR TECH INDIA PVT LTD

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 RECENT DEVELOPMENT

17.4 P2 POWER SOLUTIONS PVT. LTD.

17.4.1 COMPANY SNAPSHOT

17.4.2 SERVICE PORTFOLIO

17.4.3 RECENT DEVELOPMENT

17.5 SUN SINE SOLUTION PRIVATE LIMITED

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVELOPMENT

17.6 GRACERENEW.COM

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 INFINEON TECHNOLOGIES AG

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 SOLUTION PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 NORDIC (INDIA) SOLUTIONS PVT. LTD

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 360 POWER PRODUCTS

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 SURATEXIM

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 SMA SOLAR TECHNOLOGY AG

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENT

17.12 SUNSIGHTS SOLAR

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 TEXAS INSTRUMENTS INCORPORATED

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 SOLUTION PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 U R ENERGY

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tablas

TABLE 1 PRICE RANGE OF SOME MICRO INVERTERS BY COMPANIES IN INDIA:

TABLE 2 INDIA MICRO INVERTER MARKET, BY CONNECTION TYPE, 2020-2029 (USD THOUSAND)

TABLE 3 INDIA MICRO INVERTER MARKET, BY CONNECTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 4 INDIA GRID-TIED IN MICRO INVERTER MARKET, BY PLATFORM, 2020-2029 (USD THOUSAND)

TABLE 5 INDIA STAND-ALONE IN MICRO INVERTER MARKET, BY POWER OUTPUT TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 INDIA MICRO INVERTER MARKET, BY UTILITY, 2020-2029 (USD THOUSAND)

TABLE 7 INDIA MICRO INVERTER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 INDIA MICRO INVERTER MARKET, BY OFFERING, 2020-2029 (USD THOUSAND)

TABLE 9 INDIA MICRO INVERTER MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 10 INDIA MICRO INVERTER MARKET, BY POWER RATING, 2020-2029 (USD THOUSAND)

TABLE 11 INDIA MICRO INVERTER MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 12 INDIA MICRO INVERTER MARKET, BY INDUSTRY, 2020-2029 (USD THOUSAND)

TABLE 13 INDIA RESIDENTIAL IN MICRO INVERTER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 14 INDIA INDIVIDUAL HOMES IN MICRO INVERTER MARKET, BY UTILITY, 2020-2029 (USD THOUSAND)

TABLE 15 INDIA APARTMENTS IN MICRO INVERTER MARKET, BY UTILITY, 2020-2029 (USD THOUSAND)

TABLE 16 INDIA SOCIETIES IN MICRO INVERTER MARKET, BY UTILITY, 2020-2029 (USD THOUSAND)

TABLE 17 INDIA COMMERCIAL IN MICRO INVERTER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 18 INDIA RETAIL IN MICRO INVERTER MARKET, BY UTILITY, 2020-2029 (USD THOUSAND)

TABLE 19 INDIA HOTELS & RESTAURANTS IN MICRO INVERTER MARKET, BY UTILITY, 2020-2029 (USD THOUSAND)

TABLE 20 INDIA EDUCATIONAL INSTITUTIONS IN MICRO INVERTER MARKET, BY UTILITY, 2020-2029 (USD THOUSAND)

TABLE 21 INDIA GOVERNMENT INSTITUTIONS IN MICRO INVERTER MARKET, BY UTILITY, 2020-2029 (USD THOUSAND)

TABLE 22 INDIA HOSPITALS IN MICRO INVERTER MARKET, BY UTILITY, 2020-2029 (USD THOUSAND)

TABLE 23 INDIA AGRICULTURE IN MICRO INVERTER MARKET, BY UTILITY, 2020-2029 (USD THOUSAND)

TABLE 24 INDIA PV POWER PLANTS IN MICRO INVERTER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 25 INDIA ON-GRID IN MICRO INVERTER MARKET, BY UTILITY, 2020-2029 (USD THOUSAND)

TABLE 26 INDIA OFF-GRID IN MICRO INVERTER MARKET, BY UTILITY, 2020-2029 (USD THOUSAND)

TABLE 27 INDIA HYBRID IN MICRO INVERTER MARKET, BY UTILITY, 2020-2029 (USD THOUSAND)

Lista de figuras

FIGURE 1 INDIA MICRO INVERTER MARKET: SEGMENTATION

FIGURE 2 INDIA MICRO INVERTER MARKET: DATA TRIANGULATION

FIGURE 3 INDIA MICRO INVERTER MARKET: DROC ANALYSIS

FIGURE 4 INDIA MICRO INVERTER MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 INDIA MICRO INVERTER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 INDIA MICRO INVERTER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 INDIA MICRO INVERTER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 INDIA MICRO INVERTER MARKET: SEGMENTATION

FIGURE 9 RISE IN DEMAND OF RENEWABLE ENERGY ACROSS THE SECTOR IS EXPECTED TO DRIVE THE INDIA MICRO INVERTER MARKETIN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 10 GRID-TIED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF INDIA MICRO INVERTER MARKETIN 2022 & 2029

FIGURE 11 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF INDIA MICRO INVERTER MARKET

FIGURE 12 GLOBAL CUMULATIVE PV INSTALLATION, BY REGION (2020)

FIGURE 13 INDIA MICRO INVERTER MARKET: BY CONNECTION TYPE, 2021

FIGURE 14 INDIA MICRO INVERTER MARKET: BY UTILITY, 2021

FIGURE 15 INDIA MICRO INVERTER MARKET: BY TYPE, 2021

FIGURE 16 INDIA MICRO INVERTER MARKET: BY OFFERING, 2021

FIGURE 17 INDIA MICRO INVERTER MARKET: BY COMMUNICATION TECHNOLOGY, 2021

FIGURE 18 INDIA MICRO INVERTER MARKET: BY POWER RATING, 2021

FIGURE 19 INDIA MICRO INVERTER MARKET: BY SALES CHANNEL, 2021

FIGURE 20 INDIA MICRO INVERTER MARKET: BY INDUSTRY, 2021

FIGURE 21 INDIA MICRO INVERTER MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.