Mercado de vehículos eléctricos de la India, por potencia de salida (menos de 100 KW, de 100 a 250 KW y más de 250 KW), clase de vehículo (de precio medio y de lujo), tipo de motor eléctrico (motores de CC, motores de CC sin escobillas, motores síncronos de imán permanente y motores de inducción trifásicos), tipo de estación de carga (carga normal y súper carga), tipo de nivel (nivel 1, nivel 2, nivel 3), número de ruedas (vehículo de dos ruedas, vehículo de tres ruedas y vehículo de cuatro ruedas), tipo de propulsión (VEB, VCEV, VHEV y VHE), tendencias de la industria y pronóstico hasta 2029

Definición y perspectivas del mercado

Un vehículo eléctrico es un vehículo que funciona total o parcialmente con electricidad. A diferencia de los vehículos convencionales que solo utilizan combustibles fósiles, los vehículos eléctricos utilizan un motor eléctrico alimentado por una pila de combustible o baterías. "vehículo eléctrico" o "VE" son los términos comunes que se utilizan para un vehículo eléctrico. En la mayoría de los casos, el término incluye tanto a los BEV como a los PHEV. Las letras BEV significan vehículos eléctricos de batería, mientras que PHEV significan vehículos eléctricos híbridos enchufables.

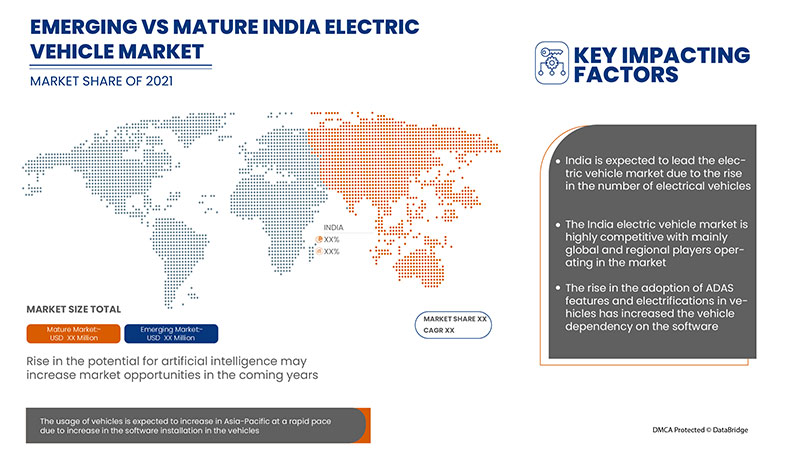

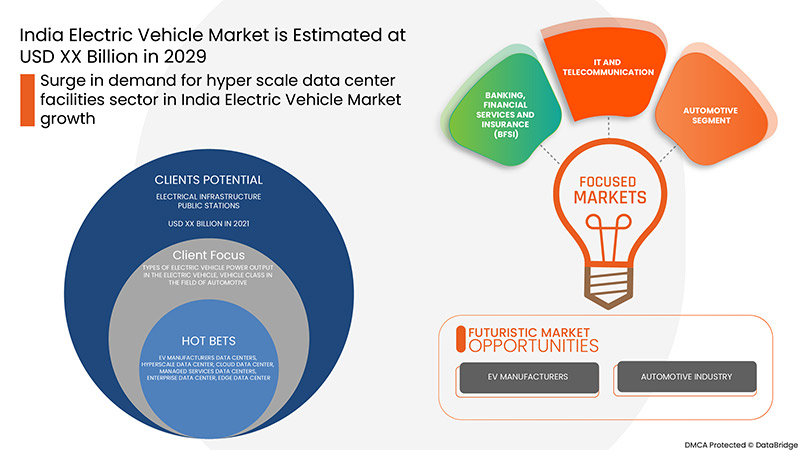

En la actualidad, la importancia de los vehículos eléctricos ha crecido drásticamente y el crecimiento de los servicios basados en estaciones de carga de CA/carga normal, estaciones de carga de CC/carga superrápida y estaciones de carga inductiva en toda la India. Además, la creciente demanda de vehículos eléctricos de diferente potencia y clase de vehículo en varios sectores ha impulsado el auge del mercado. Data Bridge Market Research analiza que el mercado de vehículos eléctricos de la India crecerá a una CAGR del 25,1% durante el período de pronóstico de 2022 a 2029.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Año histórico |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

Por potencia de salida (menos de 100 KW, de 100 a 250 KW y más de 250 KW), clase de vehículo (de precio medio y de lujo), tipo de motor eléctrico (motores de CC, motores de CC sin escobillas, motores síncronos de imán permanente y motores de inducción trifásicos), tipo de estación de carga (carga normal y carga superrápida), tipo de nivel (nivel 1, nivel 2, nivel 3), número de ruedas (vehículo de dos ruedas, vehículo de tres ruedas y vehículo de cuatro ruedas), tipo de propulsión (VEB, VEB de celda de combustible, VEB híbrido enchufable y VEB híbrido enchufable) |

|

Países cubiertos |

India |

|

Actores del mercado cubiertos |

ABB (Alemania), Tata Power (India), P2 Power Solutions (India), Fortum (India), Delta Electronics, Inc. (China), Exicom Tele-Systems (India), Ensto Oy (Finlandia), Mass-Tech Controls Pvt. Ltd. (India), BRIGHTBLU (India) y Tata Motors (India), Hero Electric (India), Ola Electric Technologies Private Ltd. (India), Greaves Electric Mobility Private Limited (India), MG Motor India Pvt. Ltd. (India), Mahindra Electric Mobility Limited (India), Olectra Greentech Limited (India), Hyundai Motor Company (India), LOHIA AUTO INDUSTRIES (India), Okinawa Autotech Pvt. Ltd (India), Ford Motor Company (EE. UU.) |

Dinámica del mercado de vehículos eléctricos en India

Conductores

- Creciente demanda de vehículos eléctricos

La industria automotriz ha experimentado un enorme crecimiento a lo largo de los años debido a la creciente demanda de vehículos eléctricos de lujo. Algunos de los factores que impulsan las ventas de vehículos eléctricos incluyen las estrictas regulaciones gubernamentales sobre las emisiones de los vehículos y la creciente demanda de vehículos de bajo consumo de combustible, alto rendimiento y bajas emisiones.

- Incentivos y subsidios del gobierno para vehículos eléctricos

El aumento de la contaminación y la escasez de recursos, particularmente en el sector automotriz, ha permitido al gobierno tomar medidas para la protección del medio ambiente, lo que está liderando el cambio de tendencia en la industria automotriz de vehículos motorizados normales a vehículos híbridos eléctricos para la protección del medio ambiente.

Por lo tanto, se ha observado que los gobiernos estatales están difundiendo entre los ciudadanos la conciencia sobre los vehículos eléctricos y sus características. El gobierno ofrece beneficios como la redención de impuestos o el reembolso por promover los vehículos eléctricos. Las opciones de las personas están cambiando hacia vehículos eléctricos automatizados y tecnológicamente actualizados. Se espera que los incentivos y subsidios del gobierno para vehículos eléctricos actúen como un factor impulsor para el mercado de vehículos eléctricos y estaciones de carga de vehículos eléctricos de la India.

- Crecientes preocupaciones medioambientales

La contaminación de los vehículos es una preocupación importante para el medio ambiente y también está relacionada con el aumento del calentamiento global desde hace décadas. Pero a medida que la tecnología se actualiza, el cambio de paradigma de los vehículos normales (que funcionan con combustibles como el petróleo, el GNC ) a los vehículos eléctricos se ha incrementado rápidamente y también lo han hecho las estaciones de carga de vehículos eléctricos, lo que ha hecho de la carga un paradigma de "reabastecimiento" diferente.

Los vehículos eléctricos son el gran futuro del sector automovilístico, ya que incluyen muchos avances tecnológicos que pueden ayudar a prevenir la contaminación del aire, la contaminación acústica y otros factores relacionados con el medio ambiente. Se ha observado que los vehículos de pasajeros producen una cantidad significativa de óxidos de nitrógeno, monóxido de carbono y otros contaminantes.

- Creciente popularidad del modelo de movilidad como servicio (MaaS)

El concepto de movilidad como servicio (MaaS) ha ido ganando popularidad en el sector de los automóviles eléctricos. Cada vez más fabricantes, proveedores de servicios, empresas, responsables políticos y el público en general están centrando su atención en la movilidad eléctrica por su comodidad.

Sin embargo, varias ciudades, estados y naciones están adoptando regulaciones que fomentan el uso de vehículos eléctricos y, por lo tanto, de estaciones de carga. La movilidad eléctrica como servicio (eMaaS) está ganando popularidad y se ha convertido en una de las soluciones más sencillas y principales para los desafíos actuales de la movilidad eléctrica.

- Adopción creciente de vehículos de pasajeros como autobuses eléctricos

El gobierno de la India ha tomado múltiples iniciativas para promover la fabricación y la adopción de vehículos eléctricos de pasajeros para el transporte público en el país. Los autobuses son el principal medio de transporte público en la India y este modo de transporte realiza entre el 20 y el 40 por ciento de los viajes urbanos en muchas grandes ciudades.

La creciente adopción de autobuses eléctricos en la India se debe a la preocupación por el medio ambiente, que aumenta día a día. La introducción y adopción de autobuses eléctricos ayudará a construir un sistema de movilidad más sostenible e inteligente que mejore la calidad de vida de todos.

Oportunidades

- Creciente adopción de fuentes de energía renovables para la electricidad

El concepto de los coches eléctricos como forma de evitar mayores daños al medio ambiente está generando revuelo entre la gente de todo el mundo, pero la electricidad para cargar estos coches se genera en centrales eléctricas de carbón, lo que conlleva un mayor uso de los recursos naturales, que los vuelven escasos.

Por lo tanto, no sería necesario cambiar los coches de gasolina por vehículos eléctricos, pero el consumo de energía ha cambiado por completo y para generar electricidad se utilizan mayoritariamente fuentes renovables.

Por lo tanto, el cambio hacia el uso de fuentes de energía renovables está haciendo que los vehículos eléctricos sean más eficientes, lo que creará una oportunidad para que el mercado crezca en la India.

Restricciones y desafíos que enfrenta el mercado de vehículos eléctricos de la India

- Altos costos de equipamiento e instalación

El número de vehículos eléctricos está aumentando rápidamente, al igual que el número de estaciones de carga. Sin embargo, el coste de instalación de las estaciones de carga es un poco alto, lo que supone un reto para los fabricantes de las estaciones de carga, ya que incurrirían en pérdidas si el número de estaciones de carga fuera menor.

Los componentes necesarios para instalar una estación de carga incluyen materiales de electricista, mano de obra de electricista, hardware de la estación de carga, red eléctrica, equipo de mantenimiento, otros materiales y mano de obra, transformador y movilización.

Se ha observado que el costo de instalación de las estaciones de carga varía según las distintas aplicaciones, y es mayor y varía según la aplicación. Por lo tanto, este factor se considerará un desafío para el mercado en el período de pronóstico.

Impacto de la COVID-19 en el mercado de vehículos eléctricos de la India

La COVID-19 ha afectado positivamente al mercado de vehículos eléctricos de la India. Como la producción de datos no se vio afectada por los confinamientos, las empresas e instituciones trabajaron constantemente en estos datos para mejorar sus productos. La demanda de más vehículos eléctricos se observó en esa fase.

Acontecimientos recientes

- En diciembre de 2021, Hero Electric colaboró con Log9 para ofrecer una carga rápida en vehículos eléctricos de dos ruedas. Esta asociación ha mejorado el rendimiento de la batería de los vehículos eléctricos de dos ruedas. El nuevo modelo del producto se lanzará para satisfacer la demanda del mercado de carga rápida.

- En mayo de 2022, Mahindra Electric Mobility Limited se asoció con Terrago Logistics. La asociación aumentará la flota de vehículos de carga con empresas de venta de comestibles en línea. El próximo mes, Mahindra suministrará vehículos eléctricos adicionales a Terrago. Esto ayudará a la empresa a lanzar vehículos de cero emisiones al mercado.

Panorama del mercado de vehículos eléctricos en India

El mercado de vehículos eléctricos de la India está segmentado en función de la potencia de salida, la clase de vehículo, el tipo de motor eléctrico, el tipo de estación de carga, el tipo de nivel, la cantidad de ruedas y el tipo de propulsión. El crecimiento entre estos segmentos lo ayudará a analizar los segmentos de crecimiento escaso en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Potencia de salida

- Menos de 100 KW

- De 100 a 250 KW

- Más de 250 KW

Sobre la base de la potencia de salida, el mercado de vehículos eléctricos de la India se segmenta en menos de 100 KW, de 100 a 250 KW y más de 250 KW.

Clase de vehículo

- Precio medio

- Lujo

Sobre la base de la clase de vehículo, el mercado de vehículos eléctricos de la India está segmentado en modelos de precio medio y de lujo.

Tipo de motor eléctrico

- Motores de corriente continua

- Motores de corriente continua sin escobillas

- Motores síncronos de imanes permanentes

- Motores de inducción trifásicos

Sobre la base del tipo de motor eléctrico, el mercado de vehículos eléctricos de la India está segmentado en motores de CC, motores de CC sin escobillas, motores síncronos de imanes permanentes y motores de inducción trifásicos.

Tipo de estación de carga

- Carga normal

- Súper carga

Sobre la base del tipo de estación de carga, el mercado de vehículos eléctricos de la India está segmentado en carga normal y súper carga.

Tipo de nivel

- Nivel 1

- Nivel 2

- Nivel 3

Sobre la base del tipo de nivel, el mercado de vehículos eléctricos de la India se segmenta en Nivel 1, Nivel 2 y Nivel 3.

Número de ruedas

- Vehículo de dos ruedas

- Triciclo

- Vehículo de cuatro ruedas

Sobre la base del número de ruedas, el mercado de vehículos eléctricos de la India se segmenta en vehículos de dos ruedas, vehículos de tres ruedas y vehículos de cuatro ruedas.

Tipo de propulsión

- VEB

- Vehículos eléctricos de pila de combustible

- Vehículo híbrido enchufable (PHEV)

- Vehículo eléctrico híbrido (HEV)

Sobre la base del tipo de propulsión, el mercado de vehículos eléctricos de la India está segmentado en BEV, FCEV, PHEV y HEV.

Análisis del panorama competitivo y de la cuota de mercado de vehículos eléctricos en la India

El panorama competitivo del mercado de vehículos eléctricos ofrece detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de vehículos eléctricos.

Algunos de los principales actores clave en el mercado de vehículos eléctricos de la India son Hero Electric, Mahindra Electric Mobility Limited (subsidiaria de Mahindra & Mahindra Ltd.), Hyundai Motor India (subsidiaria de Hyundai Motor Company), Olectra Greentech Limited (subsidiaria de MEIL Group), Greaves Electric Mobility Private Limited, LOHIA AUTO INDUSTRIES, Okinawa Autotech Pvt. Ltd, Ford Motor Company, TATA MOTORS, Ola Electric Technologies Private Ltd, MG Motor India Pvt. Ltd (subsidiaria de SAIC Motor Corporation Limited), entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.