Global Treasury Software Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

3.67 Billion

USD

4.68 Billion

2024

2032

USD

3.67 Billion

USD

4.68 Billion

2024

2032

| 2025 –2032 | |

| USD 3.67 Billion | |

| USD 4.68 Billion | |

|

|

|

|

Segmentación del mercado global de software de tesorería por sistema operativo (Windows, Linux, iOS, Android y Mac), aplicación (gestión de liquidez y efectivo, gestión de inversiones, gestión de deuda, gestión de riesgos financieros, gestión de cumplimiento, planificación fiscal, etc.), modo de implementación (local y en la nube), tamaño de la organización (grandes y medianas empresas), sector vertical (banca, servicios financieros y seguros, gobierno, manufactura, atención médica, bienes de consumo, productos químicos, energía, etc.): tendencias del sector y pronóstico hasta 2032.

Tamaño del mercado de software de tesorería

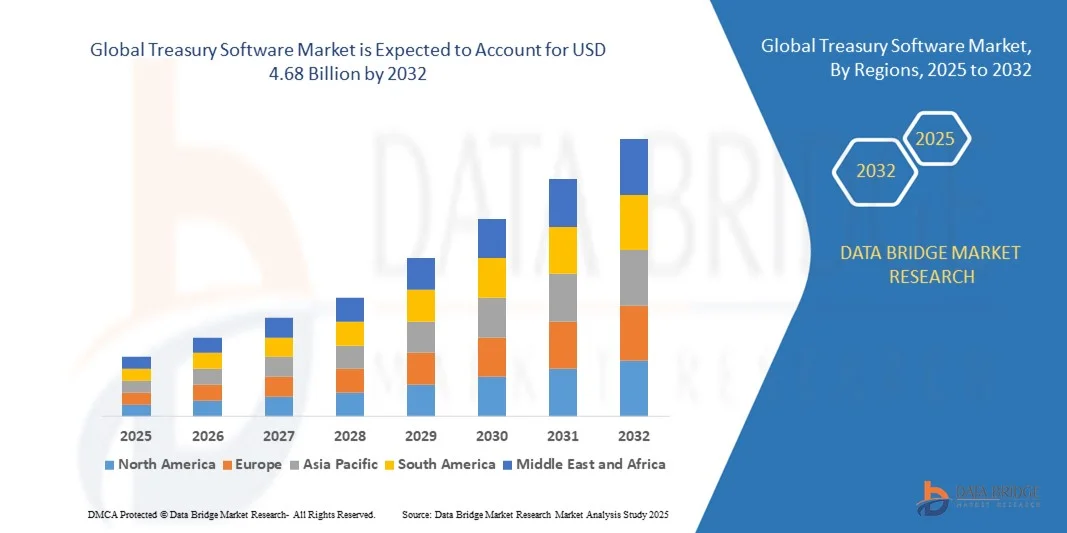

- El tamaño del mercado global de software de tesorería se valoró en USD 3.67 mil millones en 2024 y se espera que alcance los USD 4.68 mil millones para 2032 , con una CAGR del 3,1% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente adopción de soluciones de gestión financiera digital y los avances tecnológicos continuos en las operaciones de tesorería, que conducen a una mejor automatización, informes en tiempo real y una mejor visibilidad del flujo de caja para las empresas.

- Además, la creciente demanda de plataformas seguras, integradas y fáciles de usar para gestionar la liquidez, las inversiones, el riesgo y el cumplimiento normativo por parte de las organizaciones está consolidando el software de tesorería como una herramienta esencial para la gestión financiera moderna. Estos factores convergentes están acelerando la adopción de soluciones de tesorería, impulsando así significativamente el crecimiento del mercado.

Análisis del mercado de software de tesorería

- El software de tesorería se refiere a plataformas digitales que permiten a las organizaciones gestionar el efectivo, la liquidez, las inversiones, la deuda, los riesgos financieros y el cumplimiento normativo de forma eficiente. Estos sistemas se integran con la planificación de recursos empresariales (ERP) y las plataformas bancarias para proporcionar control centralizado, información en tiempo real y automatización de los procesos rutinarios.

- La creciente demanda de software de tesorería está impulsada principalmente por la necesidad de eficiencia operativa, mayor transparencia financiera, cumplimiento normativo y la creciente preferencia por soluciones basadas en la nube y accesibles desde dispositivos móviles que permiten a los tesoreros monitorear y administrar las finanzas corporativas de forma remota.

- América del Norte dominó el mercado de software de tesorería con una participación del 41,55 % en 2024, debido a una creciente demanda de gestión financiera digital y automatización en las empresas.

- Se espera que Asia-Pacífico sea la región de más rápido crecimiento en el mercado de software de tesorería durante el período de pronóstico debido a la creciente urbanización, la creciente adopción digital y los avances tecnológicos en países como China, Japón e India.

- El segmento local dominó el mercado con una cuota del 52,8 % en 2024, debido a la preferencia de las organizaciones por el control total de los datos financieros confidenciales, el cumplimiento normativo en materia de seguridad y las opciones de personalización. Muchas grandes empresas siguen invirtiendo en soluciones locales para mantener la gobernanza interna y una integración profunda con la infraestructura de TI existente. La fiabilidad y estabilidad de las implementaciones locales las convierten en la opción preferida para las operaciones de tesorería de misión crítica.

Alcance del informe y segmentación del mercado de software de tesorería

|

Atributos |

Perspectivas clave del mercado del software de tesorería |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos del mercado, como el valor de mercado, la tasa de crecimiento, los segmentos del mercado, la cobertura geográfica, los actores del mercado y el escenario del mercado, el informe de mercado elaborado por el equipo de investigación de mercado de Data Bridge incluye un análisis experto en profundidad, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y análisis pestle. |

Tendencias del mercado de software de tesorería

Creciente adopción de soluciones de tesorería móviles y basadas en la nube

- El mercado del software de tesorería se ve cada vez más influenciado por la integración de soluciones basadas en la nube y móviles, que ofrecen mayor accesibilidad, escalabilidad y seguridad a los equipos de finanzas corporativas. La tecnología en la nube permite a las organizaciones centralizar las operaciones de tesorería en diferentes geografías, reduciendo los costes de infraestructura y mejorando la agilidad operativa.

- Por ejemplo, Kyriba ha ganado relevancia en las plataformas de tesorería y gestión de riesgos en la nube, proporcionando a sus clientes empresariales herramientas seguras y nativas de la nube para la gestión de liquidez, la visibilidad del efectivo y el acceso móvil. Las alianzas de la compañía con instituciones financieras demuestran cómo los proveedores ofrecen innovación en la nube para satisfacer las cambiantes demandas de la tesorería.

- La adopción de soluciones de tesorería móviles proporciona a ejecutivos y responsables financieros acceso permanente a datos financieros críticos a través de teléfonos inteligentes y tabletas. Esto garantiza que las operaciones de tesorería, como la autorización de pagos, la verificación de la liquidez y la supervisión de los riesgos del mercado, se puedan realizar en tiempo real, independientemente de la ubicación.

- Las plataformas de tesorería nativas de la nube también ofrecen análisis integrados y aprendizaje automático para la previsión predictiva de efectivo y el análisis de escenarios, lo que mejora la velocidad y la precisión en la toma de decisiones. Estos avances permiten a las empresas identificar proactivamente la exposición a divisas, gestionar los riesgos de las tasas de interés y alinear las estrategias de liquidez con las fluctuaciones del mercado.

- La integración de la tesorería en la nube con las infraestructuras de pago digitales y blockchain está impulsando aún más la transparencia de las transacciones y la eficiencia de los pagos transfronterizos. Proveedores como FIS Global están incorporando soluciones basadas en blockchain para una liquidación de pagos más rápida y procesos de conciliación más seguros, impulsando la innovación en los flujos de trabajo financieros.

- La creciente dependencia de las soluciones de tesorería en la nube y móviles refleja una transición más amplia hacia la transformación digital en las finanzas corporativas. Esta tendencia facilita la resiliencia y la flexibilidad en las operaciones de tesorería, además de respaldar objetivos estratégicos como la mejora del cumplimiento normativo y la mitigación de riesgos en redes financieras diversificadas.

Dinámica del mercado de software de tesorería

Conductor

Demanda de flujo de caja en tiempo real y gestión de riesgos

- La necesidad de obtener información en tiempo real sobre la liquidez corporativa y la gestión de riesgos se ha convertido en un factor clave en la adopción de software de tesorería. Las empresas se enfrentan a una creciente complejidad en las operaciones financieras, lo que exige que los equipos de tesorería gestionen con precisión y rapidez las fluctuaciones cambiarias, la volatilidad de los tipos de interés y los desafíos de los pagos globales.

- Por ejemplo, los módulos de tesorería y gestión de riesgos de SAP permiten a las empresas integrar las posiciones de efectivo, prever las necesidades de liquidez y automatizar los procesos de contabilidad de cobertura. Al ofrecer visibilidad y control en tiempo real, estas herramientas ayudan a las organizaciones a minimizar los riesgos financieros y a cumplir con los marcos regulatorios en constante evolución.

- El software de tesorería facilita la visibilidad centralizada de las posiciones de efectivo multientidad y multidivisa, proporcionando a los directores financieros y tesoreros acceso instantáneo a los saldos de efectivo y las necesidades de financiación. Este nivel de transparencia permite a las organizaciones optimizar la asignación de liquidez, reducir los saldos inactivos y mejorar las estrategias de inversión para los excedentes de fondos.

- La creciente globalización de las empresas y la complejidad de las transacciones financieras transfronterizas han aumentado la necesidad de contar con herramientas robustas de gestión de riesgos. Las plataformas de tesorería apoyan a las empresas ofreciendo análisis avanzados para la medición de la exposición, la gestión del cumplimiento normativo y la generación de informes en tiempo real a las partes interesadas.

- La creciente demanda de monitorización continua de la liquidez y evaluación proactiva de riesgos hace indispensables las soluciones de tesorería. A medida que las empresas amplían sus operaciones a nivel mundial, las prácticas de tesorería en tiempo real se están convirtiendo en un factor clave para la estabilidad y la eficiencia financiera en todos los sectores.

Restricción/Desafío

Integración con sistemas bancarios y ERP heredados

- Un desafío crítico para la adopción de software de tesorería radica en la dificultad de integrar soluciones digitales avanzadas con los sistemas de planificación de recursos empresariales (ERP) existentes y las diversas plataformas bancarias. Muchas empresas multinacionales operan en entornos de TI heredados que dificultan la migración fluida de datos y la interoperabilidad.

- Por ejemplo, las empresas que utilizan sistemas ERP tradicionales, como Oracle E-Business Suite o interfaces bancarias más antiguas, suelen experimentar retrasos y mayores costos al integrar aplicaciones de tesorería modernas. Esto limita la eficacia de la visibilidad del efectivo en tiempo real y la conciliación de transacciones.

- Las dependencias de los sistemas heredados generan silos de datos fragmentados que dificultan la comprensión financiera integral. Sin conexiones optimizadas entre el software de tesorería, los módulos ERP y las redes bancarias, las empresas se enfrentan a la necesidad de conciliar manualmente los datos, duplican los procesos e ineficiencias en la elaboración de informes.

- Los desafíos de interoperabilidad se extienden a las limitaciones para automatizar los flujos de trabajo de pago y garantizar la estandarización de formatos en múltiples bancos globales. Los equipos de tesorería suelen encontrar inconsistencias en el intercambio de datos y los mensajes de liquidación, lo que puede aumentar las tasas de error y los riesgos de incumplimiento.

- Resolver estos problemas de integración requiere inversión en tecnología de middleware, API de banca abierta y la modernización gradual de los sistemas ERP. Superar estas barreras será esencial para garantizar que las plataformas de tesorería avanzadas puedan funcionar de forma óptima en ecosistemas financieros interconectados.

Alcance del mercado del software de tesorería

El mercado está segmentado según el sistema operativo, la aplicación, el modo de implementación, el tamaño de la organización y la vertical.

- Por sistema operativo

Según el sistema operativo, el mercado de software de tesorería se segmenta en Windows, Linux, iOS, Android y Mac. El segmento Windows dominó la mayor cuota de mercado en 2024, impulsado por su amplia adopción en entornos de TI corporativos y su compatibilidad con sistemas financieros tradicionales. Las empresas suelen preferir las soluciones de tesorería basadas en Windows debido a su sólido ecosistema de soporte, su interfaz intuitiva y sus capacidades de integración con software de planificación de recursos empresariales (ERP) y financiero. La familiaridad de los equipos de TI con los entornos Windows fomenta aún más su implementación continua en las operaciones de tesorería, lo que permite flujos de trabajo fluidos y una gestión eficiente del sistema.

Se prevé que el segmento Android experimente el mayor crecimiento entre 2025 y 2032, impulsado por el creciente uso de aplicaciones móviles de tesorería y la necesidad de acceso en tiempo real a los datos financieros. Las soluciones de tesorería compatibles con Android permiten a los profesionales gestionar la liquidez, los pagos y las inversiones de forma remota, lo que mejora la eficiencia operativa. La escalabilidad de la plataforma, su amplia compatibilidad con dispositivos y los menores costes de desarrollo en comparación con iOS contribuyen a su rápida adopción en empresas de diversos tamaños.

- Por aplicación

Según su aplicación, el mercado se segmenta en gestión de liquidez y efectivo, gestión de inversiones, gestión de deuda, gestión de riesgos financieros, gestión de cumplimiento normativo, planificación fiscal, entre otros. El segmento de gestión de liquidez y efectivo registró la mayor participación en los ingresos en 2024, ya que las organizaciones priorizan la monitorización en tiempo real de las posiciones de efectivo y la optimización del capital circulante. Estas soluciones ayudan a los tesoreros a mantener una liquidez adecuada, gestionar las inversiones a corto plazo y optimizar los flujos de caja internos, garantizando así la continuidad operativa. La creciente complejidad de las transacciones financieras y la necesidad de previsiones de efectivo automatizadas impulsan aún más la adopción de software de tesorería centrado en la liquidez.

Se prevé que el segmento de gestión de riesgos financieros experimente el mayor crecimiento entre 2025 y 2032, impulsado por la creciente exposición a los riesgos de mercado, crediticios y operativos. Las organizaciones utilizan cada vez más las soluciones de tesorería para modelar, supervisar y mitigar los riesgos asociados a las fluctuaciones cambiarias, las tasas de interés y las contrapartes. Las herramientas mejoradas de análisis, planificación de escenarios y cumplimiento normativo integradas en estos sistemas refuerzan la confianza en la toma de decisiones estratégicas, lo que fomenta una rápida adopción en todos los sectores.

- Por modo de implementación

Según el modo de implementación, el mercado de software de tesorería se segmenta en local y en la nube. El segmento local dominó el mercado con una participación del 52,8 % en 2024, gracias a la preferencia de las organizaciones por el control total de sus datos financieros confidenciales, el cumplimiento normativo en materia de seguridad y las opciones de personalización. Muchas grandes empresas siguen invirtiendo en soluciones locales para mantener la gobernanza interna y una integración profunda con la infraestructura de TI existente. La fiabilidad y estabilidad de las implementaciones locales las convierten en la opción preferida para las operaciones de tesorería de misión crítica.

Se prevé que el segmento de la nube experimente el mayor crecimiento entre 2025 y 2032, impulsado por la creciente demanda de soluciones de tesorería escalables, accesibles y rentables. Los sistemas en la nube ofrecen acceso remoto, informes en tiempo real y actualizaciones fluidas, lo que permite a las organizaciones adaptarse rápidamente a entornos financieros dinámicos. Las pequeñas y medianas empresas, en particular, están adoptando cada vez más las implementaciones en la nube para reducir la sobrecarga de TI y, al mismo tiempo, obtener funcionalidades de nivel empresarial.

- Por tamaño de la organización

Según el tamaño de la organización, el mercado se segmenta en grandes empresas y pequeñas y medianas empresas (PYME). El segmento de grandes empresas dominó la cuota de mercado en 2024, ya que estas organizaciones gestionan operaciones de tesorería complejas en múltiples geografías y divisas. Las grandes empresas se benefician de soluciones de tesorería avanzadas para consolidar la gestión de efectivo, automatizar los pagos, mitigar riesgos y garantizar el cumplimiento de las regulaciones financieras globales. Su importante capacidad de inversión permite la personalización e integración del software de tesorería con otros sistemas empresariales, lo que impulsa su adopción.

Se prevé que el segmento de las pymes experimente el mayor crecimiento entre 2025 y 2032, impulsado por la creciente concienciación sobre las herramientas de tesorería digital y la necesidad de una gestión eficiente de la tesorería y los riesgos. Las pymes están adoptando soluciones escalables y rentables para mejorar la eficiencia operativa, obtener visibilidad en tiempo real de los flujos de caja y optimizar la toma de decisiones. Las ofertas basadas en la nube y los modelos de precios de suscripción facilitan aún más su adopción entre las pequeñas empresas con recursos de TI limitados.

- Por Vertical

Según el sector vertical, el mercado de software de tesorería se segmenta en banca, servicios financieros y seguros (BFSI), gobierno, manufactura, salud, bienes de consumo, productos químicos, energía, entre otros. El segmento BFSI dominó el mercado en 2024 debido a la necesidad del sector de gestionar grandes volúmenes de transacciones financieras, liquidez y requisitos de cumplimiento. Los bancos y las instituciones financieras dependen en gran medida de las soluciones de tesorería para optimizar la gestión de efectivo, las operaciones de inversión y la supervisión de riesgos, garantizando así el cumplimiento normativo y la eficiencia operativa. Las capacidades de análisis avanzado y monitorización en tiempo real hacen que estas soluciones sean indispensables para el sector BFSI.

Se prevé que el segmento manufacturero experimente el mayor crecimiento entre 2025 y 2032, impulsado por la creciente complejidad de las cadenas de suministro, las transacciones internacionales y los requisitos de gestión del flujo de caja. Los fabricantes están adoptando software de tesorería para optimizar el capital circulante, gestionar la exposición cambiaria y mejorar la planificación financiera general. La integración con sistemas ERP y el procesamiento automatizado de pagos mejora aún más la eficiencia, impulsando una rápida adopción en todo el sector.

Análisis regional del mercado de software de tesorería

- América del Norte dominó el mercado de software de tesorería con la mayor participación en los ingresos del 41,55 % en 2024, impulsada por una creciente demanda de gestión financiera digital y automatización en las empresas.

- Las organizaciones de la región valoran mucho el monitoreo del flujo de efectivo en tiempo real, la gestión de riesgos y el cumplimiento simplificado que ofrecen las soluciones de tesorería.

- La adopción generalizada se ve respaldada además por una infraestructura tecnológicamente avanzada, un alto gasto en TI y la presencia de importantes instituciones financieras, que establecen el software de tesorería como una herramienta clave para operaciones financieras corporativas eficientes.

Perspectivas del mercado de software del Tesoro de EE. UU.

El mercado estadounidense de software de tesorería captó la mayor participación en ingresos de Norteamérica en 2024, impulsado por la rápida transformación digital y la adopción de soluciones de tesorería automatizadas. Las empresas priorizan cada vez más la optimización de la liquidez, la supervisión de las inversiones y la mitigación de riesgos mediante plataformas de software integradas. La creciente demanda de soluciones en la nube, acceso móvil y análisis avanzados para la toma de decisiones en tiempo real impulsa aún más el crecimiento del mercado. Además, la presencia de proveedores de software líderes y el énfasis del país en la innovación fintech contribuyen significativamente a la expansión del mercado.

Perspectivas del mercado de software de tesorería en Europa

Se prevé que el mercado europeo de software de tesorería se expanda a una tasa de crecimiento anual compuesta (TCAC) sustancial durante el período de pronóstico, impulsado principalmente por los requisitos de cumplimiento normativo y la creciente necesidad de una mayor transparencia financiera en las empresas. Las organizaciones están adoptando soluciones de tesorería para optimizar la gestión de efectivo, gestionar los riesgos financieros y mejorar la supervisión de las inversiones. El aumento de las transacciones transfronterizas, sumado a la creciente adopción digital en el sector corporativo, está impulsando la implementación de software de tesorería. Las empresas europeas también están integrando sus sistemas de tesorería con sistemas ERP y plataformas de informes financieros para garantizar la eficiencia y el cumplimiento normativo.

Perspectivas del mercado de software del Tesoro del Reino Unido

Se prevé que el mercado británico de software de tesorería crezca a una tasa de crecimiento anual compuesta (TCAC) notable durante el período de pronóstico, impulsado por la demanda de una sólida gestión del riesgo financiero y soluciones automatizadas de liquidez. Las empresas se centran en la visibilidad del efectivo en tiempo real, el cumplimiento normativo y la asignación eficiente de fondos, lo que impulsa la adopción de software de tesorería. El sólido ecosistema fintech del Reino Unido, la infraestructura de banca digital y el uso generalizado de soluciones en la nube impulsan aún más el crecimiento del mercado entre las grandes empresas y las pymes.

Análisis del mercado de software del Tesoro alemán

Se espera que el mercado alemán de software de tesorería se expanda a una tasa de crecimiento anual compuesta (TCAC) considerable durante el período de pronóstico, impulsado por la adopción de soluciones financieras digitales avanzadas y un enfoque en la gestión de riesgos y el cumplimiento normativo. Las empresas implementan cada vez más software de tesorería para optimizar la liquidez, supervisar las carteras de inversión y automatizar los procesos de generación de informes. La sólida base industrial de Alemania, el énfasis en la digitalización y las rigurosas regulaciones financieras fomentan la implementación de soluciones de tesorería tanto en el sector corporativo como en el gubernamental.

Análisis del mercado de software de tesorería de Asia-Pacífico

Se prevé que el mercado de software de tesorería en Asia-Pacífico crezca a la tasa de crecimiento anual compuesta (TCAC) más alta durante el período de pronóstico de 2025 a 2032, impulsado por la creciente urbanización, la creciente adopción digital y los avances tecnológicos en países como China, Japón e India. Las empresas de la región adoptan cada vez más soluciones de tesorería basadas en la nube y accesibles desde dispositivos móviles para mejorar la gestión de la liquidez y el control del riesgo financiero. Las iniciativas gubernamentales que promueven las finanzas digitales, junto con la aparición de proveedores regionales de software, están impulsando la adopción de software de tesorería en todos los sectores.

Perspectivas del mercado de software del Tesoro de Japón

El mercado japonés de software de tesorería está cobrando impulso gracias a la avanzada infraestructura tecnológica del país y a la creciente adopción de la automatización en las operaciones financieras. Las empresas están aprovechando las soluciones de tesorería para optimizar el flujo de caja, supervisar las inversiones y cumplir con las normativas. La integración del software de tesorería con los sistemas de planificación de recursos empresariales y de informes financieros está impulsando el crecimiento, mientras que la demanda de soluciones fáciles de usar y seguras, tanto en grandes empresas como en pymes, sigue en aumento.

Análisis del mercado de software del Tesoro de China

El mercado chino de software de tesorería representó la mayor participación en ingresos en Asia-Pacífico en 2024, gracias a la rápida urbanización, la adopción de tecnología y el crecimiento de las operaciones financieras corporativas. Las organizaciones están implementando software de tesorería para una gestión eficiente de la liquidez, la supervisión de las inversiones y la mitigación de riesgos. El fuerte impulso hacia las finanzas digitales, sumado a la disponibilidad de soluciones rentables de proveedores nacionales e internacionales, está impulsando el crecimiento del mercado en múltiples sectores, como la manufactura, la banca comercial, la inversión en bienes de consumo y la banca de inversión.

Cuota de mercado del software de tesorería

La industria del software de tesorería está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Finastra (Reino Unido)

- ZenTreasury Ltd (Finlandia)

- Emphasys Software (EE. UU.)

- SS&C Technologies, Inc. (EE. UU.)

- CAPIX (Australia)

- Adenza (Reino Unido y EE. UU.)

- Coupa Software Inc. (EE. UU.)

- DataLog Finance (Francia y Singapur)

- FIS (EE.UU.)

- Access Systems (UK) Limited (Reino Unido)

- Treasury Software Corp. (EE. UU.)

- MUREX SAS (Francia)

- EdgeVerve Systems Limited (India)

- Financial Sciences Corp. (EE. UU.)

- Broadridge Financial Solutions, Inc. (EE. UU.)

- CashAnalytics (Irlanda)

- Oracle (EE. UU.)

- Fiserv, Inc. (EE. UU.)

- ION (Reino Unido)

- SAP (Alemania)

- Solomon Software (EE. UU.)

- Nube ABM (Georgia)

Últimos avances en el mercado global de software de tesorería

- En junio de 2023, ZenTreasury introdujo mejoras significativas en su software de contabilidad de arrendamientos según la NIIF 16, optimizando los procesos de cumplimiento para las empresas. El software actualizado incorpora funciones avanzadas de automatización, lo que permite el seguimiento y la generación de informes en tiempo real de las obligaciones de arrendamiento. Esta mejora reduce la introducción manual de datos y minimiza el riesgo de errores, garantizando la precisión de los informes financieros. Al integrarse a la perfección con los sistemas de planificación de recursos empresariales (ERP) existentes, el software facilita auditorías más ágiles y mejora la eficiencia operativa general. Esta actualización posiciona a ZenTreasury como líder en la provisión de soluciones integrales de contabilidad de arrendamientos que cumplen con los requisitos regulatorios en constante evolución.

- En mayo de 2023, Treasury Intelligence Solutions (TIS) y Delega ampliaron su colaboración para optimizar las funcionalidades de la Gestión Electrónica de Cuentas Bancarias (eBAM). La integración ahora ofrece funciones avanzadas para gestionar los derechos de los firmantes en múltiples relaciones bancarias. Este desarrollo permite a los tesoreros corporativos automatizar la creación, modificación y eliminación de registros de firmantes, reduciendo significativamente las intervenciones manuales y los riesgos asociados. Las capacidades ampliadas de eBAM garantizan el cumplimiento de la normativa bancaria global y mejoran la eficiencia de las operaciones de tesorería. Esta mejora estratégica subraya el compromiso de TIS y Delega de ofrecer soluciones innovadoras para la gestión moderna de la tesorería.

- En abril de 2023, ZenTreasury lanzó un módulo multidivisa dentro de su software de contabilidad de arrendamientos según la NIIF 16, que aborda las complejidades que enfrentan las corporaciones multinacionales. Esta nueva función permite a las empresas gestionar las obligaciones de arrendamiento en diferentes divisas desde una única plataforma. El módulo automatiza la conversión de divisas y garantiza la precisión de los informes financieros, de conformidad con las normas internacionales de contabilidad. Al centralizar los datos de arrendamientos y proporcionar información en tiempo real, el módulo multidivisa optimiza la toma de decisiones y apoya los esfuerzos de consolidación financiera global. Esta incorporación refuerza el compromiso de ZenTreasury de ofrecer soluciones escalables para empresas que operan en diversos entornos financieros.

- En marzo de 2022, ZenTreasury y su socio local MCA proporcionaron a Redington Gulf un software de contabilidad de arrendamientos para la NIIF-16. Los clientes ya no tienen que importar datos de varias fuentes ni almacenarlos en múltiples plataformas. Todo se gestiona con un único software. Esta integración simplifica los flujos de trabajo, reduce la redundancia de datos y mejora su precisión, lo que se traduce en procesos de contabilidad de arrendamientos más eficientes. El enfoque integral de la solución agiliza las tareas de cumplimiento normativo y generación de informes, lo que permite a las empresas centrarse más en la gestión financiera estratégica.

- En septiembre de 2022, TIS y Delega colaboraron para ofrecer a sus clientes una gestión automatizada de derechos de firma multibanco de última generación. Gracias al acuerdo, los clientes de TIS y Delega pueden aprovechar la gestión electrónica de cuentas bancarias (eBAM) de última generación. Esta colaboración permite a las organizaciones automatizar y centralizar la gestión de firmantes de cuentas bancarias, mejorando la eficiencia y reduciendo el riesgo de errores. Al optimizar el proceso, las empresas pueden garantizar un mejor cumplimiento de la normativa bancaria y mejorar la seguridad de sus operaciones financieras.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.