Global Sustainable Finance Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

5.49 Billion

USD

24.17 Billion

2024

2032

USD

5.49 Billion

USD

24.17 Billion

2024

2032

| 2025 –2032 | |

| USD 5.49 Billion | |

| USD 24.17 Billion | |

|

|

|

|

Segmentación del mercado global de finanzas sostenibles, por tipo de inversión (renta variable, renta fija, asignación mixta), tipo de transacción (bono verde, bono social, bono de sostenibilidad mixta), verticales de la industria (servicios públicos, transporte y logística, productos químicos, alimentos y bebidas, gobierno) - Tendencias de la industria y pronóstico hasta 2032.

Tamaño del mercado de finanzas sostenibles

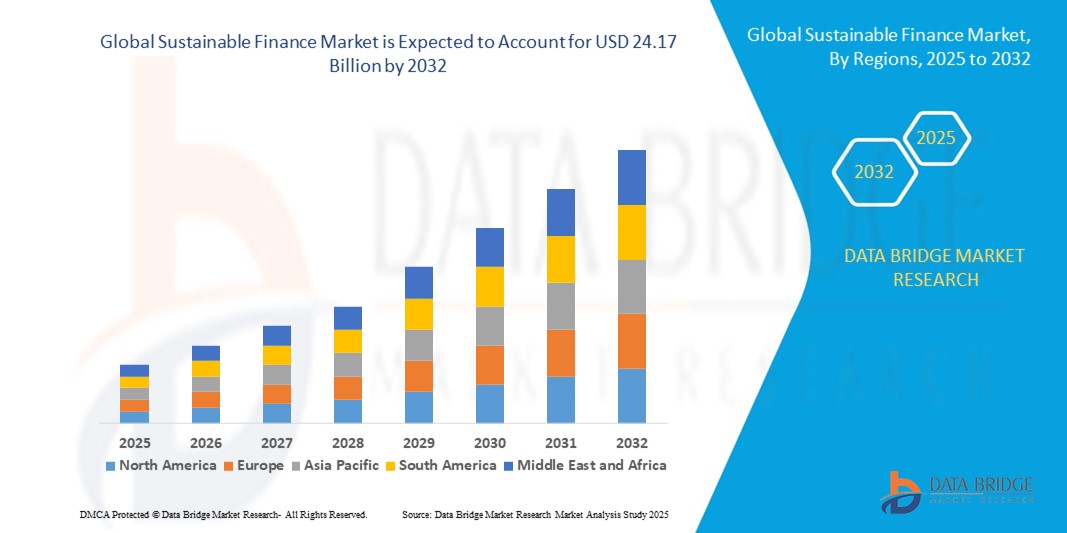

- El tamaño del mercado global de finanzas sostenibles se valoró en USD 5.49 mil millones en 2024 y se espera que alcance los USD 24.17 mil millones para 2032 , con una CAGR del 20,36% durante el período de pronóstico.

- El crecimiento del mercado está impulsado principalmente por la creciente demanda de inversiones ambiental y socialmente responsables, una mayor conciencia del cambio climático y políticas gubernamentales de apoyo que promueven el desarrollo sostenible.

- El creciente interés de los inversores en los criterios ESG (ambientales, sociales y de gobernanza) y la creciente adopción de soluciones financieras sostenibles por parte de las empresas están impulsando aún más la expansión del mercado en los canales de inversión institucionales y minoristas.

Análisis del mercado de finanzas sostenibles

- El mercado de finanzas sostenibles está experimentando un sólido crecimiento a medida que los inversores y las corporaciones priorizan la sostenibilidad, impulsados por las presiones regulatorias y la demanda de los consumidores de opciones de inversión éticas.

- El creciente interés de los inversores institucionales y minoristas está animando a las instituciones financieras a innovar con productos de inversión sostenibles, como bonos verdes y fondos de renta variable centrados en ESG.

- América del Norte dominó el mercado de finanzas sostenibles con la mayor participación en los ingresos del 36,4 % en 2024, impulsada por un ecosistema financiero bien establecido, estrictas regulaciones ESG y una gran conciencia de los inversores sobre las oportunidades de inversión sostenible.

- Se espera que Asia-Pacífico sea la región de más rápido crecimiento durante el período de pronóstico, impulsada por un rápido crecimiento económico, una creciente adopción de prácticas sostenibles en mercados emergentes como China e India, e iniciativas gubernamentales de apoyo al financiamiento verde.

- El segmento de renta fija representó la mayor cuota de mercado en ingresos, con un 58,2%, en 2024, impulsado por la creciente emisión de bonos verdes y sociales, que ofrecen rentabilidades estables y se alinean con los objetivos ambientales y sociales. Los inversores institucionales prefieren los instrumentos de renta fija por su menor perfil de riesgo y su capacidad para financiar proyectos sostenibles a gran escala, como las energías renovables y el desarrollo de infraestructuras.

Alcance del informe y segmentación del mercado de finanzas sostenibles

|

Atributos |

Perspectivas clave del mercado de finanzas sostenibles |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, producción y capacidad por empresa representadas geográficamente, diseños de red de distribuidores y socios, análisis detallado y actualizado de tendencias de precios y análisis deficitario de la cadena de suministro y la demanda. |

Tendencias del mercado de finanzas sostenibles

Aumento de la integración de la IA y el análisis de big data

- El mercado global de finanzas sostenibles está experimentando una tendencia significativa hacia la integración de la Inteligencia Artificial (IA) y el análisis de Big Data.

- Estas tecnologías permiten el procesamiento y análisis avanzado de datos, brindando conocimientos más profundos sobre el desempeño de las inversiones, el impacto ambiental y las métricas de gobernanza social.

- Las plataformas de finanzas sostenibles impulsadas por IA permiten una toma de decisiones proactiva, identificando oportunidades de inversión de alto impacto y riesgos potenciales antes de que afecten el rendimiento de la cartera.

- Por ejemplo, varias instituciones financieras están desarrollando herramientas impulsadas por IA que analizan datos ESG (ambientales, sociales y de gobernanza) para adaptar las estrategias de inversión u optimizar las asignaciones de bonos verdes en función de las tendencias del mercado y la sostenibilidad en tiempo real.

- Esta tendencia mejora la propuesta de valor de los instrumentos de finanzas sostenibles, haciéndolos más atractivos para inversores institucionales, gestores de activos y partes interesadas individuales.

- Los algoritmos de IA pueden evaluar una amplia gama de factores ESG, incluidas las huellas de carbono, las prácticas laborales y las estructuras de gobernanza, para garantizar la alineación con los objetivos de sostenibilidad.

Dinámica del mercado de finanzas sostenibles

Conductor

Creciente demanda de inversiones sostenibles y apoyo regulatorio

- La creciente demanda de los inversores de productos financieros sostenibles, como los bonos verdes y los bonos sociales, es un importante impulsor del mercado mundial de finanzas sostenibles.

- Las finanzas sostenibles mejoran la resiliencia de la cartera al integrar factores ESG y ofrecen valor a largo plazo mediante inversiones en energía renovable, transporte sostenible y gobernanza ética.

- Las regulaciones gubernamentales y los marcos internacionales, particularmente en América del Norte, que es la región dominante, están acelerando la adopción de prácticas de finanzas sostenibles.

- La proliferación de plataformas digitales y tecnología blockchain está permitiendo aún más procesos de transacción transparentes y eficientes, apoyando el crecimiento de bonos verdes y de sostenibilidad mixta.

- Las instituciones financieras están incorporando cada vez más opciones de financiación sostenible en sus ofertas para satisfacer las expectativas de los inversores y alinearse con los objetivos globales de sostenibilidad.

Restricción/Desafío

Altos costos de implementación y preocupaciones sobre la transparencia de los datos

- La sustancial inversión inicial requerida para desarrollar marcos de finanzas sostenibles, incluidos sistemas de integración de datos ESG y cumplimiento, puede ser una barrera importante, en particular en los mercados emergentes.

- Integrar los principios de finanzas sostenibles en las carteras de inversión existentes puede ser una tarea compleja y requerir muchos recursos.

- La transparencia y la fiabilidad de los datos plantean un gran desafío. Las finanzas sostenibles dependen de datos ESG precisos, lo que plantea problemas de posible lavado de imagen, inconsistencias en los datos y el cumplimiento de diversos estándares globales.

- El panorama regulatorio fragmentado en las diferentes regiones, en particular en el mercado de rápido crecimiento de Asia y el Pacífico, complica las operaciones para los inversores internacionales y las instituciones financieras.

- Estos factores pueden disuadir a posibles inversores y limitar la expansión del mercado, especialmente en regiones con un conocimiento limitado de las finanzas sostenibles o donde la sensibilidad a los costos es una preocupación importante.

Alcance del mercado de Finanzas Sostenibles

El mercado está segmentado según el tipo de inversión, el tipo de transacción y los sectores industriales.

- Por tipo de inversión

Según el tipo de inversión, el mercado global de finanzas sostenibles se segmenta en renta variable, renta fija y asignación mixta. El segmento de renta fija representó la mayor cuota de mercado en ingresos, con un 58,2%, en 2024, impulsado por la creciente emisión de bonos verdes y sociales, que ofrecen rentabilidades estables y se alinean con los objetivos ambientales y sociales. Los inversores institucionales prefieren los instrumentos de renta fija por su menor perfil de riesgo y su capacidad para financiar proyectos sostenibles a gran escala, como las energías renovables y el desarrollo de infraestructuras. Sus estructuras estandarizadas y su transparencia refuerzan aún más su atractivo para los inversores reacios al riesgo.

Se prevé que el segmento de renta variable registre la tasa de crecimiento más rápida entre 2025 y 2032, impulsado por el creciente interés de los inversores en empresas con un sólido desempeño ambiental, social y de gobernanza (ESG). Las inversiones en renta variable permiten la participación directa en negocios sostenibles, ofreciendo una mayor rentabilidad potencial y apoyando la innovación en tecnologías limpias y prácticas sostenibles. La creciente concienciación sobre los riesgos climáticos y la transición hacia carteras centradas en ESG impulsan la demanda de soluciones de financiación sostenible basadas en renta variable.

- Por tipo de transacción

Según el tipo de transacción, el mercado global de finanzas sostenibles se segmenta en bonos verdes, bonos sociales y bonos de sostenibilidad mixta. Los bonos verdes dominaron la mayor participación en ingresos en 2024, gracias a su amplia adopción para financiar proyectos respetuosos con el medio ambiente, como las energías renovables, la eficiencia energética y las infraestructuras sostenibles. Los bonos verdes se benefician de un sólido respaldo regulatorio, marcos claros como los Principios de Bonos Verdes y una creciente demanda por parte de inversores institucionales que buscan un impacto ambiental medible.

Se proyecta que el segmento de bonos de sostenibilidad mixta crecerá a su tasa de crecimiento anual compuesto (TCAC) más alta entre 2025 y 2032, a medida que los emisores combinan cada vez más objetivos ambientales y sociales en un solo instrumento. Estos bonos atraen a una base de inversores más amplia al abordar múltiples desafíos de sostenibilidad, como el cambio climático y la inclusión social, a la vez que ofrecen flexibilidad en la asignación de fondos. El auge de los modelos de financiación mixta y el creciente interés de los inversores por resultados ESG diversificados son factores clave del rápido crecimiento de este segmento.

- Por verticales de la industria

Según los sectores verticales, el mercado global de finanzas sostenibles se segmenta en servicios públicos, transporte y logística, productos químicos, alimentación y bebidas, y gobierno. El sector de servicios públicos registró la mayor participación en los ingresos en 2024, impulsado por importantes inversiones en proyectos de energías renovables, como la solar, la eólica y la hidroeléctrica. El papel crucial del sector en el logro de los objetivos de cero emisiones netas, sumado a las políticas e incentivos gubernamentales de apoyo, lo ha posicionado como un pilar fundamental de las finanzas sostenibles.

Se prevé que el segmento de transporte y logística crezca a su ritmo más rápido entre 2025 y 2032, impulsado por el impulso global hacia la descarbonización y la adopción de soluciones de transporte sostenibles, como los vehículos eléctricos y el transporte marítimo ecológico. Las inversiones en infraestructuras bajas en carbono, cadenas de suministro sostenibles y tecnologías logísticas innovadoras están acelerando el crecimiento de este segmento. La creciente demanda de productos ecológicos por parte de los consumidores y las estrictas regulaciones sobre emisiones refuerzan aún más la necesidad de financiación sostenible en este sector.

Análisis regional del mercado de finanzas sostenibles

- América del Norte dominó el mercado de finanzas sostenibles con la mayor participación en los ingresos del 36,4 % en 2024, impulsada por un ecosistema financiero bien establecido, estrictas regulaciones ESG y una gran conciencia de los inversores sobre las oportunidades de inversión sostenible.

- La tendencia hacia la inversión sostenible y el aumento de la normativa que promueve la transparencia en los informes ESG impulsan aún más la expansión del mercado. La creciente emisión de bonos verdes y sociales por parte de las instituciones financieras complementa el crecimiento de la inversión minorista, creando un ecosistema diverso de productos financieros sostenibles.

Perspectivas del mercado de finanzas sostenibles de EE. UU.

El mercado estadounidense de finanzas sostenibles captó la mayor participación en los ingresos, con un 83,5 %, en 2024 en Norteamérica, impulsado por la sólida demanda de bonos verdes e inversiones de capital en sectores sostenibles. La tendencia hacia carteras con enfoque ESG y el creciente apoyo regulatorio a los estándares de finanzas sostenibles impulsan aún más el crecimiento del mercado. La integración de las finanzas sostenibles en las estrategias de financiación corporativa y gubernamental impulsa un ecosistema de mercado próspero.

Perspectivas del mercado europeo de finanzas sostenibles

Se prevé un crecimiento significativo del mercado europeo de finanzas sostenibles, impulsado por el énfasis regulatorio en el cumplimiento de los criterios ESG y el desarrollo sostenible. Los inversores buscan instrumentos financieros que se alineen con los objetivos climáticos y ofrezcan rentabilidades estables. Este crecimiento se destaca tanto en las nuevas emisiones de bonos verdes y sociales como en las inversiones en renta variable sostenible, con países como Alemania y Francia mostrando una importante aceptación debido a la creciente preocupación por el medio ambiente y las necesidades de infraestructura urbana.

Perspectivas del mercado de finanzas sostenibles del Reino Unido

Se prevé un rápido crecimiento del mercado británico de finanzas sostenibles, impulsado por la demanda de bonos verdes y sociales en centros financieros urbanos y suburbanos. El creciente interés en las inversiones que cumplen con los criterios ESG y la mayor concienciación sobre los beneficios de la mitigación del riesgo climático fomentan su adopción. La evolución de las regulaciones, como el Marco de Finanzas Sostenibles del Reino Unido, influye en las decisiones de los inversores, buscando un equilibrio entre la rentabilidad y el cumplimiento normativo.

Perspectivas del mercado alemán de finanzas sostenibles

Se espera que Alemania experimente un rápido crecimiento de las finanzas sostenibles, gracias a su avanzado sector financiero y al gran enfoque de los inversores en la integración de criterios ESG y la eficiencia energética. Los inversores alemanes prefieren instrumentos financieros tecnológicamente avanzados, como los bonos verdes, que apoyan las energías renovables y contribuyen a la reducción de las emisiones de carbono. La integración de las finanzas sostenibles en la financiación empresarial y gubernamental impulsa el crecimiento sostenido del mercado.

Perspectivas del mercado de finanzas sostenibles de Asia y el Pacífico

Se prevé que la región Asia-Pacífico experimente la tasa de crecimiento más rápida, impulsada por la expansión de los mercados financieros y el aumento de la renta disponible en países como China, India y Japón. La creciente concienciación sobre los principios ESG, la mitigación del riesgo climático y el desarrollo sostenible está impulsando la demanda. Las iniciativas gubernamentales que promueven la financiación verde y la infraestructura sostenible incentivan aún más la adopción de instrumentos financieros avanzados.

Perspectivas del mercado de finanzas sostenibles de Japón

Se prevé un rápido crecimiento del mercado japonés de finanzas sostenibles debido a la fuerte preferencia de los inversores por instrumentos financieros de alta calidad y alineados con criterios ESG que mejoran la sostenibilidad y la resiliencia de las carteras. La presencia de importantes instituciones financieras y la integración de los bonos verdes en la financiación pública y corporativa aceleran la penetración en el mercado. El creciente interés en las inversiones de renta variable sostenible también contribuye al crecimiento.

Perspectivas del mercado de finanzas sostenibles de China

China posee la mayor participación en el mercado de finanzas sostenibles de Asia-Pacífico, impulsada por la rápida urbanización, el creciente interés de los inversores y la creciente demanda de bonos verdes y sociales. La creciente clase media del país y su enfoque en el desarrollo sostenible impulsan la adopción de instrumentos financieros avanzados. La sólida capacidad financiera nacional y los precios competitivos mejoran el acceso al mercado.

Cuota de mercado de las finanzas sostenibles

La industria de las finanzas sostenibles está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- BlackRock, Inc. (EE. UU.)

- Refinitiv (EE. UU.)

- Socios de conocimiento de Acuity (EE. UU.)

- NOMURA HOLDINGS, INC (Japón)

- Aspiration Partners, Inc. (EE. UU.)

- Banco de América (EE. UU.)

- BNP Paribas (Francia)

- Goldman Sachs (EE.UU.)

- Grupo HSBC (Reino Unido)

- KPMG International (Países Bajos)

- Polo Sur (Suiza)

- Deutsche Bank AG (Alemania)

- Stripe, Inc. (EE. UU.)

- Tred Earth Limited (Reino Unido)

- Triodos Bank UK Ltd. (Reino Unido)

- UBS (Suiza)

- Starling Bank (Reino Unido)

- Clarity AI (EE. UU.)

¿Cuáles son los avances recientes en el mercado global de finanzas sostenibles?

- En agosto de 2025, ISS Sustainability Solutions, la división de inversión sostenible de ISS STOXX, adquirió Sust Global, proveedor de datos de riesgo climático basados en inteligencia artificial geoespacial. Esta estrategia subraya la creciente importancia del análisis avanzado de datos en las finanzas sostenibles, ya que los inversores buscan cada vez más herramientas precisas para evaluar y gestionar los riesgos climáticos. La plataforma propia de Sust Global integra datos satelitales y aprendizaje automático para ofrecer información de alta resolución sobre los riesgos climáticos físicos. Esta adquisición permite a ISS mejorar sus capacidades de mapeo de riesgos a nivel de activos y ampliar su oferta a clientes institucionales de todo el mundo.

- En julio de 2025, Mizuho Financial Group, empresa líder en banca y servicios financieros con sede en Tokio, anunció la adquisición de Augusta & Co, un banco de inversión con sede en el Reino Unido especializado en energías renovables y la transición energética. Esta estrategia fortalece la plataforma de asesoramiento en fusiones y adquisiciones de Mizuho y profundiza su experiencia en finanzas sostenibles. Augusta conservará su marca y liderazgo, operando como la división de asesoramiento en energías renovables de Mizuho en la región EMEA. La adquisición refleja una tendencia más amplia de instituciones financieras tradicionales a adquirir empresas nicho para ampliar sus capacidades y cuota de mercado en el sector de la transición energética, en rápido crecimiento.

- En junio de 2024, Australia hizo historia al emitir su primer bono verde soberano por valor de 7000 millones de dólares, convirtiéndose en el primer país en hacerlo a esa escala. El bono atrajo ofertas de 105 instituciones inversoras globales, lo que subraya la sólida confianza internacional en la estrategia climática de Australia. Los fondos recaudados se destinarán a proyectos como centros de hidrógeno verde, transporte limpio, baterías comunitarias y conservación de la biodiversidad. Esta iniciativa marca un hito importante en las finanzas sostenibles, reforzando el compromiso de Australia de alcanzar cero emisiones netas para 2050 y alineándose con los Objetivos de Desarrollo Sostenible de las Naciones Unidas.

- En marzo de 2024, el Fondo Conjunto para los ODS, auspiciado por la ONU, amplió significativamente su programación, alcanzando un aumento del 160 % con respecto al año anterior. Este aumento de capital refleja el creciente compromiso de los socios internacionales para aunar recursos en pos del desarrollo sostenible global. El alcance ampliado del Fondo apoya iniciativas transformadoras en materia de acceso digital, sistemas alimentarios y transición energética, beneficiando a más de 10 millones de personas solo en 2024. Al movilizar financiación pública y privada, el Fondo Conjunto para los ODS sigue desempeñando un papel fundamental para acelerar el progreso hacia la Agenda 2030 y generar impacto donde más importa.

- En febrero de 2024, Japón anunció la emisión de sus primeros bonos soberanos de transición climática, convirtiéndose en el primer país en lanzar este innovador producto de deuda. Con un valor de 1,6 billones de yenes (aproximadamente 11 000 millones de dólares estadounidenses), los bonos buscan financiar los esfuerzos de descarbonización de Japón en el marco de su estrategia de Transformación Verde (GX). Los fondos recaudados se destinarán a proyectos en sectores como el hidrógeno, el amoníaco, los reactores de nueva generación y las tecnologías de eficiencia energética. Esta iniciativa refleja el compromiso de Japón con una transición gradual e inclusiva de las prácticas de altas emisiones a alternativas sostenibles y destaca el creciente papel de las finanzas soberanas en el impulso de la acción climática.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.