Global Shipping Container Liner Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

1,275.46

1,963.37

2021

2029

1,275.46

1,963.37

2021

2029

| 2022 –2029 | |

| USD 1,275.46 | |

| USD 1,963.37 | |

|

|

|

|

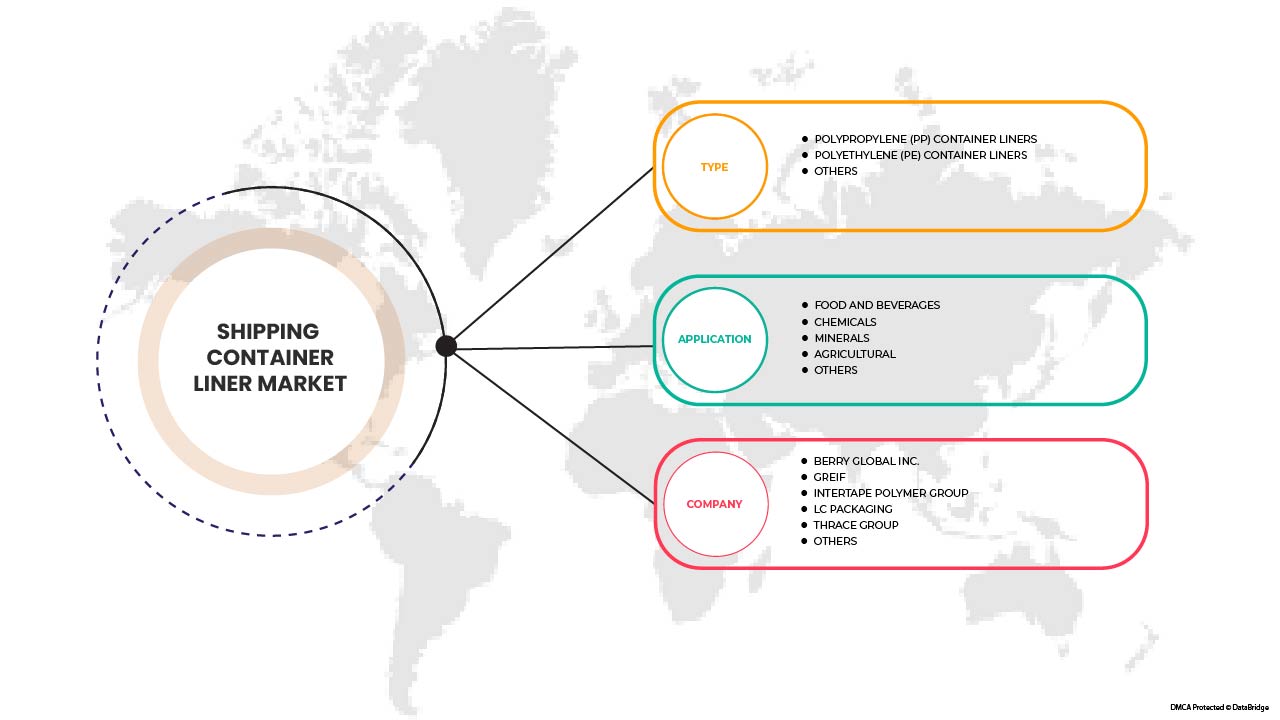

Mercado mundial de revestimientos para contenedores de envío, por tipo (revestimientos de contenedores de polipropileno (PP), revestimientos de contenedores de polietileno (PE) y otros), aplicación (alimentos y bebidas, productos químicos , minerales, agricultura y otros): tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado de contenedores de transporte marítimo

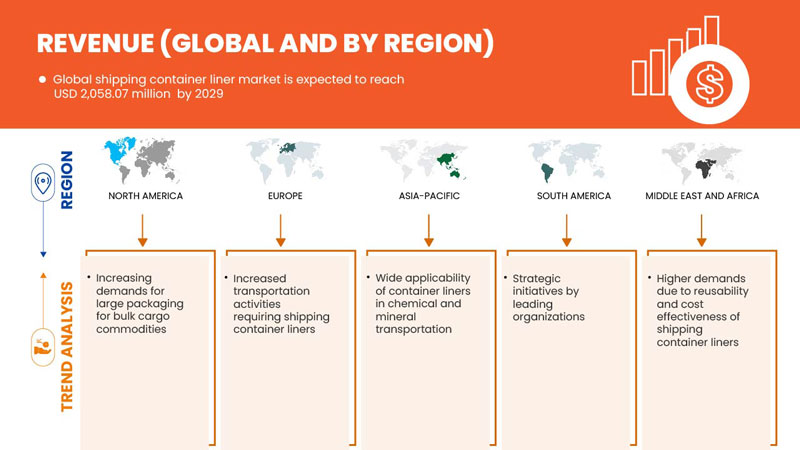

Se espera que el mercado mundial de revestimientos para contenedores de envío crezca significativamente en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 3,9% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 2.058,07 millones para 2029. El principal factor que impulsa el crecimiento del mercado de revestimientos para contenedores de envío es la creciente prevalencia de los revestimientos para contenedores en la alimentación y la agricultura y el aumento de las actividades de transporte.

Los revestimientos para contenedores se pueden utilizar para envasar todo tipo de alimentos secos, como trigo, arroz, café, legumbres, azúcar y otros alimentos. Para un envasado seguro y libre de contaminación, los revestimientos para contenedores ofrecen una solución de envasado rentable, protectora y valiosa. Se espera que la creciente prevalencia de los revestimientos para contenedores en la industria alimentaria y agrícola y el aumento de las actividades de transporte impulsen el mercado mundial de revestimientos para contenedores de envío. Además, la reutilización y la rentabilidad de los revestimientos para contenedores de envío impulsarán el crecimiento del mercado mundial de revestimientos para contenedores de envío. Sin embargo, los altos costos de transporte y el aumento de las tarifas de flete pueden obstaculizar el crecimiento del mercado.

El informe del mercado global de contenedores de transporte marítimo proporciona detalles sobre la participación de mercado, los nuevos desarrollos y el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un resumen analítico. Nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

Por tipo (revestimientos de polipropileno (PP), revestimientos de polietileno (PE) y otros), aplicación (alimentos y bebidas, productos químicos, minerales, agricultura y otros) |

|

Países cubiertos |

EE. UU., Canadá, México, Reino Unido, Rusia, Francia, España, Italia, Alemania, Turquía, Países Bajos, Suiza, Bélgica, Luxemburgo, resto de Europa, Japón, China, Corea del Sur, India, Singapur, Tailandia, Indonesia, Malasia, Filipinas, Australia y Nueva Zelanda, resto de Asia-Pacífico, Brasil, Argentina, resto de Sudamérica, Egipto, Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Israel y resto de Oriente Medio y África. |

|

Actores del mercado cubiertos |

Entre otras, se encuentran UNITED BAGS, INC., Bulk Corp International, Nier Systems Inc., Rishi FIBC Solutions PVT. Ltd., Dev Ventures India Pvt. Ltd., Ven Pack, BERRY GLOBAL INC., Bulk Handling Australia, Eceplast, Greif., LC Packaging, Thrace Group, CDF Corporation, Composite Containers, LLC, INTERTAPE POLYMER GROUP y BULK FLOW. |

Definición de mercado

Los contenedores de granel son el medio más económico para embalar y transportar productos secos y fluidos a granel. Son de vital importancia en lo que respecta a los requisitos de embalaje para entregas a granel de mercancías y otros materiales. Cuando las mercancías se trasladan de una ubicación geográfica a otra, entran en contacto de forma natural con elementos naturales como el aceite, el polvo, el aire y la tierra, que pueden arruinar o degradar la calidad de las mercancías. Existe la posibilidad de que la contaminación excesiva haga que las mercancías no sean aptas para el transporte. Cuando las autoridades rechazan las mercancías transportadas, es muy importante que cumplan con los estándares de calidad establecidos por el gobierno correspondiente del país de destino. Para evitar todas estas situaciones, se utilizan contenedores de granel como capa protectora. Al utilizar contenedores de granel para el transporte, las mercancías se mantienen seguras y se evita por completo la contaminación.

Dinámica del mercado mundial de contenedores de transporte marítimo

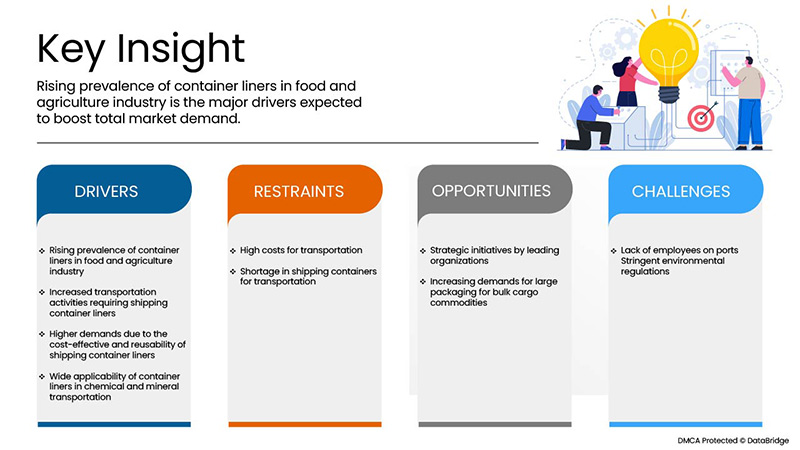

Conductores

- Aumento de la prevalencia de los revestimientos para contenedores en la industria alimentaria y agrícola

Los revestimientos para contenedores de envío se han vuelto cada vez más populares en la industria naviera, especialmente en la alimentación y la agricultura. Los productos y artículos alimenticios deben transportarse con cadenas bien mantenidas y precauciones para mantener su calidad y seguridad alimentaria. De manera similar, en la industria agrícola, el transporte de semillas, fertilizantes y diversos productos químicos debe transportarse con el cuidado adecuado y manipularse con precaución. Los revestimientos para contenedores evitan la humedad, la temperatura y otros tipos de contaminación en el producto. Varios fabricantes están proporcionando dichos revestimientos para contenedores según las necesidades de los usuarios finales para diversas aplicaciones. La amplia aplicabilidad de los revestimientos para contenedores en la alimentación y la agricultura genera mayores demandas y se espera que impulse el crecimiento del mercado.

- Aumento de las actividades de transporte que requieren contenedores de transporte marítimo

El aumento del transporte de mercancías en todo el mundo ha provocado una mayor demanda de buques portacontenedores en el sector. Estos buques proporcionan seguridad a las mercancías y son muy eficientes en la carga y descarga. Con este aumento del transporte, la demanda de buques portacontenedores también está aumentando y se espera que impulse el crecimiento del mercado.

- Mayores exigencias debido a la rentabilidad y reutilización de los revestimientos para contenedores de transporte

Los revestimientos para contenedores están compuestos de polietileno y polipropileno de alta densidad, lo que permite que los usuarios finales los vuelvan a utilizar. Los revestimientos para contenedores se pueden utilizar muchas veces, lo que resulta en una mayor rentabilidad. Los fabricantes ofrecen revestimientos para contenedores de envío en diversos materiales, lo que contribuye a su rentabilidad y calidad. Por lo tanto, los revestimientos para contenedores tienen una gran demanda debido a su rentabilidad y capacidad de reutilización, lo que se espera que impulse el crecimiento del mercado.

Oportunidades

- Iniciativas estratégicas de las organizaciones líderes

La aceptación y el alto uso de los revestimientos para contenedores de envío en el mercado han aumentado la demanda del producto. Para satisfacer las demandas de los usuarios finales en relación con diversas aplicaciones, los fabricantes toman decisiones estratégicas y ofrecen productos nuevos e innovadores en el mercado.

- Demanda creciente de embalajes de gran tamaño para mercancías a granel

Los revestimientos para contenedores evitan la contaminación de la carga y otros productos transportados después del embalaje. Protegen la carga a granel de la humedad y garantizan que la carga se envíe de forma segura e higiénica. Con los revestimientos para contenedores, se requiere muy poca manipulación durante el envío, lo que facilita todas las operaciones. Los fabricantes ofrecen revestimientos para contenedores en diferentes diseños y tamaños para transportar carga a granel al tiempo que garantizan la seguridad del producto. Por lo tanto, la creciente demanda de embalajes de gran tamaño para mercancías de carga a granel podría crear oportunidades para el mercado mundial de revestimientos para contenedores de transporte marítimo.

Restricciones/Desafíos

- Altos costos de transporte

Debido a este aumento de los precios del transporte de mercancías, el sector naviero se ve afectado en general. La evidencia empírica subraya que un aumento del 10% de los costes de transporte reduce los volúmenes comerciales en más de un 20%. Los altos costes de transporte afectan a la estructura de las actividades económicas y al comercio internacional, lo que en última instancia afecta a la demanda de buques portacontenedores.

- Normas ambientales estrictas

Debido a las muchas normas y regulaciones estrictas, los fabricantes se lo piensan dos veces antes de dedicarse a un negocio en el que se deben cumplir muchas normas y regulaciones y mantener las pautas adecuadas. Esto representa un gran desafío para la industria naviera y, en última instancia, afecta al mercado mundial de contenedores de transporte marítimo.

Impacto posterior a la COVID-19 en el mercado de contenedores marítimos

La COVID-19 ha afectado al mercado en cierta medida. Debido al confinamiento, se detuvo la fabricación y producción de muchas empresas pequeñas y grandes, y la demanda de contenedores de transporte disminuyó, ya que las actividades de envío y transporte se vieron gravemente afectadas debido a las medidas de cuarentena, lo que influyó en el mercado. Debido al cambio en muchos mandatos y regulaciones, los fabricantes pueden diseñar y lanzar nuevos productos al mercado, lo que ayudará al crecimiento del mercado.

Desarrollo reciente

United Bags Inc. se ha asociado con una empresa de reciclaje que instala máquinas empacadoras y recoge periódicamente los FIBC usados sin costo alguno de los clientes. Los participantes en esta iniciativa reciben una certificación que indica que todos sus FIBC han sido reciclados, sin causar daño al medio ambiente.

Alcance del mercado mundial de contenedores de transporte marítimo

El mercado mundial de revestimientos para contenedores de envío se clasifica en función del tipo y la aplicación. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Revestimientos de polipropileno (PP) para contenedores

- Revestimientos de polietileno (PE) para contenedores

- Otros

Según el tipo, el mercado mundial de revestimientos para contenedores de envío se clasifica en dos segmentos: revestimientos para contenedores de polipropileno (PP), revestimientos para contenedores de polietileno (PE) y otros.

Solicitud

- Alimentos y bebidas

- Productos químicos

- Minerales

- Agrícola

- Otros

Según la aplicación, el mercado mundial de revestimientos para contenedores de envío se clasifica en cinco segmentos: alimentos y bebidas, productos químicos, minerales, agricultura y otros.

Análisis y perspectivas regionales del mercado mundial de contenedores de transporte marítimo

El mercado global de revestimientos para contenedores de envío está segmentado según el tipo y la aplicación.

Los países del mercado mundial de contenedores de envío son EE. UU., Canadá, México, Reino Unido, Rusia, Francia, España, Italia, Alemania, Turquía, Países Bajos, Suiza, Bélgica, Luxemburgo, resto de Europa, Japón, China, Corea del Sur, India, Singapur, Tailandia, Indonesia, Malasia, Filipinas, Australia y Nueva Zelanda, y el resto de Asia-Pacífico, Brasil, Argentina, resto de Sudamérica, Egipto, Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Israel y el resto de Medio Oriente y África.

La región Asia-Pacífico domina el mercado mundial de revestimientos para contenedores de transporte marítimo. China domina en la región Asia-Pacífico debido a la mayor demanda que genera la rentabilidad y la reutilización de los revestimientos para contenedores de transporte marítimo.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. El análisis de los puntos de datos de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos afrontados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado global de contenedores de transporte marítimo

El panorama competitivo del mercado global de revestimientos para contenedores de envío proporciona detalles de los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de supervivencia de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en el mercado global de revestimientos para contenedores de envío.

Algunos de los participantes destacados que operan en el mercado global de contenedores de envío son UNITED BAGS, INC., Bulk Corp International, Nier Systems Inc., Rishi FIBC Solutions PVT. Ltd., Dev Ventures India Pvt. Ltd., Ven Pack, BERRY GLOBAL INC., Bulk Handling Australia, Eceplast, Greif., LC Packaging, Thrace Group, CDF Corporation, Composite Containers, LLC, INTERTAPE POLYMER GROUP y BULK FLOW, entre otros.

Metodología de la investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con tamaños de muestra grandes. Los datos del mercado se analizan y estiman utilizando modelos estadísticos y coherentes del mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrículas de posicionamiento de proveedores, análisis de la línea de tiempo del mercado, descripción general y guía del mercado, cuadrículas de posicionamiento de la empresa, análisis de la participación de mercado de la empresa, estándares de medición, análisis global vs. regional y de la participación de los proveedores. Solicite una llamada de un analista en caso de tener más consultas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL SHIPPING CONTAINER LINER MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TESTING TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CONSUMER BUYING BEHAVIOR

4.1.1 OVERVIEW

4.1.1.1 COMPLEX BUYING BEHAVIOR

4.1.1.2 DISSONANCE-REDUCING BUYING BEHAVIOR

4.1.1.3 HABITUAL BUYING BEHAVIOR

4.1.1.4 VARIETY-SEEKING BEHAVIOR

4.1.1.5 conclusion

4.2 FACTORS INFLUENCING BUYING DECISION

4.3 PORTER'S FIVE ANALYSIS FOR THE GLOBAL SHIPPING CONTAINER LINER MARKET

4.3.1 BARGAINING POWER OF BUYERS/CONSUMERS

4.3.2 BARGAINING POWER OF SUPPLIERS

4.3.3 THE THREAT OF NEW ENTRANTS

4.3.4 THREAT OF SUBSTITUTES

4.3.5 RIVALRY AMONG EXISTING COMPETITORS

4.4 PRICING INDEX

4.4.1 FOB & B2B PRICES –GLOBAL SHIPPING CONTAINER LINER MARKET

4.4.2 B2B PRICES – GLOBAL SHIPPING CONTAINER LINER MARKET

4.5 GLOBAL SHIPPING CONTAINER LINER MARKET: RAW MATERIAL SOURCING ANALYSIS

4.5.1 POLYETHYLENE (PE)

4.5.2 POLYPROPYLENE (PP)

4.5.3 HIGH DENSITY POLYETHYLENE(HDPE) AND LOW DENSITY POLYETHYLENE (LDPE)

4.6 TRADE ANALYSIS

4.6.1 GLOBAL EXPORTERS OF SHIPPING CONTAINER LINERS, HS CODE OF PRODUCT: 392321

4.6.2 GLOBAL IMPORTERS OF SHIPPING CONTAINER LINER, HS CODE OF PRODUCT: 392321

4.6.3 IMPORTS BY RUSSIAN FEDERATION, HS CODE OF PRODUCT: 392321

4.6.4 EXPORTS BY RUSSIAN FEDERATION, HS CODE OF PRODUCT: 392321

4.7 PRODUCT ADOPTION SCENARIO

4.7.1 OVERVIEW

4.7.2 PRODUCT AWARENESS

4.7.3 PRODUCT INTEREST

4.7.4 PRODUCT EVALUATION

4.7.5 PRODUCT TRIAL

4.7.6 PRODUCT ADOPTION

4.7.7 CONCLUSION

5 SUPPLY CHAIN ANALYSIS

5.1 OVERVIEW

5.2 LOGISTIC COST SCENARIO

5.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

6 REGULATION COVERAGE

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING PREVALENCE OF CONTAINER LINERS IN THE FOOD AND AGRICULTURE INDUSTRY

7.1.2 INCREASED TRANSPORTATION ACTIVITIES REQUIRING SHIPPING CONTAINER LINERS

7.1.3 HIGHER DEMANDS DUE TO THE COST-EFFECTIVE AND REUSABILITY OF SHIPPING CONTAINER LINERS

7.1.4 WIDE APPLICABILITY OF CONTAINER LINERS IN CHEMICAL AND MINERAL TRANSPORTATION

7.2 RESTRAINTS

7.2.1 HIGH COSTS FOR TRANSPORTATION

7.2.2 SHORTAGE IN SHIPPING CONTAINERS FOR TRANSPORTATION

7.3 OPPORTUNITIES

7.3.1 STRATEGIC INITIATIVES BY LEADING ORGANIZATIONS

7.3.2 INCREASING DEMANDS FOR LARGE PACKAGING FOR BULK CARGO COMMODITIES

7.4 CHALLENGES

7.4.1 LACK OF EMPLOYEES ON PORTS

7.4.2 STRINGENT ENVIRONMENTAL REGULATIONS

8 GLOBAL SHIPPING CONTAINER LINER MARKET, BY TYPE

8.1 OVERVIEW

8.2 POLYETHYLENE

8.3 POLYPROPYLENE

8.4 OTHERS

9 GLOBAL SHIPPING CONTAINER LINER MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 FOOD AND BEVERAGE

9.2.1 POLYPROPYLENE

9.2.2 POLYETHYLENE

9.2.3 OTHERS

9.3 CHEMICAL

9.3.1 POLYPROPYLENE

9.3.2 POLYETHYLENE

9.3.3 OTHERS

9.4 AGRICULTURAL

9.4.1 POLYPROPYLENE

9.4.2 POLYETHYLENE

9.4.3 OTHERS

9.5 MINERAL

9.5.1 POLYPROPYLENE

9.5.2 POLYETHYLENE

9.5.3 OTHERS

9.6 OTHERS

9.6.1 POLYPROPYLENE

9.6.2 POLYETHYLENE

9.6.3 OTHERS

10 GLOBAL SHIPPING CONTAINER LINER MARKET, BY REGION

10.1 OVERVIEW

10.2 ASIA-PACIFIC

10.2.1 CHINA

10.2.2 INDIA

10.2.3 JAPAN

10.2.4 SOUTH KOREA

10.2.5 THAILAND

10.2.6 SINGAPORE

10.2.7 INDONESIA

10.2.8 AUSTRALIA & NEW ZEALAND

10.2.9 PHILIPPINES

10.2.10 MALAYSIA

10.2.11 REST OF ASIA-PACIFIC

10.3 NORTH AMERICA

10.3.1 U.S.

10.3.2 CANADA

10.3.3 MEXICO

10.4 EUROPE

10.4.1 GERMANY

10.4.2 U.K.

10.4.3 FRANCE

10.4.4 ITALY

10.4.5 SPAIN

10.4.6 RUSSIA

10.4.7 SWITZERLAND

10.4.8 TURKEY

10.4.9 BELGIUM

10.4.10 NETHERLANDS

10.4.11 LUXEMBURG

10.4.12 REST OF EUROPE

10.5 SOUTH AMERICA

10.5.1 BRAZIL

10.5.2 ARGENTINA

10.5.3 REST OF SOUTH AMERICA

10.6 MIDDLE EAST AND AFRICA

10.6.1 SAUDI ARABIA

10.6.2 UNITED ARAB EMIRATES

10.6.3 SOUTH AFRICA

10.6.4 EGYPT

10.6.5 ISRAEL

10.6.6 REST OF MIDDLE EAST & AFRICA

11 COMPANY LANDSCAPE, GLOBAL SHIPPING CONTAINER LINER MARKET

11.1 COMPANY SHARE ANALYSIS: GLOBAL

11.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.3 COMPANY SHARE ANALYSIS: EUROPE

11.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

12 COMPANY PROFILES

12.1 BERRY GLOBAL INC.

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 SWOT

12.1.5 PRODUCT PORTFOLIO

12.1.6 RECENT UPDATES

12.2 GREIF

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 SWOT

12.2.5 PRODUCT PORTFOLIO

12.2.6 RECENT UPDATE

12.3 INTERTAPE POLYMER GROUP

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 SWOT

12.3.5 RECENT UPDATE

12.4 LC PACKAGING

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 SWOT

12.4.5 RECENT UPDATES

12.5 BULK HANDLING AUSTRALIA

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 SWOT

12.5.5 RECENT UPDATE

12.6 BULK CORP INTERNATIONAL

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 SWOT

12.6.4 RECENT UPDATES

12.7 BULK FLOW

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 SWOT

12.7.4 RECENT UPDATES

12.8 COMPOSITE CONTAINERS, LLC

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 SWOT

12.8.4 RECENT UPDATE

12.9 CDF CORPORATION

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 SWOT

12.9.4 RECENT UPDATE

12.1 DEV VENTURES INDIA PVT. LTD.

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 SWOT

12.10.4 RECENT DEVELOPMENT

12.11 ECEPLAST

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 SWOT

12.11.4 RECENT UPDATES

12.12 NIER SYSTEMS INC.

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 SWOT

12.12.4 RECENT UPDATES

12.13 RISHI FIBC SOLUTIONS PVT. LTD.

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 SWOT

12.13.4 RECENT UPDATE

12.14 THRACE GROUP

12.14.1 COMPANY SNAPSHOT

12.14.2 REVENUE ANALYSIS

12.14.3 SWOT

12.14.4 PRODUCT PORTFOLIO

12.14.5 RECENT UPDATE

12.15 UNITED BAGS, INC

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 SWOT

12.15.4 RECENT UPDATE

12.16 VEN PACK

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 SWOT

12.16.4 RECENT UPDATES

13 SWOT ANALYSIS AND DATABRIDGE MARKET RESEARCH ANALYSIS

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tablas

TABLE 1 FREE ON BOARD (FOB) OF SCREEN PRINTING MESH

TABLE 2 EXPORTERS OF SHIPPING CONTAINER LINERS UNIT: USD THOUSAND

TABLE 3 IMPORTERS OF SHIPPING CONTAINER LINER , UNIT: USD THOUSAND

TABLE 4 IMPORTS BY RUSSIAN FEDERATION , UNIT: USD THOUSAND

TABLE 5 EXPORTS BY RUSSIAN FEDERATION UNIT: USD THOUSAND

TABLE 6 GLOBAL SHIPPING CONTAINER LINER MARKET: BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 GLOBAL POLYETHYLENE IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 GLOBAL POLYPROPYLENE IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 GLOBAL OTHERS IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 GLOBAL SHIPPING CONTAINER LINER MARKET: BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 11 GLOBAL FOOD AND BEVERAGE IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 GLOBAL FOOD AND BEVERAGE IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 GLOBAL CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 GLOBAL CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 GLOBAL AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 GLOBAL AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 GLOBAL MINERAL IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 GLOBAL MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 GLOBAL OTHERS IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 GLOBAL OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 GLOBAL SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA-PACIFIC SHIPPING CONTAINER LINER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 23 ASIA-PACIFIC SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 ASIA-PACIFIC SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 25 ASIA-PACIFIC FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 ASIA-PACIFIC CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 ASIA-PACIFIC AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 ASIA-PACIFIC MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 ASIA-PACIFIC OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 CHINA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 CHINA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 32 CHINA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 CHINA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 CHINA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 CHINA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 CHINA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 INDIA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 INDIA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 INDIA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 INDIA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 INDIA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 INDIA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 INDIA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 JAPAN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 JAPAN SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 JAPAN FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 JAPAN CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 JAPAN AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 JAPAN MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 JAPAN OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 SOUTH KOREA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 SOUTH KOREA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 SOUTH KOREA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 SOUTH KOREA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 SOUTH KOREA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 SOUTH KOREA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 SOUTH KOREA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 THAILAND SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 THAILAND SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 60 THAILAND FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 HAILAND CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 THAILAND AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 THAILAND MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 THAILAND OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 SINGAPORE SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 SINGAPORE SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 SINGAPORE FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 SINGAPORE CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 SINGAPORE AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 SINGAPORE MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 SINGAPORE OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 INDONESIA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 INDONESIA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 INDONESIA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 INDONESIA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 INDONESIA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 INDONESIA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 INDONESIA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 AUSTRALIA & NEW ZEALAND SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 AUSTRALIA & NEW ZEALAND SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 AUSTRALIA & NEW ZEALAND FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 AUSTRALIA & NEW ZEALAND CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 AUSTRALIA & NEW ZEALAND AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 AUSTRALIA & NEW ZEALAND MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 AUSTRALIA & NEW ZEALAND OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 PHILIPPINES SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 PHILIPPINES SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 88 PHILIPPINES FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 PHILIPPINES CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 PHILIPPINES AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 PHILIPPINES MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 PHILIPPINES OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 MALAYSIA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 MALAYSIA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 MALAYSIA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 MALAYSIA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 MALAYSIA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 MALAYSIA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 MALAYSIA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 REST OF ASIA-PACIFIC SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 NORTH AMERICA SHIPPING CONTAINER LINER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 102 NORTH AMERICA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 NORTH AMERICA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 104 NORTH AMERICA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 NORTH AMERICA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 NORTH AMERICA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 NORTH AMERICA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 NORTH AMERICA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 U.S. SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 U.S. SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 111 U.S. FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 U.S. CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 U.S. AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 U.S. MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 U.S. OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 CANADA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 CANADA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 118 CANADA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 CANADA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 CANADA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 CANADA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 CANADA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 MEXICO SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 MEXICO SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 125 MEXICO FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 MEXICO CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 MEXICO AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 MEXICO MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 MEXICO OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 EUROPE SHIPPING CONTAINER LINER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 131 EUROPE SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 EUROPE SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 133 EUROPE FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 EUROPE CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 EUROPE AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 EUROPE MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 EUROPE OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 GERMANY SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 GERMANY SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 140 GERMANY FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 GERMANY CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 GERMANY AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 GERMANY MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 GERMANY OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 U.K. SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 U.K. SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 147 U.K. FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 U.K. CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 U.K. AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 U.K. MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 U.K. OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 FRANCE SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 153 FRANCE SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 154 FRANCE FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 FRANCE CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 FRANCE AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 FRANCE MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 FRANCE OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 ITALY SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 ITALY SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 161 ITALY FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 ITALY CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 163 ITALY AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 ITALY MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 ITALY OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 SPAIN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 SPAIN SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 168 SPAIN FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 169 SPAIN CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 SPAIN AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 171 SPAIN MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 SPAIN OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 RUSSIA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 RUSSIA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 175 RUSSIA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 RUSSIA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 RUSSIA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 RUSSIA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 179 RUSSIA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 SWITZERLAND SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 SWITZERLAND SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 182 SWITZERLAND FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 183 SWITZERLAND CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 184 SWITZERLAND AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 185 SWITZERLAND MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 186 SWITZERLAND OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 187 TURKEY SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 188 TURKEY SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 189 TURKEY FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 TURKEY CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 TURKEY AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 192 TURKEY MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 193 TURKEY OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 194 BELGIUM SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 BELGIUM SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 196 BELGIUM FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 197 BELGIUM CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 BELGIUM AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 199 BELGIUM MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 200 BELGIUM OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 201 NETHERLANDS SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 202 NETHERLANDS SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 203 NETHERLANDS FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 204 NETHERLANDS CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 205 NETHERLANDS AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 206 NETHERLANDS MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 207 NETHERLANDS OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 208 LUXEMBURG SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 209 LUXEMBURG SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 210 LUXEMBURG FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 211 LUXEMBURG CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 LUXEMBURG AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 213 LUXEMBURG MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 214 LUXEMBURG OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 215 REST OF EUROPE SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 216 SOUTH AMERICA SHIPPING CONTAINER LINER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 217 SOUTH AMERICA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 218 SOUTH AMERICA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 219 SOUTH AMERICA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 220 SOUTH AMERICA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 221 SOUTH AMERICA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 222 SOUTH AMERICA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 223 SOUTH AMERICA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 224 BRAZIL SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 225 BRAZIL SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 226 BRAZIL FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 227 BRAZIL CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 228 BRAZIL AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 229 BRAZIL MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 230 BRAZIL OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 231 ARGENTINA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 232 ARGENTINA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 233 ARGENTINA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 234 ARGENTINA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 235 ARGENTINA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 236 ARGENTINA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 237 ARGENTINA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 238 REST OF SOUTH AMERICA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 239 MIDDLE EAST & AFRICA SHIPPING CONTAINER LINER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 240 MIDDLE EAST AND AFRICA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 241 MIDDLE EAST AND AFRICA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 242 IDDLE EAST AND AFRICA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 243 MIDDLE EAST AND AFRICA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 244 MIDDLE EAST AND AFRICA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 245 MIDDLE EAST AND AFRICA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 246 MIDDLE EAST AND AFRICA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 247 SAUDI ARABIA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 248 SAUDI ARABIA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 249 SAUDI ARABIA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 250 SAUDI ARABIA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 251 SAUDI ARABIA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 252 SAUDI ARABIA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 253 SAUDI ARABIA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 254 UNITED ARAB EMIRATES SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 255 UNITED ARAB EMIRATES SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 256 UNITED ARAB EMIRATES FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 257 UNITED ARAB EMIRATES CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 258 UNITED ARAB EMIRATES AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 259 UNITED ARAB EMIRATES MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 260 UNITED ARAB EMIRATES OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 261 SOUTH AFRICA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 262 SOUTH AFRICA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 263 SOUTH AFRICA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 264 SOUTH AFRICA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 265 SOUTH AFRICA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 266 SOUTH AFRICA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 267 SOUTH AFRICA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 268 EGYPT SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 269 EGYPT SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 270 EGYPT FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 271 EGYPT CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 272 EGYPT AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 273 EGYPT MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 274 EGYPT OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 275 ISRAEL SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 276 ISRAEL SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 277 ISRAEL FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 278 ISRAEL CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 279 ISRAEL AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 280 ISRAEL MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 281 ISRAEL OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 282 REST OF MIDDLE EAST AND AFRICA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 GLOBAL SHIPPING CONTAINER LINER MARKET: SEGMENTATION

FIGURE 2 GLOBAL SHIPPING CONTAINER LINER MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL SHIPPING CONTAINER LINER MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL SHIPPING CONTAINER LINER MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL SHIPPING CONTAINER LINER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL SHIPPING CONTAINER LINER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL SHIPPING CONTAINER LINER MARKET: DBMR SAFETY MARKET POSITION GRID

FIGURE 8 GLOBAL SHIPPING CONTAINER LINER MARKET: APPLICATION COVERAGE GRID

FIGURE 9 GLOBAL SHIPPING CONTAINER LINER MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA IS EXPECTED TO DOMINATE THE GLOBAL SHIPPING CONTAINER LINER MARKET AND GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 11 RISING PREVALANCE OF SHIPPING CONTAINER LINER IN FOOD AND AGRICULTURE INSUTRY IS DRIVING THE GLOBAL SHIPPING CONTAINER LINER MARKET IN THE FORECAST PERIOD

FIGURE 12 XXX SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL SHIPPING CONTAINER LINER MARKET IN 2022 & 2029

FIGURE 13 XXX IS THE FASTEST-GROWING REGION IN GLOBAL SHIPPING CONTAINER LINER MARKET IN THE FORECAST PERIOD

FIGURE 14 GLOBAL SHIPPING CONTAINER LINER MARKET: TYPES OF CONSUMER BUYING BEHAVIOR

FIGURE 15 PORTER'S 5 ANALYSIS

FIGURE 16 GLOBAL SHIPPING CONTAINER LINER MARKET: PRODUCT ADOPTION SCENARIO

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL SHIPPING CONTAINER LINER MARKET

FIGURE 18 GLOBAL SHIPPING CONTAINER LINER MARKET: BY TYPE, 2021

FIGURE 19 GLOBAL SHIPPING CONTAINER LINER MARKET: BY APPLICATION, 2021

FIGURE 20 GLOBAL SHIPPING CONTAINER LINER MARKET: SNAPSHOT (2021)

FIGURE 21 GLOBAL SHIPPING CONTAINER LINER MARKET: BY REGION (2021)

FIGURE 22 GLOBAL SHIPPING CONTAINER LINER MARKET: BY REGION (2022 & 2029)

FIGURE 23 GLOBAL SHIPPING CONTAINER LINER MARKET: BY REGION (2021 & 2029)

FIGURE 24 GLOBAL SHIPPING CONTAINER LINER MARKET: BY TYPE (2022-2029)

FIGURE 25 ASIA-PACIFIC SHIPPING CONTAINER LINER MARKET: SNAPSHOT (2021)

FIGURE 26 ASIA-PACIFIC SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2021)

FIGURE 27 ASIA-PACIFIC SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 28 ASIA-PACIFIC SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 29 ASIA-PACIFIC SHIPPING CONTAINER LINER MARKET: BY TYPE (2022 & 2029)

FIGURE 30 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: SNAPSHOT (2021)

FIGURE 31 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2021)

FIGURE 32 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 33 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 34 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: BY TYPE (2022 & 2029)

FIGURE 35 EUROPE SHIPPING CONTAINER LINER MARKET: SNAPSHOT (2021)

FIGURE 36 EUROPE SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2021)

FIGURE 37 EUROPE SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 EUROPE SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 EUROPE SHIPPING CONTAINER LINER MARKET: BY TYPE (2022 & 2029)

FIGURE 40 SOUTH AMERICA SHIPPING CONTAINER LINER MARKET: SNAPSHOT (2021)

FIGURE 41 SOUTH AMERICA SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2021)

FIGURE 42 SOUTH AMERICA SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 43 SOUTH AMERICA SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 44 SOUTH AMERICA SHIPPING CONTAINER LINER MARKET: BY TYPE (2022 - 2029)

FIGURE 45 MIDDLE EAST AND AFRICA SHIPPING CONTAINER LINER MARKET: SNAPSHOT (2021)

FIGURE 46 MIDDLE EAST AND AFRICA SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2021)

FIGURE 47 MIDDLE EAST AND AFRICA SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 48 MIDDLE EAST AND AFRICA SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 49 MIDDLE EAST AND AFRICA SHIPPING CONTAINER LINER MARKET: BY TYPE (2022 - 2029)

FIGURE 50 GLOBAL SHIPPING CONTAINER LINER MARKET: COMPANY SHARE 2021 (%)

FIGURE 51 NORTH AMERICA SHIPPING CONTAINER LINER MARKET: COMPANY SHARE 2021 (%)

FIGURE 52 EUROPE SHIPPING CONTAINER LINER MARKET: COMPANY SHARE 2021 (%)

FIGURE 53 ASIA-PACIFIC SHIPPING CONTAINER LINER MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.