Global Rare Earth Metal Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

8.42 Billion

USD

19.62 Billion

2024

2032

USD

8.42 Billion

USD

19.62 Billion

2024

2032

| 2025 –2032 | |

| USD 8.42 Billion | |

| USD 19.62 Billion | |

|

|

|

|

Segmentación del mercado global de metales de tierras raras por elemento (cerio, neodimio, lantano, disprosio, terbio, erbio, europio, gadolinio, holmio, lutecio, praseodimio, prometio, samario, tulio, iterbio, itrio, escandio y otros), aplicación (catalizadores, cerámica, fósforo, vidrio y pulido, metalurgia, imanes y otros): tendencias de la industria y pronóstico hasta 2032.

Tamaño del mercado de metales de tierras raras

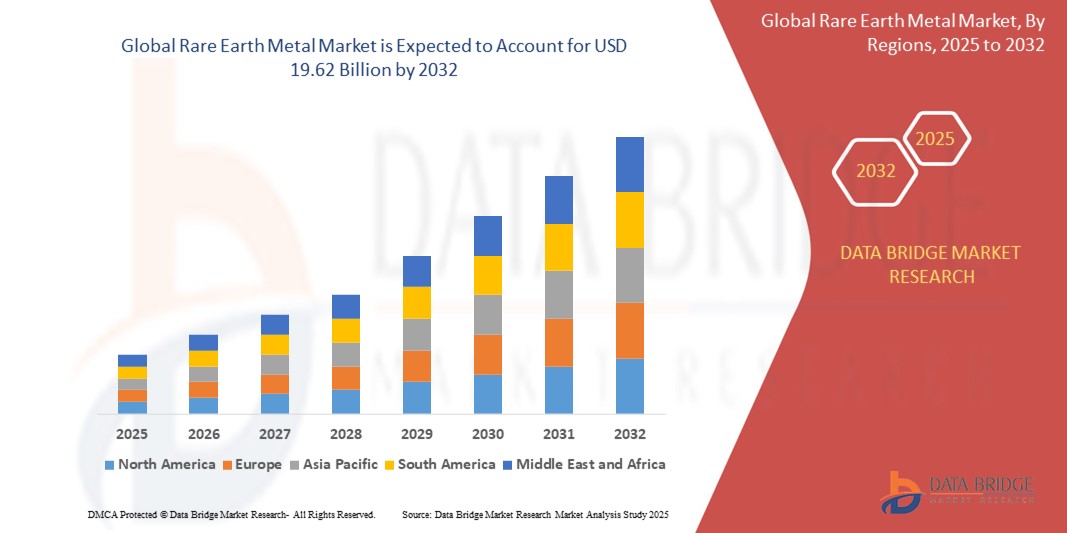

- El tamaño del mercado mundial de metales de tierras raras se valoró en USD 8.42 mil millones en 2024 y se espera que alcance los USD 19.62 mil millones para 2032 , con una CAGR del 11,15% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente demanda de imanes, catalizadores y baterías de alto rendimiento en industrias como la electrónica, las energías renovables, la automoción y la defensa.

- El mercado también está experimentando un crecimiento debido a las crecientes inversiones en vehículos eléctricos y energía eólica, donde los elementos de tierras raras como el neodimio y el disprosio son fundamentales para el rendimiento eficiente de los motores y las turbinas.

Análisis del mercado de metales de tierras raras

- El mercado de metales de tierras raras está creciendo de manera constante a medida que aumenta la demanda de productos electrónicos avanzados, tecnologías ecológicas e imanes permanentes utilizados en aplicaciones modernas.

- Las industrias están buscando activamente cadenas de suministro seguras y diversificadas para satisfacer las crecientes necesidades, lo que impulsa iniciativas de exploración y reciclaje a nivel mundial.

- Norteamérica dominó el mercado de tierras raras con una participación en los ingresos del 38,5 % en 2024, impulsada por fuertes inversiones en la minería y el procesamiento nacionales. La región se centra en asegurar sus cadenas de suministro para reducir la dependencia de las importaciones, especialmente para aplicaciones críticas de energía limpia y defensa.

- Se espera que la región de Asia y el Pacífico sea testigo de la mayor tasa de crecimiento en el mercado mundial de metales de tierras raras, impulsada por la rápida industrialización, la expansión de la producción de vehículos eléctricos y las iniciativas gubernamentales que promueven las tecnologías de energía limpia.

- El segmento del neodimio dominó el mercado con la mayor participación en los ingresos en 2024, impulsado por su papel crucial en la fabricación de imanes permanentes de alto rendimiento utilizados en vehículos eléctricos y turbinas eólicas. Su fuerza magnética y eficiencia lo convierten en la opción preferida para las industrias centradas en las energías limpias y la electrónica avanzada. La demanda de neodimio se ve impulsada aún más por el aumento de las inversiones en proyectos de energías renovables y la creciente adopción de la movilidad eléctrica en todo el mundo.

Alcance del informe y segmentación del mercado de metales de tierras raras

|

Atributos |

Perspectivas clave del mercado de metales de tierras raras |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de metales de tierras raras

Enfoque creciente en la diversificación de la cadena de suministro y las tecnologías de reciclaje

- El mercado de metales de tierras raras está cambiando hacia la diversificación de la cadena de suministro a medida que los países buscan reducir la dependencia de proveedores dominantes, como China, para garantizar la seguridad de los recursos y evitar interrupciones.

- Los fabricantes están invirtiendo en tecnologías de reciclaje para recuperar elementos de tierras raras de productos electrónicos y imanes industriales al final de su vida útil, lo que ofrece una alternativa sostenible y rentable a la minería tradicional.

- El Departamento de Energía de EE. UU. ha financiado proyectos de recuperación de tierras raras, como el liderado por MP Materials, con sede en Texas, para promover el abastecimiento nacional y reducir la dependencia de las importaciones.

- Japón está impulsando sus iniciativas de reciclaje de tierras raras a través de empresas como Hitachi, que han desarrollado técnicas para extraer tierras raras de electrodomésticos usados y motores de vehículos híbridos.

- Estas estrategias están ayudando a las industrias globales a cumplir objetivos ambientales, estabilizar las cadenas de suministro y apoyar la economía circular, al tiempo que reducen los riesgos geopolíticos y ambientales asociados con la extracción primaria.

Dinámica del mercado de metales de tierras raras

Conductor

Creciente demanda de tecnologías de energía limpia y vehículos eléctricos

- La creciente demanda de tecnologías de energía limpia está impulsando el uso de metales de tierras raras, en particular para producir imanes de alto rendimiento.

- Elementos como el neodimio, el disprosio y el praseodimio son esenciales para los generadores de turbinas eólicas y los motores de vehículos eléctricos .

- Los gobiernos de todo el mundo están promoviendo la energía renovable y la movilidad eléctrica mediante incentivos y políticas de sostenibilidad.

- Empresas como Tesla y General Motors están expandiendo la fabricación de vehículos eléctricos, impulsando el consumo de metales de tierras raras.

- Los proyectos de energía eólica marina, especialmente en Europa y Asia, están contribuyendo a la creciente necesidad de componentes basados en tierras raras, como en el Proyecto Hornsea en el Reino Unido, que es uno de los parques eólicos marinos más grandes del mundo y depende en gran medida de imanes de tierras raras de alto rendimiento para los generadores de sus turbinas.

Restricción/Desafío

Preocupaciones ambientales y complejidades del procesamiento en la minería de tierras raras

- La extracción y el procesamiento de metales de tierras raras generan importantes preocupaciones ambientales, que incluyen la alteración del suelo, el alto consumo de agua y la generación de desechos tóxicos.

- La refinación de minerales de tierras raras es compleja y costosa, y requiere instalaciones especializadas y estrictas salvaguardias ambientales.

- Las regulaciones más estrictas en regiones como América del Norte y Europa dificultan el inicio de nuevos proyectos mineros debido a los requisitos de cumplimiento ambiental.

- La oposición de la comunidad local y el activismo ambiental han retrasado o detenido proyectos, aumentando los costos y disuadiendo a los inversores.

- Por ejemplo, las iniciativas de minería de tierras raras en los EE. UU. se han enfrentado a tales desafíos.

- Estos problemas limitan el suministro mundial y alientan a los fabricantes a buscar alternativas sostenibles, como el reciclaje y estrategias de abastecimiento diversificado.

Alcance del mercado de metales de tierras raras

El mercado mundial de metales de tierras raras está segmentado según el elemento y la aplicación.

- Por elemento

Según el elemento, el mercado de tierras raras se segmenta en cerio, neodimio, lantano, disprosio, terbio, erbio, europio, gadolinio, holmio, lutecio, praseodimio, prometio, samario, tulio, iterbio, itrio, escandio, entre otros. El segmento de neodimio dominó el mercado con la mayor participación en los ingresos en 2024, gracias a su papel fundamental en la fabricación de imanes permanentes de alto rendimiento utilizados en vehículos eléctricos y turbinas eólicas. Su fuerza magnética y eficiencia lo convierten en una opción preferida para las industrias centradas en las energías limpias y la electrónica avanzada. La demanda de neodimio se ve impulsada aún más por el aumento de las inversiones en proyectos de energías renovables y la creciente adopción de la movilidad eléctrica en todo el mundo.

Se espera que el segmento de disprosio experimente la tasa de crecimiento más rápida durante el período de pronóstico de 2025 a 2032, debido a su capacidad para mejorar la estabilidad de la temperatura y el rendimiento de los imanes utilizados en entornos hostiles, lo que lo hace vital para aplicaciones automotrices y aeroespaciales.

- Por aplicación

Según su aplicación, el mercado de tierras raras se segmenta en catalizadores, cerámica, fósforos, vidrio y pulido, metalurgia, imanes, entre otros. El segmento de imanes registró la mayor cuota de mercado en 2024, principalmente debido a la creciente demanda de vehículos eléctricos, energías renovables y electrónica de consumo, donde los imanes potentes y ligeros son esenciales para un funcionamiento eficiente. Los imanes de tierras raras ofrecen un rendimiento superior, eficiencia energética y ventajas de miniaturización que impulsan su uso generalizado.

Se prevé que el segmento de catalizadores experimente el mayor crecimiento durante el período de pronóstico de 2025 a 2032, impulsado por la creciente demanda de convertidores catalíticos para automóviles y procesos químicos industriales destinados a reducir las emisiones nocivas y mejorar la eficiencia energética. Esta tendencia es especialmente marcada en las regiones con regulaciones ambientales estrictas.

Análisis regional del mercado de tierras raras

- Norteamérica dominó el mercado de tierras raras con una participación en los ingresos del 38,5 % en 2024, impulsada por fuertes inversiones en la minería y el procesamiento nacionales. La región se centra en asegurar sus cadenas de suministro para reducir la dependencia de las importaciones, especialmente para aplicaciones críticas de energía limpia y defensa.

- Las iniciativas gubernamentales que promueven la producción de tierras raras y los programas de reciclaje apoyan aún más el crecimiento del mercado

- La adopción de tecnología avanzada y la sólida demanda de los sectores automotriz y electrónico contribuyen significativamente a la expansión del mercado.

Perspectiva del mercado de tierras raras de EE. UU.

Estados Unidos representó alrededor del 85% de la cuota de mercado de Norteamérica en 2024, impulsado por políticas gubernamentales destinadas a impulsar la producción nacional de tierras raras y reducir la dependencia de las importaciones. La creciente demanda de vehículos eléctricos, turbinas eólicas y aplicaciones de seguridad nacional es un importante motor de crecimiento. Varios proyectos para desarrollar nuevas instalaciones de minería y refinación están en marcha, lo que respalda la independencia estratégica de recursos del país. Además, las inversiones en tecnologías de reciclaje están contribuyendo a mejorar la recuperación de materiales y la sostenibilidad.

Perspectiva del mercado de tierras raras de Asia-Pacífico

Se prevé que el mercado de Asia-Pacífico experimente la tasa de crecimiento más rápida durante el período de pronóstico de 2025 a 2032. La rápida industrialización, la urbanización y el crecimiento de la fabricación de productos electrónicos contribuyen a este crecimiento. Países como China, Japón e India están ampliando su capacidad de producción de tierras raras y sus instalaciones de procesamiento. El fuerte enfoque de la región en las energías renovables y los vehículos eléctricos está impulsando aún más la demanda. Las iniciativas gubernamentales que promueven la innovación tecnológica y la sostenibilidad aceleran el desarrollo del mercado.

Perspectivas del mercado de tierras raras de China

El mercado chino lidera la región Asia-Pacífico con una participación de mercado del 65% en 2024, gracias a sus vastas reservas de tierras raras y a su completa infraestructura de minería y refinación. Sigue siendo el mayor proveedor mundial de tierras raras, satisfaciendo una amplia demanda nacional y de exportación. El creciente mercado de vehículos eléctricos y los proyectos de energías renovables del país generan una demanda constante de tierras raras. Además, las iniciativas estratégicas de China para controlar la cadena de suministro global de tierras raras refuerzan su dominio del mercado.

Perspectiva del mercado japonés de tierras raras

Se prevé que el mercado japonés experimente la tasa de crecimiento más rápida durante el período de pronóstico de 2025 a 2032, impulsado por su sector tecnológico avanzado y la alta demanda de soluciones energéticas sostenibles. El país se centra en el desarrollo de tecnologías de reciclaje y recuperación de tierras raras para reducir la dependencia de las importaciones. Los sectores de producción de vehículos eléctricos y fabricación de productos electrónicos en Japón contribuyen significativamente a la demanda de tierras raras. El apoyo gubernamental, mediante alianzas estratégicas e inversiones, mejora las capacidades nacionales de procesamiento y la resiliencia de la cadena de suministro. El compromiso de Japón con la innovación y la sostenibilidad lo posiciona como un actor clave en el mercado global de tierras raras.

Perspectivas del mercado europeo de tierras raras

Se prevé que el mercado europeo experimente la tasa de crecimiento más rápida durante el período de pronóstico de 2025 a 2032, impulsado por la creciente demanda de los sectores de las tecnologías verdes y las iniciativas de reciclaje. Los países europeos están invirtiendo fuertemente en asegurar fuentes sostenibles y mejorar sus capacidades de procesamiento. Las industrias automotriz y electrónica de la región dependen de las tierras raras para aplicaciones de alto rendimiento. Las políticas que fomentan las prácticas de economía circular y la eficiencia de los recursos impulsan aún más el crecimiento del mercado. El enfoque de Europa en reducir la dependencia de las importaciones respalda las inversiones continuas en iniciativas relacionadas con las tierras raras.

Perspectivas del mercado alemán de tierras raras

El mercado alemán capturó alrededor del 45% de la cuota de mercado europea de tierras raras en 2024, gracias a su sólido sector automotriz y su base industrial. El país prioriza la innovación en el abastecimiento sostenible y las tecnologías de procesamiento ecológicas. Las estrictas regulaciones ambientales alemanas motivan a los fabricantes a adoptar métodos avanzados de reciclaje y extracción más limpia. La demanda de tierras raras en vehículos eléctricos, turbinas eólicas y electrónica impulsa la expansión constante del mercado. Las colaboraciones estratégicas entre el gobierno y la industria fortalecen su posición en la cadena de suministro global.

Perspectivas del mercado de tierras raras del Reino Unido

Se prevé que el mercado del Reino Unido experimente la tasa de crecimiento más rápida durante el período de pronóstico de 2025 a 2032, impulsado por la creciente inversión en tecnologías de reciclaje y la diversificación de la cadena de suministro. Los sectores de la electrónica y las energías limpias del Reino Unido contribuyen de forma clave a la demanda de tierras raras. La apuesta por los principios de la economía circular fomenta la gestión sostenible de los recursos y reduce la dependencia de las importaciones. Los incentivos gubernamentales y las iniciativas de investigación del país impulsan el desarrollo de la recuperación y el procesamiento de tierras raras. Este enfoque refuerza el papel del Reino Unido en el cambiante panorama mundial de las tierras raras.

Cuota de mercado de los metales de tierras raras

La industria de los metales de tierras raras está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Alkane Resources Ltd (Australia)

- Tierras raras de Arafura (Australia)

- Lynas Rare Earths Ltd (Australia)

- China Rare Earth Holdings Limited (China)

- Avalon Advanced Materials Inc. (Canadá)

- IREL(INDIA) LIMITADA (India)

- Rare Element Resources Ltd. (EE. UU.)

- Frontier Rare Earths Limited (Canadá)

- Corporación Canadiense de Tierras Raras (Canadá)

- Iluka Resources Limited (Australia)

- MINERALES DEL NORTE (Australia)

- Krakatoa Resources Ltd. (Australia)

- Ucore Rare Metals Inc. (EE. UU.)

- Namibia Critical Metals Inc. (Namibia)

Últimos avances en el mercado mundial de metales de tierras raras

- En septiembre de 2022, Solvay anunció la expansión de sus operaciones de tierras raras en La Rochelle, Francia. La compañía busca establecer un importante centro de imanes de tierras raras para satisfacer la creciente demanda en vehículos eléctricos, energías limpias y electrónica. Este desarrollo respalda la apuesta de Europa por las tecnologías sostenibles y fortalece la cadena de suministro regional de materiales críticos.

- En agosto de 2022, Lynas Rare Earths Ltd. anunció sus planes para ampliar la capacidad de su mina Mt. Weld en Australia Occidental, conocida por sus yacimientos de neodimio y praseodimio. La expansión está prevista para comenzar a principios de 2023 y estar plenamente operativa para 2024. Esta medida mejora la capacidad de la empresa para satisfacer la creciente demanda mundial y asegura un suministro estable de tierras raras clave.

- En abril de 2022, Iluka Resources Ltd. anunció una inversión de 1200 millones de dólares en el proyecto de refinería de tierras raras Eneabba Fase 3 en Australia Occidental. La iniciativa busca impulsar el procesamiento posterior de óxidos de tierras raras de la empresa, fortaleciendo su posición en el mercado global. La inversión también contribuye al desarrollo económico de Australia y promueve la gestión sostenible de los recursos.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.