Global Polyglycolic Acid In Oil And Gas Industry

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

89.27 Million

USD

127.93 Million

2024

2032

USD

89.27 Million

USD

127.93 Million

2024

2032

| 2025 –2032 | |

| USD 89.27 Million | |

| USD 127.93 Million | |

|

|

|

|

Segmentación del mercado global de ácido poliglicólico en la industria del petróleo y el gas, por formato (polvo/granular, materiales fibrosos, películas, etc.), aplicación (control y remediación de incrustaciones, estimulación de pozos horizontales, eliminación de yeso, disolución de naftenatos metálicos, eliminación de compuestos orgánicos solubles en agua, fracturación hidráulica, herramientas de fondo de pozo, gestión de la presión, control de pozos, extracción de petróleo, etc.) - Tendencias y pronóstico de la industria hasta 2032

Tamaño del mercado del ácido poliglicólico en la industria del petróleo y el gas

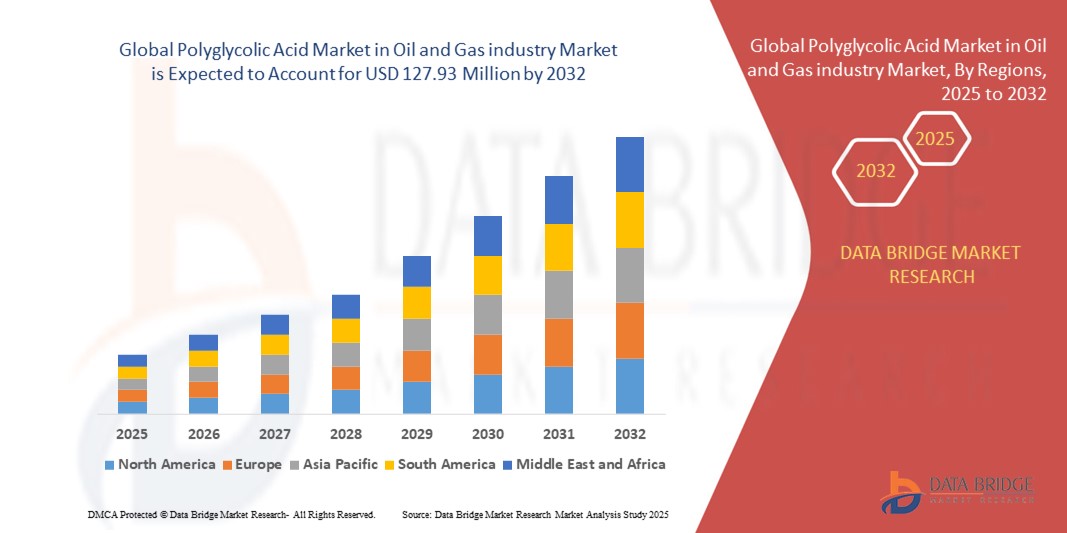

- El mercado global de ácido poliglicólico en la industria del petróleo y el gas se valoró en USD 89,27 millones en 2024 y se espera que alcance los USD 127,93 millones para 2032 , con una CAGR del 4,60% durante el período de pronóstico.

- El crecimiento del mercado está impulsado principalmente por el creciente despliegue de materiales basados en PGA en operaciones de fracturación hidráulica y limpieza de pozos debido a su alta resistencia mecánica y excelente biodegradabilidad en condiciones de fondo de pozo.

- Además, la creciente demanda de materiales degradables rentables y de alto rendimiento que mejoran la eficiencia de la perforación y reducen la limpieza posterior a la operación está consolidando el PGA como la opción preferida. Esta dinámica impulsa la adopción de soluciones de ácido poliglicólico, impulsando considerablemente la expansión del mercado en el sector del petróleo y el gas.

Análisis del mercado del ácido poliglicólico en la industria del petróleo y el gas

- El ácido poliglicólico (PGA), un polímero biodegradable de alto rendimiento , se está convirtiendo en un material crucial en las operaciones de petróleo y gas, particularmente para herramientas de fondo de pozo y fracturación hidráulica, debido a su resistencia, degradación controlada y compatibilidad ambiental en condiciones de pozo desafiantes.

- La creciente demanda de soluciones sostenibles y rentables que eliminen la necesidad de recuperación mecánica está acelerando la adopción de herramientas basadas en PGA en los procesos de perforación y estimulación en campos convencionales y no convencionales.

- América del Norte dominó el mercado de ácido poliglicólico en el sector de petróleo y gas con la mayor participación en los ingresos del 39,2 % en 2024, impulsada por la exploración generalizada de gas de esquisto, la innovación tecnológica en el diseño de herramientas degradables y el creciente enfoque en la reducción de los tiempos de limpieza posteriores a la fracturación.

- Se espera que Asia-Pacífico sea la región de más rápido crecimiento en el mercado de ácido poliglicólico durante el período de pronóstico, respaldada por el aumento de las actividades de perforación en China e India, el aumento de la demanda de energía y la creciente conciencia de los materiales biodegradables en las prácticas de intervención de pozos.

- El segmento de fracturación hidráulica dominó el mercado de ácido poliglicólico con una participación del 41,8% en 2024, impulsado por el creciente uso de tapones de fracturación degradables y desviadores que simplifican las operaciones y reducen los costos en entornos de fracturación de múltiples etapas.

Alcance del informe y segmentación del mercado de ácido poliglicólico en la industria del petróleo y el gas

|

Atributos |

Mercado de ácido poliglicólico en la industria del petróleo y el gas: Perspectivas clave del mercado |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado del ácido poliglicólico en la industria del petróleo y el gas

Mayor uso de herramientas biodegradables para la eficiencia operativa y el cumplimiento ambiental

- Una tendencia significativa y en aceleración en el mercado global de ácido poliglicólico (PGA) dentro de la industria del petróleo y el gas es la creciente adopción de herramientas de fondo de pozo biodegradables que ofrecen tanto eficiencia operativa como cumplimiento de las regulaciones ambientales.

- Por ejemplo, los principales proveedores de servicios como Halliburton y Baker Hughes están implementando tapones de fracturación y desviadores basados en PGA que se degradan naturalmente en el pozo, eliminando la necesidad de recuperación mecánica y reduciendo el tiempo total de finalización del pozo.

- La degradabilidad controlada del PGA en condiciones específicas de temperatura y presión lo hace ideal para el aislamiento zonal temporal y otras aplicaciones de estimulación. A medida que la industria prioriza el ahorro de tiempo y la reducción de las intervenciones post-fractura, estas herramientas degradables están ganando terreno rápidamente.

- Además, el uso de materiales respetuosos con el medio ambiente es cada vez más crucial para cumplir con las normas regulatorias, especialmente en regiones con estrictas directrices ambientales. Este cambio está animando a los operadores de yacimientos petrolíferos a incorporar prácticas sostenibles utilizando polímeros degradables como el PGA.

- La integración del PGA en los flujos de trabajo estándar de construcción y terminación de pozos está transformando radicalmente los enfoques operativos. Fabricantes como Kureha Corporation y Evonik están intensificando la I+D para mejorar la resistencia térmica y mecánica del PGA y lograr una mayor compatibilidad con los pozos.

- Esta tendencia constante hacia la simplicidad operativa, el ahorro de costos y la alineación regulatoria está transformando el panorama del PGA, convirtiéndolo en un material clave en el futuro del desarrollo sustentable de los yacimientos petrolíferos.

Dinámica del mercado del ácido poliglicólico en la industria del petróleo y el gas

Conductor

Ahorro de tiempo y costos operativos con herramientas degradables para fondo de pozo

- La creciente demanda de reducir el tiempo de plataforma, las intervenciones posteriores a la fracturación y los costos operativos generales es un impulsor principal que impulsa la adopción de ácido poliglicólico en las operaciones de petróleo y gas.

- Por ejemplo, los tapones de fracturación a base de PGA se degradan tras su uso, eliminando la necesidad de fresado, que suele implicar tubería flexible y mano de obra adicional. Esto se traduce en ahorros significativos de costos y plazos de terminación de pozos más rápidos.

- La combinación de alta resistencia mecánica y degradación predecible de PGA brinda a los operadores una solución confiable y eficiente para aplicaciones temporales en el fondo del pozo, como desviación de flujo y operaciones de tapón y perforación.

- A medida que los operadores buscan aumentar la producción y al mismo tiempo reducir los gastos de capital, particularmente en regiones de alta actividad como la Cuenca Pérmica de América del Norte, las herramientas basadas en PGA se están convirtiendo en una alternativa preferida a las herramientas metálicas o compuestas convencionales.

- La escalabilidad y la facilidad de integración en los sistemas actuales de perforación y terminación fortalecen aún más el papel de PGA como impulsor de la eficiencia de los yacimientos petrolíferos modernos, posicionándolo como una solución de alto valor para los operadores.

Restricción/Desafío

Alto costo del material y compatibilidad limitada en entornos de fondo de pozo hostiles

- Uno de los principales desafíos que enfrenta la adopción generalizada del ácido poliglicólico es su costo de producción relativamente alto en comparación con los materiales de herramientas de fondo de pozo tradicionales, lo que limita su atractivo en mercados sensibles a los costos.

- Además, es posible que el PGA no funcione de manera óptima en ciertas condiciones adversas de fondo de pozo, como temperaturas ultra altas o entornos altamente corrosivos, donde la degradación prematura podría comprometer la integridad de la herramienta y los resultados operativos.

- Por ejemplo, los operadores que trabajan en pozos de aguas profundas o de alta temperatura pueden mostrarse reacios a adoptar herramientas PGA sin datos comprobados a largo plazo, citando riesgos asociados con la variabilidad del rendimiento del material.

- La necesidad de condiciones especializadas de manipulación y almacenamiento, así como la disponibilidad limitada de herramientas compatibles con PGA en algunas regiones del mundo, restringen aún más su alcance de mercado.

- Abordar estas limitaciones mediante la I+D continua, el desarrollo de variantes de PGA resistentes térmica y químicamente y el logro de economías de escala en la producción serán fundamentales para superar estos desafíos y expandir la presencia de PGA en el sector del petróleo y el gas.

Alcance del mercado del ácido poliglicólico en la industria del petróleo y el gas

El mercado está segmentado en función de la forma y la aplicación.

- Por formulario

En cuanto a su forma, el mercado del ácido poliglicólico (PGA) en la industria del petróleo y el gas se segmenta en polvo/granular, materiales fibrosos, películas y otros. El segmento de materiales fibrosos dominó el mercado con la mayor participación en los ingresos, con un 39,6 % en 2024, gracias a su amplio uso en la fabricación de herramientas degradables para fondo de pozo, como tapones de fracturación, desviadores y selladores de bolas. El PGA fibroso ofrece alta resistencia mecánica, tasas de degradación controladas y compatibilidad con las condiciones estándar de los pozos, lo que lo hace ideal para aplicaciones petroleras exigentes. La posibilidad de personalizar las formas fibrosas para perfiles específicos de presión y temperatura también contribuye a su dominio en el mercado.

Se prevé que el segmento de polvo/granular registre la tasa de crecimiento más rápida, del 20,4 %, entre 2025 y 2032, impulsada por su creciente adopción en aplicaciones de control de incrustaciones y remediación. El PGA en polvo permite una dispersión eficiente y un rendimiento preciso en sistemas de fluidos, lo que lo hace adecuado para el bloqueo temporal, la eliminación de compuestos orgánicos solubles en agua y otros tratamientos de pozos basados en fluidos. Su facilidad de inyección y disolución en condiciones complejas de pozos respalda su creciente demanda en operaciones de recuperación secundaria y terciaria.

- Por aplicación

Según su aplicación, el mercado de PGA se segmenta en control y remediación de incrustaciones, estimulación de pozos horizontales, remoción de yeso, disolución de naftenatos metálicos, remoción de compuestos orgánicos solubles en agua, fracturación hidráulica, herramientas de fondo de pozo, gestión de presión, control de pozos , extracción de petróleo , entre otros. El segmento de fracturación hidráulica dominó el mercado con la mayor participación en ingresos, con un 41,8 % en 2024, impulsado por el creciente uso de tapones y desviadores de fracturación degradables que se disuelven después de la operación, eliminando así la necesidad de recuperación mecánica. La degradación confiable del PGA en condiciones específicas de fondo de pozo reduce significativamente el tiempo y el costo operativos, lo que lo convierte en una opción preferida para los métodos de fracturación de tapón y perforación en formaciones de gas de esquisto y petróleo de baja presión.

Se proyecta que el segmento de herramientas de fondo de pozo experimentará la tasa de crecimiento anual compuesta (TCAC) más rápida, del 19,6 %, entre 2025 y 2032, impulsada por la expansión de las operaciones de perforación no convencionales y la creciente preferencia por materiales respetuosos con el medio ambiente. Los componentes degradables basados en PGA en herramientas como selladores de bolas, tapones de puente y empacadores están ganando popularidad por su capacidad para simplificar las operaciones y cumplir con las normas ambientales. Su capacidad para mantener una alta integridad estructural, a la vez que garantiza la desintegración completa después de su uso, es crucial en las estrategias modernas de terminación de yacimientos petrolíferos.

Análisis regional del mercado del ácido poliglicólico en la industria del petróleo y el gas

- América del Norte dominó el mercado de ácido poliglicólico en el sector de petróleo y gas con la mayor participación en los ingresos del 39,2 % en 2024, impulsada por la exploración generalizada de gas de esquisto, la innovación tecnológica en el diseño de herramientas degradables y el creciente enfoque en la reducción de los tiempos de limpieza posteriores a la fracturación.

- Los operadores de la región priorizan materiales como el PGA, que pueden mejorar la productividad de los pozos y minimizar la intervención posoperatoria. El uso de tapones de fracturación y divergentes degradables se está convirtiendo en una práctica habitual en yacimientos importantes como la Cuenca Pérmica y Eagle Ford.

- Este dominio regional está respaldado además por una infraestructura de perforación avanzada, la presencia de proveedores clave de servicios petrolíferos y una creciente demanda de materiales sostenibles que reducen el impacto ambiental y simplifican las operaciones de los pozos, posicionando a PGA como una solución preferida en el desarrollo de recursos no convencionales de América del Norte.

Perspectivas del mercado estadounidense de ácido poliglicólico en la industria del petróleo y el gas

El mercado estadounidense de ácido poliglicólico capturó la mayor participación en los ingresos, con un 81,2 %, en 2024 en Norteamérica, impulsado por la alta producción de gas de esquisto y la adopción generalizada de herramientas degradables en las operaciones de fracturación hidráulica. Los operadores integran cada vez más tapones y desviadores de fracturación basados en PGA para reducir el tiempo de terminación de pozos y eliminar las operaciones de recuperación postfracturación. La sólida presencia de proveedores de servicios petrolíferos y el énfasis en la rentabilidad y la sostenibilidad ambiental siguen reforzando el uso de PGA en la perforación no convencional en importantes cuencas como la del Pérmico y la de Bakken.

Análisis del mercado europeo del ácido poliglicólico en la industria del petróleo y el gas

Se proyecta que el mercado europeo de PGA en el sector del petróleo y el gas se expandirá a una tasa de crecimiento anual compuesta (TCAC) sustancial durante el período de pronóstico, impulsado por el endurecimiento de las regulaciones ambientales y la creciente demanda de materiales degradables en los procesos de estimulación de pozos. Los países de la región están invirtiendo en tecnologías de perforación ecológicas, y el PGA está ganando reconocimiento por su capacidad para reducir los residuos operativos. Además, la tendencia hacia soluciones energéticas más ecológicas en yacimientos petrolíferos maduros, especialmente en el Mar del Norte, está impulsando la sustitución gradual de las herramientas metálicas de fondo de pozo por alternativas biodegradables como el PGA.

Análisis del mercado del ácido poliglicólico en el Reino Unido para la industria del petróleo y el gas

Se prevé que el mercado británico de PGA crezca a una CAGR notable durante el período de pronóstico, impulsado por los estrictos estándares de perforación offshore del país y el creciente enfoque en operaciones petroleras sostenibles. Con el aumento de la actividad en zonas offshore y el envejecimiento de los pozos, los operadores están recurriendo a soluciones basadas en PGA por su capacidad para simplificar la extracción de tapones y reducir el tiempo de intervención. Las iniciativas respaldadas por el gobierno que promueven la seguridad ambiental y el uso eficiente de los recursos respaldan aún más la adopción de PGA en las aplicaciones petroleras del Reino Unido.

Análisis del mercado alemán del ácido poliglicólico en la industria del petróleo y el gas

Se espera que el mercado alemán de PGA se expanda a una tasa de crecimiento anual compuesta (TCAC) considerable durante el período de pronóstico, impulsado por la innovación tecnológica y un fuerte énfasis en prácticas ambientalmente sostenibles en las operaciones industriales. La consolidada base de fabricación de productos químicos del país contribuye a la producción nacional de PGA, mientras que los proveedores de servicios petrolíferos exploran cada vez más opciones de herramientas degradables para las actividades de exploración y mantenimiento en tierra. El enfoque de Alemania en tecnologías limpias se alinea con el uso de PGA en procesos de perforación de bajo impacto.

Análisis del mercado de ácido poliglicólico en la industria del petróleo y el gas en Asia-Pacífico

Se prevé que el mercado de PGA en Asia-Pacífico crezca a la tasa de crecimiento anual compuesta (TCAC) más alta, del 24,1 %, entre 2025 y 2032, impulsado por la expansión de las actividades de perforación, especialmente en China e India, y el desarrollo de infraestructura energética impulsado por los gobiernos. La transición hacia técnicas de exploración sostenibles y la creciente concienciación sobre los materiales biodegradables en aplicaciones petrolíferas impulsan el crecimiento del mercado. Además, la aparición de centros regionales de fabricación está mejorando la asequibilidad y la disponibilidad de PGA en toda la región, lo que fomenta su adopción en proyectos energéticos tanto nacionales como privados.

Análisis del mercado japonés del ácido poliglicólico en la industria del petróleo y el gas

El mercado japonés de PGA está cobrando impulso gracias a la prioridad del país en la eficiencia energética, las capacidades avanzadas en ciencia de materiales y las prácticas responsables con el medio ambiente en yacimientos petrolíferos. El énfasis de Japón en minimizar la huella ecológica de sus operaciones offshore y de mantenimiento está fomentando el uso de herramientas degradables basadas en PGA. Además, la colaboración entre fabricantes químicos japoneses y empresas globales de servicios petrolíferos está impulsando la innovación en formulaciones de PGA de alto rendimiento adaptadas a las condiciones locales.

Análisis del mercado indio de ácido poliglicólico en la industria del petróleo y el gas

El mercado indio de PGA representó la mayor cuota de mercado en ingresos en Asia Pacífico en 2024, debido a la creciente demanda energética del país, el rápido desarrollo de los yacimientos petrolíferos y el énfasis político en la eficiencia de la producción nacional. Las herramientas de PGA están ganando popularidad en las zonas de perforación de alta actividad de la India gracias a su capacidad para optimizar los procesos de terminación y reducir los costos de intervención. El apoyo a la fabricación local, las iniciativas de exploración inteligente respaldadas por el gobierno y una mayor concienciación sobre las tecnologías degradables impulsan la adopción de PGA en la industria india del petróleo y el gas.

Cuota de mercado del ácido poliglicólico en la industria del petróleo y el gas

El mercado del ácido poliglicólico en la industria del petróleo y el gas está liderado principalmente por empresas bien establecidas, entre las que se incluyen:

- Corporación Kureha (Japón)

- Evonik Industries AG (Alemania)

- Corbion NV (Países Bajos)

- DuPont de Nemours, Inc. (EE. UU.)

- BMG Incorporated (Japón)

- Shenzhen Polymtek Biomaterial Co., Ltd. (China)

- Samyang Holdings Corporation (Corea del Sur)

- Dispositivos médicos Huizhou Foryou Co., Ltd. (China)

- Teleflex Incorporated (EE. UU.)

- Mitsubishi Chemical Corporation (Japón)

- Toray Industries, Inc. (Japón)

- Ashland Inc. (EE. UU.)

- BASF SE (Alemania)

- EMS-Grivory (Suiza)

- SABIC (Arabia Saudita)

- Jiangsu Junhua High Performance Specialty Engineering Plastics Co., Ltd. (China)

- NatureWorks LLC (EE. UU.)

- Perstorp Holding AB (Suecia)

- DSM Engineering Materials (Países Bajos)

- Arkema SA (Francia)

¿Cuáles son los desarrollos recientes en el mercado global de ácido poliglicólico en la industria del petróleo y el gas?

- En abril de 2023, Evonik Industries AG, empresa líder en productos químicos especializados, anunció la expansión de su capacidad de producción de PGA para satisfacer la creciente demanda mundial del sector del petróleo y el gas. La compañía presentó un nuevo grado de PGA de alto rendimiento, diseñado específicamente para entornos de fondo de pozo rigurosos, compatible con aplicaciones de fracturación hidráulica y aislamiento de pozos. Este desarrollo refuerza la estrategia de Evonik de proporcionar materiales innovadores y sostenibles, adaptados a las exigentes operaciones de los yacimientos petrolíferos, a la vez que permite a los operadores reducir su impacto ambiental.

- En marzo de 2023, Kureha Corporation, un productor clave de ácido poliglicólico, anunció su alianza estratégica con un importante proveedor de servicios petrolíferos para el desarrollo conjunto de herramientas degradables de fondo de pozo utilizando formulaciones avanzadas de PGA. La colaboración se centra en la creación de tapones de fracturación y selladores de bolas que ofrecen una degradación controlada en diversas condiciones de temperatura y presión, en línea con la creciente tendencia de la industria hacia tecnologías de terminación rentables y respetuosas con el medio ambiente.

- En febrero de 2023, Saudi Aramco realizó pruebas de campo con sistemas de desvío degradables basados en PGA en varios pozos de gas no convencionales, como parte de su compromiso con el desarrollo de energía sostenible. Las pruebas demostraron ahorros significativos de tiempo y costos al eliminar las operaciones de molienda post-fractura. Se espera que el éxito de estas pruebas impulse una mayor integración de las soluciones de PGA en las operaciones de Oriente Medio, contribuyendo así a los objetivos a largo plazo de Aramco de reducir la complejidad operativa y el impacto ambiental.

- En enero de 2023, Baker Hughes, empresa global de tecnología energética, lanzó una nueva línea de herramientas degradables para fondo de pozo que incorporan ácido poliglicólico, con el objetivo de optimizar el aislamiento zonal en la fracturación hidráulica multietapa. Las herramientas están diseñadas para una degradación eficiente después de su uso, lo que mejora la eficiencia operativa y elimina la necesidad de extracción mecánica. Este lanzamiento de producto destaca la inversión continua de Baker Hughes en materiales avanzados que apoyan la sostenibilidad de las operaciones petroleras y la simplificación operativa.

- En enero de 2023, Schlumberger se asoció con un fabricante de materiales compuestos para desarrollar mezclas de PGA de última generación con resistencia térmica mejorada para su uso en entornos de pozos de alta presión y alta temperatura (HPHT). La iniciativa busca ampliar la aplicabilidad del PGA en condiciones más extremas, abordando un desafío clave para una adopción más amplia. Esta colaboración demuestra el enfoque de SLB en la ingeniería de materiales innovadores para satisfacer las cambiantes demandas técnicas del sector energético global.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.