Global Polyethylene Terephthalate Glycol Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

2.10 Billion

USD

3.48 Billion

2024

2032

USD

2.10 Billion

USD

3.48 Billion

2024

2032

| 2025 –2032 | |

| USD 2.10 Billion | |

| USD 3.48 Billion | |

|

|

|

|

Segmentación del mercado global de glicol de tereftalato de polietileno (PETG) por tipo de producto (extruido, moldeado por inyección y soplado), tipo (PETG amorfo y semicristalino), aplicación (prototipos, envases, herramientas, plantillas, accesorios, equipos y maquinaria, entre otros), proceso (extruido, moldeado por inyección, moldeado por soplado), uso final (alimentos y bebidas, cosméticos, medicina, entre otros): tendencias y pronóstico de la industria hasta 2032.

Tamaño del mercado de glicol de tereftalato de polietileno

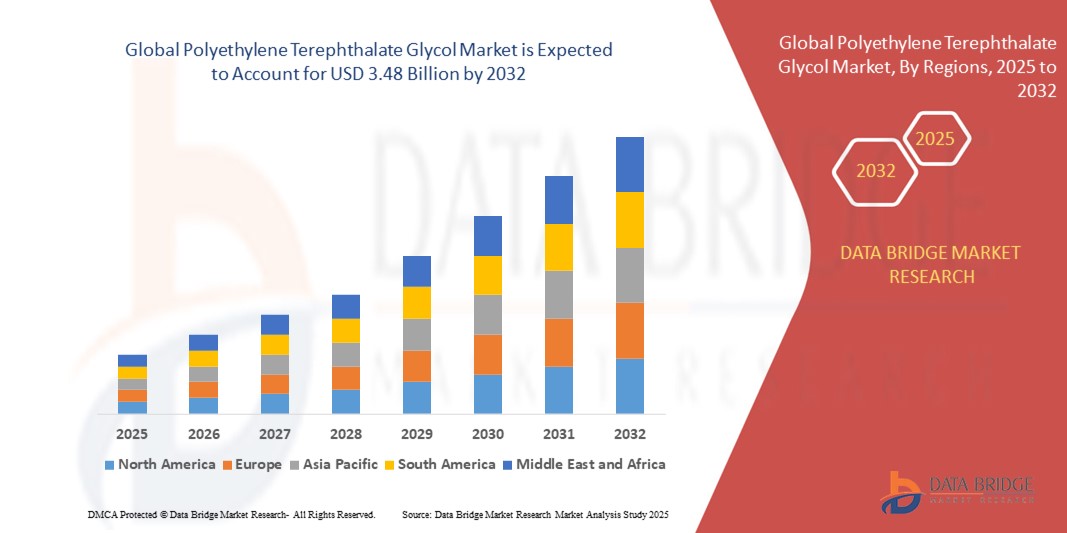

- El tamaño del mercado global de tereftalato de polietileno glicol se valoró en USD 2.10 mil millones en 2024 y se espera que alcance los USD 3.48 mil millones para 2032 , con una CAGR del 6,50% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente demanda de materiales duraderos, livianos y rentables en las industrias de embalaje, automotriz y bienes de consumo.

- La creciente adopción de PETG en aplicaciones de impresión 3D, debido a su superior flexibilidad y claridad, está contribuyendo aún más a la expansión del mercado.

Análisis del mercado del glicol de tereftalato de polietileno

- El mercado está experimentando un fuerte crecimiento debido a los avances en las tecnologías de fabricación y la creciente popularidad del PETG en los sectores de dispositivos médicos, electrónica y construcción.

- Los principales fabricantes se están centrando en innovaciones de productos y expansiones de capacidad para satisfacer la creciente demanda en las economías emergentes, lo que se espera que fortalezca aún más las perspectivas del mercado en los próximos años.

- América del Norte dominó el mercado de PETG con la mayor participación en los ingresos del 39,5 % en 2024, impulsada por la creciente demanda de plásticos duraderos, livianos y reciclables en los sectores de embalaje, atención médica e industrial.

- Se espera que la región de Asia y el Pacífico sea testigo de la mayor tasa de crecimiento en el mercado mundial de tereftalato de polietileno glicol , impulsada por la creciente urbanización, el crecimiento de los sectores manufactureros en China, Japón y Corea del Sur, y la creciente conciencia de los materiales sostenibles y de alto rendimiento en todas las industrias.

- El segmento de grado extruido obtuvo la mayor participación en los ingresos en 2024 gracias a su transparencia superior, facilidad de termoformado e idoneidad para la producción de láminas de gran tamaño, utilizadas en aplicaciones de embalaje y exhibición. Este grado es el preferido por su equilibrio entre resistencia, transparencia y procesabilidad en la producción a gran escala.

Alcance del informe y segmentación del mercado de glicol de tereftalato de polietileno

|

Atributos |

Análisis clave del mercado del polietilenglicol tereftalato |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado del polietilenglicol tereftalato

Creciente adopción de PETG en soluciones de envasado sostenibles

El creciente énfasis en los materiales ecológicos impulsa la demanda de PETG en el sector del envasado, especialmente en alimentos, bebidas y productos farmacéuticos. Su reciclabilidad, durabilidad y bajo impacto ambiental lo convierten en una alternativa preferida a los plásticos tradicionales, ya que las industrias buscan soluciones más ecológicas.

• Con las crecientes regulaciones en torno a los plásticos de un solo uso y la preferencia de los consumidores por envases sostenibles, los fabricantes de PETG están desarrollando materiales de embalaje innovadores, livianos y reciclables para cumplir con los objetivos ambientales y, al mismo tiempo, mantener la seguridad del producto y el atractivo en las estanterías.

• El rápido crecimiento del comercio electrónico y los hábitos cambiantes de los consumidores están impulsando aún más la adopción de envases basados en PETG, que ofrecen una mayor protección del producto con un menor consumo de material y una mejor eficiencia de costos en toda la cadena de suministro.

• Por ejemplo, en 2023, varias empresas de bebidas en Europa cambiaron a botellas de PETG con mayor contenido reciclado, lo que garantiza el cumplimiento de los mandatos de sostenibilidad de la UE y, al mismo tiempo, mantiene los estándares de seguridad, durabilidad y vida útil del producto.

• Si bien el PETG está ganando terreno en los envases sustentables, la I+D continua y la optimización de costos siguen siendo clave para expandir sus aplicaciones en diversas industrias, especialmente porque los usuarios finales demandan materiales ecológicos pero de alto rendimiento.

Dinámica del mercado del polietilenglicol tereftalato

Conductor

Creciente demanda de PETG en impresión 3D y aplicaciones médicas

El auge de las tecnologías de fabricación aditiva está impulsando el uso de filamentos PETG en la impresión 3D gracias a su durabilidad, resistencia química y facilidad de procesamiento. El PETG ofrece mayor resistencia que el PLA y mayor flexibilidad que el ABS, lo que lo hace ideal para la creación de prototipos y piezas funcionales en las industrias automotriz, aeroespacial y de bienes de consumo.

En el sector sanitario, el PETG se utiliza ampliamente para la fabricación de componentes de dispositivos médicos, protectores faciales y embalajes debido a su cumplimiento de las normas de seguridad y biocompatibilidad. La demanda aumentó durante la pandemia de COVID-19, cuando las láminas de PETG se utilizaron ampliamente para barreras protectoras, piezas de respiradores y equipos de diagnóstico en todo el mundo.

Las crecientes inversiones en infraestructura sanitaria y tecnologías de fabricación digital impulsan aún más la demanda de PETG en múltiples sectores. La transparencia, esterilizabilidad y durabilidad del material lo hacen ideal tanto para productos médicos desechables como para componentes de equipos de larga duración.

• Por ejemplo, en 2022, varios fabricantes de dispositivos médicos en América del Norte adoptaron PETG para producir bandejas de instrumentos quirúrgicos esterilizables y duraderas, carcasas de diagnóstico y equipos de protección, lo que impulsó el crecimiento del mercado y mejoró la confiabilidad del producto en las operaciones de atención médica.

• Si bien la demanda está aumentando, la innovación continua en métodos de producción rentables, como procesos de extrusión avanzados y una mayor reciclabilidad, será esencial para mantener la competitividad del mercado y satisfacer la creciente necesidad de soluciones PETG de alta calidad a nivel mundial.

Restricción/Desafío

Precios fluctuantes de las materias primas e infraestructura de reciclaje limitada

La producción de PETG depende en gran medida de materias primas como el ácido tereftálico purificado (PTA) y el monoetilenglicol (MEG). La volatilidad de los precios del petróleo crudo afecta directamente a estas materias primas, lo que genera fluctuaciones en los costos de producción de PETG, menores márgenes de rentabilidad e incertidumbre en los contratos de suministro a largo plazo.

• El reciclaje de PETG sigue siendo un desafío debido a la falta de sistemas avanzados de recolección y clasificación en muchas regiones, lo que limita el suministro de materiales de PETG reciclado de alta calidad para uso industrial, embalaje e iniciativas de fabricación ecológicas en las principales economías.

En las economías emergentes, la ausencia de una infraestructura de reciclaje organizada y la escasa concienciación sobre la segregación del plástico obstaculizan las iniciativas de economía circular en la industria del PETG. Esto limita la adopción de PETG reciclado en aplicaciones de alto valor, lo que resulta en una mayor dependencia de materias primas vírgenes.

• Por ejemplo, en 2023, las empresas de embalaje del sudeste asiático informaron retrasos en la adopción de PETG reciclado debido al suministro inconsistente de materia prima, instalaciones inadecuadas de gestión de residuos y la ausencia de protocolos de reciclaje estándar, lo que ralentizó los objetivos regionales de sostenibilidad.

• Abordar las brechas de infraestructura de reciclaje, invertir en tecnologías de reciclaje químico e introducir incentivos respaldados por el gobierno serán fundamentales para reducir la volatilidad de las materias primas, respaldar los objetivos de la economía circular y garantizar la sostenibilidad a largo plazo en las aplicaciones de PETG a nivel mundial.

Alcance del mercado del glicol de tereftalato de polietileno

El mercado está segmentado según el tipo de producto, tipo, aplicación, proceso y uso final.

- Por tipo de producto

Según el tipo de producto, el mercado de PETG se segmenta en grado extruido, grado de moldeo por inyección y grado de moldeo por soplado. El segmento de grado extruido registró la mayor participación en los ingresos en 2024 gracias a su transparencia superior, facilidad de termoformado e idoneidad para la producción de láminas de gran tamaño, utilizadas en aplicaciones de envasado y expositores. Este grado es el preferido por su equilibrio entre resistencia, transparencia y procesabilidad en la producción a gran escala.

Se prevé que el segmento de grado de moldeo por inyección experimente el mayor crecimiento entre 2025 y 2032, impulsado por la creciente demanda de componentes de precisión y geometrías complejas en bienes de consumo, dispositivos médicos y piezas industriales. Este grado permite a los fabricantes crear formas complejas con una calidad constante, reduciendo el desperdicio de material y el tiempo de procesamiento.

- Por tipo

Según el tipo, el mercado del PETG se segmenta en PETG amorfo y PETG semicristalino. El segmento del PETG amorfo dominó el mercado en 2024 gracias a sus excelentes propiedades ópticas, facilidad de termoformado y su idoneidad para aplicaciones que requieren alta transparencia y resistencia al impacto, como barreras protectoras y envases médicos.

Se espera que el segmento PETG semicristalino experimente la tasa de crecimiento más rápida entre 2025 y 2032 debido a su resistencia química mejorada y su resistencia mecánica mejorada, lo que lo hace cada vez más preferido para aplicaciones industriales y estructurales exigentes que requieren durabilidad y resistencia al calor.

- Por aplicación

Según su aplicación, el mercado de PETG se segmenta en Prototipos, Contenedores/Embalaje, Herramientas, Plantillas, Accesorios, Equipos y Maquinaria, y Otros. El segmento de Contenedores/Embalaje representó la mayor participación en los ingresos en 2024, impulsado por el crecimiento de los sectores de alimentos, bebidas y farmacéutico, que exigen soluciones de envasado seguras, transparentes y rentables con alta durabilidad.

Se espera que el segmento de Prototipos sea testigo de la tasa de crecimiento más rápida entre 2025 y 2032, impulsado por la rápida adopción de tecnologías de impresión 3D y la necesidad de materiales de alta calidad y fáciles de procesar en el diseño, las pruebas y el desarrollo de productos en las industrias automotriz, aeroespacial y electrónica.

- Por proceso

Según el proceso, el mercado de PETG se segmenta en extrusión, moldeo por inyección y moldeo por soplado. El proceso de extrusión dominó el mercado en 2024 gracias a su idoneidad para producir láminas, películas y perfiles continuos, ampliamente utilizados en las industrias del embalaje, la señalización y la construcción.

Se espera que el proceso de moldeo por soplado experimente la tasa de crecimiento más rápida entre 2025 y 2032 a medida que aumenta la demanda de contenedores y botellas livianos, duraderos y rentables, particularmente en los sectores de alimentos, bebidas y cuidado personal.

- Por uso final

Según el uso final, el mercado de PETG se segmenta en alimentos y bebidas, cosméticos, productos médicos y otros. El segmento de alimentos y bebidas tuvo la mayor participación en 2024, debido a la creciente demanda de soluciones de envasado transparentes, reciclables y seguras que cumplan con los estrictos estándares regulatorios y las preferencias de los consumidores por la visibilidad del producto.

Se espera que el segmento médico sea testigo de la tasa de crecimiento más rápida entre 2025 y 2032, impulsada por el aumento de las inversiones en infraestructura de atención médica, la creciente demanda de materiales biocompatibles y el uso generalizado de PETG en componentes de dispositivos médicos, barreras protectoras y envases farmacéuticos.

Análisis regional del mercado de glicol de tereftalato de polietileno

• América del Norte dominó el mercado de PETG con la mayor participación en los ingresos del 39,5 % en 2024, impulsada por la creciente demanda de plásticos duraderos, livianos y reciclables en los sectores de embalaje, atención médica e industrial.

• El énfasis de la región en la sostenibilidad, junto con la adopción de tecnologías de fabricación avanzadas como la impresión 3D, está respaldando un consumo significativo de PETG en las industrias de uso final.

• Además, la creciente conciencia sobre los materiales ecológicos y las iniciativas gubernamentales que promueven los plásticos reciclables contribuyen a la fuerte presencia de la región en el mercado.

Perspectiva del mercado de PETG en EE. UU.

El mercado estadounidense de PETG captó la mayor participación en los ingresos en 2024 en Norteamérica, impulsado por la consolidada industria del envasado y la rápida adopción de tecnologías de fabricación aditiva. La creciente demanda de PETG en aplicaciones médicas, envasado de alimentos y bebidas, y fabricación de bienes de consumo está impulsando el crecimiento del mercado. Además, las inversiones en I+D para desarrollar productos de PETG de alto rendimiento con mayor reciclabilidad y eficiencia de procesamiento están fortaleciendo aún más las perspectivas del mercado estadounidense.

Perspectivas del mercado europeo de PETG

Se prevé que el mercado europeo de PETG experimente su mayor crecimiento entre 2025 y 2032, gracias a las estrictas regulaciones de la UE que promueven el uso de plásticos sostenibles y reciclables. La creciente demanda de PETG en envases de consumo, dispositivos sanitarios y materiales de impresión 3D está acelerando su adopción regional. Además, el enfoque de la región en iniciativas de economía circular, junto con la innovación en bioplásticos y envases ecológicos, está impulsando el consumo de PETG en múltiples industrias.

Perspectivas del mercado de PETG en el Reino Unido

Se prevé que el mercado británico de PETG experimente su mayor crecimiento entre 2025 y 2032, impulsado por la creciente demanda de materiales de embalaje reciclables y plásticos de grado médico. El crecimiento del comercio electrónico, junto con el aumento de las inversiones en infraestructura sanitaria y tecnologías de impresión 3D, está impulsando el consumo de PETG. Además, la preferencia de los consumidores por soluciones de embalaje sostenibles está fortaleciendo las perspectivas de crecimiento a largo plazo del mercado en el Reino Unido.

Perspectivas del mercado de PETG en Alemania

Se prevé que el mercado alemán de PETG experimente el mayor crecimiento entre 2025 y 2032, impulsado por la sólida base manufacturera del país y su énfasis en plásticos reciclables de alto rendimiento. Siendo Alemania un centro de ingeniería avanzada y tecnologías médicas, el uso de PETG en dispositivos médicos, componentes automotrices y aplicaciones industriales está en aumento. El enfoque del país en prácticas de fabricación ecológicas impulsa aún más la adopción de PETG en diversos sectores.

Perspectiva del mercado de PETG en Asia-Pacífico

Se prevé que el mercado de PETG en Asia-Pacífico experimente su mayor crecimiento entre 2025 y 2032, impulsado por la rápida industrialización, la expansión de las industrias de embalaje y el aumento de las inversiones en el sector sanitario en países como China, Japón e India. Además, el creciente uso de PETG en la impresión 3D y la fabricación de bienes de consumo, junto con las políticas gubernamentales que fomentan los materiales sostenibles, está acelerando el crecimiento del mercado regional.

Perspectivas del mercado japonés de PETG

Se prevé que el mercado japonés de PETG experimente su mayor crecimiento entre 2025 y 2032, impulsado por el avanzado sector manufacturero del país y la innovación tecnológica en las industrias del envasado y la medicina. Su alta resistencia, transparencia y resistencia química lo convierten en un material predilecto para dispositivos médicos, electrónica de consumo y envasado de alimentos. Además, la apuesta de Japón por la sostenibilidad y la fabricación de precisión está impulsando la adopción del PETG en diversas aplicaciones industriales.

Perspectiva del mercado de PETG en China

El mercado chino de PETG representó la mayor participación en los ingresos de Asia-Pacífico en 2024, impulsado por la expansión del sector de envases del país, su rápida urbanización y sus capacidades de fabricación rentables. China se está consolidando como un importante centro de producción y consumo de PETG, con una creciente demanda en los sectores de alimentos y bebidas, medicina e industria. Además, se espera que las iniciativas gubernamentales que promueven los plásticos reciclables y la fabricación inteligente fortalezcan aún más la presencia de China en el mercado de PETG.

Cuota de mercado del glicol de tereftalato de polietileno

La industria del poli(tereftalato de etileno)glicol está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Eastman Chemical Company (EE. UU.)

- CLARIANT (Suiza)

- SK Inc. (Corea del Sur)

- SM Kunststofftechnologie GmbH (Austria)

- Good Natured Products Inc. (EE. UU.)

- Preferred Plastics, Inc. (EE. UU.)

- Condiciones generales de venta (Bélgica)

- Shandong Shenghe Plastic Development Co., LTD. (China)

- Celanese Corporation (EE. UU.)

- Daicel Corporation (Japón)

Últimos avances en el mercado global de tereftalato de polietileno glicol

- En noviembre de 2021, SK Chemicals reforzó su capacidad de fabricación en un 25 % con una inversión en CHDM, una materia prima clave para la producción de copoliéster. Simultáneamente, la empresa inició la producción a gran escala de ECOTRIA CR en sus instalaciones de Ulsan. ECOTRIA CR incorpora componentes de polietilen tereftalato glicol (PETG) derivados de residuos plásticos regenerados químicamente, en consonancia con el compromiso de SK Chemicals con las prácticas sostenibles y la iniciativa de economía circular.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.