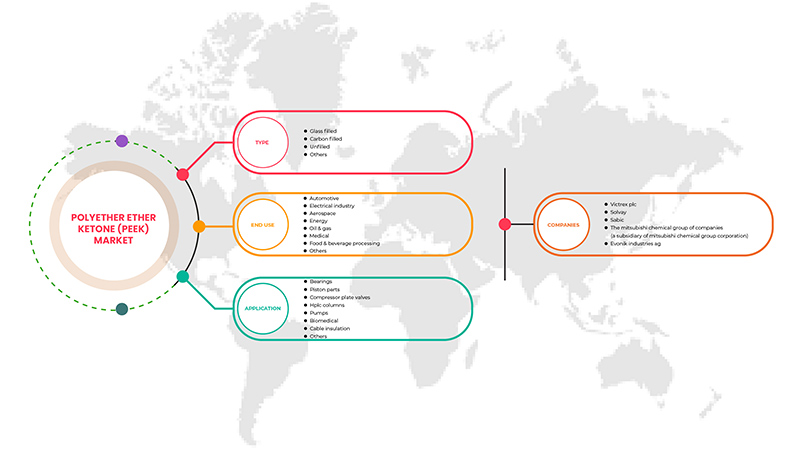

Mercado global de poliéter éter cetona (PEEK), por tipo (relleno de vidrio, relleno de carbono, sin relleno y otros), aplicación (cojinetes, piezas de pistón, bombas, columnas de HPLC, válvulas de placa de compresor, aislamiento de cables, biomédico y otros), uso final (aeroespacial, automotriz, procesamiento de alimentos y bebidas, petróleo y gas, industria eléctrica, energía, médica y otros) - Tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado de poliéter éter cetona (PEEK)

El aumento de las aplicaciones de poliéter éter cetona (PEEK) en diversas industrias es un factor importante para el mercado mundial de poliéter éter cetona (PEEK). Se espera que las excelentes características y propiedades del PEEK y del PEEK como posible alternativa a los metales en la industria automotriz impulsen el crecimiento del mercado mundial de poliéter éter cetona (PEEK).

Las principales restricciones que pueden afectar negativamente al mercado mundial de poliéter éter cetona (PEEK) son los altos costos de los productos de poliéter éter cetona (PEEK) y la fácil disponibilidad de sustitutos.

Se espera que el rápido avance en las aplicaciones médicas y de atención médica y las estrictas regulaciones para reducir las emisiones de CO2 brinden oportunidades en el mercado global de poliéter éter cetona (PEEK). Sin embargo, las difíciles condiciones de procesamiento de las poliéter éter cetonas pueden desafiar el crecimiento del mercado global de poliéter éter cetona (PEEK).

Se espera que el mercado global de poliéter éter cetona (PEEK) gane un crecimiento significativo en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 5,6% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 1.062,29 millones para 2029.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

Por tipo (relleno de vidrio, relleno de carbono, sin relleno y otros), aplicación (cojinetes, piezas de pistón, bombas, columnas de HPLC, válvulas de placa de compresor, aislamiento de cables, biomédico y otros), uso final (aeroespacial, automotriz, procesamiento de alimentos y bebidas, petróleo y gas, industria eléctrica, energía, médica y otros) |

|

Países cubiertos |

EE. UU., Canadá, México, Reino Unido, Alemania, Reino Unido, Francia, Italia, España, Rusia, Suiza, Turquía, Bélgica, Países Bajos y resto de Europa, Japón, China, Corea del Sur, India, Singapur, Tailandia, Indonesia, Malasia, Filipinas, Australia y Nueva Zelanda y resto de Asia-Pacífico, Egipto, Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Israel y resto de Oriente Medio y África |

|

Actores del mercado cubiertos |

Victrex Plc, Evonik Industries AG, Solvay, DAIKIN COMPOUNDING ITALY SpA, Freudenberg, Arkema, Ensinger, Mitsubishi Chemical Group of Companies (una subsidiaria de Mitsubishi Chemical Group Corporation), Avient, BARLOG Plastics GmbH, SABIC, SAINT-GOBAIN, Westlake Plastics, Fluorocarbon Group, entre otros. |

Definición de mercado

El PEEK es un polímero termoplástico orgánico incoloro, miembro de la familia de las poliarilétercetonas (PAEK). Es un homopolímero que tiene un solo monómero. Es un termoplástico semicristalino con propiedades químicas y mecánicas excepcionales que se conservan incluso a temperaturas más altas. Muestra resistencia al deterioro durante varios procedimientos de esterilización. Por lo tanto, se puede esterilizar con métodos de esterilización por calor sin afectar sus propiedades. Su estructura química lo hace altamente resistente al daño químico y por radiación, compatible con agentes de refuerzo como fibras de vidrio y carbono y tiene mayor resistencia que los metales. Estas propiedades lo hacen muy adecuado para aplicaciones industriales.

Dinámica del mercado global de poliéter éter cetona (PEEK)

En esta sección se aborda la comprensión de los factores impulsores, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- Aplicaciones crecientes del poliéter éter cetona (PEEK) en diversas industrias

Estos polímeros tienen muchas aplicaciones emergentes en la industria aeroespacial, automotriz, de petróleo y gas, médica y electrónica en el futuro cercano, lo que mejorará aún más las perspectivas de crecimiento del mercado global de poliéter éter cetona (PEEK). Además, el poliéter éter cetona (PEEK) se considera un polímero líder de alto rendimiento en toda la industria del plástico. Los metales solían ser los materiales de elección en las industrias automotriz, aeroespacial, de dispositivos médicos y otras, pero ahora el polímero PEEK los está reemplazando rápidamente al cumplir con las regulaciones de emisiones globales actuales y ayudar a reducir la emisión de CO2 a través de una tecnología más eficiente.

- Excelentes características y propiedades del PEEK

Los polímeros PEEK se funden a una temperatura relativamente alta en comparación con otros termoplásticos. El rango de su temperatura de fusión se puede procesar y mejorar más mediante el moldeo por inyección, métodos de extrusión, formación por pulverización o métodos de prensado. Aparte de esto, la capacidad de procesar polímeros de poliéter éter cetona (PEEK) con impresión 3D lo convierte en un material deseado por sus crecientes aplicaciones.

- PEEK como alternativa potencial a los metales en la industria automotriz

El aumento del poder adquisitivo de los consumidores, la rápida industrialización en varios países y la rápida expansión del sector automovilístico en China, India, Alemania y muchos otros países han impulsado el crecimiento de este sector. La poliéter éter cetona se utiliza cada vez más en piezas de automóviles, como motores, juntas, anillos de transmisión, anillos de fricción y arandelas de empuje, lo que, a su vez, impulsa el crecimiento del mercado.

Oportunidades

- Avance rápido en aplicaciones médicas y sanitarias

También se prevé que el mercado en general experimente una amplia gama de aplicaciones en la industria médica durante el período de pronóstico. Actualmente, se utiliza para cirugía de columna y se espera que se utilice para más aplicaciones clínicas y productos médicos comerciales con más investigación y desarrollo. Existe una necesidad continua de investigación y desarrollo en la industria médica para explorar aplicaciones clínicas sin explotar de PEEK. Debido a la falta de datos clínicos a largo plazo, actualmente, el producto PEEK tiene una aplicación limitada en el campo, pero se espera que aumente en el futuro cercano debido a su enorme potencial como reemplazo de otros materiales utilizados.

- Normativas estrictas para reducir las emisiones de CO2

El PEEK se perfila como una solución respetuosa con el medio ambiente en diversas aplicaciones. Su aplicación conduce a bajas emisiones de carbono en comparación con otros polímeros, incluidos los laminados de poliéster, el cloruro de polivinilo y el poliestireno , entre otros. El PEEK aumenta la vida útil de los productos en los que se utiliza al proporcionar una excelente resistencia a la corrosión. También tiene un buen rendimiento a altas temperaturas. Es uno de los productos más versátiles en términos de proporcionar libertad de diseño de fabricación y, por lo tanto, da como resultado una menor dependencia de la mano de obra.

Restricciones/Desafíos

- Altos costos de los productos de poliéter éter cetona (PEEK)

El fabricante de polímeros de poliéter éter cetona (PEEK) y sus productos requieren una inversión considerablemente alta, ya que el proceso de fabricación es más complejo que el de cualquier otro grupo de polímeros o metales. Además, la fabricación de productos de PEEK que puedan soportar altas temperaturas requiere un alto nivel de competencia técnica, técnicos e investigación. Debido a estos factores, la producción de PEEK es costosa y, por lo tanto, el coste de los productos finales también es muy alto.

- Fácil disponibilidad de sustitutos

El plástico es un material ligero, duradero, económico y fácil de modificar. Por eso su uso ha aumentado rápidamente y sigue creciendo. El plástico está formado por polímeros, que son moléculas orgánicas de gran tamaño. En el mercado de polímeros, existen diversos sustitutos que se pueden utilizar en lugar del polímero PEEK. Existe una variedad de polímeros de alto rendimiento disponibles en el mercado.

- Condiciones de procesamiento desafiantes para las cetonas de poliéter éter

El moldeo por compresión de PEEK presenta muchos desafíos. El proceso requiere mucho tiempo, es muy sensible y muy específico en cuanto al tipo de herramientas necesarias. El moldeo por compresión es conocido por su baja productividad; incluso un procesador grande solo puede consumir entre 20 y 25 kg por día de producción. El proceso real de moldeo por compresión de PEEK tampoco es sencillo y necesita ser ajustado hasta que esté disponible un proceso que se adapte mejor al equipo. Además, la selección de matrices es fundamental. En su forma fundida, el PEEK puede ser un material muy agresivo y reactivo y el acero se corroe durante el moldeo. Por lo tanto, encontrar un equilibrio entre un metal de matriz resistente y el proceso correcto es fundamental para obtener un proceso final que sea económico y productivo y que produzca un producto final de alta calidad.

- Aumento de la competencia de los materiales compuestos y polímeros híbridos

Además, los compuestos de polímeros reforzados con fibra están ganando importancia en diversos campos, desde artículos para el hogar hasta la industria automotriz. Las fibras naturales y sintéticas tienen un bajo costo, son livianas y tienen una alta resistencia específica y mecánica. Los compuestos híbridos reforzados con fibra han surgido ampliamente como materiales potenciales para fabricar compuestos para diferentes aplicaciones. El uso de técnicas de procesamiento y métodos de modificación bien caracterizados ayuda a lograr cualidades deseables en el producto.

Desarrollo reciente

- En febrero de 2022, Arkema se convirtió en finalista de los JEC Composites Innovation Awards 2022. Arkema, en colaboración con Somocap, fue uno de los 30 finalistas de esta edición de 2022 en la categoría de Edificación e Ingeniería Civil a través del proyecto liderado por Optimas. Esto ha mejorado la reputación de la empresa en el mercado.

Alcance del mercado mundial de poliéter éter cetona (PEEK)

El mercado global de poliéter éter cetona (PEEK) se clasifica según el tipo, la aplicación y el uso final. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Relleno de carbono

- Relleno de vidrio

- Sin llenar

- Otros

Según el tipo, el mercado mundial de poliéter éter cetona (PEEK) se clasifica en relleno de vidrio, relleno de carbono, sin relleno y otros.

Solicitud

- Aspectos

- Piezas de pistón

- Válvulas de placa de compresor

- Columnas HPLC

- Zapatillas

- Biomédica

- Aislamiento de cables

- Otros

Sobre la base de la aplicación, el mercado global de poliéter éter cetona (PEEK) se clasifica en cojinetes, piezas de pistón, bombas, columnas HPLC, válvulas de placa de compresor, aislamiento de cables, biomédicos y otros.

Uso final

- Automotor

- Industria eléctrica

- Aeroespacial

- Energía

- Petróleo y gas

- Médico

- Procesamiento de alimentos y bebidas

- Otros

Sobre la base del uso final, el mercado global de poliéter éter cetona (PEEK) se clasifica en aeroespacial, automotriz, procesamiento de alimentos y bebidas, petróleo y gas, industria eléctrica, energía, medicina y otros.

Análisis y perspectivas regionales del mercado global de poliéter éter cetona (PEEK)

El mercado global de poliéter éter cetona (PEEK) está segmentado según el país, el tipo, la aplicación y el uso final.

Algunos países del mercado mundial de poliéter éter cetona (PEEK) son EE. UU., Canadá, México, Reino Unido, Alemania, Reino Unido, Francia, Italia, España, Rusia, Suiza, Turquía, Bélgica, Países Bajos y el resto de Europa, Japón, China, Corea del Sur, India, Singapur, Tailandia, Indonesia, Malasia, Filipinas, Australia y Nueva Zelanda y el resto de Asia-Pacífico, Egipto, Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Israel y el resto de Medio Oriente y África.

Se espera que China domine el mercado de poliéter éter cetona (PEEK) de Asia-Pacífico debido a la creciente demanda de automóviles y bienes de consumo en la región. Se espera que Estados Unidos domine en la región de América del Norte debido a la creciente demanda de polímero PEEK para cojinetes en la región. Se espera que Alemania domine el mercado de poliéter éter cetona (PEEK) de Europa debido a la creciente conciencia de las excelentes características y propiedades del PEEK en la región.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. El análisis de los puntos de datos de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas y el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos afrontados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado global de poliéter éter cetona (PEEK)

El panorama competitivo del mercado global de poliéter éter cetona (PEEK) proporciona detalles por competidores. Los detalles incluidos son la descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones, la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado global de poliéter éter cetona (PEEK).

Algunos de los participantes destacados que operan en el mercado global de poliéter éter cetona (PEEK) son Victrex Plc, Evonik Industries AG, Solvay, DAIKIN COMPOUNDING ITALY SpA, Freudenberg, Arkema, Ensinger, Mitsubishi Chemical Group of Companies (una subsidiaria de Mitsubishi Chemical Group Corporation), Avient, BARLOG Plastics GmbH, SABIC, SAINT-GOBAIN, Westlake Plastics, Fluorocarbon Group, entre otros.

Metodología de la investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con tamaños de muestra grandes. Los datos del mercado se analizan y estiman utilizando modelos estadísticos y coherentes del mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Aparte de esto, los modelos de datos incluyen cuadrículas de posicionamiento de proveedores, análisis de la línea de tiempo del mercado, descripción general y guía del mercado, cuadrículas de posicionamiento de la empresa, análisis de la participación de mercado de la empresa, estándares de medición, análisis global versus regional y de la participación de los proveedores. Solicite una llamada de un analista en caso de tener más consultas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.3 VENDOR SELECTION CRITERIA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING APPLICATIONS OF POLYETHER ETHER KETONE (PEEK) IN VARIOUS INDUSTRIES

5.1.2 EXCELLENT CHARACTERISTICS AND PROPERTIES OF PEEK

5.1.3 PEEK AS A POTENTIAL ALTERNATIVE TO METALS IN THE AUTOMOTIVE INDUSTRY

5.2 RESTRAINTS

5.2.1 HIGH COSTS OF POLYETHER ETHER KETONE (PEEK) PRODUCTS

5.2.2 EASY AVAILABILITY OF SUBSTITUTES

5.3 OPPORTUNITIES

5.3.1 RAPID ADVANCEMENT IN MEDICAL AND HEALTHCARE APPLICATION

5.3.2 STRINGENT REGULATIONS TO REDUCE CO2 EMISSIONS

5.4 CHALLENGES

5.4.1 CHALLENGING PROCESSING CONDITIONS FOR POLYETHER ETHER KETONES

5.4.2 AN INCREASE IN COMPETITION FROM COMPOSITES AND HYBRID POLYMERS

6 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE

6.1 OVERVIEW

6.2 CARBON FILLED

6.3 GLASS FILLED

6.4 UNFILLED

6.5 OTHERS

7 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 BEARINGS

7.3 PISTON PARTS

7.4 COMPRESSOR PLATE VALVES

7.5 HPLC COLUMNS

7.6 PUMPS

7.7 BIOMEDICAL

7.8 CABLE INSULATION

7.9 OTHERS

8 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET, BY END-USE

8.1 OVERVIEW

8.2 AUTOMOTIVE

8.3 ELECTRICAL INDUSTRY

8.4 AEROSPACE

8.5 ENERGY

8.6 OIL & GAS

8.7 MEDICAL

8.8 FOOD & BEVERAGE PROCESSING

8.9 OTHERS

9 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION

9.1 OVERVIEW

9.2 ASIA PACIFIC

9.2.1 CHINA

9.2.2 INDIA

9.2.3 JAPAN

9.2.4 SOUTH KOREA

9.2.5 THAILAND

9.2.6 SINGAPORE

9.2.7 INDONESIA

9.2.8 AUSTRALIA & NEW ZEALAND

9.2.9 PHILIPPINES

9.2.10 MALAYSIA

9.2.11 REST OF ASIA-PACIFIC

9.3 MIDDLE EAST AND AFRICA

9.3.1 SAUDI ARABIA

9.3.2 U.A.E.

9.3.3 SOUTH AFRICA

9.3.4 EGYPT

9.3.5 ISRAEL

9.3.6 REST OF MIDDLE EAST AND AFRICA

9.4 SOUTH AMERICA

9.4.1 BRAZIL

9.4.2 ARGENTINA

9.4.3 REST OF SOUTH AMERICA

9.5 EUROPE

9.5.1 GERMANY

9.5.2 U.K.

9.5.3 FRANCE

9.5.4 ITALY

9.5.5 SPAIN

9.5.6 RUSSIA

9.5.7 SWITZERLAND

9.5.8 TURKEY

9.5.9 BELGIUM

9.5.10 NETHERLANDS

9.5.11 REST OF EUROPE

9.6 NORTH AMERICA

9.6.1 U.S.

9.6.2 CANADA

9.6.3 MEXICO

10 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

10.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

10.3 COMPANY SHARE ANALYSIS: EUROPE

10.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

10.5 REGULATORY APPROVAL

10.6 PRODUCT LAUNCH

10.7 AWARD

10.8 MERGER

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 VICTREX PLC

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT UPDATES

12.2 SOLVAY

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT UPDATES

12.3 SABIC

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT UPDATES

12.4 THE MITSUBISHI CHEMICAL GROUP OF COMPANIES (A SUBSIDIARY OF MITSUBISHI CHEMICAL GROUP CORPORATION)

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT UPDATES

12.5 EVONIK INDUSTRIES AG

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT UPDATES

12.6 ARKEMA

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT UPDATES

12.7 AVIENT

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT UPDATES

12.8 BARLOG PLASTICS GMBH

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT UPDATES

12.9 DAIKIN COMPOUNDING ITALY S.P.A

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT UPDATES

12.1 ENSINGER

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT UPDATES

12.11 FREUDENBERG

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT UPDATES

12.12 FLUOROCARBON GROUP

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT UPDATES

12.13 SAINT-GOBAIN

12.13.1 COMPANY SNAPSHOT

12.13.2 REVENUE ANALYSIS

12.13.3 PRODUCT PORTFOLIO

12.13.4 RECENT UPDATES

12.14 WESTLAKE PLASTICS

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT UPDATES

13 QUESTIONNAIRE

14 RELATED REPORTS

Lista de Tablas

TABLE 1 IMPORT DATA OF SATURATED POLYESTERS IN PRIMARY FORMS (EXCLUDING POLYCARBONATES, ALKYD RESINS, POLYETHYLENE TEREPHTHALATE, AND POLYLACTIC ACID); HS CODE – 390799 (USD THOUSAND)

TABLE 2 EXPORT DATA OF SATURATED POLYESTERS IN PRIMARY FORMS (EXCLUDING POLYCARBONATES, ALKYD RESINS, POLYETHYLENE TEREPHTHALATE, AND POLYLACTIC ACID); HS CODE – 390799 (USD THOUSAND)

TABLE 3 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 5 GLOBAL CARBON FILLED IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 GLOBAL CARBON FILLED IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 7 GLOBAL GLASS FILLED IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 GLOBAL GLASS FILLED IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 9 GLOBAL UNFILLED IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 GLOBAL UNFILLEDIN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 11 GLOBAL OTHERS IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 GLOBAL OTHERS IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 13 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 14 GLOBAL BEARINGS IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 GLOBAL PISTON PARTS IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 GLOBAL COMPRESSOR PLATE VALVES IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 GLOBAL HPLC COLUMNS IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 GLOBAL PUMPS IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 GLOBAL BIOMEDICAL IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 GLOBAL CABLE INSULATION IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 GLOBAL OTHERS IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 23 GLOBAL AUTOMOTIVE IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 GLOBAL ELECTRICAL INDUSTRY IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 GLOBAL AEROSPACE IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 GLOBAL ENERGY IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 GLOBAL OIL & GAS IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 GLOBAL MEDICAL IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 GLOBAL FOOD & BEVERAGE PROCESSING IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 GLOBAL OTHERS IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 33 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 34 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 35 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 37 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 39 CHINA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 CHINA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 41 CHINA POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 42 CHINA POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 43 INDIA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 INDIA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 45 INDIA POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 INDIA POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 47 JAPAN POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 JAPAN POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 49 JAPAN POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 JAPAN POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 51 SOUTH KOREA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 SOUTH KOREA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 53 SOUTH KOREA POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 SOUTH KOREA POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 55 THAILAND POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 THAILAND POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 57 THAILAND POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 THAILAND POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 59 SINGAPORE POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 SINGAPORE POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 61 SINGAPORE POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 SINGAPORE POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 63 INDONESIA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 INDONESIA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 65 INDONESIA POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 INDONESIA POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 67 AUSTRALIA & NEW ZEALAND POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 AUSTRALIA & NEW ZEALAND POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 69 AUSTRALIA & NEW ZEALAND POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 AUSTRALIA & NEW ZEALAND POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 71 PHILIPPINES POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 PHILIPPINES POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 73 PHILIPPINES POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 PHILIPPINES POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 75 MALAYSIA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 MALAYSIA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 77 MALAYSIA POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 78 MALAYSIA POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 79 REST OF ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 REST OF ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 81 MIDDLE EAST AND AFRICA POLYETHER ETHER KETONE (PEEK) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 82 MIDDLE EAST AND AFRICA POLYETHER ETHER KETONE (PEEK) MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 83 MIDDLE EAST AND AFRICA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 MIDDLE EAST AND AFRICA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 85 MIDDLE EAST AND AFRICA POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 86 MIDDLE EAST AND AFRICA POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 87 SAUDI ARABIA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 SAUDI ARABIA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 89 SAUDI ARABIA POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 SAUDI ARABIA POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 91 U.A.E. POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 U.A.E. POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 93 U.A.E. POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 94 U.A.E. POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 95 SOUTH AFRICA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 SOUTH AFRICA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 97 SOUTH AFRICA POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 SOUTH AFRICA POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 99 EGYPT POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 EGYPT POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 101 EGYPT POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 102 EGYPT POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 103 ISRAEL POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 ISRAEL POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 105 ISRAEL POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 106 ISRAEL POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 107 REST OF MIDDLE EAST AND AFRICA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 REST OF MIDDLE EAST AND AFRICA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 109 SOUTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 110 SOUTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 111 SOUTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 SOUTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 113 SOUTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 114 SOUTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 115 BRAZIL POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 BRAZIL POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 117 BRAZIL POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 118 BRAZIL POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 119 ARGENTINA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 ARGENTINA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 121 ARGENTINA POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 ARGENTINA POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 123 REST OF SOUTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 REST OF SOUTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 125 EUROPE POLYETHER ETHER KETONE (PEEK) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 126 EUROPE POLYETHER ETHER KETONE (PEEK) MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 127 EUROPE POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 EUROPE POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 129 EUROPE POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 130 EUROPE POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 131 GERMANY POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 GERMANY POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 133 GERMANY POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 GERMANY POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 135 U.K. POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 U.K. POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 137 U.K. POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 138 U.K. POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 139 FRANCE POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 FRANCE POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 141 FRANCE POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 142 FRANCE POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 143 ITALY POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 ITALY POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 145 ITALY POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 146 ITALY POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 147 SPAIN POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 SPAIN POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 149 SPAIN POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 150 SPAIN POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 151 RUSSIA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 RUSSIA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 153 RUSSIA POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 154 RUSSIA POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 155 SWITZERLAND POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 SWITZERLAND POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 157 SWITZERLAND POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 158 SWITZERLAND POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 159 TURKEY POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 TURKEY POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 161 TURKEY POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 162 TURKEY POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 163 BELGIUM POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 BELGIUM POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 165 BELGIUM POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 166 BELGIUM POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 167 NETHERLANDS POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 168 NETHERLANDS POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 169 NETHERLANDS POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 170 NETHERLANDS POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 171 REST OF EUROPE POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 REST OF EUROPE POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 173 NORTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 174 NORTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 175 NORTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 NORTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 177 NORTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 178 NORTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 179 U.S. POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 U.S. POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 181 U.S. POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 182 U.S. POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 183 CANADA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 184 CANADA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 185 CANADA POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 186 CANADA POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 187 MEXICO POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 188 MEXICO POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 189 MEXICO POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 190 MEXICO POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET

FIGURE 2 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: MULTIVARIATE MODELLING

FIGURE 8 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: DBMR MARKET POSITION GRID

FIGURE 10 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: SEGMENTATION

FIGURE 14 ASIA PACIFIC IS EXPECTED TO DOMINATE THE GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET, WHILE NORTH AMERICA IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 15 RISING APPLICATIONS OF POLYETHER ETHER KETONE (PEEK) IN VARIOUS INDUSTRIES ARE EXPECTED TO DRIVE THE GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET GROWTH IN THE FORECAST PERIOD

FIGURE 16 CARBON FILLED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET IN 2022 & 2029

FIGURE 17 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR POLYETHER ETHER KETONE (PEEK) MARKET MANUFACTURERS IN THE FORECAST PERIOD

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET

FIGURE 19 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: BY TYPE, 2021

FIGURE 20 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: BY APPLICATION, 2021

FIGURE 21 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: BY END-USE, 2021

FIGURE 22 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: SNAPSHOT (2021)

FIGURE 23 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: BY REGION (2021)

FIGURE 24 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: BY REGION (2022 & 2029)

FIGURE 25 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: BY REGION (2021 & 2029)

FIGURE 26 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: BY TYPE (2022-2029)

FIGURE 27 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: SNAPSHOT (2021)

FIGURE 28 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: BY COUNTRY (2021)

FIGURE 29 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 30 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 31 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: BY TYPE (2022-2029)

FIGURE 32 MIDDLE EAST AND AFRICA POLYETHER ETHER KETONE (PEEK) MARKET: SNAPSHOT (2021)

FIGURE 33 MIDDLE EAST AND AFRICA POLYETHER ETHER KETONE (PEEK) MARKET: BY COUNTRY (2021)

FIGURE 34 MIDDLE EAST AND AFRICA POLYETHER ETHER KETONE (PEEK) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 35 MIDDLE EAST AND AFRICA POLYETHER ETHER KETONE (PEEK) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 36 MIDDLE EAST AND AFRICA POLYETHER ETHER KETONE (PEEK) MARKET: BY TYPE (2022 & 2029)

FIGURE 37 SOUTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET: SNAPSHOT (2021)

FIGURE 38 SOUTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET: BY COUNTRY (2021)

FIGURE 39 SOUTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 40 SOUTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 41 SOUTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET: BY TYPE (2022-2029)

FIGURE 42 EUROPE POLYETHER ETHER KETONE (PEEK) MARKET: SNAPSHOT (2021)

FIGURE 43 EUROPE POLYETHER ETHER KETONE (PEEK) MARKET: BY COUNTRY (2021)

FIGURE 44 EUROPE POLYETHER ETHER KETONE (PEEK) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 45 EUROPE POLYETHER ETHER KETONE (PEEK) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 46 EUROPE POLYETHER ETHER KETONE (PEEK) MARKET: BY TYPE (2022-2029)

FIGURE 47 NORTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET: SNAPSHOT (2021)

FIGURE 48 NORTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET: BY COUNTRY (2021)

FIGURE 49 NORTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 50 NORTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 51 NORTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET: BY TYPE (2022-2029)

FIGURE 52 GLOBAL POLYETHER ETHER KETONE (PEEK) MARKET: COMPANY SHARE 2021 (%)

FIGURE 53 NORTH AMERICA POLYETHER ETHER KETONE (PEEK) MARKET: COMPANY SHARE 2021 (%)

FIGURE 54 EUROPE POLYETHER ETHER KETONE (PEEK) MARKET: COMPANY SHARE 2021 (%)

FIGURE 55 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.