Global Payment Processor Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

54.32 Billion

USD

110.00 Billion

2024

2032

USD

54.32 Billion

USD

110.00 Billion

2024

2032

| 2025 –2032 | |

| USD 54.32 Billion | |

| USD 110.00 Billion | |

|

|

|

|

Segmentación del mercado global de procesadores de pagos, por método de pago (tarjeta de débito, tarjeta de crédito, billetera electrónica, cámara de compensación automatizada y otros), modo de implementación (local y en la nube), sector vertical del usuario final (banca, servicios financieros y seguros [BFSI], gobierno y servicios públicos, telecomunicaciones y TI, atención médica, bienes raíces, comercio minorista y electrónico, medios y entretenimiento, viajes y hotelería, y otros): tendencias de la industria y pronóstico hasta 2032.

Tamaño del mercado de procesadores de pagos

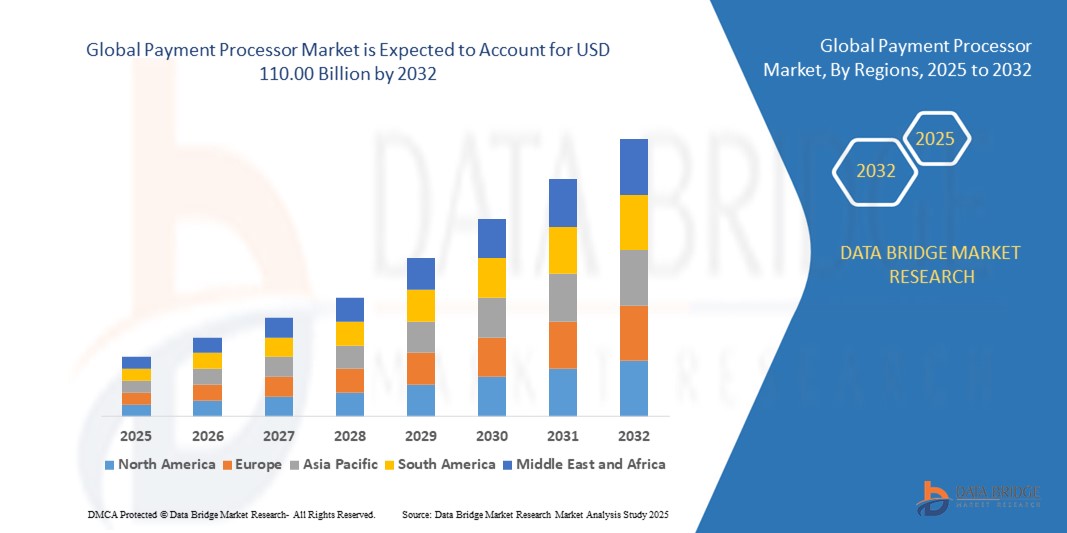

- El tamaño del mercado global de procesadores de pagos se valoró en USD 54,32 mil millones en 2024 y se espera que alcance los USD 110,00 mil millones para 2032 , con una CAGR del 9,22% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente adopción de métodos de pago digitales y los rápidos avances tecnológicos en la infraestructura de servicios financieros, lo que lleva a un aumento en los volúmenes de transacciones en los sectores minoristas, de comercio electrónico y de servicios.

- Además, la creciente demanda de los consumidores de experiencias de pago rápidas, seguras y sin fricciones está impulsando a las empresas a adoptar soluciones integradas de procesamiento de pagos que facilitan el comercio omnicanal, las liquidaciones en tiempo real y una mejor prevención del fraude. Estos factores convergentes están impulsando significativamente el crecimiento del sector.

Análisis del mercado de procesadores de pagos

- Los procesadores de pagos son plataformas tecnológicas que facilitan la autorización, el enrutamiento y la liquidación de transacciones electrónicas entre consumidores, comerciantes e instituciones financieras. Estos sistemas admiten una amplia gama de métodos de pago, como tarjetas, billeteras, ACH y pagos en tiempo real a través de múltiples canales.

- El mercado de procesadores de pagos en expansión está impulsado por el aumento del comercio digital, las iniciativas gubernamentales que promueven economías sin efectivo y la creciente dependencia de infraestructuras de pago seguras, escalables y basadas en datos en todas las industrias.

- América del Norte dominó el mercado de procesadores de pagos con una participación del 32,2% en 2024, debido al alto volumen de transacciones digitales, la adopción temprana de soluciones fintech avanzadas y una infraestructura de comercio electrónico bien establecida.

- Se espera que Asia-Pacífico sea la región de más rápido crecimiento en el mercado de procesadores de pagos durante el período de pronóstico debido al rápido crecimiento en el uso de Internet móvil, la expansión del panorama del comercio electrónico y las políticas gubernamentales favorables para la inclusión digital.

- El segmento basado en la nube dominó el mercado con una cuota de mercado del 59,1 % en 2024, gracias a la escalabilidad, la rentabilidad y la facilidad de integración que ofrecen las plataformas en la nube. Los procesadores de pagos aprovechan cada vez más la infraestructura en la nube para optimizar la velocidad de las transacciones, habilitar análisis en tiempo real y dar soporte a pasarelas de pago globales. La implementación en la nube también facilita actualizaciones fluidas, marcos robustos de seguridad de datos y un cumplimiento más sencillo de las normas regulatorias en constante evolución, lo que la hace muy atractiva para empresas de todos los tamaños.

Alcance del informe y segmentación del mercado de procesadores de pagos

|

Atributos |

Perspectivas clave del mercado de procesadores de pagos |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos del mercado, como el valor de mercado, la tasa de crecimiento, los segmentos del mercado, la cobertura geográfica, los actores del mercado y el escenario del mercado, el informe de mercado elaborado por el equipo de investigación de mercado de Data Bridge incluye un análisis en profundidad de expertos, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y análisis pestle. |

Tendencias del mercado de procesadores de pagos

Integración de IA y aprendizaje automático en el procesamiento de pagos

- El mercado de procesadores de pagos está experimentando una importante transformación a medida que los proveedores incorporan cada vez más inteligencia artificial (IA) y aprendizaje automático (ML) en el monitoreo de transacciones, la detección de fraudes y las experiencias de pago personalizadas, con el objetivo de aumentar la precisión, la velocidad y la seguridad.

- Por ejemplo, líderes de la industria como Stripe, Adyen, Worldpay y Fiserv están aprovechando algoritmos avanzados de IA para evaluar patrones de comportamiento, marcar actividades sospechosas en tiempo real, automatizar la gestión de devoluciones de cargo y habilitar una puntuación de riesgo dinámica para los comerciantes, lo que resulta en tasas de fraude más bajas y una mejor eficiencia operativa.

- Las herramientas de aprendizaje automático admiten la autenticación adaptativa, flujos de pago fluidos y cumplimiento automatizado, lo que mejora tanto las operaciones del comerciante como la satisfacción del usuario.

- La IA incorporada permite a los procesadores de pagos personalizar ofertas, recomendar rutas de pago óptimas, anticipar las necesidades de los usuarios y optimizar los costos de transacción a escala.

- El uso de análisis predictivos agiliza la incorporación, mejora las decisiones de suscripción para las aprobaciones de cuentas comerciales y respalda la maximización de ingresos para plataformas y mercados.

- La evolución continua de las tecnologías de IA/ML garantiza la diferenciación competitiva, actualizaciones frecuentes del sistema y la capacidad de responder rápidamente a los vectores de fraude emergentes y los requisitos regulatorios.

Dinámica del mercado de procesadores de pagos

Conductor

Intervención y adopción rápida de tecnologías emergentes

- Los rápidos avances en tecnología, incluidos los pagos móviles, las transacciones sin contacto, NFC, la autenticación biométrica y la cadena de bloques, están acelerando la adopción de soluciones de procesamiento de pagos en entornos minoristas, de comercio digital y omnicanal.

- Por ejemplo, los procesadores de pago como Global Payments y PayPal están a la vanguardia en la implementación de pagos sin contacto, integración de billeteras digitales, aceptación de criptomonedas y soporte de pagos transfronterizos en tiempo real para satisfacer las cambiantes expectativas de los consumidores en cuanto a conveniencia y flexibilidad.

- La proliferación del comercio electrónico, la expansión de la infraestructura de puntos de venta (POS) y la digitalización de las pequeñas y medianas empresas (PYME) impulsan aún más la demanda de servicios de procesamiento de pagos integrados, automatizados y seguros.

- Las iniciativas de banca abierta, las plataformas basadas en API y las finanzas integradas facilitan una conectividad fluida entre comerciantes, consumidores, bancos y aplicaciones fintech, lo que impulsa nuevas experiencias de pago y flujos de ingresos.

- La innovación en el ecosistema de pagos permite a los comerciantes aceptar una gama más amplia de tipos de pago (incluidas tarjetas, billeteras y métodos de pago emergentes), mejorando el alcance global y atendiendo a diversos segmentos de clientes.

Restricción/Desafío

Crecientes preocupaciones sobre seguridad

- La creciente complejidad de los ecosistemas de pago, junto con la creciente frecuencia y sofisticación de las amenazas cibernéticas, presenta importantes desafíos de seguridad para los procesadores de pagos que deben protegerse contra violaciones de datos, fraude e incumplimiento normativo.

- Por ejemplo, las violaciones de alto perfil o los ciberataques coordinados pueden exponer información de pago confidencial o interrumpir los flujos de transacciones, lo que requiere que empresas como Adyen y Fiserv inviertan continuamente en tokenización, cifrado de extremo a extremo, cumplimiento de PCI DSS y prevención de fraude impulsada por IA.

- La expansión global introduce regulaciones de seguridad regionales y leyes de protección de datos, lo que crea complejidad operativa y exige actualizaciones continuas del sistema.

- El aumento de las transacciones CNP (sin tarjeta presente), en particular en el comercio electrónico, amplifica la exposición a ataques de phishing, robo de credenciales y fraude sintético.

- La confianza de los comerciantes y los consumidores depende de la capacidad de los procesadores para ofrecer experiencias seguras y sin fricciones, exigiendo transparencia, alertas en tiempo real y procesos sólidos de resolución de disputas.

Alcance del mercado de procesadores de pagos

El mercado está segmentado según el método de pago, el modo de implementación y el sector vertical del usuario final.

- Por método de pago

Según el método de pago, el mercado de procesadores de pagos se segmenta en tarjetas de débito, tarjetas de crédito, monederos electrónicos, cámaras de compensación automatizadas (ACH) y otros. El segmento de tarjetas de crédito representó la mayor cuota de mercado en 2024, principalmente debido a la amplia aceptación de los pagos con tarjeta de crédito en entornos de comercio físico y digital. Las tarjetas de crédito siguen siendo el método de pago preferido por los consumidores por sus beneficios, como recompensas, reembolsos y límites de crédito. Los comercios también prefieren las transacciones con tarjeta de crédito por su alta tasa de éxito y su interoperabilidad global. La fiabilidad y la integración del procesamiento de tarjetas de crédito con herramientas de prevención de fraude y sistemas de contracargos contribuyen a su dominio del mercado.

Se prevé que el segmento de los monederos electrónicos experimente la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, impulsada por la creciente penetración de los teléfonos inteligentes, la creciente preferencia de los consumidores por las transacciones sin contacto y el creciente ecosistema de aplicaciones de pago móvil. Los monederos electrónicos ofrecen una comodidad inigualable, especialmente para pagos en línea y entre particulares, y están respaldados por funciones de valor añadido como alertas de transacciones, escaneo de códigos QR e integración de programas de fidelización. Su rápida adopción en las economías emergentes y su alineación con las tendencias de la banca digital los convierten en un importante catalizador del crecimiento en la industria de los procesadores de pagos.

- Por modo de implementación

Según el modo de implementación, el mercado se segmenta en local y en la nube. El segmento en la nube obtuvo la mayor cuota de mercado en ingresos, con un 59,1%, en 2024, impulsado por la escalabilidad, la rentabilidad y la facilidad de integración que ofrecen las plataformas en la nube. Los procesadores de pagos aprovechan cada vez más la infraestructura en la nube para optimizar la velocidad de las transacciones, habilitar análisis en tiempo real y dar soporte a pasarelas de pago globales. La implementación en la nube también facilita actualizaciones fluidas, marcos robustos de seguridad de datos y un cumplimiento más sencillo de las normas regulatorias en constante evolución, lo que la hace muy atractiva para empresas de todos los tamaños.

Se prevé un crecimiento constante del segmento local, especialmente en organizaciones con estrictos requisitos de residencia de datos y dependencias de sistemas heredados. Sectores como el gobierno, la defensa y las instituciones financieras altamente reguladas suelen preferir soluciones locales para mantener el control directo sobre los datos confidenciales y cumplir con las normativas legales específicas de cada región. Este modelo de implementación permite a las empresas personalizar la infraestructura según sus políticas internas e integrarla con los sistemas heredados existentes. También ofrece un mayor control sobre la gestión de acceso, las actualizaciones del sistema y las configuraciones de seguridad. Si bien los costos operativos suelen ser más altos, las ventajas percibidas en seguridad y cumplimiento normativo siguen impulsando su adopción. Por lo tanto, la implementación local sigue siendo una opción viable para las empresas que priorizan la soberanía de los datos y el control de la infraestructura.

- Por vertical de usuario final

Según el sector vertical del usuario final, el mercado se segmenta en servicios financieros bancarios y seguros (BFSI), gobierno y servicios públicos, telecomunicaciones y TI, salud, bienes raíces, comercio minorista y comercio electrónico, medios de comunicación y entretenimiento, viajes y hostelería, entre otros. El segmento BFSI capturó la mayor participación en los ingresos en 2024, a medida que las instituciones financieras invierten cada vez más en sistemas robustos de procesamiento de pagos para gestionar el creciente volumen de transacciones y mejorar la experiencia del cliente. La detección avanzada de fraudes, las capacidades de liquidación instantánea y las plataformas basadas en API son factores clave de diferenciación en el sector BFSI. El cumplimiento normativo, la transparencia de los datos y la confiabilidad del sistema son primordiales, lo que impulsa a los bancos y aseguradoras a priorizar las tecnologías de procesamiento de vanguardia.

Se proyecta que el segmento minorista y de comercio electrónico experimente el mayor crecimiento entre 2025 y 2032, impulsado por el auge de las compras en línea, el comercio omnicanal y las opciones de pago móvil. Los minoristas exigen un procesamiento de transacciones fluido y en tiempo real con compatibilidad multidivisa y funciones integradas de interacción con el cliente, como el seguimiento de la fidelización y las ofertas personalizadas. La expansión de las plataformas globales de comercio electrónico y los modelos de venta directa al consumidor está impulsando a los comerciantes a adoptar soluciones de procesamiento de pagos flexibles y seguras a gran escala.

Análisis regional del mercado de procesadores de pagos

- América del Norte dominó el mercado de procesadores de pagos con la mayor participación en los ingresos del 32,2 % en 2024, impulsada por el alto volumen de transacciones digitales, la adopción temprana de soluciones fintech avanzadas y una infraestructura de comercio electrónico bien establecida.

- Las empresas y los consumidores de la región dependen cada vez más de soluciones de procesamiento de pagos seguras, eficientes y en tiempo real, respaldadas por el uso generalizado de tarjetas de crédito, la adopción de billeteras móviles y la penetración de Internet de alta velocidad.

- Los sólidos marcos regulatorios de la región, junto con la presencia de importantes instituciones financieras y proveedores de tecnología de pago, continúan apoyando la adopción generalizada de plataformas de procesamiento innovadoras en diversas industrias.

Perspectiva del mercado de procesadores de pagos de EE. UU.

El mercado estadounidense de procesadores de pagos captó la mayor cuota de ingresos en 2024 en Norteamérica, impulsado por el auge de las transacciones sin efectivo y la innovación continua en tecnologías de pago digital. La presencia de empresas fintech líderes, junto con la fuerte demanda de pagos sin contacto, billeteras digitales y servicios de compra inmediata y pago posterior, está impulsando una rápida expansión del mercado. La mayor dependencia de las plataformas de procesamiento en la nube, impulsada por el análisis de datos en tiempo real, las integraciones de API y la detección de fraudes con IA, continúa mejorando la eficiencia y la seguridad del mercado en sectores como el comercio minorista, los servicios financieros, financieros y de salud.

Perspectiva del mercado de procesadores de pagos en Europa

Se proyecta que el mercado europeo de procesadores de pagos crezca a una tasa de crecimiento anual compuesta (TCAC) notable durante el período de pronóstico, gracias al sólido respaldo regulatorio para los pagos digitales y al lanzamiento de iniciativas de pago paneuropeas. La transición hacia el uso del efectivo, combinada con la sólida penetración del comercio electrónico, está impulsando la demanda de soluciones de procesamiento de pagos fiables y multicanal. Las empresas europeas están adoptando procesadores avanzados para satisfacer las crecientes expectativas de los consumidores en cuanto a velocidad, seguridad y soporte omnicanal, especialmente en sectores como el comercio minorista, la administración pública y las telecomunicaciones.

Perspectiva del mercado de procesadores de pagos del Reino Unido

Se espera que el mercado de procesadores de pagos del Reino Unido se expanda significativamente durante el período de pronóstico, impulsado por la creciente preferencia de los consumidores por los pagos móviles y sin contacto. El marco de banca abierta del Reino Unido y el entorno favorable a las tecnologías financieras están impulsando la rápida implementación de soluciones innovadoras de procesamiento de pagos. Con una población experta en tecnología y un ecosistema minorista altamente digitalizado, la demanda de plataformas de transacciones fluidas y seguras continúa aumentando tanto en los canales en línea como en las tiendas físicas.

Análisis del mercado de procesadores de pagos en Alemania

Se proyecta que el mercado alemán de procesadores de pagos crecerá a una sólida tasa de crecimiento anual compuesta (TCAC), impulsado por la creciente digitalización de los servicios financieros y la transición constante hacia los pagos sin efectivo. El mercado se beneficia del sólido sector bancario alemán, la expansión del comercio electrónico y la creciente confianza de los consumidores en las herramientas financieras digitales. Las empresas están adoptando soluciones de procesamiento que garantizan la protección de datos, el cumplimiento de la normativa de la UE y la integración con los sistemas empresariales, lo que impulsa su adopción.

Perspectiva del mercado de procesadores de pagos de Asia-Pacífico

Se prevé que el mercado de procesadores de pagos de Asia-Pacífico experimente la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, impulsado por la transformación digital de economías como China, India y países del Sudeste Asiático. El rápido crecimiento del uso de internet móvil, la expansión del comercio electrónico y las políticas gubernamentales favorables a la inclusión digital están acelerando la adopción de procesadores de pagos avanzados. El floreciente ecosistema fintech de la región y la creciente demanda de soluciones de pago transfronterizo en tiempo real impulsan aún más el crecimiento del mercado.

Perspectiva del mercado de procesadores de pagos de Japón

El mercado japonés de procesadores de pagos está cobrando impulso gracias a la constante transición del país hacia una sociedad sin efectivo y a su fuerte enfoque en la comodidad y la seguridad. La infraestructura de procesamiento de pagos de Japón está evolucionando para dar soporte a billeteras móviles, pagos con códigos QR y sistemas integrados de punto de venta. Las iniciativas gubernamentales para el uso sin efectivo y el creciente uso de plataformas digitales en los sectores del transporte, el comercio minorista y la hostelería son factores clave para la expansión del mercado.

Análisis del mercado de procesadores de pagos de China

El mercado chino de procesadores de pagos registró la mayor participación en ingresos en la región Asia-Pacífico en 2024, impulsado por el predominio de los pagos móviles y la sólida penetración de los servicios financieros digitales. Plataformas como Alipay y WeChat Pay están profundamente integradas en la vida diaria del consumidor, generando volúmenes masivos de transacciones en tiempo real. El impulso gubernamental a la digitalización financiera y el auge de las ciudades inteligentes están acelerando aún más la demanda de soluciones de procesamiento ágiles, escalables y seguras tanto en regiones urbanas como rurales.

Cuota de mercado de los procesadores de pagos

La industria de procesadores de pagos está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- ACI Worldwide (EE. UU.)

- PayPal, Inc. (EE. UU.)

- Novatti Group Ltd (Australia)

- Global Payments Inc. (EE. UU.)

- Visa (EE.UU.)

- Stripe, Inc. (Irlanda)

- Google, LLC (EE. UU.)

- Finastra. (Reino Unido)

- SAMSUNG (Corea del Sur)

- Amazon Web Services, Inc. (EE. UU.)

- Financial Software & Systems Pvt. Ltd. (EE. UU.)

- Aurus Inc. (EE. UU.)

- Adyen (Países Bajos)

- Apple Inc. (EE. UU.)

- Fiserv, Inc. (EE. UU.)

- WEX Inc. (EE. UU.)

- wirecard (EE. UU.)

- Mastercard. (EE. UU.)

Últimos avances en el mercado global de procesadores de pagos

- En agosto de 2024, Razorpay lanzó Push Provisioning, una innovación pionera en el panorama de pagos de la India, que permite a los comerciantes tokenizar las tarjetas de sus clientes en el momento de la emisión. Esta estrategia mejora significativamente la integración de usuarios y la eficiencia de los pagos, incrementando las tasas de activación de tarjetas hasta en un 40 % y las tasas de conversión en un 5 %. Como pionero del mercado en implementar esta función, Razorpay establece un nuevo estándar para las transacciones digitales con tarjeta, consolidando su posición como facilitador clave de experiencias de pago seguras y fluidas en la India.

- En agosto de 2024, Adyen, líder global en soluciones de pago, anunció su expansión a la India tras recibir la autorización del Banco de la Reserva de la India para operar como Agregador de Pagos en Línea. Esta aprobación permite a Adyen procesar transacciones nacionales e internacionales, lo que mejora su capacidad para atender a comerciantes globales y locales en uno de los mercados de pagos de mayor crecimiento del mundo. La compañía también estableció un centro tecnológico en Bangalore para impulsar la innovación en pagos, lo que demuestra su compromiso a largo plazo con el fortalecimiento de la infraestructura de pagos digitales de la India y la atención a una base de consumidores en rápida evolución.

- En enero de 2020, PayPal Holdings Inc. firmó una alianza estratégica con UnionPay International (UPI) para ampliar sus redes globales de aceptación. Como parte del acuerdo, PayPal se comprometió a permitir la aceptación de tarjetas UnionPay dondequiera que se utilice PayPal. Esta colaboración abrió importantes oportunidades de compra transfronterizas para los titulares de tarjetas UnionPay y amplió la aceptación de pagos internacionales de PayPal, especialmente en Asia, impulsando así el volumen de transacciones y la cobertura comercial en ambas plataformas.

- En enero de 2020, PayU adquirió una participación mayoritaria en la plataforma de crédito digital PaySense, lo que marcó una consolidación clave en el sector de préstamos al consumo en India. El acuerdo incluyó la integración de LazyPay de PayU con PaySense para crear una plataforma integral de préstamos digitales adaptada a los consumidores indios. Esta fusión mejoró las capacidades de PayU en suscripción, evaluación de riesgos y desembolso, posicionándola para atender mejor la creciente demanda de soluciones de crédito rápidas y digitales en el creciente ecosistema fintech de India.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.