Global Military Drones Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

15.59 Billion

USD

45.41 Billion

2024

2032

USD

15.59 Billion

USD

45.41 Billion

2024

2032

| 2025 –2032 | |

| USD 15.59 Billion | |

| USD 45.41 Billion | |

|

|

|

|

Segmentación del mercado global de drones militares, por plataforma (estratégico, táctico y pequeño), velocidad (subsónico y supersónico), tipo de servicio (ala fija, ala rotatoria e híbrido/de transición), tipo de propulsión (pila de combustible híbrida, batería y otros), modo de lanzamiento (lanzador de catapulta, despegue y aterrizaje automáticos, lanzamiento manual y despegue vertical), alcance (más allá de la línea de visión (BLOS), línea de visión visual extendida (EVLOS) y línea de visión visual (VLOS)), aplicación (reconocimiento, vigilancia y adquisición de objetivos (ISRT), inteligencia, operaciones de combate, entrega y transporte, y vehículos aéreos de combate no tripulados (UCAV) y gestión de daños de batalla), modo de operación (pilotado a distancia, pilotado opcionalmente y totalmente autónomo), autonomía (6 horas, 2-6 horas y 150 kilogramos, 25-150 kilogramos y

Tamaño del mercado de drones militares

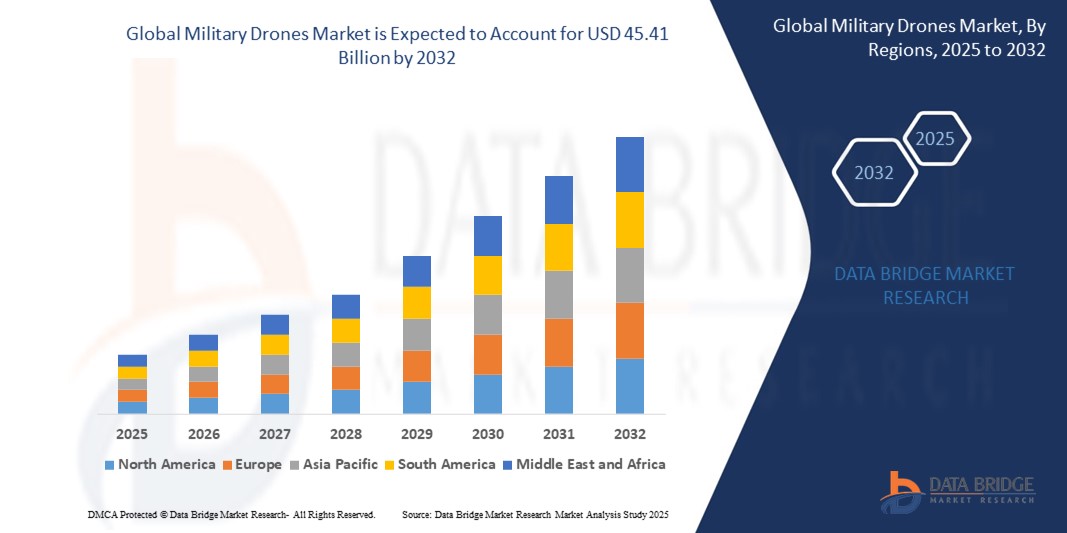

- El tamaño del mercado mundial de drones militares se valoró en USD 15,59 mil millones en 2024 y se espera que alcance los USD 45,41 mil millones para 2032 , con una CAGR del 14,3% durante el período de pronóstico.

- El crecimiento del mercado se debe en gran medida al aumento del gasto en defensa y a los rápidos avances en la tecnología de drones, incluyendo la inteligencia artificial, la navegación autónoma y los sistemas de enlace de datos. Estas innovaciones permiten que los drones militares realicen una gama más amplia de misiones estratégicas, tácticas y de vigilancia con mayor eficiencia y precisión en diversos escenarios de combate.

- Además, el aumento de las tensiones geopolíticas, los conflictos transfronterizos y la creciente demanda de inteligencia, vigilancia y reconocimiento (ISR) en tiempo real están acelerando la adopción global de vehículos aéreos no tripulados (UAV) por parte de las fuerzas de defensa. La integración de drones en operaciones multidominio está impulsando significativamente el desarrollo y el despliegue de sistemas aéreos no tripulados (UAV) tanto en economías desarrolladas como emergentes.

Análisis del mercado de drones militares

- Los drones militares son vehículos aéreos no tripulados (UAV) utilizados por las fuerzas armadas para misiones como vigilancia, adquisición de objetivos, recopilación de inteligencia, operaciones de combate y apoyo logístico. Estos sistemas varían en alcance, tamaño, resistencia y capacidad, y suelen estar equipados con sensores, cámaras, municiones y sistemas de comunicación para misiones autónomas o pilotadas remotamente.

- La creciente demanda de drones militares se debe a su eficacia para reducir el riesgo humano, mejorar la precisión operativa y facilitar la toma de decisiones en tiempo real, tanto en tiempos de paz como en situaciones de conflicto. Las crecientes inversiones en tecnologías de enjambre de drones, vehículos aéreos no tripulados (UAV) furtivos y plataformas de eficacia probada en combate contribuyen aún más a la expansión de este mercado.

- América del Norte dominó el mercado de drones militares con una participación del 40,5% en 2024, debido a los sólidos presupuestos de defensa, la infraestructura tecnológica avanzada y el creciente despliegue de vehículos aéreos no tripulados para vigilancia, seguridad fronteriza y misiones de combate.

- Se espera que Asia-Pacífico sea la región de más rápido crecimiento en el mercado de drones militares durante el período de pronóstico debido al aumento de los gastos de defensa, la escalada de disputas territoriales y la creciente adopción de sistemas no tripulados en países como China, India, Japón y Corea del Sur.

- El segmento subsónico dominó el mercado con una cuota de mercado del 63,3 % en 2024, gracias a su amplio uso en operaciones de inteligencia, vigilancia y reconocimiento (ISR), donde la larga autonomía de vuelo, el consumo de combustible y la estabilidad de la navegación son cruciales. Estos drones son ideales para misiones de monitoreo persistente en áreas extensas y son apreciados por su funcionamiento más silencioso, menores costes de desarrollo y compatibilidad con la infraestructura de defensa existente, lo que los convierte en la opción preferida de las fuerzas armadas a nivel mundial.

Alcance del informe y segmentación del mercado de drones militares

|

Atributos |

Perspectivas clave del mercado de drones militares |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos del mercado, como el valor de mercado, la tasa de crecimiento, los segmentos del mercado, la cobertura geográfica, los actores del mercado y el escenario del mercado, el informe de mercado elaborado por el equipo de investigación de mercado de Data Bridge incluye un análisis en profundidad de expertos, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y análisis pestle. |

Tendencias del mercado de drones militares

Creciente adopción de tecnologías de aviónica avanzada

- El mercado de drones militares está siendo testigo de un importante cambio tecnológico a medida que las agencias de defensa mejoran las capacidades de los drones con aviónica avanzada, controles de vuelo impulsados por IA, sensores multiespectrales y comunicaciones encriptadas para satisfacer las necesidades de la guerra moderna.

- Por ejemplo, el RQ-4 Global Hawk de Northrop Grumman y el MQ-9 Reaper de General Atomics están equipados con sistemas de aviónica de última generación, que ofrecen vigilancia en tiempo real, navegación autónoma e intercambio de datos integrado con centros de comando durante operaciones de alto riesgo.

- Las fuerzas de defensa están desplegando cada vez más drones con capacidades de vuelo autónomo y resistencia a la guerra electrónica para garantizar el éxito de la misión en entornos disputados y sin GPS.

- Los UAV tácticos miniaturizados están ganando importancia (con estabilización avanzada, imágenes térmicas y reconocimiento de objetos basado en IA), lo que permite a las unidades de infantería realizar reconocimientos localizados y detección de amenazas.

- Empresas como Elbit Systems, Thales Group y Turkish Aerospace Industries están invirtiendo fuertemente en la actualización de plataformas UAV con sistemas de orientación de última generación, desviación de radar y vuelo adaptativo, lo que respalda la creciente demanda de defensa global.

- La adopción de equipos tripulados y no tripulados, la integración de contramedidas electrónicas y la autonomía de última generación hacen que la aviónica avanzada sea fundamental para las estrategias modernas de diseño e implementación de UAV.

Dinámica del mercado de drones militares

Conductor

Creciente demanda de inteligencia, vigilancia y reconocimiento (ISR)

- Las crecientes tensiones geopolíticas, la guerra asimétrica y las preocupaciones por la seguridad fronteriza han hecho de la ISR la aplicación más estratégica en las operaciones con drones, impulsando a las fuerzas militares a adoptar plataformas capaces de realizar seguimiento y reconocimiento las 24 horas del día, los 7 días de la semana.

- Por ejemplo, el MQ-1 Predator y el MQ-9 Reaper de General Atomics, así como el Heron TP de Israel Aerospace Industries, son ampliamente utilizados por la Fuerza Aérea de los EE. UU., las Fuerzas Armadas de la India y las Fuerzas de Defensa de Israel (FDI) para misiones ISR de gran altitud y larga duración.

- Estos drones proporcionan vigilancia aérea persistente, imágenes en tiempo real y capacidades de orientación precisa, lo que permite a las fuerzas de defensa tomar decisiones estratégicas más rápidas y al mismo tiempo reducir la dependencia de aeronaves de reconocimiento tripuladas.

- Los sistemas ISR mejorados con IA, disponibles en plataformas como PHASA-35 de BAE Systems y Falco EVO de Leonardo, permiten un procesamiento de inteligencia más rápido, una clasificación de objetos y un monitoreo predictivo de amenazas en entornos de campo de batalla dinámicos.

- Muchos países están priorizando los sistemas ISR basados en drones en sus programas de modernización, incluyendo el Proyecto Cheetah de la India y la iniciativa MALE RPAS (Eurodrone) de Europa, lo que impulsa la innovación constante en la tecnología de vehículos aéreos no tripulados (UAV) militares. Los drones ISR también están avanzando hacia funciones de vigilancia marítima, con plataformas como el Boeing MQ-25 Stingray listo para apoyar las operaciones navales de la Armada de los EE. UU.

Restricción/Desafío

“Dependencia de la conectividad satelital”

- La eficacia operativa de los drones militares, en particular para misiones más allá de la línea visual (BVLOS), reconocimiento estratégico y ataque, depende en gran medida de sistemas de comunicación satelital confiables, que presentan vulnerabilidades tanto operativas como de seguridad.

- Por ejemplo, las fuerzas que utilizan el RQ-4 Global Hawk de Northrop Grumman y el MQ-9 Reaper de General Atomics han informado interrupciones de la misión debido a fallas o interferencias temporales de las comunicaciones por satélite, especialmente en zonas de conflicto donde los adversarios despliegan sistemas sofisticados de guerra electrónica (EW).

- Las aplicaciones de alto ancho de banda, como la transmisión de video HD en tiempo real, la telemetría y la fusión de sensores ISR, requieren enlaces satelitales estables, lo que aumenta la complejidad y el costo de la implementación, particularmente en regiones remotas o subdesarrolladas.

- Los principales proveedores de servicios satelitales como Viasat, Inmarsat e Iridium Communications desempeñan un papel fundamental en el mantenimiento de las operaciones con drones, pero la dependencia de la infraestructura de terceros hace que estos sistemas sean más susceptibles a amenazas externas o interrupciones del servicio.

- Los fabricantes están explorando sistemas de comunicación híbridos, como redes de satélites LEO (por ejemplo, Starlink Military de SpaceX) y conmutaciones por error multibanda, para reducir la latencia y combatir la interferencia de la señal, pero estas soluciones aún se están probando operativamente.

Alcance del mercado de drones militares

El mercado está segmentado en función de la plataforma, la velocidad, el tipo de servicio, el tipo de propulsión, el modo de lanzamiento, el alcance, la aplicación, el modo de operación, la resistencia y el MTOW.

- Por plataforma

Según su plataforma, el mercado de drones militares se segmenta en estratégicos, tácticos y pequeños. El segmento estratégico registró la mayor participación en los ingresos en 2024, debido a su papel vital en misiones de largo alcance y vigilancia a gran altitud en zonas de conflicto geopolítico. Los drones estratégicos son valorados por su capacidad para transportar cargas útiles sofisticadas, como sensores, radares y equipos de comunicación, lo que facilita operaciones de larga duración para la recopilación de inteligencia y el monitoreo de amenazas. Los gobiernos de todo el mundo priorizan estos drones para la vigilancia fronteriza, los sistemas de alerta temprana y las capacidades de ataque en profundidad debido a su superior resistencia y alto techo operativo.

Se proyecta que el segmento de drones pequeños experimentará el mayor crecimiento entre 2025 y 2032, impulsado por su rápida adopción en la guerra urbana y las misiones de inteligencia localizadas en el campo de batalla. Su portabilidad, rentabilidad y facilidad de despliegue los hacen ideales para unidades tácticas y fuerzas especiales. La creciente integración de la detección de objetos basada en IA, la coordinación de enjambres y la tecnología de sigilo en drones pequeños mejora su idoneidad para el reconocimiento en tiempo real y las misiones dirigidas en terrenos complejos.

- Por velocidad

En función de la velocidad, el mercado se segmenta en drones subsónicos y supersónicos. Los drones subsónicos dominaron el mercado en 2024 con una cuota sustancial del 63,3%, impulsados por su amplio uso en operaciones de inteligencia, vigilancia y reconocimiento (ISR), donde la larga autonomía de vuelo, el consumo de combustible y la estabilidad de la navegación son cruciales. Estos drones son ideales para misiones de monitoreo persistente en áreas extensas y son apreciados por su funcionamiento más silencioso, menores costos de desarrollo y compatibilidad con la infraestructura de defensa existente, lo que los convierte en la opción preferida de las fuerzas armadas a nivel mundial.

Se prevé que los drones supersónicos registren el mayor crecimiento entre 2025 y 2032 debido a la creciente inversión en drones de combate de alta velocidad y última generación, capaces de penetrar los sistemas de defensa enemigos avanzados. Su aplicación en el despliegue de señuelos, la guerra electrónica y la ejecución rápida de ataques se está expandiendo gracias a los programas de modernización de la defensa que priorizan la capacidad de respuesta más rápida en zonas de conflicto dinámico.

- Por tipo de servicio

Según el tipo de servicio, el mercado se divide en drones de ala fija, de ala rotatoria y de transición. El segmento de ala fija obtuvo la mayor cuota de mercado en 2024, debido principalmente a su eficiencia aerodinámica y mayor autonomía de vuelo, lo que lo convierte en la configuración preferida para operaciones de vigilancia y combate de largo alcance. Estas plataformas son las preferidas por las agencias de defensa para misiones que requieren cobertura a gran altitud y flexibilidad de carga útil.

Se prevé que el segmento híbrido/de transición crezca a su tasa de crecimiento anual compuesto (TCAC) más alta entre 2025 y 2032, impulsado por la creciente demanda de vehículos aéreos no tripulados (UAV) versátiles que combinan capacidades de despegue vertical con la amplia gama de diseños de ala fija. Estos drones son especialmente valiosos en regiones con infraestructura de pistas limitada o para misiones que requieren un despliegue rápido seguido de un vuelo de larga duración.

- Por tipo de propulsión

Según el tipo de propulsión, el mercado de drones militares se clasifica en híbridos de pila de combustible, de batería y otros. El segmento de baterías lideró el mercado en 2024 gracias a los avances en las tecnologías de baterías de iones de litio y de estado sólido, que ofrecen mayor autonomía y diseños de UAV más ligeros. Los sistemas de baterías son los preferidos para drones tácticos debido a su menor firma acústica y emisiones de calor reducidas, lo que facilita las operaciones encubiertas.

Se prevé que el segmento de celdas de combustible híbridas presente el mayor crecimiento hasta 2032, impulsado por su capacidad para combinar densidad energética con tiempos de reabastecimiento más cortos, lo que lo hace ideal para misiones de alta resistencia. Los sectores de defensa priorizan cada vez más los drones de celdas de combustible híbridas para ampliar el alcance de las misiones, a la vez que reducen el apoyo logístico y el impacto ambiental.

- Por modo de lanzamiento

Según el modo de lanzamiento, el mercado se segmenta en lanzadores de catapulta, despegue y aterrizaje automáticos (ATOL), lanzamiento manual y despegue vertical. El segmento de despegue y aterrizaje automáticos (ATOL) capturó la mayor cuota de mercado en 2024 gracias a su precisión operativa y a la menor necesidad de pilotos cualificados, lo que mejora la fiabilidad del despliegue en entornos remotos u hostiles. Estos sistemas se utilizan ampliamente en drones estratégicos y de ala fija que requieren un control autónomo constante.

Se prevé que el despegue vertical crezca a su ritmo más rápido entre 2025 y 2032, impulsado por el creciente despliegue de drones de ala rotatoria e híbridos en vigilancia urbana, operaciones marítimas y terrenos restringidos. Su capacidad de despegue y recuperación sin infraestructura tradicional es crucial para la logística militar moderna y las misiones de respuesta rápida.

- Por rango

En función del alcance, el mercado se segmenta en más allá de la línea de visión (BLOS), línea de visión visual extendida (EVLOS) y línea de visión visual (VLOS). El segmento BLOS tuvo la mayor participación en 2024, impulsado por su necesidad para operaciones estratégicas transfronterizas y en territorio adversario. Estos drones son esenciales para la recopilación de inteligencia persistente y el apoyo a través de sistemas de comunicación satelital, lo que los convierte en un elemento central de las operaciones de defensa global.

Se proyecta que el segmento EVLOS se expandirá a su tasa de crecimiento anual compuesta (TCAC) más alta, impulsado por la creciente integración de telemetría en tiempo real, análisis basados en IA y retransmisión de datos cifrados en drones tácticos y pequeños. Las capacidades EVLOS acortan la distancia entre las operaciones de corto alcance y la vigilancia profunda, ofreciendo flexibilidad en la inteligencia del campo de batalla.

- Por aplicación

Según su aplicación, el mercado se segmenta en reconocimiento, vigilancia y adquisición de objetivos (ISRT), inteligencia, operaciones de combate, entrega y transporte, vehículos aéreos de combate no tripulados (UCAV) y gestión de daños en combate. El segmento ISRT dominó el mercado en 2024, debido a la creciente dependencia de los drones por parte de las fuerzas armadas para la recopilación de inteligencia y la detección de amenazas las 24 horas del día. Los drones son activos esenciales para monitorear el movimiento del enemigo, proporcionar datos de objetivos y asistir en ataques de precisión.

Se proyecta que el segmento UCAV experimente el mayor crecimiento durante el período de pronóstico, impulsado por la creciente demanda de capacidades ofensivas no tripuladas que reduzcan el riesgo del piloto. Los avances en sistemas de armas autónomos, tecnología furtiva y cargas útiles multifunción están convirtiendo a los UCAV en un elemento central de las doctrinas modernas de guerra aérea.

- Por modo de operación

Según el modo de operación, el mercado se divide en sistemas de pilotaje remoto, de pilotaje opcional y totalmente autónomos. El segmento de pilotaje remoto lideró el mercado en 2024, impulsado por su amplia adopción en misiones de combate y vigilancia, donde la toma de decisiones humanas en tiempo real es crucial. Los operadores militares prefieren estos sistemas por su probada fiabilidad y adaptabilidad táctica.

Se prevé que el segmento de vehículos totalmente autónomos crezca a su ritmo más rápido hasta 2032, impulsado por los rápidos avances en IA, computación a bordo y fusión de sensores. Estos sistemas se están implementando para tareas que exigen un funcionamiento continuo sin intervención manual, como la patrulla fronteriza, la ISR y la selección automatizada de objetivos.

- Por resistencia

En función de la autonomía, el mercado se segmenta en >6 horas, 2-6 horas y <1-2 horas. El segmento de >6 horas captó la mayor cuota de mercado en 2024, impulsado por el creciente despliegue de drones estratégicos para misiones prolongadas. Estos UAV de larga autonomía son esenciales para la vigilancia continua, la guerra electrónica y la transmisión segura de comunicaciones en amplios teatros de operaciones.

Se prevé que el segmento de <1–2 horas crezca con mayor rapidez, impulsado en particular por la demanda de drones tácticos ligeros para reconocimiento de corta duración y apoyo al combate urbano. Estos drones ofrecen un despliegue rápido, facilidad de control y son ideales para la inteligencia en el campo de batalla, que requiere tiempo.

- Por MTOW

Según el MTOW, el mercado se segmenta en >150 kilogramos, 25-150 kilogramos y <25 kilogramos. El segmento de >150 kilogramos lideró el mercado en 2024, dominado por drones de carga pesada capaces de transportar sistemas ISR avanzados, munición pesada y cargas útiles multisensoriales. Estas plataformas se utilizan ampliamente en misiones estratégicas y operaciones de largo alcance.

Se prevé que el segmento de <25 kilogramos registre la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, impulsada por el creciente despliegue de microdrones y minidrones en combate cuerpo a cuerpo, operaciones especiales y patrulla fronteriza. Su ligereza permite su lanzamiento manual y una rápida movilidad, lo que los hace ideales para aplicaciones militares ágiles en tiempo real.

Análisis regional del mercado de drones militares

- América del Norte dominó el mercado de drones militares con la mayor participación en los ingresos del 40,5 % en 2024, impulsada por sólidos presupuestos de defensa, infraestructura tecnológica avanzada y el creciente despliegue de vehículos aéreos no tripulados para vigilancia, seguridad fronteriza y misiones de combate.

- La región se beneficia de una sólida base industrial de defensa y de programas de modernización liderados por el gobierno centrados en sistemas autónomos, integración de IA y drones de alta resistencia.

- El creciente énfasis en las capacidades de inteligencia, vigilancia y reconocimiento (ISR) y el rápido ritmo de innovación en tecnologías UAV continúan consolidando el liderazgo de América del Norte en el panorama mundial de drones militares.

Perspectiva del mercado de drones militares de EE. UU.

El mercado estadounidense de drones militares representó la mayor participación en los ingresos de Norteamérica en 2024, impulsado por una importante inversión del Departamento de Defensa y una hoja de ruta integral para la integración de drones en todas las ramas militares. Estados Unidos busca activamente capacidades avanzadas como drones de enjambre, conceptos de "loyal wingman" y vehículos aéreos de combate no tripulados (UCAV) para misiones de ataque de precisión. El enfoque continuo del país en la modernización de su infraestructura de defensa aérea, junto con un mayor énfasis en los sistemas autónomos y la inteligencia, vigilancia y reconocimiento (ISR) en tiempo real, refuerza su dominio en el mercado global de drones militares.

Análisis del mercado europeo de drones militares

Se espera que Europa experimente un crecimiento sustancial en el mercado de drones militares durante el período de pronóstico, impulsado por la creciente inestabilidad geopolítica, las amenazas transfronterizas y la creciente demanda de vehículos aéreos no tripulados (UAV) tácticos y estratégicos en los países miembros de la OTAN. Los gobiernos europeos destinan cada vez más presupuestos de defensa al desarrollo de drones autóctonos, empresas conjuntas y colaboraciones internacionales como el programa Eurodrone. Las aplicaciones de ISR y vigilancia siguen siendo una prioridad absoluta en las operaciones militares, especialmente en las misiones de seguridad fronteriza y mantenimiento de la paz. La integración de drones en operaciones multidominio y en los planes nacionales de modernización de la defensa es un factor clave que impulsa el mercado europeo.

Análisis del mercado de drones militares del Reino Unido

Se prevé que el mercado británico de drones militares se expanda a una tasa de crecimiento anual compuesta (TCAC) sólida durante el período de pronóstico, impulsado por las inversiones estratégicas del Ministerio de Defensa en sistemas UAV de próxima generación y la integración de drones en el Sistema Aéreo de Combate Futuro (FCAS). El Reino Unido se centra en el desarrollo de drones de apoyo y en el despliegue de UAV para vigilancia marítima, reconocimiento en el campo de batalla y funciones de apoyo aéreo autónomo. Estas iniciativas se alinean con los objetivos generales de transformación de la defensa del país, que priorizan la innovación, la interoperabilidad y la capacidad de respuesta rápida en la guerra moderna.

Análisis del mercado de drones militares en Alemania

Se prevé un crecimiento constante del mercado alemán de drones militares, ya que el gobierno sigue priorizando la innovación en defensa y la cooperación multilateral con la Unión Europea. El país desempeña un papel importante en proyectos conjuntos de defensa como Eurodrone, cuyo objetivo es reducir la dependencia de plataformas no europeas. La Bundeswehr alemana está incorporando drones tácticos y de clase MALE a su marco de defensa para operaciones de ISR, vigilancia y conocimiento de la situación. Se prevé que la evolución de los desafíos de seguridad y la inversión sostenida en la adquisición de drones impulsen la expansión del mercado durante el período de pronóstico.

Análisis del mercado de drones militares en Asia-Pacífico

Se proyecta que Asia-Pacífico crecerá a la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, impulsada por el aumento del gasto en defensa, la escalada de disputas territoriales y la creciente adopción de sistemas no tripulados en países como China, India, Japón y Corea del Sur. La región está experimentando una rápida militarización y modernización de sus fuerzas de defensa, donde los drones desempeñan un papel fundamental en la vigilancia fronteriza, la contrainsurgencia y las operaciones marítimas. Los gobiernos locales están invirtiendo fuertemente en la capacidad nacional de fabricación de drones, la navegación autónoma y los vehículos aéreos no tripulados (UAV) de alta resistencia. Los programas de innovación respaldados por los gobiernos, las iniciativas de autosuficiencia tecnológica y las alianzas estratégicas están fortaleciendo aún más la posición de Asia-Pacífico en el mercado global de drones militares.

Análisis del mercado de drones militares de China

China representó la mayor participación en los ingresos del mercado de drones militares de Asia-Pacífico en 2024, gracias a sus ambiciosos planes de modernización militar, la producción a gran escala de drones y su enfoque estratégico en aplicaciones de inteligencia, vigilancia y reconocimiento (ISR) y drones de combate. El ejército chino está utilizando drones para ampliar la patrulla fronteriza, el reconocimiento naval y las capacidades de ataque en diversos terrenos. Las iniciativas gubernamentales que fomentan la autosuficiencia en la fabricación de defensa y la exportación global de vehículos aéreos no tripulados (UAV) militares están impulsando aún más la influencia de China en este sector. El rápido desarrollo de tecnologías de enjambre basadas en IA y sistemas de drones furtivos subraya la ambición de China de convertirse en una potencia dominante en la innovación de drones militares.

Análisis del mercado de drones militares en Japón

El mercado japonés de drones militares está cobrando impulso gracias al enfoque del país en mejorar sus capacidades de defensa para responder a las tensiones de seguridad regionales y las limitaciones demográficas. Con un personal de defensa limitado, Japón recurre cada vez más a sistemas no tripulados para realizar misiones de inteligencia, seguridad y vigilancia (IRS) y patrullas marítimas en sus vastas aguas territoriales. El gobierno japonés apoya el desarrollo nacional de tecnologías UAV y explora la integración de inteligencia artificial (IA), 5G y funciones autónomas para mejorar la funcionalidad de los drones. Se espera que el énfasis estratégico de Japón en la autodefensa, sumado a los avances tecnológicos, impulse significativamente el crecimiento de su mercado de drones militares.

Cuota de mercado de drones militares

La industria de los drones militares está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Grupo Safran (Francia)

- General Atomics (EE. UU.)

- IAI (Israel)

- Lockheed Martin Corporation (EE. UU.)

- AeroVironment, Inc. (EE. UU.)

- Textron Inc. (EE. UU.)

- Teledyne FLIR LLC (EE. UU.)

- Northrop Grumman (EE. UU.)

- BAE Systems (Reino Unido)

- AERONÁUTICA (Israel)

- Boeing (EE.UU.)

- Thales (Francia)

- Leonardo SpA (Italia)

- Elbit Systems Ltd (Israel)

- SAAB (Suecia)

Últimos avances en el mercado mundial de drones militares

- En junio de 2024, el Grupo Thales lanzó OpenDRobotics, una solución de vanguardia destinada a mejorar el combate colaborativo mediante la integración de tecnologías robóticas en vehículos aéreos y terrestres no tripulados. Al aprovechar la Inteligencia Artificial (IA), la plataforma habilita capacidades de misión con intervención humana y aumenta la autonomía de los drones militares, a la vez que minimiza la carga de trabajo del operador. Se espera que esta innovación tenga un impacto significativo en el mercado de drones militares, acelerando la adopción de sistemas de drones interoperables basados en IA y consolidando la transición hacia operaciones de combate más autónomas y eficientes en las fuerzas de defensa globales.

- En marzo de 2023, Northrop Grumman Corporation, en colaboración con Shield AI, fue seleccionada por el Ejército de los EE. UU. para la competencia Future Tactical Unmanned Aircraft System (FTUAS), Increment 2. Esta oportunidad los posiciona como posibles reemplazos del UAS táctico RQ-7B Shadow, mostrando su tecnología de vanguardia y experiencia en sistemas aéreos no tripulados.

- En febrero de 2023, Boeing anunció que su dron MQ-28 podría ser una valiosa incorporación al arsenal de la Fuerza Aérea de EE. UU., lo que supone un avance significativo para el gigante aeroespacial. Este desarrollo abre nuevas vías de crecimiento y colaboración en el sector de defensa, demostrando el compromiso de Boeing con la innovación y su capacidad de adaptación a las cambiantes necesidades militares.

- En marzo de 2022, Gambit, una Plataforma de Colaboración Autónoma (ACP), se diseñó mediante ingeniería digital para acelerar el tiempo de comercialización y reducir los costos de adquisición. Esta plataforma, propulsada por jet, está diseñada para la supremacía aérea y aprovecha los avances en inteligencia artificial y sistemas autónomos, con el objetivo de revolucionar las futuras capacidades de defensa.

- En diciembre de 2021, se presentó Mojave, un vehículo aéreo no tripulado (UAV) con capacidades de despegue y aterrizaje cortos (STOL). Basado en la aviónica y los sistemas de control de vuelo del MQ-9 Reaper y el MQ-1C Gray Eagle Extended Range, cuenta con una estructura Gray Eagle, alas ampliadas con dispositivos de hipersustentación y un motor turbohélice Rolls-Royce de 450 hp.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.