Mercado mundial de caolín, por grado (calcinado, hidratado, deslaminado, tratado superficialmente y estructurado), proceso (lavado con agua, flotado por aire, calcinado, deslaminado y modificado superficialmente y sin procesar), aplicación (papel, cerámica , pintura y revestimientos, fibra de vidrio, plástico, caucho, productos farmacéuticos y médicos, cosméticos y otros), tendencias de la industria y pronóstico hasta 2029

Análisis y perspectivas del mercado del caolín

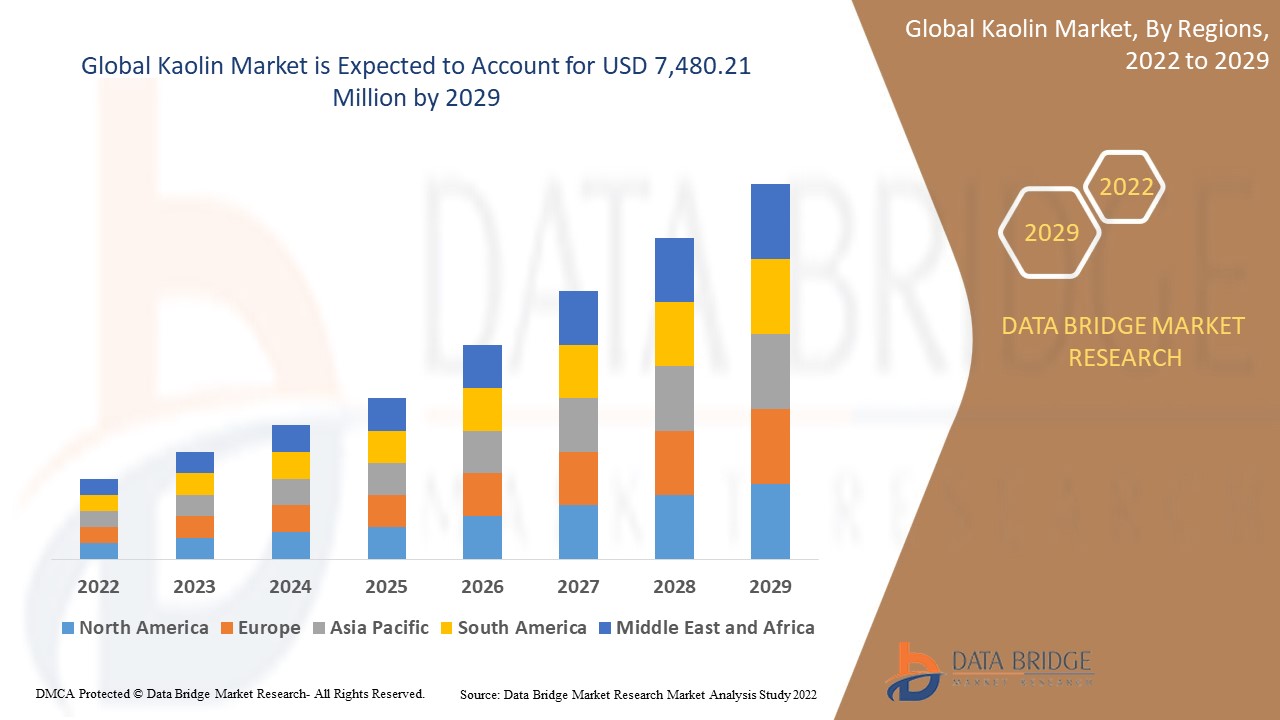

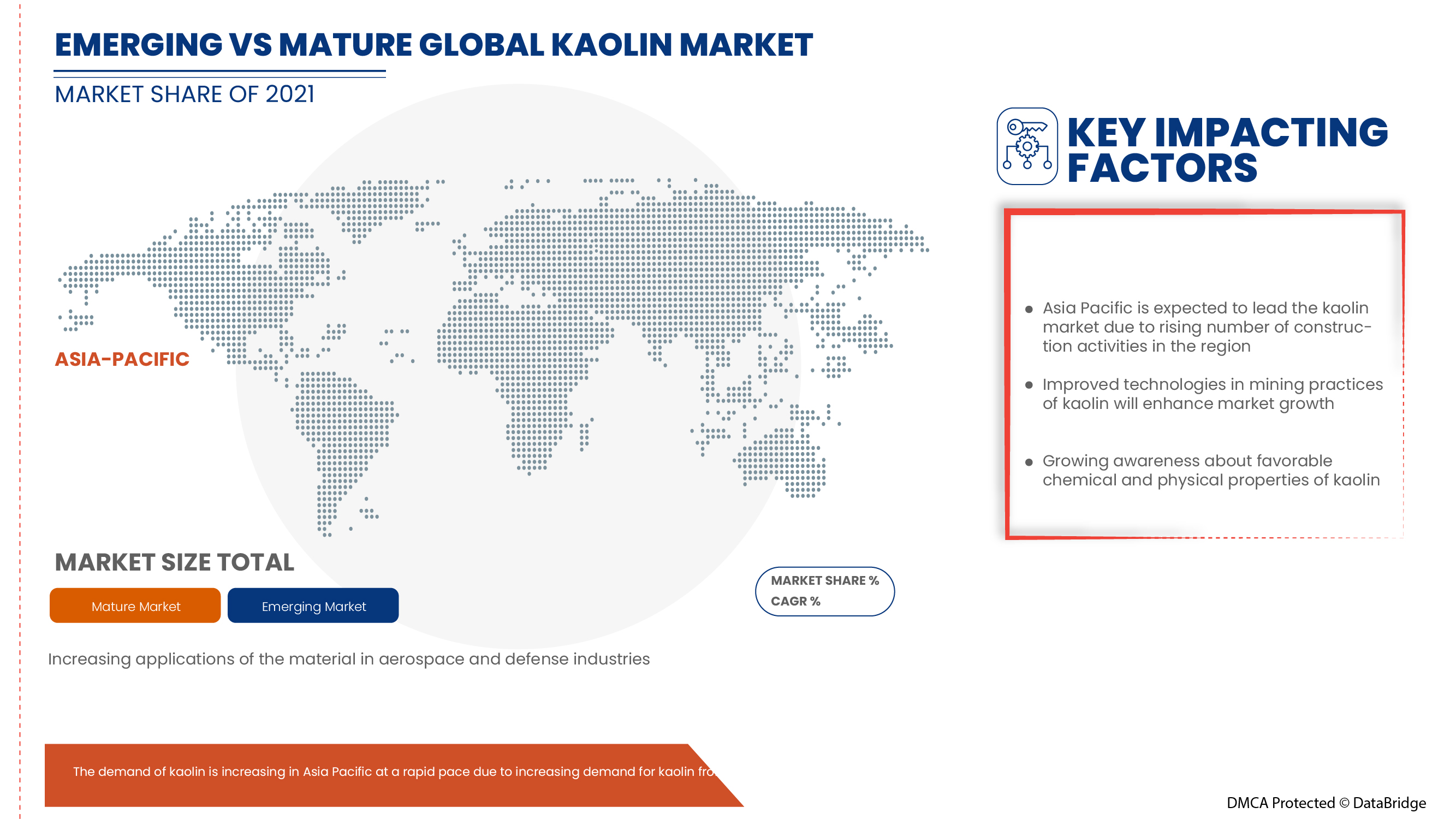

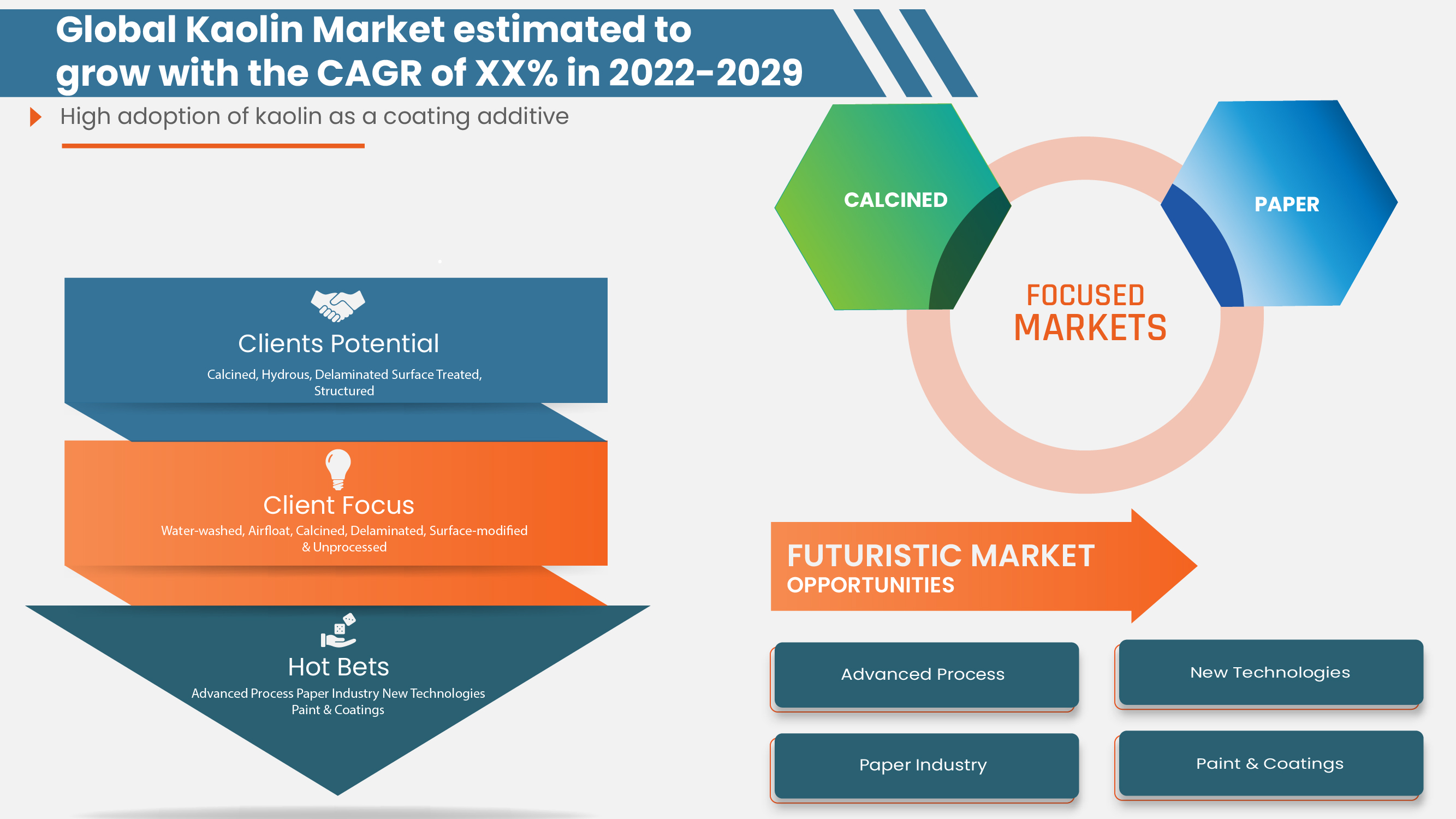

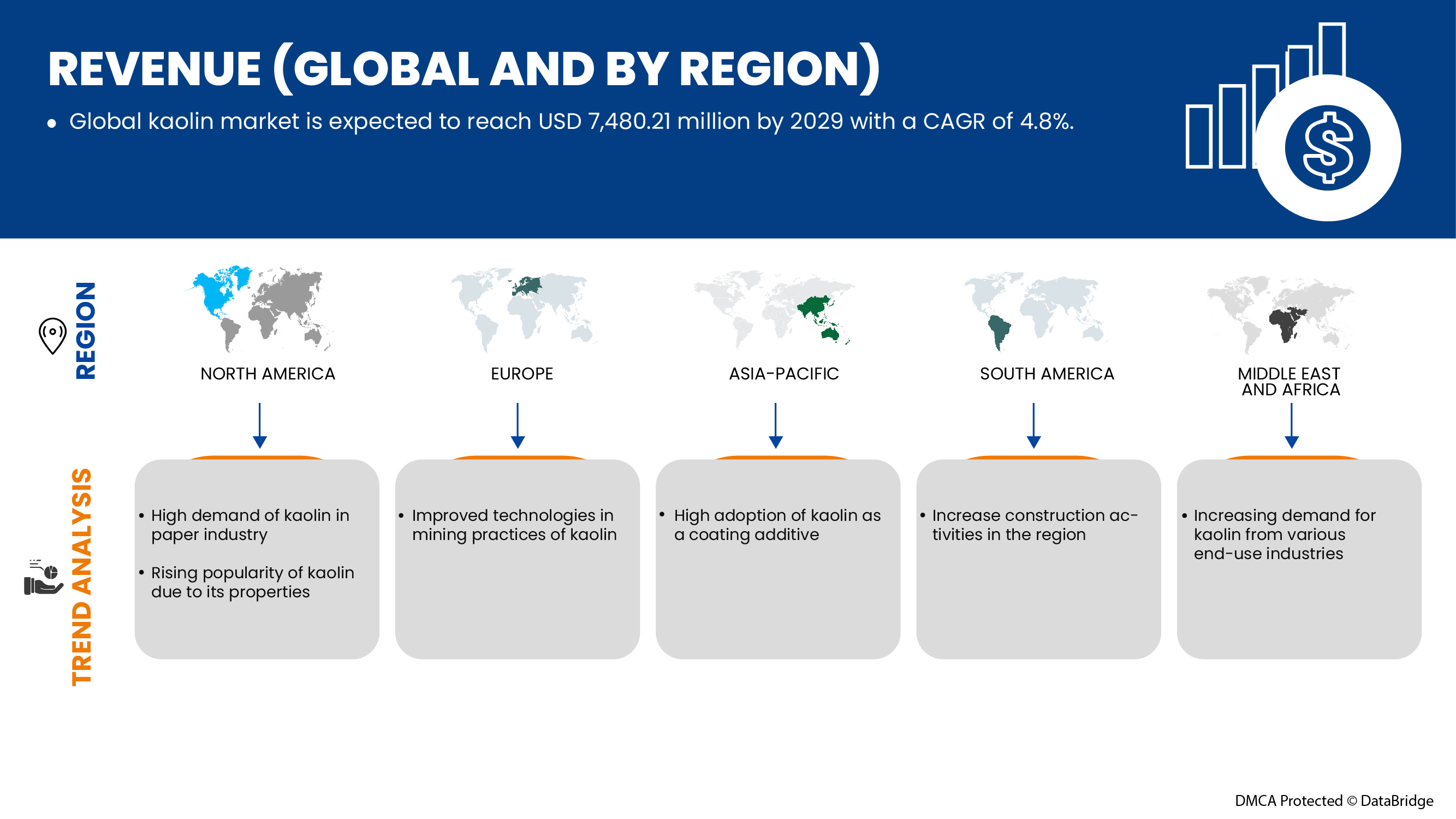

Se espera que el mercado mundial de caolín crezca significativamente en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 4,8% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 7.480,21 millones para 2029. El principal factor que impulsa el crecimiento del mercado de caolín es el aumento de las actividades de construcción en todo el mundo, las propiedades químicas y físicas favorables del caolín, el aumento de la demanda de caolín de varias industrias de uso final y la alta adopción del caolín como aditivo de recubrimiento.

Las industrias están adoptando cada vez más el caolín como materia prima para la producción de productos medicinales y cosméticos de importancia comercial. Además, las propiedades químicas, como la adsorción de proteínas, lípidos y aceites, han aumentado el uso del caolín para producir jabones faciales, mascarillas faciales, mascarillas de barro, exfoliantes corporales y otros productos cosméticos. Los productos medicinales, como enjuagues bucales, compresas quirúrgicas, agentes secantes y protectores temporales contra la dermatitis del pañal, utilizan el caolín como ingrediente clave debido a sus propiedades químicas favorables. Por lo tanto, el uso extensivo del caolín en diversas aplicaciones e industrias puede impulsar el crecimiento del mercado mundial del caolín.

El informe del mercado global de caolín proporciona detalles sobre la participación de mercado, los nuevos desarrollos y el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un informe de analista. Nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

Por grado (calcinado, hidratado, deslaminado, tratado superficialmente y estructurado), proceso (lavado con agua, flotado por aire, calcinado, deslaminado y modificado superficialmente y sin procesar), aplicación (papel, cerámica, pintura y revestimientos, fibra de vidrio, plástico, caucho, productos farmacéuticos y médicos, cosméticos y otros) |

|

Países cubiertos |

EE. UU., Canadá, México, Reino Unido, Rusia, Francia, España, Italia, Alemania, Turquía, Países Bajos, Suiza, Bélgica, Resto de Europa, Japón, China, Corea del Sur, India, Singapur, Tailandia, Indonesia, Malasia, Filipinas, Australia y Nueva Zelanda, Resto de Asia-Pacífico, Brasil, Argentina, Resto de Sudamérica, Egipto, Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Israel y Resto de Medio Oriente y África |

|

Actores del mercado cubiertos |

BASF SE, LB MINERALS, Ltd., Thiele Kaolin Company, Quartz Works GmbH, KaMin LLC. / CADAM, Grupo Ashapura, Imerys SA, SIBELCO, I-Minerals Inc., EICL |

Definición de mercado

El caolín, también llamado caolín, es una arcilla blanca blanda que se utiliza como ingrediente necesario en la fabricación de papel, caucho, cosméticos y otros materiales. El caolín se utiliza como agente de relleno en la industria papelera con adhesivos, lo que mejora la apariencia del papel, dándole un brillo variado, suavidad, luminosidad, opacidad y capacidad de impresión. Además, el producto mejora la capacidad de impresión del papel al proporcionar una mayor absorción de tinta, retención de pigmentos de tinta y mayor rugosidad. Se utiliza mucho en la industria cerámica para la fabricación de porcelana y refractarios. El caolín mejora la resistencia mecánica y la resistencia a la abrasión en la industria del caucho.

Dinámica del mercado mundial del caolín

En esta sección se aborda la comprensión de los factores impulsores, las limitaciones, las oportunidades y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- Aumento de las actividades de construcción en todo el mundo

El aumento de las actividades de construcción en las economías en desarrollo se ha visto respaldado por una mayor migración de la población rural a los centros urbanos y una mayor inversión en el desarrollo de infraestructuras. La creciente demanda de productos debido a las crecientes prácticas de remodelación residencial en varios países, como la tendencia de los consumidores estadounidenses a sustituir los suelos de madera por baldosas de cerámica, impulsa el crecimiento del mercado del caolín. Además, también se espera que Europa sea testigo de un ritmo rápido debido al aumento de la producción y el consumo de cerámica en sus países.

- Propiedades químicas y físicas favorables del caolín

El caolín es el metal preferido en diversas aplicaciones e industrias de uso final debido a las propiedades físicas y químicas deseadas y favorables que presenta cuando se utiliza. Existe una creciente demanda de arcilla de caolín en la industria del plástico, ya que su uso mejora su rendimiento eléctrico, durabilidad y resistencia. Además, la creciente adopción de cerámica se debe a la opacidad, inercia química, textura no abrasiva y forma plana de la arcilla de caolín. Además, el uso de caolín en hormigones y morteros está aumentando debido a su estabilidad térmica. Algunos grados de caolín tienen tamaños de partículas finos, alta adsorción y propiedades de suspensión.

- Aumento de la demanda de caolín por parte de diversas industrias de uso final

Muchas variables y propiedades significativas que actúan a favor del caolín y la creciente demanda de productos elaborados con caolín han mantenido el mercado del caolín en constante crecimiento en todo el mundo. La aplicación más común del caolín es en el sector del papel, lo que permite su uso como revestimiento de papel con una textura suave y una opacidad adecuada. El aumento se debe a una mayor demanda de papel por parte de diversas industrias de uso final, como el embalaje y la impresión. Además, este material se utiliza ampliamente para rellenar y revestir piezas, ya que reduce el tamaño de las partículas y mejora la resistencia. El caolín se utiliza con frecuencia en la industria del papel porque ofrece una variedad de cualidades, incluida una buena receptividad de la tinta, suavidad del papel y la opacidad óptima para la fabricación de papel.

- Alta adopción de caolín como aditivo de recubrimiento

La industria del papel y de las pinturas y revestimientos se encuentran entre los principales usuarios de caolín en sus productos. El caolín se utiliza para mejorar el rendimiento de las pinturas en forma de mejores propiedades de suspensión, dispersión rápida, resistencia a la corrosión, resistencia superior al agua y viscosidades reducidas. Además, el caolín se emplea como agente de recubrimiento y relleno cuando se combina con adhesivos en el recubrimiento de papel para proporcionar su opacidad, color y capacidad de impresión. El caolín es el mineral particulado más utilizado en el relleno y recubrimiento de papel. Mejora la apariencia del papel, que se caracteriza por el brillo, la suavidad, el brillo y la opacidad, y lo que es más importante, mejora la capacidad de impresión. El papel también se rellena con caolín para extender la fibra.

Oportunidad

- Iniciativas estratégicas clave implementadas por empresas líderes

El mercado mundial del caolín ha experimentado un efecto negativo inesperado debido a la aparición de la COVID-19 y a los confinamientos y restricciones de movimiento a nivel nacional. Por lo tanto, los fabricantes se centran principalmente en mantener el flujo de liquidez para evitar más pérdidas. Además, los actores clave del mercado del caolín han estado implementando diversas iniciativas y desarrollos estratégicos para ganar una participación de mercado importante y dominante y mejorar sus operaciones.

Restricciones/Desafíos

- Efecto negativo en la industria papelera por la aparición del covid-19

El brote de COVID-19 ha interrumpido la fabricación y el suministro del mercado de caolín, retrasando la expansión de la industria mundial. Muchas empresas de caolín están empleando formas de evitar pérdidas por tiempo de inactividad, que son cada vez más preocupantes a medida que perduran los efectos de la pandemia. El rendimiento del caolín en aplicaciones de relleno de papel se ha visto erosionado por la competencia de materiales alternativos, en particular los carbonatos de calcio. El lento crecimiento de la producción de papel estucado limitará los avances del caolín en el futuro, lo que restringirá el desarrollo del mercado mundial del caolín.

- Fácil disponibilidad de sustitutos

Otros sustitutos que se encuentran fácilmente en el mercado son la arcilla bentonita. La arcilla bentonita tiene poderosas propiedades de absorción de aceite y puede absorber más que su masa corporal en agua. Esto la convierte en un ingrediente excelente para personas con piel extremadamente grasa e impulsa su uso en productos cosméticos. La arcilla bentonita está compuesta de montmorillonita, un tipo de arcilla esmectita. Tiene un alto contenido de agua y se hincha cuando entra en contacto con el agua. Esto la hace eficaz para extraer las impurezas de la piel. Otra alternativa es la tierra de batán, que también se utiliza para el cuidado de la piel y la desintoxicación. Además, la arcilla rhassoul es una arcilla que se extrae en las montañas del Atlas en Marruecos. Es rica en minerales, tiene propiedades limpiadoras y acondicionadoras y es una gran alternativa a la arcilla de caolín.

- Aumento del precio del caolín

Las empresas y actores que operan en el mercado global del caolín se centran en aumentar los precios del caolín para garantizar la sostenibilidad a largo plazo del negocio. Estos actores anunciaron un aumento de precios en 2021 para diferentes aplicaciones, en las que el papel fue una de las aplicaciones clave. La mayoría de las empresas experimentaron inflación en varios aspectos del negocio, incluida la inflación en los productos químicos y los costos de transporte. Además, la degradación causada por el brote de la pandemia en sectores de aplicación clave afectó directamente a las ganancias de ingresos de los principales participantes del mercado.

Desarrollo reciente

- En julio de 2022, Thiele Kaolin Company anunció un aumento de precios del 9 % para todas las categorías de productos debido al clima económico mundial actual, que ha provocado un aumento de los costos de las operaciones de fabricación en todo el mundo. Para la empresa, estos aumentos de costos han afectado a la energía, los productos químicos, la mano de obra, la minería, el mantenimiento y otros insumos necesarios para producir productos de calidad.

- En noviembre de 2021, KaMin LLC y CADAM SA acordaron adquirir el negocio de minerales de caolín de BASF SE. El negocio de minerales de caolín forma parte de la división Performance Chemicals de BASF. Esto fortalece enormemente el negocio de caolín de la empresa en todo el mundo.

Alcance del mercado mundial del caolín

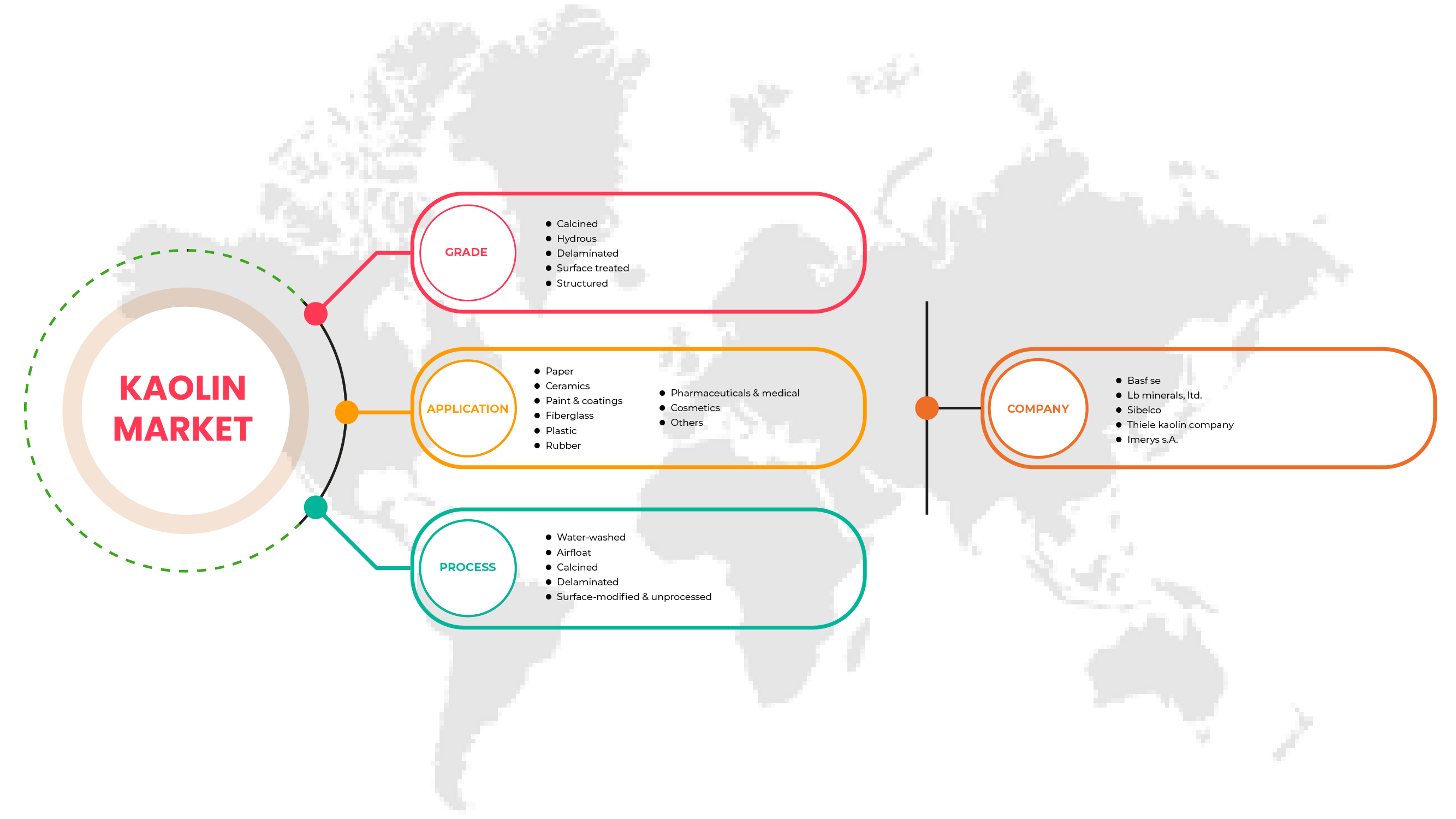

El mercado mundial del caolín se clasifica en función del grado, el proceso y la aplicación. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas a fin de identificar las principales aplicaciones del mercado.

Calificación

- Calcinado

- Hidratado

- Delaminado

- Superficie tratada

- Estructurado

Según el grado, el mercado mundial de caolín se clasifica en cinco segmentos, a saber, calcinado, hidratado, deslaminado, tratado superficialmente y estructurado.

Proceso

- Lavado con agua

- Flotador de aire

- Calcinado

- Delaminado

- Superficie modificada y sin procesar

Según el proceso, el mercado mundial de caolín se clasifica en cinco segmentos: lavado con agua, flotado en aire, calcinado, deslaminado y modificado superficialmente y sin procesar.

Solicitud

- Papel

- Cerámica

- Pinturas y recubrimientos

- Fibra de vidrio

- Plástico

- Goma

- Productos farmacéuticos y médicos

- Productos cosméticos

- Otros

Based on the application, the global kaolin market is classified into nine segments paper, ceramics, paint & coatings, fiberglass, plastic, rubber, pharmaceuticals & medical, cosmetics, and others.

Global Kaolin Market Regional Analysis/Insights

The global kaolin market is segmented based on grade, process, and application.

The countries in the global kaolin market are the U.S., Canada, Mexico, U.K., Russia, France, Spain, Italy, Germany, Turkey, Netherlands, Switzerland, Belgium, and the Rest of Europe, Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia & New Zealand, and the rest of Asia-Pacific, Brazil, Argentina, rest of South America, Egypt, Saudi Arabia, United Arab Emirates, South Africa, Israel and rest of the Middle East and Africa.

The U.S. dominates in the North American region due to the region's high adoption of kaolin as a coating additive. Germany dominated expected to dominate the Europe Kaolin market due to growing awareness of the excellent characteristics and properties of kaolin in the region. Saudi Arabia dominated the Kaolin market in the Middle East and Africa, increasing the use of paints & coatings in the region.

The country section of the report also provides individual market-impacting factors and market regulation changes that impact the market's current and future trends. Data point downstream and upstream value chain analysis, technological trends, porter's five forces analysis, and case studies are some pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Kaolin Market Share Analysis

Global kaolin market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies focus on the global kaolin market.

Some prominent participants operating in the global kaolin market are BASF SE, LB MINERALS, Ltd., Thiele Kaolin Company, Quartz Works GmbH, KaMin LLC. / CADAM, Ashapura Group, Imerys S.A., SIBELCO, I-MineralsInc., and EICL.

Research Methodology

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con tamaños de muestra grandes. Los datos del mercado se analizan y estiman utilizando modelos estadísticos y coherentes del mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrículas de posicionamiento de proveedores, análisis de la línea de tiempo del mercado, descripción general y guía del mercado, cuadrículas de posicionamiento de la empresa, análisis de la participación de mercado de la empresa, estándares de medición, análisis global versus regional y de la participación de los proveedores. Solicite una llamada de un analista en caso de tener más consultas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL KAOLIN MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 CRITICAL SELECTION CRITERIA FOR BUSINESS DECISION

4.4 IMPORT EXPORT SCENARIO

4.5 MANUFACTURING PROCESS: GLOBAL KAOLIN MARKET

4.6 MARKET CHANGES / CURRENT EVENTS

4.7 PRODUCTION CAPACITY BY MANUFACTURERS: GLOBAL KAOLIN MARKET

4.8 SUPPLY CHAIN ANALYSIS- GLOBAL KAOLIN MARKET

4.8.1 OVERVIEW

4.8.2 LOGISTIC COST SCENARIO

4.8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.9 TECHNOLOGIES OVERVIEW

4.1 VENDOR SELECTION CRITERIA

4.11 PRICE ANALYSIS SCENARIO

4.11.1 RAW MATERIALS PRICE ANALYSIS

4.11.2 CURRENT PRICE STATISTICS

4.11.3 PRICE FORECASTS

4.12 PRODUCTION CONSUMPTION ANALYSIS

4.13 REGULATION COVERAGE

4.14 MANUFACTURING COST SCENARIO AND FUTURE IMPACT

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN CONSTRUCTION ACTIVITIES ACROSS THE GLOBE

5.1.2 FAVOURABLE CHEMICAL AND PHYSICAL PROPERTIES OF KAOLIN

5.1.3 INCREASE IN DEMAND FOR KAOLIN FROM VARIOUS END-USE INDUSTRIES

5.1.4 HIGH ADOPTION OF KAOLIN AS A COATING ADDITIVE

5.2 RESTRAINTS

5.2.1 NEGATIVE EFFECT ON PAPER INDUSTRY DUE TO EMERGENCE OF COVID-19

5.2.2 KAOLIN MINING CAUSES NUMEROUS ENVIRONMENTAL AND HEALTH HAZARDS

5.3 OPPORTUNITIES

5.3.1 KEY STRATEGIC INITIATIVES IMPLEMENTED BY LEADING COMPANIES

5.3.2 IMPROVED TECHNOLOGIES IN MINING PRACTICES OF KAOLIN

5.4 CHALLENGES

5.4.1 EASY AVAILABILITY OF SUBSTITUTES

5.4.2 RISE IN THE PRICE OF KAOLIN

6 GLOBAL KAOLIN MARKET, BY GRADE

6.1 OVERVIEW

6.2 CALCINED

6.3 HYDROUS

6.4 DELAMINATED

6.5 SURFACE TREATED

6.6 STRUCTURED

7 GLOBAL KAOLIN MARKET, BY PROCESS

7.1 OVERVIEW

7.2 WATER-WASHED

7.3 AIRFLOAT

7.4 CALCINED

7.5 DELAMINATED

7.6 SURFACE-MODIFIED & UNPROCESSED

8 GLOBAL KAOLIN MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 PAPER

8.3 CERAMICS

8.4 PAINT & COATINGS

8.5 FIBERGLASS

8.6 PLASTIC

8.7 RUBBER

8.8 PHARMACEUTICALS & MEDICAL

8.9 COSMETICS

8.1 OTHERS

9 GLOBAL KAOLIN MARKET, BY REGION

9.1 OVERVIEW

9.2 ASIA-PACIFIC

9.2.1 CHINA

9.2.2 INDIA

9.2.3 JAPAN

9.2.4 SOUTH KOREA

9.2.5 THAILAND

9.2.6 SINGAPORE

9.2.7 INDONESIA

9.2.8 AUSTRALIA & NEW ZEALAND

9.2.9 PHILIPPINES

9.2.10 MALAYSIA

9.2.11 REST OF ASIA-PACIFIC

9.3 EUROPE

9.3.1 GERMANY

9.3.2 U.K.

9.3.3 FRANCE

9.3.4 ITALY

9.3.5 SPAIN

9.3.6 RUSSIA

9.3.7 SWITZERLAND

9.3.8 TURKEY

9.3.9 BELGIUM

9.3.10 NETHERLANDS

9.3.11 REST OF EUROPE

9.4 NORTH AMERICA

9.4.1 U.S.

9.4.2 CANADA

9.4.3 MEXICO

9.5 MIDDLE EAST AND AFRICA

9.5.1 SAUDI ARABIA

9.5.2 U.A.E.

9.5.3 SOUTH AFRICA

9.5.4 EGYPT

9.5.5 ISRAEL

9.5.6 REST OF MIDDLE EAST AND AFRICA

9.6 SOUTH AMERICA

9.6.1 BRAZIL

9.6.2 ARGENTINA

9.6.3 REST OF SOUTH AMERICA

10 GLOBAL KAOLIN MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

10.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

10.3 COMPANY SHARE ANALYSIS: EUROPE

10.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

10.5 DISINVESTMENT

10.6 PRICE INCREASE

10.7 ACQUISITION

10.8 FACILITY EXPANSION

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 IMERYS S.A.

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENT

12.2 SIBELCO

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENT

12.3 BASF SE

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT DEVELOPMENT

12.4 KAMIN LLC. / CADAM

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENTS

12.5 THIELE KAOLIN COMPANY

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENTS

12.6 ASHAPURA GROUP

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENTS

12.7 EICL

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENTS

12.8 I-MINERALSINC.

12.8.1 COMPANY SNAPSHOT

12.8.2 REVENUE ANALYSIS

12.8.3 PRODUCT PORTFOLIO

12.8.4 RECENT DEVELOPMENTS

12.9 LB MINERALS, LTD.

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENTS

12.1 QUARTZ WORKS GMBH

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

Lista de Tablas

TABLE 1 IMPORT DATA OF KAOLIN AND OTHER KAOLINIC CLAYS, WHETHER OR NOT CALCINED; HS CODE – 2507 (USD THOUSAND)

TABLE 2 EXPORT DATA OF KAOLIN AND OTHER KAOLINIC CLAYS, WHETHER OR NOT CALCINED; HS CODE – 2507 (USD THOUSAND)

TABLE 3 THE FOLLOWING TABLE SHOWS THE PRODUCTION CAPACITIES OF VARIOUS COMPANIES OPERATING IN THE GLOBAL KAOLIN MARKET.

TABLE 4 REGULATORY FRAMEWORK

TABLE 5 GLOBAL KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 6 GLOBAL KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 7 GLOBAL CALCINED IN KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 GLOBAL CALCINED IN KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 9 GLOBAL HYDROUS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 GLOBAL HYDROUS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 11 GLOBAL DELAMINATED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 GLOBAL DELAMINATED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 13 GLOBAL SURFACE TREATED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 GLOBAL SURFACE TREATED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 15 GLOBAL STRUCTURED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 GLOBAL STRUCTURED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 17 GLOBAL KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 18 GLOBAL KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 19 GLOBAL WATER-WASHED IN KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 GLOBAL WATER-WASHED IN KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 21 GLOBAL AIRFLOAT IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 GLOBAL AIRFLOAT IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 23 GLOBAL CALCINED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 GLOBAL CALCINED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 25 GLOBAL DELAMINATED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 GLOBAL DELAMINATED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 27 GLOBAL SURFACE-MODIFIED & UNPROCESSED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 GLOBAL SURFACE-MODIFIED & UNPROCESSED IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 29 GLOBAL KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 30 GLOBAL KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 31 GLOBAL PAPER IN KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 GLOBAL PAPER IN KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 33 GLOBAL CERAMICS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 GLOBAL CERAMICS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 35 GLOBAL PAINT & COATINGS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 GLOBAL PAINT & COATINGS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 37 GLOBAL FIBERGLASS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 GLOBAL FIBERGLASS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 39 GLOBAL PLASTIC IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 GLOBAL PLASTIC IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 41 GLOBAL RUBBER IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 GLOBAL RUBBER IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 43 GLOBAL PHARMACEUTICALS & MEDICAL IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 GLOBAL PHARMACEUTICALS & MEDICAL IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 45 GLOBAL COSMETICS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 GLOBAL COSMETICS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 47 GLOBAL OTHERS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 GLOBAL OTHERS IN GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 49 GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 GLOBAL KAOLIN MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 51 ASIA-PACIFIC KAOLIN MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 52 ASIA-PACIFIC KAOLIN MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 53 ASIA-PACIFIC KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 54 ASIA-PACIFIC KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 55 ASIA-PACIFIC KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 56 ASIA-PACIFIC KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 57 ASIA-PACIFIC KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 ASIA-PACIFIC KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 59 CHINA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 60 CHINA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 61 CHINA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 62 CHINA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 63 CHINA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 CHINA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 65 INDIA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 66 INDIA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 67 INDIA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 68 INDIA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 69 INDIA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 INDIA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 71 JAPAN KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 72 JAPAN KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 73 JAPAN KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 74 JAPAN KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 75 JAPAN KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 76 JAPAN KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 77 SOUTH KOREA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 78 SOUTH KOREA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 79 SOUTH KOREA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 80 SOUTH KOREA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 81 SOUTH KOREA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 SOUTH KOREA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 83 THAILAND KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 84 THAILAND KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 85 THAILAND KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 86 THAILAND KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 87 THAILAND KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 88 THAILAND KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 89 SINGAPORE KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 90 SINGAPORE KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 91 SINGAPORE KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 92 SINGAPORE KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 93 SINGAPORE KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 94 SINGAPORE KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 95 INDONESIA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 96 INDONESIA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 97 INDONESIA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 98 INDONESIA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 99 INDONESIA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 100 INDONESIA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 101 AUSTRALIA & NEW ZEALAND KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 102 AUSTRALIA & NEW ZEALAND KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 103 AUSTRALIA & NEW ZEALAND KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 104 AUSTRALIA & NEW ZEALAND KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 105 AUSTRALIA & NEW ZEALAND KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 106 AUSTRALIA & NEW ZEALAND KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 107 PHILIPPINES KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 108 PHILIPPINES KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 109 PHILIPPINES KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 110 PHILIPPINES KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 111 PHILIPPINES KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 PHILIPPINES KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 113 MALAYSIA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 114 MALAYSIA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 115 MALAYSIA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 116 MALAYSIA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 117 MALAYSIA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 118 MALAYSIA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 119 REST OF ASIA-PACIFIC KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 120 REST OF ASIA-PACIFIC KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 121 EUROPE KAOLIN MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 122 EUROPE KAOLIN MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 123 EUROPE KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 124 EUROPE KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 125 EUROPE KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 126 EUROPE KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 127 EUROPE KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 128 EUROPE KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 129 GERMANY KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 130 GERMANY KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 131 GERMANY KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 132 GERMANY KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 133 GERMANY KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 GERMANY KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 135 U.K. KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 136 U.K. KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 137 U.K. KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 138 U.K. KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 139 U.K. KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 140 U.K. KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 141 FRANCE KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 142 FRANCE KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 143 FRANCE KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 144 FRANCE KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 145 FRANCE KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 146 FRANCE KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 147 ITALY KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 148 ITALY KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 149 ITALY KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 150 ITALY KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 151 ITALY KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 152 ITALY KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 153 SPAIN KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 154 SPAIN KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 155 SPAIN KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 156 SPAIN KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 157 SPAIN KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 158 SPAIN KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 159 RUSSIA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 160 RUSSIA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 161 RUSSIA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 162 RUSSIA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 163 RUSSIA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 164 RUSSIA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 165 SWITZERLAND KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 166 SWITZERLAND KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 167 SWITZERLAND KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 168 SWITZERLAND KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 169 SWITZERLAND KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 170 SWITZERLAND KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 171 TURKEY KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 172 TURKEY KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 173 TURKEY KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 174 TURKEY KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 175 TURKEY KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 176 TURKEY KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 177 BELGIUM KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 178 BELGIUM KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 179 BELGIUM KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 180 BELGIUM KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 181 BELGIUM KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 182 BELGIUM KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 183 NETHERLANDS KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 184 NETHERLANDS KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 185 NETHERLANDS KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 186 NETHERLANDS KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 187 NETHERLANDS KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 188 NETHERLANDS KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 189 REST OF EUROPE KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 190 REST OF EUROPE KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 191 NORTH AMERICA KAOLIN MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 192 NORTH AMERICA KAOLIN MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 193 NORTH AMERICA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 194 NORTH AMERICA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 195 NORTH AMERICA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 196 NORTH AMERICA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 197 NORTH AMERICA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 198 NORTH AMERICA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 199 U.S. KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 200 U.S. KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 201 U.S. KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 202 U.S. KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 203 U.S. KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 204 U.S. KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 205 CANADA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 206 CANADA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 207 CANADA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 208 CANADA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 209 CANADA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 210 CANADA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 211 MEXICO KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 212 MEXICO KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 213 MEXICO KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 214 MEXICO KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 215 MEXICO KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 216 MEXICO KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 217 MIDDLE EAST AND AFRICA KAOLIN MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 218 MIDDLE EAST AND AFRICA KAOLIN MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 219 MIDDLE EAST AND AFRICA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 220 MIDDLE EAST AND AFRICA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 221 MIDDLE EAST AND AFRICA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 222 MIDDLE EAST AND AFRICA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 223 MIDDLE EAST AND AFRICA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 224 MIDDLE EAST AND AFRICA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 225 SAUDI ARABIA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 226 SAUDI ARABIA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 227 SAUDI ARABIA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 228 SAUDI ARABIA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 229 SAUDI ARABIA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 230 SAUDI ARABIA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 231 U.A.E. KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 232 U.A.E. KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 233 U.A.E. KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 234 U.A.E. KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 235 U.A.E. KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 236 U.A.E. KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 237 SOUTH AFRICA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 238 SOUTH AFRICA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 239 SOUTH AFRICA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 240 SOUTH AFRICA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 241 SOUTH AFRICA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 242 SOUTH AFRICA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 243 EGYPT KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 244 EGYPT KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 245 EGYPT KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 246 EGYPT KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 247 EGYPT KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 248 EGYPT KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 249 ISRAEL KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 250 ISRAEL KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 251 ISRAEL KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 252 ISRAEL KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 253 ISRAEL KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 254 ISRAEL KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 255 REST OF MIDDLE EAST AND AFRICA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 256 REST OF MIDDLE EAST AND AFRICA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 257 SOUTH AMERICA KAOLIN MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 258 SOUTH AMERICA KAOLIN MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 259 SOUTH AMERICA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 260 SOUTH AMERICA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 261 SOUTH AMERICA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 262 SOUTH AMERICA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 263 SOUTH AMERICA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 264 SOUTH AMERICA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 265 BRAZIL KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 266 BRAZIL KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 267 BRAZIL KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 268 BRAZIL KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 269 BRAZIL KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 270 BRAZIL KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 271 ARGENTINA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 272 ARGENTINA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

TABLE 273 ARGENTINA KAOLIN MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 274 ARGENTINA KAOLIN MARKET, BY PROCESS, 2020-2029 (KILO TONS)

TABLE 275 ARGENTINA KAOLIN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 276 ARGENTINA KAOLIN MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 277 REST OF SOUTH AMERICA KAOLIN MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 278 REST OF SOUTH AMERICA KAOLIN MARKET, BY GRADE, 2020-2029 (KILO TONS)

Lista de figuras

FIGURE 1 GLOBAL KAOLIN MARKET

FIGURE 2 GLOBAL KAOLIN MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL KAOLIN MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL KAOLIN MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL KAOLIN MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL KAOLIN MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 GLOBAL KAOLIN MARKET: MULTIVARIATE MODELLING

FIGURE 8 GLOBAL KAOLIN MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 GLOBAL KAOLIN MARKET: DBMR MARKET POSITION GRID

FIGURE 10 GLOBAL KAOLIN MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 GLOBAL KAOLIN MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 GLOBAL KAOLIN MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 GLOBAL KAOLIN MARKET: SEGMENTATION

FIGURE 14 ASIA PACIFIC IS EXPECTED TO DOMINATE THE GLOBAL KAOLIN MARKET, WHILE NORTH AMERICA IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 15 RISE IN CONSTRUCTION ACTIVITIES ACROSS THE GLOBE IS EXPECTED TO DRIVE THE GLOBAL KAOLIN MARKET IN THE FORECAST PERIOD

FIGURE 16 CALCINED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL KAOLIN MARKET IN 2022 & 2029

FIGURE 17 ASIA-PACIFIC IS THE FASTEST-GROWING MARKET FOR KAOLIN MARKET MANUFACTURERS IN THE FORECAST PERIOD

FIGURE 18 IMPORT-EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 CURRENT PRICE STATISTICS (PER KG)

FIGURE 20 PRICE FORECASTS (PER KG)

FIGURE 21 PRODUCTION CONSUMPTION ANALYSIS

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL KAOLIN MARKET

FIGURE 23 GLOBAL KAOLIN MARKET: BY GRADE, 2021

FIGURE 24 GLOBAL KAOLIN MARKET: BY PROCESS, 2021

FIGURE 25 GLOBAL KAOLIN MARKET: BY APPLICATION, 2021

FIGURE 26 GLOBAL KAOLIN MARKET: SNAPSHOT (2021)

FIGURE 27 GLOBAL KAOLIN MARKET: BY REGION (2021)

FIGURE 28 GLOBAL KAOLIN MARKET: BY REGION (2022 & 2029)

FIGURE 29 GLOBAL KAOLIN MARKET: BY REGION (2021 & 2029)

FIGURE 30 GLOBAL KAOLIN MARKET: BY GRADE (2022-2029)

FIGURE 31 ASIA-PACIFIC KAOLIN MARKET: SNAPSHOT (2021)

FIGURE 32 ASIA-PACIFIC KAOLIN MARKET: BY COUNTRY (2021)

FIGURE 33 ASIA-PACIFIC KAOLIN MARKET: BY COUNTRY (2022 & 2029)

FIGURE 34 ASIA-PACIFIC KAOLIN MARKET: BY COUNTRY (2021 & 2029)

FIGURE 35 ASIA-PACIFIC KAOLIN MARKET: BY GRADE (2022-2029)

FIGURE 36 EUROPE KAOLIN MARKET: SNAPSHOT (2021)

FIGURE 37 EUROPE KAOLIN MARKET: BY COUNTRY (2021)

FIGURE 38 EUROPE KAOLIN MARKET: BY COUNTRY (2022 & 2029)

FIGURE 39 EUROPE KAOLIN MARKET: BY COUNTRY (2021 & 2029)

FIGURE 40 EUROPE KAOLIN MARKET: BY GRADE (2022-2029)

FIGURE 41 NORTH AMERICA KAOLIN MARKET: SNAPSHOT (2021)

FIGURE 42 NORTH AMERICA KAOLIN MARKET: BY COUNTRY (2021)

FIGURE 43 NORTH AMERICA KAOLIN MARKET: BY COUNTRY (2022 & 2029)

FIGURE 44 NORTH AMERICA KAOLIN MARKET: BY COUNTRY (2021 & 2029)

FIGURE 45 NORTH AMERICA KAOLIN MARKET: BY GRADE (2022-2029)

FIGURE 46 MIDDLE EAST AND AFRICA KAOLIN MARKET: SNAPSHOT (2021)

FIGURE 47 MIDDLE EAST AND AFRICA KAOLIN MARKET: BY COUNTRY (2021)

FIGURE 48 MIDDLE EAST AND AFRICA KAOLIN MARKET: BY COUNTRY (2022 & 2029)

FIGURE 49 MIDDLE EAST AND AFRICA KAOLIN MARKET: BY COUNTRY (2021 & 2029)

FIGURE 50 MIDDLE EAST AND AFRICA KAOLIN MARKET: BY GRADE (2022 & 2029)

FIGURE 51 SOUTH AMERICA KAOLIN MARKET: SNAPSHOT (2021)

FIGURE 52 SOUTH AMERICA KAOLIN MARKET: BY COUNTRY (2021)

FIGURE 53 SOUTH AMERICA KAOLIN MARKET: BY COUNTRY (2022 & 2029)

FIGURE 54 SOUTH AMERICA KAOLIN MARKET: BY COUNTRY (2021 & 2029)

FIGURE 55 SOUTH AMERICA KAOLIN MARKET: BY GRADE (2022-2029)

FIGURE 56 GLOBAL KAOLIN MARKET: COMPANY SHARE 2021 (%)

FIGURE 57 NORTH AMERICA KAOLIN MARKET: COMPANY SHARE 2021 (%)

FIGURE 58 EUROPE KAOLIN MARKET: COMPANY SHARE 2021 (%)

FIGURE 59 ASIA-PACIFIC KAOLIN MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.