Global Industrial Metrology Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

11.76 Billion

USD

19.19 Billion

2024

2032

USD

11.76 Billion

USD

19.19 Billion

2024

2032

| 2025 –2032 | |

| USD 11.76 Billion | |

| USD 19.19 Billion | |

|

|

|

|

Segmentación del mercado global de metrología industrial, por oferta (hardware, software y servicios), equipo (CMM, ODS, rayos X y CT), aplicación (control de calidad e inspección, ingeniería inversa, mapeo y modelado, y otros), usuario final (automotriz, fabricación, aeroespacial y defensa, semiconductores y otros): tendencias de la industria y pronóstico hasta 2032

Análisis del mercado de metrología industrial

El mercado mundial de metrología industrial está impulsado en gran medida por la creciente demanda de soluciones de medición de alta precisión. A medida que las industrias buscan mejorar la eficiencia y la precisión, se están adoptando tecnologías de metrología avanzadas, como el escaneo 3D y los sistemas de medición láser, para garantizar la producción precisa de componentes. Además, la creciente demanda de control de calidad en varios sectores, incluidos el automotriz, el aeroespacial y el electrónico, impulsa aún más este mercado. Los estrictos requisitos regulatorios y la necesidad de cumplir con los estándares de calidad internacionales obligan a los fabricantes a invertir en sistemas de medición confiables. Este enfoque en el control de calidad no solo minimiza los defectos y los costos de producción, sino que también mejora la confiabilidad del producto y la satisfacción del cliente, consolidando la trayectoria de crecimiento del mercado.

Tamaño del mercado de metrología industrial

El tamaño del mercado global de metrología industrial se valoró en USD 11,76 mil millones en 2024 y se proyecta que alcance los USD 19,19 mil millones para 2032, con una CAGR del 6,30% durante el período de pronóstico de 2025 a 2032. Además de la información sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis experto en profundidad, producción y capacidad por empresa representada geográficamente, diseños de red de distribuidores y socios, análisis de tendencias de precios detallado y actualizado y análisis de déficit de la cadena de suministro y la demanda.

Tendencias del mercado de metrología industrial

"Estrictos requisitos regulatorios y cumplimiento de normas"

Los estrictos requisitos regulatorios en diversas industrias representan una oportunidad importante para el mercado mundial de metrología industrial. Industrias como la aeroespacial, la automotriz y la farmacéutica se rigen por estándares estrictos que dictan la precisión y confiabilidad de los procesos de medición. A medida que estas regulaciones evolucionan y se vuelven más rigurosas, los fabricantes se ven obligados a invertir en soluciones de metrología avanzadas para garantizar el cumplimiento y evitar sanciones asociadas con el incumplimiento.

Además, el cumplimiento de normas internacionales, como ISO 9001 y AS9100, exige controles de calidad constantes durante todo el proceso de producción. Las herramientas de metrología que facilitan la medición y la documentación precisas son fundamentales para cumplir con estas normas. Esta necesidad de cumplimiento impulsa la demanda de sistemas de medición sofisticados, lo que crea un mercado en crecimiento para los proveedores de soluciones de metrología que puedan ayudar a los fabricantes a desenvolverse en entornos regulatorios complejos. Esta tendencia no solo impulsa la demanda del mercado, sino que también enfatiza la importancia de la medición de precisión en las industrias reguladas.

Alcance del informe y segmentación del mercado de metrología industrial

|

Atributos |

Perspectivas clave del mercado de metrología industrial |

|

Segmentos cubiertos |

|

|

Países cubiertos |

EE. UU., Canadá y México en América del Norte, Alemania, Francia, Reino Unido, Países Bajos, Suiza, Bélgica, Rusia, Italia, España, Turquía, Resto de Europa en Europa, China, Japón, India, Corea del Sur, Singapur, Malasia, Australia, Tailandia, Indonesia, Filipinas, Resto de Asia-Pacífico (APAC) en Asia-Pacífico (APAC), Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Egipto, Israel, Resto de Medio Oriente y África (MEA) como parte de Medio Oriente y África (MEA), Brasil, Argentina y Resto de América del Sur como parte de América del Sur |

|

Actores clave del mercado |

Bruker (EE. UU.), Baker Hughes Company (EE. UU.), Hexagon AB (Suecia), KEYENCE CORPORATION (Japón), Applied Materials, Inc. (EE. UU.), SGS Société Générale de Surveillance (Suiza), FARO (EE. UU.), TriMet (EE. UU.), Intertek Group plc (Reino Unido), CREAFORM (Canadá), Automated Precision Inc (API) (EE. UU.), CyberOptics Corporation (EE. UU.), Cairnhill (Singapur), Metrologic Group (Francia) y ATT Metrology Solutions (EE. UU.) |

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de la información sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, producción y capacidad por empresa representada geográficamente, diseños de red de distribuidores y socios, análisis detallado y actualizado de tendencias de precios y análisis de déficit de la cadena de suministro y la demanda. |

Definición del mercado de metrología industrial

El mercado mundial de metrología industrial abarca el desarrollo, la fabricación y la utilización de tecnologías de medición e inspección diseñadas para garantizar la precisión y exactitud en los procesos industriales. Este mercado incluye una amplia gama de equipos y soluciones, como máquinas de medición por coordenadas (CMM), sistemas de medición ópticos y láser, y software para análisis de datos y control de calidad. La metrología industrial desempeña un papel fundamental en varios sectores, incluidos el automotriz, el aeroespacial, la electrónica y la atención médica, al permitir a los fabricantes mantener altos estándares de calidad, reducir errores y mejorar la productividad. A medida que las industrias adoptan cada vez más la automatización y las tecnologías de fabricación avanzadas, se espera que crezca la demanda de soluciones de medición precisas, impulsada por la necesidad de cumplir con estrictas regulaciones de calidad y la búsqueda de la eficiencia operativa. El mercado se caracteriza por avances tecnológicos continuos y un panorama de aplicaciones en expansión, lo que contribuye a su crecimiento y evolución generales.

Dinámica del mercado de metrología industrial

Conductores

- Demanda creciente de soluciones de medición de alta precisión

El panorama industrial se caracteriza cada vez más por la necesidad de soluciones de medición de alta precisión en diversos sectores, incluidos el aeroespacial, el automotriz y el electrónico. A medida que los productos se vuelven más sofisticados y las tolerancias se reducen, los fabricantes deben confiar en herramientas de metrología avanzadas para garantizar que los componentes cumplan con especificaciones estrictas. La medición de alta precisión es esencial no solo para el control de calidad, sino también para el cumplimiento normativo, lo que la convierte en una prioridad máxima para las industrias que buscan mantener la seguridad y la confiabilidad de sus productos.

Por ejemplo,

- En octubre de 2024, ZEISS presentó el ZEISS VersaXRM 730, un innovador sistema de microscopía de rayos X 3D que responde a la creciente demanda de tecnología de precisión en diversas industrias. Este innovador sistema ofrece una resolución mejorada y un rendimiento más rápido, lo que permite a los fabricantes realizar un escaneo eficiente y un control de calidad preciso de los componentes. Con características como el galardonado software ZEN navx y el modo FAST para la obtención rápida de imágenes, el VersaXRM 730 mejora significativamente la productividad, lo que respalda la creciente necesidad de soluciones de medición de alta precisión en sectores como el automotriz, el aeroespacial y los dispositivos médicos.

Demanda creciente de control de calidad

El control de calidad se ha convertido en un aspecto no negociable de la fabricación, lo que influye significativamente en el mercado mundial de metrología industrial. Los consumidores esperan productos de alta calidad y un mayor escrutinio por parte de los organismos reguladores, por lo que los fabricantes se ven obligados a implementar rigurosas medidas de control de calidad. Las soluciones de metrología avanzada proporcionan las capacidades necesarias para supervisar y garantizar la calidad del producto durante todo el proceso de producción, lo que reduce la probabilidad de defectos y garantiza el cumplimiento de las normas de la industria.

Por ejemplo,

En octubre de 2024, según E-Zine Media, la integración de la realidad aumentada (RA) transformó significativamente los procesos de control de calidad en la fabricación avanzada. Al superponer información digital sobre componentes físicos, la RA permitió la visualización de datos en tiempo real y mejoró la precisión en las inspecciones. Esta tecnología agilizó las operaciones, mejoró la precisión y facilitó la colaboración entre los operadores in situ y los expertos remotos.

Oportunidades

- Personalización de Soluciones en Metrología

La capacidad de personalizar las soluciones de metrología para satisfacer las necesidades únicas de diferentes industrias ofrece una valiosa oportunidad en el mercado global de metrología industrial. Diversos sectores, incluidos el automotriz, la electrónica y los dispositivos médicos, tienen requisitos de medición específicos que las soluciones estándar pueden no abordar adecuadamente. Al proporcionar sistemas de metrología personalizados, las empresas pueden atender mejor las diversas necesidades de sus clientes, mejorando la satisfacción y la lealtad de los mismos.

Por ejemplo,

En agosto de 2023, Bowers Group ayudó a Virtue Aerospace con éxito con una solución de medición personalizada que aceleró la velocidad de inspección en un 92 %. El sistema a medida ayudó a Virtue Aerospace a cumplir con los estrictos requisitos de cumplimiento para los impulsores de las bombas de combustible de aviación. Ian Smith, gerente de calidad y medio ambiente, elogió el sistema por su facilidad de uso y las mejoras significativas en el flujo de trabajo.

- Creciente adopción de la tecnología de gemelos digitales

La creciente adopción de la tecnología de gemelos digitales en los procesos de fabricación presenta una oportunidad sustancial para el mercado de la metrología industrial. Los gemelos digitales crean réplicas virtuales de activos físicos, lo que permite a los fabricantes simular, analizar y optimizar las operaciones en tiempo real. La precisión de los datos de metrología es crucial para desarrollar y mantener gemelos digitales eficaces, ya que garantiza que los modelos virtuales reflejen las condiciones y el rendimiento reales de los activos físicos.

Por ejemplo,

Según el informe técnico de Siemens, la tecnología de gemelos digitales permitió a los fabricantes desarrollar réplicas virtuales de activos físicos, mejorando las simulaciones operativas. Los datos metrológicos precisos resultaron esenciales para garantizar que estos modelos digitales reflejaran con precisión las condiciones del mundo real. Esto aumenta la adopción de la tecnología de gemelos digitales en el mercado mundial de metrología industrial.

Restricciones/Desafíos

- La elevada inversión inicial dificulta el crecimiento del mercado

La elevada inversión inicial que se requiere para las soluciones de metrología avanzadas representa una limitación importante en el mercado mundial de metrología industrial. Los sistemas de medición sofisticados, como los escáneres láser, las máquinas de medición por coordenadas (CMM) y las tecnologías de inspección automatizada, suelen tener costos sustanciales que pueden resultar prohibitivos, especialmente para las pequeñas y medianas empresas (PYME). Estas empresas pueden tener dificultades para asignar presupuestos para tales gastos de capital, lo que lleva a una adopción tardía de herramientas de metrología esenciales.

Por ejemplo,

En junio de 2024, el artículo destacó que la elevada inversión inicial requerida para las soluciones de metrología avanzada supone una importante limitación para el mercado de la metrología industrial. Muchas pequeñas y medianas empresas (PYME) se enfrentan a limitaciones presupuestarias, lo que retrasa la adopción de tecnologías de medición esenciales. Además, los gastos constantes de mantenimiento y actualizaciones de software complican aún más su capacidad de inversión, lo que limita el potencial de crecimiento del mercado.

Este informe de mercado proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado, comuníquese con Data Bridge Market Research para obtener un informe de analista, nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Alcance del mercado de metrología industrial

El mercado está segmentado en función de la oferta, el equipo, la aplicación y el usuario final. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Ofrenda

- Hardware

- Software

- Servicios

Equipo

- CMM

- SAO

- Radiografía

- Connecticut

Solicitud

- Control de calidad e inspección

- Ingeniería inversa

- Mapeo y modelado

- Otro

Usuario final

- Automotor

- Fabricación

- Aeroespacial y defensa

- Semiconductor

- Otros

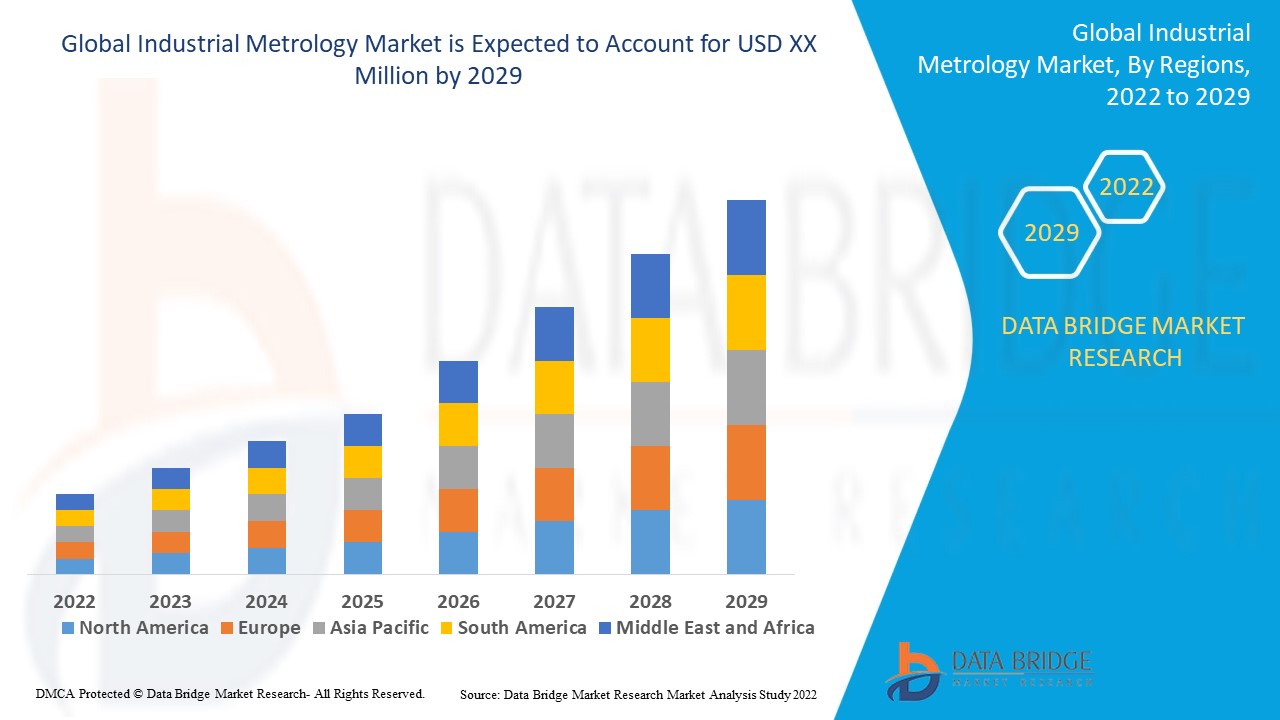

Análisis regional del mercado de metrología industrial

Se analiza el mercado y se proporcionan información y tendencias del tamaño del mercado por país, oferta, equipo, aplicación y usuario final como se menciona anteriormente.

Los países cubiertos en el informe de mercado son EE. UU., Canadá y México en América del Norte, Alemania, Francia, Reino Unido, Países Bajos, Suiza, Bélgica, Rusia, Italia, España, Turquía, Resto de Europa en Europa, China, Japón, India, Corea del Sur, Singapur, Malasia, Australia, Tailandia, Indonesia, Filipinas, Resto de Asia-Pacífico (APAC) en Asia-Pacífico (APAC), Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Egipto, Israel, Resto de Medio Oriente y África (MEA) como parte de Medio Oriente y África (MEA), Brasil, Argentina y Resto de América del Sur como parte de América del Sur.

La región de América del Norte domina el mercado mundial de metrología industrial debido a sus capacidades de fabricación avanzadas, fuertes inversiones en tecnología, un enfoque en el control de calidad y la presencia de actores clave de la industria.

Se espera que la región de Asia y el Pacífico sea la de más rápido crecimiento debido a la presencia de fabricantes clave que consolida aún más el liderazgo del mercado de la región y los estrictos estándares regulatorios impulsan la demanda de soluciones de medición precisas en varios sectores.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor aguas arriba y aguas abajo, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Cuota de mercado de la metrología industrial

El panorama competitivo del mercado proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado.

Los líderes del mercado de metrología industrial que operan en el mercado son:

- Bruker (Estados Unidos)

- Compañía Baker Hughes (Estados Unidos)

- Hexagon AB (Suecia)

- KEYENCE CORPORATION (Japón)

- Applied Materials, Inc. (Estados Unidos)

- SGS Société Générale de Surveillance (Suiza)

- FARO (Estados Unidos)

- TriMet (Estados Unidos)

- Intertek Group plc (Reino Unido)

- CREAFORM (Canadá)

- Automated Precision Inc (API) (Estados Unidos)

- Corporación CyberOptics (Estados Unidos)

- Cairnhill (Singapur)

- Grupo Metrologic (Francia)

- Soluciones de metrología ATT (Estados Unidos)

Últimos avances en el mercado de la metrología industrial

- En julio de 2024, los profesores Andrew Webb y Bernhard Blumich recibieron el premio Richard R. Ernst en EUROMAR 2024, en reconocimiento a sus importantes contribuciones a la investigación en RMN y resonancia magnética, impulsando la comprensión científica en estos campos.

- En febrero de 2021, Baker Hughes Company adquirió ARMS Reliability para reforzar su cartera de gestión del rendimiento de activos (APM), impulsando sus soluciones digitales en sectores como la minería, la energía y los servicios públicos. Esta adquisición mejora las capacidades de gestión de activos industriales de Baker Hughes al integrar las soluciones de ARMS Reliability en su plataforma Bently Nevada, lo que proporciona una supervisión de activos y una gestión del ciclo de vida más precisas y respalda el compromiso de la empresa de mejorar la productividad en metrología industrial.

- En septiembre de 2024, Hexagon AB presentó una nueva tecnología para reducir los retrasos en la inspección de calidad en la fabricación a gran escala. El Leica Absolute Tracker ATS800 combinaba la funcionalidad de seguimiento láser y radar, lo que permitía a los fabricantes medir características detalladas a distancia y cumplir con tolerancias de montaje estrictas. Este sistema mejoró la productividad al minimizar los cuellos de botella en los sectores aeroespacial y automotriz. El lanzamiento fortaleció la posición de mercado de Hexagon AB, mostrando su compromiso de abordar las necesidades básicas de la industria y mejorar las capacidades de inspección automatizada.

- En marzo de 2023, KEYENCE CORPORATION lanzó el sistema de medición multisensor LM-X de alta precisión, que combina mediciones ópticas, láser y de sonda táctil en una sola unidad. Este sistema permitió realizar mediciones sencillas y de alta precisión sin necesidad de realizar un posicionamiento que consumiera mucho tiempo, lo que permitió a los usuarios obtener informes de inspección confiables de manera eficiente y precisa.

- En junio de 2022, Applied Materials, Inc. anunció la adquisición de Picosun Oy, mejorando las capacidades de su grupo ICAPS con la tecnología de deposición de capas atómicas de Picosun. Esta medida tenía como objetivo abordar la creciente demanda de semiconductores especiales en varios mercados.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.