Mercado global de computación de alto rendimiento para automoción, por oferta (solución, software y servicios), modelo de implementación (local y en la nube), tamaño de la organización (grandes empresas, pequeñas y medianas empresas (PYMES)), tipo de computación (computación paralela, computación distribuida y computación a exaescala), plataforma (HPC de seguridad y movimiento, HPC de conducción autónoma, HPC de carrocería, HPC de cabina y HPC entre dominios), tipo de vehículo (automóvil de pasajeros, vehículo comercial ligero y vehículo comercial pesado): tendencias de la industria y pronóstico hasta 2030.

Análisis y dimensionamiento del mercado de computación de alto rendimiento para la industria automotriz

El aumento de la demanda de investigación en HPC en todo el mundo actúa como uno de los principales factores que impulsan el crecimiento del mercado de la computación de alto rendimiento. El aumento de la necesidad de computación eficiente, escalabilidad mejorada y almacenamiento confiable, y la creciente necesidad de diversificación continua, expansión de la industria de TI, computación de alta eficiencia y avances en virtualización, aceleran el crecimiento del mercado. El aumento en la adopción de computación de alto rendimiento debido a su capacidad de los sistemas HPC para procesar grandes volúmenes de datos a velocidades más altas y un alto uso en varios sectores influye aún más en el mercado.

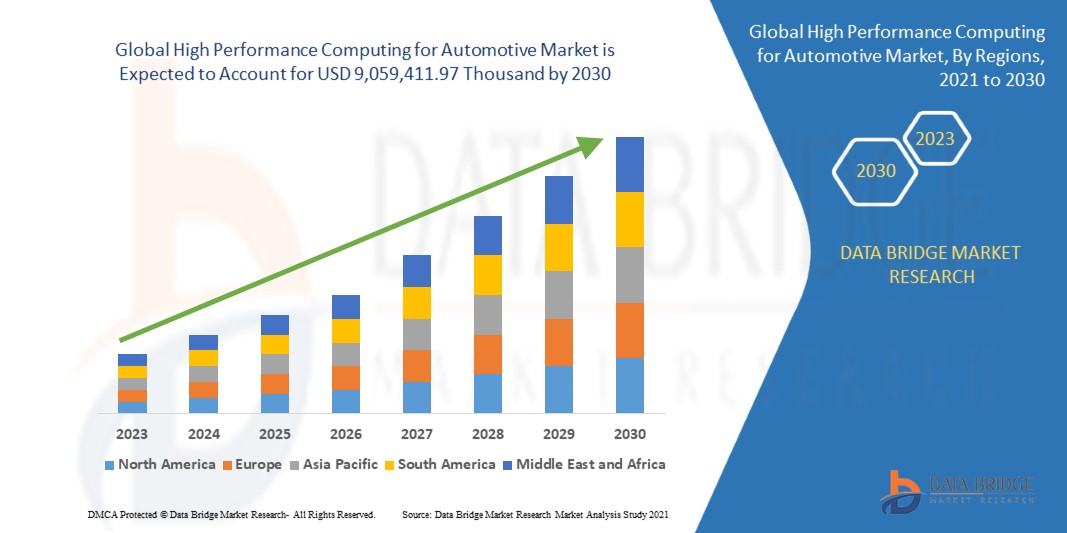

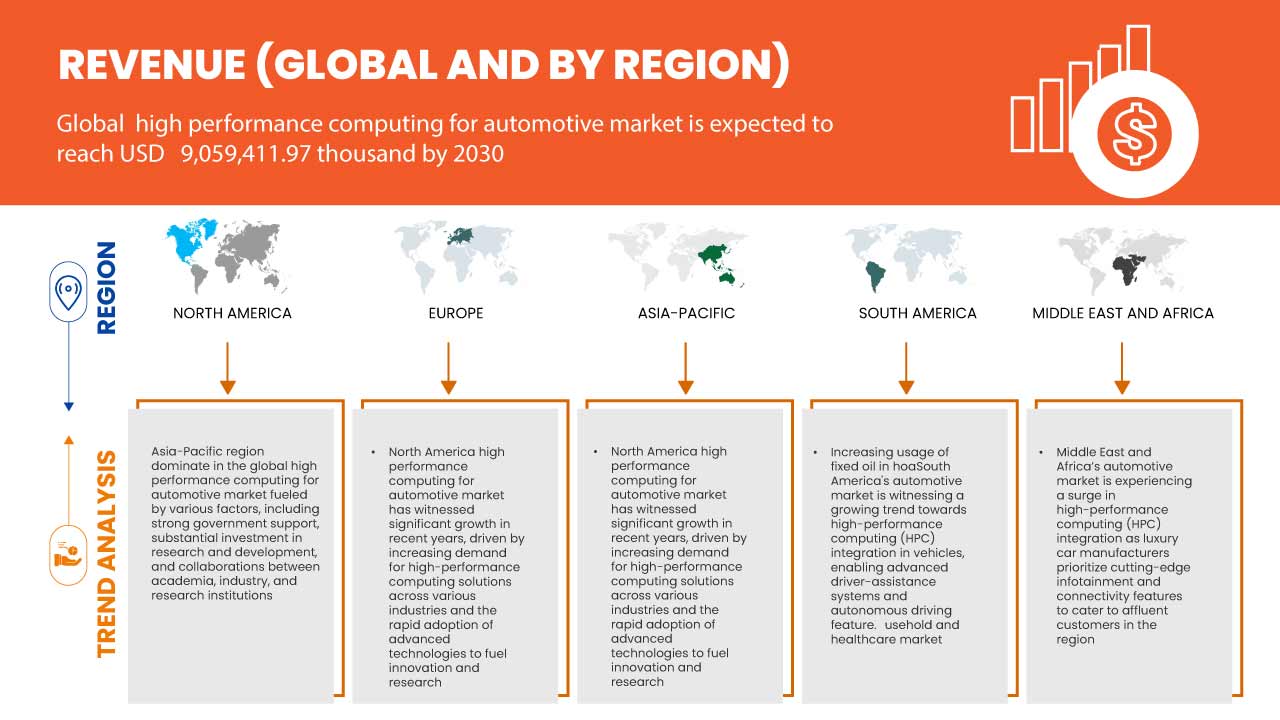

Data Bridge Market Research analiza que se espera que el mercado mundial de computación de alto rendimiento para la industria automotriz alcance un valor de USD 9.059.411,97 mil para 2030, con una CAGR del 12,1 % durante el período de pronóstico. El informe del mercado mundial de computación de alto rendimiento para la industria automotriz también cubre de manera integral el análisis de precios, el análisis de patentes y los avances tecnológicos.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2015-2020) |

|

Unidades cuantitativas |

Ingresos en miles de USD, precios en USD |

|

Segmentos cubiertos |

Oferta (solución, software y servicios), modelo de implementación (local y en la nube), tamaño de la organización (grandes empresas, pequeñas y medianas empresas [PYMES]), tipo de computación (computación paralela, computación distribuida y computación a exaescala), plataforma (HPC de seguridad y movimiento, HPC de conducción autónoma, HPC de carrocería, HPC de cabina y HPC de dominio cruzado), tipo de vehículo (automóvil de pasajeros, vehículo comercial ligero y vehículo comercial pesado) |

|

Regiones cubiertas |

EE. UU., Canadá, México, Brasil, Argentina, Resto de Sudamérica, Alemania, Francia, Reino Unido, Rusia, Italia, España, Países Bajos, Polonia, Suiza, Bélgica, Suecia, Turquía, Dinamarca, Resto de Europa, Japón, China, India, Corea del Sur, Vietnam, Taiwán, Australia y Nueva Zelanda, Singapur, Malasia, Tailandia, Indonesia, Filipinas, Resto de Asia-Pacífico, Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Egipto, Israel, Kuwait, Qatar, Resto de Medio Oriente y África |

|

Actores del mercado cubiertos |

Español: Hewlett Packard Enterprise Development LP, IBM, Lenovo, NVIDIA Corporation, Advanced Micro Devices, Inc., Microsoft, Taiwan Semiconductor Manufacturing Company Limited, Dell Inc., Fujitsu, Elektrobit, NEC Corporation, Beijing Jingwei Hirain Technologies Co., Inc., NXP Semiconductors, ANSYS, Inc., ESI Group, Super Micro Computer, Inc., Altair Engineering, Inc., TotalCAE, Vector Informatik GmbH, MiTAC Computing Technology Corporation, Rescale, Inc. |

Definición de mercado

La computación de alto rendimiento (HPC, por sus siglas en inglés) se refiere al uso de sistemas informáticos potentes y especializados capaces de procesar y analizar grandes cantidades de datos a velocidades increíblemente altas. Estos sistemas emplean técnicas avanzadas de procesamiento en paralelo y, a menudo, utilizan múltiples procesadores o nodos que trabajan juntos para resolver problemas complejos en la investigación científica, las simulaciones de ingeniería, los modelos financieros, la previsión meteorológica y otras tareas que requieren un uso intensivo de los recursos computacionales. La HPC permite a los investigadores y profesionales abordar desafíos que serían inviables o poco prácticos utilizando computadoras convencionales, lo que conduce a descubrimientos acelerados, mejores conocimientos y una resolución de problemas más eficiente en varios dominios.

Dinámica del mercado mundial de computación de alto rendimiento para la industria automotriz

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

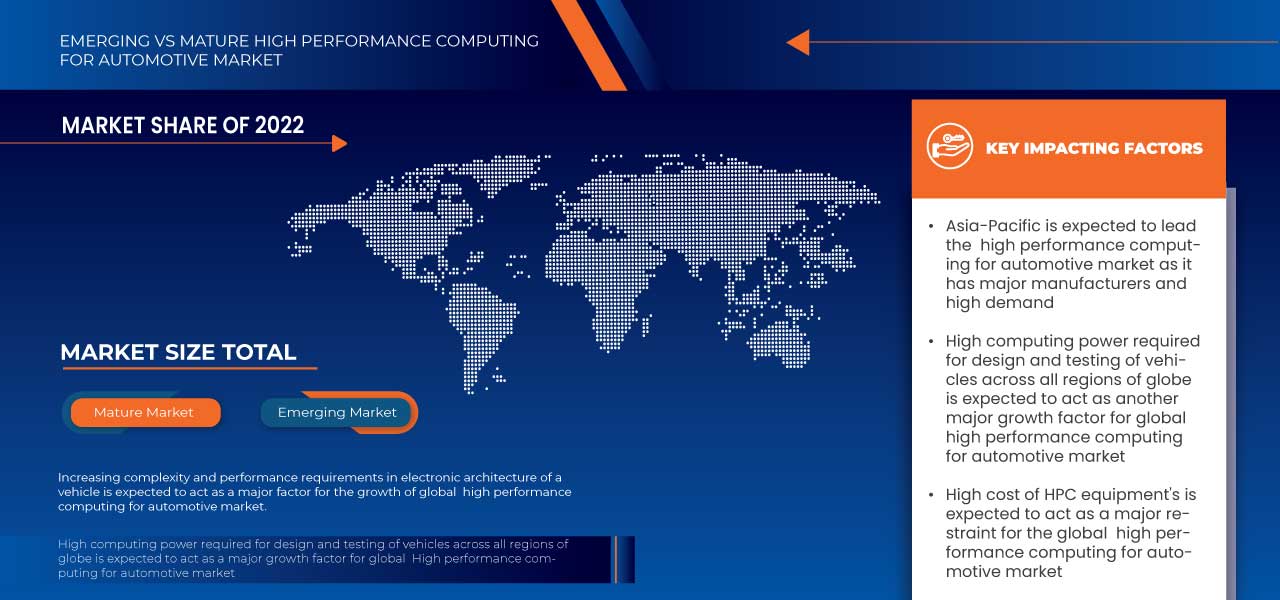

- Aumento de la complejidad y de los requisitos de rendimiento en la arquitectura electrónica de un vehículo

La movilidad del futuro tendrá acceso a una variedad de nuevas funciones y servicios gracias a la digitalización. Sin embargo, esto también está provocando un aumento exponencial en el volumen de datos e información que necesita ser procesada. La arquitectura eléctrica/electrónica (E/E) actual ya ha superado su punto de ruptura. Las megatendencias en la industria automotriz, como la conducción automatizada, los vehículos definidos por software y la movilidad vinculada, requieren una cantidad cada vez mayor de inteligencia y capacidad informática. La complejidad y el rendimiento de las arquitecturas eléctricas/electrónicas de los automóviles actuales están en su punto máximo. Se necesita una gran capacidad de procesamiento para soportar la conectividad, las actualizaciones inalámbricas, la conducción automatizada y autónoma y los sistemas avanzados de asistencia al conductor (ADAS).

- Se requiere un alto poder de procesamiento para el diseño y prueba de vehículos.

La computación de alto rendimiento (HPC) para la industria automotriz es un tipo mejorado de HPC creado para satisfacer las demandas de la industria de fabricación de automóviles en términos de potencia de procesamiento y compatibilidad de software. Los vehículos modernos se producen utilizando ingeniería de precisión habilitada por software, lo que requiere un grado significativo de rendimiento computacional. La HPC puede proporcionar la capacidad de procesamiento necesaria en cualquier nivel del proceso de diseño, incluidas las pruebas de características y la simulación de seguridad. Las características entregadas por software dentro de los propios automóviles también están recibiendo más atención. Con una visión CASE (conectado, autónomo, compartido, eléctrico), los automóviles están evolucionando hacia vehículos definidos por software (SDV), donde las características que son posibles gracias al código vinculan las capacidades mecánicas.

Oportunidad

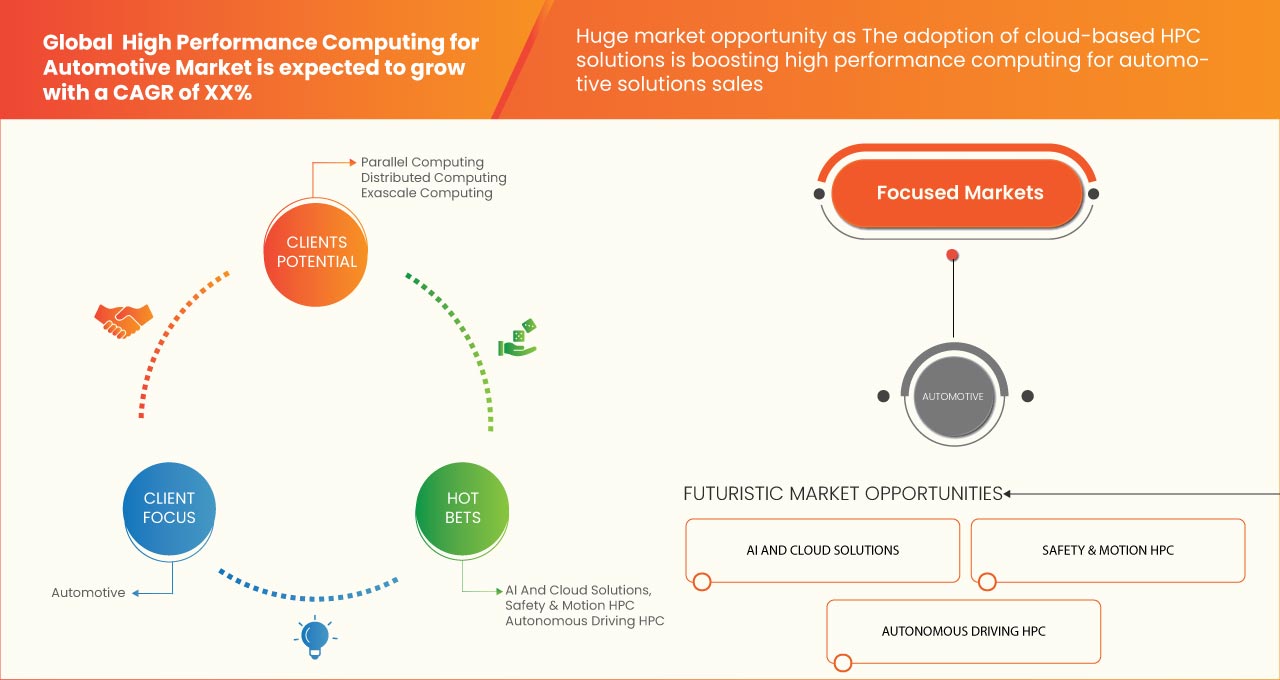

- La adopción de soluciones HPC basadas en la nube

La industria automotriz está atravesando un cambio drástico debido a los avances tecnológicos que impulsan innovaciones en movilidad eléctrica, vehículos sin conductor y automóviles conectados. Las empresas automotrices están buscando formas de acelerar el desarrollo de productos, mejorar el rendimiento de los vehículos y optimizar los procesos de producción para seguir siendo competitivas en este entorno que cambia rápidamente. La adopción de tecnologías de computación de alto rendimiento (HPC) basadas en la nube es una estrategia que ha ganado fuerza últimamente. Las empresas automotrices están abriendo nuevas puertas para procesos de investigación, diseño y prueba más rápidos, más productivos y menos costosos al aprovechar el poder de la computación en la nube y las capacidades informáticas de vanguardia.

Restricción/Desafío

- Alto costo de los equipos HPC

Uno de los principales obstáculos para la aceptación de las tecnologías HPC en los automóviles es su coste. El alto coste de adquisición y mantenimiento de los sistemas HPC puede ser un obstáculo importante para las empresas automotrices, en particular las pequeñas y medianas. Los sistemas HPC suelen tener una gran cantidad de procesadores, lo que puede aumentar el coste. Los sistemas HPC suelen utilizar procesadores de alta velocidad, lo que también puede aumentar el coste. Los sistemas HPC suelen necesitar mucha memoria, lo que también puede aumentar el coste. Los sistemas HPC generan mucho calor, lo que requiere sistemas de refrigeración especializados. Esto también puede aumentar el coste.

- Manejo de datos automotrices sensibles

Los fabricantes de automóviles y los proveedores de movilidad otorgan hoy una gran prioridad a la seguridad y la privacidad de los datos de los automóviles conectados. La información de identificación personal (PII), la ubicación, el comportamiento y los datos financieros del cliente, así como la propiedad intelectual asociada con el automóvil y los servicios ofrecidos, pueden incluirse en los datos confidenciales recopilados a través de los automóviles conectados. Los empleados y contratistas de todo el mundo tienen acceso a estos datos confidenciales a medida que pasan por muchos entornos y plataformas, tanto locales como en la nube. Los fabricantes corren un gran riesgo de sufrir ciberataques debido a este señuelo de información.

Acontecimientos recientes

- En enero de 2023, NVIDIA Corporation y Hon Hai Technology Group (Foxconn) anunciaron hoy una asociación estratégica para desarrollar plataformas de vehículos automatizados y autónomos. Como parte del acuerdo, Foxconn producirá unidades de control electrónico (ECU) basadas en NVIDIA DRIVE Orin para el mercado automotriz mundial como fabricante de primer nivel.

- En noviembre de 2022, Dell Inc. anunció una ampliación de su cartera de computación de alto rendimiento (HPC), con nuevo hardware, servicios y una solución de computación cuántica híbrida. La solución de computación cuántica de Dell permite a las empresas beneficiarse de la computación mejorada de la tecnología cuántica. Los clientes pueden utilizarla para acelerar el aprendizaje automático, el procesamiento del lenguaje natural y la simulación de materiales y química.

Alcance del mercado mundial de computación de alto rendimiento para la industria automotriz

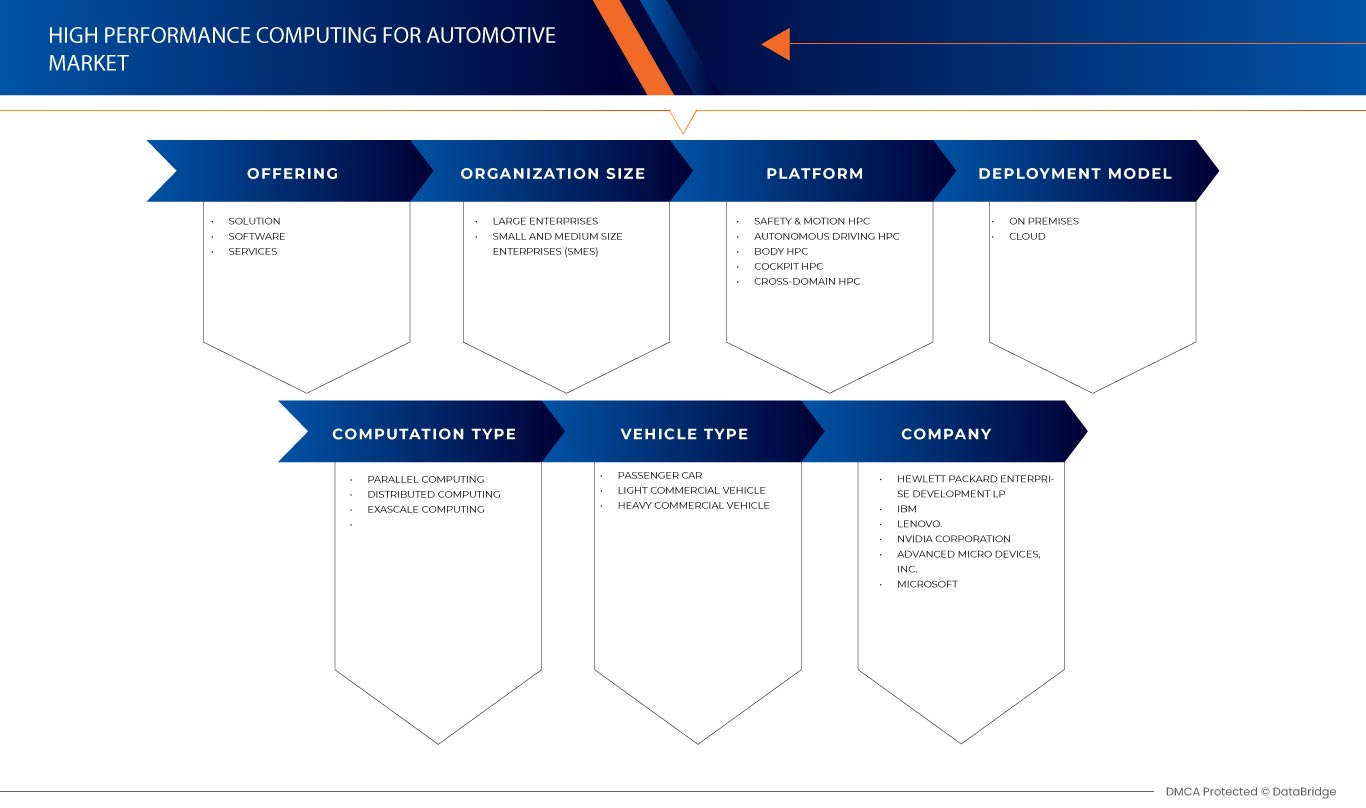

El mercado mundial de computación de alto rendimiento para la industria automotriz está segmentado en función de la oferta, el modelo de implementación, el tamaño de la organización, el tipo de computación, la plataforma y el tipo de vehículo. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Ofrenda

- Solución

- Software

- Servicios

Sobre la base de la oferta, el mercado global de computación de alto rendimiento para automoción se ha segmentado en soluciones, software y servicios.

Modelo de implementación

- En las instalaciones

- Nube

Sobre la base del modelo de implementación, el mercado global de computación de alto rendimiento para automoción se ha segmentado en local y en la nube.

Tamaño de la organización

- Grandes empresas

- Pequeñas y medianas empresas (PYMES)

Sobre la base del tamaño de la organización, el mercado global de computación de alto rendimiento para automoción se ha segmentado en grandes empresas y pequeñas y medianas empresas (PYMES).

Tipo de cálculo

- Computación paralela

- Computación distribuida

- Computación a escala de exaescala

Sobre la base del tipo de cálculo, el mercado global de computación de alto rendimiento para automoción se ha segmentado en computación paralela, computación distribuida y computación a exaescala.

Plataforma

- Seguridad y movimiento HPC

- Conducción autónoma HPC

- Cuerpo HPC

- Cabina HPC

- HPC entre dominios

Sobre la base de la plataforma, el mercado global de computación de alto rendimiento para automoción se ha segmentado en HPC de seguridad y movimiento, HPC de conducción autónoma, HPC de carrocería, HPC de cabina y HPC de dominio cruzado.

Tipo de vehículo

- Coche de pasajeros

- Vehículo comercial ligero

- Vehículo comercial pesado

Sobre la base del tipo de vehículo, el mercado global de computación de alto rendimiento para automoción se ha segmentado en automóviles de pasajeros, vehículos comerciales ligeros y vehículos comerciales pesados.

Análisis y perspectivas regionales del mercado mundial de computación de alto rendimiento para la industria automotriz

Se analiza el mercado global de computación de alto rendimiento para automoción y se proporcionan información y tendencias del tamaño del mercado por región, tipo, modo de implementación, aplicación y usuario final como se menciona anteriormente.

Las regiones cubiertas en el informe del mercado mundial de computación de alto rendimiento para la automoción son América del Norte, América del Sur, Europa, Asia-Pacífico, Oriente Medio y África. Se espera que la región de Asia-Pacífico domine en el mercado mundial de computación de alto rendimiento para la automoción impulsada por varios factores, incluido un fuerte apoyo gubernamental, una inversión sustancial en investigación y desarrollo y colaboraciones entre la academia, la industria y las instituciones de investigación. China domina en la región de Asia-Pacífico, ya que China ha estado invirtiendo fuertemente en infraestructura e investigación de HPC para mejorar sus capacidades tecnológicas y avances científicos. Además, Estados Unidos domina la región de América del Norte debido a factores como la alta adopción de tecnologías de HPC en los sectores automotrices que dependen de HPC para acelerar el desarrollo de productos, mejorar los descubrimientos científicos y optimizar las operaciones.

El mercado europeo de computación de alto rendimiento para la automoción ha sido testigo de la mayor tasa de crecimiento entre todas las regiones en este ámbito, debido a factores como la creciente adopción de vehículos eléctricos (VE) y tecnología de conducción autónoma. Alemania está dominando la región debido a los esfuerzos de colaboración entre los fabricantes de automóviles y los proveedores de HPC para desarrollar materiales livianos y ecológicos y optimizar los procesos de fabricación, promoviendo la sostenibilidad y reduciendo el impacto ambiental.

La sección de regiones del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos de la región.

Análisis del panorama competitivo y de la cuota de mercado global de la informática de alto rendimiento para la automoción

El panorama competitivo del mercado mundial de computación de alto rendimiento para la industria automotriz ofrece detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado mundial de computación de alto rendimiento para la industria automotriz.

Algunos de los principales actores que operan en el mercado global de computación de alto rendimiento para automoción son Hewlett Packard Enterprise Development LP, IBM, Lenovo, NVIDIA Corporation, Advanced Micro Devices, Inc., Microsoft, Taiwan Semiconductor Manufacturing Company Limited, Dell Inc., Fujitsu, Elektrobit, NEC Corporation, Beijing Jingwei Hirain Technologies Co., Inc., NXP Semiconductors, ANSYS, Inc, ESI Group, Super Micro Computer, Inc., Altair Engineering Inc., TotalCAE, Vector Informatik GmbH, MiTAC Computing Technology Corporation, Rescale, Inc. y entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 COMPANY SHARE ANALYSIS AT COUNTRY LEVEL

4.2 COMPANY COMPARATIVE ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING COMPLEXITY AND PERFORMANCE REQUIREMENTS IN THE ELECTRONIC ARCHITECTURE OF A VEHICLE

5.1.2 HIGH COMPUTING POWER REQUIRED FOR DESIGN AND TESTING OF VEHICLES

5.1.3 RISING INTEGRATION OF AI AND ML TECHNOLOGIES IN AUTOMOBILES

5.2 RESTRAINTS

5.2.1 HIGH COST OF HPC EQUIPMENTS

5.3 OPPORTUNITIES

5.3.1 HIGH-PERFORMANCE COMPUTING CAN OPTIMIZE AUTOMOTIVE MANUFACTURING PROCESSES

5.3.2 THE ADOPTION OF CLOUD-BASED HPC SOLUTIONS

5.4 CHALLENGES

5.4.1 HANDLING SENSITIVE AUTOMOTIVE DATA

6 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOLUTION

6.2.1 SERVER

6.2.2 STORAGE

6.2.3 NETWORKING DEVICE

6.3 SOFTWARE

6.4 SERVICES

6.4.1 INTEGRATION AND IMPLEMENTATION

6.4.2 SUPPORT AND MAINTENANCE

6.4.3 DESIGNING AND CONSULTING

7 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY DEPLOYMENT MODEL

7.1 OVERVIEW

7.2 ON PREMISES

7.3 CLOUD

8 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY ORGANIZATION SIZE

8.1 OVERVIEW

8.2 LARGE ENTERPRISES

8.2.1 ON PREMISES

8.2.2 CLOUD

8.3 SMALL AND MEDIUM SIZE ENTERPRISES (SMES)

8.3.1 ON PREMISES

8.3.2 CLOUD

9 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY COMPUTATION TYPE

9.1 OVERVIEW

9.2 PARALLEL COMPUTING

9.3 DISTRIBUTED COMPUTING

9.4 EXASCALE COMPUTING

10 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY PLATFORM

10.1 OVERVIEW

10.2 SAFETY & MOTION HPC

10.3 AUTONOMOUS DRIVING HPC

10.4 BODY HPC

10.5 COCKPIT HPC

10.6 CROSS-DOMAIN HPC

11 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE

11.1 OVERVIEW

11.2 PASSENGER CAR

11.2.1 BY TYPE

11.2.1.1 SUV

11.2.1.2 HATCHBACK

11.2.1.3 SEDAN

11.2.1.4 COUPE

11.2.1.5 SPORT CAR

11.2.1.6 CONVERTIBLE

11.2.1.7 OTHERS

11.2.2 BY OFFERING

11.2.2.1 SOLUTION

11.2.2.1.1 SERVER

11.2.2.1.2 STORAGE

11.2.2.1.3 NETWORKING DEVICE

11.2.2.2 SOFTWARE

11.2.2.3 SERVICES

11.3 LIGHT COMMERCIAL VEHICLE

11.3.1 BY TYPE

11.3.1.1 VANS

11.3.1.2 PICK UP TRUCKS

11.3.1.3 MINI BUS

11.3.1.4 TOW TRUCK

11.3.1.5 OTHER

11.3.2 BY OFFERING

11.3.2.1 SOLUTION

11.3.2.1.1 SERVER

11.3.2.1.2 STORAGE

11.3.2.1.3 NETWORKING DEVICE

11.3.2.2 SOFTWARE

11.3.2.3 SERVICES

11.4 HEAVY COMMERCIAL VEHICLE

11.4.1 BY TYPE

11.4.1.1 HEAVY TRUCK

11.4.1.1.1 SEMI-TRAILER TRUCK

11.4.1.1.2 BOX TRUCK

11.4.1.2 OTHERS

11.4.2 BY OFFERING

11.4.2.1 SOLUTION

11.4.2.1.1 SERVER

11.4.2.1.2 STORAGE

11.4.2.1.3 NETWORKING DEVICE

11.4.2.2 SOFTWARE

11.4.2.3 SERVICES

12 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION

12.1 OVERVIEW

12.2 ASIA-PACIFIC

12.2.1 CHINA

12.2.2 JAPAN

12.2.3 SOUTH KOREA

12.2.4 INDIA

12.2.5 AUSTRALIA & NEW ZEALAND

12.2.6 SINGAPORE

12.2.7 TAIWAN

12.2.8 THAILAND

12.2.9 INDONESIA

12.2.10 MALAYSIA

12.2.11 PHILIPPINES

12.2.12 VIETNAM

12.2.13 REST OF ASIA-PACIFIC

12.3 NORTH AMERICA

12.3.1 U.S.

12.3.2 CANADA

12.3.3 MEXICO

12.4 EUROPE

12.4.1 GERMANY

12.4.2 FRANCE

12.4.3 U.K.

12.4.4 RUSSIA

12.4.5 ITALY

12.4.6 SPAIN

12.4.7 NETHERLANDS

12.4.8 POLAND

12.4.9 SWITZERLAND

12.4.10 BELGIUM

12.4.11 SWEDEN

12.4.12 TURKEY

12.4.13 DENMARK

12.4.14 REST OF EUROPE

12.5 SOUTH AMERICA

12.5.1 BRAZIL

12.5.2 ARGENTINA

12.5.3 REST OF SOUTH AMERICA

12.6 MIDDLE EAST AND AFRICA

12.6.1 SAUDI ARABIA

12.6.2 U.A.E.

12.6.3 ISRAEL

12.6.4 SOUTH AFRICA

12.6.5 EGYPT

12.6.6 KUWAIT

12.6.7 QATAR

12.6.8 REST OF MIDDLE EAST AND AFRICA

13 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: ASIA PACIFIC

13.3 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.4 COMPANY SHARE ANALYSIS: EUROPE

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 IBM

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 LENOVO

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 NVIDIA CORPORATION

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PROTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 ADVANCED MICRO DEVICES, INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ALTAIR ENGINEERING INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 ANSYS, INC

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 BEIJING JINGWEI HIRAIN TECHNOLOGIES CO., INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.9 DELL INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 ELEKTROBIT

15.10.1 COMPANY SNAPSHOT

15.10.2 SOLUTION PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 ESI GROUP

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 FUJITSU

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.13 MICROSOFT

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 NEC CORPORATION

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENTS

15.15 NXP SEMICONDUCTORS

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENTS

15.16 RESCALE, INC.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 SUPER MICRO COMPUTER, INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

15.18 TAIWAN SEMICONDUCTOR

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.19 TOTALCAE

15.19.1 COMPANY SNAPSHOT

15.19.2 SOLUTION PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 TYAN

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 VECTOR INFORMATIK GMBH

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 2 GLOBAL SOLUTION IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 3 GLOBAL SOLUTION IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 GLOBAL SOFTWARE IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 GLOBAL SERVICES IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 GLOBAL SERVICES IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 8 GLOBAL ON PREMISES IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 GLOBAL CLOUD IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD THOUSAND)

TABLE 11 GLOBAL LARGE ENTERPRISES IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 GLOBAL LARGE ENTERPRISES IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 13 GLOBAL SMALL AND MEDIUM SIZE ENTERPRISES (SMES) IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 GLOBAL SMALL AND MEDIUM SIZE ENTERPRISES (SMES) IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 15 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY COMPUTATION TYPE, 2021-2030 (USD THOUSAND)

TABLE 16 GLOBAL PARALLEL COMPUTING IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 GLOBAL DISTRIBUTED COMPUTING IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 GLOBAL EXASCALE COMPUTING IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY PLATFORM, 2021-2030 (USD THOUSAND)

TABLE 20 GLOBAL SAFETY & MOTION HPC IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 GLOBAL AUTONOMOUS DRIVING HPC IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 GLOBAL BODY HPC IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 GLOBAL COCKPIT HPC IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 GLOBAL CROSS-DOMAIN HPC IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2021-2030 (USD THOUSAND)

TABLE 26 GLOBAL PASSENGER CAR IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 GLOBAL PASSENGER CAR IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 GLOBAL PASSENGER CAR IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 29 GLOBAL SOLUTION IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 30 GLOBAL LIGHT COMMERCIAL VEHICLE IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 31 GLOBAL LIGHT COMMERCIAL VEHICLE IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 GLOBAL LIGHT COMMERCIAL VEHICLE IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 33 GLOBAL SOLUTION IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 GLOBAL HEAVY COMMERCIAL VEHICLE IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 35 GLOBAL HEAVY COMMERCIAL VEHICLE IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 GLOBAL HEAVY TRUCK IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 GLOBAL HEAVY COMMERCIAL VEHICLE IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 38 GLOBAL SOLUTION IN HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

Lista de figuras

FIGURE 1 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: SEGMENTATION

FIGURE 2 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: MULTIVARIATE MODELING

FIGURE 10 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: OFFERING TIMELINE CURVE

FIGURE 11 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: SEGMENTATION

FIGURE 12 INCREASING COMPLEXITY AND PERFORMANCE REQUIREMENT IN ELECTRONICS ARCHITECTURE OF A VEHICLE IS EXPECTED TO DRIVE THE GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 SOLUTIONS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET IN 2023 & 2030

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE IN THE GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 EUROPE IS THE FASTEST GROWING MARKET FOR HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 16 COMPANY SHARE ANALYSIS AT COUNTRY LEVEL

FIGURE 17 COMPANY COMPARISON

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET

FIGURE 19 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: BY OFFERING, 2022

FIGURE 20 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: BY DEPLOYMENT MODEL, 2022

FIGURE 21 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: BY ORGANIZATION SIZE, 2022

FIGURE 22 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: BY COMPUTATION TYPE, 2022

FIGURE 23 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: BY PLATFORM, 2022

FIGURE 24 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: BY VEHICLE TYPE, 2022

FIGURE 25 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: SNAPSHOT (2022)

FIGURE 26 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: BY COUNTRY (2022)

FIGURE 27 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 28 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 29 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: BY REGION (2023-2030)

FIGURE 30 GLOBAL HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: COMPANY SHARE 2022 (%)

FIGURE 31 ASIA-PACIFIC HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: COMPANY SHARE 2022 (%)

FIGURE 32 NORTH AMERICA HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: COMPANY SHARE 2022 (%)

FIGURE 33 EUROPE HIGH PERFORMANCE COMPUTING FOR AUTOMOTIVE MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.