Global Hemostats Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

3.34 Billion

USD

5.67 Billion

2024

2032

USD

3.34 Billion

USD

5.67 Billion

2024

2032

| 2025 –2032 | |

| USD 3.34 Billion | |

| USD 5.67 Billion | |

|

|

|

|

Segmentación del mercado global de hemostáticos, por tipo de producto (hemostáticos a base de trombina, combinados, de celulosa regenerada oxidada, de gelatina y de colágeno), formulación (hemostáticos de matriz y gel, de lámina y almohadilla, de esponja y en polvo), aplicación (ortopedia, cirugía general, neurocirugía, cirugía cardiovascular, reconstructiva y ginecológica), indicación (cierre de heridas y cirugía), usuario final (hospitales, clínicas, centros ambulatorios, atención médica comunitaria, etc.): tendencias y pronóstico del sector hasta 2032.

Tamaño del mercado de hemostáticos

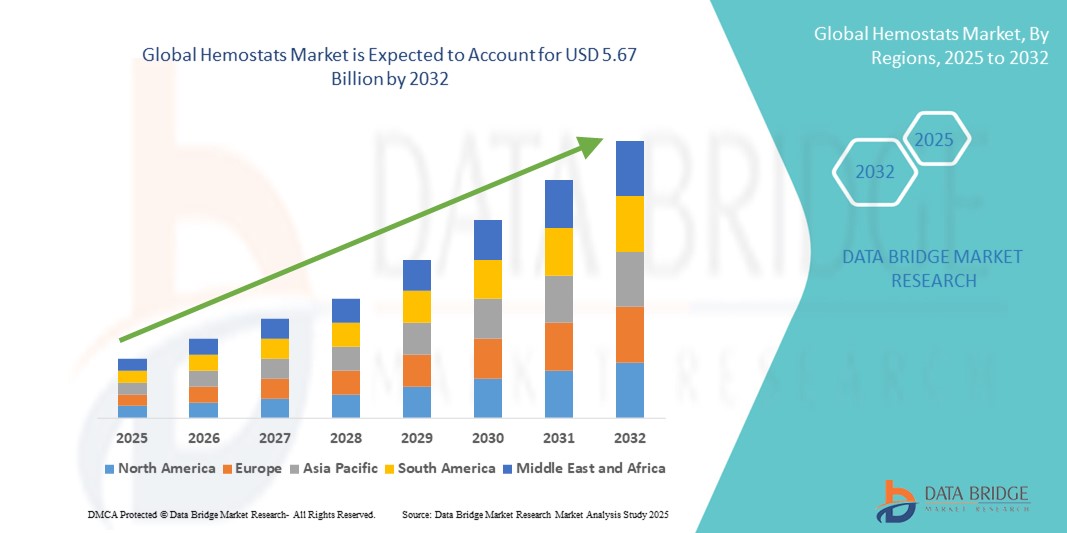

- El tamaño del mercado global de hemostáticos se valoró en USD 3.34 mil millones en 2024 y se espera que alcance los USD 5.67 mil millones para 2032 , con una CAGR del 6,85% durante el período de pronóstico.

- El crecimiento del mercado se debe en gran medida a la creciente incidencia de procedimientos quirúrgicos en todo el mundo y la creciente necesidad de un manejo eficaz de la pérdida de sangre, especialmente en entornos de atención de trauma y emergencia. Los hemostáticos desempeñan un papel fundamental en la mejora de la eficiencia quirúrgica al ofrecer un control rápido y localizado del sangrado, lo que reduce las complicaciones intraoperatorias y mejora los resultados del paciente.

- Además, los avances en tecnologías hemostáticas, como materiales bioabsorbibles, agentes basados en trombina y productos combinados, están acelerando la adopción de hemostáticos en cirugía general, procedimientos cardiovasculares e intervenciones ortopédicas. Estas innovaciones no solo mejoran la eficacia, sino que también permiten una aplicación más amplia en cirugías mínimamente invasivas y laparoscópicas, impulsando así significativamente el crecimiento del mercado.

Análisis del mercado de hemostáticos

- Los hemostáticos, agentes quirúrgicos vitales diseñados para controlar el sangrado y facilitar la coagulación durante las cirugías, son cada vez más indispensables en la atención de traumatismos, procedimientos ortopédicos, cirugías cardiovasculares e intervenciones mínimamente invasivas debido a su capacidad para garantizar una hemostasia rápida y mejorar los resultados quirúrgicos.

- La creciente demanda de hemostatos se debe principalmente al creciente volumen de procedimientos quirúrgicos a nivel mundial, las crecientes incidencias de traumatismos y accidentes, y la creciente población de edad avanzada propensa a enfermedades crónicas que requieren atención quirúrgica.

- Norteamérica dominó el mercado de hemostáticos con la mayor participación en los ingresos, un 39,8 % en 2024, gracias a su avanzada infraestructura sanitaria, su elevado gasto sanitario per cápita y la sólida presencia de actores líderes del mercado. Estados Unidos, en particular, ha experimentado una alta adopción de agentes hemostáticos, tanto pasivos como activos, en hospitales y centros de cirugía ambulatoria.

- Se proyecta que Asia-Pacífico será la región de más rápido crecimiento en el mercado de hemostáticos durante el período de pronóstico de 2025 a 2032, impulsada por la rápida urbanización, el aumento de las inversiones en atención médica, la mejora del acceso a la atención quirúrgica en países como China e India, y la creciente conciencia sobre el manejo eficaz de la pérdida de sangre durante los procedimientos.

- El segmento de Cirugía dominó el mercado de hemostáticos con una participación de mercado del 65,4% en 2024, debido al creciente número de intervenciones quirúrgicas complejas que requieren un control inmediato y eficiente del sangrado para minimizar las complicaciones.

Alcance del informe y segmentación del mercado de hemostáticos

|

Atributos |

Perspectivas clave del mercado de hemostáticos |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de hemostáticos

Creciente demanda de agentes hemostáticos avanzados en la cirugía moderna

- Una tendencia significativa y en auge en el mercado global de hemostatos es la creciente adopción de agentes hemostáticos avanzados en diversos campos quirúrgicos, como la ortopedia, la cirugía cardiovascular, la traumatología y la neurocirugía. La evolución de las técnicas quirúrgicas ha generado una mayor demanda de soluciones fiables y de acción rápida para gestionar eficazmente el sangrado intraoperatorio.

- Los hemostáticos modernos, incluidos agentes activos como la trombina y los selladores de fibrina, están ganando popularidad debido a su eficacia superior, especialmente en procedimientos complejos o mínimamente invasivos donde los métodos mecánicos tradicionales (como suturas o ligaduras) no son suficientes.

- Los hospitales y centros de cirugía ambulatoria prefieren cada vez más hemostáticos combinados que ofrecen mecanismos duales —físicos y bioquímicos— para controlar el sangrado. Este cambio refleja una mayor preferencia por agentes versátiles que puedan utilizarse en diversos entornos quirúrgicos y tipos de heridas.

- Además, el aumento de las poblaciones geriátricas a nivel mundial (que son más propensas a enfermedades crónicas que requieren cirugía) ha influido directamente en el aumento del consumo de productos hemostáticos en la atención operatoria y la recuperación posquirúrgica.

- Los principales fabricantes se centran en el desarrollo de hemostáticos de próxima generación con biocompatibilidad mejorada, respuesta inmunogénica mínima y tiempos de aplicación más rápidos, que se alinean con la creciente tendencia de reducir la duración quirúrgica y mejorar los resultados de los pacientes.

- Con el aumento de las inversiones en infraestructura de atención médica y la innovación quirúrgica, particularmente en las economías emergentes, el mercado mundial de hemostáticos está preparado para un crecimiento sostenido, impulsado por la eficacia clínica, la seguridad del paciente y el alcance en expansión de los procedimientos quirúrgicos que requieren un control preciso de la pérdida de sangre.

Dinámica del mercado de hemostáticos

Conductor

Creciente demanda de gestión de la pérdida de sangre en todas las especialidades quirúrgicas

- El creciente volumen quirúrgico mundial, en particular en procedimientos cardiovasculares, ortopédicos, traumatológicos y neurocirugía, está impulsando significativamente la demanda de agentes hemostáticos eficientes.

- Los hospitales y centros quirúrgicos están priorizando el uso de hemostáticos avanzados para controlar el sangrado intraoperatorio y posoperatorio de manera más efectiva, reduciendo así las tasas de complicaciones y mejorando los resultados de los pacientes.

- Por ejemplo, la creciente adopción de técnicas quirúrgicas mínimamente invasivas, donde la visibilidad y la precisión son primordiales, ha reforzado la necesidad de agentes hemostáticos tópicos de acción rápida.

- Esto anima a los fabricantes a desarrollar soluciones innovadoras que proporcionen una coagulación rápida sin interferir con el campo operatorio.

- Las enfermedades crónicas como la diabetes, las enfermedades hepáticas y las coagulopatías, que aumentan el riesgo de sangrado durante la cirugía, están impulsando aún más la demanda de soluciones hemostáticas confiables tanto en procedimientos electivos como de emergencia.

- El uso de hemostáticos adyuvantes se está convirtiendo en una práctica estándar en muchas cirugías de alto riesgo.

Restricción/Desafío

Altos costos y restricciones regulatorias

- A pesar de su eficacia clínica, el alto costo asociado con los hemostáticos biológicos y activos avanzados, como los productos a base de trombina o fibrina, sigue siendo un obstáculo clave en entornos de atención médica con recursos limitados. Muchos hospitales públicos y pequeños centros quirúrgicos, especialmente en economías en desarrollo, aún dependen de métodos mecánicos básicos debido a limitaciones de costo.

- Además, el estricto marco regulatorio que rige la aprobación de productos hemostáticos de origen biológico añade complejidad y costos a la entrada al mercado. Los fabricantes deben invertir fuertemente en la validación clínica y cumplir rigurosos requisitos de cumplimiento, lo que puede ralentizar la innovación y la accesibilidad.

- Otro desafío radica en la compatibilidad y la facilidad de uso de los productos. Algunos agentes hemostáticos requieren un almacenamiento o preparación especializados, lo que los hace menos convenientes en situaciones de emergencia o rurales. Como resultado, existe una creciente demanda de productos listos para usar, estables y con amplia aplicabilidad en diferentes tipos de procedimientos.

- La falta de conocimiento generalizado sobre los beneficios de los hemostáticos avanzados en ciertos mercados en desarrollo limita su adopción. Los cirujanos y los departamentos de adquisiciones pueden seguir dependiendo de las técnicas tradicionales debido a la escasa formación o exposición a las nuevas tecnologías.

- Los desafíos de reembolso en varias regiones también frenan el crecimiento del mercado. Muchos sistemas de salud no ofrecen reembolso completo por productos hemostáticos costosos, lo que genera una carga financiera tanto para los proveedores como para los pacientes.

- Las interrupciones de la cadena de suministro, especialmente durante eventos globales como la pandemia de COVID-19, pueden obstaculizar la disponibilidad constante de hemostáticos esenciales en hospitales y centros quirúrgicos, lo que afecta los protocolos de tratamiento y las decisiones de inventario.

- Las retiradas de productos y las preocupaciones relacionadas con la seguridad o la contaminación pueden afectar significativamente la confianza y la adopción de la marca. Por ejemplo, los productos biológicos pueden conllevar un riesgo de reacción inmunogénica o transmisión viral si no se manipulan o procesan adecuadamente.

- También existe una creciente preocupación por el impacto ambiental y la generación de residuos de los productos hemostáticos de un solo uso, lo que empuja a los organismos reguladores y a los hospitales a buscar alternativas más sostenibles, algo que no todas las empresas están actualmente equipadas para ofrecer.

Alcance del mercado de hemostáticos

El mercado está segmentado según el tipo de producto, la formulación, la aplicación, la indicación y el usuario final.

- Por tipo de producto

Según el tipo de producto, el mercado de hemostáticos se segmenta en hemostáticos basados en trombina, combinados, de celulosa regenerada oxidada, de gelatina y de colágeno. El segmento de hemostáticos basados en trombina dominó el mercado con una participación en los ingresos del 31,8 % en 2024, gracias a su rápida coagulación y compatibilidad con diversos procedimientos quirúrgicos. Estos productos son altamente eficaces para controlar hemorragias menores y mayores, lo que los convierte en los preferidos por cirujanos de todo el mundo.

Mientras tanto, se proyecta que el segmento de hemostáticos combinados crecerá a la CAGR más rápida del 6,9 % entre 2025 y 2032, debido a sus mecanismos de doble acción y su mayor eficacia en entornos quirúrgicos complejos, como procedimientos cardíacos y ortopédicos.

- Por formulación

Según su formulación, el mercado de hemostáticos se segmenta en hemostáticos de matriz y gel, hemostáticos de lámina y almohadilla, hemostáticos de esponja y hemostáticos en polvo. El segmento de hemostáticos de matriz y gel representó la mayor participación en los ingresos, con un 34,2 %, en 2024, gracias a su excelente adaptabilidad a superficies irregulares de heridas y a su rápida acción en cirugías mínimamente invasivas. Su fácil aplicación y el reducido daño tisular los han convertido en la opción preferida por los cirujanos en operaciones de alta precisión.

Se anticipa que el segmento de hemostáticos en polvo experimentará la CAGR más rápida del 7,3 % entre 2025 y 2032, impulsada por su versatilidad, facilidad de almacenamiento y mayor uso en procedimientos laparoscópicos y de trauma de emergencia.

- Por aplicación

Según su aplicación, el mercado de hemostáticos se segmenta en ortopedia, cirugía general, neurocirugía, cirugía cardiovascular, cirugía reconstructiva y cirugía ginecológica. La cirugía general lideró el segmento con una participación en los ingresos del 28,6 % en 2024, debido al uso generalizado de agentes hemostáticos en cirugías abdominales, traumatológicas y de hernias, donde el control eficaz de la hemorragia es crucial.

Se espera que el segmento de cirugía neurológica crezca a la CAGR más rápida del 7,5 % entre 2025 y 2032, ya que estos procedimientos requieren herramientas hemostáticas de alta precisión para controlar hemorragias delicadas cerca de los tejidos cerebrales y espinales.

- Por indicación

Según la indicación, el mercado de hemostatos se segmenta en cierre de heridas y cirugía. El segmento quirúrgico captó la mayor parte del mercado, con un 65,4 % en 2024, debido al creciente número de intervenciones quirúrgicas complejas que requieren un control inmediato y eficiente del sangrado para minimizar las complicaciones.

Se espera que el segmento de cierre de heridas crezca a la CAGR más rápida entre 2025 y 2032, debido al uso creciente de hemostáticos tópicos en la atención de emergencia y la recuperación posoperatoria para reducir el tiempo de curación y el riesgo de infección.

- Por el usuario final

En función del usuario final, el mercado de hemostáticos se segmenta en hospitales, clínicas, centros ambulatorios, atención médica comunitaria y otros. Los hospitales representaron la mayor participación de mercado, con un 58,1 %, en 2024, gracias al alto volumen de cirugías y la disponibilidad de equipos e infraestructura quirúrgica especializada. Los hospitales son los principales centros para procedimientos complejos que requieren un control avanzado del sangrado.

Se pronostica que los centros ambulatorios registrarán la CAGR más rápida del 8,1 % entre 2025 y 2032, debido al aumento de las cirugías ambulatorias y la creciente adopción de procedimientos rentables en el mismo día que requieren hemostáticos confiables y de acción rápida.

Análisis regional del mercado de hemostáticos

- América del Norte dominó el mercado de hemostáticos con la mayor participación en los ingresos del 39,8 % en 2024, impulsada por el aumento de los procedimientos quirúrgicos, la alta adopción de agentes hemostáticos avanzados y una sólida infraestructura de atención médica.

- La presencia de importantes actores del mercado, junto con políticas de reembolso favorables y un enfoque creciente en minimizar las complicaciones quirúrgicas, ha contribuido aún más al dominio de la región.

- La demanda de hemostáticos en Norteamérica también se ve impulsada por el aumento de la población geriátrica, la alta prevalencia de enfermedades crónicas y el creciente número de cirugías traumatológicas y cardiovasculares en la región. Los hospitales y centros quirúrgicos invierten cada vez más en soluciones hemostáticas modernas y eficientes para reducir el sangrado intraoperatorio y mejorar los resultados de los pacientes.

Perspectiva del mercado de hemostáticos en EE. UU.

El mercado estadounidense de hemostáticos captó la mayor participación en los ingresos de Norteamérica, con un 64%, en 2024, impulsado por la creciente preferencia por las cirugías mínimamente invasivas, la creciente concienciación sobre el manejo de la pérdida de sangre y los avances tecnológicos en productos hemostáticos. El país también se beneficia de un marco regulatorio consolidado, la adopción clínica generalizada de hemostáticos combinados y las colaboraciones estratégicas entre hospitales y empresas de dispositivos médicos. Además, la financiación gubernamental y la presencia de instituciones académicas de primer nivel que realizan investigaciones en hemostasia quirúrgica impulsan aún más el crecimiento del mercado.

Perspectiva del mercado de hemostáticos en Europa

Se proyecta que el mercado europeo de hemostáticos se expandirá a una tasa de crecimiento anual compuesta (TCAC) sustancial durante el período de pronóstico, debido principalmente al aumento del volumen de procedimientos quirúrgicos electivos y de emergencia, la mayor atención a los resultados postoperatorios y la financiación favorable de la sanidad pública. Países como Alemania, Francia y el Reino Unido están experimentando un creciente uso de hemostáticos biológicos y activos avanzados en cirugías ortopédicas, cardiovasculares y traumatológicas. Además, los crecientes esfuerzos para mejorar la formación de cirujanos, la innovación en dispositivos médicos y la seguridad quirúrgica están impulsando su adopción en centros sanitarios tanto públicos como privados.

Perspectiva del mercado de hemostáticos del Reino Unido

Se prevé que el mercado británico de hemostáticos crezca a una tasa de crecimiento anual compuesta (TCAC) notable durante el período de pronóstico, impulsado por la creciente prevalencia de enfermedades crónicas que requieren intervención quirúrgica y un fuerte énfasis en la mejora de los resultados quirúrgicos mediante herramientas intraoperatorias avanzadas. Las inversiones del Servicio Nacional de Salud (NHS) en equipos quirúrgicos modernos y la creciente presencia de los centros de cirugía ambulatoria (CAA) contribuyen al aumento de la demanda. Además, el auge de las cirugías ambulatorias y los procedimientos laparoscópicos está incrementando la demanda de agentes hemostáticos absorbibles de acción rápida.

Perspectiva del mercado de hemostáticos en Alemania

Se espera que el mercado alemán de hemostáticos se expanda a una tasa de crecimiento anual compuesta (TCAC) considerable durante el período de pronóstico, impulsado por un sistema de salud tecnológicamente avanzado, la atención de calidad y un número creciente de pacientes mayores sometidos a tratamientos quirúrgicos. Hospitales de toda Alemania están incorporando hemostáticos combinados y basados en selladores de fibrina por su eficacia en cirugías complejas. Los incentivos regulatorios y la innovación local en materiales quirúrgicos impulsan aún más la expansión del mercado en Alemania.

Perspectiva del mercado de hemostáticos en Asia-Pacífico

Se prevé que el mercado de hemostáticos en Asia-Pacífico crezca a la tasa de crecimiento anual compuesta (TCAC) más alta durante el período de pronóstico de 2025 a 2032, impulsado por el aumento de las inversiones en atención médica, la creciente adopción de prácticas quirúrgicas modernas y un marcado incremento en el volumen de cirugías en las economías emergentes. Países como China, Japón e India están experimentando una rápida expansión de su infraestructura hospitalaria, junto con iniciativas gubernamentales para mejorar los resultados quirúrgicos. Se espera que la creciente demanda de soluciones hemostáticas rentables y eficientes en hospitales públicos y privados impulse significativamente el crecimiento en la región.

Perspectiva del mercado de hemostáticos en Japón

El mercado japonés de hemostáticos está cobrando impulso, impulsado por un alto volumen de cirugías, el aumento de la población geriátrica y un mayor enfoque en la prevención de infecciones y la mejora de la cicatrización posquirúrgica. Las instituciones sanitarias japonesas priorizan productos hemostáticos de alta calidad con seguridad y eficacia clínicas comprobadas. Los hospitales más avanzados están adoptando hemostáticos combinados y sintéticos para reducir la duración de las cirugías y las necesidades de transfusión sanguínea. Además, la innovación nacional y las sólidas directrices regulatorias están acelerando la introducción de nuevos productos.

Perspectiva del mercado de hemostáticos en China

El mercado chino de hemostáticos representó la mayor cuota de mercado en ingresos en Asia Pacífico en 2024, gracias a la rápida modernización de la infraestructura sanitaria del país, la expansión de los hospitales terciarios y el creciente número de procedimientos quirúrgicos realizados anualmente. La sólida capacidad de fabricación local y el apoyo gubernamental a las empresas nacionales de dispositivos médicos están impulsando aún más la disponibilidad y asequibilidad de los hemostáticos en el país. El crecimiento de la clase media, sumado al aumento en la penetración de los seguros médicos, está mejorando el acceso a la atención quirúrgica e impulsando la demanda de agentes hemostáticos eficaces.

Cuota de mercado de hemostáticos

La industria de hemostatos está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- CR Bard, Inc. (EE. UU.)

- B. Braun SE (Alemania)

- Baxter International, Inc. (EE. UU.)

- Integra LifeSciences (EE. UU.)

- Marine Polymer Technologies, Inc. (EE. UU.)

- Teleflex (EE. UU.)

- Ethicon, Inc. (EE. UU.)

- Pfizer, Inc. (EE. UU.)

- Z-Medica LLC (EE. UU.)

- Gelita Medical GmbH (Alemania)

- Anika Therapeutics, Inc. (EE. UU.)

- Stryker (EE. UU.)

- Integra LifeSciences Corporation (EE. UU.)

Últimos avances en el mercado global de hemostáticos

- En abril de 2023, Olympus presentó tres nuevos productos hemostáticos: el adhesivo EndoClot (ECA), el aerosol hemostático de polisacáridos EndoClot (PHS) y la inyección submucosa EndoClot, diseñados para el control rápido del sangrado durante procedimientos endoscópicos. Estas innovaciones reflejan el crecimiento continuo de las herramientas de soporte quirúrgico mínimamente invasivas.

- En marzo de 2023, Axio Biosolutions recibió la autorización 510(k) de la FDA estadounidense para su hemostático quirúrgico Ax-Surgi, un producto a base de quitosano diseñado para el tratamiento de hemorragias quirúrgicas graves. Esta aprobación pone de manifiesto el impulso regulatorio en el desarrollo de agentes hemostáticos.

- En enero de 2024, Baxter International Inc. adquirió PerClot, un hemostático en polvo a base de almidón vegetal, ampliando su oferta en el segmento de hemostasia adyuvante y subrayando la consolidación estratégica en la industria.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.