Global Graphite Recycling Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

66.25 Million

USD

101.68 Million

2024

2032

USD

66.25 Million

USD

101.68 Million

2024

2032

| 2025 –2032 | |

| USD 66.25 Million | |

| USD 101.68 Million | |

|

|

|

|

Segmentación del mercado mundial de reciclaje de grafito por fuente (residuos de fabricación y productos al final de su vida útil), tipo (grafito sintético y grafito natural), aplicación (reciclaje de baterías, lubricantes, refractarios, fundición y otros): tendencias de la industria y pronóstico hasta 2031

Análisis del mercado del reciclaje de grafito

El mercado mundial del reciclaje de grafito está experimentando un sólido crecimiento debido al aumento de las regulaciones ambientales, los avances tecnológicos y la creciente demanda de soluciones sostenibles. A medida que industrias como la automotriz, la electrónica y la energía continúan expandiéndose, aumenta la necesidad de grafito reciclado, un material clave en las baterías de iones de litio y otras aplicaciones. El reciclaje de grafito no solo aborda las limitaciones de la cadena de suministro, sino que también reduce significativamente el impacto ambiental al minimizar los desechos y reducir las emisiones de carbono. Las innovaciones tecnológicas en los procesos de reciclaje están mejorando la eficiencia y la rentabilidad de la recuperación de grafito, lo que lo convierte en una opción más atractiva para las empresas. Además, la creciente conciencia y las estrictas regulaciones con respecto al reciclaje de materiales críticos están impulsando a las industrias hacia prácticas sostenibles. En general, el mercado está preparado para el crecimiento, ya que se alinea con las tendencias globales de sostenibilidad y el aumento de la eficiencia de los recursos.

Tamaño del mercado de reciclaje de grafito

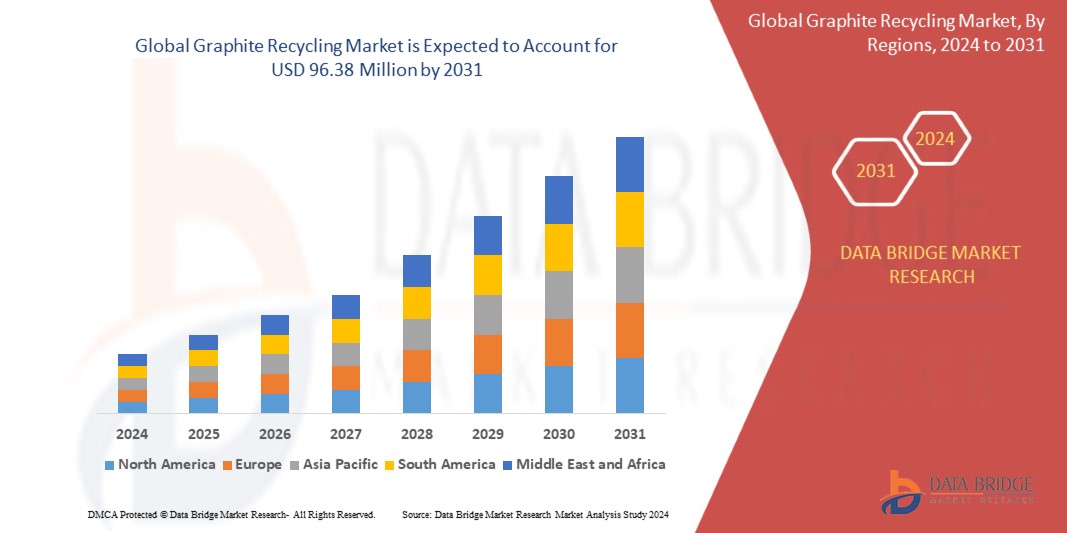

El tamaño del mercado mundial de reciclaje de grafito se valoró en USD 62,8 millones en 2023 y se proyecta que alcance los USD 96,38 millones para 2031, con una CAGR del 5,5% durante el período de pronóstico de 2024 a 2031. Además de la información sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis de consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas / consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio.

Tendencias en el reciclaje de grafito

“Creciente demanda de vehículos eléctricos”

La creciente adopción de vehículos eléctricos (VE) es un factor importante para el mercado mundial del reciclaje de grafito. Las baterías de los VE, en particular las de iones de litio, contienen una cantidad sustancial de grafito. A medida que los gobiernos de todo el mundo presionan para una transición hacia la energía limpia y reducen las emisiones de carbono, se espera que las ventas de VE crezcan exponencialmente en los próximos años. Este aumento en la demanda de VE conducirá a un aumento correspondiente en la necesidad de reciclar grafito para gestionar los desechos de las baterías de manera eficiente. El reciclaje de grafito de las baterías usadas ayuda a la conservación de recursos y a reducir el impacto ambiental de la extracción de grafito natural. Al reciclar, los fabricantes pueden satisfacer la creciente demanda de grafito en las baterías de los VE y, al mismo tiempo, contribuir a una cadena de suministro sostenible. Por ejemplo, países como China y los EE. UU. están implementando activamente programas de reciclaje de componentes de baterías, incluido el grafito, para respaldar el mercado en expansión de los VE.

Alcance del informe y segmentación del mercado

|

Atributos |

Perspectivas clave del mercado del reciclaje de grafito |

|

Segmentación |

|

|

Países cubiertos |

EE. UU., Canadá, México, Alemania, Francia, Reino Unido, Países Bajos, Suiza, Bélgica, Rusia, Italia, España, Turquía, Resto de Europa, China, Japón, India, Corea del Sur, Singapur, Malasia, Australia, Tailandia, Indonesia, Filipinas, Resto de Asia-Pacífico, Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Egipto, Israel, Resto de Oriente Medio y África, Brasil, Argentina, Resto de Sudamérica |

|

Actores clave del mercado |

GrafTech International (EE. UU.), Superior Graphite (EE. UU.), SGL Carbon (Alemania), carbiderecycling.com (EE. UU.), RS Mines (PVT) Ltd (India), ECOGRAF (Australia), Ceylon Graphite Corp (Canadá), Graphite India Limited (India), Imerys SA (Francia) y Toyo Tanso Co. Ltd. (Japón) |

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de la información sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis de consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Definición de reciclaje de grafito

El reciclaje de grafito implica el proceso de recuperación y reutilización de materiales de grafito a partir de productos de desecho, como baterías de iones de litio, electrodos, lubricantes y componentes industriales. Este proceso incluye la recolección, separación, purificación y reprocesamiento del grafito para cumplir con los estándares de calidad requeridos para su reutilización en diversas aplicaciones. Al reciclar el grafito, las industrias pueden reducir la dependencia de la minería de grafito natural, disminuir el impacto ambiental y conservar los recursos.

Dinámica del reciclaje del grafito

Conductores

- Uso indispensable del grafito en la industria del acero y los refractarios

El grafito sintético se utiliza principalmente en la producción de electrodos de grafito, cruciales para la fabricación de acero en hornos de arco eléctrico (EAF), donde transfieren energía eléctrica para fundir el acero. La excelente resistencia térmica del grafito también se emplea en revestimientos para cucharas y recipientes en el proceso de fabricación de acero. Además, el grafito es clave en la fabricación de materiales refractarios, ya que mejora la conductividad térmica y la resistencia a altas temperaturas. Se utiliza en moldes y matrices para la colada continua de acero y como lubricante en la pulvimetalurgia y la producción de metales no ferrosos. Los lubricantes a base de grafito reducen la fricción y el desgaste en la maquinaria de la industria del acero, lo que mejora la eficiencia y la longevidad. Por ejemplo, según la producción mundial de acero crudo de los 63 países que informan a la Asociación Mundial del Acero, fue de 158,5 millones de toneladas (Mt) en julio de 2023, lo que supone un aumento del 6,6% en comparación con julio de 2022. China produjo 90,8 Mt en julio de 2023, un 11,5% más que en julio de 2022. India produjo 11,5 Mt, un 14,3% más. Japón produjo 7,4 Mt, un 0,9% más. Estados Unidos produjo 6,9 Mt, un 0,5% más. Se estima que Rusia produjo 6,3 Mt, un 5,8% más. Corea del Sur produjo 5,7 Mt, un 9,0% menos. Alemania produjo 3,0 Mt, un 0,5% menos. Turquía produjo 2,9 Mt, un 6,4% más. Brasil produjo 2,7 Mt, un 4,7% menos. Irán produjo 2,0 Mt, un 1,5% menos.

- Crecimiento de los sistemas de almacenamiento de baterías y energía renovable

La creciente demanda de sistemas de almacenamiento de energía, en particular de fuentes de energía renovables, es otro factor que impulsa el mercado mundial del reciclaje de grafito. El grafito es un componente crucial en la producción de baterías que se utilizan para aplicaciones de almacenamiento de energía, como el almacenamiento de energía solar y la estabilización de la red. A medida que los países aumentan su dependencia de la energía renovable, crece la demanda de sistemas de almacenamiento de baterías eficientes y, con ella, la demanda de grafito. El reciclaje de grafito de los sistemas de almacenamiento de energía usados ayuda a abordar los desafíos de la cadena de suministro y, al mismo tiempo, reduce la dependencia de las actividades mineras. Esto garantiza un enfoque más sostenible para satisfacer la creciente demanda de sistemas de almacenamiento de energía renovable, lo que impulsa el mercado del reciclaje de grafito. Además, varios gobiernos están incentivando los esfuerzos de reciclaje como parte de sus objetivos de energía renovable y sostenibilidad, lo que impulsa aún más esta tendencia.

Oportunidades

- Iniciativas estratégicas adoptadas por los principales actores del mercado

Las iniciativas estratégicas de los actores del mercado abarcan una amplia gama de acciones y enfoques destinados a lograr objetivos comerciales, mantener la competitividad e impulsar el crecimiento. Los acuerdos de colaboración con otras empresas, empresas emergentes o instituciones de investigación pueden fomentar la innovación, el intercambio de conocimientos y el desarrollo conjunto de productos. Las fusiones y adquisiciones son movimientos estratégicos que emplean los líderes del mercado para fortalecer su posición en el mercado, adquirir activos valiosos o integrar negocios complementarios. Por ejemplo, en abril de 2023, GrafTech International Ltd., un destacado productor de productos de electrodos de grafito de primera calidad cruciales para la producción de acero para hornos de arco eléctrico, inauguró oficialmente una nueva oficina de ventas en Dubái (EAU). La inauguración de la última oficina de ventas en Dubái subraya su enfoque estratégico para realizar negocios a escala mundial. Estas acciones pueden generar sinergias, eficiencias de costos y una mayor participación de mercado. Los acuerdos de colaboración y las asociaciones con otros líderes de la industria, empresas emergentes o instituciones de investigación son una estrategia común.

- Avances tecnológicos en los procesos de reciclaje

Los avances tecnológicos en los procesos de reciclaje están abriendo nuevas oportunidades en el mercado mundial del reciclaje de grafito. Las tecnologías emergentes, como la separación automatizada de materiales y el reciclaje químico, están facilitando y haciendo más rentable la recuperación del grafito de productos usados, como baterías, productos electrónicos y desechos industriales. A medida que estas tecnologías maduran, mejoran la calidad y la pureza del grafito reciclado, haciéndolo más competitivo frente al grafito virgen. Esto crea oportunidades para que las empresas inviertan en tecnologías de reciclaje avanzadas, escalen sus operaciones y satisfagan la creciente demanda de grafito de alta calidad en sectores como la electrónica, la automoción y el almacenamiento de energía. El desarrollo de métodos de reciclaje nuevos y eficientes podría reducir significativamente el impacto ambiental de la extracción de grafito y crear cadenas de suministro más sostenibles.

Restricciones/Desafíos

- El alto costo de las tecnologías de reciclaje de grafito

Uno de los principales desafíos en el mercado global de reciclaje de grafito es el alto costo asociado con las tecnologías de reciclaje. Los procesos involucrados en la recuperación de grafito de productos como baterías de iones de litio o productos electrónicos pueden ser complejos y requieren una inversión de capital significativa en equipos e instalaciones. Las tecnologías avanzadas de separación, los tratamientos químicos y los métodos de purificación son costosos, lo que limita su adopción, especialmente por parte de los actores más pequeños del mercado. Además, los altos costos de mano de obra, transporte y manipulación aumentan aún más los gastos generales. Estas barreras financieras ralentizan la implementación generalizada de iniciativas de reciclaje, lo que dificulta que la industria logre operaciones a gran escala.

- Falta de estandarización en los procesos de reciclaje

Un desafío importante al que se enfrenta el mercado del reciclaje de grafito es la falta de estandarización en los procesos de reciclaje en las distintas regiones e industrias. A diferencia de los metales como el aluminio o el acero, que tienen prácticas de reciclaje bien establecidas, el reciclaje de grafito aún está evolucionando. Diferentes industrias generan desechos que contienen grafito en diversas formas, como ánodos de baterías, lubricantes industriales o pastillas de freno, lo que dificulta la creación de un enfoque de reciclaje uniforme. Esta falta de estandarización da como resultado una calidad inconsistente del grafito recuperado, lo que afecta su uso en aplicaciones de alto rendimiento. La ausencia de pautas y estándares claros también crea ineficiencias en la recolección, separación y procesamiento, lo que obstaculiza aún más el crecimiento del mercado.

Este informe de mercado proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado, comuníquese con Data Bridge Market Research para obtener un informe de analista, nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Impacto y situación actual del mercado ante la escasez de materias primas y retrasos en los envíos

Data Bridge Market Research ofrece un análisis de alto nivel del mercado y brinda información teniendo en cuenta el impacto y el entorno actual del mercado en relación con la escasez de materias primas y los retrasos en los envíos. Esto se traduce en la evaluación de posibilidades estratégicas, la creación de planes de acción efectivos y la asistencia a las empresas para tomar decisiones importantes.

Además del informe estándar, también ofrecemos un análisis en profundidad del nivel de adquisiciones a partir de retrasos de envío previstos, mapeo de distribuidores por región, análisis de productos básicos, análisis de producción, tendencias de mapeo de precios, abastecimiento, análisis del desempeño de categorías, soluciones de gestión de riesgos de la cadena de suministro, evaluación comparativa avanzada y otros servicios para adquisiciones y soporte estratégico.

Impacto esperado de la desaceleración económica en los precios y la disponibilidad de los productos

Cuando la actividad económica se desacelera, las industrias comienzan a sufrir. Los efectos previstos de la crisis económica sobre los precios y la accesibilidad de los productos se tienen en cuenta en los informes de conocimiento del mercado y los servicios de inteligencia que ofrece DBMR. Con esto, nuestros clientes pueden normalmente mantenerse un paso por delante de sus competidores, proyectar sus ventas e ingresos y estimar sus gastos de ganancias y pérdidas.

Alcance global del reciclaje de grafito

El mercado está segmentado en función de la fuente, el tipo y la aplicación. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Fuente

- Residuos de fabricación

- Productos al final de su vida útil

Tipo

- Grafito sintético

- Grafito natural

Solicitud

- Reciclaje de baterías

- Lubricantes

- Refractarios

- Fundición

- Otros

Análisis regional del reciclaje mundial de grafito

Se analiza el mercado y se proporcionan información y tendencias del tamaño del mercado por fuente, tipo y aplicación como se menciona anteriormente.

Los países cubiertos en el mercado son EE. UU., Canadá, México, Alemania, Francia, Reino Unido, Países Bajos, Suiza, Bélgica, Rusia, Italia, España, Turquía, resto de Europa, China, Japón, India, Corea del Sur, Singapur, Malasia, Australia, Tailandia, Indonesia, Filipinas, resto de Asia-Pacífico, Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Egipto, Israel, resto de Medio Oriente y África, Brasil, Argentina y resto de Sudamérica.

América del Norte domina el mercado mundial del reciclaje de grafito gracias a su avanzado sector manufacturero, su importante demanda de materiales sostenibles y su infraestructura establecida para el reciclaje. El fuerte énfasis de la región en las regulaciones ambientales y las iniciativas ecológicas promueve el reciclaje de grafito, en particular en industrias como la electrónica, la automoción y el almacenamiento de energía.

Se espera que Asia Pacífico sea la región de más rápido crecimiento en el mercado mundial de reciclaje de grafito debido a varios factores clave. La región alberga a algunos de los mayores fabricantes de baterías y productos electrónicos, en particular en China, Japón y Corea del Sur. Con el rápido crecimiento de la producción de vehículos eléctricos (VE) y la creciente demanda de baterías de iones de litio, ha aumentado la necesidad de grafito, un componente crucial. El reciclaje proporciona una solución sostenible para satisfacer esta demanda, reduciendo la dependencia de la minería.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Puntos de datos como análisis de la cadena de valor aguas abajo y aguas arriba, tendencias técnicas y análisis de las cinco fuerzas de Porter, estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Cuota mundial de reciclaje de grafito

El panorama competitivo del mercado proporciona detalles por competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado.

Los líderes en reciclaje de grafito que operan en el mercado son:

- GrafTech International (Estados Unidos)

- Grafito superior (EE. UU.)

- SGL Carbon - Alemania

- Empresa de reciclaje de carburo (EE. UU.)

- Minas RS (India)

- EcoGraf Limited (Australia)

- Ceylon Graphite Corp (Canadá)

- Graphite India Limited (India)

- Imerys Graphite & Carbon (Francia)

- Toyo Tanso Co. Ltd. (Japón)

Últimos avances en el mercado del reciclaje de grafito

- En abril de 2023, NEXTSOURCE MATERIALS INC inauguró su mina Molo en Madagascar, que puede producir 17.000 toneladas de grafito al año. Su objetivo es iniciar la producción anual en una planta de ánodos de batería en Mauricio en 2024 con una capacidad de producción de 3.600 toneladas.

- En enero de 2023, Showa Denko KK y Showa Denko Materials Co., Ltd se fusionaron y formaron Resonac Holdings Corporation. La división de grafito de Resonac tiene su sede en EE. UU.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.