Global Food Flavor Encapsulation Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1.60 Billion

USD

3.56 Billion

2021

2029

USD

1.60 Billion

USD

3.56 Billion

2021

2029

| 2022 –2029 | |

| USD 1.60 Billion | |

| USD 3.56 Billion | |

|

|

|

|

Mercado mundial de encapsulación de sabores alimentarios, por material de cubierta (polisacáridos, proteínas, lípidos, emulsionantes), fase central (chocolates y marrones, vainilla, frutas y nueces, lácteos, especias, otros), tecnología (microencapsulación, nanoencapsulación, encapsulación híbrida), método (método físico, método químico, método físico-químico), aplicación (suplementos dietéticos, productos alimenticios funcionales , productos de panadería, productos de confitería, bebidas, productos congelados, productos lácteos): tendencias de la industria y pronóstico hasta 2029.

Análisis y tamaño del mercado de encapsulación de saborizantes alimentarios

Varios ingredientes alimentarios se encapsulan para protegerlos de las condiciones ambientales o para lograr una liberación controlada y dirigida del ingrediente activo. Varios fabricantes de ingredientes han desarrollado productos encapsulados como parte de su oferta de productos, y varias empresas ofrecen esta tecnología como un servicio para formular productos personalizados en función de las necesidades del cliente.

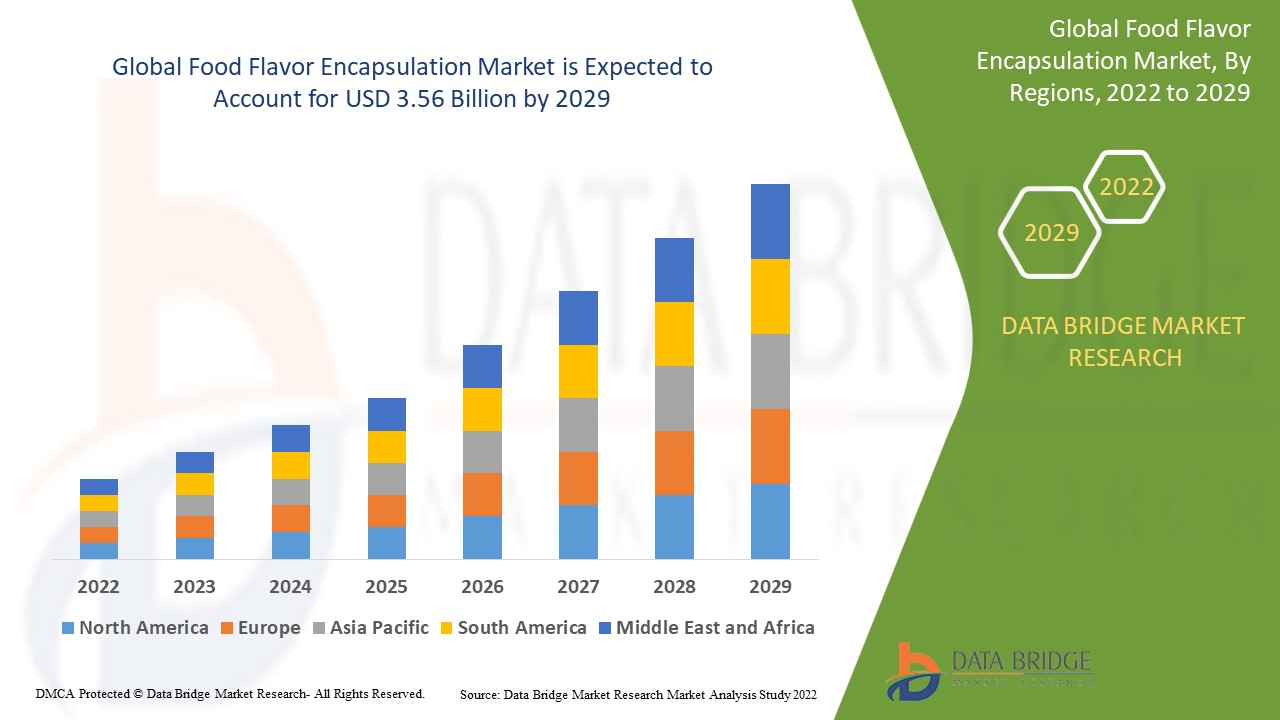

Data Bridge Market Research analiza que el mercado de encapsulación de saborizantes alimentarios se valoró en USD 1.6 mil millones en 2021 y se espera que alcance el valor de USD 3.56 mil millones para 2029, a una CAGR del 10,50% durante el período de pronóstico de 2022-2029. Además de la información sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis experto en profundidad, producción y capacidad por empresa representada geográficamente, diseños de red de distribuidores y socios, análisis detallado y actualizado de tendencias de precios y análisis de déficit de la cadena de suministro y la demanda.

Alcance y segmentación del mercado de encapsulación de sabores de alimentos

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2014 - 2019) |

|

Unidades cuantitativas |

Ingresos en miles de millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Material de la cubierta (polisacáridos, proteínas, lípidos, emulsionantes), fase central (chocolates y marrones, vainilla, frutas y nueces, lácteos, especias, otros), tecnología (microencapsulación, nanoencapsulación, encapsulación híbrida), método (método físico, método químico, método físico-químico), aplicación (suplementos dietéticos, productos alimenticios funcionales, productos de panadería, productos de confitería, bebidas, productos congelados, productos lácteos) |

|

Países cubiertos |

EE. UU., Canadá, México en América del Norte, Alemania, Suecia, Polonia, Dinamarca, Italia, Reino Unido, Francia, España, Países Bajos, Bélgica, Suiza, Turquía, Rusia, Resto de Europa en Europa, Japón, China, India, Corea del Sur, Nueva Zelanda, Vietnam, Australia, Singapur, Malasia, Tailandia, Indonesia, Filipinas, Resto de Asia-Pacífico (APAC) en Asia-Pacífico (APAC), Brasil, Argentina, Resto de Sudamérica como parte de Sudamérica, Emiratos Árabes Unidos, Arabia Saudita, Omán, Qatar, Kuwait, Sudáfrica, Resto de Medio Oriente y África (MEA) como parte de Medio Oriente y África (MEA). |

|

Actores del mercado cubiertos |

Cargill, Incorporated (EE. UU.), BASF SE (Alemania), DuPont (EE. UU.), DSM (Países Bajos), FrieslandCampina (Países Bajos), Ingredion (Suiza), International Flavors & Fragrances Inc. IFF (EE. UU.), Symrise (Alemania), Sensient Technologies Corporation (EE. UU.), Blachem Inc. (EE. UU.), Firmenich SA (Suiza), Vitablend (Países Bajos), Advanced Bionutrition Corp (EE. UU.), Encpasys LLC (EE. UU.), Clextral (Francia), Sphera Encapsulation (Italia), Aveka (EE. UU.), Lycored (Israel) y Tastetech (EE. UU.) |

|

Oportunidades |

|

Definición de mercado

La encapsulación de alimentos es un método para incorporar ingredientes a los alimentos. Envuelve la capa protectora alrededor del saborizante, bioactivo u otros ingredientes. Esta capa protectora protege los productos finales de las duras condiciones ambientales durante la producción. Conserva el sabor de los ingredientes de los alimentos al tiempo que elimina el mal gusto. Prolonga la vida de los productos alimenticios. Mantiene los ingredientes de los alimentos en su forma original estable. Reduce eficazmente la degradación o pérdida del sabor durante la fabricación y el almacenamiento de productos alimenticios.

Dinámica del mercado mundial de encapsulación de sabores alimentarios

Conductores

- Rasgos positivos de la tecnología de encapsulación

Los diversos beneficios de la encapsulación, como la liberación controlada de ingredientes, impulsan la expansión del mercado de encapsulación de sabores alimentarios. La mejora de la resistencia al calor y a la oxidación, el aumento de la consistencia de la vida útil y la mejora de la calidad del producto final están impulsando el crecimiento del mercado de encapsulación de sabores alimentarios. Además, la encapsulación ayuda a enmascarar el sabor y el olor, así como a suministrar niveles precisos de nutrientes, lo que impulsa las tendencias de la industria. La encapsulación de ingredientes vivos también proporciona una estabilidad mejorada en los productos finales y durante el procesamiento, lo que está impulsando el mercado de encapsulación de sabores alimentarios durante el período de pronóstico.

- Creciente demanda de una nutrición equilibrada

En la actualidad, los consumidores prefieren alimentos y bebidas bien balanceados con un alto valor nutricional y sabor natural. La encapsulación permite convertir los ingredientes de frutas y verduras en sabores naturales, manteniendo al mismo tiempo su valor nutricional. A medida que aumenta la demanda de ingredientes naturales, los fabricantes del mercado de sabores encapsulados aprovecharán las oportunidades lucrativas y formarán alianzas con diversos fabricantes de alimentos y bebidas en distintas regiones.

Oportunidad

- Alta demanda de alimentos preparados

Además, se espera que el rápido crecimiento de la demanda mundial de alimentos procesados y envasados como resultado de una preferencia cada vez mayor por productos alimenticios convenientes y saludables impulse el crecimiento del mercado. Además, el desarrollo de tecnologías avanzadas para aprovechar nichos de mercado, como la reducción del tamaño de las cápsulas y el aumento de la biodisponibilidad, así como el apoyo gubernamental y la mejora de las condiciones económicas en los países en desarrollo, crearán nuevas oportunidades para el mercado de encapsulación de sabores alimentarios entre 2022 y 2029.

Restricciones

- Alto costo

Sin embargo, se espera que el alto costo de los ingredientes encapsulados, que impide la comercialización masiva, desacelere el crecimiento del mercado. La falta de comercialización en el mercado debido a las estrictas regulaciones planteará un desafío para el mercado de encapsulación de sabores de alimentos durante el período de pronóstico.

Este informe de mercado de encapsulación de sabor de alimentos proporciona detalles de nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis de crecimiento estratégico del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de encapsulación de sabor de alimentos, comuníquese con Data Bridge Market Research para obtener un informe de analista, nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Impacto y situación actual del mercado ante la escasez de materias primas y retrasos en los envíos

Data Bridge Market Research ofrece un análisis de alto nivel del mercado y brinda información teniendo en cuenta el impacto y el entorno actual del mercado en relación con la escasez de materias primas y los retrasos en los envíos. Esto se traduce en la evaluación de posibilidades estratégicas, la creación de planes de acción efectivos y la asistencia a las empresas para tomar decisiones importantes.

Además del informe estándar, también ofrecemos un análisis en profundidad del nivel de adquisiciones a partir de retrasos de envío previstos, mapeo de distribuidores por región, análisis de productos básicos, análisis de producción, tendencias de mapeo de precios, abastecimiento, análisis del desempeño de categorías, soluciones de gestión de riesgos de la cadena de suministro, evaluación comparativa avanzada y otros servicios para adquisiciones y soporte estratégico.

Impacto de la COVID-19 en el mercado de encapsulación de sabores alimentarios

Se espera que la pandemia de COVID-19 afecte significativamente al mercado de encapsulación de alimentos debido a las interrupciones en la cadena de suministro. Los polisacáridos, las proteínas, los lípidos y los emulsionantes son materias primas y formulaciones importantes en el mercado de encapsulación de alimentos. Los países europeos como Alemania y Polonia importan materias primas en grandes cantidades desde Asia Pacífico. Los cierres de fronteras internacionales y las barreras comerciales han detenido todas las importaciones y exportaciones, lo que ha interrumpido el proceso de fabricación. En los países de Asia Pacífico, como India y China, se encuentran varias empresas emergentes de pequeña escala de productos de encapsulación de alimentos. Estas empresas obtienen materias primas localmente y luego exportan productos terminados a los mercados nacionales e internacionales.

Impacto esperado de la desaceleración económica en los precios y la disponibilidad de los productos

Cuando la actividad económica se desacelera, las industrias comienzan a sufrir. Los efectos previstos de la crisis económica sobre los precios y la accesibilidad de los productos se tienen en cuenta en los informes de conocimiento del mercado y los servicios de inteligencia que ofrece DBMR. Con esto, nuestros clientes pueden normalmente mantenerse un paso por delante de sus competidores, proyectar sus ventas e ingresos y estimar sus gastos de ganancias y pérdidas.

Desarrollo reciente

- En abril de 2021, BASF SE y Sandoz GmbH, una filial de Novartis, acordaron invertir en el campus Kundl/Schaftenau en Austria. Este acuerdo permite a BASF SE ampliar su red de producción de enzimas y productos biotecnológicos.

- En mayo de 2021, Kerry anunció que construirá un centro de excelencia en innovación y tecnología alimentaria especialmente diseñado en Queensland, Australia.

- En octubre de 2019, Cargill Incorporated invertirá USD 100 millones en su planta de edulcorantes de Indonesia para construir un molino húmedo de maíz con un secador de almidón para aumentar la producción de almidón y edulcorantes.

- En noviembre de 2021, la empresa invirtió 50 millones de euros en una nueva planta de fabricación de ingredientes alimentarios naturales en Georgia, EE. UU., para mejorar las instalaciones de producción en ese país.

Alcance del mercado mundial de encapsulación de sabores alimentarios

El mercado de encapsulación de saborizantes alimentarios está segmentado en función del material de la cubierta, la fase central, la tecnología, el método y la aplicación. El crecimiento entre estos segmentos le ayudará a analizar los escasos segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Material de la carcasa

- Polisacáridos

- Proteínas

- Lípidos

- Emulsionantes

- Otros materiales de concha

Fase central

- Chocolates y marrones

- Vainilla

- Frutas y nueces

- Lácteos

- Especias

- Otros

Tecnología

- Microencapsulación

- Encapsulación nanométrica

- Encapsulación del sabor de los alimentos

Método

- Método físico

- Atomización

- Secado por aspersión

- Enfriamiento por aspersión

- Disco giratorio

- Recubrimiento de lecho fluido

- Extrusión

- Otros métodos físicos

- Método químico

- Polimerización

- Método sol-gel

- Método físico-químico

- Coacervación

- Evaporación-difusión de disolventes

- Encapsulación capa por capa

- Ciclodextrinas

- Liposomas

- Otros métodos físico-químicos

Solicitud

- Suplementos dietéticos

- Productos alimenticios funcionales

- Bakery Products

- Confectionery Products

- Beverages

- Frozen Products

- Dairy Products

Food Flavor Encapsulation Market Regional Analysis/Insights

The food flavor encapsulation market is analysed and market size insights and trends are provided by country, hell material, core phase, technology, method and application as referenced above.

The countries covered in the food flavor encapsulation market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, UAE, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America leads the food flavor encapsulation market due to the expansion of the various end product markets in this region. Increased consumption of functional foods, combined with an increase in health-conscious consumers, will strengthen regional market statistics.

Asia-Pacific is expected to grow at a significant rate from 2022 to 2029, owing to a thriving food industry, rising disposable income, and rising urbanisation.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Food Flavor Encapsulation Market Share Analysis

The food flavor encapsulation market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to food flavor encapsulation market.

Some of the major players operating in the food flavor encapsulation market are:

- Cargill, Incorporated (U.S.)

- BASF SE (Germany)

- DuPont (U.S.)

- DSM (Netherlands)

- FrieslandCampina (Netherlands)

- Ingredion (Switzerland)

- International Flavors & Fragrances Inc. IFF (U.S.)

- Symrise (Germany)

- Sensient Technologies Corporation (U.S.)

- Blachem Inc. (U.S.)

- Firmenich S.A. (Switzerland)

- Vitablend (Netherlands)

- Advanced Bionutrition Corp (U.S.)

- Encpasys LLC (U.S.)

- Clextral (France)

- Sphera Encapsulation (Italy)

- Aveka (U.S.)

- Lycored (Israel)

- Tastetech (U.S.)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.