Global Fluorobenzene Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

266.63 Million

USD

370.55 Million

2024

2032

USD

266.63 Million

USD

370.55 Million

2024

2032

| 2025 –2032 | |

| USD 266.63 Million | |

| USD 370.55 Million | |

|

|

|

|

Segmentación del mercado global de fluorobenceno por pureza (99 % a 99,9 % y superior al 99,9 %), aplicación (intermedios farmacéuticos, agroquímicos, disolventes, producción de polímeros, productos químicos industriales, reactivos, colorantes y otros): tendencias de la industria y pronóstico hasta 2032

Tamaño del mercado del fluorobenceno

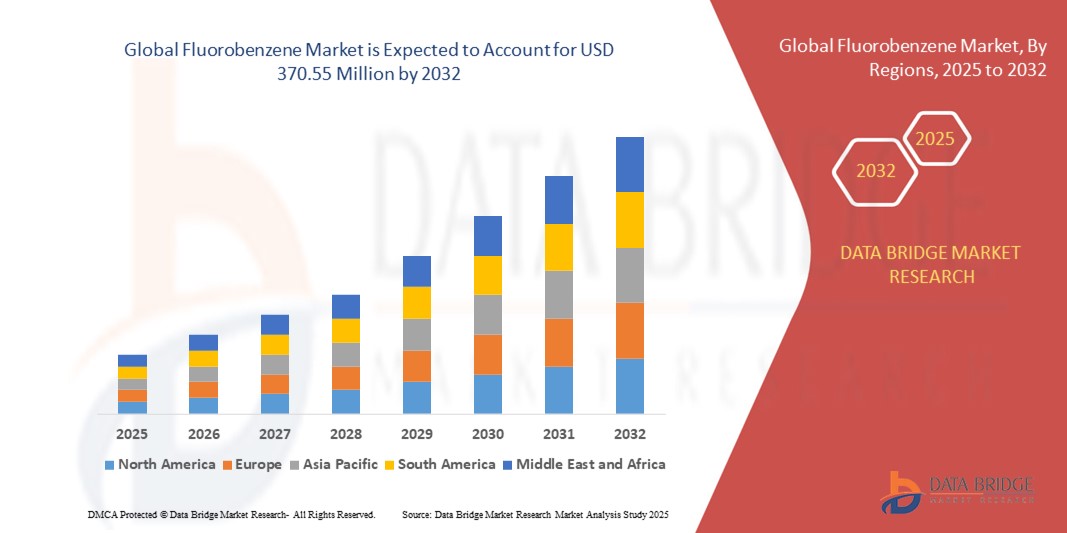

- El tamaño del mercado global de fluorobenceno se valoró en USD 266,63 millones en 2024 y se espera que alcance los USD 370,55 millones para 2032 , con una CAGR del 4,2% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente demanda de intermedios fluorados en la síntesis farmacéutica y agroquímica, impulsada por las crecientes necesidades de atención médica mundial y la expansión de la producción agrícola.

- Además, la transición hacia productos químicos de alta pureza y especializados, sumada a la fuerte demanda de los fabricantes de medicamentos y agroquímicos, refuerza la importancia del fluorobenceno como componente fundamental. Estos factores convergentes están acelerando el uso del compuesto en todos los sectores, impulsando significativamente el crecimiento de la industria.

Análisis del mercado del fluorobenceno

- El fluorobenceno es un compuesto aromático ampliamente utilizado como intermediario en la producción de productos farmacéuticos, agroquímicos, colorantes y polímeros especiales. Su estructura química permite la introducción de átomos de flúor en moléculas más grandes, lo que mejora la estabilidad, la biodisponibilidad y la eficacia.

- El uso creciente de fluorobenceno se debe principalmente a la creciente demanda de medicamentos fluorados y agentes de protección de cultivos, la rápida expansión de la fabricación de medicamentos genéricos y las crecientes inversiones en la producción de productos químicos especializados en las economías emergentes.

- Asia-Pacífico dominó el mercado de fluorobenceno con una participación del 35,5% en 2024, debido a la expansión de la fabricación farmacéutica, la creciente demanda de agroquímicos fluorados y una fuerte presencia de centros de producción química.

- Se espera que América del Norte sea la región de más rápido crecimiento en el mercado de fluorobenceno durante el período de pronóstico debido a la sólida demanda de productos químicos fluorados en productos farmacéuticos, agroquímicos y polímeros.

- El segmento del 99% al 99,9% dominó el mercado con una cuota del 61,9% en 2024, gracias a su amplia aplicabilidad en la síntesis química estándar y los procesos industriales. Este nivel de pureza se utiliza ampliamente en la fabricación a gran escala, donde la precisión ultraalta no es crucial, como en tintes, reactivos industriales y algunas formulaciones agroquímicas. La rentabilidad y la facilidad de producción refuerzan aún más su preferencia entre los fabricantes que buscan aplicaciones de gran volumen.

Alcance del informe y segmentación del mercado de fluorobenceno

|

Atributos |

Fluorobenceno: Perspectivas clave del mercado |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado del fluorobenceno

Creciente demanda de fluorobenceno de alta pureza en la síntesis farmacéutica

- El mercado del fluorobenceno se está expandiendo rápidamente debido a las crecientes aplicaciones en la síntesis farmacéutica, donde el fluorobenceno de alta pureza sirve como un intermedio clave en el desarrollo de ingredientes farmacéuticos activos (API) y compuestos farmacológicos avanzados.

- Por ejemplo, empresas como SDFuer, LIANCHANG y XLH Chemical suministran fluorobenceno de alta calidad diseñado para la fabricación de fármacos oncológicos y cardiovasculares, lo que ayuda a mejorar la eficacia, la estabilidad y la biodisponibilidad de los fármacos.

- Los avances en las tecnologías de síntesis, incluidos procesos catalíticos más ecológicos y métodos de purificación mejorados, están permitiendo la producción de fluorobenceno ultrapuro que cumple con estrictas especificaciones de grado farmacéutico con un impacto ambiental reducido.

- La demanda de fluorobenceno en la síntesis agroquímica también está creciendo, lo que respalda la producción de herbicidas e insecticidas de alto rendimiento que mejoran el rendimiento de los cultivos y la sostenibilidad agrícola.

- Las industrias de electrónica y semiconductores están adoptando fluorobenceno para la fabricación de productos químicos especiales utilizados en pantallas de cristal líquido (LCD), semiconductores y materiales de baterías, lo que refleja la diversificación de los sectores de uso final.

- El énfasis regulatorio en la fabricación de productos químicos sustentables y el uso creciente de solventes ecológicos están dirigiendo el mercado hacia la innovación en procesos de producción de fluorobenceno que minimizan las emisiones y los desechos peligrosos.

Dinámica del mercado del fluorobenceno

Conductor

Creciente industria de la electrónica y los semiconductores

- El auge de la fabricación de productos electrónicos y semiconductores avanzados está impulsando la demanda de fluorobenceno como intermediario fundamental en la producción de materiales como polímeros, placas de circuitos y recubrimientos especiales esenciales para el rendimiento del dispositivo.

- Por ejemplo, los principales proveedores de productos químicos como Mitsui Chemicals y HAL Advanced Chemicals proporcionan fluorobenceno purificado para cumplir con los rigurosos estándares de calidad requeridos para aplicaciones electrónicas, incluidas pantallas LCD y microelectrónica.

- La expansión de la electrónica de consumo, la infraestructura 5G, los vehículos eléctricos y las tecnologías de energía renovable amplifican globalmente los requisitos de fluorobenceno de alta pureza y productos químicos especiales relacionados.

- El crecimiento de los países de Asia y el Pacífico como centros mundiales de fabricación de productos electrónicos y semiconductores impulsa aún más la demanda regional de fluorobenceno y los desarrollos asociados de la cadena de suministro.

- La I+D colaborativa entre fabricantes de productos químicos y empresas de electrónica permite la formulación de derivados de fluorobenceno personalizados que mejoran las propiedades térmicas y eléctricas de los componentes semiconductores.

Restricción/Desafío

Competencia de otros productos químicos y disolventes

- El fluorobenceno enfrenta una intensa competencia de solventes aromáticos y fluorados alternativos a medida que las industrias buscan opciones rentables, escalables y, a veces, menos estrictas desde el punto de vista ambiental para los procesos de síntesis y fabricación.

- Por ejemplo, los solventes como el clorobenceno, el bromobenceno y los éteres fluorados pueden sustituir al fluorobenceno en ciertas aplicaciones debido a menores costos o cadenas de suministro establecidas, lo que desafía el crecimiento de la participación de mercado para los proveedores de fluorobenceno.

- Los altos requisitos de pureza y los métodos de fabricación complejos del fluorobenceno resultan en costos de producción elevados, lo que limita la competitividad de precios en mercados químicos más amplios.

- Las estrictas regulaciones ambientales en torno a la producción y manipulación de compuestos fluorados agregan costos de cumplimiento y complejidades operativas tanto para productores como para usuarios.

- La penetración del mercado en sectores emergentes puede verse frenada por barreras técnicas donde los solventes alternativos demuestran un rendimiento comparable, lo que requiere innovación continua y educación del cliente.

Alcance del mercado del fluorobenceno

El mercado está segmentado en función de la pureza y la aplicación.

- Por la pureza

En función de su pureza, el mercado del fluorobenceno se segmenta en 99% a 99,9% y superior al 99,9%. El segmento del 99% al 99,9% representó la mayor cuota de mercado, con un 61,9%, en 2024, debido principalmente a su amplia aplicabilidad en la síntesis química estándar y los procesos industriales. Este nivel de pureza se utiliza ampliamente en la fabricación a gran escala, donde la precisión ultraalta no es crucial, como en tintes, reactivos industriales y algunas formulaciones agroquímicas. Su rentabilidad y facilidad de producción refuerzan aún más su preferencia entre los fabricantes que buscan aplicaciones de gran volumen.

Se proyecta que el segmento superior al 99,9 % registrará la tasa de crecimiento más rápida entre 2025 y 2032, impulsado por la creciente demanda de aplicaciones de alta pureza en productos farmacéuticos y polímeros especiales. Este nivel de pureza es crucial en el desarrollo de fármacos y la síntesis química fina, donde cualquier impureza puede comprometer la eficacia o la seguridad del producto final. El creciente rigor regulatorio y la creciente necesidad de materiales fiables de alto rendimiento impulsan la demanda de fluorobenceno ultrapuro en los sectores avanzados.

- Por aplicación

Según su aplicación, el mercado del fluorobenceno se segmenta en intermedios farmacéuticos, agroquímicos, solventes, producción de polímeros, productos químicos industriales, reactivos, colorantes y otros. El segmento de intermedios farmacéuticos obtuvo la mayor participación en los ingresos del mercado en 2024, gracias al amplio uso del fluorobenceno en la síntesis de principios activos farmacéuticos y otros intermedios clave. Su capacidad para servir como fuente de flúor en las moléculas de fármacos mejora la biodisponibilidad y la estabilidad metabólica, lo que lo hace indispensable en la química farmacéutica moderna.

Se prevé que el segmento de producción de polímeros experimente la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, impulsada por el creciente uso de polímeros fluorados en aplicaciones automotrices, electrónicas y aeroespaciales. El fluorobenceno desempeña un papel vital en la introducción de la funcionalidad flúor durante la síntesis de polímeros, mejorando la resistencia química, la estabilidad térmica y las propiedades dieléctricas. A medida que las industrias se orientan cada vez más hacia materiales avanzados de alto rendimiento, se prevé una fuerte aceleración de la demanda de fluorobenceno en aplicaciones poliméricas.

Análisis regional del mercado del fluorobenceno

- Asia-Pacífico dominó el mercado de fluorobenceno con la mayor participación en los ingresos del 35,5 % en 2024, impulsada por la expansión de la fabricación farmacéutica, la creciente demanda de agroquímicos fluorados y una fuerte presencia de centros de producción química.

- El panorama de fabricación rentable de la región, las crecientes inversiones en la producción de productos químicos especializados y las crecientes exportaciones de intermedios fluorados están acelerando la expansión del mercado.

- La disponibilidad de mano de obra calificada, políticas gubernamentales favorables y la rápida industrialización en las economías en desarrollo están contribuyendo a un mayor consumo de fluorobenceno tanto en el sector farmacéutico como en el industrial.

Análisis del mercado del fluorobenceno en China

China ocupó la mayor participación en el mercado de fluorobenceno de Asia-Pacífico en 2024, gracias a su posición como líder mundial en la fabricación de productos químicos y la producción de ingredientes farmacéuticos activos (API). La sólida base industrial del país, las políticas gubernamentales favorables que apoyan la expansión del sector químico y la amplia capacidad de exportación de compuestos fluorados son importantes impulsores del crecimiento. La demanda también se ve impulsada por las continuas inversiones en productos químicos especiales y finos para los mercados nacionales e internacionales.

Perspectivas del mercado del fluorobenceno en India

India está experimentando el crecimiento más rápido de la región Asia-Pacífico, impulsado por un sector farmacéutico en rápido crecimiento, el aumento de la producción de medicamentos genéricos y el aumento de las inversiones en infraestructura química especializada. La iniciativa "Make in India", junto con un cambio hacia la autosuficiencia en productos intermedios farmacéuticos, está fortaleciendo la demanda de fluorobenceno. Además, el aumento de las exportaciones de agroquímicos y la expansión de las capacidades de I+D en productos químicos finos están contribuyendo a una sólida expansión del mercado.

Perspectivas del mercado europeo del fluorobenceno

El mercado europeo del fluorobenceno se encuentra en constante expansión, impulsado por marcos regulatorios estrictos, una alta demanda de intermedios fluorados de alta pureza y una creciente inversión en la producción química sostenible y especializada. La región prioriza la calidad, el cumplimiento ambiental y las formulaciones avanzadas, especialmente en productos farmacéuticos y materiales de alto rendimiento. El creciente uso de compuestos fluorados en la síntesis a medida impulsa aún más el crecimiento del mercado.

Análisis del mercado del fluorobenceno en Alemania

El mercado alemán del fluorobenceno se basa en su liderazgo en la fabricación farmacéutica de alta precisión, su sólida trayectoria en la industria química y su modelo de producción orientado a la exportación. El país cuenta con sólidas redes de I+D y colaboraciones entre instituciones académicas y fabricantes de productos químicos, lo que impulsa la innovación continua en intermedios fluorados. La demanda es especialmente alta para su uso en productos químicos finos, polímeros e ingredientes farmacéuticos.

Perspectivas del mercado del fluorobenceno en el Reino Unido

El mercado británico se sustenta en una industria de ciencias de la vida consolidada, los crecientes esfuerzos para localizar las cadenas de suministro farmacéuticas y químicas tras el Brexit y la mayor demanda de reactivos y productos intermedios especializados. Con un enfoque creciente en I+D, la colaboración entre la academia y la industria, y las inversiones en la síntesis y producción a escala de laboratorio de compuestos fluorados de nicho, el Reino Unido continúa desempeñando un papel importante en los mercados químicos de alto valor.

Perspectivas del mercado de fluorobenceno en América del Norte

Se proyecta que América del Norte crecerá a la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, impulsada por la sólida demanda de productos químicos fluorados en productos farmacéuticos, agroquímicos y polímeros. Un fuerte enfoque en el descubrimiento de fármacos, los avances en la ciencia de los materiales y la creciente dependencia de productos intermedios de alta pureza están impulsando la demanda. Además, la creciente relocalización de la fabricación de productos químicos y la creciente colaboración entre las empresas farmacéuticas y de productos químicos especializados están impulsando la expansión del mercado.

Perspectiva del mercado estadounidense del fluorobenceno

Estados Unidos representó la mayor participación en el mercado norteamericano en 2024, gracias a su creciente industria farmacéutica, una sólida infraestructura de I+D y una importante inversión en la producción de productos químicos especializados. El enfoque del país en la innovación, el cumplimiento normativo y la sostenibilidad está fomentando el uso de compuestos fluorados de alta pureza en la síntesis de fármacos y el desarrollo de materiales avanzados. La presencia de actores clave y una red de distribución consolidada consolidan aún más el liderazgo de Estados Unidos en la región.

Cuota de mercado del fluorobenceno

La industria del fluorobenceno está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Grupo Azelis (Bélgica)

- Kishida Chemical Co., Ltd. (Japón)

- KANTO KAGAKU (Japón)

- CHEMOS GmbH & Co. KG (Alemania)

- Xiangshui Xinlianhe Chemical Co., Ltd. (China)

- Shandong Fore Co., Ltd. (China)

- Nacalai Tesque Inc. (Japón)

- Fuxin Hongchang Chemical Co., Ltd. (China)

- Hridaan Pharma Chem (India)

- Regal Remedies Limited (India)

- Tokyo Chemical Industry Co., Ltd. (Japón)

- Productos químicos Muby (India)

- Industria de Haihang (China)

- Grupo Molekula (Reino Unido)

- AB ENTERPRISES (India)

Últimos avances en el mercado mundial del fluorobenceno

- En marzo de 2023, AGC anunció la expansión de su capacidad de producción de fluoroquímicos en la planta de Chiba (Japón), lo que refleja la creciente demanda mundial de compuestos fluorados de alto rendimiento. Esta estrategia subraya la intención de la compañía de fortalecer su posición en el mercado del fluorobenceno y de los fluoroquímicos en general, mejorando su capacidad de suministro y satisfaciendo las crecientes necesidades de los sectores electrónico, farmacéutico y químico.

- En 2022, Tata Steel completó la adquisición de Neelachal Ispat Nigam Ltd. (NINL), obteniendo acceso a 1,1 millones de toneladas anuales de capacidad de producción de aceros largos y aproximadamente 100 millones de toneladas de reservas de mineral de hierro. Esta adquisición fortalece significativamente la seguridad de la materia prima y la capacidad de producción de Tata Steel, consolidando su posición en el mercado de aceros largos y mejorando su capacidad para satisfacer las demandas de los sectores de infraestructura y construcción en India.

- En 2022, FMC India lanzó Corprima, un novedoso insecticida formulado para cultivos de tomate y okra. Este producto amplía la cartera de agroquímicos de FMC y apoya al sector agrícola indio al ofrecer un control de plagas más duradero, mejorar el rendimiento de los cultivos y generar una mayor rentabilidad para los agricultores. El lanzamiento refuerza la presencia de FMC en el creciente segmento de protección de cultivos de la India.

- En 2022, Novo Nordisk introdujo en el mercado indio la semaglutida oral, un innovador medicamento antidiabético oral diseñado para el tratamiento de la diabetes tipo 2. Este lanzamiento representa un avance importante en el cuidado de la diabetes al ofrecer una alternativa oral eficaz a los inyectables, mejorando la adherencia y la accesibilidad del paciente. Además, fortalece la presencia de Novo Nordisk en el mercado farmacéutico y de tratamiento de la diabetes de la India, en rápida expansión.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.