Global Dosage Cups Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

885.30 Million

USD

1,555.56 Million

2024

2032

USD

885.30 Million

USD

1,555.56 Million

2024

2032

| 2025 –2032 | |

| USD 885.30 Million | |

| USD 1,555.56 Million | |

|

|

|

|

Segmentación del mercado global de vasos dosificadores por tipo (desechables y reutilizables), tipo de producto (vasos impresos y en relieve), capacidad (25 ml), usuario final (hospitales, clínicas, farmacias, productos farmacéuticos, etc.): tendencias y pronóstico del sector hasta 2032.

Tamaño del mercado de vasos dosificadores

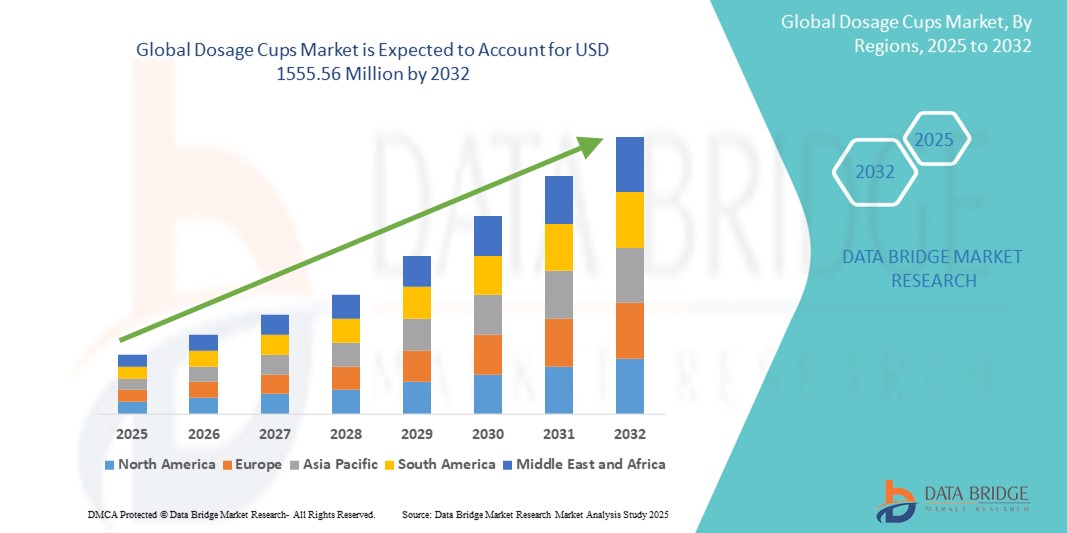

- El tamaño del mercado global de vasos dosificadores se valoró en USD 885,30 millones en 2024 y se espera que alcance los USD 1.555,56 millones para 2032 , con una CAGR del 7,30 % durante el período de pronóstico.

- Este crecimiento está impulsado por la alta demanda de vasos dosificadores debido al creciente énfasis regulatorio en la seguridad del paciente.

Análisis del mercado de vasos dosificadores

- Existe una creciente demanda de vasos dosificadores reutilizables debido a su relación coste-beneficio, sus beneficios ambientales y el creciente énfasis en la sostenibilidad en los envases de atención médica.

- La creciente infraestructura de atención médica y el aumento de las soluciones de atención médica domiciliaria están impulsando la demanda de vasos dosificadores confiables y fáciles de usar, especialmente para tratamientos autoadministrados y manejo de enfermedades crónicas.

- Se espera que América del Norte domine el mercado de vasos dosificadores, respaldada por su infraestructura de atención médica avanzada, un alto consumo farmacéutico y estándares regulatorios que garantizan la administración precisa de medicamentos.

- Se proyecta que Asia-Pacífico registre la tasa de crecimiento más alta en el mercado de vasos dosificadores debido al aumento de las inversiones en atención médica, la rápida urbanización y la creciente conciencia de la seguridad de los medicamentos en los mercados emergentes.

- Se espera que el segmento reutilizable domine el segmento de materiales con la mayor participación de mercado del 81,55%, debido a la creciente preferencia entre los usuarios finales por los vasos dosificadores reutilizables, impulsados por su relación calidad-precio y sus propiedades reciclables y respetuosas con el medio ambiente.

Alcance del informe y segmentación del mercado de vasos dosificadores

|

Atributos |

Vasos dosificadores: Perspectivas clave del mercado |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de vasos dosificadores

Creciente demanda de vasos dosificadores ecológicos y reutilizables

- Una tendencia creciente en el mercado de vasos dosificadores es la transición hacia vasos dosificadores ecológicos y reutilizables, impulsada por la creciente preocupación por el medio ambiente y la necesidad de prácticas sanitarias sostenibles. Estos vasos reutilizables ayudan a reducir los residuos plásticos y están ganando popularidad en hospitales, farmacias y hogares.

- Los consumidores y los proveedores de atención médica optan cada vez más por vasos dosificadores hechos de materiales biodegradables o plásticos reciclables, en línea con el impulso mundial por la sostenibilidad en los envases de atención médica.

- Esta tendencia está en línea con la creciente conciencia de reducir el impacto ambiental de los productos médicos, así como con la demanda de soluciones más rentables en los entornos de atención médica.

- Por ejemplo, en 2024, Yasharyn Packaging Pvt. Ltd. introdujo vasos dosificadores biodegradables, que ofrecen una alternativa más sostenible a los vasos de plástico convencionales en el mercado sanitario.

- Se espera que la creciente preferencia por productos ecológicos amplíe el mercado de vasos dosificadores sostenibles, especialmente en regiones con conciencia ambiental.

Dinámica del mercado de vasos dosificadores

Conductor

Creciente demanda de soluciones de atención médica domiciliaria

- La creciente adopción de servicios de atención médica domiciliaria está impulsando significativamente la demanda de vasos dosificadores, ya que los pacientes ahora requieren formas precisas y convenientes de administrar medicamentos en casa.

- Con el envejecimiento de la población y la creciente prevalencia de enfermedades crónicas, las soluciones de atención médica domiciliaria se están volviendo más comunes, lo que lleva a un mayor uso de herramientas de medicación autoadministrada, incluidos los vasos dosificadores.

- La conveniencia y accesibilidad de los vasos dosificadores en entornos de atención domiciliaria promueven aún más su uso, ya que los pacientes pueden medir y administrar fácilmente las dosis de sus medicamentos.

- Por ejemplo, en 2023, Medline Industries, Inc. lanzó una gama de vasos dosificadores especializados diseñados para pacientes de atención médica domiciliaria, que brindan soluciones fáciles de usar para la administración de medicamentos en el hogar.

- Se espera que la creciente demanda de atención médica domiciliaria impulse el mercado de vasos dosificadores, ofreciendo oportunidades de crecimiento a largo plazo en este segmento.

Oportunidad

Integración tecnológica para una mejor precisión de dosificación

- La integración de tecnologías como la medición digital y las funciones inteligentes en los vasos dosificadores presenta una oportunidad importante para mejorar la precisión y exactitud de la administración de medicamentos.

- Los vasos dosificadores inteligentes equipados con sensores pueden ofrecer información en tiempo real sobre el volumen del medicamento, lo que garantiza una mejor adherencia a las dosis prescritas, especialmente para pacientes con regímenes de medicación complejos.

- Este avance tecnológico es ideal para la creciente tendencia de la medicina personalizada y la atención centrada en el paciente, donde la dosificación precisa de los medicamentos es fundamental.

- Por ejemplo, en 2024, Origin Pharma Packaging introdujo vasos dosificadores inteligentes que integran sensores digitales para medir y rastrear el volumen de medicamento líquido administrado, lo que garantiza una dosificación precisa para los pacientes.

- Se espera que la convergencia de la tecnología y el diseño de vasos dosificadores impulse el crecimiento del mercado al ofrecer soluciones más confiables y eficientes para la gestión de medicamentos.

Restricción/Desafío

“Alto costo de materiales y fabricación avanzados”

- Uno de los principales desafíos que enfrenta el mercado de vasos dosificadores es el alto costo asociado con el desarrollo de vasos dosificadores especializados que utilizan materiales y técnicas de fabricación avanzados.

- Los materiales como plásticos biodegradables o polímeros de alta calidad pueden ser costosos y los procesos de fabricación a menudo requieren equipos y experiencia especializados, lo que puede aumentar los costos de producción.

- Esto puede crear una barrera para los fabricantes más pequeños y las empresas en mercados emergentes que buscan ingresar al mercado de vasos dosificadores pero enfrentan desafíos para producir soluciones rentables.

- Por ejemplo, en 2023, el Grupo de Empresas Adelphi enfrentó retrasos en la ampliación de la producción de sus vasos dosificadores ecológicos debido al alto costo de los materiales sostenibles y los desafíos para optimizar los procesos de fabricación.

- Superar estos desafíos relacionados con los costos será fundamental para lograr una adopción generalizada de vasos dosificadores innovadores y sostenibles, especialmente en mercados sensibles a los precios.

Alcance del mercado de vasos dosificadores

El mercado está segmentado según tipo, tipo de producto, capacidad y usuario final.

|

Segmentación |

Subsegmentación |

|

Por tipo |

|

|

Por tipo de producto |

|

|

Por capacidad |

|

|

Por el usuario final |

|

Se proyecta que en 2025, los reutilizables dominarán el mercado con la mayor participación en el segmento de tipos.

Se espera que el segmento reutilizable domine el mercado de vasos dosificadores con la mayor participación de mercado del 81,55 % en 2025, debido a la creciente preferencia entre los usuarios finales por los vasos dosificadores reutilizables, impulsada por su relación calidad-precio y sus propiedades reciclables y respetuosas con el medio ambiente.

Se espera que el hospital represente la mayor participación durante el período de pronóstico en el segmento de usuarios finales.

En 2025, se prevé que el segmento hospitalario domine el mercado con la mayor cuota de mercado, un 41,25 %, debido al alto volumen de administración de medicamentos, lo que requiere herramientas de dosificación precisas y fiables, como los vasos dosificadores. El creciente número de ingresos hospitalarios y la expansión de la infraestructura sanitaria, especialmente en las regiones en desarrollo, impulsan aún más esta demanda.

Análisis regional del mercado de vasos dosificadores

Norteamérica posee la mayor participación en el mercado de vasos dosificadores.

- Se espera que América del Norte domine el mercado mundial de vasos dosificadores, impulsada por el uso generalizado de envases de dosis unitaria, la creciente demanda de administración de medicamentos centrada en el paciente y la presencia de importantes empresas de envasado farmacéutico y de atención médica.

- Estados Unidos domina la región debido a una infraestructura de atención médica avanzada, estrictas regulaciones de precisión de dosis y un fuerte enfoque en la reducción de errores de medicación.

- Se espera que la innovación continua en tecnologías de envasado de medicamentos, la creciente prevalencia de enfermedades crónicas y las inversiones en envases médicos sostenibles refuercen el dominio de América del Norte durante el período de pronóstico.

Se proyecta que Asia-Pacífico registre la mayor tasa de crecimiento anual compuesta (TCAC) en el mercado de vasos dosificadores.

- Se espera que Asia-Pacífico experimente la tasa de crecimiento anual compuesta (CAGR) más alta en el mercado de vasos dosificadores, impulsada por el aumento del acceso a los servicios de atención médica, las crecientes capacidades de fabricación farmacéutica y la creciente conciencia de la salud pública.

- Países como China, India y Japón son motores clave del crecimiento, con programas gubernamentales como “Ayushman Bharat” y “Made in China 2025” que fomentan la producción local de soluciones de administración de medicamentos asequibles y precisas, incluidos los vasos dosificadores.

- La rápida urbanización, el crecimiento de la población de clase media y la creciente preferencia por la atención médica domiciliaria están acelerando la demanda de vasos dosificadores desechables y reutilizables en toda la región.

Cuota de mercado de vasos dosificadores

El panorama competitivo del mercado ofrece detalles por competidor. Se incluye información general de la empresa, sus estados financieros, ingresos generados, potencial de mercado, inversión en investigación y desarrollo, nuevas iniciativas de mercado, presencia global, plantas de producción, capacidad de producción, fortalezas y debilidades de la empresa, lanzamiento de productos, alcance y variedad de productos, y dominio de las aplicaciones. Los datos anteriores se refieren únicamente al enfoque de mercado de las empresas.

Los principales líderes del mercado que operan en el mercado son:

- Comar (EE. UU.)

- Qosina (EE. UU.)

- Laboratorios Lyne (EE. UU.)

- O.BERK (EE.UU.)

- Marca de salud (EE. UU.)

- Origin Pharma Packaging (Reino Unido)

- Compañía química Eastman (EE. UU.)

- Medline Industries, Inc. (EE. UU.)

- Yasharyn Packaging Pvt. Ltd. (India)

- EL GRUPO DE EMPRESAS ADELPHI (REINO UNIDO)

- gpcmedical (India)

- Rutvik Pharma (India)

- INDUSTRIAS PLÁSTICAS PRABHOTI (India)

- ALPLA (Austria)

- Mikart LLC (EE. UU.)

- GA2 (Malasia)

- Farmmash (Ucrania)

- SGH Medical Pharma (India)

- Gramß GmbH Kunststoffverarbeitung (Alemania)

Últimos avances en el mercado mundial de vasos dosificadores

- En febrero de 2022, Comar LLC adquirió Automatic Plastics Ltd., lo que reforzó la capacidad de fabricación de Comar en el sector de envases para dispositivos médicos y productos farmacéuticos. Se espera que esta adquisición amplíe significativamente la capacidad de producción y la presencia de Comar en el sector de envases para el sector sanitario.

- En diciembre de 2021, H&T Presspart Manufacturing Ltd. se asoció con BIOCORP, empresa francesa de dispositivos médicos, para desarrollar la tecnología digital TM, un sensor inteligente que transforma los inhaladores tradicionales en dispositivos conectados para apoyar el tratamiento del asma. Esta colaboración busca mejorar la adherencia al tratamiento y la integración digital en la atención respiratoria.

- En enero de 2020, LLC Farmmash comenzó a fabricar el vaso dosificador SD-15, que ofrece la opción de una tapa a prueba de niños para mayor seguridad. Esta innovación impulsa soluciones de dosificación seguras en entornos de atención médica pediátrica y familiar.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.