Mercado global de envases farmacéuticos por contrato, por tipo (sistema de envasado primario, sistema de envasado secundario y sistema de envasado terciario), materia prima (plástico y polímeros, vidrio, metales, papel y cartón, caucho, algodón y otros), aplicación (envases para administración transmucosa de fármacos, envases para administración pulmonar de fármacos, envases para administración nasal de fármacos, envases para administración tópica de fármacos, envases inyectables, envases para administración oral de fármacos y otros): tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de envases farmacéuticos por contrato

El mercado de envasado de productos farmacéuticos por contrato es un segmento crítico dentro de la industria farmacéutica, que consiste en servicios de envasado de las compañías farmacéuticas. Este mercado está impulsado por la creciente demanda de soluciones de envasado eficientes y regulaciones estrictas, con un énfasis creciente en la seguridad del paciente y las tecnologías innovadoras, el sector de envasado de productos farmacéuticos por contrato está preparado para un crecimiento constante.

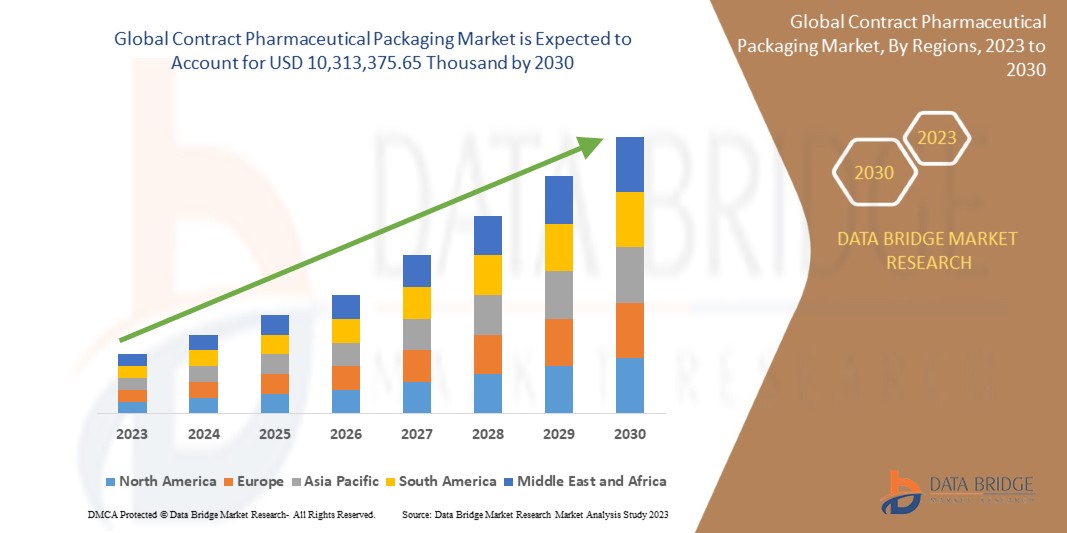

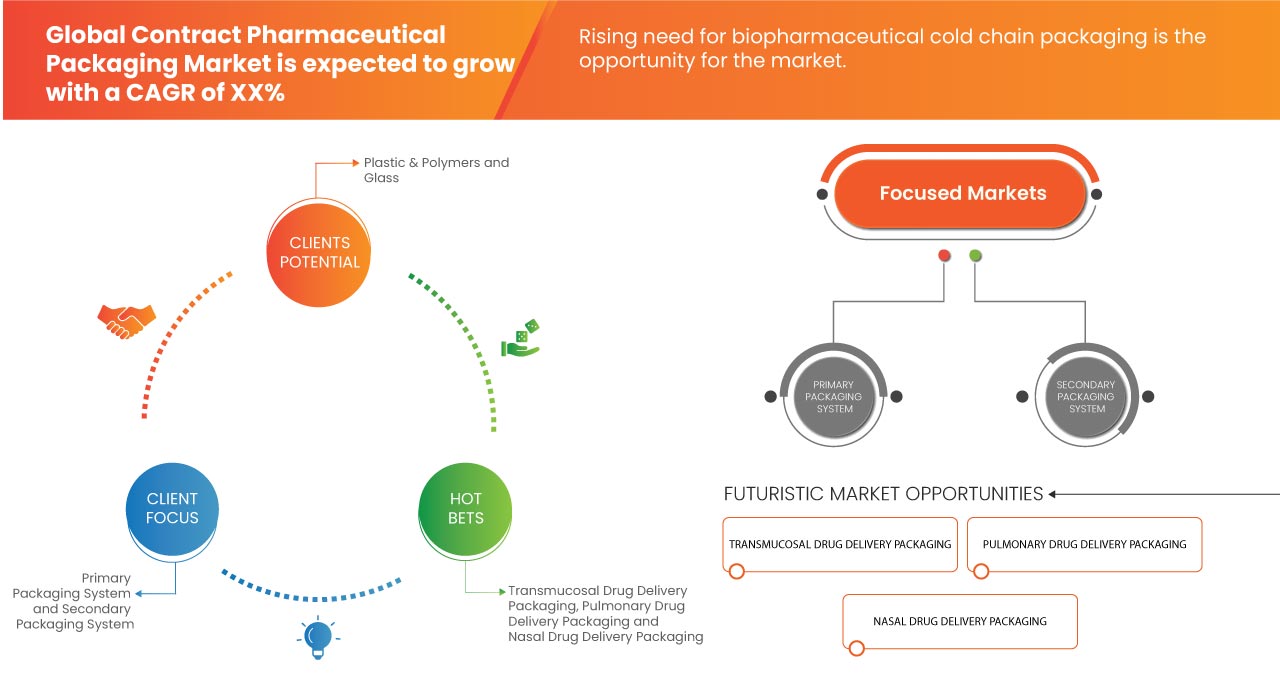

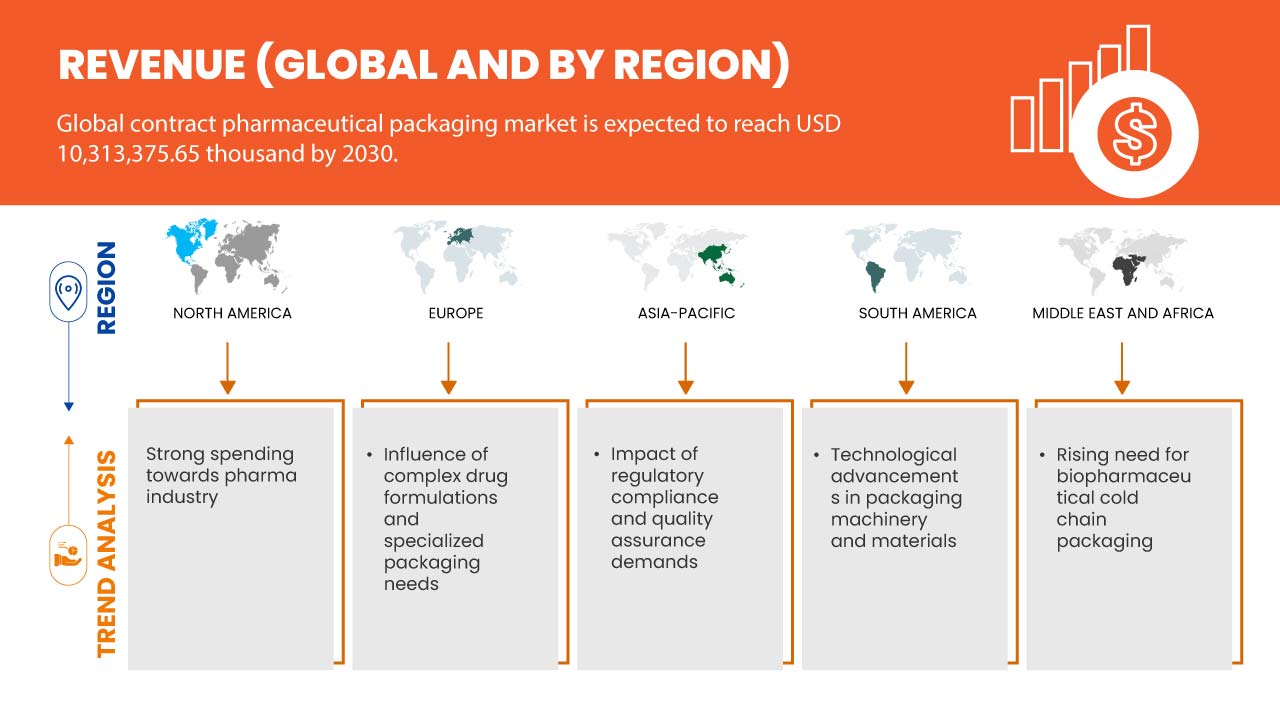

Data Bridge Market Research analiza que se espera que el mercado global de envases farmacéuticos por contrato alcance un valor de USD 10.313.375,65 mil para 2030, con una CAGR del 7,4% durante el período de pronóstico.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Año histórico |

2021 (Personalizable para 2015 - 2020) |

|

Unidades cuantitativas |

Ingresos en miles de USD |

|

Segmentos cubiertos |

Tipo (sistema de envasado primario, sistema de envasado secundario y sistema de envasado terciario), materia prima (plástico y polímeros, vidrio, metales, papel y cartón, caucho, algodón y otros), aplicación (envasado para administración transmucosa de medicamentos, envasado para administración pulmonar de medicamentos, envasado para administración nasal de medicamentos, envasado para administración tópica de medicamentos, envasado inyectable, envasado para administración oral de medicamentos y otros) |

|

Países cubiertos |

Estados Unidos, Canadá y México, Alemania, Reino Unido, Francia, Italia, España, Países Bajos, Bélgica, Rusia, Turquía, Suiza, Luxemburgo y resto de Europa, China, India, Japón, Corea del Sur, Australia y Nueva Zelanda, Indonesia, Singapur, Malasia, Tailandia, Filipinas y resto de Asia-Pacífico, Brasil, Argentina y resto de Sudamérica, Emiratos Árabes Unidos, Sudáfrica, Egipto, Arabia Saudita, Israel y resto de Oriente Medio y África |

|

Actores del mercado cubiertos |

Entre otros, se encuentran: AbbVie Inc., PCI Pharma Services, Nelipak Healthcare, Sharp Services, LLC, Aphena Pharma Solutions, ROPACK INC., SilganUnicep 2, Reed-Lane, Jones Healthcare Group, Wasdell Packaging Group, SternMaid &Co. KG, Sepha, Tripak Pharmaceuticals, Assemblies Unlimited, Inc., AmeriPac y Tjoapack. |

Definición de mercado

El mercado de envases farmacéuticos por contrato abarca un sector especializado dentro de la industria farmacéutica, centrado en soluciones de envases a medida. Implica el diseño, desarrollo y producción de envases primarios, secundarios y terciarios, y soluciones de gestión de etiquetado y material gráfico para productos farmacéuticos. Los impulsores clave del mercado incluyen una mayor demanda, la necesidad de envases complejos debido a productos innovadores y regulaciones estrictas. Las tendencias notables incluyen la adopción de envases pospuestos para lograr eficiencia y reducir el desperdicio, la serialización para la integridad de los datos y las mejoras en la cadena de suministro, y un cambio hacia materiales ecológicos para minimizar el impacto ambiental. Este mercado tiene como objetivo preservar la integridad, la facilidad de uso y la comercialización del producto, al mismo tiempo que cumple con las regulaciones y pautas de la industria.

Dinámica del mercado global de envases farmacéuticos por contrato

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores:

- Alto gasto en la industria farmacéutica

En los últimos años, las compañías farmacéuticas han estado desarrollando cada vez más formulaciones complejas de medicamentos para mejorar la eficacia de los medicamentos, mejorar el cumplimiento del tratamiento por parte de los pacientes y reducir los efectos secundarios. Estas formulaciones a menudo requieren una dosificación precisa, mecanismos de administración especializados y perfiles de liberación controlada. Por lo tanto, el envasado farmacéutico ha evolucionado más allá de los simples blísters y frascos. Ha aumentado la demanda de envases especializados que puedan preservar la integridad de estas formulaciones complejas y, al mismo tiempo, garantizar una dosificación y administración precisas. Este cambio ha abierto oportunidades para los proveedores de envases por contrato que poseen la experiencia técnica para manejar estos intrincados requisitos de envasado.

- Impacto de las formulaciones complejas de medicamentos y las necesidades de envases especializados

El aumento sustancial de la asignación financiera dentro de la industria farmacéutica ha surgido como un catalizador significativo para la expansión del mercado global de envases farmacéuticos por contrato. Este aumento en la inversión puede atribuirse a varios factores que impulsan colectivamente el crecimiento del sector del envasado. La creciente demanda de productos farmacéuticos, impulsada por factores como el envejecimiento de la población y la prevalencia de enfermedades crónicas, ha llevado a un aumento de los volúmenes de producción. Este aumento en la producción implica naturalmente una necesidad proporcional de servicios de envasado. Los proveedores de envases farmacéuticos por contrato intervienen para satisfacer esta demanda ofreciendo soluciones escalables que se adaptan a diversas carteras y cantidades de productos.

Oportunidades

- Avances tecnológicos en maquinaria y materiales de envasado

Los avances tecnológicos en maquinaria y materiales de envasado han sido fundamentales para dar forma al panorama del mercado global de envasado farmacéutico por contrato. Estos avances, impulsados por innovaciones en automatización, ciencia de materiales y sostenibilidad, están destinados a crear oportunidades sustanciales para el crecimiento del mercado. Un aspecto clave del avance tecnológico es la automatización de los procesos de envasado. La maquinaria de envasado moderna está equipada con sofisticados sistemas robóticos, controles computarizados y capacidades de monitoreo en tiempo real. Esto se traduce en mayor precisión, eficiencia y menor cantidad de errores humanos en el proceso de envasado.

- Creciente necesidad de envases de cadena de frío para productos biofarmacéuticos

La creciente demanda de envases de cadena de frío para productos biofarmacéuticos se ha convertido en un factor decisivo en la industria farmacéutica, lo que genera importantes oportunidades de crecimiento del mercado mundial de envases farmacéuticos por contrato. Este aumento se sustenta en la necesidad imperiosa de mantener la eficacia y la integridad de los productos biofarmacéuticos sensibles a la temperatura a lo largo de sus intrincadas cadenas de suministro. Los productos biofarmacéuticos, incluidas las vacunas, las terapias genéticas y los medicamentos especializados, suelen ser vulnerables a las variaciones de temperatura, lo que requiere un control estricto de la temperatura durante el almacenamiento y el transporte.

Restricciones/ Desafíos

- Disponibilidad de elección de embalaje interno por parte de los fabricantes

En el ámbito del envasado por contrato, la disponibilidad de opciones de envasado internas por parte de los fabricantes se ha convertido en un factor importante. Las empresas buscan constantemente vías para mejorar la eficiencia y optimizar sus procesos de producción y envasado. La tendencia a invertir en la automatización de los procesos de envasado internamente ha ganado un impulso sustancial. La perspectiva de envasar productos internamente presenta una oportunidad rentable para las empresas que buscan nuevos territorios de mercado o aquellas que buscan optimizar sus operaciones establecidas. Esto implica adquirir equipos de envasado de capital y realizar el proceso de envasado dentro de las instalaciones de la empresa. Esto indica que el envasado interno puede generar buenos rendimientos durante un largo período, con gastos continuos limitados a los salarios del personal, el mantenimiento y el reemplazo de piezas desgastadas.

- Preocupaciones de sostenibilidad debido al uso de plásticos en materiales de embalaje

El uso extensivo de plásticos de un solo uso en los envases farmacéuticos, si bien sirve para mantener la integridad del producto y la seguridad del paciente, contradice las crecientes preocupaciones por la sostenibilidad en todo el mundo. La adhesión del sector farmacéutico a las buenas prácticas de fabricación (BPF) es esencial para garantizar la calidad y la seguridad de los medicamentos, pero estas regulaciones a menudo carecen de una orientación explícita sobre las prácticas de envasado sostenibles. Esto conduce a prácticas como el doble embalaje con revestimientos y bridas de plástico, y el revestimiento interno de los equipos con plástico para evitar costos de limpieza. Estas prácticas se alinean con las BPF, pero van en contra de los objetivos sostenibles, lo que genera desafíos ambientales. Las BPF garantizan la seguridad del paciente y la calidad del producto, pero no priorizan la sostenibilidad ambiental. Esta contradicción muestra la lucha de la industria por equilibrar el bienestar del paciente con la responsabilidad ambiental.

- Diversas preocupaciones relacionadas con obstáculos operativos

El envasado farmacéutico por contrato tiene sus ventajas, pero se enfrenta a una amplia gama de desafíos que surgen de diversas preocupaciones relacionadas con obstáculos operativos. En un panorama en el que la dinámica del envasado cambia constantemente, las complejidades de la cadena de suministro de envases se han convertido en un problema preocupante. El papel esencial de los ingenieros de envasado en el diseño de cajas plegables y en garantizar operaciones de línea de etiquetado consistentes es vital. Sin embargo, la búsqueda de precios competitivos a menudo choca con la necesidad de satisfacer las demandas de los equipos de producción de pedidos puntuales y completos.

Un desafío es la falta de espacio disponible para la producción en áreas densamente pobladas y ubicaciones inmobiliarias de alto valor. La necesidad de maximizar la rentabilidad en espacios reducidos ejerce una enorme presión sobre los equipos de envasado por contrato para mejorar la productividad. Los cambios de formato, otro aspecto desafiante, plantean una amenaza directa a la eficiencia y la rentabilidad.

Acontecimientos recientes

- En diciembre de 2022, Nelipak Corporation estableció una planta de producción de envases flexibles de última generación en Winston-Salem, Carolina del Norte. Esta medida estratégica ampliará las capacidades de Nelipak en materia de envases para el sector sanitario de Europa a las Américas, satisfaciendo así la creciente demanda en la región. La instalación de 110.000 pies cuadrados, equipada con sala limpia ISO-7 y certificación ISO 13485, representa una inversión de 20 millones de dólares y se prevé que genere aproximadamente 80 puestos de trabajo en los próximos cinco años.

- En octubre de 2022, Aphena Pharma Solutions Inc. anunció que su expansión y renovación de USD 20 millones, que comenzó a mediados de 2019 en Cookeville, Tennessee, ya está completa, agregando una gran cantidad de capacidad disponible de envasado de dosis sólidas. Este espacio adicional ha permitido a Aphena aumentar en gran medida la capacidad de envasado en frascos y blísters de la empresa, con cuatro líneas de embotellado de alta velocidad adicionales y dos líneas de blíster de alta velocidad adicionales para productos sólidos, lo que convierte a Aphena en un socio de crecimiento estratégico sólido para cualquier empresa farmacéutica de genéricos o de venta libre.

- En septiembre de 2022, Nelipak Corporation obtuvo la Certificación Internacional de Sostenibilidad y Carbono (ISCC) PLUS para sus instalaciones en Phoenix, Arizona, y Whitehall, Pensilvania. Este reconocimiento destacó la dedicación de Nelipak a las prácticas sostenibles, utilizando una cadena de suministro circular mediante la incorporación de materiales reciclados y de origen biológico.

- En octubre de 2020, Alnylam Pharmaceuticals se asoció con Sharp para envasar sus productos terapéuticos de ARNi aprobados en los mercados europeos. La planta de Sharp en Hamont-Achel, Bélgica, se encargará del envasado de las ofertas de Alnylam en los países europeos. Esta colaboración marcó una importante inversión internacional para Alnylam en Bélgica, en línea con su estrategia de mejorar su presencia en la región y establecerla como un centro clave para las operaciones.

- En mayo de 2020, Sharp adquirió una planta de envasado de productos farmacéuticos en Macungie, Pensilvania. Esta instalación, que anteriormente era propiedad de Quality Packaging Specialists International, LLC (QPSI), tiene una superficie de 160 000 pies cuadrados y está completamente equipada para el envasado farmacéutico primario y secundario, incluidos los servicios de embotellado, blíster, etiquetado de viales, preparación de kits de dispositivos médicos y serialización. La adquisición estratégica satisfizo las crecientes demandas de volumen de los clientes, lo que reforzó la capacidad de Sharp para proporcionar soluciones de envasado eficientes.

Alcance del mercado global de envases farmacéuticos por contrato

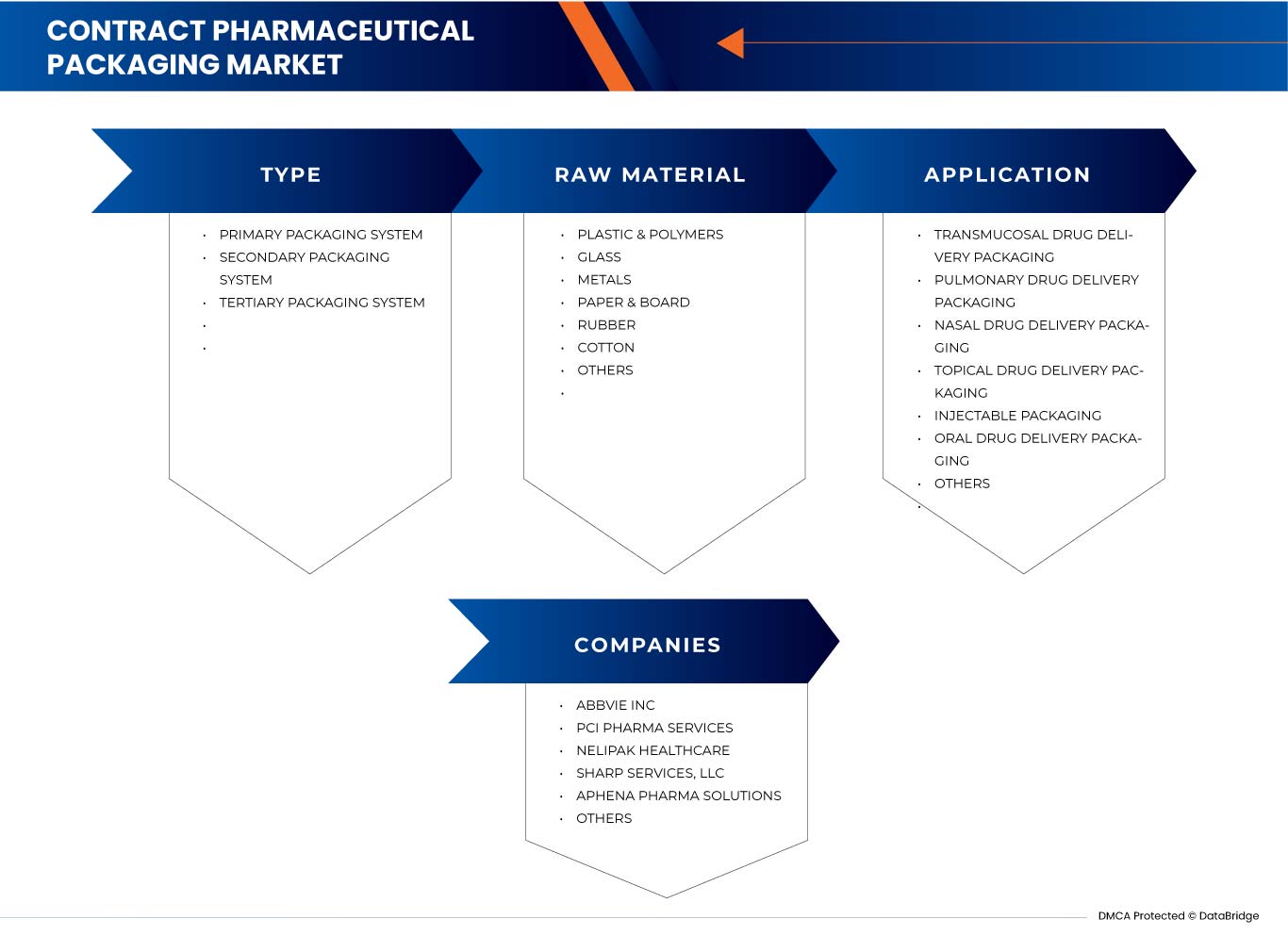

El mercado global de envases farmacéuticos por contrato está segmentado por tipo, materia prima y aplicación. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Sistema de embalaje primario

- Sistema de embalaje secundario

- Sistema de envasado terciario

Según el tipo, el mercado se segmenta en sistema de embalaje primario, sistema de embalaje secundario y sistema de embalaje terciario.

Materia prima

- Plásticos y polímeros

- Vaso

- Rieles

- Papel y cartón

- Goma

- Algodón

- Otros

Sobre la base de la materia prima, el mercado está segmentado en plástico y polímeros, vidrio, metales, papel y cartón, caucho, algodón y otros.

Solicitud

- Envases para administración transmucosa de medicamentos

- Envases para administración de fármacos pulmonares

- Envases para administración nasal de medicamentos

- Envases para administración tópica de medicamentos

- Envases inyectables

- Envases para administración oral de medicamentos

- Otros

Sobre la base de la aplicación, el mercado está segmentado en envases para administración transmucosa de medicamentos, envases para administración pulmonar de medicamentos, envases para administración nasal de medicamentos, envases para administración tópica de medicamentos, envases inyectables, envases para administración oral de medicamentos y otros.

Análisis regional y perspectivas del mercado mundial de envases farmacéuticos por contrato

Se analiza el mercado global de envases farmacéuticos por contrato y se proporcionan información y tendencias sobre el tamaño del mercado por país según tipo, materia prima y aplicación, como se mencionó anteriormente.

Los países cubiertos en el informe global del mercado de envases farmacéuticos por contrato son EE. UU., Canadá y México, Alemania, Reino Unido, Francia, Italia, España, Países Bajos, Bélgica, Rusia, Turquía, Suiza, Luxemburgo y el resto de Europa, China, India, Japón, Corea del Sur, Australia y Nueva Zelanda, Indonesia, Singapur, Malasia, Tailandia, Filipinas y el resto de Asia-Pacífico, Brasil, Argentina y el resto de América del Sur, Emiratos Árabes Unidos, Sudáfrica, Egipto, Arabia Saudita, Israel y el resto de Medio Oriente y África.

Se espera que la región de América del Norte domine el mercado y siga creciendo debido a la creciente demanda de soluciones de envasado eficientes y regulaciones estrictas. Se espera que Estados Unidos domine en la región de América del Norte debido a la creciente adopción de métodos de envasado innovadores para satisfacer las preferencias de los consumidores, que cambian rápidamente, y las crecientes preocupaciones ambientales. Se espera que Alemania domine en la región de Europa debido al aumento del consumo y la demanda. Se espera que China domine en la región de Asia y el Pacífico debido a los importantes desarrollos e inversiones realizados por varias industrias farmacéuticas en todo el mundo.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado global de envases farmacéuticos por contrato

El panorama competitivo del mercado global de envases farmacéuticos por contrato proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en el mercado.

Algunos de los principales actores que operan en el mercado global de envases farmacéuticos por contrato son AbbVie Inc, PCI Pharma Services Nelipak Healthcare, Sharp Services, LLC, Aphena Pharma Solutions, ROPACK INC., SilganUnicep 2, Reed-Lane, Jones Healthcare Group, Wasdell Packaging Group, SternMaid & Co. KG, Sepha, Tripak Pharmaceuticals, Assemblies Unlimited, Inc., AmeriPac y Tjoapack, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS:

4.1.2 ECONOMIC FACTORS:

4.1.3 SOCIAL FACTORS:

4.1.4 TECHNOLOGICAL FACTORS:

4.1.5 LEGAL FACTORS:

4.1.6 ENVIRONMENTAL FACTORS:

4.2 PORTER’S FIVE FORCES

4.3 VENDOR SELECTION CRITERIA

5 DYNAMICS OF RAW MATERIAL PREFERENCES

5.1 PLASTIC AND POLYMERS:

5.1.1 HDPE (HIGH-DENSITY POLYETHYLENE):

5.1.2 LDPE (LOW-DENSITY POLYETHYLENE):

5.1.3 PET (POLYETHYLENE TEREPHTHALATE):

5.1.4 PVC (POLYVINYL CHLORIDE):

5.1.5 PP (POLYPROPYLENE):

5.1.6 COC (CYCLIC OLEFIN COPOLYMER):

5.2 GLASS:

5.2.1 TYPE IV-NP (GENERAL PURPOSE SODA LIME GLASS):

5.2.2 TYPE I (BOROSILICATE GLASS):

5.2.3 TYPE III (REGULAR SODA-LIME GLASS):

5.2.4 TREATED SODA LIME GLASS:

5.3 METAL:

5.3.1 TIN:

5.3.2 IRON:

5.3.3 ALUMINIUM:

5.3.4 LEAD:

5.4 PAPER AND BOARD:

5.4.1 SOLID BOARD:

5.4.2 CHIPBOARD:

5.4.3 CARDBOARD:

5.4.4 FIBER BOARD:

5.5 RUBBER:

5.5.1 NATURAL RUBBER IN CONTRACT PHARMACEUTICAL PACKAGING:

5.5.2 NEOPRENE RUBBER IN CONTRACT PHARMACEUTICAL PACKAGING:

5.5.3 BUTYL RUBBER IN CONTRACT PHARMACEUTICAL PACKAGING:

6 PARTNERSHIP DETAILS

7 TECHNOLOGICAL ADVANCEMENTS

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 STRONG SPENDING TOWARDS PHARMA INDUSTRY

8.1.2 IMPACT OF COMPLEX DRUG FORMULATIONS AND SPECIALIZED PACKAGING NEEDS

8.1.3 IMPACT OF REGULATORY COMPLIANCE AND QUALITY ASSURANCE DEMANDS

8.2 RESTRAINTS

8.2.1 AVAILABILITY OF CHOICE OF IN-HOUSE PACKAGING FROM MANUFACTURERS

8.2.2 SUSTAINABILITY CONCERNS DUE TO USAGE OF PLASTICS IN PACKAGING MATERIALS

8.3 OPPORTUNITIES

8.3.1 TECHNOLOGICAL ADVANCEMENTS IN PACKAGING MACHINERY AND MATERIALS

8.3.2 RISING NEED FOR BIOPHARMACEUTICAL COLD CHAIN PACKAGING

8.4 CHALLENGE

8.4.1 DIVERSE CONCERNS RELATED TO OPERATIONAL HURDLES

9 GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET: BY REGION

9.1 OVERVIEW

9.2 EUROPE

9.3 NORTH AMERICA

9.4 SOUTH AMERICA

9.5 ASIA-PACIFIC

9.6 MIDDLE EAST & AFRICA

10 GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

10.2 COMPANY SHARE ANALYSIS: EUROPE

10.3 COMPANY SHARE ANALYSIS: NORTH AMERICA

10.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 ABBVIE INC.

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 SERVICE PORTFOLIO

12.1.5 RECENT DEVELOPMENTS

12.2 PCI PHARMA SERVICES

12.2.1 COMPANY SNAPSHOT

12.2.2 COMPANY SHARE ANALYSIS

12.2.3 SERVICE PORTFOLIO

12.2.4 RECENT DEVELOPMENTS

12.3 NELIPAK CORPORATION

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENTS

12.4 SHARP SERVICES, LLC

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENTS

12.5 APHENA PHARMA SOLUTIONS

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 SERVICE PORTFOLIO

12.5.4 RECENT DEVELOPMENT

12.6 AMERIPAC

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENT

12.7 ASSEMBLIES UNLIMITED, INC.

12.7.1 COMPANY SNAPSHOT

12.7.2 SERVICE PORTFOLIO

12.7.3 RECENT DEVELOPMENT

12.8 JONES HEALTHCARE GROUP

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 REED-LANE

12.9.1 SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 ROPACK INC.

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENT

12.11 SEPHA

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENTS

12.12 SILGANUNICEP

12.12.1 COMPANY SNAPSHOT

12.12.2 SERVICE PORTFOLIO

12.12.3 RECENT DEVELOPMENTS

12.13 STERNMAID GMBH & CO. KG

12.13.1 COMPANY SNAPSHOT

12.13.2 SERVICE PORTFOLIO

12.13.3 RECENT DEVELOPMENTS

12.14 TJOAPACK

12.14.1 COMPANY SNAPSHOT

12.14.2 SERVICE PORTFOLIO

12.14.3 RECENT DEVELOPMENT

12.15 TRIPAK PHARMACEUTICALS

12.15.1 COMPANY SNAPSHOT

12.15.2 SERVICE PORTFOLIO

12.15.3 RECENT DEVELOPMENTS

12.16 WASDELL PACKAGING GROUP

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

Lista de figuras

FIGURE 1 GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET: SEGMENTATION

FIGURE 2 GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 7 GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 9 GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET: APPLICATION COVERAGE GRID

FIGURE 10 GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET: SEGMENTATION

FIGURE 12 NORTH AMERICA IS EXPECTED TO DOMINATE THE GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET, WHILE ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 13 STRONG SPENDING TOWARDS PHARMA INDUSTRY IS EXPECTED TO DRIVE THE GROWTH OF THE GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET IN THE FORECAST PERIOD

FIGURE 14 THE PRIMARY PACKAGING SYSTEM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET IN 2023 AND 2030

FIGURE 15 ASIA-PACIFIC IS THE FASTEST-GROWING MARKET FOR THE GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET IN THE FORECAST PERIOD

FIGURE 16 VENDOR SELECTION CRITERIA

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET

FIGURE 18 FDI INFLOWS IN DRUGS & PHARMACEUTICALS ACTIVITIES

FIGURE 19 GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET: SNAPSHOT (2022)

FIGURE 20 EUROPE CONTRACT PHARMACEUTICAL PACKAGING MARKET: SNAPSHOT (2022)

FIGURE 21 NORTH AMERICA CONTRACT PHARMACEUTICAL PACKAGING MARKET: SNAPSHOT (2022)

FIGURE 22 SOUTH AMERICA CONTRACT PHARMACEUTICAL PACKAGING MARKET: SNAPSHOT (2022)

FIGURE 23 ASIA-PACIFIC CONTRACT PHARMACEUTICAL PACKAGING MARKET: SNAPSHOT (2022)

FIGURE 24 MIDDLE EAST & AFRICA CONTRACT PHARMACEUTICAL PACKAGING MARKET: SNAPSHOT (2022)

FIGURE 25 GLOBAL CONTRACT PHARMACEUTICAL PACKAGING MARKET: COMPANY SHARE 2022 (%)

FIGURE 26 EUROPE CONTRACT PHARMACEUTICAL PACKAGING MARKET: COMPANY SHARE 2022 (%)

FIGURE 27 NORTH AMERICA CONTRACT PHARMACEUTICAL PACKAGING MARKET: COMPANY SHARE 2022 (%)

FIGURE 28 ASIA-PACIFIC CONTRACT PHARMACEUTICAL PACKAGING MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.