Mercado mundial de carbón vegetal, por producto (carbón vegetal en trozos, briquetas de carbón, carbón japonés, carbón de azúcar y otros), aplicación (actividades al aire libre, negocios de restaurantes, combustible metalúrgico, combustible industrial, filtración y otros), tendencias de la industria y pronóstico hasta 2029.

Definición de mercado

El carbón vegetal es un residuo de carbón negro artificial que se produce a partir de material vegetal como la madera. Este proceso se lleva a cabo en presencia de oxígeno para eliminar los componentes volátiles y el agua. Debido a la mayor demanda del producto en la cocina recreativa y la fabricación de metales, la construcción y edificación , la atención médica, la filtración industrial y las aplicaciones farmacéuticas, se estima que el mercado mundial del carbón vegetal se desarrollará significativamente durante el período de pronóstico. En la cocina recreativa, el carbón vegetal se puede utilizar como sustituto del carbón. Además, es probable que la creciente popularidad de la cocina a la parrilla en los restaurantes impulse la demanda de carbón vegetal.

Análisis y tamaño del mercado

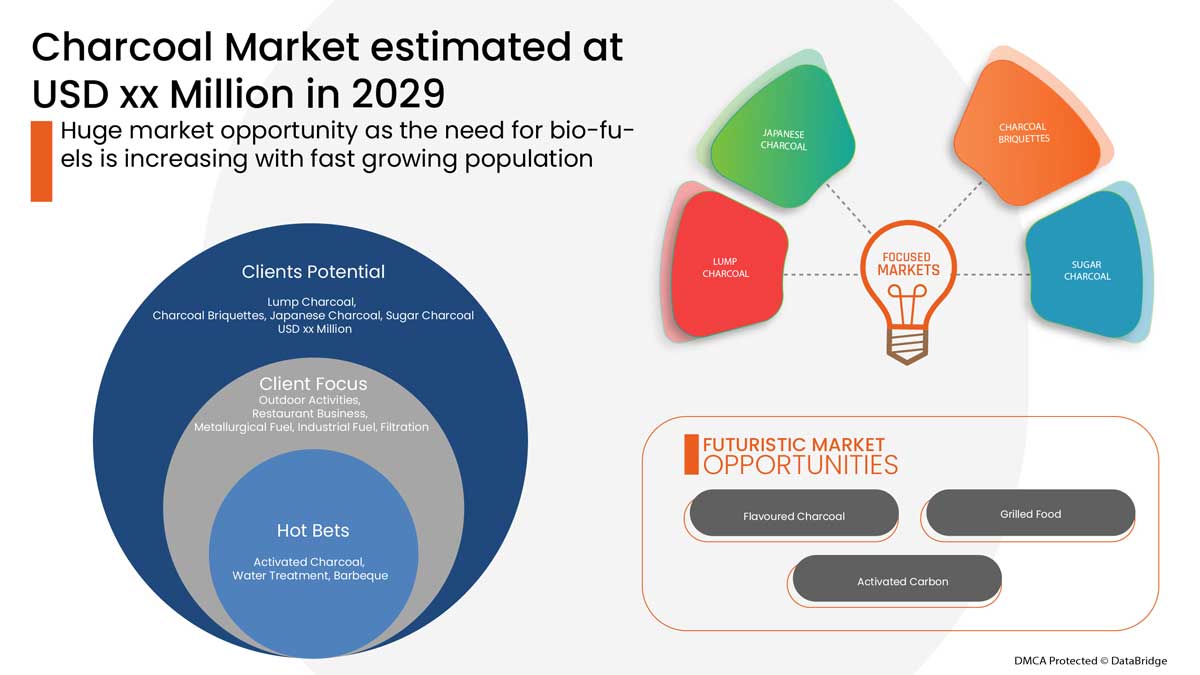

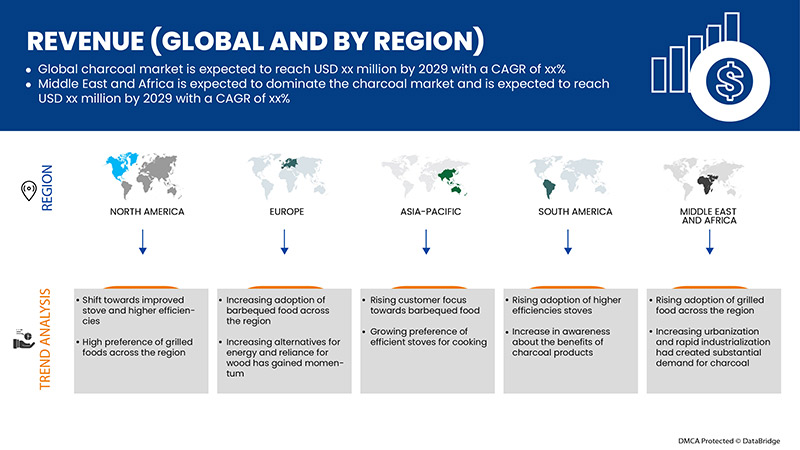

Data Bridge Market Research analiza que se espera que el mercado del carbón vegetal alcance un valor de 6.946,21 millones de dólares en 2029, con una tasa de crecimiento anual compuesta (CAGR) del 2,7 % durante el período de pronóstico. El informe sobre el mercado del carbón vegetal también cubre en profundidad el análisis de precios, el análisis de patentes y los avances tecnológicos.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Subproducto (Carbón en trozos, briquetas de carbón, carbón japonés, carbón de azúcar y otros), aplicación (actividades al aire libre, negocios de restauración, combustible metalúrgico, combustible industrial, filtración y otros) |

|

Países cubiertos |

EE. UU., Canadá y México en América del Norte, Alemania, Francia, Reino Unido, Países Bajos, Suiza, Bélgica, Rusia, Italia, España, Turquía, Resto de Europa en Europa, China, Japón, India, Corea del Sur, Singapur, Malasia, Australia, Tailandia, Indonesia, Filipinas, Hong Kong, Taiwán, Resto de Asia-Pacífico (APAC) en Asia-Pacífico (APAC), Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Egipto, Israel, Resto de Medio Oriente y África (MEA) como parte de Medio Oriente y África (MEA), Brasil, Argentina y Resto de América del Sur como parte de América del Sur. |

|

Actores del mercado cubiertos |

Plantar, Rancher Charcoal, E & C Charcoal, Jumbo Charcoal (Pty) Ltd., Sagar Charcoal and Firewood Depot, Subur Tiasa Holdings Berhad, Etosha, The Clorox Company, Fire & Flavor, Timber Charcoal Company LLC, FogoCharcoal.com, NamCo Charcoal and Timber Products, Namchar, Mesjaya Sdn Bhd, Cook In Wood, maurobera.com, Royal Oak Enterprises, LLC., Duraflame, Inc. |

Dinámica del mercado del carbón vegetal

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

Conductores

- El aumento de la urbanización y la rápida industrialización habían creado una demanda sustancial de carbón.

La demanda de carbón vegetal está aumentando principalmente debido a la población urbana en los países en desarrollo. Más de la mitad de la población mundial vive actualmente en ciudades, y los habitantes urbanos están limitados al uso de carbón vegetal debido a la facilidad de producción, acceso, transporte y tradición. La urbanización ha influido en el tipo de combustibles utilizados y también en el consumo total de energía para diferentes funciones, lo que ha aumentado aún más la demanda de producción de carbón vegetal en toda la región.

- Aumento del consumo de alimentos a la parrilla

En gran parte del mundo, hacer barbacoas es una actividad prácticamente muy común en muchas regiones, especialmente en verano. Y aunque algunas personas hacen parrilladas con gas y electricidad, muchas personas también prefieren asar con carbón, ya que le da a sus alimentos un sabor particularmente ahumado. Además, el carbón se utiliza principalmente para barbacoas recreativas en lugares como América del Norte y Europa, pero es el principal combustible para cocinar en la mayoría de las naciones africanas. Además, se informa que el mercado está impulsado principalmente por la creciente influencia de la comida a la parrilla en todo el mundo y la creciente adopción de la comida a la parrilla entre los millennials. Además, las restricciones de confinamiento y la necesidad de mantener el distanciamiento social debido a la pandemia de COVID-19 en curso han hecho que un mayor número de personas se queden en casa. Por lo tanto, un número cada vez mayor de personas se han dedicado a cocinar en casa y a organizar pequeños eventos sociales en casa. Esta situación ha dado lugar a una creciente demanda de equipos y materiales para cocinar en casa.

Oportunidad

- Cambio hacia estufas mejoradas y de mayor eficiencia

Las cocinas tradicionales para calentar y cocinar en los hogares suelen ser ineficientes y generan una considerable contaminación del aire en interiores, lo que puede ser perjudicial para la salud humana. En muchos países se han instalado cocinas mejoradas con el fin de mejorar la eficiencia de la cocción y la calefacción y reducir la contaminación interior de los hogares. Además, el carbón se puede quemar de forma limpia y segura si se prepara adecuadamente y se utiliza correctamente en aparatos eficientes. Las cocinas mejoradas tienen forma convexa y están aisladas por todos los lados. Debido a su aislamiento, requieren menos carbón para generar una cantidad equivalente de calor útil y retienen el calor durante más tiempo. Además, recientemente se han introducido cocinas mejoradas que pueden reducir las emisiones de GEI al mejorar la eficiencia del combustible y, por lo tanto, reducir la demanda de carbón para la misma cantidad de energía para cocinar.

Restricciones/Desafíos

- Regulación gubernamental estricta para la producción de carbón

Se han puesto en marcha varias políticas y normas para la producción de carbón vegetal con el fin de garantizar la calidad y la manipulación segura del producto. Por ejemplo, la Ley de Seguridad de los Productos de Consumo de Canadá (SC 2010, c. 21) aborda los riesgos para la salud o la seguridad de las personas que entrañan los productos de consumo en Canadá, incluidos los que circulan en el país y los que se importan.

- Información de base insuficiente para la formulación de políticas relacionadas con el carbón

El crecimiento de la población y el cambio de la leña al carbón vegetal se destacaron como los principales factores impulsores del crecimiento del mercado del carbón vegetal . Sin embargo, la explotación de combustible de madera por sí sola claramente no proporciona una explicación resumida de la deforestación en curso a escala nacional. Los problemas relacionados con el combustible de madera han aumentado debido a la información de referencia no estructurada relacionada con diversas políticas de producción de carbón vegetal, que han creado una brecha entre la demanda y la oferta de carbón vegetal en toda la región. Por lo tanto, es necesario proporcionar datos precisos sobre la cadena de valor del carbón vegetal para un excelente punto de entrada para dar forma a los marcos de políticas adecuados. Esto también ofrecerá una oportunidad a las diversas partes interesadas para agregar conocimiento, capital de innovación y tecnología en cada paso o eslabón de la cadena de valor de la producción de carbón vegetal. Por lo tanto, la información de referencia inadecuada para la formulación de políticas está creando un gran desafío para el crecimiento del mercado.

Impacto del COVID-19 en el mercado del carbón

La COVID-19 ha tenido un gran impacto en el mercado del carbón, ya que casi todos los países han optado por cerrar todas las instalaciones de producción, excepto las que se dedican a producir bienes esenciales.

La pandemia de COVID-19 ha afectado al mercado del carbón vegetal de forma negativa. Por lo tanto, el mercado ha tenido una tasa de crecimiento interanual estimada más baja en comparación con 2019 debido a la menor cantidad de actividades de los sectores asociados con el mercado del carbón vegetal. Sin embargo, el crecimiento ha sido alto después de la apertura del mercado después de COVID-19, y se espera que haya un crecimiento considerable en el sector debido a una mayor demanda de alimentos a la parrilla. Y se espera que este factor impulse aún más el crecimiento general del mercado.

Los fabricantes están tomando diversas decisiones estratégicas para recuperarse tras la COVID-19. Los actores están llevando a cabo múltiples actividades de investigación y desarrollo para mejorar la tecnología relacionada con el carbón. Con esto, las empresas traerán tecnologías avanzadas al mercado. Además, las iniciativas gubernamentales para el uso de vehículos eléctricos han impulsado el crecimiento del mercado.

Desarrollo reciente

- En marzo de 2022, Kingsford Products Company, una subsidiaria de The Clorox Company, lanzó una nueva línea de productos de carbón vegetal con sabores exclusivos y pellets de madera dura. El objetivo principal del lanzamiento de este producto es mejorar la experiencia de asar a la parrilla con diversos sabores y aromas. Esto mejorará la cartera de productos de la empresa.

Alcance del mercado mundial del carbón vegetal

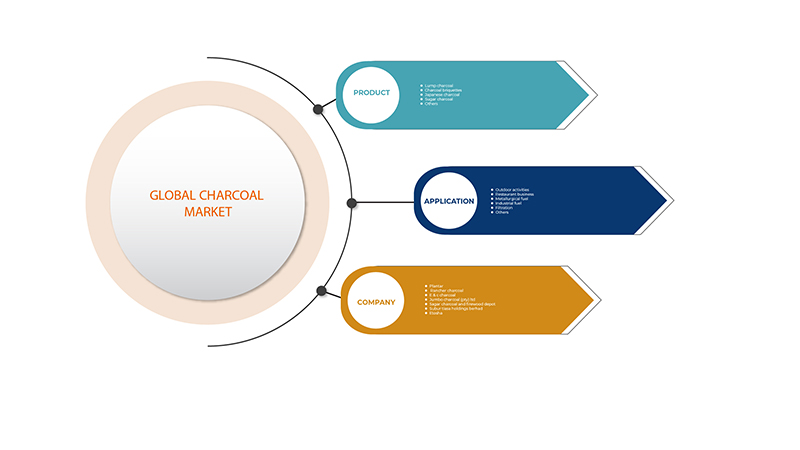

El mercado del carbón vegetal está segmentado en función del producto y la aplicación. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Producto

- Carbón vegetal en trozos

- Briquetas de carbón

- Carbón japonés

- Carbón de azúcar

- Otros

Sobre la base del producto, el mercado mundial de carbón vegetal se segmenta en carbón en trozos, briquetas de carbón, carbón japonés, carbón de azúcar y otros.

Solicitud

- Actividades al aire libre

- Negocio de Restaurante

- Combustible metalúrgico

- Combustible industrial

- Filtración

- Otros

Sobre la base de la aplicación, el mercado mundial del carbón se ha segmentado en las siguientes actividades al aire libre, negocios de restauración, combustible metalúrgico, combustible industrial, filtración y otros.

Análisis y perspectivas regionales del mercado del carbón vegetal

Se analiza el mercado del carbón vegetal y se proporcionan información y tendencias del tamaño del mercado por país, producto y aplicación como se menciona anteriormente.

Los países cubiertos en el informe del mercado del carbón vegetal son EE. UU., Canadá y México en América del Norte, Alemania, Francia, Reino Unido, Países Bajos, Suiza, Bélgica, Rusia, Italia, España, Turquía, Resto de Europa en Europa, China, Japón, India, Corea del Sur, Singapur, Malasia, Australia, Tailandia, Indonesia, Filipinas, Hong Kong, Taiwán, Resto de Asia-Pacífico (APAC) en Asia-Pacífico (APAC), Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Egipto, Israel, Resto de Medio Oriente y África (MEA) como parte de Medio Oriente y África (MEA), Brasil, Argentina y Resto de América del Sur como parte de América del Sur.

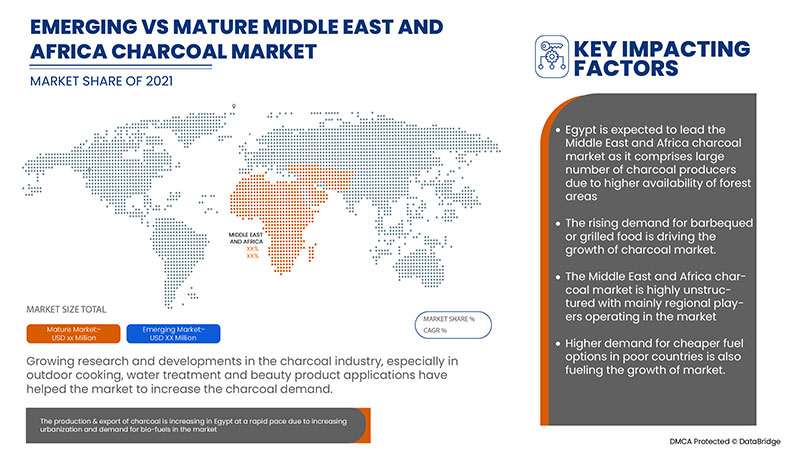

La región de Medio Oriente y África domina el mercado del carbón porque ha demostrado una fuerte demanda de tratamiento de aguas y residuos industriales utilizando carbón activado.

Egipto domina la región de Medio Oriente y África debido a la demanda masiva de combustible de madera más barato y eficiente en este país.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Puntos de datos como análisis de la cadena de valor aguas arriba y aguas abajo, tendencias técnicas y análisis de las cinco fuerzas de Porter, estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado del carbón vegetal

El panorama competitivo del mercado del carbón vegetal ofrece detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado del carbón vegetal.

Algunos de los principales actores que operan en el mercado del carbón vegetal son Plantar, Rancher Charcoal, E & C Charcoal, Jumbo Charcoal (Pty) Ltd., Sagar Charcoal and Firewood Depot, Subur Tiasa Holdings Berhad, Etosha, The Clorox Company, Fire & Flavor, Timber Charcoal Company LLC, FogoCharcoal.com, NamCo Charcoal and Timber Products, Namchar, Mesjaya Sdn Bhd, Cook In Wood, maurobera.com, Royal Oak Enterprises, LLC., Duraflame, Inc.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL CHARCOAL MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TIMELINE CURVE

2.1 MARKET CHALLENGE MATRIX

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PRODUCTION CONSUMPTION ANALYSIS

4.2 IMPORT-EXPORT SCENARIO

4.3 RAW MATERIAL PRODUCTION COVERAGE

4.4 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.5 LIST OF KEY BUYERS BY REGION

4.5.1 NORTH AMERICA

4.5.2 EUROPE

4.5.3 ASIA-PACIFIC

4.5.4 SOUTH AMERICA

4.5.5 MIDDLE EAST AND AFRICA

4.6 PORTER'S FIVE FORCES

4.7 VENDOR SELECTION CRITERIA

4.8 PESTEL ANALYSIS

4.9 REGULATION COVERAGE

5 SUPPLY CHAIN ANALYSIS

5.1 OVERVIEW

5.2 LOGISTIC COST SCENARIO

5.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

6 CLIMATE CHANGE SCENARIO

6.1 ENVIRONMENTAL CONCERNS

6.2 INDUSTRY RESPONSE

6.3 GOVERNMENT'S ROLE

6.4 ANALYST RECOMMENDATION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 AN INCREASE IN URBANIZATION AND RAPID INDUSTRIALIZATION HAS CREATED SUBSTANTIAL DEMAND FOR CHARCOAL

7.1.2 RISE IN CONSUMPTION OF BARBEQUED FOOD

7.1.3 INCREASING ALTERNATIVES FOR ENERGY AND RELIANCE ON WOOD HAS GAINED MOMENTUM

7.1.4 GROWING DEMAND FOR INDUSTRIAL WASTE AND WATER TREATMENT USING ACTIVATED CARBON

7.2 RESTRAINTS

7.2.1 STRINGENT GOVERNMENT REGULATIONS FOR CHARCOAL PRODUCTION

7.2.2 HIGHER ENVIRONMENTAL IMPACTS OF CHARCOAL PRODUCTION IN TROPICAL ECOSYSTEM

7.3 OPPORTUNITIES

7.3.1 SHIFT TOWARDS IMPROVED STOVE AND HIGHER EFFICIENCIES

7.3.2 INCREASE IN SOURCE OF INCOME FOR RURAL DWELLERS WITH CHARCOAL PRODUCTION

7.3.3 HIGH PREFERENCE FOR GRILLED FOODS ACROSS THE REGION

7.4 CHALLENGES

7.4.1 INADEQUATE BASELINE INFORMATION FOR POLICY FORMULATION RELATED TO CHARCOAL

7.4.2 LACK OF AWARENESS OF THE ENVIRONMENTAL EFFECTS OF CHARCOAL PRODUCTION

8 IMPACT OF COVID-19 ON THE GLOBAL CHARCOAL MARKET

8.1 AFTERMATH AND GOVERNMENT INITIATIVES FOR THE CHARCOAL MARKET

8.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

8.3 IMPACT ON DEMAND AND PRICE

8.4 IMPACT ON SUPPLY CHAIN

8.5 CONCLUSION

9 GLOBAL CHARCOAL MARKET, BY PRODUCT

9.1 OVERVIEW

9.2 LUMP CHARCOAL

9.3 CHARCOAL BRIQUETTES

9.4 JAPANESE CHARCOAL

9.5 SUGAR CHARCOAL

9.6 OTHERS

10 GLOBAL CHARCOAL MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 OUTDOOR ACTIVITIES

10.3 RESTAURANT BUSINESS

10.4 METALLURGICAL FUEL

10.5 INDUSTRIAL FUEL

10.6 FILTRATION

10.7 OTHERS

11 GLOBAL CHARCOAL MARKET, BY REGION

11.1 OVERVIEW

11.2 MIDDLE EAST & AFRICA

11.2.1 EGYPT

11.2.2 SOUTH AFRICA

11.2.3 SAUDI ARABIA

11.2.4 U.A.E.

11.2.5 ISRAEL

11.2.6 REST OF MIDDLE EAST & AFRICA

11.3 ASIA-PACIFIC

11.3.1 CHINA

11.3.2 INDIA

11.3.3 JAPAN

11.3.4 SOUTH KOREA

11.3.5 THAILAND

11.3.6 INDONESIA

11.3.7 AUSTRALIA

11.3.8 MALAYSIA

11.3.9 SINGAPORE

11.3.10 PHILIPPINES

11.3.11 HONG KONG

11.3.12 TAIWAN

11.3.13 REST OF ASIA-PACIFIC

11.4 SOUTH AMERICA

11.4.1 BRAZIL

11.4.2 ARGENTINA

11.4.3 REST OF SOUTH AMERICA

11.5 NORTH AMERICA

11.5.1 U.S.

11.5.2 CANADA

11.5.3 MEXICO

11.6 EUROPE

11.6.1 GERMANY

11.6.2 FRANCE

11.6.3 U.K.

11.6.4 ITALY

11.6.5 NETHERLANDS

11.6.6 SPAIN

11.6.7 RUSSIA

11.6.8 BELGIUM

11.6.9 SWITZERLAND

11.6.10 TURKEY

11.6.11 REST OF EUROPE

12 GLOBAL CHARCOAL MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

12.3 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.4 COMPANY SHARE ANALYSIS: EUROPE

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 THE CLOROX COMPANY

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 ROYAL OAK ENTERPRISES, LLC.

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 DURAFLAME, INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 SUBUR TIASA HOLDINGS BERHAD

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 NAMCO CHARCOAL AND TIMBER PRODUCTS

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 COOK IN WOOD

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 E&C CHARCOAL

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 ETOSHA

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 FIRE & FLAVOR

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 FOGOCHARCOAL.COM

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 JUMBO CHARCOAL (PTY) LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 MAUROBERA.COM

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 MESJAYA SDN BHD

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 NAMCHAR

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 RANCHER CHARCOAL

14.15.1 COMPANY SNPASHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 SAGAR CHARCOAL AND FIREWOOD DEPOT

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 TIMBER CHARCOAL CO. LLC

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 PLANTAR

14.18.1 COMPANY SNAPSHOT

14.18.2 SOLUTION PORTFOLIO

14.18.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 VALUES OF CERTAIN CHARCOAL CHARACTERISTICS PURSUANT TO THE EUROPEAN EN 1860-2 AND GERMAN DIN 51749 STANDARD

TABLE 2 CHARCOAL TRANSPORTATION COSTS WITH DISTANCE TRAVELED THROUGH DIFFERENT DISTRICTS OF THAILAND ARE BELOW:

TABLE 3 GLOBAL CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 4 GLOBAL LUMP CHARCOAL IN CHARCOAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 GLOBAL CHARCOAL BRIQUETTES IN CHARCOAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 GLOBAL JAPANESE CHARCOAL IN CHARCOAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 GLOBAL SUGAR CHARCOAL IN CHARCOAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 GLOBAL OTHERS IN CHARCOAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 GLOBAL CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 10 GLOBAL OUTDOOR ACTIVITIES IN CHARCOAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 GLOBAL RESTAURANT BUSINESS IN CHARCOAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 GLOBAL METALLURGICAL FUEL IN CHARCOAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 GLOBAL INDUSTRIAL FUEL IN CHARCOAL MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 14 GLOBAL FILTRATION IN CHARCOAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 GLOBAL OTHERS IN CHARCOAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA CHARCOAL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 EGYPT CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 21 EGYPT CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 22 SOUTH AFRICA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 23 SOUTH AFRICA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 24 SAUDI ARABIA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 25 SAUDI ARABIA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 U.A.E. CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 27 U.A.E. CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 ISRAEL CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 29 ISRAEL CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 30 REST OF MIDDLE EAST & AFRICA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 31 ASIA-PACIFIC CHARCOAL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 32 ASIA-PACIFIC CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 33 ASIA-PACIFIC CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 34 CHINA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 35 CHINA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 36 INDIA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 37 INDIA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 38 JAPAN CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 39 JAPAN CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 40 SOUTH KOREA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 41 SOUTH KOREA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 42 THAILAND CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 43 THAILAND CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 INDONESIA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 45 INDONESIA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 AUSTRALIA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 47 AUSTRALIA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 MALAYSIA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 49 MALAYSIA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 SINGAPORE CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 51 SINGAPORE CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 PHILIPPINES CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 53 PHILIPPINES CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 HONG KONG CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 55 HONG KONG CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 TAIWAN CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 57 TAIWAN CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 REST OF ASIA-PACIFIC CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 59 SOUTH AMERICA CHARCOAL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 60 SOUTH AMERICA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 61 SOUTH AMERICA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 BRAZIL CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 63 BRAZIL CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 ARGENTINA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 65 ARGENTINA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 REST OF SOUTH AMERICA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA CHARCOAL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 U.S. CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 71 U.S. CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 72 CANADA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 73 CANADA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 MEXICO CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 75 MEXICO CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 76 EUROPE CHARCOAL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 77 EUROPE CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 78 EUROPE CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 GERMANY CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 80 GERMANY CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 FRANCE CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 82 FRANCE CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 U.K. CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 84 U.K. CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 ITALY CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 86 ITALY CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 87 NETHERLANDS CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 88 NETHERLANDS CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 89 SPAIN CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 90 SPAIN CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 91 RUSSIA CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 92 RUSSIA CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 93 BELGIUM CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 94 BELGIUM CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 SWITZERLAND CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 96 SWITZERLAND CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 TURKEY CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 98 TURKEY CHARCOAL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 99 REST OF EUROPE CHARCOAL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 GLOBAL CHARCOAL MARKET: SEGMENTATION

FIGURE 2 GLOBAL CHARCOAL MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL CHARCOAL MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL CHARCOAL MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL CHARCOAL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL CHARCOAL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL CHARCOAL MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL CHARCOAL MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GLOBAL CHARCOAL MARKET: SEGMENTATION

FIGURE 10 RISING CONSUMPTION OF BARBEQUED FOOD IS EXPECTED TO DRIVE THE GLOBAL CHARCOAL MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 LUMP CHARCOAL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF GLOBAL CHARCOAL MARKET IN 2022 & 2029

FIGURE 12 MIDDLE EAST & AFRICA IS EXPECTED TO DOMINATE AND IS THE FASTEST GROWING REGION IN THE GLOBAL CHARCOAL MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 MIDDLE EAST & AFRICA IS THE FASTEST GROWING MARKET FOR CHARCOAL MANUFACTURERS IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 WOOD CHARCOAL PRODUCTION QUANTITY SHARE BY REGION (2020)

FIGURE 15 TOP IMPORTERS OF WOOD CHARCOAL 2020

FIGURE 16 TOP EXPORTERS OF WOOD CHARCOAL 2020

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES & CHALLENGES OF GLOBAL CHARCOAL MARKET

FIGURE 18 AVERAGE WOOD CHARCOAL PRODUCTION QUANTITY SHARE BY REGION (2019-2020)

FIGURE 19 GLOBAL CHARCOAL MARKET: BY PRODUCT, 2021

FIGURE 20 GLOBAL CHARCOAL MARKET: BY APPLICATION, 2021

FIGURE 21 GLOBAL CHARCOAL MARKET: SNAPSHOT (2021)

FIGURE 22 GLOBAL CHARCOAL MARKET: BY REGION (2021)

FIGURE 23 GLOBAL CHARCOAL MARKET: BY REGION (2022 & 2029)

FIGURE 24 GLOBAL CHARCOAL MARKET: BY REGION (2021 & 2029)

FIGURE 25 GLOBAL CHARCOAL MARKET: BY PRODUCT (2022-2029)

FIGURE 26 MIDDLE EAST & AFRICA CHARCOAL MARKET: SNAPSHOT (2021)

FIGURE 27 MIDDLE EAST & AFRICA CHARCOAL MARKET: BY COUNTRY (2021)

FIGURE 28 MIDDLE EAST & AFRICA CHARCOAL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 MIDDLE EAST & AFRICA CHARCOAL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 MIDDLE EAST & AFRICA CHARCOAL MARKET: BY PRODUCT (2022-2029)

FIGURE 31 ASIA-PACIFIC CHARCOAL MARKET: SNAPSHOT (2021)

FIGURE 32 ASIA-PACIFIC CHARCOAL MARKET: BY COUNTRY (2021)

FIGURE 33 ASIA-PACIFIC CHARCOAL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 34 ASIA-PACIFIC CHARCOAL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 35 ASIA-PACIFIC CHARCOAL MARKET: BY PRODUCT (2022-2029)

FIGURE 36 SOUTH AMERICA CHARCOAL MARKET: SNAPSHOT (2021)

FIGURE 37 SOUTH AMERICA CHARCOAL MARKET: BY COUNTRY (2021)

FIGURE 38 SOUTH AMERICA CHARCOAL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 39 SOUTH AMERICA CHARCOAL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 40 SOUTH AMERICA CHARCOAL MARKET: BY PRODUCT (2022-2029)

FIGURE 41 NORTH AMERICA CHARCOAL MARKET: SNAPSHOT (2021)

FIGURE 42 NORTH AMERICA CHARCOAL MARKET: BY COUNTRY (2021)

FIGURE 43 NORTH AMERICA CHARCOAL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 44 NORTH AMERICA CHARCOAL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 45 NORTH AMERICA CHARCOAL MARKET: BY PRODUCT (2022-2029)

FIGURE 46 EUROPE CHARCOAL MARKET: SNAPSHOT (2021)

FIGURE 47 EUROPE CHARCOAL MARKET: BY COUNTRY (2021)

FIGURE 48 EUROPE CHARCOAL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 49 EUROPE CHARCOAL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 50 EUROPE CHARCOAL MARKET: BY PRODUCT (2022-2029)

FIGURE 51 GLOBAL CHARCOAL MARKET: COMPANY SHARE 2021 (%)

FIGURE 52 ASIA-PACIFIC CHARCOAL MARKET: COMPANY SHARE 2021 (%)

FIGURE 53 NORTH AMERICA CHARCOAL MARKET: COMPANY SHARE 2021 (%)

FIGURE 54 EUROPE CHARCOAL MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.