Global Building Management System Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

88,841,536.28 Thousand

USD

200,517,985.93 Thousand

2023

2031

USD

88,841,536.28 Thousand

USD

200,517,985.93 Thousand

2023

2031

| 2024 –2031 | |

| USD 88,841,536.28 Thousand | |

| USD 200,517,985.93 Thousand | |

|

|

|

|

Mercado global de sistemas de gestión de edificios, por tipo de sistema (sistemas de gestión de instalaciones (FMS), sistemas de seguridad y control de acceso, sistemas de gestión de energía, software de gestión de edificios (BMS), sistemas de protección contra incendios y otros), tecnología (tecnologías inalámbricas y tecnologías cableadas), aplicación (residencial, comercial e industrial): tendencias de la industria y pronóstico hasta 2031.

Análisis y tamaño del mercado de sistemas de gestión de edificios

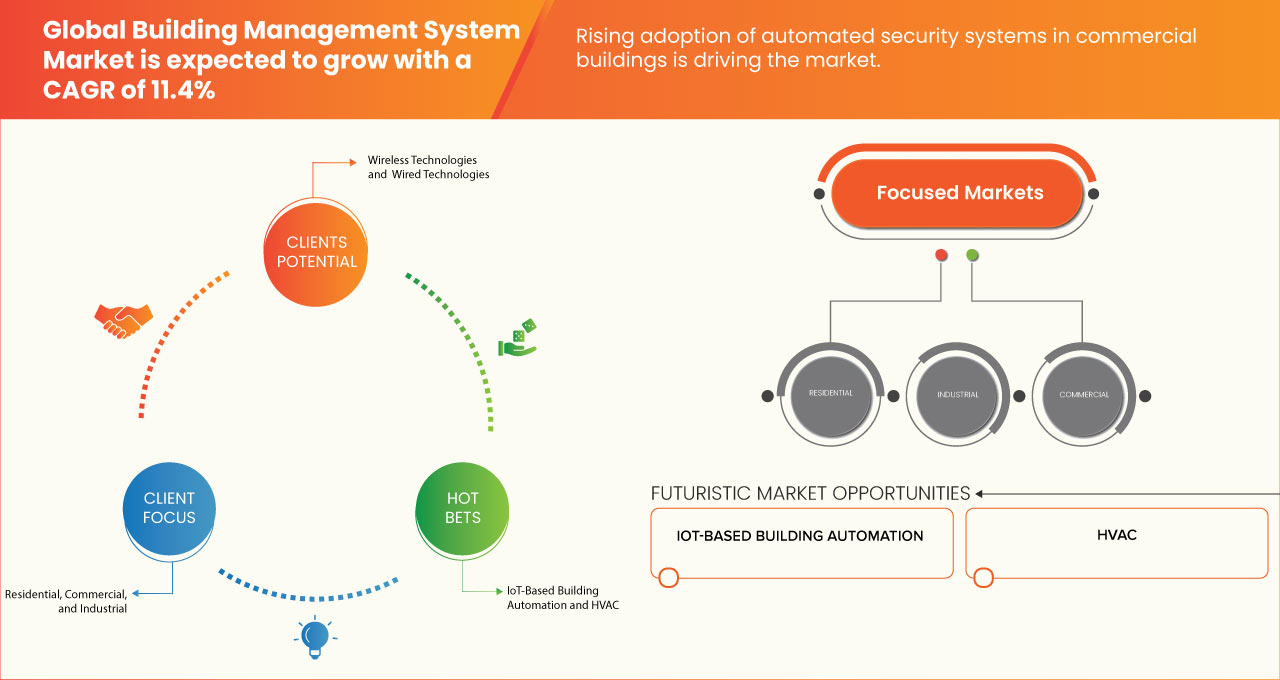

El aumento del enfoque en el diseño de edificios energéticamente eficientes y ecológicos, la creciente adopción de sistemas de seguridad automatizados en edificios comerciales y la creciente popularidad de los sistemas de automatización de edificios (BAS) basados en IoT son algunos de los principales factores que impulsan el crecimiento del mercado.

Sin embargo, la aparición de problemas de seguridad y el alto costo de mantenimiento de los BAS como un problema para los fabricantes a la hora de producir productos innovadores son algunos de los principales factores que restringen el crecimiento del mercado.

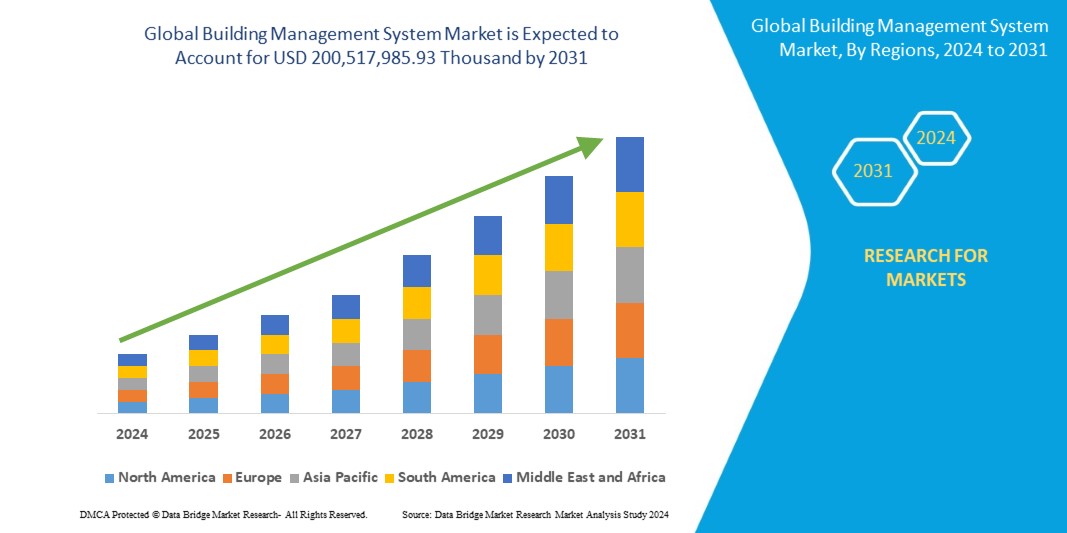

Data Bridge Market Research analiza que se espera que el mercado global de sistemas de gestión de edificios alcance los USD 200.517.985,93 mil para 2031 desde USD 88.841.536,28 mil en 2023, creciendo con una CAGR del 11,4% durante el período de pronóstico de 2024 a 2031.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2024 a 2031 |

|

Año base |

2023 |

|

Años históricos |

2022 (Personalizable para 2016-2021) |

|

Unidades cuantitativas |

Ingresos en miles de USD |

|

Segmentos cubiertos |

Tipo de sistema (sistemas de gestión de instalaciones (FMS), sistemas de seguridad y control de acceso, sistemas de gestión de energía, software de gestión de edificios (BMS), sistemas de protección contra incendios y otros), tecnología (tecnologías inalámbricas y tecnologías cableadas), aplicación (residencial, comercial e industrial) |

|

Países cubiertos |

EE. UU., Canadá, México, Alemania, Francia, Reino Unido, Italia, Turquía, España, Países Bajos, Rusia, Bélgica, Suiza, Resto de Europa, China, Japón, Corea del Sur, India, Australia, Singapur, Malasia, Tailandia, Filipinas, Indonesia, Resto de Asia-Pacífico, Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Israel, Egipto, Resto de Medio Oriente y África, Brasil, Argentina y Resto de Sudamérica. |

|

Actores del mercado cubiertos |

Johnson Controls, Schneider Electric, Siemens, Hangzhou Hikvision Digital Technology Co., Ltd., Honeywell International Inc., Trane Technologies plc, IBM, Convergint Technologies LLC, Veolia, Delta Controls, ACUITY BRANDS, INC., Snap One, LLC, Virtusa Corp., Crestron Electronics, Beckhoff Automation GmbH & Co. KG, Bajaj Electricals Ltd, GridPoint, UNIPOWER, Novius Services, Elipse Software, BuildingIQ y Axonator Inc, entre otros. |

Definición del mercado global de sistemas de gestión de edificios

Un sistema de gestión de edificios (BMS) es un sistema informático que gestiona y supervisa diversos sistemas de edificios, como calefacción, ventilación, aire acondicionado, iluminación, seguridad, prevención de incendios y suministro de energía. Puede reducir el consumo de energía, los costes de mantenimiento y el impacto medioambiental ajustando la configuración de los sistemas del edificio en función de los datos recopilados por sensores y medidores. Un BMS también puede proporcionar información y alertas en tiempo real a los operadores y administradores del edificio, lo que les permite controlar y optimizar el rendimiento del edificio.

Dinámica del mercado global de sistemas de gestión de edificios

En esta sección se aborda la comprensión de los factores impulsores, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- Aumenta el interés por diseñar edificios energéticamente eficientes y respetuosos con el medio ambiente

El ahorro de energía a través de la eficiencia energética en la construcción ha adquirido una importancia primordial en todo el mundo. Los aspectos principales de la eficiencia energética en un edificio incluyen el diseño de edificios energéticamente pasivos antes de la construcción propiamente dicha y el uso de materiales de construcción de bajo consumo energético durante la construcción. El enfoque principal de la construcción de edificios ecológicos es la integración de tecnologías de energía renovable y el uso de equipos eficientes con bajos requisitos de energía operativa.

El consumo de energía en edificios e infraestructuras aumenta exponencialmente, lo que sugiere la necesidad de desarrollar alternativas para ahorrar energía y operar los edificios de manera sustentable. La eficiencia energética se puede lograr con aislamiento, técnicas de construcción mejoradas y métodos de construcción modificados para edificios, lo que aumenta la demanda de sistemas de automatización sustentables. Como resultado, esto aumenta la demanda de sistemas de gestión de edificios, lo que impulsa el crecimiento del mercado.

- Creciente adopción de sistemas de seguridad automatizados en edificios comerciales

Los sistemas de seguridad son esenciales para todos los edificios, especialmente para los edificios comerciales. Garantizan la coherencia de las operaciones comerciales y la seguridad de la propiedad física e intelectual. Las propiedades comerciales, como las empresas industriales, las instituciones financieras y gubernamentales, las escuelas, las instalaciones médicas y las compañías de petróleo y gas, requieren un conjunto único de medidas de seguridad, ya que cada tipo de propiedad es vulnerable a diferentes peligros.

Un sistema de seguridad para edificios comerciales presenta una solución más completa que los sistemas de seguridad típicos de los edificios de apartamentos y comprende diferentes sistemas de automatización. Esto incluye un control de acceso comercial de múltiples capas, varios sensores y detectores, como sensores infrarrojos, de microondas o láser , y seguridad perimetral (CCTV). Todos los sistemas de seguridad comerciales se pueden integrar en una solución de seguridad compleja con mayor flexibilidad y escalabilidad y, por lo tanto, impulsando el crecimiento del mercado.

Oportunidad

- Iniciativas gubernamentales favorables e incentivos para las ciudades inteligentes emergentes

Los edificios inteligentes incluyen tecnología avanzada de automatización y gestión de edificios que mejora la forma en que los gobiernos supervisan y controlan la maquinaria, la calefacción, la refrigeración y los sistemas de iluminación en los edificios federales de todos los países, aumentando así la eficiencia de estos sistemas. La tecnología de sistemas de gestión de edificios recopila datos sin procesar de los sistemas mecánicos o eléctricos, los analiza y utiliza los resultados para identificar ineficiencias que se pueden corregir de inmediato.

La iniciativa de edificios inteligentes permite a los gobiernos marcar una verdadera diferencia mediante la implementación de tecnologías innovadoras e identificando oportunidades para ahorrar energía. A través de la iniciativa de edificios inteligentes, el gobierno está intensificando los esfuerzos para mejorar la gestión del rendimiento energético en los edificios federales. Esto conducirá a una reducción de la huella ambiental y los costos de energía mediante la implementación de sistemas de gestión de edificios inteligentes. A través de la iniciativa de edificios inteligentes, el gobierno de cada país está mejorando la gestión del rendimiento energético de los edificios federales, lo que se traduce en menores emisiones de gases de efecto invernadero y menores costos de energía. Por lo tanto, se prevé que cree una oportunidad significativa para el crecimiento del mercado.

Restricción/Desafío

- Aparición de problemas de seguridad

En los últimos años, muchos edificios han sido equipados con sistemas de comunicación bidireccional para la monitorización y control avanzados de los recursos del centro de datos, lo que fomenta la necesidad de sistemas de automatización. Por lo tanto, la difusión de los BMS también ha aumentado la prevalencia de ciberataques a empresas, instituciones gubernamentales y otros edificios de nueva construcción, por lo que es probable que surjan preocupaciones genuinas sobre los sistemas de seguridad de los edificios.

El software malicioso puede penetrar en el sistema de un edificio a través de redes no seguras y provocar interrupciones. Los problemas técnicos y otras amenazas virales a menudo pueden provocar la pérdida de comunicación y acceso a datos confidenciales, lo que afecta el funcionamiento de dispositivos como la videovigilancia en los edificios.

Si bien el mercado continúa creciendo, la aparición de problemas de seguridad limita considerablemente su progreso. Por lo tanto, las vulnerabilidades de seguridad cibernética , si no se abordan adecuadamente, pueden comprometer la seguridad, la privacidad y la funcionalidad de los edificios. Para sostener el crecimiento del mercado y garantizar la seguridad de la infraestructura crítica, las partes interesadas deben priorizar e invertir en medidas de seguridad cibernética sólidas. Además, cuando un edificio conecta todos los dispositivos del sistema a una única red de control, existe el riesgo de que un usuario malintencionado o un tercero pueda piratear el edificio, lo que reduciría la demanda de sistemas de gestión de edificios y restringiría el crecimiento del mercado.

Acontecimientos recientes

- En octubre de 2023, Hangzhou Hikvision Digital Technology Co., Ltd. se asoció con la eficiencia de los edificios ecológicos mediante el uso de "gemelos digitales". Hikvision desarrolló una solución avanzada de gemelos digitales para satisfacer la creciente demanda de construcciones inteligentes y ecológicas. La solución crea una réplica digital de los edificios, lo que permite el monitoreo en tiempo real de indicadores clave como la eficiencia energética y la seguridad. Esto permite intervenciones rápidas durante incidentes o problemas técnicos, lo que mejora la eficacia operativa general.

- En junio de 2023, Atrius, una división de ACUITY BRANDS, INC., presentó Atrius DataLab, su última plataforma de automatización de edificios. El producto, lanzado ayer, revoluciona las operaciones en espacios construidos al ofrecer un control centralizado. Atrius DataLab facilita la automatización rápida de aplicaciones para un control escalable. La plataforma, construida sobre Microsoft Azure, proporciona una arquitectura independiente de los datos. Permite a los usuarios crear aplicaciones personalizadas, ayudando a los administradores de instalaciones, energía y sostenibilidad a rastrear e informar el consumo de recursos.

- En mayo de 2023, ACUITY BRANDS, INC. completó la adquisición de KE2 Therm Solutions, Inc. La empresa de tecnología industrial integró KE2 Therm, conocida por sus soluciones de control de refrigeración inteligente, en Distech Controls dentro del segmento de negocio de Intelligent Spaces Group. Esta medida tiene como objetivo mejorar la eficiencia del sistema y reducir los costos operativos y de servicio, lo que contribuye a mejorar la rentabilidad. Esta adquisición ayudó a la empresa a aumentar la oferta de productos y llegar a nuevos clientes en el mercado comercial.

- En marzo de 2022, GridPoint, un actor clave en tecnología de gestión energética, concluyó con éxito una recaudación de capital de 75,00 millones de dólares. El grupo de inversión sostenible de Goldman Sachs Asset Management encabezó la financiación estratégica, junto con Shell Ventures. La inversión impulsará los esfuerzos de GridPoint por descarbonizar los edificios comerciales y avanzar en la modernización de la red.

- En diciembre de 2021, ACUITY BRANDS, INC. lanzó Atrius Building Manager, una solución en la nube que tiene como objetivo reducir costos y mejorar la eficiencia de los edificios. La plataforma que debutó hoy se centra inicialmente en el control de la iluminación para reducir los gastos operativos y aumentar la satisfacción de los ocupantes. Atrius Building Manager ofrece funciones escalables e integradas para mejorar la visibilidad y la automatización en varios tipos de edificios comerciales. Este lanzamiento ayudó a la empresa a satisfacer la demanda de los consumidores al brindar opciones comparativamente más económicas para administrar los sistemas de iluminación y ahorrar costos de mano de obra.

Alcance del mercado de sistemas de gestión de edificios a nivel mundial

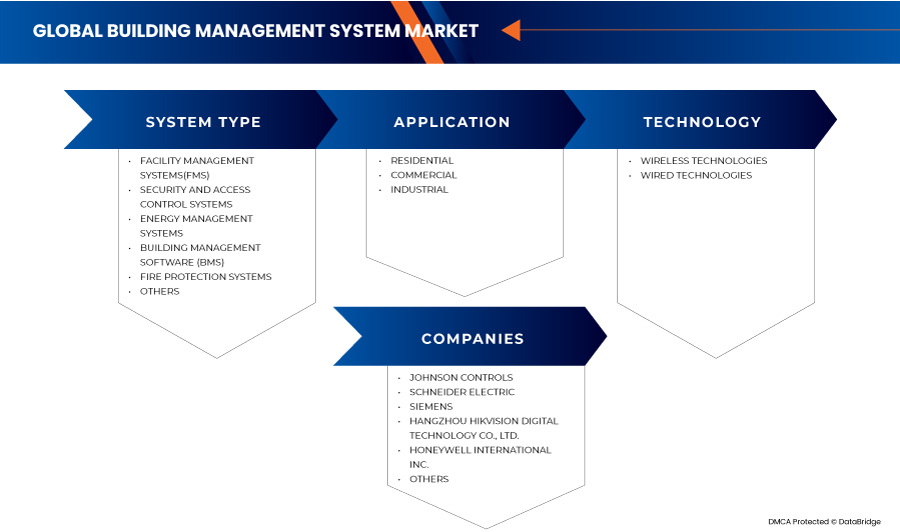

El mercado global de sistemas de gestión de edificios se divide en tres segmentos importantes según el tipo de sistema, la tecnología y la aplicación. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de sistema

- Sistemas de gestión de instalaciones (FMS)

- Sistemas de Seguridad y Control de Acceso

- Sistemas de gestión energética

- Software de gestión de edificios (BMS)

- Sistemas de protección contra incendios

- Otros

Según el tipo de sistema, el mercado global de sistemas de gestión de edificios se segmenta en sistemas de gestión de instalaciones (FMS), sistemas de protección contra incendios, sistemas de seguridad y control de acceso, sistemas de gestión de energía, software de gestión de edificios (BMS) y otros.

Tecnología

- Tecnologías inalámbricas

- Tecnologías cableadas

Sobre la base de la tecnología, el mercado global de sistemas de gestión de edificios está segmentado en tecnologías inalámbricas y tecnologías cableadas.

Solicitud

- Residencial

- Comercial

- Industrial

Sobre la base de la aplicación, el mercado global de sistemas de gestión de edificios se segmenta en residencial, comercial e industrial.

Análisis y perspectivas regionales del mercado global de sistemas de gestión de edificios

El mercado global de sistemas de gestión de edificios está segmentado en tres segmentos notables según el tipo de sistema, la tecnología y la aplicación.

Los países cubiertos en este informe de mercado son EE. UU., Canadá, México, Alemania, Francia, Reino Unido, Italia, Turquía, España, Países Bajos, Rusia, Bélgica, Suiza, resto de Europa, China, Japón, Corea del Sur, India, Australia, Singapur, Malasia, Tailandia, Filipinas, Indonesia, resto de Asia-Pacífico, Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Israel, Egipto, resto de Medio Oriente y África, Brasil, Argentina y resto de América del Sur.

Se espera que Europa domine el mercado global de sistemas de gestión de edificios, ya que cuenta con importantes fabricantes y una gran demanda de sistemas de gestión de edificios. Se espera que Alemania domine en la región de Europa debido al aumento de la incidencia de violaciones de seguridad y al aumento de la necesidad de soluciones innovadoras de seguridad. Se espera que Estados Unidos domine en la región de América del Norte debido a la mayor capacidad de gasto de los consumidores para digitalizar las instalaciones de los edificios, lo que aumenta la demanda del mercado. Se espera que China domine en la región de Asia y el Pacífico debido a la creciente demanda de edificios ecológicos.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, y el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis de la cuota de mercado y panorama competitivo del mercado global de sistemas de gestión de edificios

El panorama competitivo del mercado global de sistemas de gestión de edificios proporciona detalles de los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos y el dominio de las aplicaciones. Los puntos de datos proporcionados anteriormente solo están relacionados con el enfoque de las empresas en el mercado.

Algunos de los principales actores del mercado que operan en este mercado global de sistemas de gestión de edificios son Johnson Controls, Schneider Electric, Siemens, Hangzhou Hikvision Digital Technology Co., Ltd., Honeywell International Inc., Trane Technologies plc, IBM, Convergint Technologies LLC, Veolia, Delta Controls, ACUITY BRANDS, INC., Snap One, LLC, Virtusa Corp., Crestron Electronics, Beckhoff Automation GmbH & Co. KG, Bajaj Electricals Ltd, GridPoint, UNIPOWER, Novius Services, Elipse Software, BuildingIQ y Axonator Inc, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL BUILDING MANAGEMENT SYSTEM MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 SYSTEM TYPE TIMELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES ANALYSIS

4.2 REGULATIONS

4.3 BUILDING AUTOMATION SYSTEM REGULATIONS

4.4 TRADE AND TARIFF ANALYSIS

4.5 AVERAGE SELLING PRICE ANALYSIS

4.6 MARKET LANDSCAPE OF AUSTRALIAN MANUFACTURES AND THEIR COMPETENCIES

4.7 BUILDING AUTOMATION SYSTEM ECOSYSTEM

4.8 ATTRACTIVE OPPORTUNITIES IN THE BUILDING AUTOMATION SYSTEM MARKET

4.9 VALUE CHAIN ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 UPSURGE IN THE FOCUS ON DESIGNING ENERGY-EFFICIENT AND ECO-FRIENDLY BUILDINGS

5.1.2 RISING ADOPTION OF AUTOMATED SECURITY SYSTEMS IN COMMERCIAL BUILDINGS

5.1.3 GROWING POPULARITY OF IOT BUILDING AUTOMATION SYSTEMS

5.1.4 INCREASING DEMAND FOR WIRELESS SENSOR NETWORK TECHNOLOGY

5.2 RESTRAINTS

5.2.1 EMERGENCE OF SECURITY ISSUES

5.2.2 HIGH MAINTENANCE COST OF BUILDING AUTOMATION SYSTEMS

5.3 OPPORTUNITIES

5.3.1 FAVORABLE GOVERNMENT INITIATIVES AND INCENTIVES FOR EMERGING SMART CITIES

5.3.2 SHIFTING CONSUMER’S PREFERENCE TOWARDS HVAC CONTROL SYSTEMS

5.3.3 INCREASING COLLABORATION AND PARTNERSHIPS FOR BUILDING MANAGEMENT SYSTEMS

5.4 CHALLENGES

5.4.1 INVOLVEMENT OF VARIOUS LENGTHY COMMUNICATION PROTOCOLS DURING THE INSTALLATION PROCESS

5.4.2 FALSE NOTION ABOUT HIGH INSTALLATION COSTS OF BUILDING MANAGEMENT SYSTEMS

6 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE

6.1 OVERVIEW

6.2 FACILITY MANAGEMENT SYSTEMS (FMS)

6.2.1 FACILITY MANAGEMENT SYSTEMS(FMS), BY TYPE

6.2.1.1 HVAC CONTROL SYSTEMS

6.2.1.1.1 HVAC CONTROL SYSTEMS, BY TYPE

6.2.1.1.1.1 SENSORS

6.2.1.1.1.2 ACTUATORS

6.2.1.1.1.3 ACTUATORS, BY TYPE

6.2.1.1.1.4 ELECTRIC

6.2.1.1.1.5 HYDRAULIC

6.2.1.1.1.6 PNEUMATIC

6.2.1.1.1.7 CONTROL VALVES

6.2.1.1.1.8 HEATING AND COOLING COILS

6.2.1.1.1.9 SMART THERMOSTATS

6.2.1.1.1.10 PUMPS AND FANS

6.2.1.1.1.11 DAMPERS

6.2.1.1.1.12 DAMPERS, BY TYPE

6.2.1.1.1.13 PARALLEL AND OPPOSED BLADE DAMPERS

6.2.1.1.1.14 LOW-LEAKAGE DAMPERS

6.2.1.1.1.15 ROUND DAMPERS

6.2.1.1.1.16 OTHERS

6.2.1.2 SMART DEVICES

6.2.1.2.1 SMART DEVICES, BY TYPE

6.2.1.2.1.1 SMART APPLIANCES

6.2.1.2.1.2 ENVIRONMENT AND AIR QUALITY MONITORING SYSTEMS

6.2.1.2.1.3 SMART METER

6.2.1.3 LIGHTING CONTROL SYSTEMS

6.2.1.3.1 LIGHTING CONTROL SYSTEMS, BY SYSTEM

6.2.1.3.1.1 HARDWARE

6.2.1.3.1.2 HARDWARE, BY TYPE

6.2.1.3.1.3 RECEIVERS

6.2.1.3.1.4 ACTUATORS

6.2.1.3.1.5 TRANSMITTERS

6.2.1.3.1.6 SENSORS

6.2.1.3.1.7 TIMERS

6.2.1.3.1.8 RELAY

6.2.1.3.1.9 SOFTWARE

6.2.1.3.1.10 SERVICES

6.2.1.3.1.11 SERVICES, BY TYPE

6.2.1.3.1.12 INSTALLATION

6.2.1.3.1.13 SUPPORT AND MAINTENANCE

6.3 SECURITY AND ACCESS CONTROL SYSTEMS

6.3.1 SECURITY AND ACCESS CONTROL SYSTEMS, BY TYPE

6.3.1.1 BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS

6.3.1.1.1 BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEM, BY SYSTEM

6.3.1.1.1.1 HARDWARE

6.3.1.1.1.2 HARDWARE, BY TYPE

6.3.1.1.1.3 MULTI FACTOR AUTHENTICATION

6.3.1.1.1.4 SINGLE FACTOR AUTHENTICATION

6.3.1.1.1.5 SOFTWARE

6.3.1.1.1.6 SERVICES

6.3.1.1.1.7 SERVICES, BY TYPE

6.3.1.1.1.8 INSTALLATION

6.3.1.1.1.9 SUPPORT & MAINTENANCE

6.3.1.1.1.10 ACCESS CONTROL AS A SERVICE (ACAAS)

6.3.1.2 VIDEO SURVEILLANCE SYSTEMS

6.3.1.2.1 VIDEO SURVEILLANCE SYSTEMS, BY TYPE

6.3.1.2.1.1 HARDWARE

6.3.1.2.1.2 HARDWARE, BY TYPE

6.3.1.2.1.3 CAMERAS

6.3.1.2.1.4 STORAGE SYSTEMS

6.3.1.2.1.5 ACCESSORIES

6.3.1.2.1.6 MONITORS

6.3.1.2.1.7 SOFTWARE

6.3.1.2.1.8 SERVICES

6.3.1.2.1.9 SERVICES, BY TYPE

6.3.1.2.1.10 INSTALLATION

6.3.1.2.1.11 SUPPORT & MAINTENANCE

6.3.1.2.1.12 VIDEO SURVEILLANCE AS A SERVICE (VSAAS)

6.4 ENERGY MANAGEMENT SYSTEMS

6.5 BUILDING MANAGEMENT SOFTWARE (BMS)

6.6 FIRE PROTECTION SYSTEMS

6.6.1 FIRE PROTECTION SYSTEMS BY TYPE

6.6.1.1 SENSORS AND DETECTORS

6.6.1.1.1 SENSORS AND DETECTORS, BY TYPE

6.6.1.1.1.1 SMOKE DETECTORS

6.6.1.1.1.2 SMOKE DETECTORS, BY TYPE

6.6.1.1.1.3 DUAL-SENSOR SMOKE DETECTORS

6.6.1.1.1.4 IONIZATION

6.6.1.1.1.5 PHOTOELECTRIC

6.6.1.1.1.6 FLAME DETECTORS

6.6.1.1.1.7 FLAME DETECTORS, BY TYPE

6.6.1.1.1.8 SINGLE IR /SINGLE UV

6.6.1.1.1.9 DUAL IR /SINGLE UV

6.6.1.1.1.10 MULTI IR /SINGLE UV

6.7 OTHERS

7 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 WIRELESS TECHNOLOGIES

7.2.1 ZIGBEE

7.2.2 Z–WAVE

7.2.3 ENOCEAN

7.2.4 WI-FI

7.2.5 THREAD

7.2.6 BLUETOOTH

7.2.7 INFRARED

7.3 WIRED TECHNOLOGIES

7.3.1 KNX

7.3.2 DIGITAL ADDRESSABLE LIGHTING INTERFACE (DALI)

7.3.3 BUILDING AUTOMATION AND CONTROL NETWORK (BACNET)

7.3.4 LONWORKS

7.3.5 MODBUS

8 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 RESIDENTIAL

8.2.1 FACILITY MANAGEMENT SYSTEMS (FMS)

8.2.1.1 HVAC CONTROL SYSTEMS

8.2.1.2 SMART DEVICES

8.2.1.3 LIGHTING CONTROL SYSTEMS

8.2.2 SECURITY AND ACCESS CONTROL SYSTEMS

8.2.2.1 BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS

8.2.2.2 VIDEO SURVEILLANCE SYSTEMS

8.2.3 ENERGY MANAGEMENT SYSTEMS

8.2.4 BUILDING MANAGEMENT SOFTWARE (BMS)

8.2.5 FIRE PROTECTION SYSTEMS

8.2.6 OTHERS

8.3 COMMERCIAL

8.3.1.1 AIRPORTS AND RAILWAY STATIONS

8.3.1.2 GOVERNMENT

8.3.1.3 HOSPITALS AND HEALTHCARE FACILITIES

8.3.1.4 HOSPITALITY

8.3.1.5 OFFICE BUILDINGS

8.3.1.6 RETAIL AND PUBLIC ASSEMBLY BUILDINGS

8.3.1.7 EDUCATION

8.3.1.8 OTHERS

8.3.1.9 FACILITY MANAGEMENT SYSTEMS (FMS)

8.3.1.9.1 HVAC CONTROL SYSTEMS

8.3.1.9.2 SMART DEVICES

8.3.1.9.3 LIGHTING CONTROL SYSTEMS

8.3.1.10 SECURITY AND ACCESS CONTROL SYSTEMS

8.3.1.10.1 BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS

8.3.1.10.2 VIDEO SURVEILLANCE SYSTEMS

8.3.1.11 ENERGY MANAGEMENT SYSTEMS

8.3.1.12 BUILDING MANAGEMENT SOFTWARE (BMS)

8.3.1.13 FIRE PROTECTION SYSTEMS

8.3.1.14 OTHERS

8.4 INDUSTRIAL

8.4.1 FACILITY MANAGEMENT SYSTEMS (FMS)

8.4.1.1 HVAC CONTROL SYSTEMS

8.4.1.2 SMART DEVICES

8.4.1.3 LIGHTING CONTROL SYSTEMS

8.4.2 SECURITY AND ACCESS CONTROL SYSTEMS

8.4.2.1 BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS

8.4.2.2 VIDEO SURVEILLANCE SYSTEMS

8.4.3 ENERGY MANAGEMENT SYSTEMS

8.4.4 BUILDING MANAGEMENT SOFTWARE (BMS)

8.4.5 FIRE PROTECTION SYSTEMS

8.4.6 OTHERS

9 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET, BY REGION

9.1 OVERVIEW

10 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

10.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

10.3 COMPANY SHARE ANALYSIS: EUROPE

10.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

10.5 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

10.6 COMPANY SHARE ANALYSIS: SOUTH AMERICA

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 JOHNSON CONTROLS

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENTS

12.2 SCHNEIDER ELECTRIC

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENTS

12.3 SIEMENS

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT DEVELOPMENTS

12.4 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT DEVELOPMENTS

12.5 HONEYWELL INTERNATIONAL INC.

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT DEVELOPMENTS

12.6 ACUITY BRANDS, INC.

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENTS

12.7 AXONATOR INC

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENT

12.8 BECKHOFF AUTOMATION GMBH & CO. KG

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENTS

12.9 BAJAJ ELECTRICALS LTD

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 PRODUCT PORTFOLIO

12.9.4 RECENT DEVELOPMENTS

12.1 BUILDINGIQ

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENTS

12.11 CONVERGINT TECHNOLOGIES LLC

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENTS

12.12 CRESTON ELECTRONICS

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENT

12.13 DELTA CONTROLS

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENTS

12.14 ELIPSE SOFTWARE

12.14.1 COMPANY SNAPSHOT

12.14.2 SOLUTION PORTFOLIO

12.14.3 RECENT DEVELOPMENTS

12.15 GRIDPOINT

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT DEVELOPMENTS

12.16 IBM

12.16.1 COMPANY SNAPSHOT

12.16.2 REVENUE ANALYSIS

12.16.3 PRODUCT PORTFOLIO

12.16.4 RECENT DEVELOPMENT

12.17 NOVIUS SERVICES

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT DEVELOPMENT

12.18 SNAP ONE, LLC

12.18.1 COMPANY SNAPSHOT

12.18.2 REVENUE ANALYSIS

12.18.3 SOLUTION PORTFOLIO

12.18.4 RECENT DEVELOPMENT

12.19 TRANE TECHNOLOGIES PLC

12.19.1 COMPANY SNAPSHOT

12.19.2 REVENUE ANALYSIS

12.19.3 PRODUCT PORTFOLIO

12.19.4 RECENT DEVELOPMENT

12.2 UNIPOWER

12.20.1 COMPANY SNAPSHOT

12.20.2 PRODUCT PORTFOLIO

12.20.3 RECENT DEVELOPMENT

12.21 VEOLIA

12.21.1 COMPANY SNAPSHOT

12.21.2 REVENUE ANALYSIS

12.21.3 SOLUTION PORTFOLIO

12.21.4 RECENT DEVELOPMENTS

12.22 VIRTUSA CORP.

12.22.1 COMPANY SNAPSHOT

12.22.2 SERVICE PORTFOLIO

12.22.3 RECENT DEVELOPMENT

13 QUESTIONNAIRES

14 RELATED REPORTS

Lista de Tablas

TABLE 1 BUILDING AUTOMATION SYSTEM REGULATIONS

TABLE 2 VIDEO SURVEILLANCE PRIVACY AND WIRETAPPING REGULATIONS

TABLE 3 GOVERNMENT REGULATIONS FOR BIOMETRIC SYSTEM

TABLE 4 COMPREHENSIVE IMPORT DATA OF THE BUILDING MANAGEMENT SYSTEM

TABLE 5 COMPREHENSIVE EXPORT DATA OF THE BUILDING MANAGEMENT SYSTEM

TABLE 6 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 7 GLOBAL FACILITY MANAGEMENT SYSTEMS(FMS) IN BUILDING MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 8 GLOBAL FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 9 GLOBAL HVAC CONTROL SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 10 GLOBAL ACTUATORS IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 11 GLOBAL DAMPERS IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 12 GLOBAL SMART DEVICES IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 13 GLOBAL LIGHTING CONTROL SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY SYSTEM, 2022-2031 (USD THOUSAND)

TABLE 14 GLOBAL HARDWARE IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 15 GLOBAL SERVICES IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 16 GLOBAL SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 17 GLOBAL SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 18 GLOBAL BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY SYSTEM, 2022-2031 (USD THOUSAND)

TABLE 19 GLOBAL HARDWARE IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 20 GLOBAL SERVICES IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 21 GLOBAL VIDEO SURVEILLANCE SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 22 GLOBAL HARDWARE IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 23 GLOBAL SERVICES IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 24 GLOBAL ENERGY MANAGEMENT SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 25 GLOBAL BUILDING MANAGEMENT SOFTWARE (BMS) IN BUILDING MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 26 GLOBAL FIRE PROTECTION SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 27 GLOBAL FIRE PROTECTION SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 28 GLOBAL SENSORS AND DETECTORS IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 29 GOBAL SMOKE DETECTORS IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 30 GLOBAL FLAME DETECTORS IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 31 GLOBAL OTHERS IN BUILDING MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 32 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 33 GLOBAL WIRELESS TECHNOLOGIES IN BUILDING MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 34 GLOBAL WIRELESS TECHNOLOGIES IN BUILDING MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2022-2031 (USD THOUSAND)

TABLE 35 GLOBAL WIRED TECHNOLOGIES IN BUILDING MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 36 GLOBAL MANAGED NETWORK SERVICES IN TELECOM MANAGED SERVICES MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 37 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 38 GLOBAL RESIDENTIAL IN BUILDING MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 39 GLOBAL RESIDENTIAL IN BUILDING MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 40 GLOBAL FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 41 GLOBAL SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 42 GLOBAL COMMERCIAL IN BUILDING MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 43 GLOBAL COMMERCIAL IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 44 GLOBAL COMMERCIAL IN BUILDING MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 45 GLOBAL FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 46 GLOBAL SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 47 GLOBAL INDUSTRIAL IN BUILDING MANAGEMENT SYSTEM MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 48 GLOBAL INDUSTRIAL IN BUILDING MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

TABLE 49 GLOBAL FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING MANAGEMENT SYSTEM MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 50 GLOBAL SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2022-2031 (USD THOUSAND)

Lista de figuras

FIGURE 1 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: SEGMENTATION

FIGURE 2 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: GLOBAL VS. REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: MULTIVARIATE MODELLING

FIGURE 7 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: SYSTEM TYPE TIMELINE CURVE

FIGURE 8 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: DBMR MARKET POSITION GRID

FIGURE 10 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: SEGMENTATION

FIGURE 12 EUROPE IS EXPECTED TO DOMINATE THE GLOBAL BUILDING MANAGEMENT SYSTEM MARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 13 UPSURGE IN THE FOCUS ON DESIGNING ENERGY-EFFICIENT AND ECO-FRIENDLY BUILDINGS IS DRIVING THE GROWTH OF THE GLOBAL BUILDING MANAGEMENT SYSTEM MARKET IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 14 FACILITY MANAGEMENT SYSTEMS (FMS) IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL BUILDING MANAGEMENT SYSTEM MARKET IN 2024 AND 2031

FIGURE 15 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR BUILDING MANAGEMENT SYSTEM MARKET MANUFACTURERS IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 16 AUSTRALIAN MANUFACTURES AND THEIR COMPETENCIES

FIGURE 17 VALUE CHAIN ANALYSIS FOR GLOBAL BUILDING MANAGEMENT SYSTEM MARKET

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL BUILDING MANAGEMENT SYSTEM MARKET

FIGURE 19 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: BY SYSTEM TYPE, 2023

FIGURE 20 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: BY TECHNOLOGY, 2023

FIGURE 21 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: BY APPLICATION, 2023

FIGURE 22 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: SNAPSHOT (2023)

FIGURE 23 GLOBAL BUILDING MANAGEMENT SYSTEM MARKET: COMPANY SHARE 2023 (%)

FIGURE 24 NORTH AMERICA BUILDING MANAGEMENT SYSTEM MARKET: COMPANY SHARE 2023 (%)

FIGURE 25 EUROPE BUILDING MANAGEMENT SYSTEM MARKET: COMPANY SHARE 2023 (%)

FIGURE 26 ASIA-PACIFIC BUILDING MANAGEMENT SYSTEM MARKET: COMPANY SHARE 2023 (%)

FIGURE 27 MIDDLE EAST AND AFRICA BUILDING MANAGEMENT SYSTEM MARKET: COMPANY SHARE 2023 (%)

FIGURE 28 SOUTH AMERICA BUILDING MANAGEMENT SYSTEM MARKET: COMPANY SHARE 2023 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.