Global Biodegradable Mulch Film Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

65.38 Billion

USD

114.35 Billion

2024

2032

USD

65.38 Billion

USD

114.35 Billion

2024

2032

| 2025 –2032 | |

| USD 65.38 Billion | |

| USD 114.35 Billion | |

|

|

|

Segmentación del mercado global de películas de mantillo biodegradables, por material (ácido poliláctico (PLA), almidón, poli(butileno-adipato-co-tereftalato) (PBAT), polihidroxialcanoatos (PHA), celulosa, poli(butileno-succinato) (PBS), poliésteres de origen fósil, poli(butileno-succinato-co-adipato) (PBSA) y otros), espesor (15 micrones, 20 micrones, 25 micrones, 30 micrones, 32 micrones, 50 micrones, 100 micrones y otros), forma (no transparente y transparente), categoría (mantillo de barrera contra malezas, mantillo estabilizado contra rayos UV, mantillo de solarización, mantillo de barrera contra pesticidas, mantillo repelente de insectos, mantillo de liberación de herbicidas, mantillo de barrera para fumigación y otros), % de superficie cubierta (70-80%, 40-60%, 40-45%, 90-100% y 20-25%), duración del cultivo (cultivos de corta duración, cultivos de duración media, cultivos de larga duración y otros), aplicación (verduras, frutas, cereales y granos, semillas oleaginosas y legumbres, césped y adornos, floricultura y otros): tendencias de la industria y pronóstico hasta 2032

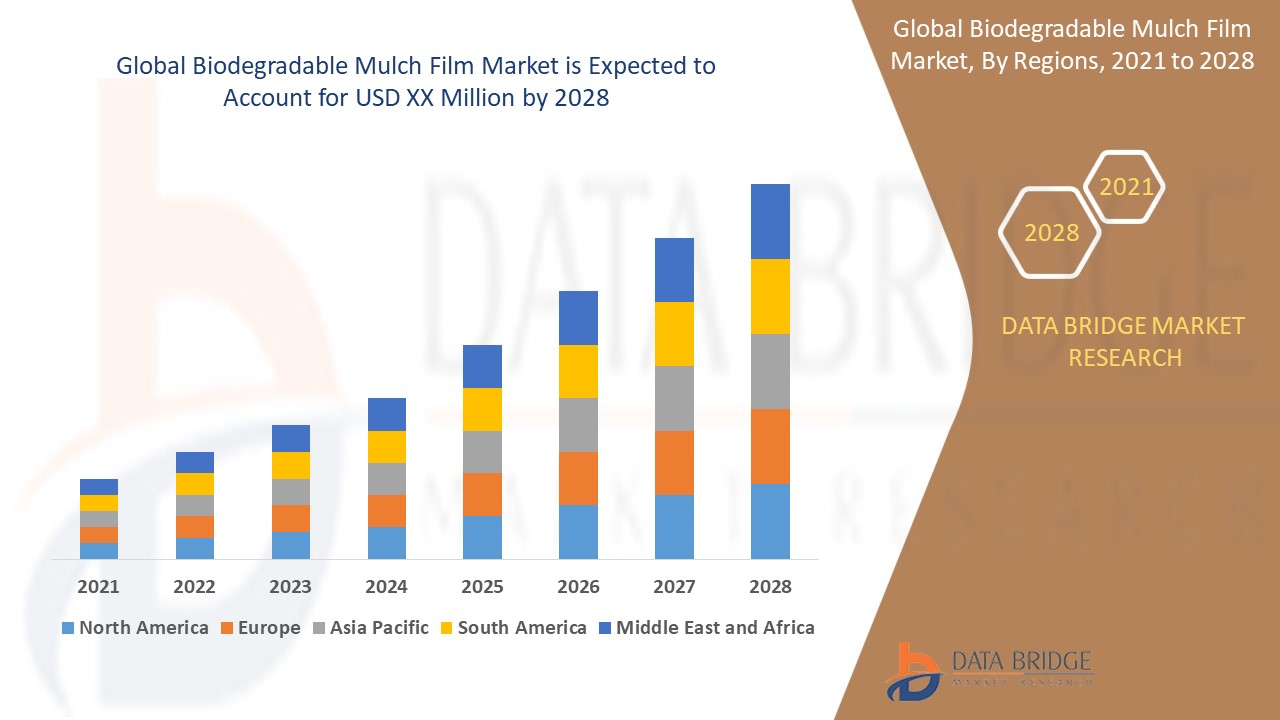

Análisis del mercado de películas de mantillo biodegradables

El mercado mundial de películas biodegradables para mantillo está experimentando un crecimiento sólido debido a las crecientes preocupaciones ambientales y las prácticas agrícolas sostenibles. Con un cambio hacia soluciones ecológicas, las películas biodegradables para mantillo están ganando terreno debido a su capacidad de degradarse naturalmente, lo que reduce la contaminación del suelo. Los avances en la tecnología de biopolímeros y las iniciativas gubernamentales que apoyan la agricultura sostenible impulsan aún más la expansión del mercado. América del Norte y Europa dominan el mercado debido a las estrictas regulaciones ambientales y la adopción generalizada de métodos agrícolas sostenibles. Asia-Pacífico está surgiendo como un mercado lucrativo debido a la creciente conciencia y las iniciativas gubernamentales que promueven alternativas biodegradables. Los actores clave en el mercado se están centrando en la investigación y el desarrollo para mejorar la eficiencia del producto y expandir su presencia en el mercado. Se anticipa que el mercado continuará su trayectoria ascendente impulsada por la creciente conciencia ambiental y la necesidad de prácticas agrícolas sostenibles a nivel mundial.

Tamaño del mercado de películas de mantillo biodegradables

El tamaño del mercado de películas de mantillo biodegradable se valoró en USD 65,38 mil millones en 2024 y se proyecta que alcance los USD 114,35 mil millones para 2032, con una CAGR del 7,24% durante el período de pronóstico de 2025 a 2032. Además de la información sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis de consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas / consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio.

Alcance del informe y segmentación de la película de mantillo biodegradable

|

Atributos |

Perspectivas clave del mercado de películas de mantillo biodegradables |

|

Segmentos cubiertos |

|

|

Países cubiertos |

EE. UU., Canadá y México en América del Norte, Alemania, Francia, Reino Unido, Países Bajos, Suiza, Bélgica, Rusia, Italia, España, Turquía, Resto de Europa en Europa, China, Japón, India, Corea del Sur, Singapur, Malasia, Australia, Tailandia, Indonesia, Filipinas, Resto de Asia-Pacífico (APAC) en Asia-Pacífico (APAC), Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Egipto, Israel, Resto de Medio Oriente y África (MEA) como parte de Medio Oriente y África (MEA), Brasil, Argentina y Resto de América del Sur como parte de América del Sur |

|

Actores clave del mercado |

BASF SE, Groupe Barbier, Dubois Agrinovation Inc., Coverfields, PolyExpert, SWAMISAMARTH AGRO BIOTECH LLP, Smurfit Kappa, PLASTIKA KRITIS, CAPTAIN POLYPLAST LTD., Novamont SpA, ARMANDO ÁLVAREZ, SA, FILMORGANIC, BioBag International AS, Fujian Greenjoy Biomaterial Co., Ltd, Tilak Polypack, SUKI CREATIONS PVT. LTD, SPR PACKAGING, LLC, Chennai Polypack Private Limited, Shivam Polymers y Reya Pack |

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de la información sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis de consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Definición del mercado de películas de mantillo biodegradables

La película de mantillo biodegradable es un tipo de película agrícola que está diseñada para descomponerse naturalmente en el suelo después de su uso, lo que evita la necesidad de retirarla y desecharla. Estas películas suelen estar hechas de materiales biodegradables, como bioplásticos o fibras naturales, que pueden descomponerse por los microorganismos del suelo. Las películas de mantillo biodegradables ofrecen varias ventajas sobre las películas de mantillo de plástico tradicionales, entre ellas, la reducción de los residuos plásticos en el medio ambiente, la mejora de la salud del suelo al añadir materia orgánica y la reducción de la necesidad de herbicidas químicos.

Dinámica del mercado de películas de mantillo biodegradables

Conductores

- Demanda creciente de alternativas biodegradables

Las películas de mantillo son un componente vital en la agricultura moderna, que se utilizan para mejorar el rendimiento de los cultivos, conservar la humedad del suelo, regular la temperatura del suelo y suprimir el crecimiento de las malezas. Estas películas se colocan normalmente sobre el suelo alrededor de las plantas para crear un microambiente favorable para el crecimiento de las mismas. Tradicionalmente, las películas de plástico para mantillo han dominado el mercado de las películas de mantillo debido a su eficacia y rentabilidad. Sin embargo, su impacto ambiental ha suscitado importantes preocupaciones entre los agricultores, lo que ha provocado un creciente interés en las alternativas biodegradables.

- Normas y reglamentos gubernamentales para reducir los residuos plásticos

La crisis ambiental mundial causada por la contaminación plástica se ha convertido en una preocupación importante para los gobiernos de todo el mundo. La alarmante acumulación de desechos plásticos en océanos, vertederos y hábitats naturales ha llevado a los organismos reguladores a implementar normas y regulaciones estrictas destinadas a reducir el uso de plástico. Estas medidas están diseñadas para mitigar los impactos ambientales adversos de los desechos plásticos, promover prácticas sostenibles y alentar la adopción de alternativas ecológicas. El sector agrícola, en particular, ha experimentado un aumento de la regulación, con un enfoque significativo en las películas de plástico para acolchado, que se utilizan ampliamente para la producción de cultivos pero plantean serios desafíos para su eliminación.

Oportunidades

- Investigación y desarrollo continuos en materiales biodegradables

El mercado de películas para mantillo ha evolucionado significativamente desde que se introdujeron las primeras películas para mantillo en la década de 1950. Estas películas, diseñadas inicialmente para conservar la humedad del suelo, reducir el crecimiento de malezas y mejorar el rendimiento de los cultivos, se han convertido en una herramienta esencial en la agricultura moderna. Las películas para mantillo tradicionales, generalmente hechas de polietileno, planteaban importantes desafíos ambientales debido a su naturaleza no biodegradable, lo que generaba problemas de contaminación del suelo y eliminación. Para abordar estas preocupaciones, los esfuerzos de Investigación y Desarrollo (R&D) se han centrado cada vez más en la creación de alternativas biodegradables que se alineen con los objetivos de sostenibilidad.

- La adopción de películas de mantillo biodegradables se está expandiendo en las economías emergentes

El crecimiento demográfico en las economías emergentes está impulsando una mayor demanda de producción de alimentos, lo que hace necesaria la adopción de prácticas agrícolas modernas. A medida que estas regiones experimentan un importante crecimiento demográfico, la presión sobre los sistemas agrícolas se intensifica, lo que obliga a adoptar métodos agrícolas más eficientes y sostenibles. Las prácticas modernas, como el uso de películas biodegradables para abono, ofrecen numerosos beneficios, entre ellos, un mejor rendimiento de los cultivos, la conservación del suelo y un menor impacto ambiental. Este cambio de atención de los agricultores hacia técnicas agrícolas avanzadas es esencial para satisfacer la creciente demanda de alimentos y garantizar la seguridad alimentaria en estas regiones en rápido desarrollo.

Restricciones/Desafíos

- Incertidumbre sobre el rendimiento de las películas de mantillo biodegradables

Las películas de mantillo biodegradables ofrecen varias ventajas en comparación con las películas de plástico tradicionales, entre ellas, un menor impacto ambiental y la capacidad de degradarse en subproductos no tóxicos. Sin embargo, se han planteado inquietudes sobre su rendimiento en comparación con las películas de plástico convencionales. Factores como la durabilidad, la eficacia en el control de malezas y la consistencia de las tasas de degradación plantean incertidumbres para los agricultores y las partes interesadas.

- Coste más elevado que las películas plásticas tradicionales

Las películas de mantillo biodegradables, diseñadas para descomponerse de forma natural en el suelo, ofrecen una alternativa ecológica a las películas de plástico tradicionales. Sin embargo, el mayor coste asociado a las películas de mantillo biodegradables en comparación con sus homólogas no biodegradables supone una limitación importante para su adopción generalizada. Los agricultores y las empresas agrícolas suelen sopesar los beneficios frente a los gastos, y la disparidad de costes puede ser un factor decisivo que limite el crecimiento del mercado de las películas de mantillo biodegradables.

Este informe de mercado proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado, comuníquese con Data Bridge Market Research para obtener un informe de analistas, nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Impacto y situación actual del mercado ante la escasez de materias primas y retrasos en los envíos

Data Bridge Market Research ofrece un análisis de alto nivel del mercado y brinda información teniendo en cuenta el impacto y el entorno actual del mercado en relación con la escasez de materias primas y los retrasos en los envíos. Esto se traduce en la evaluación de posibilidades estratégicas, la creación de planes de acción efectivos y la asistencia a las empresas para tomar decisiones importantes.

Además del informe estándar, también ofrecemos un análisis en profundidad del nivel de adquisiciones a partir de retrasos de envío previstos, mapeo de distribuidores por región, análisis de productos básicos, análisis de producción, tendencias de mapeo de precios, abastecimiento, análisis del desempeño de categorías, soluciones de gestión de riesgos de la cadena de suministro, evaluación comparativa avanzada y otros servicios para adquisiciones y soporte estratégico.

Impacto esperado de la desaceleración económica en los precios y la disponibilidad de los productos

Cuando la actividad económica se desacelera, las industrias comienzan a sufrir. Los efectos previstos de la crisis económica sobre los precios y la accesibilidad de los productos se tienen en cuenta en los informes de conocimiento del mercado y los servicios de inteligencia que ofrece DBMR. Con esto, nuestros clientes pueden normalmente mantenerse un paso por delante de sus competidores, proyectar sus ventas e ingresos y estimar sus gastos de ganancias y pérdidas.

Alcance del mercado de películas de mantillo biodegradables

El mercado está segmentado en función del material, el grosor, la forma, la categoría, el porcentaje de superficie cubierta, la duración del cultivo y la aplicación. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Material

- Ácido poliláctico (PLA)

- Almidón

- Poli(butileno-adipato-co-tereftalato) (PBAT)

- Polihidroxialcanoatos (PHA)

- Celulosa

- Poli(succinato de butileno) (PBS)

- Poliésteres de origen fósil

- Poli(succinato de butileno-coadipato) (PBSA)

- Otros

Espesor

- 15 micrones

- 20 micrones

- 25 micrones

- 30 micrones

- 32 micrones

- 50 micrones

- 100 micrones

- Otros

Forma

- No transparente

- Transparente

Categoría

- Mantillo de barrera contra malezas

- Mantillo estabilizado contra los rayos UV

- Mantillo solarizador

- Mantillo de barrera de pesticidas

- Mantillo repelente de insectos

- Mantillo de liberación herbicida

- Barrera de mantillo para fumigación

- Otros

% de superficie cubierta

- 70-80%

- 40-60%

- 40-45%

- 90-100%

- 20-25%

Duración del cultivo

- Cultivos de corta duración

- Cultivos de duración media

- Cultivos de larga duración

- Otros

Solicitud

- Verduras

- Frutas

- Cereales y Granos

- Semillas oleaginosas y legumbres

- Césped y adornos

- Floricultura

- Otros

Análisis regional del mercado de películas de mantillo biodegradables

Se analiza el mercado y se proporcionan información y tendencias del tamaño del mercado por país, material, espesor, forma, categoría, porcentaje de superficie cubierta, duración del cultivo y aplicación como se mencionó anteriormente.

Los países cubiertos en el informe de mercado son EE. UU., Canadá, México, Brasil, Argentina, Resto de América del Sur, Alemania, Francia, Italia, Reino Unido, Bélgica, España, Rusia, Turquía, Países Bajos, Suiza, Resto de Europa, Japón, China, India, Corea del Sur, Australia y Nueva Zelanda, Singapur, Malasia, Tailandia, Indonesia, Filipinas, Resto de Asia-Pacífico, Emiratos Árabes Unidos, Arabia Saudita, Egipto, Israel, Sudáfrica, Resto de Medio Oriente y África.

Se espera que Asia-Pacífico domine el mercado mundial de películas de mantillo biodegradables debido a la creciente adopción de prácticas sostenibles en cultivos agrícolas y hortícolas. Se espera que India domine el mercado de películas de mantillo biodegradables de Asia-Pacífico debido a las normas y regulaciones gubernamentales para reducir los desechos plásticos. Se espera que Rusia domine el mercado de películas de mantillo biodegradables de Europa debido a la creciente demanda de alternativas biodegradables. Se espera que Estados Unidos domine el mercado de películas de mantillo biodegradables de América del Norte debido a la creciente adopción de películas de mantillo biodegradables en las economías emergentes.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor aguas arriba y aguas abajo, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Cuota de mercado de películas de mantillo biodegradables

El panorama competitivo del mercado proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado.

Los líderes del mercado de películas de mantillo biodegradables que operan en el mercado son:

- BASF SE

- Grupo Barbier

- Dubois Agrinovation Inc.

- Campos de cobertura

- Poliexperto

- SWAMISAMARTH AGROBIOTECNOLOGÍA LLP

- Smurfit Kappa

- CRÍTICA PLÁSTICA

- CAPITÁN POLYPLAST LTD.

- Novamont SpA

- ARMANDO ÁLVAREZ, S.A.

- FILMORGANICO

- BioBag Internacional AS

- Fujian Greenjoy Biomaterial Co., Ltd

- Envase de polietileno Tilak

- CREACIONES SUKI PVT. LTD

- EMBALAJE SPR, LLC

- Chennai Polypack Sociedad Privada Limitada

- Polímeros Shivam

- Paquete Reya

Últimos avances en el mercado de películas de mantillo biodegradables

- Según la ABA, en octubre de 2023, la agricultura australiana utilizó cada año 200.000 kilómetros de película plástica para acolchado. Su eliminación supuso un gran problema, ya que se estima que anualmente se almacenan, entierran o queman unas 40.000 toneladas debido a las limitadas opciones de reciclaje. Los plásticos convencionales degradables por OXO se fracturan en microplásticos cuando se dejan degradar, lo que provoca una contaminación duradera del suelo y su posible entrada en la cadena alimentaria.

- En abril de 2024, la Comisión Europea instó a prohibir a nivel mundial determinados productos plásticos para combatir la contaminación. Abogó por un enfoque integral del ciclo de vida de los plásticos, que incluya prohibiciones y un mejor diseño de los productos. Más de 4000 participantes de diversos sectores se reunieron en Canadá para negociar un tratado jurídicamente vinculante para poner fin a la contaminación por plásticos en 2024. El tratado propuesto hizo hincapié en la eliminación obligatoria y las restricciones de los plásticos problemáticos para reducir los riesgos ambientales y para la salud.

- En octubre de 2023, BioBag International AS. (BioBag World Australia) desarrolló una película de mantillo agrícola biodegradable para el suelo, que facilita su eliminación para los productores sin dañar la calidad del suelo. Verificada por la Asociación Australasiana de Bioplásticos para cumplir con la norma ISO 23517: 2021, se convirtió en el único productor de Australia con esta acreditación, ofreciendo una alternativa ecológica, reduciendo los costos de eliminación y mejorando la salud del suelo.

- En octubre de 2022, según la investigación publicada por ABC Publication, la American Chemical Society se enfrentó a tres desventajas principales con respecto a la película de mantillo biodegradable de ácido poliláctico (PLA): baja ductilidad, alto costo en comparación con el LDPE y biodegradabilidad lenta en el suelo. Con un alargamiento a la rotura de alrededor del 5%, era más del doble de caro que el LDPE y se degradaba rápidamente solo en condiciones de compostaje industrial a 58 °C.

- En febrero de 2020, según el artículo de investigación publicado por ResearchGate GmbH, las películas de mantillo biodegradables, fabricadas principalmente con ácido poliláctico (PLA), cuestan más de 4000 USD por tonelada métrica, significativamente más que los polímeros convencionales, cuyo precio oscila entre 1000 y 1500 USD por tonelada métrica. En consecuencia, se descubrió que las películas de mantillo biodegradables eran entre 1,5 y 1,8 veces más caras que los mantillos de plástico tradicionales.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.