Global Bike Tyre Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

2.85 Billion

USD

6.50 Billion

2024

2032

USD

2.85 Billion

USD

6.50 Billion

2024

2032

| 2025 –2032 | |

| USD 2.85 Billion | |

| USD 6.50 Billion | |

|

|

|

|

Segmentación del mercado global de neumáticos para bicicletas, por tipo de bicicleta (montaña, híbrida, eléctrica, confort, juvenil, crucero y carretera), tipo de producto (neumático con cámara, neumático sin cámara y neumático sólido), tamaño de neumático (hasta 12 pulgadas, de 12 a 22 pulgadas y más de 22 pulgadas), canal de venta (OEM y posventa): tendencias de la industria y pronóstico hasta 2032.

Tamaño del mercado de neumáticos de bicicleta

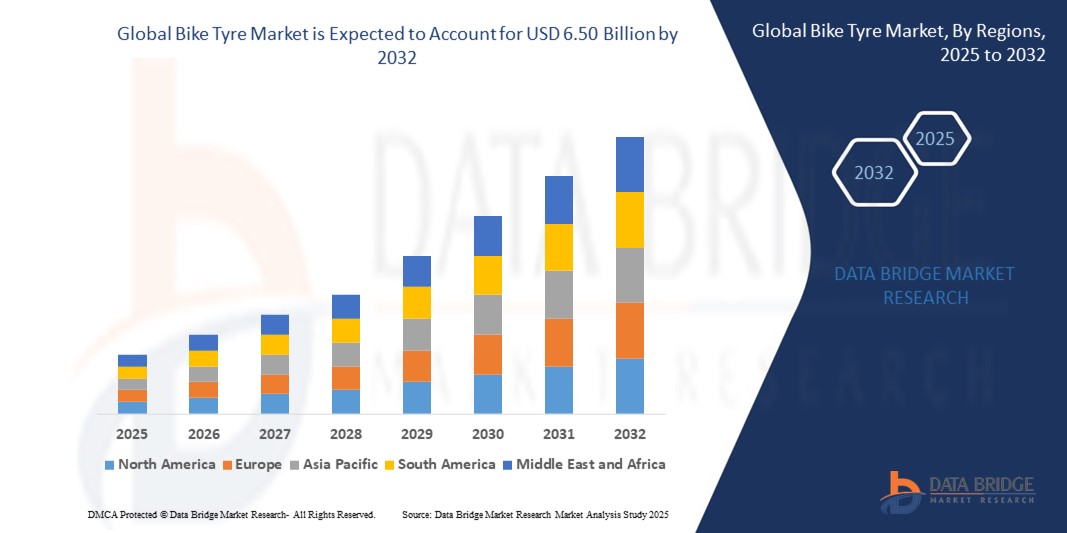

- El tamaño del mercado mundial de neumáticos para bicicletas se valoró en USD 2.85 mil millones en 2024 y se espera que alcance los USD 6.50 mil millones para 2032 , con una CAGR del 10,83% durante el período de pronóstico.

- El crecimiento del mercado se debe en gran medida a la creciente popularidad del ciclismo como modo sostenible de transporte y actividad física, junto con la creciente urbanización y el desarrollo de infraestructura que apoya el uso de la bicicleta.

- Además, la creciente demanda de tecnologías de neumáticos duraderas, ligeras y que mejoren el rendimiento, especialmente en motos eléctricas y deportivas, está consolidando los neumáticos avanzados como un componente fundamental de la movilidad moderna de dos ruedas. Estos factores convergentes están acelerando la innovación y la adopción en el segmento de neumáticos para motos, impulsando así significativamente el crecimiento de la industria.

Análisis del mercado de neumáticos para bicicletas

- Los neumáticos de bicicleta, componentes esenciales para bicicletas de carretera, montaña, híbridas y eléctricas, son cada vez más vitales para respaldar el cambio global hacia la movilidad ecológica, los estilos de vida centrados en la salud y el ciclismo recreativo en las regiones desarrolladas y en desarrollo debido a su impacto en la calidad de conducción, la seguridad y el rendimiento.

- La creciente demanda de neumáticos para bicicletas se debe principalmente al aumento de las actividades ciclistas, la rápida urbanización, las iniciativas gubernamentales que promueven el transporte sostenible y el uso creciente de bicicletas eléctricas y de alto rendimiento que requieren tecnologías de neumáticos avanzadas.

- América del Norte dominó el mercado de neumáticos para bicicletas con la mayor participación en los ingresos del 41,8 % en 2024, caracterizada por un fuerte interés de los consumidores en el ciclismo de fitness y de ocio, una amplia disponibilidad de bicicletas premium y una alta tasa de reemplazo de neumáticos, especialmente en EE. UU. y Canadá.

- Se espera que Asia-Pacífico sea la región de más rápido crecimiento en el mercado de neumáticos para bicicletas durante el período de pronóstico debido al aumento de los ingresos disponibles, las tendencias de desplazamientos urbanos y una sólida base de fabricación en países como China e India.

- El segmento de neumáticos con cámara dominó el mercado de neumáticos para bicicletas con una participación de mercado del 48,3 % en 2024, respaldado por su relación calidad-precio, amplia compatibilidad entre tipos de bicicletas y una fuerte demanda del mercado de accesorios, particularmente en las economías emergentes.

Alcance del informe y segmentación del mercado de neumáticos para bicicletas

|

Atributos |

Perspectivas clave del mercado de neumáticos para bicicletas |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de neumáticos para bicicletas

Creciente demanda de neumáticos para bicicletas eléctricas y materiales sostenibles

- Una tendencia significativa y en auge en el mercado global de neumáticos para bicicletas es la creciente demanda de neumáticos específicos para bicicletas eléctricas y la transición hacia materiales sostenibles y ecológicos en su fabricación. A medida que las bicicletas eléctricas ganan popularidad en todo el mundo para desplazamientos urbanos y uso recreativo, los fabricantes se centran en neumáticos que puedan soportar mayores velocidades, mayor peso y el par generado por las transmisiones eléctricas.

- Por ejemplo, Continental ofrece la línea de neumáticos Contact Plus E, diseñada específicamente para bicicletas eléctricas, que ofrece protección antipinchazos, alto kilometraje y mejor agarre. De igual manera, el Marathon E-Plus de Schwalbe está diseñado para bicicletas eléctricas y cumple con la certificación europea ECE-R75.

- Paralelamente, existe un creciente impulso hacia soluciones de neumáticos sostenibles que utilizan compuestos de caucho natural, aditivos de origen biológico y materiales reciclados. Empresas como Michelin y Vittoria están explorando alternativas ecológicas como el grafeno y el sílice para reducir las emisiones de carbono durante la producción y prolongar la vida útil de los neumáticos.

- La integración de un diseño inteligente, que incluye capas antipinchazos, compatibilidad con tubeless y patrones de banda de rodadura inteligentes para múltiples terrenos, mejora aún más el rendimiento del producto. Los usuarios de bicicletas eléctricas se benefician especialmente de flancos reforzados y compuestos más duraderos, lo que mejora la seguridad y la fiabilidad.

- Esta tendencia hacia neumáticos de bicicleta duraderos, de alto rendimiento y sostenibles está transformando las expectativas de los consumidores, especialmente en los mercados de movilidad urbana. Por ello, las principales empresas están invirtiendo en I+D para crear neumáticos que equilibren el impacto ambiental, la durabilidad y el rendimiento en condiciones de alto estrés, lo que contribuye a establecer un nuevo estándar tanto para los segmentos de bicicletas eléctricas como para el ciclismo tradicional.

- El creciente interés en los desplazamientos sostenibles, apoyado por iniciativas gubernamentales y una mejor infraestructura para ciclistas, está acelerando la demanda de tecnologías avanzadas para neumáticos de bicicleta tanto en los mercados desarrollados como en los emergentes.

Dinámica del mercado de neumáticos para bicicletas

Conductor

Creciente popularidad del ciclismo y la adopción de bicicletas eléctricas

- La creciente adopción de la bicicleta como medio de transporte principal o complementario, herramienta de ejercicio y actividad recreativa es un importante impulsor del mercado mundial de neumáticos para bicicletas. Esta tendencia es especialmente evidente en las zonas urbanas, donde la preocupación por la contaminación, la congestión vehicular y la salud personal está impulsando una transición hacia el ciclismo.

- Por ejemplo, en 2024, las ventas mundiales de bicicletas eléctricas experimentaron un crecimiento de dos dígitos, especialmente en Europa y Norteamérica, impulsadas por la concienciación medioambiental, el ahorro de combustible y las subvenciones gubernamentales. Estos avances están impulsando la demanda de neumáticos robustos y de alta calidad que se adapten a diversos terrenos y necesidades de rendimiento.

- Además, el aumento de los ingresos disponibles y los cambios en el estilo de vida de los consumidores están promoviendo el uso de bicicletas de alta gama, lo que a su vez impulsa la demanda de tecnologías de neumáticos de primera calidad, como productos sin cámara, resistentes a los pinchazos y específicos para el terreno.

- La creciente infraestructura ciclista, los programas de bicicletas compartidas y la mayor participación en deportes y eventos ciclistas están contribuyendo aún más a los ciclos de reemplazo de neumáticos y a la expansión general del mercado.

- Las asociaciones de fabricantes de equipos originales (OEM) con fabricantes de bicicletas y la expansión de los canales de venta de repuestos en línea y fuera de línea están haciendo que los neumáticos sean más accesibles y están estimulando el crecimiento, particularmente en las economías en desarrollo donde la propiedad de bicicletas está aumentando rápidamente.

Restricción/Desafío

Volatilidad de los precios de las materias primas e infiltración de productos falsificados

- El mercado de neumáticos para bicicletas se enfrenta a importantes desafíos debido a la fluctuación de los precios de materias primas como el caucho natural y sintético , el negro de humo y los derivados del petróleo crudo. Estas fluctuaciones de precios afectan los costes de producción y los márgenes de beneficio, especialmente para los pequeños fabricantes con una flexibilidad de precios limitada.

- Por ejemplo, las incertidumbres geopolíticas, las perturbaciones climáticas que afectan a las plantaciones de caucho y las limitaciones de la cadena de suministro han contribuido a la fijación de precios inconsistentes de insumos clave desde 2022, lo que obliga a los fabricantes de neumáticos a adoptar estrategias de optimización de costos o aumentar los precios de los productos, ambos factores que pueden afectar la competitividad del mercado.

- Además, el mercado global se enfrenta cada vez más al problema de los neumáticos falsificados y de baja calidad, especialmente en regiones con precios sensibles. Estos productos comprometen la seguridad del conductor y afectan negativamente la reputación de marcas de confianza.

- Si bien los organismos reguladores están endureciendo los estándares y los controles de calidad, la falta de cumplimiento en algunas regiones dificulta la protección efectiva del mercado. Esto socava la confianza del consumidor y genera competencia desleal para los actores establecidos.

- Para superar estos desafíos, las empresas se están centrando en asegurar cadenas de suministro de materias primas sostenibles, desarrollar tecnologías de fabricación rentables e invertir en la protección de la marca a través de tecnologías de autenticación, certificación y campañas de concientización para reforzar la confianza y el crecimiento a largo plazo.

Análisis del mercado de neumáticos para bicicletas

El mercado está segmentado según el tipo de bicicleta, el tipo de producto, el tamaño de los neumáticos y el canal de ventas.

- Por tipo de bicicleta

Según el tipo de bicicleta, el mercado de neumáticos se segmenta en bicicletas de montaña, híbridas, eléctricas, de confort, juveniles, de paseo y de carretera. El segmento de bicicletas de carretera dominó el mercado con la mayor cuota de ingresos, un 32,4 %, en 2024, gracias a su uso generalizado para desplazamientos urbanos, fitness y viajes de larga distancia. La creciente preferencia por bicicletas ligeras y de alta velocidad en las ciudades, junto con el creciente número de aficionados al ciclismo que participan en eventos de ciclismo de carretera, refuerza el dominio de este segmento.

Se prevé que el segmento de bicicletas eléctricas experimente la tasa de crecimiento más rápida, del 21,1 %, entre 2025 y 2032, impulsada por la creciente adopción de bicicletas eléctricas en todo el mundo. Las bicicletas eléctricas requieren neumáticos especializados con mayor durabilidad, agarre y capacidad de carga, lo que impulsa a los fabricantes a desarrollar soluciones innovadoras de neumáticos específicos para bicicletas eléctricas. Los incentivos gubernamentales para la movilidad eléctrica y el desarrollo de infraestructuras para el transporte ecológico también contribuyen a la rápida expansión de este segmento.

- Por tipo de producto

Según el tipo de producto, el mercado de neumáticos para bicicletas se segmenta en neumáticos con cámara, neumáticos sin cámara y neumáticos sólidos. El segmento de neumáticos con cámara obtuvo la mayor cuota de mercado, con un 48,3%, en 2024, gracias a su rentabilidad, facilidad de instalación y compatibilidad con una amplia gama de bicicletas. Los neumáticos con cámara son especialmente comunes en las regiones en desarrollo y se prefieren en el mercado de repuestos por su asequibilidad y disponibilidad.

Se proyecta que el segmento de neumáticos sin cámara crecerá a su tasa de crecimiento anual compuesto (TCAC) más alta entre 2025 y 2032, ya que los ciclistas de alto rendimiento y los usuarios de bicicletas eléctricas los prefieren cada vez más por su mayor resistencia a los pinchazos, mejor tracción y menor resistencia a la rodadura. Los avances en selladores de neumáticos y compatibilidad de llantas impulsan aún más la adopción de neumáticos sin cámara tanto en fabricantes de equipos originales (OEM) como en el mercado de accesorios.

- Por tamaño de neumático

Según el tamaño de las llantas, el mercado de llantas para bicicletas se segmenta en hasta 12 pulgadas, de 12 a 22 pulgadas y más de 22 pulgadas. El segmento de 12 a 22 pulgadas dominó el mercado con una participación en los ingresos del 45,6 % en 2024, gracias a su amplio uso en diversas categorías de bicicletas, como bicicletas juveniles, híbridas y de paseo estándar. Estos tamaños ofrecen versatilidad, lo que los hace adecuados tanto para bicicletas de nivel básico como de gama media.

Se prevé que el segmento de bicicletas de 22 pulgadas alcance su mayor tasa de crecimiento anual compuesto (TCAC) entre 2025 y 2032, impulsado por la creciente popularidad de las bicicletas de alto rendimiento y de montaña, que requieren ruedas más grandes para un mejor control, velocidad y capacidad todoterreno. Este segmento también se beneficia del crecimiento del ciclismo recreativo y los deportes de competición.

- Por canal de venta

Según el canal de venta, el mercado de neumáticos para motocicletas se segmenta en fabricantes de equipos originales (OEM) y posventa. El segmento de posventa lideró el mercado con la mayor cuota de ingresos, un 63,1 %, en 2024, gracias a la frecuente necesidad de sustitución de neumáticos debido al desgaste, los cambios de terreno y las mejoras de rendimiento. El creciente interés de los consumidores por la personalización, sumado a la expansión de las plataformas de venta online, ha impulsado aún más las ventas de posventa a nivel mundial.

Se espera que el segmento OEM experimente un crecimiento sostenido durante el período de pronóstico, impulsado por el aumento de la producción y las ventas de bicicletas nuevas, especialmente las versiones eléctricas e híbridas. Las alianzas estratégicas entre fabricantes de neumáticos y fabricantes de equipos originales (OEM) de bicicletas están impulsando la demanda de modelos de neumáticos especializados preinstalados.

Análisis regional del mercado de neumáticos para bicicletas

- América del Norte dominó el mercado de neumáticos para bicicletas con la mayor participación en los ingresos del 41,8 % en 2024, caracterizada por un fuerte interés de los consumidores en el ciclismo de fitness y de ocio, una amplia disponibilidad de bicicletas premium y una alta tasa de reemplazo de neumáticos, especialmente en EE. UU. y Canadá.

- Los consumidores de la región valoran mucho los neumáticos duraderos, livianos y resistentes a los pinchazos que mejoran la calidad de conducción y son compatibles con diversos terrenos, particularmente en entornos urbanos y todoterreno.

- Esta fuerte presencia en el mercado está respaldada además por una infraestructura ciclista bien desarrollada, un alto gasto de los consumidores en bicicletas y accesorios de primera calidad y una mayor conciencia de la salud, la sostenibilidad y las opciones de transporte ecológicas.

Análisis del mercado de neumáticos para bicicletas en EE. UU.

El mercado estadounidense de neumáticos para bicicletas captó la mayor cuota de ingresos, con un 79%, en 2024 en Norteamérica, impulsado por el auge del ciclismo recreativo y de fitness, la creciente adopción de bicicletas eléctricas y una infraestructura ciclista bien desarrollada. Los consumidores invierten cada vez más en neumáticos de alto rendimiento y resistentes a los pinchazos para mejorar la durabilidad y la calidad de conducción en terrenos urbanos y todoterreno. El auge del mantenimiento de bicicletas por parte de los aficionados y la sólida demanda de neumáticos premium de posventa impulsan aún más el mercado. Además, la expansión del comercio electrónico y de las tiendas especializadas de bicicletas impulsa la accesibilidad y la personalización de los productos.

Análisis del mercado europeo de neumáticos para bicicletas

Se proyecta que el mercado europeo de neumáticos para bicicletas se expanda a una tasa de crecimiento anual compuesta (TCAC) sustancial durante el período de pronóstico, impulsado principalmente por la creciente concienciación ambiental, una infraestructura ciclista consolidada y políticas gubernamentales de apoyo que promueven la movilidad sostenible. El aumento de las ventas de bicicletas eléctricas y las tendencias de desplazamiento urbano están impulsando la demanda de neumáticos de alto rendimiento y duraderos. Europa está experimentando un fuerte crecimiento en las categorías de ciclismo urbano y recreativo, con neumáticos que se actualizan o reemplazan con frecuencia como parte de la creciente actividad del mercado de accesorios y la preferencia de los consumidores por un mayor rendimiento y seguridad.

Análisis del mercado de neumáticos para bicicletas del Reino Unido

Se prevé que el mercado británico de neumáticos para bicicletas crezca a una tasa de crecimiento anual compuesta (TCAC) notable durante el período de pronóstico, impulsado por la creciente adopción del ciclismo como medio de transporte diario y actividad física. Las inversiones gubernamentales en infraestructuras adaptadas a las bicicletas y la mayor participación en el ciclismo recreativo están impulsando las ventas de neumáticos. Los consumidores muestran una fuerte preferencia por los neumáticos para bicicletas de carretera e híbridas, especialmente los que ofrecen resistencia a los pinchazos y un alto agarre. Además, la sólida red de tiendas en línea del Reino Unido y el entusiasmo por las bicicletas eléctricas contribuyen a una mayor demanda de productos especializados en neumáticos.

Análisis del mercado alemán de neumáticos para bicicletas

Se espera que el mercado alemán de neumáticos para bicicletas se expanda a una tasa de crecimiento anual compuesta (TCAC) considerable durante el período de pronóstico, impulsado por la sólida cultura ciclista del país, la alta penetración de las bicicletas eléctricas y la prioridad en la sostenibilidad. Los consumidores alemanes priorizan los productos ecológicos y de alta durabilidad, lo que impulsa la innovación en el diseño y los materiales de los neumáticos. El segmento de posventa se mantiene sólido gracias a los frecuentes cambios de neumáticos y la personalización entre los ciclistas urbanos y de cicloturismo. La integración con tecnologías de ciclismo inteligente y la prioridad en la seguridad y el rendimiento siguen influyendo en el comportamiento de compra.

Análisis del mercado de neumáticos para bicicletas en Asia-Pacífico

Se prevé que el mercado de neumáticos para bicicletas de Asia-Pacífico crezca a la tasa de crecimiento anual compuesta (TCAC) más rápida, del 23,4 %, durante el período de pronóstico de 2025 a 2032, impulsado por la rápida urbanización, el aumento de la renta disponible y el creciente uso de la bicicleta en países como China, India e Indonesia. El creciente apoyo gubernamental al transporte no motorizado y a las iniciativas de ciudades inteligentes está impulsando la demanda de neumáticos para bicicletas, tanto tradicionales como eléctricas. El papel de Asia-Pacífico como centro global de fabricación de bicicletas y componentes también garantiza precios competitivos y una amplia disponibilidad de productos en todos los mercados.

Análisis del mercado de neumáticos para bicicletas en Japón

El mercado japonés de neumáticos para bicicletas está cobrando impulso gracias a la sólida cultura del ciclismo urbano, el creciente interés en la movilidad ecológica y el creciente uso de bicicletas eléctricas. Los consumidores japoneses priorizan la calidad, la seguridad y la innovación tecnológica, lo que fomenta la demanda de neumáticos avanzados con características como resistencia a los pinchazos, diseño ligero y compatibilidad inteligente. La integración del ciclismo en los desplazamientos diarios y las rutinas de ejercicio, junto con las necesidades del envejecimiento de la población, impulsa la demanda de neumáticos fiables y de fácil mantenimiento.

Análisis del mercado de neumáticos para bicicletas en India

El mercado indio de neumáticos para bicicletas representó la mayor cuota de ingresos en Asia-Pacífico en 2024, gracias al alto número de bicicletas, su asequibilidad y el rápido crecimiento de la población urbana del país. El mercado se sustenta en una sólida base manufacturera nacional, una fuerte demanda tanto en el segmento urbano como en el rural, y la creciente popularidad de las bicicletas eléctricas y de alto rendimiento. Se espera que las iniciativas gubernamentales que promueven el ciclismo y el transporte asequible, junto con la creciente concienciación sobre sus beneficios para la salud y el medio ambiente, impulsen aún más la demanda en los canales de fabricantes de equipos originales (OEM) y de posventa.

Cuota de mercado de neumáticos de bicicleta

La industria de neumáticos para bicicletas está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Continental AG (Alemania)

- Michelin (Francia)

- Pirelli y CSpA (Italia)

- Bridgestone Corporation (Japón)

- Ralf Bohle GmbH (Alemania)

- Cheng Shin Rubber Ind. Co., Ltd. (Taiwán)

- Neumáticos de bicicleta Goodyear (EE. UU.)

- Kenda Rubber Industrial Co., Ltd. (Taiwán)

- Corporación Panaracer (Japón)

- Vittoria SpA (Italia)

- Hutchinson SA (Francia)

- Grupo Trelleborg (República Checa)

- Innova Rubber Co., Ltd. (Tailandia)

- Cheng Shin Tire (Taiwán)

- Inoue Rubber Co., Ltd. (Japón)

- Duro Tire & Wheel (Taiwán)

- Componentes de bicicleta especializados, Inc. (EE. UU.)

- Trek Bicycle Corporation (EE. UU.)

- Bicicletas para senderos silvestres (EE. UU.)

- Ralson India Ltd. (India)

¿Cuáles son los desarrollos recientes en el mercado mundial de neumáticos de bicicleta?

- En mayo de 2023, Continental AG amplió su capacidad de producción de neumáticos para bicicletas en su planta de Korbach (Alemania), con el objetivo de satisfacer la creciente demanda mundial de neumáticos de alto rendimiento específicos para bicicletas eléctricas. Esta inversión estratégica subraya el enfoque de Continental en soluciones de movilidad premium y su compromiso de ofrecer tecnologías de neumáticos de vanguardia diseñadas para la seguridad, la velocidad y la durabilidad en diversas categorías de ciclismo, especialmente en Europa y Norteamérica.

- En abril de 2023, Michelin anunció el lanzamiento de su nueva gama E-Wild de neumáticos para bicicleta de montaña, diseñados específicamente para bicicletas eléctricas de montaña (e-MTB). Estos neumáticos ofrecen mayor agarre, durabilidad y resistencia al par, satisfaciendo las necesidades específicas de los ciclistas de e-MTB. Este desarrollo refleja la innovación continua de Michelin en soluciones de ciclismo sostenibles y de alto rendimiento, y destaca su esfuerzo por liderar el segmento de las bicicletas eléctricas, en rápido crecimiento.

- En marzo de 2023, JK Tyre & Industries Ltd., un destacado fabricante indio de neumáticos, entró en el segmento de neumáticos premium para bicicletas con el lanzamiento de su serie Blaze. Diseñada tanto para bicicletas de paseo como para bicicletas de alto rendimiento, esta serie busca satisfacer las necesidades del creciente segmento demográfico de ciclistas de clase media de la India. Esta iniciativa refleja la estrategia de diversificación de JK Tyre y su intención de captar una mayor cuota de mercado de la movilidad en dos ruedas.

- En febrero de 2023, Pirelli presentó sus nuevos neumáticos Scorpion XC RC, pensados para el ciclismo de montaña cross-country competitivo. El nuevo producto integra el compuesto SmartGRIP y la tecnología Lite Liner para una protección superior contra pinchazos y una baja resistencia a la rodadura. Este lanzamiento se enmarca en la estrategia de Pirelli de reforzar su presencia en el ciclismo de alto rendimiento y atraer a ciclistas profesionales y aficionados de todo el mundo.

- En enero de 2023, Rubena Tyres (una marca del Grupo Trelleborg) lanzó una nueva línea de neumáticos ecológicos para bicicletas, fabricados con materiales parcialmente reciclados y compuestos de caucho de origen biológico. Esta línea de productos satisface la creciente demanda de componentes de ciclismo sostenibles y refuerza el compromiso de Rubena con la responsabilidad ambiental y la innovación. Esta iniciativa respalda las tendencias más amplias del sector hacia soluciones de movilidad más ecológicas sin comprometer el rendimiento ni la fiabilidad.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.