Global Banking Hardware Maintenance Software Support And Helpdesk Support Services Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

12.16 Billion

USD

22.67 Billion

2024

2032

USD

12.16 Billion

USD

22.67 Billion

2024

2032

| 2025 –2032 | |

| USD 12.16 Billion | |

| USD 22.67 Billion | |

|

|

|

|

Segmentación del mercado global de servicios de mantenimiento de hardware, soporte de software y soporte técnico bancario, por tipo de servicio (costos de mantenimiento de cajeros automáticos, costos de soporte operativo de cajeros automáticos, sistemas de señalización digital y sistema de gestión de colas), aplicación (clasificadores de divisas, detectores y contadores, quioscos bancarios, dispositivos de usuario final y periféricos), componentes (hardware y software): tendencias de la industria y pronóstico hasta 2032.

Tamaño del mercado de servicios de mantenimiento de hardware, soporte de software y soporte técnico bancario

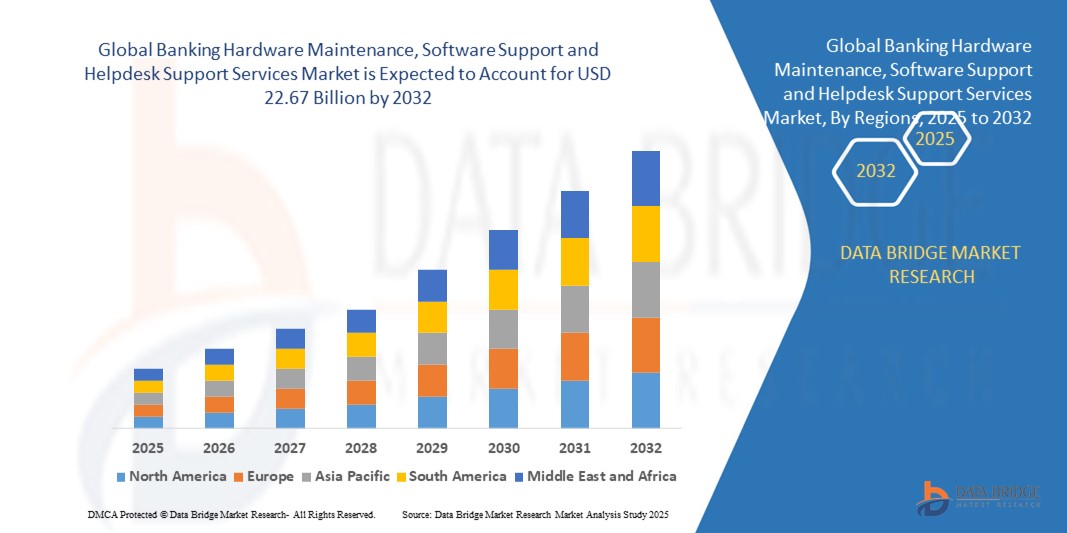

- El tamaño del mercado global de servicios de mantenimiento de hardware, soporte de software y soporte de mesa de ayuda bancaria se valoró en USD 12,16 mil millones en 2024 y se espera que alcance los USD 22,67 mil millones para 2032 , con una CAGR de 8,10% durante el período de pronóstico .

- El crecimiento del mercado está impulsado en gran medida por la creciente digitalización de las operaciones bancarias, la creciente adopción de tecnologías de autoservicio como cajeros automáticos y quioscos, y la creciente demanda de servicios bancarios ininterrumpidos y confiabilidad del sistema.

- La creciente dependencia de las plataformas de banca digital y la necesidad de garantizar la disponibilidad del sistema las 24 horas del día, los 7 días de la semana, están impulsando a las instituciones financieras a realizar grandes inversiones en servicios de soporte integrales, que incluyen mantenimiento preventivo de hardware, resolución de problemas de software en tiempo real y operaciones de soporte técnico dedicadas.

Análisis del mercado de servicios de mantenimiento de hardware, soporte de software y asistencia técnica para bancos

- El creciente enfoque en la ciberseguridad y el cumplimiento normativo está alentando a los bancos a invertir en servicios proactivos de mantenimiento y soporte.

- La rápida transformación de la infraestructura bancaria, junto con la integración de la Inteligencia Artificial y la Internet de las Cosas en los sistemas bancarios, está impulsando la demanda de soluciones especializadas de soporte de software y hardware.

- América del Norte dominó el mercado de servicios de mantenimiento de hardware, soporte de software y soporte de mesa de ayuda bancaria con la mayor participación en los ingresos del 38,26 % en 2024, impulsada por la fuerte presencia de instituciones financieras y su enfoque continuo en mejorar la infraestructura digital y la eficiencia operativa.

- Se espera que la región Asia-Pacífico sea testigo de la tasa de crecimiento más alta en el mercado global de mantenimiento de hardware bancario, soporte de software y servicios de soporte de mesa de ayuda, impulsado por la expansión de las redes bancarias en áreas rurales y semiurbanas, el aumento de las instalaciones de cajeros automáticos y quioscos de autoservicio, y la creciente necesidad de soluciones de soporte al cliente localizadas y multilingües en diversos entornos bancarios.

- El segmento de costos de mantenimiento de cajeros automáticos dominó el mercado con la mayor participación en ingresos, un 39,4 % en 2024, impulsado por la alta dependencia de los cajeros automáticos para transacciones en efectivo y servicios bancarios 24/7. Los bancos priorizan el mantenimiento de los cajeros automáticos para garantizar la disponibilidad ininterrumpida del servicio y minimizar el tiempo de inactividad, lo cual es fundamental para la satisfacción del cliente y la eficiencia operativa.

Alcance del informe y segmentación del mercado de servicios de mantenimiento de hardware, soporte de software y soporte de mesa de ayuda para banca

|

Atributos |

Servicios de mantenimiento de hardware, soporte de software y soporte técnico bancario: información clave del mercado |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

• Expansión de soluciones de mantenimiento predictivo basadas en IA |

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos del mercado, como el valor de mercado, la tasa de crecimiento, los segmentos del mercado, la cobertura geográfica, los actores del mercado y el escenario del mercado, el informe de mercado elaborado por el equipo de investigación de mercado de Data Bridge incluye un análisis en profundidad de expertos, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y análisis pestle. |

Tendencias del mercado de servicios de mantenimiento de hardware, soporte de software y soporte técnico bancario

Creciente demanda de servicios integrados de soporte de TI en la infraestructura bancaria

- La creciente complejidad de las operaciones bancarias y las plataformas digitales está impulsando un aumento repentino de la demanda de servicios integrados de hardware, software y soporte técnico. Las instituciones financieras están adoptando cada vez más el soporte informático centralizado para optimizar el rendimiento, minimizar el tiempo de inactividad y mantener el cumplimiento normativo, especialmente a medida que el sector migra hacia modelos de banca híbrida y remota.

- Los bancos priorizan los contratos de servicio integrales que ofrecen soluciones integrales de mantenimiento y soporte, incluyendo la monitorización proactiva de sistemas y la resolución de problemas. Estos servicios garantizan interrupciones mínimas en las operaciones y mejoran la fiabilidad de las redes de cajeros automáticos, los centros de datos y las interfaces de los clientes.

- Esta tendencia también se ve impulsada por las iniciativas de transformación digital, donde las soluciones bancarias en la nube y las mejoras en ciberseguridad están ampliando la necesidad de soporte técnico constante. Los proveedores de servicios están integrando la monitorización en tiempo real y el diagnóstico basado en IA para anticipar fallos y reducir los tiempos de respuesta a incidentes.

- Por ejemplo, en 2024, un importante banco del sudeste asiático se asoció con una empresa global de TI para implementar un modelo integrado de soporte de hardware y software en sus sucursales regionales. Esto generó una mejora del 28 % en el tiempo de actividad del sistema y redujo el tiempo de resolución de incidencias en un 36 %.

- A medida que los bancos adoptan la banca abierta, las plataformas móviles y las herramientas de inteligencia artificial, los proveedores de servicios de soporte evolucionan para ofrecer un soporte ágil y a demanda. El futuro del mercado reside en modelos de servicio escalables y predictivos que reduzcan costos y mejoren la satisfacción del cliente.

Dinámica del mercado de servicios de mantenimiento de hardware, soporte de software y soporte técnico bancario

Conductor

Énfasis creciente en la continuidad operativa y el tiempo de actividad en las redes bancarias

Las instituciones financieras se encuentran bajo una enorme presión para brindar acceso ininterrumpido a los servicios bancarios en plataformas digitales y físicas. A medida que aumentan las expectativas de los clientes de una disponibilidad de servicio 24/7, los bancos invierten en sistemas de soporte robustos para mantener la continuidad operativa. Esto es especialmente crucial para la disponibilidad de los cajeros automáticos, la banca en línea segura y el procesamiento de transacciones interbancarias.

Con la expansión de la banca digital y la proliferación de tecnologías de autoservicio, la demanda de mantenimiento oportuno y resolución de problemas de software ha aumentado. Garantizar el funcionamiento ininterrumpido de la infraestructura, tanto tradicional como moderna, es esencial para evitar pérdidas de ingresos, retrasos en el servicio e insatisfacción del cliente.

Las regulaciones gubernamentales y los estándares del sector también están impulsando a los bancos a priorizar la disponibilidad del sistema y la integridad de los datos. Como resultado, se ha intensificado la necesidad de contratos de soporte dedicados que garanticen el tiempo de respuesta y los protocolos de escalamiento en la banca minorista y comercial.

• Por ejemplo, en 2023, un banco europeo líder informó una reducción del 22 % en las interrupciones del servicio después de expandir sus servicios de soporte de hardware y software subcontratados, lo que garantiza un rendimiento continuo del sistema en todas las sucursales y canales digitales.

La búsqueda de cero tiempos de inactividad y un servicio en tiempo real ha convertido los servicios de soporte en un activo estratégico. Los proveedores que ofrecen capacidades de respuesta integradas y escalonadas están mejor posicionados para satisfacer las crecientes demandas del sector y asegurar contratos a largo plazo.

Restricción/Desafío

Altos costos de servicio y complejidad de la infraestructura heredada

El costo asociado con el mantenimiento continuo de hardware bancario obsoleto y plataformas de software heredadas personalizadas sigue siendo un desafío importante. Muchos bancos, en particular las instituciones medianas, encuentran financieramente oneroso asegurar soporte integral para sistemas obsoletos que requieren atención especializada y parches periódicos.

Los sistemas heredados suelen carecer de compatibilidad con las herramientas modernas, lo que resulta en tiempos de resolución más largos y una mayor dependencia de los técnicos de cada proveedor. Esta falta de interoperabilidad incrementa los costos generales de soporte y limita la flexibilidad operativa al migrar a nuevas plataformas.

Además, la escasez de profesionales cualificados con experiencia en el mantenimiento de sistemas bancarios antiguos agrava aún más el problema. La curva de aprendizaje y los altos costes asociados a la formación o la externalización de estos servicios limitan la escalabilidad y afectan a la eficiencia.

• Por ejemplo, en 2022, varias cooperativas de crédito de América del Norte destacaron excesos presupuestarios causados por el mantenimiento de redes de cajeros automáticos obsoletas, y los servicios de soporte representaron más del 35 % de su gasto en TI.

• Para abordar esto, los bancos deben priorizar la modernización de la infraestructura, eliminar gradualmente los sistemas obsoletos y buscar proveedores de apoyo que ofrezcan vías de migración y modelos de soporte híbridos rentables tanto para tecnologías antiguas como nuevas.

Alcance del mercado de servicios de mantenimiento de hardware, soporte de software y soporte técnico bancario

El mercado está segmentado según el tipo de servicio, la aplicación y los componentes.

- Por tipo de servicio

Según el tipo de servicio, el mercado de servicios de mantenimiento de hardware, soporte de software y soporte técnico bancario se segmenta en costos de mantenimiento de cajeros automáticos, costos de soporte operativo de cajeros automáticos, sistemas de señalización digital y sistemas de gestión de colas. El segmento de costos de mantenimiento de cajeros automáticos dominó el mercado con la mayor participación en ingresos, un 39,4 % en 2024, debido a la alta dependencia de los cajeros automáticos para las transacciones en efectivo y los servicios bancarios 24/7. Los bancos priorizan el mantenimiento de los cajeros automáticos para garantizar la disponibilidad ininterrumpida del servicio y minimizar el tiempo de inactividad, lo cual es fundamental para la satisfacción del cliente y la eficiencia operativa.

Se prevé que el segmento de sistemas de señalización digital experimente el mayor crecimiento entre 2025 y 2032, impulsado por la creciente demanda de una mejor comunicación con los clientes en las sucursales y actualizaciones de servicio en tiempo real. Estos sistemas proporcionan a los bancos una entrega dinámica de contenido, lo que facilita la promoción de la marca y el control de colas. La integración con plataformas de gestión centralizada mejora aún más su utilidad en redes bancarias con múltiples sucursales.

- Por aplicación

Según su aplicación, el mercado se segmenta en clasificadores, detectores y contadores de billetes, quioscos bancarios, dispositivos para usuarios finales y periféricos. El segmento de quioscos bancarios obtuvo la mayor cuota de mercado en 2024 gracias al aumento de la implementación de soluciones de autoservicio destinadas a reducir los tiempos de espera y mejorar la eficiencia de la atención al cliente. Los quioscos desempeñan un papel fundamental en la gestión de tareas bancarias rutinarias, como la actualización de cuentas, el depósito de cheques y la impresión de documentos.

Se prevé que el segmento de detectores y contadores de divisas experimente el mayor crecimiento entre 2025 y 2032, impulsado por un mayor enfoque en la detección de fraudes, la precisión en el manejo de efectivo y el cumplimiento normativo. Estos dispositivos cuentan cada vez más con contratos de mantenimiento y actualizaciones de software para garantizar un rendimiento óptimo y el seguimiento de datos.

- Por componentes

En función de los componentes, el mercado se segmenta en hardware y software. El segmento de hardware dominó el mercado en 2024, debido a la amplia instalación y el mantenimiento de la infraestructura bancaria física, incluyendo cajeros automáticos, quioscos y recicladores de efectivo. La demanda de mantenimiento periódico de hardware y la sustitución de sistemas heredados contribuye significativamente a los costos de servicio.

Se prevé que el segmento de software experimente el mayor crecimiento entre 2025 y 2032, impulsado por la creciente adopción de plataformas de banca digital y tecnologías de automatización. Los bancos están invirtiendo en diagnósticos remotos, parches de software y soporte técnico para garantizar la seguridad de los sistemas, reducir las interrupciones y mejorar la experiencia del usuario.

Análisis regional del mercado de servicios de mantenimiento de hardware, soporte de software y soporte técnico bancario

• América del Norte dominó el mercado de servicios de mantenimiento de hardware, soporte de software y soporte de mesa de ayuda bancaria con la mayor participación en los ingresos del 38,26 % en 2024, impulsada por la fuerte presencia de instituciones financieras y su enfoque continuo en mejorar la infraestructura digital y la eficiencia operativa.

• La región se beneficia de la adopción temprana de sistemas bancarios avanzados, el aumento de las inversiones en ciberseguridad y una sólida demanda de soporte técnico las 24 horas, los 7 días de la semana en sucursales urbanas y suburbanas.

• La alta demanda de una experiencia de usuario fluida, junto con los estrictos requisitos de cumplimiento normativo, está obligando a los bancos a externalizar los servicios de mantenimiento y soporte, contribuyendo así al crecimiento del mercado en toda la región.

Análisis del mercado de servicios de mantenimiento de hardware, soporte de software y asistencia técnica del sector bancario estadounidense

El mercado estadounidense capturó la mayor participación en los ingresos en 2024 en Norteamérica, impulsado por la rápida digitalización de los servicios bancarios y la alta dependencia de los cajeros automáticos y quioscos para usuarios finales para las transacciones financieras. La creciente preferencia por los proveedores de servicios gestionados que ofrecen paquetes integrales de soporte de hardware y software está acelerando el crecimiento del mercado. La creciente demanda de resolución de problemas en tiempo real, parches de software y mantenimiento de equipos bancarios críticos está impulsando la inversión continua en infraestructura de soporte técnico.

Análisis del mercado de servicios de mantenimiento de hardware, soporte de software y asistencia técnica de banca europea

Se prevé que el mercado europeo experimente el mayor crecimiento entre 2025 y 2032, impulsado por la creciente modernización de la infraestructura bancaria tradicional y la creciente dependencia de proveedores externos de mantenimiento. Ante el creciente escrutinio regulatorio y las exigencias de protección de datos, los bancos de toda la región están recurriendo a servicios gestionados para garantizar la disponibilidad y el cumplimiento normativo de sus sistemas. La creciente adopción de quioscos de autoservicio y sistemas de gestión de colas en la banca minorista incrementa aún más la demanda de servicios.

Análisis del mercado de servicios de mantenimiento de hardware, soporte de software y asistencia técnica del sector bancario del Reino Unido

Se prevé que el mercado del Reino Unido experimente la tasa de crecimiento más rápida entre 2025 y 2032, impulsada por la transición del país hacia modelos bancarios híbridos que combinan sucursales físicas y canales digitales. A medida que los bancos priorizan la satisfacción del cliente, aumenta la necesidad de un funcionamiento ininterrumpido del sistema y de un soporte informático proactivo. Las instituciones financieras invierten cada vez más en servicios externalizados de mantenimiento y asistencia técnica para reducir el tiempo de inactividad, mejorar la eficiencia y satisfacer las cambiantes expectativas de los consumidores.

Análisis del mercado de servicios de mantenimiento de hardware, soporte de software y asistencia técnica del sector bancario alemán

Se prevé que Alemania experimente la tasa de crecimiento más rápida entre 2025 y 2032, impulsada por una fuerte demanda de soluciones bancarias automatizadas y sólidos marcos de soporte de TI. Los bancos alemanes están invirtiendo en servicios de soporte de software y hardware seguros y escalables para abordar las crecientes ciberamenazas y mantener servicios bancarios ininterrumpidos. El énfasis del país en la infraestructura de nivel industrial y el cumplimiento normativo garantiza una demanda constante de sistemas de mantenimiento y soporte de alta calidad.

Análisis del mercado de servicios de soporte técnico, mantenimiento de hardware y software para banca en Asia-Pacífico

Se prevé que el mercado de Asia-Pacífico experimente la tasa de crecimiento más rápida entre 2025 y 2032, impulsado por la rápida inclusión financiera, la creciente penetración de cajeros automáticos y la creciente adopción de quioscos bancarios en economías en desarrollo como India, Indonesia y Filipinas. La necesidad de un servicio de hardware fiable y soporte remoto de software en regiones semiurbanas y rurales está impulsando la expansión del mercado. Los bancos locales se están asociando con proveedores de servicios globales para mejorar la fiabilidad de sus servicios y reducir los costes operativos.

Análisis del mercado de servicios de mantenimiento de hardware, soporte de software y asistencia técnica de la banca japonesa

Se prevé que el mercado japonés experimente la tasa de crecimiento más rápida entre 2025 y 2032, con un alto índice de uso de cajeros automáticos y un énfasis en la fiabilidad tecnológica. Los bancos japoneses priorizan la disponibilidad y la eficiencia, lo que impulsa la demanda de soporte técnico en tiempo real y actualizaciones de software. La integración de sistemas biométricos y quioscos con IA aumenta la complejidad y las necesidades de mantenimiento de la infraestructura bancaria, promoviendo el uso de proveedores de servicios especializados.

Análisis del mercado de servicios de mantenimiento de hardware, soporte de software y asistencia técnica de la banca china

China representó la mayor participación en los ingresos de Asia-Pacífico en 2024, impulsada por su extensa red bancaria, sólidas estrategias de transformación digital e iniciativas gubernamentales que promueven la inclusión financiera. Con el creciente uso de cajeros automáticos inteligentes, quioscos táctiles y sistemas de señalización digital, la demanda de servicios de soporte integrales está en auge. Los proveedores de servicios locales están ampliando sus carteras para satisfacer las crecientes necesidades de los bancos estatales y privados en las regiones urbanas y rurales.

Cuota de mercado de servicios de mantenimiento de hardware, soporte de software y soporte técnico bancario

La industria de servicios de mantenimiento de hardware, soporte de software y soporte técnico bancario está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Diebold Nixdorf, Incorporated (EE. UU.)

- Corporación NCR (EE. UU.)

- Oki Electric Industry Co., Ltd. (Japón)

- Loomis AB (Suecia)

- Glory Global Solutions (Internacional) Limited (Reino Unido)

- Hitachi, Ltd. (Japón)

- CashLink Global Systems Pvt. Ltd. (India)

- Cardtronics (EE. UU.)

Últimos avances en el mercado global de servicios de mantenimiento de hardware, soporte de software y soporte técnico bancario

- En enero de 2023, United Heritage Credit Union (UHCU) se asoció con NCR Corporation para implementar la solución de cajeros automáticos como servicio (ATM) de NCR, lo que permite una gestión más eficiente de su flota de cajeros automáticos. Este modelo ofrece a las instituciones financieras mayor eficiencia, operaciones optimizadas y una mejor experiencia del cliente al simplificar la gestión de los cajeros automáticos y la prestación de servicios.

- En septiembre de 2022, Diebold Nixdorf colaboró con PKO Bank Polski para presentar la solución de autoservicio Serie DN, que mejora la experiencia en las sucursales. Como parte de la iniciativa PKO Koncept, la Serie DN combina una estética regional con tecnología avanzada, con un módulo de reciclaje de cuarta generación y una gestión integral del efectivo para una experiencia de autoservicio moderna y fácil de usar, disponible 24/7.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.