Global Automotive Tie Rod Assembly Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

882.81 Million

USD

1,255.45 Million

2024

2032

USD

882.81 Million

USD

1,255.45 Million

2024

2032

| 2025 –2032 | |

| USD 882.81 Million | |

| USD 1,255.45 Million | |

|

|

|

|

Segmentación del mercado global de conjuntos de barras de dirección para automóviles, por tipo (conjunto de barras de dirección y conjunto de barras de dirección rectas), aplicación (turismos, vehículos comerciales ligeros y vehículos pesados): tendencias del sector y pronóstico hasta 2032

Tamaño del mercado de conjuntos de barras de acoplamiento para automóviles

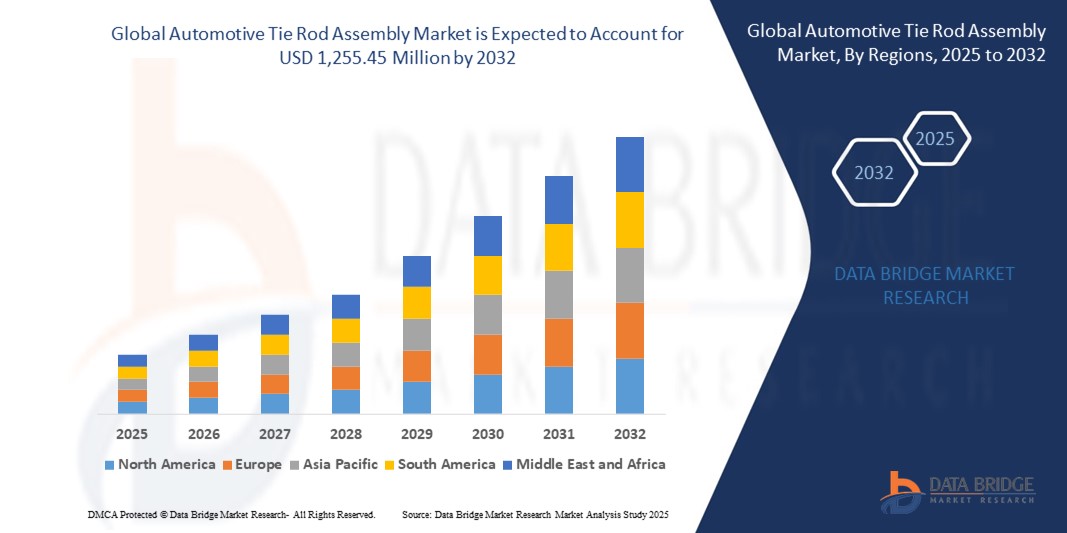

- El tamaño del mercado global de conjuntos de barras de dirección automotrices se valoró en USD 882,81 millones en 2024 y se espera que alcance los USD 1.255,45 millones para 2032 , con una CAGR del 4,50% durante el período de pronóstico.

- El crecimiento del mercado se debe en gran medida al aumento de la producción de vehículos de pasajeros y comerciales, junto con la creciente demanda de un mejor rendimiento de la dirección y la estabilidad del vehículo. Los avances tecnológicos en los sistemas de suspensión y dirección de automóviles, en particular en vehículos eléctricos y autónomos, impulsan la innovación en el diseño y los materiales de los conjuntos de barras de dirección.

- Además, las crecientes expectativas de los consumidores de una conducción más segura, suave y con mayor capacidad de respuesta están consolidando los conjuntos de barras de dirección como un componente crucial en la dinámica de los vehículos modernos. Estos factores convergentes están acelerando la adopción de soluciones avanzadas de conjuntos de barras de dirección, incluyendo variantes ligeras y resistentes a la corrosión, impulsando así significativamente el crecimiento de la industria, tanto en los segmentos de fabricantes de equipos originales (OEM) como en el mercado de repuestos.

Análisis del mercado de conjuntos de barras de acoplamiento para automóviles

- Los conjuntos de barras de dirección automotrices, que son componentes esenciales del sistema de dirección de un vehículo, desempeñan un papel fundamental para garantizar un control direccional preciso y la estabilidad al conectar la cremallera de dirección al muñón de dirección tanto en vehículos de pasajeros como comerciales.

- El creciente énfasis en la seguridad vehicular, junto con el aumento de la producción de vehículos a nivel mundial, impulsa la demanda de conjuntos de barras de dirección robustos y duraderos. Además, una mayor concienciación sobre el mantenimiento de la suspensión y la dirección contribuye al mercado de reemplazo, especialmente en flotas de vehículos antiguos.

- Norteamérica dominó el mercado de conjuntos de barras de dirección para automóviles, con la mayor participación en los ingresos, un 31,4 % en 2024, impulsada por la presencia de importantes fabricantes de automóviles, una amplia base de vehículos de carretera y una creciente demanda de vehículos premium y todoterreno que requieren sistemas de suspensión avanzados. Estados Unidos, en particular, está experimentando un aumento constante en las actividades de mantenimiento de vehículos y los servicios posventa.

- Se proyecta que Asia-Pacífico sea la región de más rápido crecimiento en el mercado de ensamblaje de barras de dirección automotrices durante el período de pronóstico, registrando una CAGR de 8.4% de 2025 a 2032, debido al rápido crecimiento de la industria automotriz en países como China, India e Indonesia, así como la expansión de la infraestructura y la urbanización.

- El segmento de conjuntos de barras de dirección dominó el mercado de conjuntos de barras de dirección para automóviles, con una cuota de mercado del 59,4 % en 2024, debido principalmente a su uso generalizado en sistemas de dirección de tracción delantera y de cuatro ruedas, tanto en vehículos de pasajeros como comerciales. Estos conjuntos son fundamentales para transferir el movimiento de la cremallera de dirección a las ruedas, garantizando un control preciso y la seguridad.

Alcance del informe y segmentación del mercado de conjuntos de barras de acoplamiento para automóviles

|

Atributos |

Análisis clave del mercado de conjuntos de barras de acoplamiento para automóviles |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos del mercado, como el valor de mercado, la tasa de crecimiento, los segmentos del mercado, la cobertura geográfica, los actores del mercado y el escenario del mercado, el informe de mercado elaborado por el equipo de investigación de mercado de Data Bridge incluye un análisis en profundidad de expertos, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y análisis pestle. |

Tendencias del mercado de conjuntos de barras de acoplamiento para automóviles

Creciente importancia de la precisión de la dirección y las mejoras en la seguridad del vehículo

- Una tendencia significativa y en aceleración en el mercado global de conjuntos de barras de dirección automotrices es la creciente demanda de componentes de dirección de alto rendimiento que mejoran el manejo del vehículo, la seguridad vial y la comodidad de conducción, especialmente en los vehículos comerciales y de pasajeros modernos.

- Los conjuntos de barras de acoplamiento son partes esenciales del sistema de articulación de la dirección, que conectan la cremallera de dirección al brazo de dirección y ahora se diseñan cada vez más para ser compatibles con la dirección asistida eléctrica (EPS) y los sistemas avanzados de asistencia al conductor (ADAS).

- Los fabricantes se están centrando en materiales ligeros y resistentes a la corrosión, como el aluminio y las aleaciones de acero de alta resistencia, para cumplir con las normativas de eficiencia de combustible y los requisitos de durabilidad. Por ejemplo, ZF Friedrichshafen AG y Nexteer Automotive están invirtiendo en tecnologías de barras de dirección de última generación que reducen el peso del vehículo a la vez que mejoran la resistencia mecánica.

- La creciente adopción de vehículos electrificados y autónomos también está influyendo en la evolución de los conjuntos de barras de dirección, ya que los mecanismos de dirección precisos y sensibles se vuelven fundamentales en los sistemas de conducción por cable y de vehículos autónomos.

- En el mercado de repuestos, la edad promedio cada vez mayor de los vehículos a nivel mundial, especialmente en regiones como América del Norte y Europa, está impulsando la demanda de conjuntos de barras de dirección de repuesto, a menudo incluidos con kits de dirección y suspensión.

- Los principales actores del mercado están ampliando sus carteras de productos y redes de distribución globales para satisfacer la creciente demanda, tanto en los canales OEM como en el mercado de repuestos. Además, las empresas están invirtiendo en prácticas de fabricación inteligentes, como la monitorización de la calidad en tiempo real y el análisis de mantenimiento predictivo, para garantizar un rendimiento y una trazabilidad constantes de los productos.

Dinámica del mercado de conjuntos de barras de acoplamiento para automóviles

Conductor

Necesidad creciente debido a las crecientes regulaciones de seguridad de los vehículos y las actualizaciones del sistema de suspensión

- La creciente atención a la seguridad vehicular, la estabilidad de marcha y la respuesta del control de la dirección está impulsando significativamente la demanda en el mercado global de conjuntos de barras de dirección para automóviles, especialmente en vehículos de pasajeros y comerciales. Los conjuntos de barras de dirección son cruciales para conectar el sistema de dirección a las ruedas, garantizando una maniobrabilidad precisa y una respuesta en carretera.

- Por ejemplo, en abril de 2024, ZF Friedrichshafen AG anunció una mejora estratégica de los componentes de su dirección asistida eléctrica (EPS), incluyendo conjuntos de barras de dirección avanzados diseñados para vehículos eléctricos y autónomos de próxima generación. Esta iniciativa pone de manifiesto cómo los fabricantes están modernizando los sistemas de dirección tradicionales para satisfacer las cambiantes necesidades de movilidad.

- A medida que consumidores y reguladores exigen mejor manejo, eficiencia de combustible y seguridad para los ocupantes, los fabricantes de automóviles incorporan cada vez más materiales ligeros, como aluminio forjado y acero de alta resistencia, en los componentes de dirección y suspensión. Este cambio también está en consonancia con el endurecimiento de las normas globales sobre emisiones.

- Además, la creciente producción y venta de vehículos eléctricos (VE) y plataformas integradas con ADAS están acelerando la necesidad de conjuntos de barras de dirección altamente precisos, duraderos y electrónicamente compatibles, especialmente en modelos premium y de alto rendimiento.

- El aumento de la propiedad de vehículos, especialmente en las economías en desarrollo, está impulsando la demanda de conjuntos de barras de dirección de repuesto en el mercado de accesorios, sobre todo en regiones donde las condiciones de la carretera provocan un desgaste más rápido de los sistemas de dirección. En los mercados maduros, la tendencia hacia las mejoras de la suspensión y la dirección en vehículos todoterreno y de alto rendimiento también está contribuyendo al crecimiento del mercado de accesorios.

Restricción/Desafío

Presión de precios y complejidad del ciclo de vida del producto

- Si bien el mercado de conjuntos de barras de dirección para automóviles está en expansión, las fluctuaciones en los costos de las materias primas (como el acero y el aluminio) y la creciente presión de los fabricantes de equipos originales (OEM) plantean desafíos para los fabricantes de componentes. Las empresas deben mantener estándares de rendimiento y seguridad, a la vez que mantienen bajos los costos de producción para mantenerse competitivas.

- Además, las complejas pruebas y validaciones del ciclo de vida que requieren los conjuntos de tirantes en sistemas críticos para la seguridad pueden retrasar el lanzamiento del producto y aumentar los costos de desarrollo. El cumplimiento de los estrictos estándares de calidad y durabilidad, especialmente en Europa y Norteamérica, supone un obstáculo operativo continuo.

- Otro desafío es la creciente diversidad de modelos de vehículos, que exige una amplia variedad de configuraciones de tirantes personalizadas. Esto complica la gestión del inventario y requiere sistemas de fabricación flexibles.

- Para abordar estos desafíos, los principales proveedores como Nexteer Automotive y Dana Incorporated están invirtiendo en plataformas de productos modulares y líneas de producción automatizadas, con el objetivo de mejorar la escalabilidad, la rentabilidad y la capacidad de respuesta a los cambiantes requisitos de los OEM.

Alcance del mercado de conjuntos de barras de acoplamiento para automóviles

El mercado está segmentado según el tipo y la aplicación.

- Por tipo

Según el tipo, el mercado de conjuntos de barras de dirección para automóviles se segmenta en conjuntos de barras de dirección de dirección y conjuntos de barras de dirección rectas. El segmento de conjuntos de barras de dirección dominó la mayor cuota de mercado, con un 59,4 % en 2024, debido principalmente a su amplio uso en sistemas de dirección de tracción delantera y de cuatro ruedas, tanto en vehículos de pasajeros como comerciales. Estos conjuntos son fundamentales para transferir el movimiento de la cremallera de dirección a las ruedas, garantizando un control preciso y la seguridad.

Se prevé que el segmento de conjuntos de barras de dirección rectas experimente la tasa de crecimiento más rápida, del 19,3 %, entre 2025 y 2032, impulsada por la creciente demanda de vehículos comerciales pesados (HCV) y vehículos utilitarios todoterreno. Su robusta construcción y compatibilidad con sistemas de dirección de alta carga los hacen ideales para entornos exigentes.

- Por aplicación

Según su aplicación, el mercado de conjuntos de barras de dirección para automóviles se segmenta en turismos, vehículos comerciales ligeros (LCV) y vehículos industriales pesados (HCV). El segmento de turismos representó la mayor cuota de mercado, con un 45%, en 2024, gracias al creciente parque automovilístico mundial, la creciente producción de vehículos compactos y medianos, y la creciente atención a la seguridad y la comodidad del conductor.

Se proyecta que el segmento de vehículos comerciales pesados (HCV) registre la CAGR más rápida entre 2025 y 2032, impulsado por la expansión de las operaciones logísticas, el desarrollo de infraestructura y la demanda de sistemas de dirección robustos capaces de manejar cargas útiles pesadas.

Análisis regional del mercado de conjuntos de barras de acoplamiento para automóviles

- América del Norte dominó el mercado de conjuntos de barras de dirección automotrices con la mayor participación en los ingresos del 31,4 % en 2024, impulsada por la creciente demanda de seguridad y rendimiento de manejo de los vehículos, una fuerte presencia de los principales fabricantes de automóviles y una tendencia creciente en la adopción de vehículos eléctricos que requiere componentes de dirección mejorados.

- El sólido mercado de repuestos automotrices de la región y el alto gasto de los consumidores en mantenimiento de vehículos también respaldan la creciente demanda de reemplazo de conjuntos de barras de dirección, especialmente en los EE. UU. y Canadá.

- Además, el enfoque en sistemas de suspensión avanzados tanto en vehículos comerciales como de pasajeros está impulsando la demanda de conjuntos de barras de dirección resistentes a la corrosión y tecnológicamente superiores.

Análisis del mercado de conjuntos de barras de acoplamiento para automóviles de EE. UU.

El mercado estadounidense de conjuntos de barras de dirección para automóviles captó aproximadamente el 66 % de los ingresos del mercado norteamericano de conjuntos de barras de dirección en 2024, gracias al elevado parque vehicular, la creciente producción de vehículos comerciales ligeros y pesados, y los rápidos avances en las tecnologías de dirección. Los principales fabricantes de equipos originales (OEM) y proveedores de primer nivel de EE. UU. invierten cada vez más en conjuntos de barras de dirección de ingeniería de precisión para vehículos eléctricos (VE), vehículos todoterreno (VTT) y coches de alto rendimiento. Además, la creciente preferencia por los sistemas de dirección equipados con ADAS y la sustitución de componentes convencionales por barras de dirección ligeras de aluminio están impulsando el crecimiento del mercado.

Análisis del mercado europeo de conjuntos de barras de acoplamiento para automóviles

Se prevé que el mercado europeo de conjuntos de barras de dirección para automóviles se expanda a una sólida tasa de crecimiento anual compuesta (TCAC) durante el período de pronóstico, impulsado por las estrictas normativas de seguridad vehicular de la región (Euro NCAP), la creciente demanda de vehículos híbridos y eléctricos, y la apuesta por la sostenibilidad. Países como Alemania, Francia y el Reino Unido experimentan una fuerte demanda de conjuntos de barras de dirección ligeros y de alta durabilidad, utilizados en sistemas de suspensión avanzados. El crecimiento del mercado de repuestos en Europa del Este contribuye aún más al ciclo de sustitución y actualización de las piezas de dirección y suspensión.

Análisis del mercado de conjuntos de barras de acoplamiento para automóviles en el Reino Unido

Se prevé que el mercado británico de conjuntos de barras de dirección para automóviles crezca a una tasa de crecimiento anual compuesta (TCAC) notable, impulsado por la creciente demanda de optimización del rendimiento de los vehículos y componentes automotrices ligeros. El aumento de las inversiones en movilidad eléctrica y plataformas para vehículos autónomos está creando oportunidades para soluciones de barras de dirección personalizadas que cumplen con los nuevos estándares de seguridad y manejo. El segmento de posventa en el Reino Unido también está prosperando, impulsado por un ecosistema de reparación bien desarrollado y la preferencia de los consumidores por piezas de repuesto de calidad.

Análisis del mercado de conjuntos de barras de acoplamiento para automóviles en Alemania

Se espera que el mercado alemán de conjuntos de barras de dirección para automóviles, siendo el mayor fabricante de automóviles de Europa, sea un factor clave en el mercado de estos conjuntos. Los fabricantes de equipos originales (OEM) se centran en integrar barras de dirección que soporten mayores cargas de dirección, mejoren la capacidad de respuesta y se adapten a las plataformas modulares para vehículos eléctricos (VE) y de combustión interna (ICE). El liderazgo alemán en ingeniería automotriz garantiza la innovación continua en materiales y durabilidad, lo que aumenta su potencial de exportación global de componentes para sistemas de dirección.

Análisis del mercado de conjuntos de barras de acoplamiento para automóviles en Asia-Pacífico

Se prevé que el mercado de conjuntos de barras de dirección para automóviles en Asia-Pacífico crezca a la tasa de crecimiento anual compuesta (TCAC) más rápida, del 8,4 %, entre 2025 y 2032, impulsado por el aumento de la producción de vehículos, la expansión de las redes viales y el aumento de la propiedad de vehículos en las economías en desarrollo. China, India y Japón están a la vanguardia, con una fuerte demanda tanto de los fabricantes de equipos originales (OEM) como del mercado de repuestos. Las regulaciones gubernamentales que exigen la seguridad vehicular y el mayor gasto de los consumidores en mantenimiento de vehículos están impulsando la adopción de conjuntos de barras de dirección mejorados. Además, el liderazgo de Asia-Pacífico en la fabricación rentable de componentes automotrices impulsa el potencial de exportación y la competitividad de los precios en los mercados nacionales.

Análisis del mercado de conjuntos de barras de acoplamiento para automóviles en Japón

El mercado japonés de conjuntos de barras de dirección para automóviles se beneficia de la apuesta del país por la innovación automotriz, incluyendo los sistemas de dirección electrónica y la ingeniería de vehículos compactos. Las altas expectativas de los consumidores en cuanto a precisión y seguridad en la conducción, especialmente en vehículos eléctricos urbanos e híbridos, están incrementando la demanda de conjuntos de barras de dirección de alta calidad. Las barras de dirección integradas en sistemas de dirección electrónicos y basados en sensores están ganando popularidad, en consonancia con el impulso de Japón hacia las plataformas de vehículos conectados y autónomos.

Análisis del mercado de conjuntos de barras de acoplamiento para automóviles en China

El mercado chino de conjuntos de barras de dirección para automóviles registró la mayor participación en los ingresos del mercado de Asia-Pacífico en 2024, gracias a su enorme base de producción de vehículos, los incentivos gubernamentales para vehículos eléctricos y su enfoque en la fabricación nacional. Los principales fabricantes de equipos originales (OEM) chinos están actualizando rápidamente sus sistemas de dirección para cumplir con los estándares de calidad globales, lo que impulsa la demanda de conjuntos de barras de dirección de precisión. Las ventas en el mercado de accesorios están en auge, especialmente debido a las duras condiciones de las carreteras y a la creciente concienciación sobre el mantenimiento rutinario de los vehículos, lo que impulsa la sustitución y actualización de productos.

Cuota de mercado de conjuntos de barras de acoplamiento para automóviles

La industria de ensamblaje de barras de dirección para automóviles está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Ample Auto Tech Pvt. Ltd. (India)

- GS Autocomp Pvt. Ltd. (India)

- Ocap Chassis Parts Pvt. Ltd. (India)

- FAI Automotive (Reino Unido)

- Powers & Sons (EE. UU.)

- GDST (China)

- CCTY (China)

- ATEK (India)

- Teknorot (Turquía)

- GKN Automotive Limited (Reino Unido)

- ZF Friedrichshafen AG (Alemania)

- Nexteer Automotive Corporation (EE. UU.)

Últimos avances en el mercado global de conjuntos de barras de dirección para automóviles

- En abril de 2023, Suprajit Engineering Ltd., fabricante líder indio de componentes para automóviles, completó la adquisición de la unidad de negocio estándar de Kongsberg Automotive. Esta estrategia fortalece la presencia global de Suprajit en cables de control mecánico y conjuntos de dirección, incluyendo sistemas de barras de dirección, y consolida su posición tanto en el segmento de fabricantes de equipos originales (OEM) como en el mercado de repuestos a nivel mundial.

- En marzo de 2023, el Grupo OCAP, proveedor europeo clave de piezas de chasis, anunció la expansión de su planta de producción de barras de dirección en India para satisfacer la creciente demanda de los fabricantes de vehículos comerciales y de pasajeros. Este desarrollo refleja la continua migración de las cadenas de suministro globales hacia los centros de fabricación de Asia-Pacífico.

- En febrero de 2023, Powers & Sons LLC, proveedor estadounidense de componentes de dirección, anunció su inversión en automatización avanzada para la fabricación de conjuntos de barras de dirección en su planta de Indiana. El objetivo es mejorar la precisión, reducir los plazos de entrega y satisfacer la creciente demanda de los fabricantes de vehículos eléctricos en Norteamérica.

- En enero de 2023, FAI Automotive Plc, proveedor líder de posventa con sede en el Reino Unido, lanzó una gama ampliada de conjuntos de barras de dirección y piezas de dirección de ingeniería de precisión para dar soporte al creciente parque automovilístico en Europa. Esta iniciativa responde a la creciente demanda de piezas de repuesto de vehículos antiguos.

- En enero de 2023, Patmax Union Corporation, con sede en China, anunció una asociación estratégica con fabricantes de equipos originales (OEM) del sudeste asiático para suministrar conjuntos de barras de dirección y de dirección para las próximas plataformas de vehículos comerciales, lo que refuerza su compromiso de expandirse en el mercado automotriz de la ASEAN.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.