Global Automotive Electronics Sensor Aftermarket

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

6,761.60 Million

USD

12,475.79 Million

2021

2029

USD

6,761.60 Million

USD

12,475.79 Million

2021

2029

| 2022 –2029 | |

| USD 6,761.60 Million | |

| USD 12,475.79 Million | |

|

|

|

|

Mercado de repuestos de sensores electrónicos para automoción a nivel mundial , por tipo de sensor (sensores de temperatura, sensores de presión, sensores de oxígeno, sensores de NOx, sensores de posición, sensores de velocidad, sensores inerciales, sensores de imagen, otros), tipo de vehículo (automóvil de pasajeros, LCV, HCV), aplicación (sistemas de tren motriz, chasis, sistemas de escape, sistemas de seguridad y control, electrónica de la carrocería del vehículo, sistemas telemáticos, otros): tendencias de la industria y pronóstico hasta 2029

Análisis y tamaño del mercado

Los sensores electrónicos automotrices se utilizan ampliamente en numerosos vehículos, incluidos vehículos de dos ruedas y camiones pesados, entre otros. Se utilizan ampliamente en aplicaciones automotrices, como tableros de instrumentos, sensores de lluvia , asientos, climatización, cierre de portón trasero, gestión de remolques, limpiaparabrisas, iluminación, techo solar y estacionamiento, entre otros.

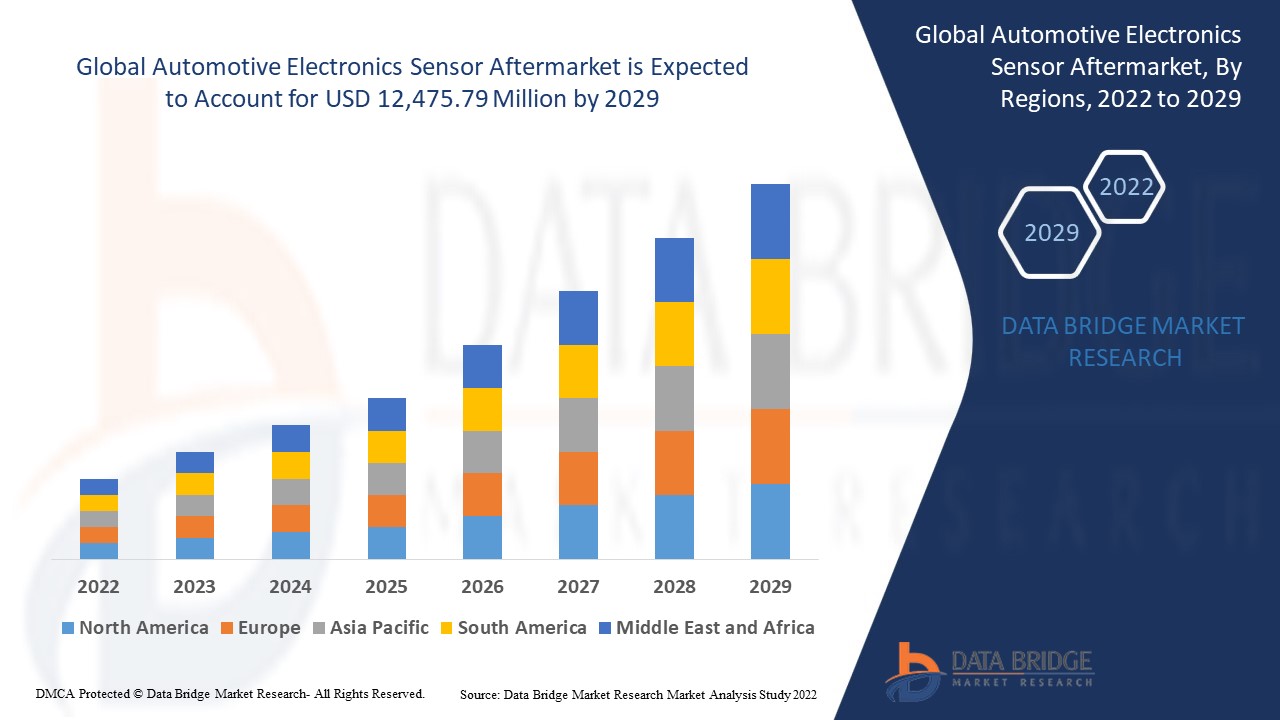

El mercado de repuestos de sensores electrónicos automotrices global se valoró en USD 6.761,60 millones en 2021 y se espera que alcance los USD 12.475,79 millones para 2029, registrando una CAGR del 6,77% durante el período de pronóstico de 2022 a 2029. Los sistemas de tren motriz representan los segmentos de aplicación más grandes en el mercado respectivo debido a la funcionalidad de varias ECU de tren motriz. El informe de mercado curado por el equipo de investigación de mercado de Data Bridge incluye un análisis experto en profundidad, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y análisis pestle.

Definición de mercado

Los sensores electrónicos automotrices se refieren al tipo de sensores que se utilizan para detectar, medir o registrar fenómenos físicos. Responden transmitiendo información y controlando el sistema o iniciando cambios. Se consideran parte integral del sistema del vehículo y están diseñados específicamente para detectar, analizar, transmitir y mostrar información sobre el rendimiento del vehículo.

Alcance del informe y segmentación del mercado

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Período de pronóstico |

2022 - 2029 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en miles de millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Tipo de sensor (sensores de temperatura, sensores de presión, sensores de oxígeno, sensores de NOx, sensores de posición, sensores de velocidad, sensores inerciales, sensores de imagen, otros), tipo de vehículo (automóvil de pasajeros, LCV, HCV), aplicación (sistemas de tren motriz, chasis, sistemas de escape, sistemas de seguridad y control, electrónica de la carrocería del vehículo, sistemas telemáticos, otros) |

|

Países cubiertos |

EE. UU., Canadá, México, Brasil, Argentina, Resto de Sudamérica, Alemania, Italia, Reino Unido, Francia, España, Países Bajos, Bélgica, Suiza, Turquía, Rusia, Resto de Europa, Japón, China, India, Corea del Sur, Australia, Singapur, Malasia, Tailandia, Indonesia, Filipinas, Resto de Asia-Pacífico, Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Egipto, Israel, Resto de Medio Oriente y África |

|

Actores del mercado cubiertos |

NXP Semiconductors (Países Bajos), STMicroelectronics (Suiza), Infineon Technologies AG (Alemania), TE Connectivity (Suiza), Texas Instruments Incorporated (EE. UU.), Sensata Technologies, Inc. (EE. UU.), Littelfuse Inc. (EE. UU.), Robert Bosch GmbH (Alemania), Continental AG (Alemania), BorgWarner Inc. (EE. UU.), Analog Devices, Inc. (EE. UU.), Sensata Technologies, Inc. (EE. UU.), DENSO CORPORATION (Japón), Autoliv Inc. (Suecia), Maxim Integrated (EE. UU.), Hitachi Astemo Americas, Inc. (EE. UU.), GMS Instruments BV (Países Bajos), Broadcom (EE. UU.), Piher Sensors & Controls (España) y Elmos Semiconductor SE (Alemania), entre otros. |

|

Oportunidades de mercado |

|

Dinámica del mercado de accesorios de sensores electrónicos automotrices

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

Conductores

- Aumento de la producción de vehículos

La creciente industria automotriz en todo el mundo es el factor clave que impulsa el crecimiento del mercado de repuestos de sensores electrónicos para automóviles. En los últimos años, ha habido un aumento en la demanda de vehículos de pasajeros, lo que contribuye al crecimiento del mercado.

- Popularidad de la automatización de vehículos

El aumento de la popularidad de la automatización de los vehículos junto con el aumento de la demanda de concept cars aceleran el crecimiento del mercado. El aumento de la demanda de vehículos con funciones y sistemas avanzados debido al aumento de la renta disponible tiene un impacto positivo en el mercado.

- Investigación y desarrollo

El aumento de la atención en investigación y desarrollo (I+D) de las industrias automotrices para desarrollar sensores automotrices avanzados, como sensores inalámbricos, sensores de radar y sensores MEMS (sistemas microelectromecánicos), influye aún más en el mercado.

Además, la expansión del sector automotriz, el aumento de las inversiones y el incremento del ingreso disponible afectan positivamente al mercado de repuestos de sensores electrónicos automotrices.

Oportunidades

Además, las asociaciones y empresas conjuntas entre fabricantes de automóviles y proveedores de tecnología lidar amplían las oportunidades rentables para los actores del mercado en el período de pronóstico de 2022 a 2029. Además, el aumento del enfoque en la electrificación en la industria automotriz intensifica el crecimiento del mercado de repuestos de sensores electrónicos automotrices.

Restricciones y desafíos que enfrenta el mercado de repuestos de sensores electrónicos automotrices

Por otra parte, se espera que el mercado de repuestos de sensores automotrices subdesarrollado en las economías emergentes obstaculice el crecimiento del mercado. Además, se prevé que las amenazas a la seguridad en los vehículos autónomos supongan un desafío para el mercado de repuestos de refrigerantes automotrices en el período de pronóstico de 2022 a 2029.

Este informe sobre el mercado de repuestos de sensores electrónicos para automóviles proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de repuestos de sensores electrónicos para automóviles, comuníquese con Data Bridge Market Research para obtener un informe de analista. Nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

La COVID-19 tuvo un gran impacto en el mercado de repuestos de sensores electrónicos para automóviles

El COVID-19 tuvo un impacto negativo en el mercado de repuestos de sensores electrónicos para automóviles debido a los estrictos cierres y el distanciamiento social para contener la propagación del virus. La incertidumbre económica, el cierre parcial de las empresas y la baja confianza de los consumidores afectaron la demanda de repuestos de sensores electrónicos para automóviles. La cadena de suministro se vio obstaculizada durante la pandemia junto con el retraso de las actividades logísticas. Sin embargo, se espera que el mercado de repuestos de sensores electrónicos para automóviles recupere su ritmo durante el escenario posterior a la pandemia debido a la flexibilización de las restricciones.

Acontecimientos recientes

- En noviembre de 2021, Robert Bosch GmbH desarrolló un sistema de asistencia al conductor avanzado e innovador para el transporte ferroviario urbano. El sistema avisa al conductor del tranvía mediante una señal. Si el conductor no interviene, el sistema frena automáticamente el tranvía hasta que se detiene por completo.

- En octubre de 2021, Infineon Technologies AG lanzó el sensor de corriente para automoción XENSIV TLE4972. El sensor de corriente sin núcleo utiliza la tecnología Hall de eficacia probada de Infineon para lograr mediciones estables y precisas.

Alcance del mercado de repuestos de sensores electrónicos automotrices globales

El mercado de repuestos de sensores electrónicos para automóviles está segmentado en función del tipo de sensor, el tipo de vehículo y la aplicación. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de sensor

- Sensores de temperatura

- Sensores de presión

- Sensores de oxígeno

- Sensores de NOx

- Sensores de posición

- Sensores de velocidad

- Sensores inerciales

- Sensores de imagen

- Otros

Tipo de vehículo

- Coche de pasajeros

- Vehículo comercial ligero

- VHC

Solicitud

- Sistemas de transmisión

- Chasis

- Sistemas de escape

- Sistemas de seguridad y control

- Electrónica de la carrocería del vehículo

- Sistemas telemáticos

- Otros

Análisis y perspectivas regionales sobre el mercado de repuestos de sensores electrónicos para automóviles

Se analiza el mercado de repuestos de sensores electrónicos automotrices y se proporcionan información y tendencias del tamaño del mercado por país, tipo de sensor, tipo de vehículo y aplicación.

Los países cubiertos en el informe de posventa de sensores electrónicos automotrices son EE. UU., Canadá y México en América del Norte, Brasil, Argentina y el resto de América del Sur como parte de América del Sur, Alemania, Italia, Reino Unido, Francia, España, Países Bajos, Bélgica, Suiza, Turquía, Rusia, el resto de Europa en Europa, Japón, China, India, Corea del Sur, Australia, Singapur, Malasia, Tailandia, Indonesia, Filipinas, el resto de Asia-Pacífico (APAC) en Asia-Pacífico (APAC), Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Egipto, Israel, el resto de Medio Oriente y África (MEA) como parte de Medio Oriente y África (MEA).

Asia-Pacífico (APAC) domina el mercado de repuestos de sensores electrónicos automotrices debido al aumento en el número de ventas de vehículos dentro de la región.

Se espera que Europa sea testigo de un crecimiento significativo durante el período de pronóstico de 2022 a 2029 debido al aumento del número de fabricantes locales en la región.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los sensores electrónicos para automóviles

El panorama competitivo del mercado de repuestos de sensores electrónicos para automóviles proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de repuestos de sensores electrónicos para automóviles.

Algunos de los principales actores que operan en el mercado de repuestos de sensores electrónicos automotrices son

- NXP Semiconductors (Países Bajos)

- STMicroelectronics (Suiza)

- Infineon Technologies AG (Alemania)

- TE Connectivity (Suiza)

- Texas Instruments Incorporated. (Estados Unidos)

- Sensata Technologies, Inc. (Estados Unidos)

- Littelfuse Inc. (Estados Unidos)

- Robert Bosch GmbH (Alemania)

- Continental AG (Alemania)

- BorgWarner Inc. (Estados Unidos)

- Analog Devices, Inc. (Estados Unidos)

- Sensata Technologies, Inc. (Estados Unidos)

- CORPORACIÓN DENSO (Japón)

- Autoliv Inc. (Suecia)

- Maxim Integrated (Estados Unidos)

- Hitachi Astemo Americas, Inc. (Estados Unidos)

- GMS Instruments BV (Países Bajos)

- Broadcom. (Estados Unidos)

- Piher Sensors & Controls (España)

- Elmos Semiconductor SE (Alemania)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.