Global Automated Material Handling Equipment Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

61.40 Billion

USD

114.30 Billion

2024

2032

USD

61.40 Billion

USD

114.30 Billion

2024

2032

| 2025 –2032 | |

| USD 61.40 Billion | |

| USD 114.30 Billion | |

|

|

|

|

Segmentación del mercado global de equipos de manipulación automatizada de materiales, por producto (robots, sistemas automatizados de almacenamiento y recuperación (ASRS), sistemas de transporte y clasificación, grúas, robots móviles autónomos (AMR), vehículos de guiado automático (AGV) , vehículos de remolque, transportadores de carga unitaria, transpaletas, carretillas elevadoras, vehículos híbridos, otros, y vehículos de guiado automático (AGV)), tipo de sistema (sistemas de manipulación de materiales de carga unitaria y sistemas de manipulación de materiales de carga a granel), software y servicios (software y servicios), función (ensamblaje, embalaje, transporte, distribución, almacenamiento y manipulación de residuos), industria (automoción, metales y maquinaria pesada, alimentos y bebidas, productos químicos, semiconductores y electrónica, salud, aviación, comercio electrónico y otros) - Tendencias de la industria y pronóstico hasta 2032

Tamaño del mercado de equipos automatizados de manipulación de materiales

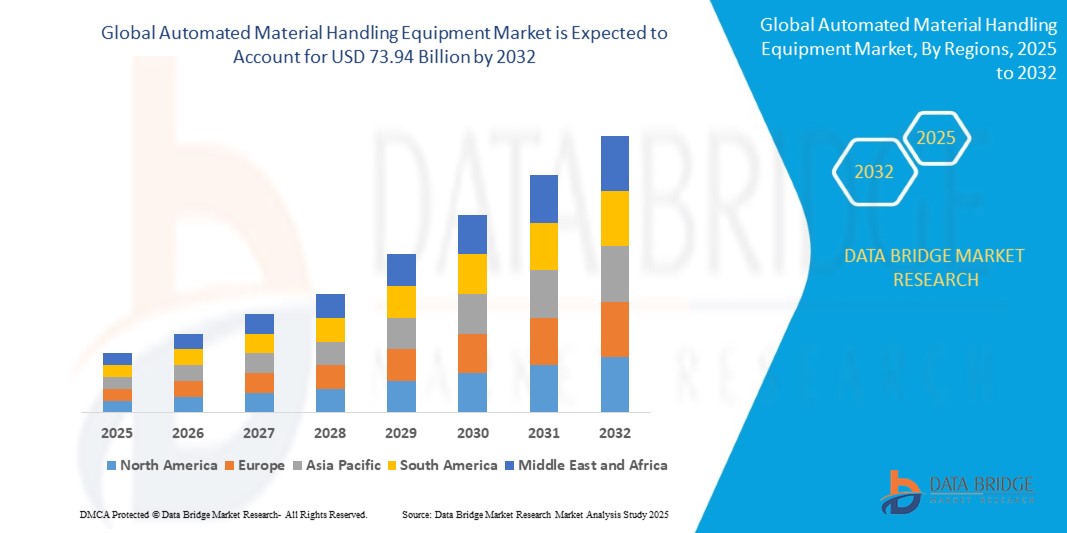

- El tamaño del mercado global de equipos automatizados de manipulación de materiales se valoró en USD 34,77 mil millones en 2024 y se espera que alcance los USD 73,94 mil millones para 2032 , con una CAGR del 9,89% durante el período de pronóstico.

- Este crecimiento está impulsado por factores como la creciente demanda de automatización en la fabricación, la rápida expansión del comercio electrónico y el creciente enfoque en la seguridad en el lugar de trabajo y la eficiencia operativa.

Análisis del mercado de equipos automatizados de manipulación de materiales

- Los equipos de manipulación de materiales automatizados (AMHE) desempeñan un papel crucial en la mejora de la productividad, la reducción de los costos laborales y la mejora de la seguridad en industrias como la fabricación, la logística, la automoción y el comercio electrónico.

- La demanda de AMHE está impulsada significativamente por el aumento del comercio electrónico, la necesidad de soluciones de almacenamiento eficientes y la creciente adopción de tecnologías de la Industria 4.0.

- Se prevé que Asia-Pacífico domine el mercado de equipos automatizados de manipulación de materiales, con una cuota de mercado del 39,4 %, debido a la creciente demanda de grúas y polipastos en el sector minero. Esta demanda se ve impulsada aún más por el aumento de la industrialización en la región, en particular en los sectores de la minería y la construcción.

- Se espera que América del Norte sea la región de más rápido crecimiento en el mercado de equipos de manipulación automatizada de materiales durante el período de pronóstico debido a la innovación tecnológica, que está impulsando el desarrollo de equipos de manipulación automatizada de materiales (AMH) nuevos y más avanzados.

- Se espera que el segmento de robots domine el mercado con la mayor cuota de mercado, un 22,01%, debido a la creciente demanda de soluciones de manipulación flexibles, precisas y eficientes en diversas industrias. Los robots ofrecen ventajas significativas en términos de velocidad, precisión y capacidad de operar de forma continua con mínima intervención humana, lo que los hace ideales para aplicaciones en los sectores de la automoción, la electrónica, la alimentación y las bebidas, y el comercio electrónico.

Alcance del informe y segmentación del mercado de equipos automatizados de manipulación de materiales

|

Atributos |

Perspectivas clave del mercado de equipos automatizados de manipulación de materiales |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, producción y capacidad por empresa representadas geográficamente, diseños de red de distribuidores y socios, análisis detallado y actualizado de tendencias de precios y análisis deficitario de la cadena de suministro y la demanda. |

Tendencias del mercado de equipos de manipulación automatizada de materiales

Integración de IA, IoT y robótica en sistemas de manipulación de materiales

- Una tendencia destacada en el mercado de equipos de manipulación de materiales automatizados es la creciente integración de la inteligencia artificial (IA ), la Internet de las cosas (IoT) y la robótica para crear sistemas de manipulación inteligentes y adaptables.

- Estas tecnologías permiten el análisis de datos en tiempo real, el mantenimiento predictivo y la toma de decisiones autónoma, mejorando significativamente la eficiencia, el rendimiento y la confiabilidad del sistema en almacenes y entornos de fabricación.

- Por ejemplo, los sistemas robóticos impulsados por IA pueden optimizar dinámicamente las rutas de selección y adaptarse a flujos de productos variables, mientras que los transportadores y sistemas de almacenamiento habilitados para IoT brindan retroalimentación operativa continua para agilizar las operaciones de la cadena de suministro.

- Esta transformación digital está revolucionando los procesos de manejo de materiales, reduciendo el tiempo de inactividad, mejorando la utilización de recursos e impulsando el cambio hacia ecosistemas logísticos totalmente automatizados e inteligentes.

Dinámica del mercado de equipos automatizados de manipulación de materiales

Conductor

Creciente demanda de automatización en el almacenamiento y la fabricación

- La creciente necesidad de eficiencia operativa, reducción de costos laborales y mejora de la productividad está impulsando la adopción generalizada de equipos automatizados de manipulación de materiales en industrias como el comercio electrónico, la automotriz, la de alimentos y bebidas y la farmacéutica.

- A medida que las cadenas de suministro globales se vuelven cada vez más complejas y aumenta la demanda de un cumplimiento de pedidos rápido y preciso, las empresas están recurriendo a la automatización para agilizar los procesos, reducir los errores y mejorar la seguridad en sus operaciones.

- El aumento de las actividades de comercio electrónico, especialmente después de la pandemia, ha ejercido una enorme presión sobre los almacenes y centros de distribución para gestionar grandes volúmenes de inventario de manera eficiente, lo que acelera aún más la adopción de la automatización.

Por ejemplo,

- Según la Federación Internacional de Robótica (IFR), la instalación mundial de robots industriales alcanzó las 553.052 unidades en 2022, lo que marca un aumento del 5% respecto al año anterior, lo que subraya la creciente dependencia de la automatización en el manejo de materiales y la logística.

- Como resultado, el impulso hacia la excelencia operativa y un rendimiento más rápido está aumentando significativamente la demanda de equipos automatizados de manipulación de materiales, lo que los convierte en un facilitador fundamental de la infraestructura industrial y logística de próxima generación.

Oportunidad

El crecimiento del comercio electrónico y la venta minorista en línea impulsa la demanda de automatización.

- El rápido crecimiento del comercio electrónico y la venta minorista en línea está impulsando significativamente la demanda de soluciones automatizadas de manejo de materiales, ya que las empresas buscan formas más rápidas y eficientes de administrar grandes volúmenes de productos y garantizar el cumplimiento rápido de los pedidos.

- Los sistemas automatizados como recolectores robóticos, cintas transportadoras y sistemas automatizados de almacenamiento y recuperación (AS/RS) se están volviendo esenciales para manejar grandes volúmenes de pedidos, mejorar la precisión y acelerar los tiempos de procesamiento en centros de distribución y almacenes.

- La demanda de gestión de inventario en tiempo real, envíos más rápidos y preparación de pedidos sin errores está impulsando la necesidad de tecnologías de automatización sofisticadas.

Por ejemplo,

- En febrero de 2024, según un informe de Statista, se proyectó que las ventas globales de comercio electrónico superarían los 5 billones de dólares en 2025, y que más del 50 % de estas ventas se procesarían a través de almacenes automatizados y centros de distribución. Este crecimiento del comercio minorista en línea crea una importante oportunidad de mercado para que los proveedores de AMHE desarrollen soluciones innovadoras que puedan gestionar una logística compleja y satisfacer las expectativas de los clientes en cuanto a una entrega rápida.

- La continua expansión del sector del comercio electrónico está creando oportunidades significativas para los sistemas automatizados de manejo de materiales, particularmente en la entrega de última milla y la automatización de almacenes, posicionando al mercado para un crecimiento sostenido en los próximos años.

Restricción/Desafío

Los altos costos iniciales de inversión y mantenimiento obstaculizan el crecimiento del mercado.

- El alto costo inicial de los equipos automatizados de manipulación de materiales, junto con los gastos operativos y de mantenimiento continuos, plantea un desafío importante para las empresas, en particular en los mercados emergentes y las pequeñas y medianas empresas (PYME).

- Los sistemas automatizados, que a menudo requieren una inversión de capital sustancial en infraestructura, software e integración, pueden costar desde decenas de miles hasta millones de dólares dependiendo de la complejidad y la escala de la solución.

- Esta carga financiera puede disuadir a las empresas más pequeñas de adoptar la automatización, obligándolas a depender de mano de obra manual o equipos obsoletos, lo que obstaculiza la productividad y la eficiencia.

Por ejemplo,

- En octubre de 2024, según un informe de la Federación Internacional de Robótica (IFR), los altos costos iniciales y los largos periodos de recuperación de la inversión de los sistemas automatizados son algunos de los principales obstáculos para que las empresas de las regiones en desarrollo adopten soluciones avanzadas de manejo de materiales. La reticencia a invertir en estos sistemas se traduce en tasas de adopción más lentas, especialmente entre empresas con presupuestos limitados y operaciones más pequeñas.

- Como resultado, tales limitaciones pueden obstaculizar la adopción generalizada de la automatización, especialmente en sectores sensibles a los precios, lo que en última instancia restringe el crecimiento general del mercado AMHE.

Alcance del mercado de equipos automatizados de manipulación de materiales

El mercado está segmentado en función del producto, tipo de sistema, software y servicios, función e industria.

|

Segmentación |

Subsegmentación |

|

Por producto |

|

|

Por tipo de sistema |

|

|

Por software y servicios |

|

|

Por función |

|

|

Por industria |

|

Se proyecta que en 2025 los robots dominarán el mercado con la mayor participación en el segmento de productos.

Se prevé que el segmento de robots domine el mercado de equipos automatizados de manipulación de materiales, con la mayor cuota de mercado (22,01 %), debido a la creciente demanda de soluciones de manipulación flexibles, precisas y eficientes en diversas industrias. Los robots ofrecen ventajas significativas en términos de velocidad, precisión y capacidad de operar de forma continua con mínima intervención humana, lo que los hace ideales para aplicaciones en los sectores de la automoción, la electrónica, la alimentación y las bebidas, y el comercio electrónico.

Se espera que el comercio electrónico represente la mayor participación durante el período de pronóstico en el segmento industrial.

En 2025, se prevé que el segmento del comercio electrónico domine el mercado con la mayor cuota de mercado, con un 20,01%. Debido a la mayor penetración de las plataformas de compra en línea, la existencia de grandes comercios en línea y el crecimiento de la infraestructura logística, se prevé que impulsen la demanda de este producto en el sector. Varias tiendas de comestibles se han convertido en tiendas de conveniencia que ofrecen servicios similares a la comida rápida, como alimentos congelados, comidas preparadas y productos frescos, lo que ha impulsado el auge de la industria alimentaria.

Análisis regional del mercado de equipos automatizados de manipulación de materiales

Asia-Pacífico posee la mayor participación en el mercado de equipos de manipulación automatizada de materiales.

- Asia-Pacífico es la región dominante en el mercado global de AMHE con la mayor participación de mercado del 35% en 2023.

- China es un contribuyente importante a este crecimiento con una participación de mercado mayor del 23,3%, impulsada por su sólido sector manufacturero, operaciones de comercio electrónico a gran escala e iniciativas gubernamentales que promueven la automatización.

- India y países del sudeste asiático como Tailandia, Vietnam e Indonesia están adoptando rápidamente tecnologías de automatización para mejorar la productividad y satisfacer las demandas de industrias en expansión como la automotriz, la electrónica y la logística.

Se proyecta que América del Norte registre la tasa de crecimiento anual compuesta (TCAC) más alta en el mercado de equipos de manipulación automatizada de materiales.

- América del Norte, en particular Estados Unidos, está experimentando un crecimiento significativo en el mercado AMHE, y se proyecta que Estados Unidos crecerá a una CAGR del 10,5 % entre 2025 y 2032.

- El crecimiento de la región está impulsado por los avances en inteligencia artificial, robótica y tecnologías de IoT, lo que conduce al desarrollo de sistemas de manipulación de materiales más eficientes e inteligentes.

- Los sectores automotriz y de comercio electrónico en EE. UU. son los principales impulsores de este crecimiento, con empresas que invierten fuertemente en automatización para mejorar la eficiencia y reducir los costos laborales.

Cuota de mercado de equipos automatizados de manipulación de materiales

El panorama competitivo del mercado ofrece detalles por competidor. Se incluye información general de la empresa, sus estados financieros, ingresos generados, potencial de mercado, inversión en investigación y desarrollo, nuevas iniciativas de mercado, presencia global, plantas de producción, capacidad de producción, fortalezas y debilidades de la empresa, lanzamiento de productos, alcance y variedad de productos, y dominio de las aplicaciones. Los datos anteriores se refieren únicamente al enfoque de mercado de las empresas.

Los principales líderes del mercado que operan en el mercado son:

- Daifuku Co., Ltd. (Japón)

- Dematic (Grupo KION) (Alemania)

- Grupo SSI Schaefer (Alemania)

- Honeywell Intelligrated (EE. UU.)

- Vanderlande (Toyota Advanced Logistics Group) (Países Bajos)

- Knapp AG (Austria)

- Murata Machinery Ltd. (Japón)

- Sistemas de manipulación de materiales (MHS) (EE. UU.)

- WITRON Logística Integrada (Alemania)

- Interlake Mecalux (Mecalux) (España)

- Beumer Group GmbH (Alemania)

- Siemens Logistics (Alemania)

- TGW Logistics Group GmbH (Austria)

- Swisslog AG (KUKA Robotics) (Suiza)

- Fives Intralogistics (Grupo Fives) (Francia)

- Kardex AG (Suiza)

- Bastian Solutions (Toyota Advanced Logistics Group) (EE. UU.)

- Elettric 80 (Italia)

- AutoStore AS (Noruega)

- System Logistics SpA (Italia)

Últimos avances en el mercado global de equipos de manipulación automatizada de materiales

- En marzo de 2023, THiRARobotics Co., Ltd. presentó sus robots móviles autónomos de nueva generación, lo que supone un gran avance en las operaciones de logística, almacenamiento, fabricación y atención médica. Estos robots de vanguardia representan un avance tecnológico significativo, ofreciendo mayor eficiencia, adaptabilidad y versatilidad en múltiples sectores. Este desarrollo subraya la creciente demanda de soluciones inteligentes y autónomas para optimizar los procesos de manipulación de materiales y mejorar la productividad operativa.

- En marzo de 2022, Toyota Industries Corporation reforzó su cartera logística con la adquisición de Viastore, un destacado proveedor de sistemas de manejo de materiales. Esta adquisición estratégica refuerza la capacidad de Toyota Industries para ofrecer soluciones de automatización avanzadas, especialmente diseñadas para centros de distribución de pequeñas y medianas empresas, consolidando aún más su liderazgo en el sector. Esta operación pone de manifiesto la creciente tendencia a la consolidación del sector y la creciente demanda de soluciones de automatización escalables y eficientes para empresas de diversos tamaños.

- En septiembre de 2020, Bohus se asoció con Jungheinrich para desarrollar un almacén central de vanguardia cerca de Oslo, Lillestrøm. El proyecto integra un conjunto completo de soluciones de automatización, que incluye sistemas Miniload, tecnología de transporte y almacenes con estanterías altas para palés. Esta iniciativa refleja el compromiso de Bohus con la optimización de sus operaciones logísticas y la mejora significativa de la eficiencia de sus procesos de manipulación de mercancías. Este desarrollo ejemplifica la creciente demanda de tecnologías avanzadas de automatización en las operaciones de almacén y logística. La integración de estas soluciones innovadoras subraya el compromiso del sector con la mejora de la eficiencia operativa, un mayor rendimiento y la rentabilidad, contribuyendo a la continua expansión y evolución del mercado de AMHE a nivel mundial.

- En marzo de 2025, Bastian Solutions se fusionó con Viastore North America, integrando sus operaciones en Toyota Automated Logistics Group. Esta colaboración estratégica combina la experiencia de Bastian Solutions en integración de sistemas con la especialización de Viastore en tecnologías automatizadas de manejo de palés, mejorando así sus capacidades combinadas en automatización de almacenes y soluciones de almacenamiento. Esta fusión pone de manifiesto la creciente tendencia de consolidación en el sector para ofrecer soluciones de automatización más completas y avanzadas.

- En marzo de 2024, OTTO Motors, líder en robots móviles autónomos (AMR), se convirtió en un actor clave en la logística de producción autónoma, un sector pionero en la innovación manufacturera. Con la incorporación de OTTO Motors a su portafolio, Rockwell Automation amplió significativamente sus capacidades de manejo de materiales, ofreciendo una solución integral para optimizar las operaciones en todas sus instalaciones. Esta adquisición subraya la creciente tendencia a integrar la robótica autónoma en los sistemas de manejo de materiales para mejorar la eficiencia, la flexibilidad y la escalabilidad.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.