Global Asset Management Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

5.84 Billion

USD

15.53 Billion

2024

2032

USD

5.84 Billion

USD

15.53 Billion

2024

2032

| 2025 –2032 | |

| USD 5.84 Billion | |

| USD 15.53 Billion | |

|

|

|

|

Segmentación del mercado global de gestión de activos por componente (solución y servicios), tipo de activo (activos digitales, activos de transporte retornables, activos en tránsito, activos de fabricación y personal), aplicación (gestión de activos de infraestructura, gestión de activos empresariales, gestión de activos sanitarios, gestión de activos de aviación, entre otros), función (seguimiento de ubicación y movimiento, registro de entrada y salida, reparación y mantenimiento, entre otros): tendencias del sector y pronóstico hasta 2032.

Tamaño del mercado de gestión de activos

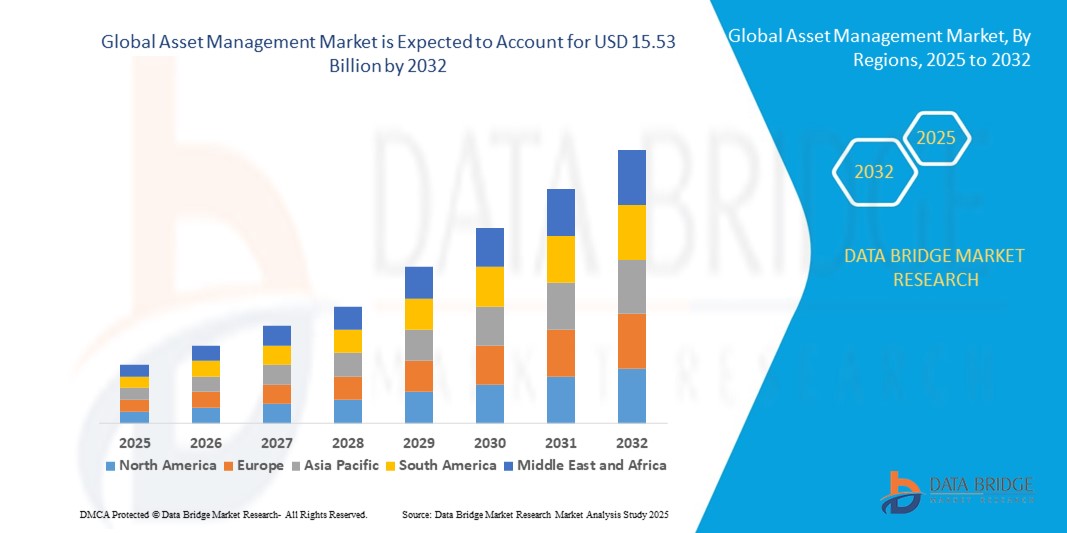

- El tamaño del mercado global de gestión de activos se valoró en USD 5.84 mil millones en 2024 y se espera que alcance los USD 15.53 mil millones para 2032 , con una CAGR del 13,0% durante el período de pronóstico.

- El crecimiento del mercado está impulsado principalmente por la creciente adopción de la transformación digital en la gestión de activos, la creciente demanda de seguimiento de activos en tiempo real y la necesidad de eficiencia operativa en todas las industrias.

- La creciente conciencia sobre la optimización de costos, el cumplimiento normativo y las iniciativas de sostenibilidad está impulsando aún más la demanda de soluciones de gestión de activos en varios sectores.

Análisis del mercado de gestión de activos

- El mercado de gestión de activos está experimentando un sólido crecimiento a medida que las organizaciones priorizan la eficiencia operativa, la gestión del ciclo de vida de los activos y la toma de decisiones basada en datos.

- La demanda de tecnologías avanzadas como IoT, IA y soluciones basadas en la nube está alentando a los proveedores a innovar con sistemas de gestión de activos escalables e integrados.

- América del Norte dominó el mercado de gestión de activos con la mayor participación en los ingresos del 33,59 % en 2024, impulsada por un sector de servicios financieros maduro, una adopción generalizada de tecnologías avanzadas y estrictos requisitos regulatorios.

- Se espera que Asia-Pacífico sea la región de más rápido crecimiento durante el período de pronóstico, impulsada por la rápida industrialización, la creciente adopción de soluciones digitales y el aumento de las inversiones en infraestructura y manufactura, particularmente en países como China, India y Japón.

- El segmento de soluciones dominó la mayor cuota de mercado en ingresos, con un 34,82 %, en 2024, impulsado por la creciente demanda de plataformas integradas que permitan a las organizaciones supervisar, analizar y optimizar el rendimiento de los activos a lo largo de su ciclo de vida. Las soluciones avanzadas de gestión de activos proporcionan información de datos en tiempo real, capacidades de mantenimiento predictivo y control centralizado, lo que las hace esenciales para las empresas que buscan eficiencia operativa y reducción de costes.

Alcance del informe y segmentación del mercado de gestión de activos

|

Atributos |

Perspectivas clave del mercado de gestión de activos |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, producción y capacidad por empresa representadas geográficamente, diseños de red de distribuidores y socios, análisis detallado y actualizado de tendencias de precios y análisis deficitario de la cadena de suministro y la demanda. |

Tendencias del mercado de gestión de activos

Creciente adopción de IA, IoT y análisis predictivo en la gestión de activos

- El mercado global de gestión de activos está experimentando una fuerte tendencia hacia la integración de la Inteligencia Artificial (IA), el Internet de las cosas (IoT) y el análisis predictivo.

- Estas tecnologías permiten el monitoreo en tiempo real, el análisis avanzado de datos y la generación de información predictiva en distintos tipos de activos, lo que ayuda a las organizaciones a optimizar la utilización y reducir los costos operativos.

- Las plataformas de gestión de activos impulsadas por IA pueden anticipar fallas de equipos, programar mantenimiento preventivo y mejorar la toma de decisiones mediante el análisis de grandes conjuntos de datos de múltiples fuentes.

- Por ejemplo, la tecnología de gemelos digitales y los análisis basados en IA se utilizan cada vez más en la gestión de activos de infraestructura y fabricación para simular escenarios de rendimiento y mejorar la eficiencia.

- Los sensores habilitados para IoT se implementan ampliamente para rastrear la ubicación, la condición y el uso de activos de transporte retornables, mercancías en tránsito y personal en tiempo real.

- El análisis predictivo favorece una mejor planificación financiera al pronosticar los costos del ciclo de vida de los activos, mejorar las estrategias de inversión y minimizar el tiempo de inactividad no planificado.

Dinámica del mercado de gestión de activos

Conductor

Creciente demanda de seguimiento de activos en tiempo real y eficiencia operativa

- La creciente demanda de soluciones que proporcionen visibilidad en tiempo real de los activos es un impulsor importante del mercado global de gestión de activos.

- Las organizaciones de sectores como infraestructura, atención médica, aviación y fabricación están adoptando cada vez más soluciones de gestión de activos para mejorar la eficiencia operativa y reducir las pérdidas.

- La adopción de sistemas de gestión de activos conectados ayuda a rastrear la ubicación, el movimiento y los requisitos de mantenimiento, lo que garantiza intervenciones oportunas y el cumplimiento de los estándares operativos.

- Los avances en la conectividad de IoT y el lanzamiento de la tecnología 5G están permitiendo una transmisión de datos más rápida y de baja latencia, lo que hace que el seguimiento de activos sea más preciso y confiable.

- En América del Norte, que dominó el mercado, la alta tasa de adopción de tecnología y los estrictos requisitos de cumplimiento normativo están acelerando el crecimiento.

- En la región Asia-Pacífico, el mercado de más rápido crecimiento, la expansión de la industrialización y la creciente inversión en infraestructura inteligente están impulsando una rápida adopción.

Restricción/Desafío

Altos costos de implementación y preocupaciones sobre la privacidad de los datos

- La importante inversión inicial requerida para hardware, software e integración de sistemas de gestión de activos puede ser una barrera importante para las pequeñas y medianas empresas, en particular en mercados sensibles a los costos.

- Modernizar los sistemas y procesos existentes para dar cabida a soluciones avanzadas de gestión de activos puede ser una tarea compleja y requerir muchos recursos.

- Las preocupaciones sobre la seguridad y la privacidad de los datos presentan otro desafío importante, ya que estos sistemas recopilan y transmiten información operativa y personal confidencial.

- El cumplimiento de diversas normativas de protección de datos en distintos países añade complejidad operativa para los proveedores de servicios globales

- El riesgo de ciberataques, acceso no autorizado y uso indebido de datos puede disuadir a algunas organizaciones de implementar completamente tecnologías de gestión de activos, especialmente en industrias que manejan datos críticos o confidenciales.

Alcance del mercado de gestión de activos

El mercado está segmentado según el componente, el tipo de activo, la aplicación y la función.

- Por componente

Según sus componentes, el mercado global de gestión de activos se segmenta en soluciones y servicios. El segmento de soluciones dominó la mayor cuota de mercado en ingresos, con un 34,82%, en 2024, impulsado por la creciente demanda de plataformas integradas que permitan a las organizaciones supervisar, analizar y optimizar el rendimiento de los activos a lo largo de su ciclo de vida. Las soluciones avanzadas de gestión de activos proporcionan información de datos en tiempo real, capacidades de mantenimiento predictivo y control centralizado, lo que las hace esenciales para las empresas que buscan eficiencia operativa y reducción de costes. Su adopción se ve impulsada además por la creciente integración de IA, IoT y gemelos digitales, que mejoran el seguimiento, la utilización y la gestión de riesgos de los activos.

Se prevé que el segmento de servicios registre la tasa de crecimiento más rápida entre 2025 y 2032, impulsado por la creciente externalización de las funciones de gestión de activos a proveedores de servicios especializados. Las empresas recurren cada vez más a la consultoría, la implementación, la formación y los servicios gestionados para maximizar el retorno de la inversión en tecnologías de gestión de activos. La complejidad de integrar sistemas de múltiples proveedores y garantizar el cumplimiento normativo impulsa a las organizaciones, especialmente en sectores con un uso intensivo de activos, a recurrir a servicios profesionales que ofrecen escalabilidad, personalización y optimización continua.

- Por tipo de activo

Según el tipo de activo, el mercado global de gestión de activos se clasifica en activos digitales, activos de transporte retornables, activos en tránsito, activos de fabricación y personal. El segmento de activos digitales representó la mayor participación en los ingresos en 2024, impulsado por la proliferación de operaciones basadas en datos y la necesidad de gestionar la propiedad intelectual, el software, el contenido multimedia y los derechos digitales. A medida que las empresas digitalizan sus flujos de trabajo, proteger y optimizar los activos digitales se ha vuelto crucial para la reputación de la marca y el cumplimiento normativo.

Se prevé que el segmento de activos de transporte retornables crezca a su tasa de crecimiento anual compuesta (TCAC) más alta entre 2025 y 2032, impulsado por la expansión de las cadenas de suministro globales y la necesidad de rastrear contenedores, palés y cajas reutilizables. Los sistemas de rastreo basados en IoT y el etiquetado RFID están mejorando la transparencia, reduciendo las pérdidas y optimizando la eficiencia de los procesos de entrega para los proveedores de logística. Mientras tanto, las categorías de transporte en tránsito, fabricación y personal siguen experimentando un crecimiento constante a medida que las industrias adoptan cada vez más el rastreo de activos para mejorar la productividad, la seguridad y la utilización.

- Por aplicación

Según su aplicación, el mercado global de gestión de activos se segmenta en gestión de activos de infraestructura, gestión de activos empresariales, gestión de activos sanitarios, gestión de activos de aviación, entre otros. El segmento de gestión de activos de infraestructura registró la mayor participación en los ingresos en 2024, debido a la creciente necesidad de mantener y optimizar infraestructuras públicas y privadas, como carreteras, servicios públicos e instalaciones. Gobiernos y empresas están invirtiendo en plataformas de gestión de activos para prolongar la vida útil de la infraestructura, cumplir con las normativas de seguridad y gestionar las inversiones de capital de forma más eficaz.

Se proyecta que el segmento de gestión de activos sanitarios crecerá a su ritmo más rápido entre 2025 y 2032, impulsado por la creciente demanda de sistemas de localización en tiempo real (RTLS), etiquetado RFID y sensores IoT en los hospitales. El sector se enfrenta a una creciente presión para optimizar el uso de los equipos, prevenir la pérdida de dispositivos críticos y garantizar el cumplimiento de las estrictas normativas sanitarias. Este crecimiento se ve impulsado aún más por la adopción de soluciones conectadas que mejoran la seguridad del paciente, reducen el tiempo de inactividad y optimizan la eficiencia operativa.

- Por función

En función de su función, el mercado global de gestión de activos se segmenta en seguimiento de ubicación y movimiento, registro de entrada y salida, reparación y mantenimiento, entre otros. Este segmento dominó el mercado en 2024, ya que las organizaciones buscan obtener visibilidad completa sobre la ubicación y el uso de sus activos en tiempo real. La integración de sensores GPS, RFID e IoT permite a las empresas prevenir robos, optimizar la logística y agilizar las operaciones en sus ubicaciones distribuidas.

Se prevé que el segmento de reparación y mantenimiento registre su mayor tasa de crecimiento entre 2025 y 2032, impulsado por la adopción de modelos de mantenimiento predictivo y preventivo. Las industrias con uso intensivo de activos implementan cada vez más análisis basados en IA para pronosticar fallos, minimizar el tiempo de inactividad y prolongar la vida útil de los activos. Esta transición del mantenimiento reactivo al proactivo está reduciendo los costes operativos y mejorando la productividad general.

Análisis regional del mercado de gestión de activos

- América del Norte dominó el mercado de gestión de activos con la mayor participación en los ingresos del 33,59 % en 2024, impulsada por un sector de servicios financieros maduro, una adopción generalizada de tecnologías avanzadas y estrictos requisitos regulatorios.

- Los consumidores y las organizaciones priorizan las soluciones de gestión de activos para optimizar la utilización de recursos, mejorar la eficiencia operativa y garantizar el cumplimiento de los estándares de la industria, particularmente en industrias con uso intensivo de activos.

- El crecimiento está respaldado por avances en tecnologías como la inteligencia artificial (IA), la Internet de las cosas (IoT) y las plataformas basadas en la nube, junto con una creciente adopción en aplicaciones empresariales y de infraestructura.

Perspectivas del mercado de gestión de activos de EE. UU.

El mercado estadounidense de gestión de activos captó la mayor cuota de ingresos, con un 83,9 %, en 2024 en Norteamérica, impulsado por la fuerte demanda de soluciones de gestión de activos digitales y físicos, y la creciente concienciación sobre los beneficios de la optimización de costes y el cumplimiento normativo. La tendencia hacia la integración de IA, IoT y análisis predictivo en los sistemas de gestión de activos impulsa aún más la expansión del mercado. La presencia de importantes proveedores de tecnología y un sector financiero consolidado complementa las aplicaciones de gestión de activos empresariales y de infraestructura, creando un ecosistema diverso.

Perspectivas del mercado de gestión de activos en Europa

Se prevé un crecimiento significativo del mercado europeo de gestión de activos, impulsado por un fuerte énfasis en el cumplimiento normativo y la sostenibilidad. Las organizaciones buscan soluciones que mejoren la visibilidad de los activos, agilicen las operaciones y cumplan con las normas ambientales. El crecimiento es notable en la gestión de infraestructuras y activos empresariales, con países como Alemania y Francia mostrando una adopción significativa debido a la creciente digitalización y las demandas de infraestructura urbana.

Perspectivas del mercado de gestión de activos del Reino Unido

Se prevé un rápido crecimiento del mercado británico de gestión de activos, impulsado por la demanda de un seguimiento y una gestión eficientes de activos en entornos urbanos e industriales. El mayor enfoque en la eficiencia operativa y la sostenibilidad fomenta la adopción de soluciones basadas en la nube e inteligencia artificial. La evolución de los requisitos regulatorios en materia de transparencia y cumplimiento normativo influye en las decisiones organizacionales, buscando un equilibrio entre la innovación tecnológica y el cumplimiento de las normas.

Perspectivas del mercado de gestión de activos en Alemania

Se prevé que Alemania experimente un rápido crecimiento en el mercado de gestión de activos, gracias a sus avanzados sectores industrial y manufacturero y al gran enfoque organizacional en la eficiencia operativa y la sostenibilidad. Las organizaciones alemanas prefieren soluciones tecnológicamente avanzadas, como los sistemas de localización en tiempo real (RTLS) y las plataformas basadas en IoT, que optimizan el ciclo de vida de los activos y reducen los costes operativos. La integración de estas soluciones en la gestión de activos empresariales y de fabricación impulsa el crecimiento sostenido del mercado.

Perspectivas del mercado de gestión de activos de Asia-Pacífico

Se prevé que la región Asia-Pacífico experimente la tasa de crecimiento más rápida, impulsada por la rápida industrialización, la creciente adopción de soluciones digitales y el aumento de las inversiones en infraestructura en países como China, India y Japón. La creciente concienciación sobre la optimización de activos, la reducción de costes y el cumplimiento normativo impulsa la demanda de soluciones de gestión de activos. Las iniciativas gubernamentales que promueven la transformación digital y la infraestructura inteligente impulsan aún más la adopción de tecnologías avanzadas de gestión de activos.

Perspectivas del mercado de gestión de activos en Japón

Se prevé un rápido crecimiento del mercado japonés de gestión de activos debido a la fuerte preferencia de las organizaciones por soluciones tecnológicamente avanzadas y de alta calidad que mejoran la eficiencia operativa y el cumplimiento normativo. La presencia de importantes empresas industriales y tecnológicas y la integración de soluciones de gestión de activos en aplicaciones empresariales y de infraestructura aceleran la penetración en el mercado. El creciente interés en la transformación digital también contribuye al crecimiento.

Perspectivas del mercado de gestión de activos de China

China posee la mayor participación en el mercado de gestión de activos de Asia-Pacífico, impulsada por la rápida urbanización, el aumento de la producción industrial y la creciente demanda de soluciones de gestión de activos digitales y en tránsito. La creciente base industrial del país y su enfoque en la fabricación inteligente impulsan la adopción de sistemas avanzados de gestión de activos. Las sólidas capacidades tecnológicas nacionales y los precios competitivos mejoran la accesibilidad al mercado.

Cuota de mercado de gestión de activos

La industria de gestión de activos está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- ABB Inc. (Suiza)

- Adobe Systems Inc. (EE. UU.)

- Brookfield Asset Management Inc. (Canadá)

- Honeywell International Inc. (EE. UU.)

- IBM Corp. (EE. UU.)

- Oracle (EE. UU.)

- Rockwell Automation, Inc. (EE. UU.)

- Siemens AG (Alemania)

- WSP Global Inc. (Canadá)

- Zebra Technologies Corp. (EE. UU.)

- Hitachi, Ltd. (Japón)

- General Electric Company (EE. UU.)

- Bentley Systems, Incorporated (EE. UU.)

- Hexagon AB (Suecia)

- AssetWorks, Inc. (EE. UU.)

- SAP SE (Alemania)

¿Cuáles son los desarrollos recientes en el mercado global de gestión de activos?

- En marzo de 2023, BlackRock, una de las gestoras de activos líderes a nivel mundial, lanzó el ETF Future of Work (ticker: WKFL), diseñado para invertir en empresas que definen el cambiante panorama laboral. Este ETF temático se dirige a empresas dedicadas a tecnologías de teletrabajo, automatización, ciberseguridad, gestión del capital humano y otras innovaciones que redefinen cómo y dónde trabajan las personas. WKFL refleja el enfoque estratégico de BlackRock en las tendencias a largo plazo y busca aprovechar las oportunidades de crecimiento impulsadas por la transformación digital, los modelos de trabajo flexibles y la optimización de la fuerza laboral en todos los sectores.

- En enero de 2023, Voya Investment Management lanzó analistas virtuales con IA como parte de su estrategia de Inteligencia Artificial (IA), lo que marca un paso significativo en la integración de la inteligencia artificial en el proceso de gestión de inversiones. Estos analistas virtuales (modelos de aprendizaje automático) analizan grandes conjuntos de datos para identificar patrones persistentes y generar recomendaciones de acciones, complementando la experiencia humana. Al transformar los datos brutos en información práctica, el sistema ayuda a los gestores de cartera a tomar decisiones informadas, manteniendo sólidos controles de riesgo. Este enfoque híbrido mejora la eficiencia, reduce el sesgo emocional y refleja el compromiso de Voya con la innovación en estrategias de renta variable activa.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.