Global Alcohol Ingredients Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1.90 Billion

USD

3.60 Billion

2024

2032

USD

1.90 Billion

USD

3.60 Billion

2024

2032

| 2025 –2032 | |

| USD 1.90 Billion | |

| USD 3.60 Billion | |

|

|

|

Mercado mundial de ingredientes alcohólicos, por tipo de ingrediente (levadura, enzimas, colorantes, sabores y sales, y otros), tipo de bebida (cerveza, licores, vino, whisky, brandy y otros): tendencias de la industria y pronóstico hasta 2029

Análisis y tamaño del mercado

En los últimos años, los consumidores han tomado decisiones más deliberadas sobre su consumo de alcohol. El movimiento de salud y bienestar ha inundado el mercado con opciones de bebidas sin alcohol, que van desde bebidas de malta sin alcohol hasta bebidas listas para beber bajas en calorías. Aunque la conciencia sobre la salud está en aumento, los gustos de los consumidores cambian y evolucionan constantemente en cambios y evoluciones sutiles. Para mantenerse por delante de la competencia, los fabricantes deben mantenerse al día con las nuevas tendencias.

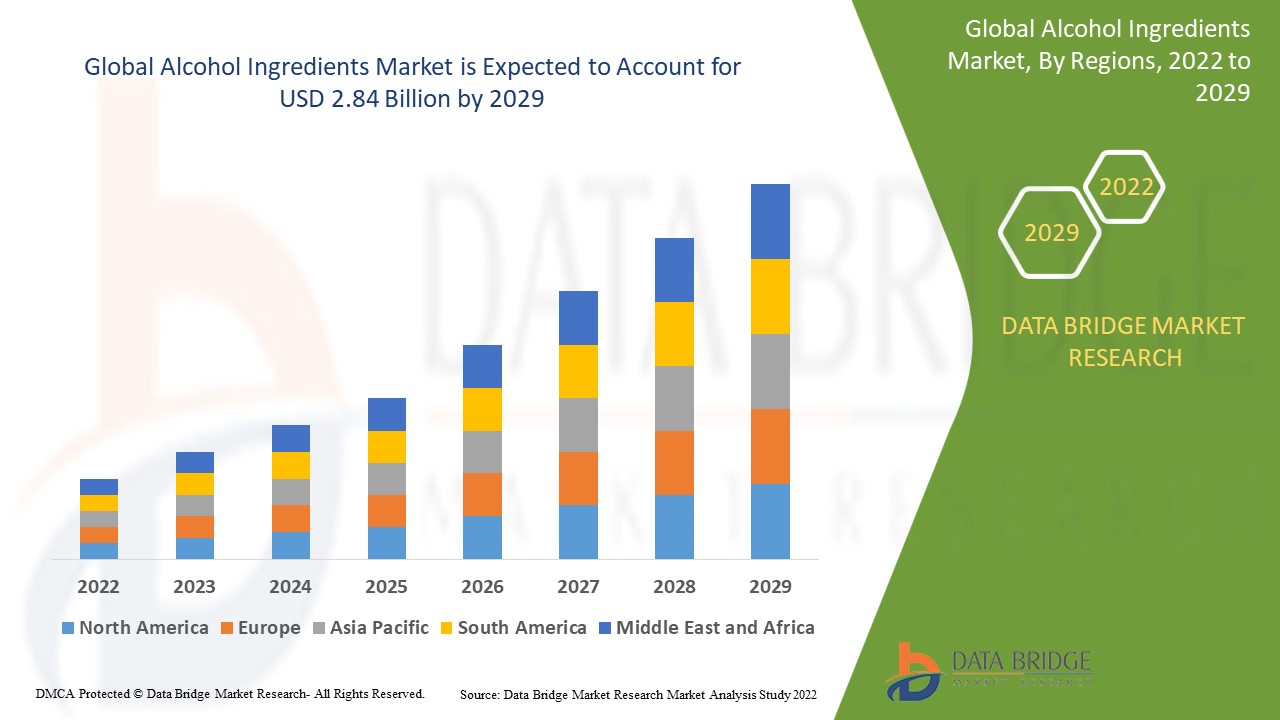

Data Bridge Market Research analiza que el mercado de ingredientes alcohólicos creció a un valor de 1.500 millones en 2021 y se espera que alcance el valor de 2.840 millones de dólares en 2029, con una CAGR del 8,3% durante el período de pronóstico de 2022 a 2029. Además de los conocimientos del mercado, como el valor de mercado, la tasa de crecimiento, los segmentos del mercado, la cobertura geográfica, los actores del mercado y el escenario del mercado, el informe de mercado seleccionado por el equipo de Data Bridge Market Research incluye un análisis profundo de expertos, análisis de importación/exportación, análisis de precios, análisis de consumo de producción, análisis de patentes y comportamiento del consumidor.

Alcance del informe y segmentación del mercado

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2014 - 2019) |

|

Unidades cuantitativas |

Ingresos en miles de millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Tipo de ingrediente (levadura, enzimas, colorantes, sabores y sales, y otros), tipo de bebida (cerveza, licores, vino, whisky, brandy y otros) |

|

Países cubiertos |

EE. UU., Canadá y México en América del Norte, Alemania, Suecia, Polonia, Dinamarca, Francia, Reino Unido, Países Bajos, Suiza, Bélgica, Rusia, Italia, España, Turquía, Resto de Europa en Europa, China, Japón, India, Corea del Sur, Singapur, Malasia, Australia, Tailandia, Indonesia, Filipinas, Resto de Asia-Pacífico (APAC) en Asia-Pacífico (APAC), Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Egipto, Israel, Resto de Medio Oriente y África (MEA) como parte de Medio Oriente y África (MEA), Brasil, Argentina y Resto de Sudamérica como parte de Sudamérica |

|

Actores del mercado cubiertos |

Cargill Incorporated (EE. UU.), DuPont (EE. UU.), Bluestar Adisseo Co. Ltd (China), BASF SE (Alemania), Kemin Industries, Inc. (EE. UU.), DSM (Países Bajos), Associated British Foods plc (Reino Unido), Novozymes (EE. UU.), Biocatalysts Ltd. (Reino Unido), Amano Enzyme Inc. (Japón), Kerry Group plc (Irlanda), Jiangsu Boli Bioproducts Co. Ltd. (China), AUM Enzymes (India), Antozyme Biotech Pvt Ltd (India), Xike Biotechnology Co. Ltd. (China), SUNSON Industry Group Co. Ltd. (China) |

|

Oportunidades |

|

Definición de mercado

El alcohol es una bebida alcohólica que contiene una cantidad significativa de etanol. Tiene uno o más grupos funcionales hidroxilo (OH) unidos a un átomo de carbono saturado. El contenido de alcohol de las distintas bebidas varía. Se dividen en cuatro categorías según el tipo de ingrediente: enzimas, levadura , colorantes, sabores y sal, y otros (Especias y suplementos).

Dinámica del mercado de ingredientes alcohólicos

Conductores

- Creciente demanda de bebidas espirituosas de alta gama debido a su fácil accesibilidad

A medida que la economía de varios países se mantiene fuerte, el interés de los consumidores por las bebidas espirituosas de alta gama y las bebidas más caras ha crecido, impulsado en parte por el fácil acceso a la información y la disposición a gastar en los productos deseados. Como resultado, la demanda de ingredientes alcohólicos ha aumentado. El whisky ha seguido siendo una bebida alcohólica popular entre muchos bebedores a lo largo de los años, asegurando una posición sólida en los mezcladores de alta calidad. Se espera que esto impulse el crecimiento del mercado de ingredientes alcohólicos. La demanda de ingredientes alcohólicos también se ve impulsada por las fuertes ventas de productos de alta gama y super premium.

- Los fabricantes se centran en las innovaciones de ingredientes para cambiar según la dinámica del consumidor

Además de buscar alternativas más saludables, cada vez más consumidores buscan marcas que puedan satisfacer sus necesidades ofreciendo un abastecimiento sostenible y responsabilidad social. Estos factores no solo están aumentando la demanda de bebidas funcionales y de fusión, sino que también están provocando una revolución dinámica en la industria de las bebidas alcohólicas. Varias empresas aspiran a aumentar la producción de bebidas sin alcohol o con bajo contenido de alcohol, lo que requiere un fuerte enfoque en la innovación de ingredientes. Los fabricantes están desarrollando ingredientes de alta calidad con pocas impurezas y un sabor limpio, que seguirán siendo fundamentales para obtener una clara ventaja competitiva en el mercado.

Oportunidad

Con la creciente demanda de productos para llevar que se adapten a los estilos de vida ajetreados pero saludables de los consumidores actuales, las bebidas alcohólicas premezcladas o RTD se están volviendo más populares, lo que podría aumentar la demanda de ingredientes alcohólicos. Además de la cerveza y los refrescos, el vino enlatado, los cócteles y los refrescos con gas se están volviendo populares, en línea directa con la cultura de la comida para llevar. Además, para aumentar las ventas, los proveedores de alcohol se centran en las ofertas directas al consumidor a través de la venta minorista en línea. Estos elementos seguirán respaldando las perspectivas futuras de los ingredientes alcohólicos.

Restricciones

Se espera que las campañas contra el alcohol compensen el crecimiento del mercado de ingredientes alcohólicos en varios países del mundo. Estas campañas tienen como objetivo demostrar los efectos negativos del consumo de alcohol. Además, el aumento de los impuestos sobre los productos alcohólicos es otro impedimento para el crecimiento del mercado de ingredientes alcohólicos.

Este informe sobre el mercado de ingredientes alcohólicos proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado por categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de ingredientes alcohólicos, comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Impacto de la COVID-19 en el mercado de ingredientes alcohólicos

La pandemia de COVID-19 ha obligado a los gobiernos a cerrar numerosos pubs, restaurantes y bares para mantener las normas de distanciamiento social. Esto ha tenido un impacto negativo en el mercado mundial de ingredientes para bebidas alcohólicas. Según un estudio de la Asociación de Cerveceros, las ventas totales de las cervecerías en los Estados Unidos cayeron un 30,5 por ciento en mayo en comparación con el año anterior. Como las ventas interanuales cayeron en abril, casi el 89 % de las empresas cerveceras detuvieron o desaceleraron su producción. Sin embargo, a medida que la situación de COVID-19 ha mejorado gradualmente, con menos restricciones impuestas a los canales de servicio de alimentos, se espera que el mercado de ingredientes para bebidas alcohólicas recupere sus niveles de consumo previamente elevados este año.

Desarrollo reciente

- En la feria comercial Supply Side West de octubre de 2019, Ashland Inc. lanzará ingredientes "demoledores" para consumidores deportistas y autónomos. Según la empresa, estos ingredientes versátiles se pueden utilizar en diversas aplicaciones, como dietas cetogénicas y control de peso, un intestino sano, el bienestar de las articulaciones y la recuperación muscular.

- En abril de 2019, Döhler Group, un actor importante en el mercado de ingredientes alcohólicos, anunció la adquisición de la mayoría de las acciones de Zumos Catalano Aragoneses SA (Zucasa), un moderno productor de cremogenados, jugos y concentrados de frutas y verduras dulces. La adquisición tiene como objetivo ampliar la oferta de concentrados de frutas, purés y jugos de la antigua empresa.

- Archer Daniels Midland anunció en marzo de 2019 que había llegado a un acuerdo para adquirir Ziegler Group, un proveedor de ingredientes de sabores cítricos naturales con sede en Europa. El acuerdo se produjo poco después de que ADM adquiriera Florida Chemical Company, que agregó capacidades cítricas líderes en la industria a su cartera de sabores.

Alcance del mercado mundial de ingredientes alcohólicos

El mercado de ingredientes alcohólicos está segmentado en función del tipo de ingrediente y del tipo de bebida. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de ingrediente

- Levadura

- Enzimas

- Colorantes

- Sabores y sales

- Otros

Tipo de bebida

- Cerveza

- Espíritu

- Vino

- Whisky

- brandy

- Otros

Análisis y perspectivas regionales del mercado de ingredientes alcohólicos

Se analiza el mercado de ingredientes alcohólicos y se proporcionan información y tendencias del tamaño del mercado por país, tipo de ingrediente y tipo de bebida como se menciona anteriormente.

Los países cubiertos en el informe del mercado de ingredientes de alcohol son EE. UU., Canadá y México en América del Norte, Alemania, Suecia, Polonia, Dinamarca, Francia, Reino Unido, Países Bajos, Suiza, Bélgica, Rusia, Italia, España, Turquía, Resto de Europa en Europa, China, Japón, India, Corea del Sur, Singapur, Malasia, Australia, Tailandia, Indonesia, Filipinas, Resto de Asia-Pacífico (APAC) en Asia-Pacífico (APAC), Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Egipto, Israel, Resto de Medio Oriente y África (MEA) como parte de Medio Oriente y África (MEA), Brasil, Argentina y Resto de América del Sur como parte de América del Sur.

La región de Asia y el Pacífico domina el mercado de ingredientes alcohólicos. La región tiene un enorme potencial en el mercado de la cerveza artesanal, con una fuerte demanda de cerveza artesanal occidentalizada que se combina con los gustos y preferencias locales. Uno de los factores que ha impulsado el crecimiento del mercado de bebidas alcohólicas de la región ha sido un cambio en las preferencias de los consumidores, que se han alejado del alcohol tradicional y se han volcado hacia el alcohol importado. Debido a su reconocida herencia y prestigio, los consumidores de países como China prefieren los vinos producidos en regiones vinícolas famosas, como Burdeos. Los whiskies, coñacs y vinos importados son cada vez más populares en toda la región a medida que los consumidores se inclinan por productos de gama más alta.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los ingredientes del alcohol

El panorama competitivo del mercado de ingredientes alcohólicos proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, el dominio de la aplicación. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de ingredientes alcohólicos.

Algunos de los principales actores que operan en el mercado de ingredientes alcohólicos son:

- Cargill Incorporated (Estados Unidos)

- DuPont (Estados Unidos)

- Bluestar Adisseo Co.Ltd (China)

- BASF SE (Alemania)

- Kemin Industries, Inc. (Estados Unidos)

- DSM (Países Bajos)

- Associated British Foods plc (Reino Unido)

- Novozymes (Estados Unidos)

- Biocatalysts Ltd. (Reino Unido)

- Amano Enzyme Inc. (Japón)

- Kerry Group plc (Irlanda)

- Jiangsu Boli Bioproducts Co.Ltd. (Porcelana)

- Enzimas AUM (India)

- Antozyme Biotech Pvt Ltd (India)

- Xike Biotecnología Co. Ltd. (China)

- Grupo industrial SUNSON Co. Ltd (China)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.