Mercado alemán de verificación y autenticación de identidad, por oferta (soluciones y servicios), tipo (biometría y no biometría), implementación (local y en la nube), tamaño de la organización (grandes empresas, medianas empresas y pequeñas empresas), vertical (gobierno electrónico, banca/servicios financieros, seguros y otros) - Tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de autenticación y verificación de identidad en Alemania

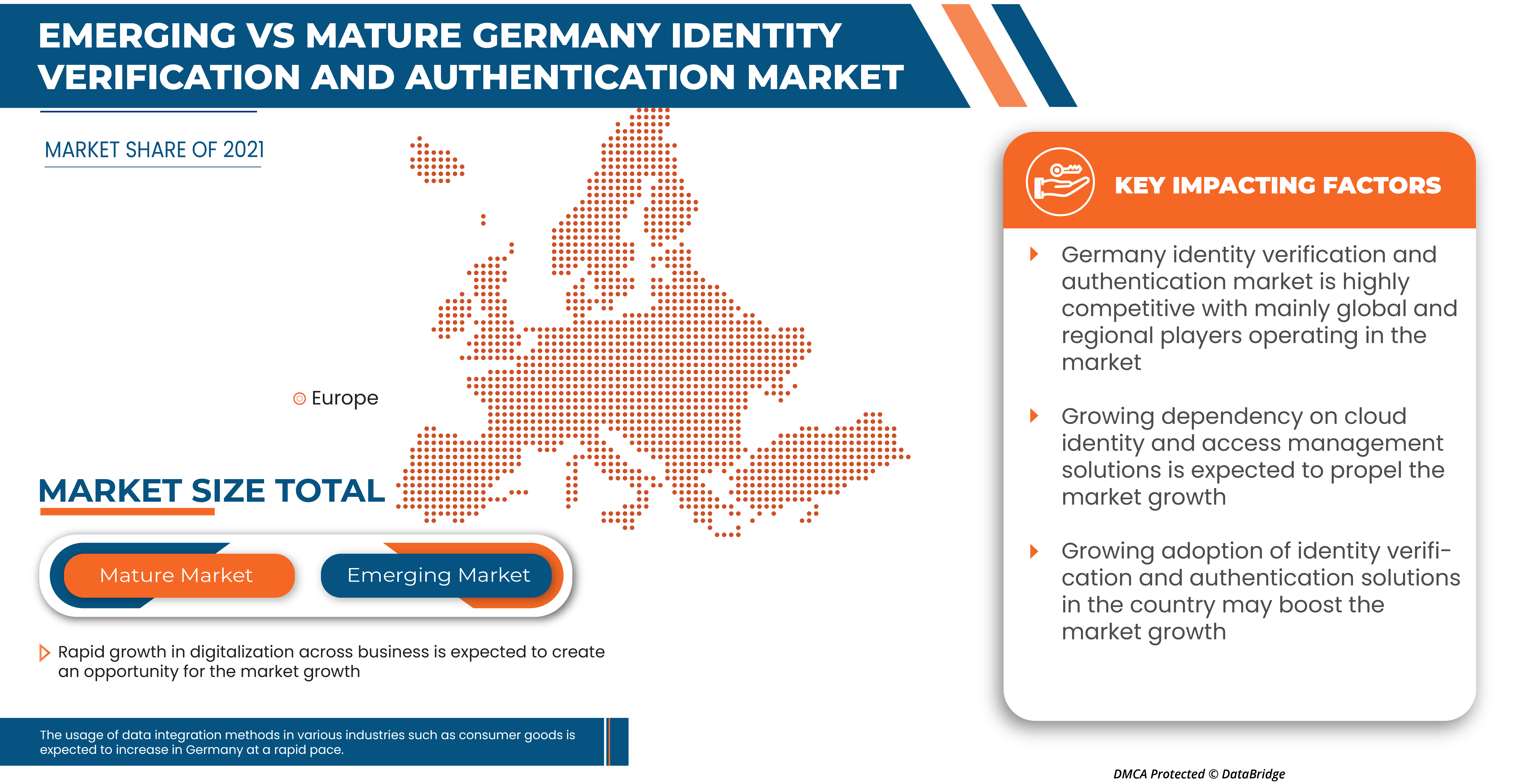

La verificación y autenticación de identidad se refiere a los servicios y soluciones que se utilizan para verificar y autenticar la identidad física de una persona o sus documentos, como una licencia de conducir, un pasaporte o un documento de identidad emitido a nivel nacional. El mercado alemán de verificación y autenticación de identidad está creciendo rápidamente debido a la creciente demanda de tecnologías de comunicación de campo cercano (NFC). Las empresas incluso están lanzando nuevas soluciones para ganar una mayor participación de mercado. La creciente adopción de pagos digitales por parte de los clientes ha impulsado enormemente el crecimiento del mercado alemán de verificación y autenticación de identidad. Las crecientes innovaciones tecnológicas en las industrias están impulsando el crecimiento del mercado. La verificación de identidad requiere un alto capital inicial para la instalación, el mantenimiento y otros costos de experiencia técnica que pueden restringir el crecimiento del mercado.

Data Bridge Market Research analiza que se espera que el mercado de verificación y autenticación de identidad de Alemania alcance un valor de USD 2.056,56 millones para 2030, con una CAGR del 17,6 % durante el período de pronóstico. Las soluciones en verificación y autenticación de identidad representan el segmento de modo de módulos más destacado. Este informe de mercado también cubre en profundidad el análisis de precios, el análisis de patentes y los avances tecnológicos.

|

Métrica del informe |

Detalles |

|

Año base |

2022 |

|

Período de pronóstico |

2023 a 2030 |

|

Año histórico |

2021 (Personalizable para 2020-2015) |

|

Unidades cuantitativas |

Millones de dólares en 2023 |

|

Segmentos cubiertos |

Por oferta (soluciones y servicios), tipo (biometría y no biometría), implementación (local y en la nube), tamaño de la organización (grandes empresas, medianas empresas y pequeñas empresas), vertical (gobierno electrónico, servicios bancarios/financieros, seguros y otros) |

|

País cubierto |

Alemania |

|

Actores del mercado cubiertos |

Onfido, IDEMIA, Thales Group, Shufti Pro, Jumio, IDnow., Trulioo, Authenteq, Prove Identity, Inc., Entrust Corporation, keyp GmbH y Bare.ID, entre otros. |

Definición de mercado

La verificación de identidad se refiere a los servicios y soluciones que se utilizan para verificar la autenticidad de la identidad física de una persona o de sus documentos, como el permiso de conducir, el pasaporte o el documento de identidad emitido a nivel nacional, entre otros. La verificación de identidad es un proceso importante que garantiza que la identidad de una persona coincida con la que se supone que es. Las soluciones y servicios de verificación de identidad garantizan que una persona real esté operando detrás de un proceso y demuestre quién dice ser, lo que evita identidades falsas o la comisión de fraudes. La verificación de identidad es un requisito esencial en muchos procesos y procedimientos comerciales.

Dinámica del mercado de autenticación y verificación de identidad en Alemania

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

Conductores

- Creciente demanda de tecnologías de comunicación de campo cercano (NFC)

La comunicación de campo cercano (NFC) es una tecnología de comunicación sin contacto basada en una frecuencia de radio (RF) con una frecuencia de trabajo de 13,56 MHz. La tecnología NFC está diseñada para intercambiar datos entre dos dispositivos electrónicos a través de un simple toque. En los últimos tiempos, la tecnología NFC ha ganado una inmensa popularidad debido a factores como los gritos de COVID en todo el mundo y los servicios sin contacto que ofrecen estos dispositivos durante estos gritos.

- Aumentar la dependencia de las soluciones de gestión de identidad y acceso en la nube

Las soluciones de gestión de identidad y acceso (IAM) son un conjunto de disciplinas de seguridad que permiten que las personas adecuadas accedan al contenido adecuado con la intención adecuada. Las soluciones de gestión de identidad y acceso garantizan la identidad del usuario antes de que se utilice el contenido. Las soluciones IAM existen desde hace bastante tiempo; inicialmente, las empresas y las corporaciones implementaban software de gestión de identidad y acceso (IAM) local para administrar las estrategias de identidad y acceso. Pero en los últimos tiempos, el avance tecnológico ha llevado al crecimiento de las soluciones de gestión de identidad y acceso (IAM) basadas en la nube o de identidad como servicio (IDaaS) basadas en la nube. Las tecnologías en la nube asistidas con inteligencia artificial (IA), aprendizaje automático (ML) y aprendizaje profundo tienen la ventaja sobre las tecnologías locales.

- Creciente adopción de soluciones de verificación y autenticación de identidad

La verificación y autenticación de identidad se refiere a los servicios y soluciones que se utilizan para verificar y autenticar la identidad física de una persona o sus documentos, como una licencia de conducir, un pasaporte o un documento de identidad emitido a nivel nacional. La verificación y autenticación de identidad es un proceso importante que garantiza que la identidad de una persona coincida con la que se supone que es.

Restricciones/Desafíos

- Aumento de las actividades fraudulentas

Las soluciones y servicios de verificación y autenticación de identidad garantizan que una persona real esté detrás de un proceso y demuestre que es quien dice ser, lo que evita que identidades falsas cometan fraude. La verificación y autenticación de identidad son requisitos esenciales en diversas empresas.

- Falta de conocimiento sobre las soluciones de verificación y autenticación de identidad

Existe una enorme demanda de digitalización y avances tecnológicos en las industrias de varios países. Las soluciones de verificación y autenticación de identidad permiten a las organizaciones verificar rápidamente las identidades digitales de clientes nuevos y existentes.

- Alto costo inicial

La verificación y autenticación de identidad implican software, soluciones y servicios que garantizan que una persona real esté detrás de un proceso. La verificación y autenticación de la identidad de una persona es un proceso crucial para una empresa y genera altos costos.

Impacto posterior a la COVID-19 en el mercado alemán de verificación y autenticación de identidad

La COVID-19 tuvo un gran impacto en el mercado alemán de verificación y autenticación de identidad, ya que casi todos los países optaron por cerrar todas las instalaciones de producción, excepto las que se dedicaban a la producción de bienes esenciales. El gobierno adoptó algunas medidas estrictas, como el cierre de la producción y venta de bienes no esenciales, el bloqueo del comercio internacional y muchas más para evitar la propagación de la COVID-19. Las únicas empresas que funcionaron durante esta pandemia fueron los servicios esenciales a los que se les permitió abrir y ejecutar los procesos.

Los fabricantes están tomando diversas decisiones estratégicas para recuperarse tras la COVID-19. Los actores están llevando a cabo múltiples actividades de I+D para mejorar la tecnología involucrada en las mangueras industriales. Las empresas traerán soluciones avanzadas y precisas al mercado. Además, las iniciativas gubernamentales para impulsar el comercio internacional han llevado al crecimiento del mercado.

Acontecimientos recientes

- En septiembre de 2022, IDnow colaboró con Adobe Document Cloud para simplificar sus servicios de firma digital para su base de clientes. Las capacidades de autenticación también estarán disponibles para los clientes que utilicen Acrobat Sign a través de plataformas como Google y Salesforce. Este paso ayudará a la empresa a crecer y expandir su cartera de soluciones con soluciones y servicios mejorados para su base de clientes.

- En octubre de 2021, Thales Group lanzó una solución de autenticación biométrica de voz. La característica principal de esta solución fue la mejora de las capacidades de autenticación basada en conocimiento e identidad de fraude. Esta solución fue diseñada para verificaciones de identidad móviles para operadores de centros de llamadas. Esta solución ayudó a la empresa a expandir su mercado y mejorar su cartera de soluciones.

Alcance del mercado de verificación y autenticación de identidad en Alemania

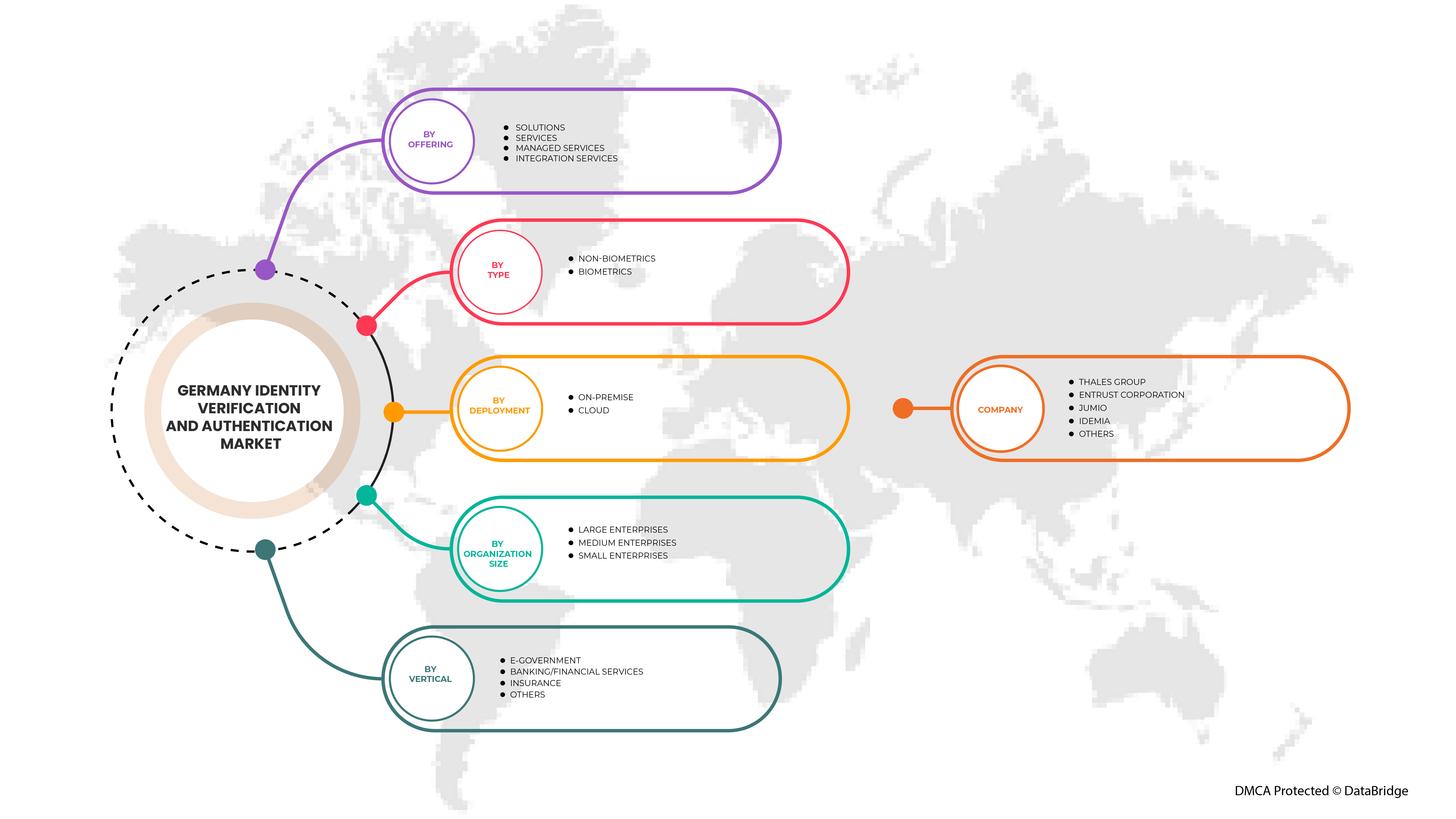

El mercado alemán de verificación y autenticación de identidad está segmentado en cinco segmentos notables según el componente, el tipo, el modo de implementación, el tamaño de la organización y la vertical. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Al ofrecer

- Soluciones

- Servicios

En cuanto a la oferta, el mercado alemán de verificación y autenticación de identidad está segmentado en soluciones y servicios.

Por tipo

- No biometría

- Biometría

En cuanto a tipología, el mercado alemán de verificación y autenticación de identidad está segmentado en biometría y no biometría.

Por implementación

- En las instalaciones

- Nube

Sobre la base de la implementación, el mercado alemán de verificación y autenticación de identidad está segmentado en nube y local.

Por tamaño de la organización

- Grandes empresas

- Medianas empresas

- Pequeñas empresas

Según el tamaño de la organización, el mercado de verificación y autenticación de identidad de Alemania está segmentado en grandes empresas, medianas empresas y pequeñas empresas.

Por vertical

- Gobierno electrónico

- Servicios bancarios/financieros

- Seguro

- Otros

Sobre la base vertical, el mercado alemán de verificación y autenticación de identidad está segmentado en gobierno electrónico, servicios bancarios/financieros, seguros y otros.

Análisis del panorama competitivo y de la cuota de mercado de verificación y autenticación de identidad en Alemania

El panorama competitivo del mercado de autenticación y verificación de identidad de Alemania proporciona detalles de los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en I+D, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de autenticación y verificación de identidad de Alemania.

Algunos de los principales actores que operan en el mercado de autenticación y verificación de identidad de Alemania son Onfido, IDEMIA, Thales Group, Shufti Pro, Jumio, IDnow., Trulioo, Authenteq, Prove Identity, Inc., Entrust Corporation, keyp GmbH y Bare.ID, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GERMANY IDENTITY VERIFICATION AND AUTHENTICATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 VALUE CHAIN

4.3 BRAND ANALYSIS

4.4 POTENTIAL IN THE PUBLIC SECTOR, INCLUDING MARKET POTENTIAL FOR THE VENDORS AND THE COMPETITORS

4.5 REGULATORY FRAMEWORK (COMPLIANCE STANDARDS FOR BANKS )

4.6 TOP WINNING STRATEGIES BY COMPANIES

4.7 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.8 PRICING ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR NEAR-FIELD COMMUNICATION (NFC) TECHNOLOGIES

5.1.2 HIGH DEPENDENCY ON CLOUD IDENTITY AND ACCESS MANAGEMENT SOLUTIONS

5.1.3 GROWING ADOPTION OF IDENTITY VERIFICATION SOLUTIONS

5.1.4 RAPID GROWTH IN DIGITALIZATION ACROSS BUSINESS

5.2 RESTRAINTS

5.2.1 SURGE IN FRAUDULENT ACTIVITIES

5.2.2 LACK OF AWARENESS REGARDING IDENTITY VERIFICATION SOLUTIONS

5.2.3 HIGH INITIAL COST

5.3 OPPORTUNITIES

5.3.1 HIGH ADOPTION OF RAZOR-SHARP BIOMETRICS IDENTITY VERIFICATION SOLUTIONS

5.3.2 INCREASING DEMAND FOR IDENTITY VERIFICATION SERVICES IN SMARTPHONES

5.3.3 WIDE RANGE ADOPTION OF IDENTITY VERIFICATION SOLUTIONS ACROSS BFSI

5.4 CHALLENGES

5.4.1 LACK OF SKILLED PROFESSIONALS WHILE OFFERING SERVICES FOR IDENTITY VERIFICATION SOLUTIONS

5.4.2 STORAGE CHALLENGE FOR HUGE VARIANTS OF DATA/INFORMATION

6 GERMANY IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOLUTIONS

6.2.1 DOCUMENT/ID VERIFICATION

6.2.2 DIGITAL/ELECTRONIC IDENTITY VERIFICATION & AUTHENTICATION

6.2.3 ANTI-MONEY LAUNDERING (AML)

6.2.4 KNOW YOUR CUSTOMER (KYC)

6.2.5 FRAUD DETECTION

6.3 SERVICES

6.3.1 MANAGED SERVICES

6.3.2 PROFESSIONAL SERVICES

7 GERMANY IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY TYPE

7.1 OVERVIEW

7.2 BIOMETRICS

7.3 NON-BIOMETRICS

8 GERMANY IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY DEPLOYMENT

8.1 OVERVIEW

8.2 ON-PREMISE

8.3 CLOUD

9 GERMANY IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISES

9.3 MEDIUM ENTERPRISES

9.4 SMALL ENTERPRISES

10 GERMANY IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY VERTICAL

10.1 OVERVIEW

10.2 E-GOVERNMENT

10.2.1 SOLUTIONS

10.2.1.1 DOCUMENT/ID VERIFICATION

10.2.1.2 DIGITAL/ELECTRONIC IDENTITY VERIFICATION & AUTHENTICATION

10.2.1.3 ANTI-MONEY LAUNDERING (AML)

10.2.1.4 KNOW YOUR CUSTOMER (KYC)

10.2.1.5 FRAUD DETECTION

10.2.2 SERVICES

10.2.2.1 MANAGED SERVICES

10.2.2.2 PROFESSIONAL SERVICES

10.3 BANKING/FINANCIAL SERVICES

10.3.1 SOLUTIONS

10.3.1.1 DOCUMENT/ID VERIFICATION

10.3.1.2 DIGITAL/ELECTRONIC IDENTITY VERIFICATION & AUTHENTICATION

10.3.1.3 ANTI-MONEY LAUNDERING (AML)

10.3.1.4 KNOW YOUR CUSTOMER (KYC)

10.3.1.5 FRAUD DETECTION

10.3.2 SERVICES

10.3.2.1 MANAGED SERVICES

10.3.2.2 PROFESSIONAL SERVICES

10.4 INSURANCE

10.4.1 SOLUTIONS

10.4.1.1 DOCUMENT/ID VERIFICATION

10.4.1.2 DIGITAL/ELECTRONIC IDENTITY VERIFICATION & AUTHENTICATION

10.4.1.3 ANTI-MONEY LAUNDERING (AML)

10.4.1.4 KNOW YOUR CUSTOMER (KYC)

10.4.1.5 FRAUD DETECTION

10.4.2 SERVICES

10.4.2.1 MANAGED SERVICES

10.4.2.2 PROFESSIONAL SERVICES

10.5 OTHERS

10.5.1 SOLUTIONS

10.5.1.1 DOCUMENT/ID VERIFICATION

10.5.1.2 DIGITAL/ELECTRONIC IDENTITY VERIFICATION & AUTHENTICATION

10.5.1.3 ANTI-MONEY LAUNDERING (AML)

10.5.1.4 KNOW YOUR CUSTOMER (KYC)

10.5.1.5 FRAUD DETECTION

10.5.2 SERVICES

10.5.2.1 MANAGED SERVICES

10.5.2.2 PROFESSIONAL SERVICES

11 GERMANY IDENTITY VERIFICATION AND AUTHENTICATION MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: GERMANY

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 THALES GROUP

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 SOLUTION PORTFOLIO

13.1.4 RECENT DEVELOPMENTS

13.2 IDNOW

13.2.1 COMPANY SNAPSHOT

13.2.2 PRODUCT PORTFOLIO

13.2.3 RECENT DEVELOPMENTS

13.3 ENTRUST CORPORATION

13.3.1 COMPANY SNAPSHOT

13.3.2 SOLUTION PORTFOLIO

13.3.3 RECENT DEVELOPMENTS

13.4 JUMIO

13.4.1 4.1 COMPANY SNAPSHOT

13.4.2 SOLUTION PORTFOLIO

13.4.3 RECENT DEVELOPMENTS

13.5 IDEMIA

13.5.1 COMPANY SNAPSHOT

13.5.2 SOLUTION PORTFOLIO

13.5.3 RECENT DEVELOPMENTS

13.6 AUTHENTEQ

13.6.1 COMPANY SNAPSHOT

13.6.2 SERVICE PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 BARE.ID

13.7.1 COMPANY SNAPSHOT

13.7.2 SOLUTION PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 KEYP GMBH

13.8.1 COMPANY SNAPSHOT

13.8.2 SOLUTION PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 ONFIDO

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 PROVEIDENTITY, INC.

13.10.1 COMPANY SNAPSHOT

13.10.2 SOLUTION PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 SHUFTI PRO

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENTS

13.12 TRULIOO.

13.12.1 COMPANY SNAPSHOT

13.12.2 SOLUTION PORTFOLIO

13.12.3 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tablas

TABLE 1 DOCUMENT VERIFICATION PRICING

TABLE 2 LIVE SELFIE VERIFY PRICING

TABLE 3 GERMANY IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2023-2030 (USD MILLION)

TABLE 4 GERMANY SOLUTIONS IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 5 GERMANY SERVICES IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 GERMANY IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY TYPE, 2023-2030 (USD MILLION)

TABLE 7 GERMANY IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY DEPLOYMENT MODE, 2023-2030 (USD MILLION)

TABLE 8 GERMANY IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY ORGANIZATION SIZE, 2023-2030 (USD MILLION)

TABLE 9 GERMANY IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY VERTICAL, 2023-2030 (USD MILLION)

TABLE 10 GERMANY E-GOVERNMENT IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2023-2030 (USD MILLION)

TABLE 11 GERMANY SOLUTIONS IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 GERMANY SERVICES IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 13 GERMANY BANKING/FINANCIAL SERVICES IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2023-2030 (USD MILLION)

TABLE 14 GERMANY SOLUTIONS IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 GERMANY SERVICES IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 16 GERMANY INSURANCE IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2023-2030 (USD MILLION)

TABLE 17 GERMANY SOLUTIONS IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 GERMANY SERVICES IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 GERMANY OTHERS IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2023-2030 (USD MILLION)

TABLE 20 GERMANY SOLUTIONS IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 GERMANY SERVICES IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY TYPE, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 GERMANY IDENTITY VERIFICATION AND AUTHENTICATION MARKET: SEGMENTATION

FIGURE 2 GERMANY IDENTITY VERIFICATION AND AUTHENTICATION MARKET: DATA TRIANGULATION

FIGURE 3 GERMANY IDENTITY VERIFICATION AND AUTHENTICATION MARKET: DROC ANALYSIS

FIGURE 4 GERMANY IDENTITY VERIFICATION AND AUTHENTICATION MARKET: COUNTRY MARKET ANALYSIS

FIGURE 5 GERMANY IDENTITY VERIFICATION AND AUTHENTICATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GERMANY IDENTITY VERIFICATION AND AUTHENTICATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GERMANY IDENTITY VERIFICATION AND AUTHENTICATION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GERMANY IDENTITY VERIFICATION AND AUTHENTICATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GERMANY IDENTITY VERIFICATION AND AUTHENTICATION MARKET: SEGMENTATION

FIGURE 10 INCREASING DEMAND FOR NEAR FIELD COMMUNICATION (NFC) TECHNOLOGIES IS EXPECTED TO DRIVE GERMANY IDENTITY VERIFICATION AND AUTHENTICATION MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 SOLUTIONS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF GERMANY IDENTITY VERIFICATION AND AUTHENTICATION MARKET IN 2023 & 2030

FIGURE 12 PORTER'S VALUE CHAIN

FIGURE 13 VALUE CHAIN FOR SOFTWARE PRODUCT DELIVERY

FIGURE 14 TECHNOLOGICAL TRENDS IN IDENTITY VERIFICATION SOLUTIONS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF GERMANY IDENTITY VERIFICATION AND AUTHENTICATION MARKET

FIGURE 16 GROWTH IN NFC TECHNOLOGIES USAGE

FIGURE 17 GROWING PREVALENCE OF BIOMETRIC SOLUTIONS AMONG CONSUMERS

FIGURE 18 GERMANY IDENTITY VERIFICATION AND AUTHENTICATION MARKET: BY OFFERING, 2022

FIGURE 19 GERMANY IDENTITY VERIFICATION AND AUTHENTICATION MARKET: BY TYPE, 2022

FIGURE 20 GERMANY IDENTITY VERIFICATION AND AUTHENTICATION MARKET: BY DEPLOYMENT, 2022

FIGURE 21 GERMANY IDENTITY VERIFICATION AND AUTHENTICATION MARKET: BY ORGANIZATION SIZE, 2022

FIGURE 22 GERMANY IDENTITY VERIFICATION AND AUTHENTICATION MARKET: BY VERTICAL, 2022

FIGURE 23 GERMANY IDENTITY VERIFICATION AND AUTHENTICATION MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.