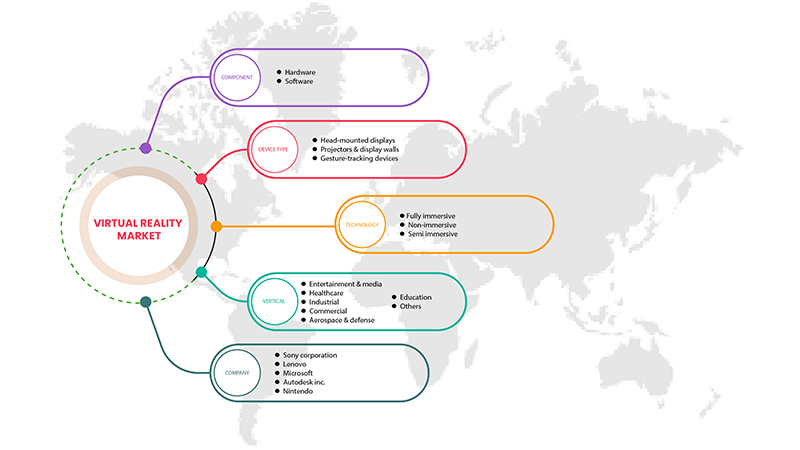

Mercado europeo de realidad virtual, por componente (hardware y software), tipo de dispositivo ( pantallas montadas en la cabeza , proyectores y paredes de visualización y dispositivos de seguimiento de gestos), tecnología (totalmente inmersiva, no inmersiva y semi inmersiva), vertical (entretenimiento y medios, atención médica, industrial, comercial, aeroespacial y defensa, automotriz, educación y otros): tendencias de la industria y pronóstico hasta 2029.

Análisis y tamaño del mercado de realidad virtual en Europa

La realidad virtual ha traído consigo un nuevo cambio en la digitalización. Se ha vuelto más fácil experimentar el mundo real estableciendo diferentes condiciones ambientales. La realidad aumentada y la realidad mixta tienen una amplia gama de aplicaciones. El crecimiento del mercado aumentó a medida que el uso de la realidad aumentada y la realidad mixta se hizo popular en los simuladores de conducción. La realidad aumentada y la realidad mixta brindan al conductor una sensación real de la carretera, las condiciones de conducción, los manuales del automóvil y el tráfico vial que ayuda a evitar accidentes en una etapa inicial de aprendizaje y prepara a los conductores para diversas situaciones. Estos atributos también han llevado a un mayor uso de la realidad virtual en defensa y aeroespacial. El personal del ejército lo utilizó para entrenar en diversas condiciones, como salto en paracaídas, submarinos, situaciones de combate y conducción en diversas condiciones ambientales.

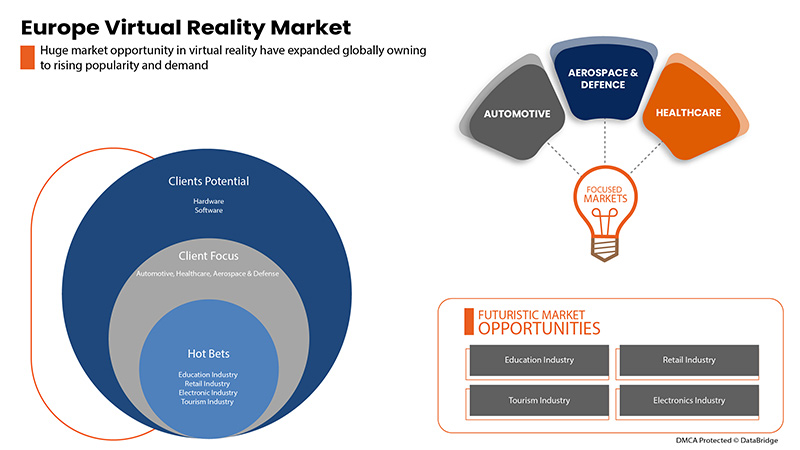

Se espera que la creciente demanda de HMD en la industria de los juegos y el entretenimiento sea un factor importante para el mercado de realidad virtual en Europa. La falta de un diseño de experiencia de usuario eficaz puede frenar el mercado. Además, el mayor despliegue de la tecnología de realidad virtual en el sector aeroespacial y de defensa y en el de la arquitectura y la planificación puede actuar como una gran oportunidad que ayude al crecimiento del mercado. Sin embargo, los riesgos y amenazas emergentes a la integridad de los datos pueden suponer un desafío para el mercado de realidad virtual en Europa.

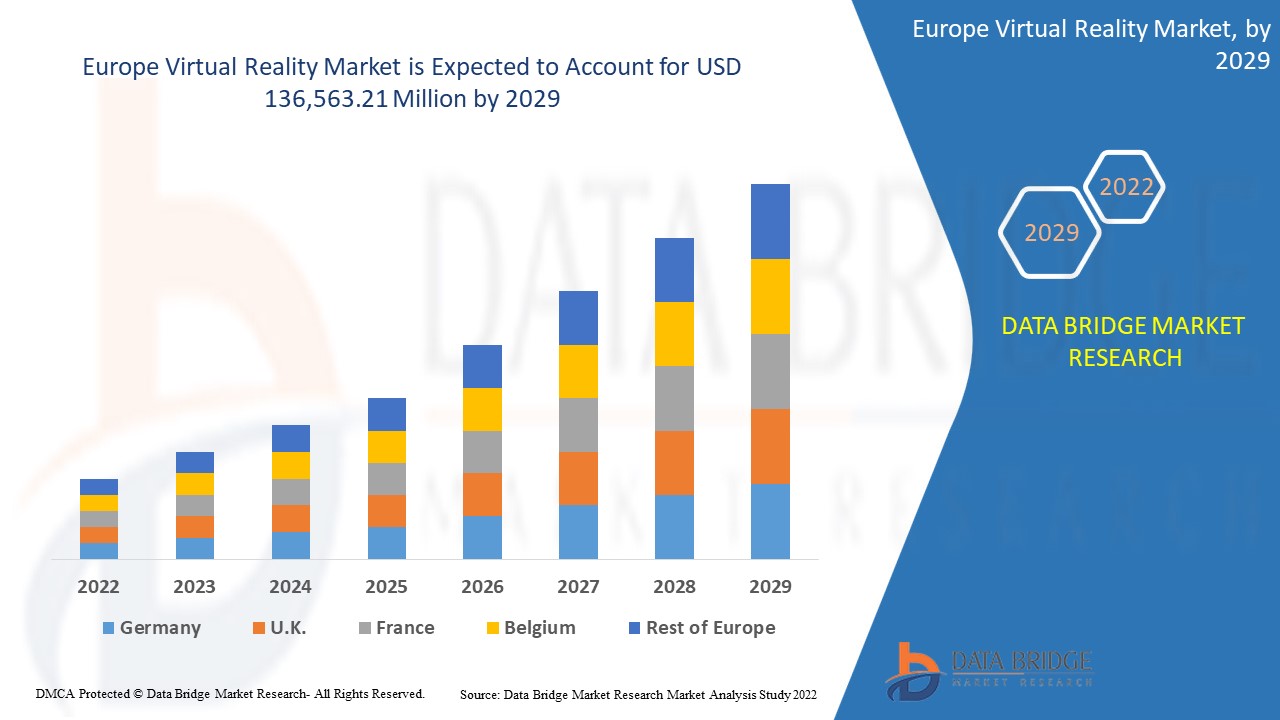

Data Bridge Market Research analiza que se espera que el mercado de realidad virtual en Europa alcance un valor de USD 136.563,21 millones para 2029, con una CAGR del 47,5 % durante el período de pronóstico. El segmento de hardware representa el segmento de oferta más grande en el mercado de realidad virtual en Europa. El informe del mercado de realidad virtual en Europa también cubre de manera integral los precios, las patentes y los avances tecnológicos.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019-2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Por componente (hardware y software), tipo de dispositivo (visores montados en la cabeza, proyectores y pantallas de pared y dispositivos de seguimiento de gestos), tecnología (totalmente inmersiva, no inmersiva y semi inmersiva), vertical (entretenimiento y medios, atención médica, industrial, comercial, aeroespacial y defensa, automotriz, educación y otros) |

|

Países cubiertos |

Alemania, Reino Unido, Francia, Suiza, Italia, España, Países Bajos, Rusia, Bélgica, Turquía, Resto de Europa |

|

Actores del mercado cubiertos |

Sony Corporation, Lenovo, Autodesk Inc., Nintendo, LG Electronics, HTC Corporation, Ultraleap, Google (una subsidiaria de Alphabet Inc.), Qualcomm Technologies, Inc., Barco, PSICO SMART APPS, SL, HP Development Company, LP, Microsoft, SAMSUNG ELECTRONICS CO., LTD., entre otros. |

Definición de mercado

La realidad virtual se puede definir como una tecnología que crea un entorno simulado a través de la tecnología informática. La realidad virtual proporciona un entorno 3D inmersivo al usuario simulando varios sentidos, como la vista, el tacto, el oído e incluso el olfato. La realidad virtual utiliza dispositivos como pantallas montadas en la cabeza , proyectores y paredes de visualización para generar imágenes y sonidos realistas para proporcionar una experiencia del mundo real en el entorno virtual. La persona que utiliza la realidad virtual puede ver el mundo artificial en 360 grados e incluso sentir el entorno virtual con equipos muy avanzados. Esta tecnología se está utilizando ampliamente en varias aplicaciones industriales, especialmente para fines de formación e investigación. La industria de defensa y aeroespacial la utiliza para entrenar al personal del ejército al proporcionar varias condiciones ambientales, lo que ayuda a reducir el costo general de la capacitación. El sector de los juegos proporciona realidad virtual directamente a los usuarios al mejorar su experiencia de juego; la gente se está acostumbrando más a la realidad virtual a través de su experiencia en la industria de los juegos y el entretenimiento. La realidad virtual también ha ayudado a los simuladores de conducción al proporcionar una experiencia de la vida real en un entorno artificial que ayuda a los usuarios a adaptarse a las condiciones de conducción y saber cómo reaccionar en diversas situaciones sin tener que tomar las lecciones de conducción directamente en la carretera.

Dinámica del mercado de realidad virtual en Europa

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- Creciente demanda de HMD en la industria del juego y el entretenimiento

Los cascos de realidad virtual (HMD) han tenido un gran éxito en el sector de los videojuegos y el entretenimiento. La industria de los videojuegos ha experimentado una evolución tecnológica con la aparición de la realidad virtual y la tecnología 3D. El uso de los HMD ha ayudado a lograr una experiencia totalmente inmersiva para los usuarios y ha llevado la experiencia de juego al siguiente nivel. La transición impecable realizada con los HMD de realidad virtual ha ayudado a brindar una experiencia de usuario única y mejorada. Los HMD tienen una alta tasa de penetración en el sector de los videojuegos y los usuarios de videojuegos los prefieren para enriquecer las experiencias y el entretenimiento. Los HMD proyectan imágenes digitales, lo que permite una vista en 3D, que mejora la experiencia del usuario. Por lo tanto, el creciente sector de los videojuegos impulsaría el mercado de los HMD y, a su vez, la realidad virtual.

- Aumento de la demanda de tecnología de realidad virtual debido a la pandemia de COVID-19

El mundo está atravesando diferentes fases de confinamiento físico y las reuniones sociales aún no están permitidas en la mayoría de los países. Por lo tanto, la tecnología AR y VR durante COVID-19 está surgiendo como superhéroes al permitir que las personas se sientan conectadas entre sí. La realidad aumentada agrega elementos digitales al mundo físico y la realidad virtual brinda una experiencia inmersiva a los espectadores. Los dispositivos de realidad virtual como Google Cardboard, HTC Vive u Oculus Rift transportan a los usuarios a experimentar varios entornos reales e imaginarios con la ayuda de dispositivos.

Oportunidad

- Mayor despliegue de tecnología de realidad virtual en los sectores aeroespacial y de defensa y de arquitectura y planificación

El diseño 3D ha permitido importantes avances en los procesos de fabricación de equipos aeroespaciales y de defensa. Esto también ha tenido un impacto positivo tanto en el rendimiento de las aeronaves como en los procesos de fabricación. Los avances en las nuevas tecnologías 3D traen consigo nuevas oportunidades de mercado para optimizar el tiempo y el coste de producción en la industria aeroespacial y de defensa. La tecnología 3D ha sido una tendencia continua, especialmente en la industria aeroespacial. Los recientes avances en la tecnología de realidad virtual han prometido nuevas aplicaciones en el ámbito aeroespacial y de defensa, lo que ha repercutido en el crecimiento de la realidad virtual en el mercado aeroespacial y de defensa. Las capacidades de visualización 3D incorporadas con maquetas digitales de objetos físicos, líneas de montaje virtuales, una integración más estrecha y un proceso de diseño sin fisuras impulsarán el mercado en breve.

Restricción/Desafío

- Riesgos y amenazas emergentes para la integridad de los datos

La realidad virtual se está utilizando mucho con fines de formación y educación en los sectores de defensa y aeroespacial, y también se utiliza en telemedicina en el sector sanitario. La realidad virtual utiliza tecnologías informáticas, el uso de la nube y los servicios de Internet para funcionar, lo que la hace muy propensa a los ciberataques, lo que amenaza la integridad de los datos y aumenta el riesgo de fuga de datos. No se está dando mucha importancia a la seguridad y la privacidad adecuadas, lo que plantea un reto importante para el mercado europeo de la realidad virtual.

Impacto de la COVID-19 en el mercado de realidad virtual en Europa

La COVID-19 afectó significativamente a varias industrias, ya que casi todos los países optaron por cerrar todas las instalaciones, excepto las del segmento de bienes esenciales. El gobierno tomó medidas estrictas, como cerrar instalaciones y vender bienes no esenciales, bloquear el comercio internacional y muchas más para evitar la propagación de la COVID-19. Las únicas empresas que se enfrentan a esta situación de pandemia son las de servicios esenciales a las que se les permite abrir y ejecutar sus procesos.

El aumento del uso de dispositivos basados en realidad virtual ha brindado oportunidades significativas en medio de la pandemia de COVID-19. Aunque el poder adquisitivo de los consumidores se ha reducido en gran medida debido a la crisis económica inducida por el coronavirus, lo que resultó en la disminución de los márgenes de ganancia en las organizaciones. Si bien muchos líderes y especialistas en marketing clave vieron signos de mejora con respecto a años anteriores, sigue siendo difícil determinar la situación real del mercado, ya que la demanda acumulada puede estar encubriendo un nivel intrínseco más bajo de demanda de dispositivos basados en VR. El aumento de las aplicaciones de VR para teléfonos inteligentes, el aumento de la demanda de colaboración remota y los avances tecnológicos en aplicaciones médicas son algunos de los factores que impulsan el crecimiento del mercado de realidad virtual en Europa.

Los fabricantes están tomando diversas decisiones estratégicas para satisfacer la creciente demanda en el período de COVID-19. Los actores participaron en actividades estratégicas como asociaciones, colaboraciones, adquisiciones y otras para mejorar la tecnología involucrada en el mercado de la realidad virtual. Las empresas traerán soluciones avanzadas y precisas al mercado. Además, las iniciativas gubernamentales para impulsar la digitalización en todas las industrias han llevado al crecimiento del mercado.

Acontecimientos recientes

- En abril de 2021, Microsoft anunció un contrato entre el Pentágono y el ejército estadounidense para la fabricación de cascos de realidad aumentada para soldados por valor de 21.880 millones de dólares. Este HoloLens ofrecerá a los soldados una visibilidad más eficiente, visión nocturna de última generación y conocimiento de la situación para cualquier guerra. Esto también ha ayudado a la empresa a trascender los límites tradicionales del espacio y el tiempo en el campo de la RA, ampliando así sus productos en el mercado.

- En octubre de 2019, Ultraleap Limited se unió a Khronos Group, un consorcio industrial que comprende 150 empresas proveedoras de hardware y software. La nueva asociación integró la tecnología de seguimiento de manos de Ultraleap con OpenXR para lograr mejores especificaciones. La nueva asociación aumentará la base de clientes de la empresa.

Alcance del mercado de realidad virtual en Europa

El mercado europeo de realidad virtual está segmentado en función de los componentes, el tipo de dispositivo, la tecnología y el sector vertical. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Componente

- Hardware

- Software

Según los componentes, el mercado europeo de realidad virtual está segmentado en hardware y software.

Tipo de dispositivo

- Pantallas montadas en la cabeza,

- Proyectores y pantallas de pared

- Dispositivos de seguimiento de gestos

Según el tipo de dispositivo, el mercado europeo de realidad virtual está segmentado en pantallas montadas en la cabeza, proyectores y paredes de visualización y dispositivos de seguimiento de gestos.

Tecnología

- Totalmente inmersivo,

- Semi inmersivo

- No inmersivo

Sobre la base de la tecnología, el mercado europeo de realidad virtual está segmentado en totalmente inmersivo, semi inmersivo y no inmersivo.

Vertical

- Automotor

- Aeroespacial y defensa

- Entretenimiento y medios

- Cuidado de la salud

- Educación

- Industrial

- Comercial

- Otros

Sobre la base vertical, el mercado europeo de realidad virtual está segmentado en automoción, aeroespacial y defensa, entretenimiento y medios, atención sanitaria, educación, industrial, comercial y otros.

Análisis y perspectivas regionales del mercado de realidad virtual en Europa

Se analiza el mercado de realidad virtual de Europa y se proporcionan información y tendencias sobre el tamaño del mercado por país, componente, tipo de dispositivo, tecnología y vertical, como se mencionó anteriormente.

Algunos de los países incluidos en el informe sobre el mercado de realidad virtual de Europa son Alemania, Reino Unido, Francia, Suiza, Italia, España, Países Bajos, Rusia, Bélgica, Turquía y el resto de Europa.

Se espera que Alemania domine el mercado de realidad virtual en Europa debido al continuo aumento del espacio de trabajo digital y la fuerza laboral móvil. Además, el Reino Unido ha sido extremadamente receptivo a la adopción de los últimos avances tecnológicos, incluidos los dispositivos móviles, la computación en la nube y la IoT, en las empresas, lo que impulsa el crecimiento del mercado.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se consideran la presencia y disponibilidad de marcas europeas y los desafíos que enfrentan debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de la realidad virtual en Europa

El panorama competitivo del mercado de realidad virtual en Europa proporciona detalles sobre el competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en Europa, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de realidad virtual en Europa.

Algunos de los principales actores que operan en el mercado de realidad virtual en Europa son Sony Corporation, Lenovo, Autodesk Inc., Nintendo, LG Electronics, HTC Corporation, Ultraleap, Google (una subsidiaria de Alphabet Inc.), Qualcomm Technologies, Inc., Barco, PSICO SMART APPS, SL, HP Development Company, LP, Microsoft, SAMSUNG ELECTRONICS CO., LTD., entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE VIRTUAL REALITY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COMPONENT TIMELINE CURVE

2.1 MARKET VERTICAL COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET TRENDS

6 LIST OF TOP COMPETITORS ACROSS THE GLOBE

7 REGULATION AND POLICY

8 REGIONAL SUMMARY

9 MARKET OVERVIEW

9.1 DRIVERS

9.1.1 GROWING DEMAND FOR HMD IN THE GAMING AND ENTERTAINMENT INDUSTRY

9.1.2 HIGH INVESTMENT IN VR MARKET

9.1.3 INCREASING DEMAND FOR VR TECHNOLOGY DUE TO COVID-19 PANDEMIC

9.1.4 AVAILABILITY OF AFFORDABLE VR DEVICES

9.1.5 INCREASING INTEREST OF LARGE TECHNOLOGY CORPORATIONS

9.1.6 INCREASE IN PENETRATION OF SMARTPHONES AND INTERNET SERVICES

9.2 RESTRAINTS

9.2.1 LACK OF EFFECTIVE IN-USER EXPERIENCE DESIGN

9.2.2 HEALTH CONCERNS AMONG THE USERS

9.2.3 EUROPE ECONOMIC SLOWDOWN

9.3 OPPORTUNITIES

9.3.1 INCREASED DEPLOYMENT OF VR TECHNOLOGY IN AEROSPACE & DEFENSE AND ARCHITECTURE & PLANNING SECTOR

9.3.2 INCREASED PENETRATION OF VR IN THE HEALTHCARE INDUSTRY

9.3.3 INCREASE IN VARIOUS STRATEGIC DECISIONS SUCH AS PARTNERSHIP AND ACQUISITION

9.3.4 DEVELOPMENT OF HARDWARE WITH FASTER PROCESSING SPEEDS

9.4 CHALLENGES

9.4.1 EMERGING RISKS AND THREATS TO DATA INTEGRITY

9.4.2 DEVELOPING USER-FRIENDLY VR SYSTEM

10 EUROPE VIRTUAL REALITY MARKET, BY COMPONENT

10.1 OVERVIEW

10.2 HARDWARE

10.2.1 DISPLAYS AND PROJECTORS

10.2.2 CONTROLLER AND PROCESSOR

10.2.3 POSITION TRACKERS

10.2.4 CAMERAS

10.2.5 OTHERS

10.3 SOFTWARE

10.3.1 VR CONTENT CREATION

10.3.2 SOFTWARE DEVELOPMENT KITS

10.3.3 CLOUD BASED SERVICES

11 EUROPE VIRTUAL REALITY MARKET, BY DEVICE TYPE

11.1 OVERVIEW

11.2 HEAD-MOUNTED DISPLAYS

11.3 PROJECTORS & DISPLAY WALLS

11.4 GESTURE-TRACKING DEVICES

12 EUROPE VIRTUAL REALITY MARKET, BY TECHNOLOGY

12.1 OVERVIEW

12.2 FULLY IMMERSIVE

12.3 NON-IMMERSIVE

12.4 SEMI IMMERSIVE

13 EUROPE VIRTUAL REALITY MARKET, BY VERTICAL

13.1 OVERVIEW

13.2 ENTERTAINMENT & MEDIA

13.2.1 ENTERTAINMENT & MEDIA, BY TECHNOLOGY

13.2.1.1 FULLY IMMERSIVE

13.2.1.2 NON-IMMERSIVE

13.2.1.3 SEMI IMMERSIVE

13.2.2 ENTERTAINMENT & MEDIA, BY APPLICATION

13.2.2.1 GAME

13.2.2.2 BROADCAST

13.2.2.3 ANIMATION

13.2.2.4 CHARACTER

13.2.2.5 CARTOON

13.2.2.6 MUSIC

13.2.2.7 FASHION

13.3 HEALTHCARE

13.3.1 HEALTHCARE, BY TYPE

13.3.1.1 SURGERY

13.3.1.2 PATIENT CARE MANAGEMENT

13.3.1.3 FITNESS MANAGEMENT

13.3.1.4 PHARMACY MANAGEMENT

13.3.2 HEALTHCARE, BY TECHNOLOGY

13.3.2.1 FULLY IMMERSIVE

13.3.2.2 NON-IMMERSIVE

13.3.2.3 SEMI IMMERSIVE

13.4 INDUSTRIAL

13.4.1 FULLY IMMERSIVE

13.4.2 NON-IMMERSIVE

13.4.3 SEMI IMMERSIVE

13.5 COMMERCIAL

13.5.1 COMMERCIAL, BY TYPE

13.5.1.1 RETAIL AND E-COMMERCE

13.5.1.2 TRAVEL AND TOURISM

13.5.1.3 ADVERTISING

13.5.2 COMMERCIAL, BY TECHNOLOGY

13.5.2.1 FULLY IMMERSIVE

13.5.2.2 NON-IMMERSIVE

13.5.2.3 SEMI IMMERSIVE

13.6 AEROSPACE & DEFENSE

13.6.1 SEMI IMMERSIVE

13.6.2 FULLY IMMERSIVE

13.6.3 NON-IMMERSIVE

13.7 AUTOMOTIVE

13.7.1 SEMI IMMERSIVE

13.7.2 FULLY IMMERSIVE

13.7.3 NON-IMMERSIVE

13.8 EDUCATION

13.8.1 FULLY IMMERSIVE

13.8.2 NON-IMMERSIVE

13.8.3 SEMI IMMERSIVE

13.9 OTHERS

14 EUROPE VIRTUAL REALITY MARKET, BY REGION

14.1 EUROPE

14.1.1 GERMANY

14.1.2 FRANCE

14.1.3 U.K.

14.1.4 ITALY

14.1.5 RUSSIA

14.1.6 SPAIN

14.1.7 NETHERLANDS

14.1.8 BELGIUM

14.1.9 SWITZERLAND

14.1.10 TURKEY

14.1.11 REST OF EUROPE

15 EUROPE VIRTUAL REALITY MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 SONY CORPORATION

17.1.1 COMPANY PROFILE

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 SAMSUNG ELECTRONICS CO., LTD.

17.2.1 COMPANY PROFILE

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 NINTENDO

17.3.1 COMPANY PROFILE

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 QUALCOMM TECHNOLOGIES, INC.

17.4.1 COMPANY PROFILE

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 MICROSOFT

17.5.1 COMPANY PROFILE

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 AUTODESK INC.

17.6.1 COMPANY PROFILE

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 BARCO

17.7.1 COMPANY PROFILE

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 BHAPTICS INC.

17.8.1 COMPANY PROFILE

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 FIRSTHAND TECHNOLOGY INC.

17.9.1 COMPANY PROFILE

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 FOVE, INC.

17.10.1 COMPANY PROFILE

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 FXGEAR INC.

17.11.1 COMPANY PROFILE

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 GOOGLE (A SUBSIDIARY OF ALPHABET INC.)

17.12.1 COMPANY PROFILE

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENT

17.13 HP DEVELOPMENT COMPANY, L.P.

17.13.1 COMPANY PROFILE

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENTS

17.14 HTC CORPORATION

17.14.1 COMPANY PROFILE

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENTS

17.15 INNOSIMULATION

17.15.1 COMPANY PROFILE

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 LENOVO

17.16.1 COMPANY PROFILE

17.16.2 REVENUE ANALYSIS

17.16.3 PRODUCT PORTFOLIO

17.16.4 RECENT DEVELOPMENT

17.17 LG ELECTRONICS

17.17.1 COMPANY PROFILE

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENTS

17.18 NOVINT

17.18.1 COMPANY PROFILE

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 PSICO SMART APPS, S.L.

17.19.1 COMPANY PROFILE

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 SIXENSE ENTERPRISES INC.

17.20.1 COMPANY PROFILE

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

17.21 SKONEC ENTERTAINMENT CO., LTD.

17.21.1 COMPANY PROFILE

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 STARVR CORP

17.22.1 COMPANY PROFILE

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

17.23 ULTRALEAP LIMITED

17.23.1 COMPANY PROFILE

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENTS

17.24 VIRTUIX

17.24.1 COMPANY PROFILE

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 WORLDVIZ, INC.

17.25.1 COMPANY PROFILE

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tablas

TABLE 1 EUROPE VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 2 EUROPE HARDWARE IN VIRTUAL REALITY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 EUROPE HARDWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 4 EUROPE SOFTWARE IN VIRTUAL REALITY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE SOFTWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 6 EUROPE VIRTUAL REALITY MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 7 EUROPE HEAD-MOUNTED DISPLAYS IN VIRTUAL REALITY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE PROJECTORS & DISPLAY WALLS IN VIRTUAL REALITY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE GESTURE-TRACKING DEVICES IN VIRTUAL REALITY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 11 EUROPE FULLY IMMERSIVE IN VIRTUAL REALITY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE NON-IMMERSIVE IN VIRTUAL REALITY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE SEMI IMMERSIVE IN VIRTUAL REALITY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE VIRTUAL REALITY MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 15 EUROPE ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 17 EUROPE ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE HEALTHCARE IN VIRTUAL REALITY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE HEALTHCARE IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 EUROPE HEALTHCARE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 21 EUROPE INDUSTRIAL IN VIRTUAL REALITY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE INDUSTRIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 23 EUROPE COMMERCIAL IN VIRTUAL REALITY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE COMMERCIAL IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 EUROPE COMMERCIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 26 EUROPE AEROSPACE & DEFENSE IN VIRTUAL REALITY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE AEROSPACE AND DEFENSE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 28 EUROPE AUTOMOTIVE IN VIRTUAL REALITY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE AUTOMOTIVE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 30 EUROPE EDUCATION IN VIRTUAL REALITY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE EDUCATION IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 32 EUROPE OTHERS IN VIRTUAL REALITY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE VIRTUAL REALITY MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 34 EUROPE VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 35 EUROPE HARDWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 36 EUROPE SOFTWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 37 EUROPE VIRTUAL REALITY MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 38 EUROPE VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 39 EUROPE VIRTUAL REALITY MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 40 EUROPE ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 41 EUROPE ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 42 EUROPE HEALTHCARE IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 EUROPE HEALTHCARE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 44 EUROPE INDUSTRIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 45 EUROPE COMMERCIAL IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 EUROPE COMMERCIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

TABLE 47 EUROPE AEROSPACE & DEFENSE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 48 EUROPE AUTOMOTIVE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 49 EUROPE EDUCATION IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 50 GERMANY VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 51 GERMANY HARDWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 52 GERMANY SOFTWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 53 GERMANY VIRTUAL REALITY MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 54 GERMANY VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 55 GERMANY VIRTUAL REALITY MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 56 GERMANY ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 57 GERMANY ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 58 GERMANY HEALTHCARE IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 GERMANY HEALTHCARE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 60 GERMANY INDUSTRIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 61 GERMANY COMMERCIAL IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 GERMANY COMMERCIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

TABLE 63 GERMANY AEROSPACE & DEFENSE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 64 GERMANY AUTOMOTIVE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 65 GERMANY EDUCATION IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 66 FRANCE VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 67 FRANCE HARDWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 68 FRANCE SOFTWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 69 FRANCE VIRTUAL REALITY MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 70 FRANCE VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 71 FRANCE VIRTUAL REALITY MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 72 FRANCE ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 FRANCE ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 74 FRANCE HEALTHCARE IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 FRANCE HEALTHCARE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 76 FRANCE INDUSTRIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 77 FRANCE COMMERCIAL IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 FRANCE COMMERCIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

TABLE 79 FRANCE AEROSPACE & DEFENSE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 80 FRANCE AUTOMOTIVE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 81 FRANCE EDUCATION IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 82 U.K. VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 83 U.K. HARDWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 84 U.K. SOFTWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 85 U.K. VIRTUAL REALITY MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 86 U.K. VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 87 U.K. VIRTUAL REALITY MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 88 U.K. ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 89 U.K. ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 90 U.K. HEALTHCARE IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 U.K. HEALTHCARE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 92 U.K. INDUSTRIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 93 U.K. COMMERCIAL IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 U.K. COMMERCIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

TABLE 95 U.K. AEROSPACE & DEFENSE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 96 U.K. AUTOMOTIVE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 97 U.K. EDUCATION IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 98 ITALY VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 99 ITALY HARDWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 100 ITALY SOFTWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 101 ITALY VIRTUAL REALITY MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 102 ITALY VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 103 ITALY VIRTUAL REALITY MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 104 ITALY ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 105 ITALY ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 106 ITALY HEALTHCARE IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 ITALY HEALTHCARE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 108 ITALY INDUSTRIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 109 ITALY COMMERCIAL IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 ITALY COMMERCIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

TABLE 111 ITALY AEROSPACE & DEFENSE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 112 ITALY AUTOMOTIVE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 113 ITALY EDUCATION IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 114 RUSSIA VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 115 RUSSIA HARDWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 116 RUSSIA SOFTWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 117 RUSSIA VIRTUAL REALITY MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 118 RUSSIA VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 119 RUSSIA VIRTUAL REALITY MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 120 RUSSIA ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 121 RUSSIA ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 122 RUSSIA HEALTHCARE IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 RUSSIA HEALTHCARE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 124 RUSSIA INDUSTRIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 125 RUSSIA COMMERCIAL IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 RUSSIA COMMERCIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

TABLE 127 RUSSIA AEROSPACE & DEFENSE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 128 RUSSIA AUTOMOTIVE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 129 RUSSIA EDUCATION IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 130 SPAIN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 131 SPAIN HARDWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 132 SPAIN SOFTWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 133 SPAIN VIRTUAL REALITY MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 134 SPAIN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 135 SPAIN VIRTUAL REALITY MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 136 SPAIN ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 137 SPAIN ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 138 SPAIN HEALTHCARE IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 SPAIN HEALTHCARE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 140 SPAIN INDUSTRIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 141 SPAIN COMMERCIAL IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 SPAIN COMMERCIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

TABLE 143 SPAIN AEROSPACE & DEFENSE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 144 SPAIN AUTOMOTIVE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 145 SPAIN EDUCATION IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 146 NETHERLANDS VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 147 NETHERLANDS HARDWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 148 NETHERLANDS SOFTWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 149 NETHERLANDS VIRTUAL REALITY MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 150 NETHERLANDS VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 151 NETHERLANDS VIRTUAL REALITY MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 152 NETHERLANDS ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 153 NETHERLANDS ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 154 NETHERLANDS HEALTHCARE IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 NETHERLANDS HEALTHCARE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 156 NETHERLANDS INDUSTRIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 157 NETHERLANDS COMMERCIAL IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 NETHERLANDS COMMERCIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

TABLE 159 NETHERLANDS AEROSPACE & DEFENSE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 160 NETHERLANDS AUTOMOTIVE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 161 NETHERLANDS EDUCATION IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 162 BELGIUM VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 163 BELGIUM HARDWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 164 BELGIUM SOFTWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 165 BELGIUM VIRTUAL REALITY MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 166 BELGIUM VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 167 BELGIUM VIRTUAL REALITY MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 168 BELGIUM ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 169 BELGIUM ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 170 BELGIUM HEALTHCARE IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 171 BELGIUM HEALTHCARE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 172 BELGIUM INDUSTRIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 173 BELGIUM COMMERCIAL IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 BELGIUM COMMERCIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

TABLE 175 BELGIUM AEROSPACE & DEFENSE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 176 BELGIUM AUTOMOTIVE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 177 BELGIUM EDUCATION IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 178 SWITZERLAND VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 179 SWITZERLAND HARDWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 180 SWITZERLAND SOFTWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 181 SWITZERLAND VIRTUAL REALITY MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 182 SWITZERLAND VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 183 SWITZERLAND VIRTUAL REALITY MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 184 SWITZERLAND ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 185 SWITZERLAND ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 186 SWITZERLAND HEALTHCARE IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 187 SWITZERLAND HEALTHCARE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 188 SWITZERLAND INDUSTRIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 189 SWITZERLAND COMMERCIAL IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 SWITZERLAND COMMERCIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

TABLE 191 SWITZERLAND AEROSPACE & DEFENSE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 192 SWITZERLAND AUTOMOTIVE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 193 SWITZERLAND EDUCATION IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 194 TURKEY VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 195 TURKEY HARDWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 196 TURKEY SOFTWARE IN VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 197 TURKEY VIRTUAL REALITY MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 198 TURKEY VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 199 TURKEY VIRTUAL REALITY MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 200 TURKEY ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 201 TURKEY ENTERTAINMENT & MEDIA IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 202 TURKEY HEALTHCARE IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 203 TURKEY HEALTHCARE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 204 TURKEY INDUSTRIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 205 TURKEY COMMERCIAL IN VIRTUAL REALITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 206 TURKEY COMMERCIAL IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

TABLE 207 TURKEY AEROSPACE & DEFENSE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 208 TURKEY AUTOMOTIVE IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 209 TURKEY EDUCATION IN VIRTUAL REALITY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 210 REST OF EUROPE VIRTUAL REALITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 EUROPE VIRTUAL REALITY MARKET: SEGMENTATION

FIGURE 2 EUROPE VIRTUAL REALITY MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE VIRTUAL REALITY MARKET: DROC ANALYSIS

FIGURE 4 EUROPE VIRTUAL REALITY MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE VIRTUAL REALITY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE VIRTUAL REALITY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE VIRTUAL REALITY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE VIRTUAL REALITY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE VIRTUAL REALITY MARKET: MARKET VERTICAL COVERAGE GRID

FIGURE 10 EUROPE VIRTUAL REALITY MARKET: SEGMENTATION

FIGURE 11 GROWING DEMAND FOR HMD IN THE GAMING AND ENTERTAINMENT INDUSTRY IS EXPECTED TO DRIVE THE EUROPE VIRTUAL REALITY MARKET GROWTH IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE VIRTUAL REALITY MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE VIRTUAL REALITY MARKET AND GROW WITH THE FASTEST GROWTH RATE IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 THE ABOVE FIGURE SHOWS THE POTENTIAL OF VIRTUAL REALITY APPLICATIONS BY CATEGORY.

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE VIRTUAL REALITY MARKET

FIGURE 16 EUROPE VIRTUAL REALITY MARKET ESTIMATION (2016-2021)

FIGURE 17 EUROPE VIRTUAL REALITY MARKET: BY COMPONENT, 2021

FIGURE 18 EUROPE VIRTUAL REALITY MARKET: BY DEVICE TYPE, 2021

FIGURE 19 EUROPE VIRTUAL REALITY MARKET: BY TECHNOLOGY, 2021

FIGURE 20 EUROPE VIRTUAL REALITY MARKET: BY VERTICAL, 2021

FIGURE 21 EUROPE VIRTUAL REALITY MARKET: SNAPSHOT (2021)

FIGURE 22 EUROPE VIRTUAL REALITY MARKET: BY COUNTRY (2021)

FIGURE 23 EUROPE VIRTUAL REALITY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 EUROPE VIRTUAL REALITY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 EUROPE VIRTUAL REALITY MARKET: BY COMPONENT (2022-2029)

FIGURE 26 EUROPE VIRTUAL REALITY MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.