Mercado europeo de dispositivos de urología, por tipo de producto (equipos de diálisis, dispositivos de tratamiento de cálculos urinarios, dispositivos de endoscopia, dispositivos de tratamiento de hiperplasia prostática benigna, incontinencia urinaria y prolapso de órganos pélvicos y otros productos), tipo (instrumentos, consumibles y accesorios), indicación (enfermedades renales, vejiga hiperactiva, hematuria, infección del tracto urinario, cálculos renales, eyaculación precoz, hiperplasia prostática benigna, cáncer urológico, prolapso de órganos pélvicos, uretrotomías, estenosis uretral y otras enfermedades), tecnología (cirugía mínimamente invasiva, cirugía robótica y otras), usuario final (hospitales y clínicas, centros de diálisis, laboratorios de investigación clínica, institutos académicos y otros), canal de distribución (licitaciones directas, distribución de terceros y otros), país (Alemania, Reino Unido, Francia, Italia, España, Países Bajos, Rusia, Turquía, Suiza y resto de Europa) Tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado : mercado europeo de dispositivos urológicos

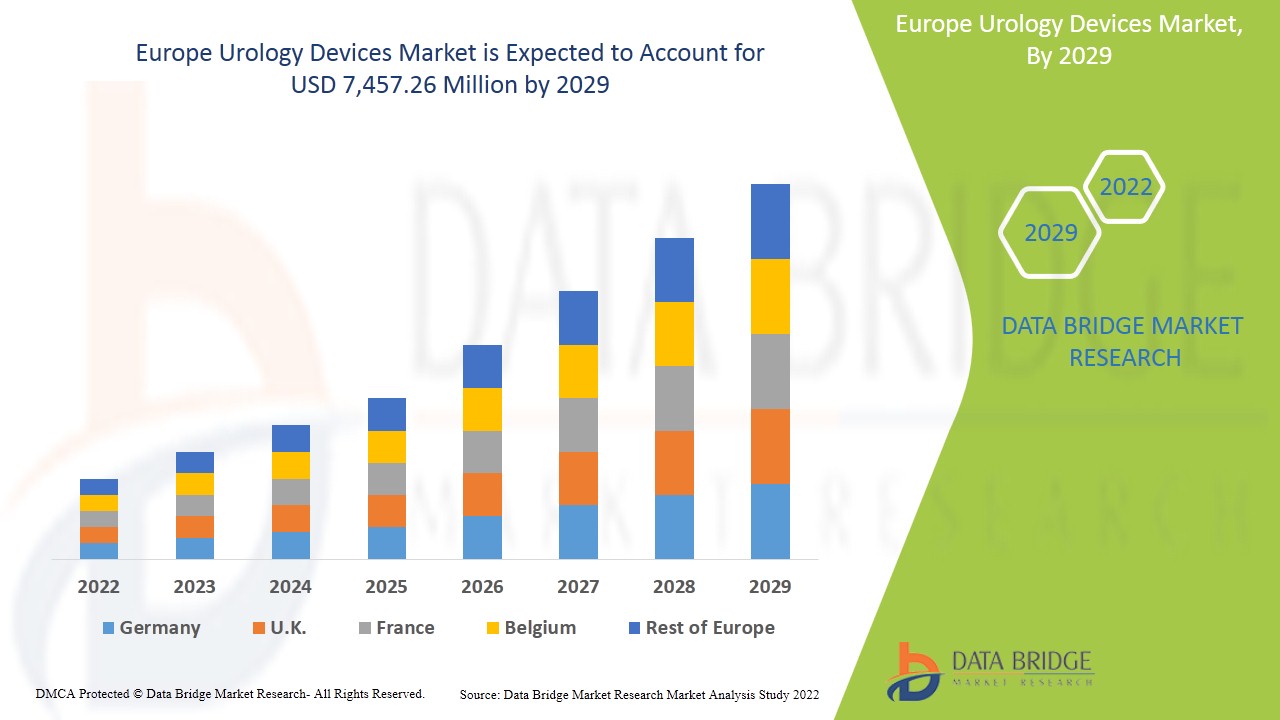

Se espera que el mercado de dispositivos de urología de Europa gane crecimiento de mercado en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 7,8% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 7.457,26 millones para 2029. El aumento del gasto en atención médica y el mayor interés por la cirugía mínimamente invasiva actúan como impulsores del crecimiento del mercado de dispositivos de urología.

Los dispositivos y suministros para urología son productos diseñados para personas que padecen enfermedades urológicas, retención urinaria y necesitan ayuda para eliminar la orina del cuerpo. Las enfermedades o afecciones urológicas incluyen infecciones del tracto urinario, cálculos renales , problemas de control de la vejiga y problemas de próstata , entre otros. Los dispositivos para urología incluyen una amplia gama de productos, como mesas de operaciones para urología, mesas de examen urológico, sillas, sistemas de imágenes por ultrasonido para urología, escáneres de vejiga, sistemas urodinámicos, medidores de flujo urinario, litotriptores intracorpóreos, litotriptores extracorpóreos, láseres urológicos, fórceps para urología, agujas para biopsia de próstata, mallas, stents , catéteres, equipos y bolsas de drenaje, estimuladores, sondas, kits de prueba de cáncer e implantes. Estos dispositivos se utilizan tanto para procedimientos de diagnóstico como de tratamiento urológico. Los procedimientos urológicos comunes que se realizan incluyen vasectomía, reversión de vasectomía, cistoscopia, procedimiento de próstata, litotricia, entre otros. Algunas afecciones urológicas duran poco tiempo, mientras que otras son duraderas. Los síntomas comunes en problemas de urología son dificultad para orinar, dolor o ardor al orinar, sangre u otra secreción en la orina, fiebre, escalofríos, dolor lumbar y dolor en los genitales.

El mercado de dispositivos urológicos en Europa está creciendo en el año de pronóstico debido al aumento de los actores del mercado y la disponibilidad de productos avanzados debido a la creciente incidencia de las afecciones urológicas. Junto con esto, los fabricantes están involucrados en actividades de I+D para lanzar productos novedosos al mercado con aprobaciones de productos exitosas. Sin embargo, el alto costo de los dispositivos urológicos y la falta de conocimiento sobre el tratamiento urológico y los dispositivos con retiros de productos pueden obstaculizar el crecimiento del mercado de dispositivos urológicos en Europa en el período de pronóstico.

El aumento del gasto sanitario y el mayor interés por la cirugía mínimamente invasiva son oportunidades para el crecimiento del mercado. Las iniciativas estratégicas de los actores del mercado están dando más oportunidades al mercado para mejorar el tratamiento. Sin embargo, la falta de profesionales cualificados y un marco normativo estricto están poniendo en peligro el crecimiento del mercado.

El informe de mercado de dispositivos de urología proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado de dispositivos de urología, comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de dispositivos de urología

El mercado europeo de dispositivos urológicos se clasifica en seis segmentos importantes según el tipo de producto, tipo, indicación, tecnología, usuario final y canal de distribución. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

- Según el tipo de producto, el mercado europeo de dispositivos urológicos se segmenta en equipos de diálisis, dispositivos para el tratamiento de cálculos urinarios, dispositivos de endoscopia, dispositivos para el tratamiento de la hiperplasia prostática benigna, incontinencia urinaria y prolapso de órganos pélvicos, entre otros productos. En 2022, se espera que el segmento de equipos de diálisis domine el mercado debido al aumento de las enfermedades renales y al elevado número de población objetivo.

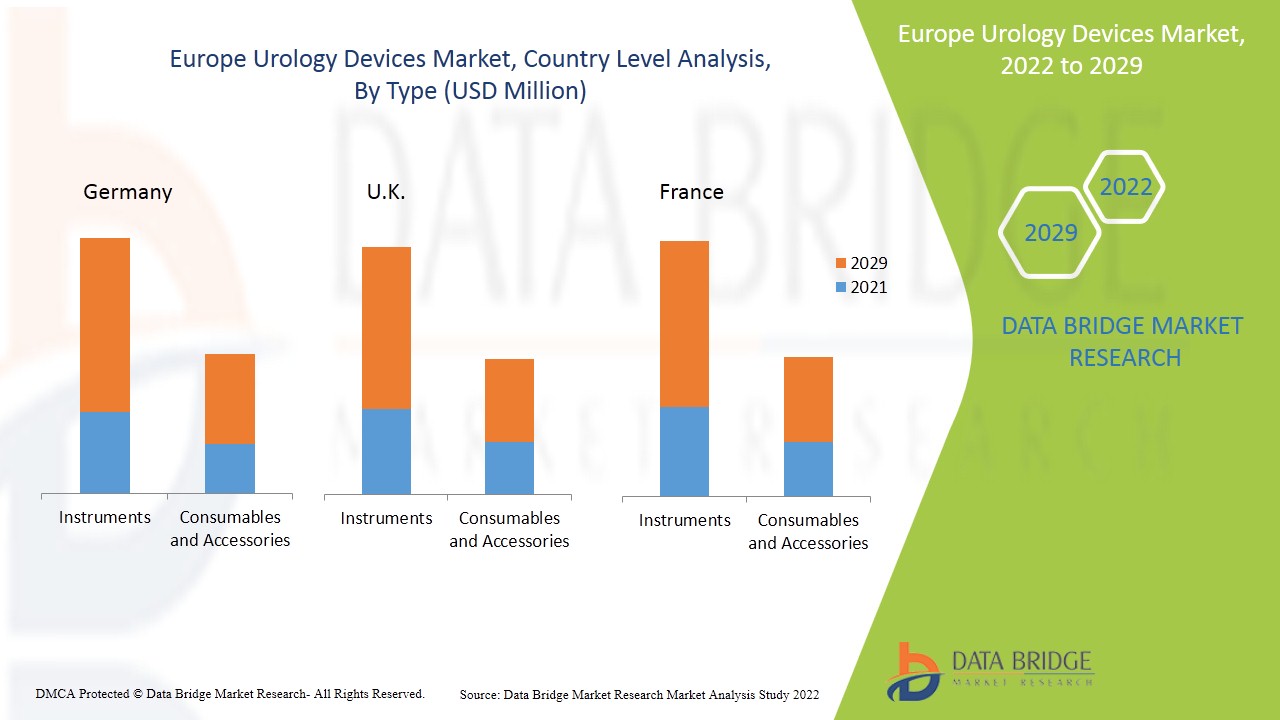

- Según el tipo, el mercado europeo de dispositivos urológicos se segmenta en instrumentos, consumibles y accesorios. En 2022, se espera que el segmento de instrumentos domine el mercado debido a las altas aprobaciones de productos en la región por parte de los actores del mercado.

- Según las indicaciones, el mercado europeo de dispositivos urológicos está segmentado en enfermedades renales, vejiga hiperactiva, hematuria, infección del tracto urinario, cálculos renales, eyaculación precoz, hiperplasia prostática benigna, cáncer urológico, prolapso de órganos pélvicos, uretrotomías, estenosis uretral y otras enfermedades. En 2022, se espera que el segmento de enfermedades renales domine el mercado debido a los hábitos alimentarios inadecuados y al aumento de enfermedades relacionadas con el estilo de vida.

- En términos de tecnología, el mercado europeo de dispositivos urológicos se segmenta en cirugía mínimamente invasiva, cirugía robótica y otros. En 2022, se espera que el segmento de cirugía mínimamente invasiva domine el mercado debido al alto avance tecnológico en el segmento mínimamente invasivo para una mayor comodidad de los pacientes.

- En función del usuario final, el mercado europeo de dispositivos urológicos se segmenta en hospitales y clínicas, centros de diálisis, laboratorios de investigación clínica, institutos académicos y otros. En 2022, se espera que el segmento de hospitales y clínicas domine el mercado debido al alto financiamiento gubernamental para mejores instalaciones de equipamiento en los hospitales.

- En función del canal de distribución, el mercado europeo de dispositivos urológicos se segmenta en licitaciones directas, distribución a terceros y otros. En 2022, se espera que el segmento de licitaciones directas domine el mercado, ya que ofrece mejores productos con buena calidad.

Análisis a nivel de país del mercado de dispositivos de urología

El mercado europeo de dispositivos urológicos se clasifica en seis segmentos notables según el tipo de producto, tipo, indicación, tecnología, usuario final y canal de distribución.

Los países cubiertos en el informe del mercado de dispositivos de urología son Alemania, Reino Unido, Italia, Francia, España, Suiza, Rusia, Turquía, Países Bajos y el resto de Europa.

Se espera que el segmento de instrumentos en Alemania crezca a la tasa más alta en el período de pronóstico de 2022 a 2029 debido a la creciente prevalencia de enfermedades urológicas. El segmento de instrumentos en el Reino Unido es el segundo que domina el mercado europeo debido al aumento de casos de enfermedades renales y las altas actividades de investigación y desarrollo. Francia es el tercer líder en el crecimiento del mercado europeo y el segmento de instrumentos domina en este país debido al creciente número de centros de biotecnología y actividades de investigación.

La sección de países del informe también proporciona factores de impacto individuales en el mercado y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se considera la presencia y disponibilidad de marcas europeas y los desafíos que enfrentan debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

Las crecientes actividades estratégicas de los principales actores del mercado para mejorar el conocimiento sobre el tratamiento con dispositivos de urología están impulsando el crecimiento del mercado de dispositivos de urología.

El mercado de dispositivos de urología también le proporciona un análisis detallado del mercado para el crecimiento de cada país en un mercado en particular. Además, proporciona información detallada sobre la estrategia de los actores del mercado y su presencia geográfica. Los datos están disponibles para el período histórico de 2011 a 2020.

Análisis del panorama competitivo y de la cuota de mercado de los dispositivos de urología

El panorama competitivo del mercado de dispositivos de urología proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa relacionado con el mercado de dispositivos de urología.

Las principales empresas que se dedican al sector de los dispositivos urológicos son Medtronic, Siemens, CooperSurgical, Inc., General Electric, BD, Stryker, Boston Scientific Corporation, Cardinal Health., Intuitive Surgical., Cook, Olympus Corporation, Med pro Medical BV, Fresenius Medical Care AG & Co. KGaA, Baxter., Richard Wolf GmbH., Dornier MedTech., KARL STORZ SE & Co. Kg, Dale Medical Products, Inc., Healthtronics, Inc., Medi Tech Devices Pvt. Ltd., Coloplast Corp., Remington MEDICAL, Medi-Globe GmbH, Nikkiso Co., Ltd., B. Braun Melsungen AG, Lumenis Be Ltd., Teleflex Incorporated, Urocare Products, Inc., Dynarex Corporation y otras empresas nacionales. Los analistas de DBMR conocen las fortalezas competitivas y ofrecen un análisis competitivo de cada competidor por separado.

Numerosos contratos y acuerdos son también iniciados por empresas de todo el mundo, lo que también está acelerando el mercado de dispositivos urológicos.

Por ejemplo,

- En enero de 2022, Stryker (EE. UU.) adquirió Vocera Communications (EE. UU.), líder en la categoría de comunicación y coordinación de atención digital. Esta adquisición ayudó a la empresa a expandir la innovadora cartera de la división médica de Stryker, impulsando el crecimiento del mercado.

- En octubre de 2021, Medtronic anunció que la empresa recibió la marca CE para su producto urológico "Sistema de cirugía asistida por robot (RAS) Hugo", que está autorizado para su venta en Europa. La aprobación de la marca CE aumentó la calidad de los productos en procedimientos urológicos y ginecológicos que representan aproximadamente la mitad de todos los procedimientos robóticos que se realizan en la actualidad. Esto mejoró la posición de la empresa en el mercado.

- En noviembre de 2020, Coloplast Corp. anunció que la empresa adquirió Nine Continents Medical, Inc., una empresa en etapa inicial pionera en un tratamiento de estimulación del nervio tibial implantable para la vejiga hiperactiva. Esta adquisición ayudó a la empresa a mejorar las oportunidades en el negocio de urología intervencionista para brindar soluciones innovadoras al mercado.

La colaboración, el lanzamiento de productos, la expansión comercial, los premios y reconocimientos, las empresas conjuntas y otras estrategias de los actores del mercado están mejorando la presencia de la empresa en el mercado de bombas de infusión veterinaria, lo que también brinda beneficios para el crecimiento de las ganancias de la organización.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE UROLOGY DEVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET INDICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 GLOBAL MEDICAL DEVICES GROWTH TRENDS - OVERVIEW

4.2 PESTEL

4.3 PORTER'S FIVE FORCES MODEL

5 EUROPE UROLOGY DEVICES MARKET: REGULATIONS

5.1 U.S.

5.2 EUROPE

5.3 GERMANY

5.4 ITALY

5.5 SPAIN

5.6 RUSSIA

5.7 NETHERLANDS

5.8 SWITZERLAND

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN RESEARCH AND DEVELOPMENT OF UROLOGY MEDICAL DEVICES

6.1.2 RISE IN INCIDENCE OF UROLOGY CONDITIONS IN EUROPE

6.1.3 TECHNOLOGICAL ADVANCEMENTS IN UROLOGICAL DEVICES

6.1.4 RISE IN GERIATRIC POPULATION

6.1.5 RISE IN PRODUCT APPROVALS

6.2 RESTRAINTS

6.2.1 RISE IN COST OF UROLOGY DEVICES AND TREATMENT OF UROLOGICAL CONDITIONS

6.2.2 RISKS OBSERVED WHILE USING UROLOGICAL DEVICES

6.2.3 RISE IN PRODUCT RECALL

6.2.4 LACK OF AWARENESS ABOUT TREATMENT FOR UROLOGICAL CONDITIONS

6.3 OPPORTUNITIES/

6.3.1 STRATEGIC INITIATIVE BY MARKET PLAYERS

6.3.2 RISE IN HEALTHCARE EXPENDITURE

6.3.3 INCREASED USE OF MINIMALLY INVASIVE SURGICAL DEVICES

6.4 CHALLENGES

6.4.1 LACK OF SKILLED PROFESSIONALS REQUIRED FOR USE OF UROLOGY DEVICES

6.4.2 STRINGENT REGULATIONS

7 IMPACT OF COVID-19 PANDEMIC ON THE MARKET

7.1 PRICE IMPACT

7.2 IMPACT ON DEMAND

7.3 IMPACT ON SUPPLY CHAIN

7.4 STRATEGIC DECISIONS FOR MANUFACTURERS/ SERVICE PROVIDERS

7.5 CONCLUSION

8 EUROPE UROLOGY DEVICES MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 DIALYSIS EQUIPMENT

8.3 URINARY STONE TREATMENT DEVICES

8.4 ENDOSCOPY DEVICES

8.5 URINARY INCONTINENCE & PELVIC ORGAN PROLAPSED

8.6 BENIGN PROSTATIC HYPERPLASIA TREATMENT DEVICES

8.7 OTHER PRODUCTS

9 EUROPE UROLOGY DEVICES MARKET, BY TYPE

9.1 OVERVIEW

9.2 INSTRUMENTS

9.2.1 DIALYSIS DEVICES

9.2.1.1 CENTER-USE HEMODIALYSIS MACHINES

9.2.1.2 HOME-USE HEMODIALYSIS MACHINES

9.2.2 LASERS AND LITHOTRIPSY DEVICES

9.2.2.1 UROLOGY LASERS

9.2.2.2 LITHOTRIPTERS

9.2.2.2.1 INTRACORPOREAL LITHOTRIPTERS

9.2.2.2.2 EXTRACORPOREAL LITHOTRIPTERS

9.2.3 ENDOSCOPES AND ENDOVISION SYSTEMS

9.2.4 OTHER INSTRUMENT

9.3 CONSUMABLES AND ACCESSORIES

9.3.1 DIALYSIS CONSUMABLES

9.3.1.1 DIALYZERS

9.3.1.2 HEMODIALYSIS CONCENTRATES

9.3.1.2.1 ACIDIC

9.3.1.2.2 ALKALINE

9.3.1.3 BLOODLINES

9.3.1.4 OTHERS

9.3.2 GUIDEWIRES AND CATHETERS

9.3.2.1 URETERAL CATHETERES

9.3.2.2 NEPHROSTOMY CATHETERES

9.3.2.3 VESICAL CATHETERES

9.3.2.4 CYSTOMETRY CATHETERES

9.3.2.5 RECTAL PRESSURE MONITORING CATHETERS

9.3.2.6 OTHER CATHETERS

9.3.3 STENTS

9.3.3.1 URETHRAL STENTS

9.3.3.2 URETERAL STENTS

9.3.3.3 PROSTATIC STENTS

9.3.4 ENDOSCOPIC BASKETS

9.3.5 BIOPSY DEVICES

9.3.5.1 PROSTATE BIOPSY NEEDLES

9.3.5.2 OTHERS

9.3.6 PELVIC IMPLANTS

9.3.7 MESHES

9.3.8 MORCELLATORS

9.3.9 OTHER CONSUMABLES AND ACCESSORIES

10 EUROPE UROLOGY DEVICES MARKET, BY INDICATION

10.1 OVERVIEW

10.2 KIDNEY DISEASES

10.3 KIDNEY STONES

10.4 UROLOGICAL CANCER

10.5 PELVIC ORGAN PROLAPSE

10.6 BENIGN PROSTATIC HYPERPLASIA

10.7 HEMATURIA

10.8 URINARY TRACT INFECTIONS

10.9 URETHROTOMIES

10.1 OVERACTIVE BLADDER

10.11 PREMATURE EJACULATION

10.12 URETHRAL STRICTURE

10.13 OTHER DISEASE

11 EUROPE UROLOGY DEVICES MARKET, BY TECHNOLOGY

11.1 OVERVIEW

11.2 MINIMALLY INVASIVE SURGERY

11.3 ROBOTIC SURGERY

11.4 OTHERS

12 EUROPE UROLOGY DEVICES MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS & CLINICS

12.3 DIALYSIS CENTERS

12.4 CLINICAL RESEARCH LABORATORIES

12.5 ACADEMIC INSTITUTES

12.6 OTHERS

13 EUROPE UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDERS

13.3 THIRD PARTY DISTRIBUTORS

13.4 OTHERS

14 EUROPE UROLOGY DEVICES MARKET, BY REGION

14.1 EUROPE

14.1.1 GERMANY

14.1.2 U.K.

14.1.3 FRANCE

14.1.4 ITALY

14.1.5 SPAIN

14.1.6 RUSSIA

14.1.7 SWITZERLAND

14.1.8 NETHERLANDS

14.1.9 TURKEY

14.1.10 REST OF EUROPE

15 EUROPE UROLOGY DEVICES MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 FRESENIUS SE & CO. KGAA

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 BAXTER

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENT

17.3 BOSTON SCIENTIFIC CORPORATION

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 OLYMPUS CORPORATION

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENTS

17.5 B. BRAUN MELSUNGEN AG

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 BD

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 MEDTRONIC

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 COOPERSURGICAL INC.

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 COLOPLAST CORP

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENTS

17.9.5 ACQUISITION

17.1 CARDINAL HEALTH

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENT

17.11 COOK

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 DORNIER MEDTECH

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 DALE MEDICAL PRODUCTS, INC.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.13.4 DEVELOPMENT

17.14 DYNAREX CORPORATION

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 GENERAL ELECTRIC

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENT

17.15.5 ACQUISITION

17.16 HEALTHTRONICS, INC

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.16.4 ACQUISITION

17.17 INTUITIVE SURGICAL

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENT

17.18 KARL STORZ SE & CO KG,TUTTLINGEN

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 LUMENIS BE LTD.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.19.4 PRODUCT LAUNCHES

17.2 MEDI GLOBE GMBH

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 MEDI TECH DEVICES PVT. LTD.

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

17.22 MED PRO MEDICAL B.V.

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

17.23 NIKKISO CO., LTD.

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENT

17.24 REMINGTON MEDICAL

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 RICHARD WOLF GMBH

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT DEVELOPMENT

17.26 STRYKER

17.26.1 COMPANY SNAPSHOT

17.26.2 REVENUE ANALYSIS

17.26.3 PRODUCT PORTFOLIO

17.26.4 RECENT DEVELOPMENTS

17.26.5 ACQUISITION

17.27 SIEMENS HEALTHCARE GMBH

17.27.1 COMPANY SNAPSHOT

17.27.2 REVENUE ANALYSIS

17.27.3 PRODUCT PORTFOLIO

17.27.4 RECENT DEVELOPMENTS

17.27.5 ACQUISITION

17.28 TELEFLEX INCORPORATED.

17.28.1 COMPANY SNAPSHOT

17.28.2 REVENUE ANALYSIS

17.28.3 PRODUCT PORTFOLIO

17.28.4 RECENT DEVELOPMENTS

17.28.5 PRODUCT LAUNCH

17.29 UROCARE PRODUCTS, INC.

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tablas

TABLE 1 EUROPE UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 EUROPE UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 EUROPE INSTRUMENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 EUROPE DIALYSIS DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 EUROPE LASERS AND LITHOTRIPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 EUROPE LITHOTRIPTERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 EUROPE CONSUMABLES AND ACCESSORIES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 EUROPE DIALYSIS CONSUMABLES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 EUROPE HEMODIALYSIS CONCENTRATES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 EUROPE GUIDEWIRES AND CATHETERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 EUROPE STENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 EUROPE BIOPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 EUROPE UROLOGY DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE UROLOGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 15 EUROPE UROLOGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 16 EUROPE UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 17 EUROPE UROLOGY DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 18 EUROPE UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 19 EUROPE UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 EUROPE INSTRUMENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 EUROPE DIALYSIS DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 EUROPE LASERS AND LITHOTRIPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 EUROPE LITHOTRIPTERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 EUROPE CONSUMABLES AND ACCESSORIES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 EUROPE DIALYSIS CONSUMABLES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 EUROPE HEMODIALYSIS CONCENTRATES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 EUROPE GUIDEWIRES AND CATHETERS UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 EUROPE STENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 EUROPE BIOPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 EUROPE UROLOGY DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE UROLOGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 32 EUROPE UROLOGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 33 EUROPE UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 34 GERMANY UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 35 GERMANY UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 GERMANY INSTRUMENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 GERMANY DIALYSIS DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 GERMANY LASERS AND LITHOTRIPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 GERMANY LITHOTRIPTERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 GERMANY CONSUMABLES AND ACCESSORIES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 GERMANY DIALYSIS CONSUMABLES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 GERMANY HEMODIALYSIS CONCENTRATES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 GERMANY GUIDEWIRES AND CATHETERS UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 GERMANY STENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 GERMANY BIOPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 GERMANY UROLOGY DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 47 GERMANY UROLOGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 48 GERMANY UROLOGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 49 GERMANY UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 50 U.K. UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 U.K. UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 U.K. INSTRUMENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 U.K. DIALYSIS DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 U.K. LASERS AND LITHOTRIPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 U.K. LITHOTRIPTERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 U.K. CONSUMABLES AND ACCESSORIES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 U.K. DIALYSIS CONSUMABLES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 U.K. HEMODIALYSIS CONCENTRATES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 U.K. GUIDEWIRES AND CATHETERS UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.K. STENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.K. BIOPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 U.K. UROLOGY DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 63 U.K. UROLOGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 64 U.K. UROLOGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 65 U.K. UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 66 FRANCE UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 67 FRANCE UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 FRANCE INSTRUMENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 FRANCE DIALYSIS DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 FRANCE LASERS AND LITHOTRIPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 FRANCE LITHOTRIPTERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 FRANCE CONSUMABLES AND ACCESSORIES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 FRANCE DIALYSIS CONSUMABLES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 FRANCE HEMODIALYSIS CONCENTRATES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 FRANCE GUIDEWIRES AND CATHETERS UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 FRANCE STENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 FRANCE BIOPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 FRANCE UROLOGY DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 79 FRANCE UROLOGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 80 FRANCE UROLOGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 81 FRANCE UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 82 ITALY UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 83 ITALY UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 ITALY INSTRUMENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 ITALY DIALYSIS DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 ITALY LASERS AND LITHOTRIPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 ITALY LITHOTRIPTERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 ITALY CONSUMABLES AND ACCESSORIES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 ITALY DIALYSIS CONSUMABLES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 ITALY HEMODIALYSIS CONCENTRATES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 ITALY GUIDEWIRES AND CATHETERS UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 ITALY STENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 ITALY BIOPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 ITALY UROLOGY DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 95 ITALY UROLOGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 96 ITALY UROLOGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 97 ITALY UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 98 SPAIN UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 99 SPAIN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 SPAIN INSTRUMENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 SPAIN DIALYSIS DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 SPAIN LASERS AND LITHOTRIPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 SPAIN LITHOTRIPTERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 SPAIN CONSUMABLES AND ACCESSORIES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 SPAIN DIALYSIS CONSUMABLES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 SPAIN HEMODIALYSIS CONCENTRATES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 SPAIN GUIDEWIRES AND CATHETERS UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 SPAIN STENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 SPAIN BIOPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 SPAIN UROLOGY DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 111 SPAIN UROLOGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 112 SPAIN UROLOGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 113 SPAIN UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 114 RUSSIA UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 115 RUSSIA UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 RUSSIA INSTRUMENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 RUSSIA DIALYSIS DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 RUSSIA LASERS AND LITHOTRIPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 RUSSIA LITHOTRIPTERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 RUSSIA CONSUMABLES AND ACCESSORIES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 RUSSIA DIALYSIS CONSUMABLES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 RUSSIA HEMODIALYSIS CONCENTRATES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 RUSSIA GUIDEWIRES AND CATHETERS UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 RUSSIA STENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 RUSSIA BIOPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 RUSSIA UROLOGY DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 127 RUSSIA UROLOGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 128 RUSSIA UROLOGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 129 RUSSIA UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 130 SWITZERLAND UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 131 SWITZERLAND UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 SWITZERLAND INSTRUMENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 SWITZERLAND DIALYSIS DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 SWITZERLAND LASERS AND LITHOTRIPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 SWITZERLAND LITHOTRIPTERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 SWITZERLAND CONSUMABLES AND ACCESSORIES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 SWITZERLAND DIALYSIS CONSUMABLES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 SWITZERLAND HEMODIALYSIS CONCENTRATES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 SWITZERLAND GUIDEWIRES AND CATHETERS UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 SWITZERLAND STENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 SWITZERLAND BIOPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 SWITZERLAND UROLOGY DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 143 SWITZERLAND UROLOGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 144 SWITZERLAND UROLOGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 145 SWITZERLAND UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 146 NETHERLANDS UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 147 NETHERLANDS UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 NETHERLANDS INSTRUMENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 NETHERLANDS DIALYSIS DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 NETHERLANDS LASERS AND LITHOTRIPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 NETHERLANDS LITHOTRIPTERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 NETHERLANDS CONSUMABLES AND ACCESSORIES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 153 NETHERLANDS DIALYSIS CONSUMABLES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 154 NETHERLANDS HEMODIALYSIS CONCENTRATES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 NETHERLANDS GUIDEWIRES AND CATHETERS UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 NETHERLANDS STENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 NETHERLANDS BIOPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 NETHERLANDS UROLOGY DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 159 NETHERLANDS UROLOGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 160 NETHERLANDS UROLOGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 161 NETHERLANDS UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 162 TURKEY UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 163 TURKEY UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 TURKEY INSTRUMENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 TURKEY DIALYSIS DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 TURKEY LASERS AND LITHOTRIPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 TURKEY LITHOTRIPTERS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 168 TURKEY CONSUMABLES AND ACCESSORIES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 169 TURKEY DIALYSIS CONSUMABLES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 TURKEY HEMODIALYSIS CONCENTRATES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 171 TURKEY GUIDEWIRES AND CATHETERS UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 TURKEY STENTS IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 TURKEY BIOPSY DEVICES IN UROLOGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 TURKEY UROLOGY DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 175 TURKEY UROLOGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 176 TURKEY UROLOGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 177 TURKEY UROLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 178 REST OF EUROPE UROLOGY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 EUROPE UROLOGY DEVICES MARKET: SEGMENTATION

FIGURE 2 EUROPE UROLOGY DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE UROLOGY DEVICES MARKET: DROC ANALYSIS

FIGURE 4 EUROPE UROLOGY DEVICES MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 EUROPE UROLOGY DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE UROLOGY DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE UROLOGY DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE UROLOGY DEVICES MARKET: INDICATION COVERAGE GRID

FIGURE 9 EUROPE UROLOGY DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE UROLOGY DEVICES MARKET: SEGMENTATION

FIGURE 11 RISING PREVALENCE OF UROLOGICAL DISORDERS IS EXPECTED TO DRIVE THE EUROPE UROLOGY DEVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 DIALYSIS EQUIPMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE UROLOGY DEVICES MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE UROLOGY DEVICES MARKET

FIGURE 14 ESTIMATED COUNT OF WOMEN SUFFERING FROM URINARY INCONTINENCE IN 2021 IN THE U.S.

FIGURE 15 PROSTATE CANCER INCIDENCE IN EUROPEAN REGION IN 2021

FIGURE 16 EUROPE UROLOGY DEVICES MARKET: BY PRODUCT TYPE, 2021

FIGURE 17 EUROPE UROLOGY DEVICES MARKET: BY PRODUCT TYPE, 2020-2029 (USD MILLION)

FIGURE 18 EUROPE UROLOGY DEVICES MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 19 EUROPE UROLOGY DEVICES MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 20 EUROPE UROLOGY DEVICES MARKET: BY TYPE, 2021

FIGURE 21 EUROPE UROLOGY DEVICES MARKET: BY TYPE, 2020-2029 (USD MILLION)

FIGURE 22 EUROPE UROLOGY DEVICES MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 23 EUROPE UROLOGY DEVICES MARKET: BY TYPE, LIFELINE CURVE

FIGURE 24 EUROPE UROLOGY DEVICES MARKET: BY INDICATION, 2021

FIGURE 25 EUROPE UROLOGY DEVICES MARKET: BY INDICATION, 2020-2029 (USD MILLION)

FIGURE 26 EUROPE UROLOGY DEVICES MARKET: BY INDICATION, CAGR (2022-2029)

FIGURE 27 EUROPE UROLOGY DEVICES MARKET: BY INDICATION, LIFELINE CURVE

FIGURE 28 EUROPE UROLOGY DEVICES MARKET: BY TECHNOLOGY, 2021

FIGURE 29 EUROPE UROLOGY DEVICES MARKET: BY TECHNOLOGY, 2020-2029 (USD MILLION)

FIGURE 30 EUROPE UROLOGY DEVICES MARKET: BY TECHNOLOGY, CAGR (2022-2029)

FIGURE 31 EUROPE UROLOGY DEVICES MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 32 EUROPE UROLOGY DEVICES MARKET: BY END USER, 2021

FIGURE 33 EUROPE UROLOGY DEVICES MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 34 EUROPE UROLOGY DEVICES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 35 EUROPE UROLOGY DEVICES MARKET: BY END USER, LIFELINE CURVE

FIGURE 36 EUROPE UROLOGY DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 37 EUROPE UROLOGY DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

FIGURE 38 EUROPE UROLOGY DEVICES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 39 EUROPE UROLOGY DEVICES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 40 EUROPE UROLOGY DEVICES MARKET: SNAPSHOT (2021)

FIGURE 41 EUROPE UROLOGY DEVICES MARKET: BY COUNTRY (2021)

FIGURE 42 EUROPE UROLOGY DEVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 43 EUROPE UROLOGY DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 44 EUROPE UROLOGY DEVICES MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 45 EUROPE UROLOGY DEVICES MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.