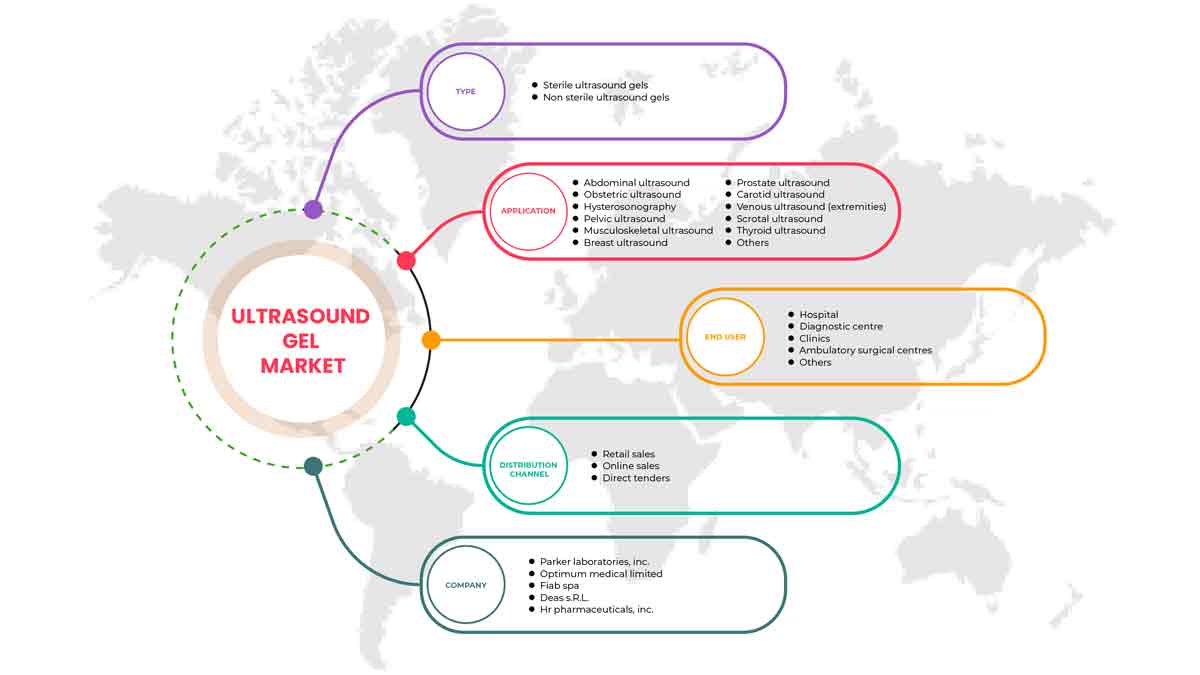

Mercado europeo de geles de ultrasonido, por tipo (estéril y no estéril), aplicación ( ecografía abdominal , ecografía obstétrica, histerosonografía, ecografía pélvica, ecografía musculoesquelética , ecografía mamaria, ecografía de próstata, ecografía carotídea, ecografía venosa (extremidades), ecografía escrotal, ecografía tiroidea y otras), usuario final (hospitales, clínicas, centros de diagnóstico, centros quirúrgicos ambulatorios y otros), canal de distribución (ventas minoristas, ventas en línea y licitación directa) - Tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado de geles de ultrasonidos en Europa

Los geles de ultrasonido son uno de los geles más utilizados para diversos procedimientos de ultrasonido que incluyen histerosonografía, ecografía obstétrica, ecografía abdominal, ecografía mamaria, ecografía carotídea, ecografía musculoesquelética, ecografía pélvica, ecografía de próstata, ecografía escrotal, ecografía tiroidea, ecografía venosa, entre otros. Los geles de ultrasonido son un fármaco anti-TNF indicado para el tratamiento de los síntomas inflamatorios. Los profesionales médicos utilizan geles de ultrasonido biológicos para obtener diagnósticos claros y precisos.

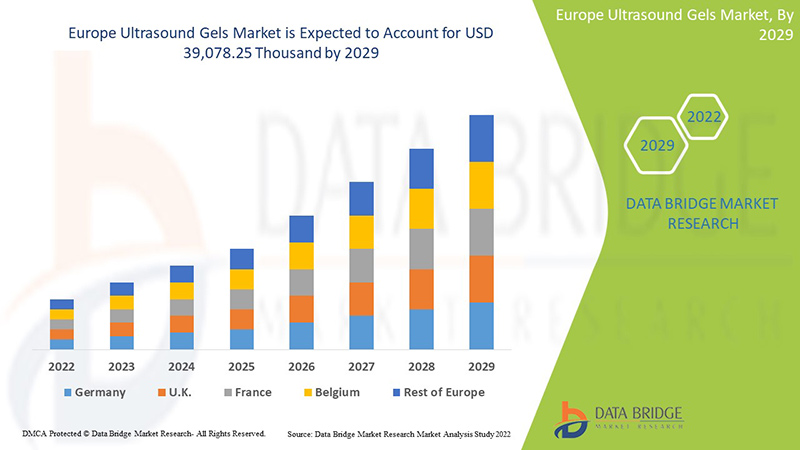

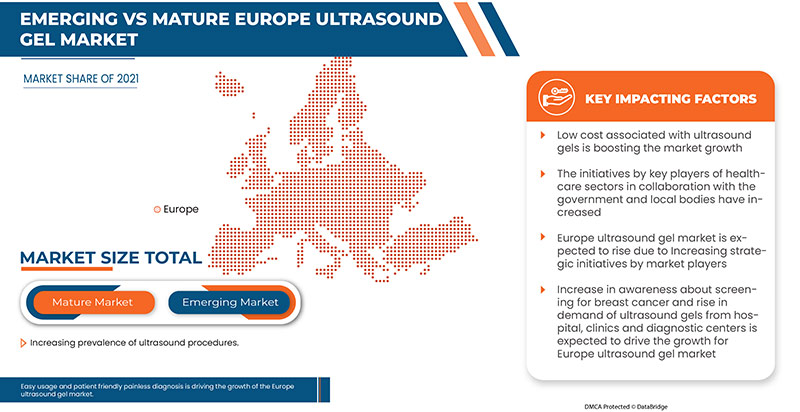

Se espera que el mercado europeo de geles de ultrasonido gane crecimiento de mercado en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 6,1% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 39.078,25 mil para 2029.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable 2019-2014) |

|

Unidades cuantitativas |

Ingresos en miles de USD |

|

Segmentos cubiertos |

Por tipo (estéril y no estéril), aplicación (ecografía abdominal, ecografía obstétrica, histerosonografía, ecografía pélvica, ecografía musculoesquelética, ecografía mamaria, ecografía prostática, ecografía carotídea, ecografía venosa (extremidades), ecografía escrotal, ecografía tiroidea y otras), usuario final (hospitales, clínicas, centros de diagnóstico, centros quirúrgicos ambulatorios y otros), canal de distribución (venta minorista, venta en línea y licitación directa) |

|

Países cubiertos |

Alemania, Francia, Reino Unido, Italia, España, Países Bajos, Suiza, Bélgica, Turquía y el resto de Europa |

|

Actores del mercado cubiertos |

Las principales empresas que operan en el mercado son Medline Industries LP, Deas srl, HR Pharmaceuticals Inc, FIAB SpA, Gima SpA, Parker Laboratories Inc, Primax Berlin GmbH, Optimum Medical Limited, Safersonic, Braun and Co. Limited, ProSys International Ltd, Turquoise Health, DJO LLC, Fannin, Lessa (subsidiaria de AB Medica Group), Rays SPA, entre otras. |

Definición de mercado:

Los geles de ultrasonido son uno de los geles más utilizados durante los procedimientos de ultrasonido. Los geles de ultrasonido se utilizan para obtener imágenes claras y precisas durante el diagnóstico. Se trata de un tipo de medio conductor que se aplica a la piel y actúa como agente de acoplamiento, por lo que ayuda a formar una unión firme entre la piel y la sonda. Este gel también ayuda a que las ondas de ultrasonido se transmitan directamente a los tejidos y otras partes donde se requieren imágenes.

Dinámica del mercado de geles de ultrasonido

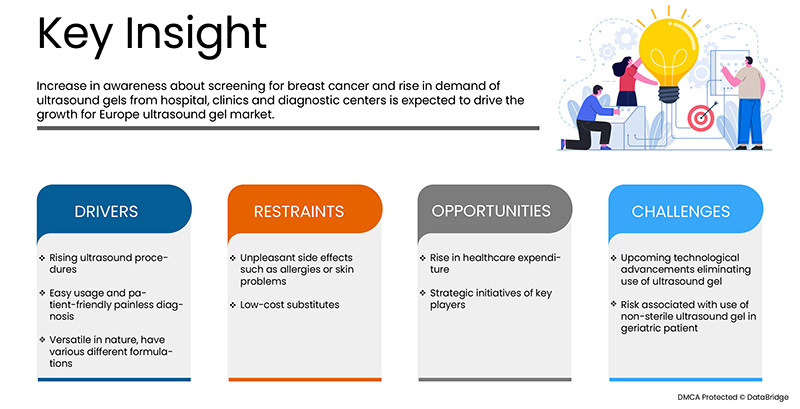

Conductores

- Procedimientos de ultrasonido en aumento

Las ondas sonoras de alta frecuencia realizan una ecografía para obtener imágenes de las estructuras corporales internas de una persona. Los médicos o clínicos aplican geles de ultrasonido en las partes del cuerpo de un paciente para obtener imágenes médicas profundas, precisas y claras. A medida que la tecnología en crecimiento permite imágenes de alta resolución en la ecografía médica, se hace más fácil diagnosticar correctamente el interior del cuerpo. Debido a su naturaleza rentable y a una mayor conciencia sobre los controles periódicos para cuerpos más saludables, el número de ecografías está aumentando. Los geles de ultrasonidos son el producto más conveniente y confiable durante estas exploraciones. La dependencia de los médicos y clínicos de las ecografías ha aumentado regularmente. Estos procedimientos se utilizan comúnmente para examinar el hígado, los riñones y otros órganos en el estómago, la pelvis y otros órganos o tejidos que se pueden evaluar a través de la piel. Aumento de la población geriátrica

- Fácil uso y diagnóstico amigable para el paciente

Al realizar exploraciones, los médicos y el personal médico suelen utilizar geles de ultrasonidos, ya que estos geles ayudan a evitar que el aire se filtre entre las ondas ultrasónicas del escáner y la parte del cuerpo donde se aplica el gel. La mayoría de los procedimientos de ultrasonidos son indoloros, ya que no son invasivos y se realizan de forma externa; solo se aplican los geles al cuerpo y el transductor se coloca cerca del contacto con la piel a medida que pasan las ondas de luz, lo que produce un efecto insignificante en el cuerpo de la persona. Los procedimientos de ultrasonidos utilizan ondas sonoras de alta frecuencia para crear una imagen de una parte del interior del cuerpo, ya que los geles de ultrasonidos capturan mejor estas imágenes. Estos geles aplicados sobre la piel son fáciles de usar y no causan ningún dolor corporal. Por lo tanto, el procedimiento de ultrasonido fácil e indoloro ayudará al crecimiento del mercado en el período de pronóstico.

Oportunidades

-

El aumento del gasto sanitario

El gasto en atención sanitaria ha aumentado en todo el mundo a medida que aumenta el ingreso disponible de las personas en varios países. Además, para satisfacer las necesidades de la población, los organismos gubernamentales y las organizaciones de atención sanitaria están tomando la iniciativa en virtud de la aceleración del gasto en atención sanitaria. Además, el aumento del gasto en atención sanitaria por parte del gobierno en la región proporcionará integridad estructural y oportunidades futuras para el mercado de geles de ultrasonido en el período de pronóstico de 2022 a 2029.

Restricciones/Desafíos

Existen varios problemas de piel y alergias que se han reportado debido al uso de geles de ultrasonido. Algunas personas desarrollan estos problemas debido a su piel sensible. Se ha producido dermatitis de contacto en una pequeña población de pacientes debido al uso de geles de ultrasonido. También puede desarrollarse otra contaminación bacteriana en la piel del paciente donde se están aplicando los geles. Algunas formulaciones o diferentes composiciones de geles se calientan cuando se tratan con luz ultravioleta debido a una reacción exotérmica. Cuanto más espesos sean los geles, más calor se produce. Por lo tanto, los efectos secundarios asociados con el uso de geles de ultrasonido pueden obstaculizar el crecimiento del mercado en el período de pronóstico.

Impacto de la COVID-19 en el mercado europeo de geles de ultrasonido

La COVID-19 ha afectado el crecimiento del mercado debido a que hay un aumento en los procedimientos de ultrasonido en la región, como la histerosonografía, la ecografía obstétrica, la ecografía abdominal, la ecografía mamaria, la ecografía carotídea, la ecografía musculoesquelética, la ecografía pélvica, la ecografía de próstata, la ecografía escrotal, la ecografía tiroidea, la ecografía venosa, entre otras. Por lo tanto, la necesidad de geles de ultrasonido sigue aumentando durante el período de COVID.

Desarrollo reciente

- En abril de 2019, Civco Medical Solutions lanzó una nueva solución, Envision Viral Barrier, que elimina el uso de geles en los procedimientos de ultrasonido. Este producto consta de una cubierta para la sonda de ultrasonido y una almohadilla de escaneo con un líquido estéril que facilita los procedimientos 100 % libres de gel. Estos avances tecnológicos ayudan a reducir el riesgo de contaminación y facilitan los flujos de trabajo de los médicos en entornos de atención médica, lo que puede impedir el crecimiento del mercado.

Alcance del mercado de geles de ultrasonidos en Europa

El mercado europeo de geles de ultrasonidos está segmentado por tipo, aplicación, usuario final y canal de distribución. El crecimiento entre estos segmentos le ayudará a analizar segmentos de crecimiento reducido en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Solicitud

- Ecografía abdominal

- Ultrasonido obstétrico

- Histerosonografía

- Ecografía pélvica

- Ultrasonido musculoesquelético

- Ecografía de mama

- Ultrasonido de próstata

- Ecografía de la carótida

- Ecografía venosa (extremidades)

- Ecografía escrotal

- Ecografía de la tiroides

- Otros

Sobre la base de la aplicación, el mercado europeo de geles de ultrasonido está segmentado en ultrasonido abdominal, ultrasonido obstétrico, histerosonografía, ultrasonido pélvico, ultrasonido musculoesquelético, ultrasonido de mama, ultrasonido de próstata, ultrasonido carotídeo, ultrasonido venoso (extremidades), ultrasonido escrotal, ultrasonido de tiroides y otros.

Tipo

- Geles estériles para ultrasonidos

- Geles de ultrasonidos no estériles

Según el tipo, el mercado europeo de geles de ultrasonido está segmentado en geles de ultrasonido estériles y no estériles.

Usuario final

- Hospitales

- Clínicas

- Centros de diagnóstico

- Centros de cirugía ambulatoria

- Otros

Sobre la base de los usuarios finales, el mercado europeo de geles de ultrasonido está segmentado en hospitales, clínicas, centros de diagnóstico, centros quirúrgicos ambulatorios y otros.

Canal de distribución

- Ventas al por menor

- Ventas en línea

- Licitación directa

Sobre la base del canal de distribución, el mercado europeo de geles de ultrasonido está segmentado en ventas minoristas, ventas en línea y licitación directa.

Definición de mercado

Los geles para ultrasonidos son uno de los geles más utilizados y se utilizan principalmente durante los procedimientos de ultrasonidos. Los geles para ultrasonidos se utilizan para obtener imágenes claras y precisas durante los diagnósticos. Son el tipo de medio conductor que se aplica a la piel y actúa como agente de acoplamiento y, por lo tanto, ayuda a formar una unión firme entre la piel y la sonda. Este gel también ayuda a que las ondas de ultrasonido se transmitan directamente a los tejidos y otras partes donde se requieren imágenes.

Análisis y perspectivas regionales del mercado de geles de ultrasonidos en Europa

Se analiza el mercado de geles de ultrasonido y se proporcionan información y tendencias del tamaño del mercado por país, tipo, aplicación, usuario final y canal de distribución, como se menciona anteriormente.

Los países que comprenden el mercado europeo de geles de ultrasonido son Alemania, Francia, Reino Unido, Italia, España, Países Bajos, Suiza, Bélgica, Turquía y el resto de Europa.

Alemania domina el mercado de geles de ultrasonidos en términos de participación de mercado e ingresos de mercado y seguirá aumentando su dominio durante el período de pronóstico. Esto se debe al aumento en la prevalencia de varias enfermedades crónicas y a la investigación y el desarrollo en el desarrollo de medicamentos en Alemania que mejoran aún más el crecimiento de este mercado.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en las regulaciones del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos, como las ventas nuevas y de reemplazo, la demografía del país, la epidemiología de las enfermedades y los aranceles de importación y exportación, son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para cada país. Además, se consideran la presencia y disponibilidad de marcas globales y los desafíos que enfrentan debido a la alta competencia de las marcas locales y nacionales y el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado

El panorama competitivo del mercado de geles de ultrasonidos proporciona detalles sobre los competidores. Los detalles incluyen una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento del producto, la amplitud y la variedad del producto y el dominio de la aplicación. Los puntos de datos anteriores solo están relacionados con el enfoque de las empresas en el mercado de geles de ultrasonidos de Europa.

Algunos de los principales actores que operan en el mercado de geles de ultrasonidos de Europa son Medline Industries LP, Deas srl, HR Pharmaceuticals Inc, FIAB SpA, Gima SpA, Parker Laboratories Inc, Primax Berlin GmbH, Optimum Medical Limited, Safersonic, Braun and Co. Limited, ProSys International Ltd, Turquoise Health, DJO LLC, Fannin, Lessa (subsidiaria de AB Medica Group), Rays SPA, entre otros.

Metodología de la investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. Los datos del mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen la cuadrícula de posicionamiento de proveedores, el análisis de la línea de tiempo del mercado, la descripción general y la guía del mercado, la cuadrícula de posicionamiento de la empresa, el análisis de la participación de mercado de la empresa, los estándares de medición, Europa frente a la región y el análisis de la participación de los proveedores. Solicite una llamada de un analista en caso de tener más consultas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE ULTRASOUND GELS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES MODEL

4.3 NUMBER OF ULTRASOUND PROCEDURES, BY COUNTRY

4.3.1 NUMBER OF ABDOMINAL ULTRASOUND PROCEDURES, BY COUNTRY

4.3.2 NUMBER OF OBSTETRIC ULTRASOUND PROCEDURES, BY COUNTRY

4.3.3 NUMBER OF HYSTEROSONOGRAPHY ULTRASOUND PROCEDURES, BY COUNTRY

4.3.4 NUMBER OF BREAST ULTRASOUND PROCEDURES, BY COUNTRY

4.3.5 NUMBER OF CAROTID ULTRASOUND PROCEDURES, BY COUNTRY

4.3.6 NUMBER OF MUSCULOSKELETAL ULTRASOUND PROCEDURES, BY COUNTRY

4.3.7 NUMBER OF PELVIC ULTRASOUND PROCEDURES, BY COUNTRY

4.3.8 NUMBER OF PROSTATE ULTRASOUND PROCEDURES, BY COUNTRY

4.3.9 NUMBER OF SCROTAL ULTRASOUND PROCEDURES, BY COUNTRY

4.3.10 NUMBER OF THYROID ULTRASOUND PROCEDURES, BY COUNTRY

4.3.11 NUMBER OF VENOUS (EXTREMITIES) ULTRASOUND PROCEDURES, BY COUNTRY

5 EUROPE ULTRASOUND GELS MARKET: REGULATIONS

5.1 REGULATION IN EUROPE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING ULTRASOUND PROCEDURES

6.1.2 EASY USAGE AND PATIENT-FRIENDLY PAINLESS DIAGNOSIS

6.1.3 VERSATILE IN NATURE, HAVE VARIOUS DIFFERENT FORMULATIONS

6.2 RESTRAINTS

6.2.1 UNPLEASANT SIDE EFFECTS SUCH AS ALLERGIES OR SKIN PROBLEMS

6.2.2 LOW-COST SUBSTITUTES

6.3 OPPORTUNITIES

6.3.1 RISE IN HEALTHCARE EXPENDITURE

6.3.2 STRATEGIC INITIATIVES OF KEY PLAYERS

6.3.3 DEVELOPMENT OF INNOVATIVE IMAGING MODALITIES AND CONTRAST AGENTS

6.4 CHALLENGES

6.4.1 UPCOMING TECHNOLOGICAL ADVANCEMENTS ELIMINATING THE USE OF ULTRASOUND GEL

6.4.2 RISK ASSOCIATED WITH USE OF NON-STERILE ULTRASOUND GEL IN GERIATRIC PATIENTS

7 EUROPE ULTRASOUND GELS MARKET, BY TYPE

7.1 OVERVIEW

7.2 NON-STERILE ULTRASOUND GELS

7.3 STERILE ULTRASOUND GELS

8 EUROPE ULTRASOUND GELS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 ABDOMINAL ULTRASOUND

8.2.1 NON-STERILE ULTRASOUND GELS

8.2.2 STERILE ULTRASOUND GELS

8.3 OBSTETRIC ULTRASOUND

8.3.1 NON-STERILE ULTRASOUND GELS

8.3.2 STERILE ULTRASOUND GELS

8.4 HYSTEROSONOGRAPHY

8.4.1 NON-STERILE ULTRASOUND GELS

8.4.2 STERILE ULTRASOUND GELS

8.5 PELVIC ULTRASOUND

8.5.1 NON-STERILE ULTRASOUND GELS

8.5.2 STERILE ULTRASOUND GELS

8.6 MUSCULOSKELETAL ULTRASOUND

8.6.1 NON-STERILE ULTRASOUND GELS

8.6.2 STERILE ULTRASOUND GELS

8.7 BREAST ULTRASOUND

8.7.1 NON-STERILE ULTRASOUND GELS

8.7.2 STERILE ULTRASOUND GELS

8.8 PROSTATE ULTRASOUND

8.8.1 NON-STERILE ULTRASOUND GELS

8.8.2 STERILE ULTRASOUND GELS

8.9 CAROTID ULTRASOUND

8.9.1 NON-STERILE ULTRASOUND GELS

8.9.2 STERILE ULTRASOUND GELS

8.1 VENOUS ULTRASOUND (EXTERMITIS)

8.10.1 NON-STERILE ULTRASOUND GELS

8.10.2 STERILE ULTRASOUND GELS

8.11 SCROTAL ULTRASOUND

8.11.1 NON-STERILE ULTRASOUND GELS

8.11.2 STERILE ULTRASOUND GELS

8.12 THYROID ULTRASOUND

8.12.1 NON-STERILE ULTRASOUND GELS

8.12.2 STERILE ULTRASOUND GELS

8.13 OTHERS

9 EUROPE ULTRASOUND GELS MARKET, BY END USER

9.1 OVERVIEW

9.2 HOSPITALS

9.3 DIAGNOSTIC CENTERS

9.4 CLINICS

9.5 AMBULATORY SURGICAL CENTERS

9.6 OTHERS

10 EUROPE ULTRASOUND GELS MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 RETAIL SALES

10.3 ONLINE SALES

10.4 DIRECT TENDER

11 EUROPE ULTRASOUND GELS MARKET, BY COUNTRY

11.1 GERMANY

11.2 FRANCE

11.3 U.K.

11.4 ITALY

11.5 TURKEY

11.6 SPAIN

11.7 NETHERLANDS

11.8 BELGIUM

11.9 SWITZERLAND

11.1 REST OF EUROPE

12 EUROPE ULTRASOUND GELS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 PARKER LABORATORIES, INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 PRODUCT PORTFOLIO

14.1.3 RECENT DEVELOPMENTS

14.2 OPTIMUM MEDICAL LIMITED

14.2.1 COMPANY SNAPSHOT

14.2.2 PRODUCT PORTFOLIO

14.2.3 RECENT DEVELOPMENTS

14.3 FIAB SPA

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT DEVELOPMENTS

14.4 DEAS S.R.L.

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 RECENT DEVELOPMENTS

14.5 HR PHARMACEUTICALS, INC.

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENTS

14.6 BRAUN & CO. LIMITED

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 DJO, LLC

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 FANNIN

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 GIMA S.P.A.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 LESSA (SUBSIDIARY OF AB MEDICA GROUP)

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 MEDLINE INDUSTRIES, LP.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 PRIMAX BERLIN GMBH

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 PROSYS INTERNATIONAL LTD

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 RAYS S.P.A

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 SAFERSONIC

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 TURQUOISE HEALTH

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 EUROPE ULTRASOUND GELS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 2 EUROPE ULTRASOUND GELS MARKET, BY TYPE, 2020-2029 (VOLUME, IN THOUSAND)

TABLE 3 EUROPE ULTRASOUND GELS MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 4 EUROPE ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 5 EUROPE ABDOMINAL ULTRASOUND IN ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 6 EUROPE OBSTETRIC ULTRASOUND IN ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 7 EUROPE HYSTEROSONOGRAPHY IN ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 8 EUROPE PELVIC ULTRASOUND IN ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 9 EUROPE MUSCULOSKELETAL ULTRASOUND IN ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 10 EUROPE BREAST ULTRASOUND IN ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 11 EUROPE PROSTATE ULTRASOUND IN ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 12 EUROPE CAROTID ULTRASOUND IN ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 13 EUROPE VENOUS ULTRASOUND (EXTREMITIS) IN ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 14 EUROPE SCROTAL ULTRASOUND IN ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 15 EUROPE THYROID ULTRASOUND IN ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 16 EUROPE ULTRASOUND GELS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 17 EUROPE ULTRASOUND GELS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 18 EUROPE ULTRASOUND GELS MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 19 GERMANY ULTRASOUND GELS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 20 GERMANY ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 21 GERMANY ABDOMINAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 22 GERMANY OBSTETRIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 23 GERMANY HYSTEROSONOGRAPHY ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 24 GERMANY PELVIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 25 GERMANY MUSCULOSKELETAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 26 ERMANY BREAST ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 27 GERMANY PROSTATE ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 28 GERMANY CAROTID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 29 GERMANY VENOUS ULTRASOUND (EXTERMITIS) GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 30 GERMANY SCROTAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 31 GERMANY THYROID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 32 GERMANY ULTRASOUND GELS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 33 GERMANY ULTRASOUND GELS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 34 FRANCE ULTRASOUND GELS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 35 FRANCE ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 36 FRANCE ABDOMINAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 37 FRANCE OBSTETRIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 38 FRANCE HYSTEROSONOGRAPHY ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 39 FRANCE PELVIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 40 FRANCE MUSCULOSKELETAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 41 FRANCE BREAST ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 42 FRANCE PROSTATE ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 43 FRANCE CAROTID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 44 FRANCE VENOUS ULTRASOUND (EXTERMITIS) GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 45 FRANCE SCROTAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 46 FRANCE THYROID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 47 FRANCE ULTRASOUND GELS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 48 FRANCE ULTRASOUND GELS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 49 U.K. ULTRASOUND GELS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 50 U.K. ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 51 U.K. ABDOMINAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 52 U.K. OBSTETRIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 53 U.K. HYSTEROSONOGRAPHY ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 54 U.K. PELVIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 55 U.K. MUSCULOSKELETAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 56 U.K. BREAST ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 57 U.K. PROSTATE ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 58 U.K. CAROTID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 59 U.K. VENOUS ULTRASOUND (EXTERMITIS) GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 60 U.K. SCROTAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 61 U.K. THYROID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 62 U.K. ULTRASOUND GELS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 63 U.K. ULTRASOUND GELS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 64 ITALY ULTRASOUND GELS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 ITALY ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 66 ITALY ABDOMINAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 67 ITALY OBSTETRIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 68 ITALY HYSTEROSONOGRAPHY ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 69 ITALY PELVIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 70 ITALY MUSCULOSKELETAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 71 ITALY BREAST ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 72 ITALY PROSTATE ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 73 ITALY CAROTID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 74 ITALY VENOUS ULTRASOUND (EXTERMITIS) GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 75 ITALY SCROTAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 76 ITALY THYROID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 77 ITALY ULTRASOUND GELS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 78 ITALY ULTRASOUND GELS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 79 TURKEY ULTRASOUND GELS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 80 TURKEY ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 81 TURKEY ABDOMINAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 82 TURKEY OBSTETRIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 83 TURKEY HYSTEROSONOGRAPHY ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 84 TURKEY PELVIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 85 TURKEY MUSCULOSKELETAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 86 TURKEY BREAST ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 87 TURKEY PROSTATE ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 88 TURKEY CAROTID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 89 TURKEY VENOUS ULTRASOUND (EXTERMITIS) GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 90 TURKEY SCROTAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 91 TURKEY THYROID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 92 TURKEY ULTRASOUND GELS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 93 TURKEY ULTRASOUND GELS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 94 SPAIN ULTRASOUND GELS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 95 SPAIN ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 96 SPAIN ABDOMINAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 97 SPAIN OBSTETRIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 98 SPAIN HYSTEROSONOGRAPHY ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 99 SPAIN PELVIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 100 SPAIN MUSCULOSKELETAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 101 SPAIN BREAST ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 102 SPAIN PROSTATE ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 103 SPAIN CAROTID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 104 SPAIN VENOUS ULTRASOUND (EXTERMITIS) GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 105 SPAIN SCROTAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 106 SPAIN THYROID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 107 SPAIN ULTRASOUND GELS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 108 SPAIN ULTRASOUND GELS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 109 NETHERLANDS ULTRASOUND GELS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 110 NETHERLANDS ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 111 NETHERLANDS ABDOMINAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 112 NETHERLANDS OBSTETRIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 113 NETHERLANDS HYSTEROSONOGRAPHY ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 114 NETHERLANDS PELVIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 115 NETHERLANDS MUSCULOSKELETAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 116 NETHERLANDS BREAST ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 117 NETHERLANDS PROSTATE ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 118 NETHERLANDS CAROTID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 119 NETHERLANDS VENOUS ULTRASOUND (EXTERMITIS) GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 120 NETHERLANDS SCROTAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 121 NETHERLANDS THYROID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 122 NETHERLANDS ULTRASOUND GELS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 123 NETHERLANDS ULTRASOUND GELS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 124 BELGIUM ULTRASOUND GELS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 125 BELGIUM ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 126 BELGIUM ABDOMINAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 127 BELGIUM OBSTETRIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 128 BELGIUM HYSTEROSONOGRAPHY ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 129 BELGIUM PELVIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 130 BELGIUM MUSCULOSKELETAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 131 BELGIUM BREAST ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 132 BELGIUM PROSTATE ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 133 BELGIUM CAROTID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 134 BELGIUM VENOUS ULTRASOUND (EXTERMITIS) GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 135 BELGIUM SCROTAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 136 BELGIUM THYROID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 137 BELGIUM ULTRASOUND GELS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 138 BELGIUM ULTRASOUND GELS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 139 SWITZERLAND ULTRASOUND GELS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 140 SWITZERLAND ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 141 SWITZERLAND ABDOMINAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 142 SWITZERLAND OBSTETRIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 143 SWITZERLAND HYSTEROSONOGRAPHY ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 144 SWITZERLAND PELVIC ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 145 SWITZERLAND MUSCULOSKELETAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 146 SWITZERLAND BREAST ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 147 SWITZERLAND PROSTATE ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 148 SWITZERLAND CAROTID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 149 SWITZERLAND VENOUS ULTRASOUND (EXTERMITIS) GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 150 SWITZERLAND SCROTAL ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 151 SWITZERLAND THYROID ULTRASOUND GELS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 152 SWITZERLAND ULTRASOUND GELS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 153 SWITZERLAND ULTRASOUND GELS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 154 REST OF EUROPE ULTRASOUND GELS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

Lista de figuras

FIGURE 1 EUROPE ULTRASOUND GELS MARKET: SEGMENTATION

FIGURE 2 EUROPE ULTRASOUND GELS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE ULTRASOUND GELS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE ULTRASOUND GELS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE ULTRASOUND GELS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE ULTRASOUND GELS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE ULTRASOUND GELS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE ULTRASOUND GELS MARKET: MARKET END-USER COVERAGE GRID

FIGURE 9 EUROPE ULTRASOUND GELS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE ULTRASOUND GELS MARKET: SEGMENTATION

FIGURE 11 THE INCREASING PREVALENCE OF ULTRASOUND PROCEDURES AND THE RISE IN THE GERIATRIC POPULATION ARE EXPECTED TO DRIVE THE EUROPE ULTRASOUND GELS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 THE NON-STERILE ULTRASOUND GELS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE ULTRASOUND GELS MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL MRI COILS MARKET

FIGURE 14 EUROPE ULTRASOUND GELS MARKET: BY TYPE, 2021

FIGURE 15 EUROPE ULTRASOUND GELS MARKET: BY TYPE, 2022-2029 (USD THOUSAND)

FIGURE 16 EUROPE ULTRASOUND GELS MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 17 EUROPE ULTRASOUND GELS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 18 EUROPE ULTRASOUND GELS MARKET: BY APPLICATION, 2021

FIGURE 19 EUROPE ULTRASOUND GELS MARKET: BY APPLICATION, 2022-2029 (USD THOUSAND)

FIGURE 20 EUROPE ULTRASOUND GELS MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 21 EUROPE ULTRASOUND GELS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 22 EUROPE ULTRASOUND GELS MARKET: BY END USER, 2021

FIGURE 23 EUROPE ULTRASOUND GELS MARKET: BY END USER, 2022-2029 (USD THOUSAND)

FIGURE 24 EUROPE ULTRASOUND GELS MARKET: BY END USER, CAGR (2022-2029)

FIGURE 25 EUROPE ULTRASOUND GELS MARKET: BY END USER, LIFELINE CURVE

FIGURE 26 EUROPE ULTRASOUND GELS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 27 EUROPE ULTRASOUND GELS MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD THOUSAND)

FIGURE 28 EUROPE ULTRASOUND GELS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 29 EUROPE ULTRASOUND GELS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 30 EUROPE ULTRASOUND GELS MARKET: SNAPSHOT (2021)

FIGURE 31 EUROPE ULTRASOUND GELS MARKET: BY COUNTRY (2021)

FIGURE 32 EUROPE ULTRASOUND GELS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 33 EUROPE ULTRASOUND GELS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 34 EUROPE ULTRASOUND GELS MARKET: BY TYPE (2022 & 2029)

FIGURE 35 EUROPE ULTRASOUND GELS MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.