Europe Small Molecule Sterile Injectable Drugs Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

49.44 Billion

USD

83.68 Billion

2025

2033

USD

49.44 Billion

USD

83.68 Billion

2025

2033

| 2026 –2033 | |

| USD 49.44 Billion | |

| USD 83.68 Billion | |

|

|

|

|

Segmentación del mercado europeo de fármacos inyectables estériles de moléculas pequeñas, por producto (llenado de viales, llenado de jeringas, llenado de cartuchos y otros), aplicación (oncología, enfermedades infecciosas, enfermedades cardiovasculares, enfermedades metabólicas, neurología, dermatología, urología, enfermedades autoinmunes, trastornos respiratorios y otros), usuarios finales (hospitales, clínicas especializadas, centros de atención domiciliaria y otros), canales de distribución (licitación directa, farmacias minoristas, farmacias en línea y otros): tendencias del sector y pronóstico hasta 2033.

Tamaño del mercado europeo de fármacos inyectables estériles de moléculas pequeñas

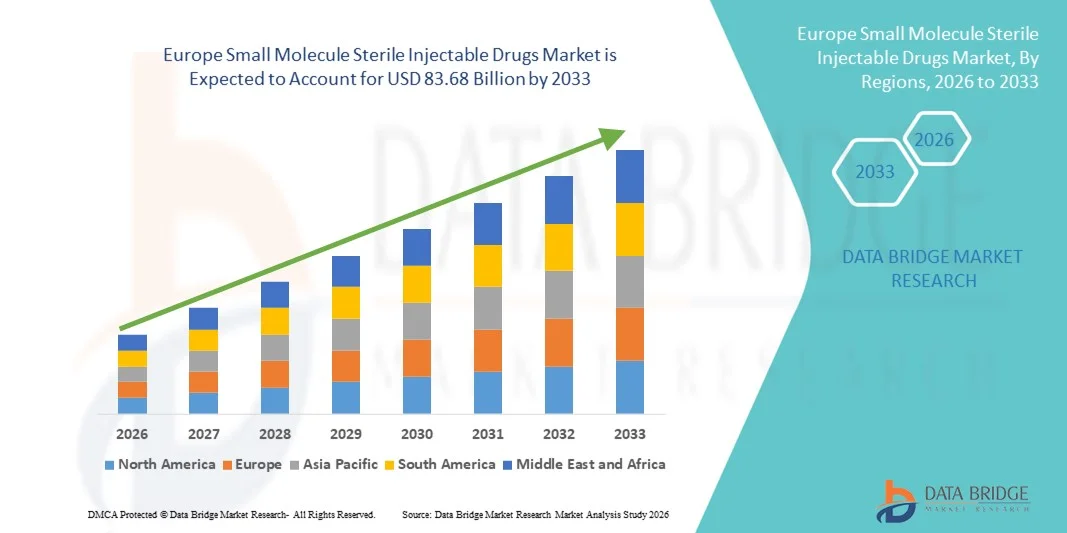

- El tamaño del mercado europeo de medicamentos inyectables estériles de moléculas pequeñas se valoró en USD 49.44 mil millones en 2025 y se espera que alcance los USD 83.68 mil millones para 2033 , con una CAGR del 6,8% durante el período de pronóstico.

- El crecimiento del mercado se ve impulsado en gran medida por la creciente prevalencia de enfermedades crónicas e infecciosas, fuertes bases de fabricación farmacéutica en países clave y estrictos estándares regulatorios que garantizan inyectables estériles de alta calidad en toda Europa.

- Además, el aumento del gasto sanitario, la expansión de los servicios hospitalarios y de clínicas especializadas, y las continuas inversiones en tecnologías de procesamiento aséptico impulsan la adopción de fármacos inyectables estériles de moléculas pequeñas, tanto en entornos hospitalarios como ambulatorios. Estos factores convergentes impulsan la demanda de inyectables estériles listos para administrar y aceleran el crecimiento del mercado en la región.

Análisis del mercado europeo de fármacos inyectables estériles de moléculas pequeñas

- Los medicamentos inyectables estériles de moléculas pequeñas, que proporcionan soluciones terapéuticas de alta pureza y listas para administrar, son componentes cada vez más críticos en los sistemas de atención médica modernos en hospitales, clínicas y entornos de atención ambulatoria debido a su eficacia, seguridad y facilidad de administración.

- La creciente demanda de estos medicamentos se ve impulsada principalmente por la creciente prevalencia de enfermedades crónicas e infecciosas, los estrictos requisitos regulatorios para las formulaciones estériles y la creciente adopción de tecnologías avanzadas de fabricación aséptica.

- Alemania dominó el mercado europeo de medicamentos inyectables estériles de moléculas pequeñas con la mayor participación en los ingresos del 28,7 % en 2025, caracterizado por su infraestructura de fabricación farmacéutica bien establecida, marcos regulatorios sólidos y un alto gasto en atención médica, con importantes contribuciones de los productos de llenado de viales y jeringas utilizados en terapias para enfermedades infecciosas y cardiovasculares.

- Se espera que Polonia sea el país de más rápido crecimiento en el mercado durante el período de pronóstico debido a la mejora de la infraestructura de atención médica, el aumento de la capacidad hospitalaria y la creciente adopción del llenado de cartuchos y otros formatos de administración avanzados para aplicaciones metabólicas y neurológicas.

- El segmento de llenado de viales dominó el mercado con una participación de mercado del 43,2 % en 2025, impulsado por su adopción generalizada para enfermedades infecciosas y terapias cardiovasculares, compatibilidad establecida con los sistemas de administración hospitalaria y capacidad para mantener una alta esterilidad y precisión de dosis.

Alcance del informe y segmentación del mercado europeo de fármacos inyectables estériles de moléculas pequeñas

|

Atributos |

Análisis clave del mercado europeo de fármacos inyectables estériles de moléculas pequeñas |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Europa

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, epidemiología de pacientes, análisis de canalización, análisis de precios y marco regulatorio. |

Tendencias del mercado europeo de fármacos inyectables estériles de moléculas pequeñas

Cambio hacia formatos precargados y listos para administrar

- Una tendencia significativa y en aceleración en el mercado europeo de medicamentos inyectables estériles de moléculas pequeñas es la creciente adopción de jeringas precargadas, cartuchos y formulaciones listas para administrar, lo que mejora la precisión de la dosificación y reduce el tiempo de preparación en hospitales y clínicas.

- Por ejemplo, las jeringas y cartuchos precargados de B. Braun agilizan los flujos de trabajo de administración, minimizando los errores de preparación y mejorando la seguridad del paciente en entornos ambulatorios y hospitalizados.

- Los inyectables precargados y listos para administrar reducen los errores de medicación, disminuyen los riesgos de contaminación y mejoran la eficiencia de enfermeras y cuidadores, al tiempo que respaldan una respuesta rápida en situaciones de emergencia y cuidados intensivos.

- La integración perfecta de estos formatos de entrega avanzados con los sistemas de automatización de farmacias hospitalarias facilita la gestión centralizada de medicamentos y un control eficiente del inventario, lo que permite a los médicos centrarse en la atención al paciente.

- Esta tendencia hacia soluciones inyectables más convenientes, seguras y automatizadas está redefiniendo las prioridades de adquisición de los hospitales e influyendo en las estrategias de fabricación farmacéutica.

- La demanda de inyectables estériles precargados y listos para administrar está creciendo rápidamente en los mercados de atención médica europeos desarrollados y emergentes, a medida que los proveedores priorizan cada vez más la seguridad, la eficiencia y la optimización del flujo de trabajo.

- La creciente preferencia de los pacientes por inyectables mínimamente invasivos y autoadministrados en entornos de atención domiciliaria está impulsando aún más la adopción de formatos de administración innovadores en toda Europa.

Dinámica del mercado europeo de fármacos inyectables estériles de moléculas pequeñas

Conductor

Aumento de la prevalencia de enfermedades crónicas e infecciosas

- La creciente prevalencia de enfermedades crónicas como trastornos cardiovasculares, metabólicos y autoinmunes, junto con enfermedades infecciosas, es un factor importante que impulsa la mayor demanda de inyectables estériles de moléculas pequeñas.

- Por ejemplo, las terapias cardiovasculares inyectables y los viales antiinfecciosos de Pfizer han experimentado un aumento en su utilización en hospitales de Alemania y Francia, lo que refleja la creciente carga de enfermedades y los requisitos de tratamiento.

- A medida que los proveedores de atención médica buscan métodos de administración seguros y efectivos para terapias críticas, los inyectables estériles ofrecen dosificaciones precisas, menor riesgo de contaminación y mejores resultados para los pacientes en comparación con las formulaciones orales tradicionales.

- Además, las iniciativas gubernamentales y hospitalarias para mejorar la accesibilidad al tratamiento y garantizar una calidad constante de los medicamentos están aumentando la adquisición de inyectables estériles, lo que los convierte en un componente esencial de la prestación de servicios de salud modernos.

- La conveniencia de los formatos listos para administrar, combinada con la aprobación regulatoria para aplicaciones en enfermedades críticas, está impulsando la adopción de inyectables estériles en hospitales, clínicas especializadas y entornos de atención domiciliaria.

- El mayor enfoque en la preparación hospitalaria y la preparación ante pandemias ha acelerado la demanda de antiinfecciosos inyectables, vacunas y terapias de emergencia en Europa.

- Las colaboraciones entre compañías farmacéuticas y proveedores de atención médica para expandir las cadenas de suministro de inyectables estériles están mejorando la disponibilidad de productos y apoyando el crecimiento del mercado.

Restricción/Desafío

Obstáculos para el cumplimiento normativo y la gestión de la cadena de frío

- Los estrictos requisitos reglamentarios para la producción de inyectables estériles, incluido el procesamiento aséptico, el cumplimiento de las BPM y las pruebas de lotes, plantean un desafío importante para los nuevos participantes del mercado y los fabricantes más pequeños.

- Por ejemplo, inspecciones recientes de la Agencia Europea de Medicamentos (EMA) pusieron de relieve deficiencias en los controles de procesamiento aséptico, lo que provocó retrasos en la producción de ciertos inyectables cardiovasculares y metabólicos.

- Mantener la integridad de la cadena de frío y garantizar la estabilidad del producto durante el transporte y el almacenamiento son fundamentales, ya que las desviaciones pueden provocar una reducción de la potencia, contaminación o retiradas del producto.

- Además, los altos costos de las instalaciones de fabricación estériles y los procesos validados pueden limitar la escalabilidad y ralentizar la adopción en los mercados europeos emergentes, a pesar de la creciente demanda.

- Superar estos desafíos mediante la inversión en tecnologías de fabricación de última generación, un sólido control de calidad y una infraestructura de cadena de frío es vital para el crecimiento sostenido y la competitividad del mercado.

- La disponibilidad limitada de personal capacitado en técnicas asépticas y producción de inyectables puede obstaculizar la eficiencia de la producción y la garantía de calidad en algunos países europeos.

- Las actualizaciones regulatorias en constante evolución en los diferentes países europeos requieren una adaptación continua al cumplimiento, lo que aumenta la complejidad operativa y los costos para los fabricantes.

Mercado europeo de fármacos inyectables estériles de moléculas pequeñas

El mercado está segmentado en función del producto, la aplicación, los usuarios finales y los canales de distribución.

- Por producto

Según el producto, el mercado se segmenta en llenado de viales, llenado de jeringas, llenado de cartuchos y otros. El segmento de llenado de viales dominó el mercado con la mayor participación en ingresos del 43,2% en 2025, impulsado por su amplia adopción en hospitales y clínicas especializadas. Los viales son muy versátiles, permitiendo múltiples dosis por envase, lo que reduce los costos de empaque y mejora la gestión del inventario. Los proveedores de atención médica prefieren los viales por su compatibilidad con las líneas de llenado automatizadas y los sistemas de procesamiento aséptico establecidos. El segmento también se beneficia de una sólida familiaridad regulatoria, lo que garantiza el cumplimiento de los estrictos estándares de la farmacopea europea. Además, los viales se utilizan ampliamente para enfermedades infecciosas y terapias cardiovasculares, que representan una parte significativa de la demanda de inyectables estériles. Su larga presencia en la práctica clínica y la facilidad de almacenamiento refuerzan aún más su dominio.

Se prevé que el segmento de llenado de jeringas experimente el mayor crecimiento, con una tasa de crecimiento anual compuesta (TCAC) del 11,8 % entre 2026 y 2033, impulsado por la creciente demanda de soluciones listas para usar en hospitales y atención domiciliaria. Las jeringas precargadas reducen los errores de preparación, mejoran la seguridad del paciente y optimizan la eficiencia del flujo de trabajo para los profesionales sanitarios. Su creciente uso en tratamientos metabólicos, neurológicos y autoinmunes está impulsando su adopción en toda Europa. Las jeringas son especialmente populares en entornos ambulatorios y de atención domiciliaria debido a su facilidad de administración y al menor riesgo de contaminación. Los avances tecnológicos en el llenado automatizado de jeringas también están permitiendo una mayor capacidad de producción, lo que impulsa un crecimiento más rápido del mercado.

- Por aplicación

Según la aplicación, el mercado se segmenta en oncología, enfermedades infecciosas, enfermedades cardiovasculares, enfermedades metabólicas, neurología, dermatología, urología, enfermedades autoinmunes, trastornos respiratorios y otros. El segmento de enfermedades infecciosas dominó el mercado en 2025 con una participación del 38,6%, impulsado por la alta prevalencia de infecciones bacterianas y virales en toda Europa. Los hospitales y las clínicas dependen en gran medida de los inyectables estériles para el tratamiento rápido de infecciones críticas. Este segmento se beneficia de los programas gubernamentales para mejorar la vacunación y la disponibilidad de antiinfecciosos. Los antiinfecciosos inyectables ofrecen una dosificación precisa y garantizan la eficacia del tratamiento, reduciendo la mortalidad en pacientes hospitalizados. Las sólidas líneas de I+D y las capacidades de fabricación en Alemania, Francia e Italia también respaldan el suministro de antiinfecciosos estériles. Además, la estabilidad del segmento en el almacenamiento en cadena de frío y su larga vida útil lo convierten en la opción preferida por los proveedores de atención médica.

Se prevé que el segmento de enfermedades cardiovasculares experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente prevalencia de insuficiencia cardíaca, trombosis e hipertensión en las poblaciones europeas en proceso de envejecimiento. Los fármacos cardiovasculares inyectables, en particular las jeringas y viales precargados, se utilizan cada vez más en cuidados intensivos hospitalarios y en entornos ambulatorios. Los avances en formulación, como los inyectables de acción prolongada, están mejorando la adherencia terapéutica y los resultados terapéuticos. El creciente enfoque en los tratamientos de urgencia y cuidados intensivos acelera aún más el crecimiento del segmento. Países con un alto gasto sanitario, como Alemania y el Reino Unido, son pioneros en la adopción de estos inyectables avanzados.

- Por los usuarios finales

En función de los usuarios finales, el mercado se segmenta en hospitales, clínicas especializadas, centros de atención domiciliaria y otros. El segmento hospitalario dominó el mercado con la mayor participación del 45,3% en 2025, debido al alto volumen de pacientes y la necesidad de cuidados críticos y tratamientos de emergencia. Los hospitales se benefician de las economías de escala en la compra de inyectables estériles y dependen de formatos de viales y jeringas para múltiples aplicaciones terapéuticas. Los sistemas de farmacia hospitalaria establecidos facilitan el control de inventario, asegurando la disponibilidad continua de inyectables. El cumplimiento normativo y los protocolos de garantía de calidad son más fáciles de mantener en entornos hospitalarios. Además, los hospitales impulsan la demanda tanto de producción de alto volumen como de inyectables listos para administrar, lo que refuerza el dominio de este segmento. Los hospitales europeos, especialmente en Alemania, Francia e Italia, siguen siendo consumidores clave de inyectables estériles.

Se espera que el segmento de atención domiciliaria experimente el mayor crecimiento durante el período de pronóstico, impulsado por la creciente adopción de terapias inyectables autoadministradas para enfermedades crónicas y metabólicas. Las jeringas y cartuchos precargados permiten a los pacientes administrar tratamientos de forma segura fuera de los hospitales. El envejecimiento de la población y la presión por la atención médica descentralizada impulsan la expansión de la atención domiciliaria. La telemedicina y los servicios de salud a domicilio facilitan aún más la adopción de inyectables estériles en entornos residenciales. La comodidad, la reducción de los costos de hospitalización y la mejora del cumplimiento terapéutico por parte de los pacientes impulsan el crecimiento en este segmento. Países como Polonia, España y los países nórdicos lideran esta tendencia en Europa.

- Por canales de distribución

Según los canales de distribución, el mercado se segmenta en licitación directa, farmacia minorista, farmacia en línea y otros. El segmento de licitación directa dominó el mercado con una participación del 50,1 % en 2025, impulsado por la adquisición a gran escala por parte de hospitales y programas gubernamentales de salud. La licitación directa garantiza menores costos, un suministro constante y el cumplimiento normativo de los medicamentos inyectables estériles. Este canal es especialmente sólido para cuidados críticos y para inyectables antiinfecciosos y cardiovasculares de alta demanda. Los contratos mediante licitación también fomentan las relaciones a largo plazo con los proveedores y facilitan la distribución a gran escala en los sistemas de salud europeos. El dominio de este segmento se ve reforzado por la fuerte participación de importantes fabricantes farmacéuticos. Países con sistemas de salud centralizados, como Alemania y Francia, utilizan ampliamente este canal.

Se prevé que el segmento de farmacias en línea experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente adopción del comercio electrónico y la demanda de terapias inyectables a domicilio. Los canales en línea ofrecen un acceso cómodo a jeringas precargadas e inyectables especiales para pacientes que necesitan atención domiciliaria. La integración con la telemedicina y los servicios de prescripción digital está ampliando el alcance de las farmacias en línea. La mejora de la logística y la capacidad de la cadena de frío permite la entrega segura de productos inyectables sensibles. Los pacientes más jóvenes y con conocimientos tecnológicos prefieren cada vez más las farmacias en línea para terapias crónicas y metabólicas. Países como el Reino Unido, Alemania y los países nórdicos son pioneros en este canal de distribución.

Análisis regional del mercado europeo de fármacos inyectables estériles de moléculas pequeñas

- Alemania dominó el mercado europeo de medicamentos inyectables estériles de moléculas pequeñas con la mayor participación en los ingresos del 28,7 % en 2025, caracterizado por su infraestructura de fabricación farmacéutica bien establecida, marcos regulatorios sólidos y un alto gasto en atención médica, con importantes contribuciones de los productos de llenado de viales y jeringas utilizados en terapias para enfermedades infecciosas y cardiovasculares.

- Los hospitales y clínicas especializadas en Alemania valoran mucho la disponibilidad de inyectables estériles de alta calidad para cuidados críticos, enfermedades infecciosas y terapias cardiovasculares, junto con formatos listos para administrar que mejoran la eficiencia del flujo de trabajo y la seguridad del paciente.

- Esta adopción generalizada está respaldada además por sistemas hospitalarios avanzados, apoyo gubernamental para el acceso a la atención médica y una fuerte presencia de importantes fabricantes farmacéuticos nacionales y multinacionales, lo que establece a Alemania como el principal centro de producción y consumo de inyectables estériles en Europa.

Análisis del mercado alemán de fármacos inyectables estériles de moléculas pequeñas

El mercado alemán dominó Europa con la mayor participación en ingresos en 2025, impulsado por una sólida base de fabricación farmacéutica, un alto gasto en atención médica y una sólida supervisión regulatoria. Los hospitales y las clínicas especializadas valoran enormemente la disponibilidad de inyectables estériles de alta calidad para enfermedades infecciosas, terapias cardiovasculares y tratamientos metabólicos. La adopción de jeringas precargadas y sistemas automatizados de llenado de viales mejora la eficiencia del flujo de trabajo y reduce los errores de medicación. El énfasis de Alemania en la innovación, las avanzadas capacidades de fabricación y el cumplimiento de las normas de la Farmacopea Europea promueven el uso generalizado de inyectables estériles. Además, los programas gubernamentales de atención médica y una sólida cartera de I+D para terapias críticas impulsan la continua expansión del mercado.

Análisis del mercado de fármacos inyectables estériles de moléculas pequeñas en el Reino Unido

Se prevé que el mercado del Reino Unido crezca a una tasa de crecimiento anual compuesta (TCAC) notable durante el período de pronóstico, impulsado por la creciente prevalencia de enfermedades crónicas y la creciente adopción de terapias inyectables domiciliarias. Los profesionales sanitarios están priorizando los formatos listos para administrar para mejorar la adherencia del paciente y reducir la carga de trabajo hospitalaria. La sólida infraestructura sanitaria del Reino Unido y las prácticas de adquisición centralizadas facilitan la distribución eficiente de inyectables estériles. La preocupación por la seguridad del paciente, la dosificación precisa y el procesamiento aséptico está impulsando a los centros sanitarios a adoptar soluciones inyectables avanzadas. Además, se espera que el creciente número de clínicas ambulatorias y centros especializados impulse la demanda en diversas áreas terapéuticas.

Análisis del mercado francés de fármacos inyectables estériles de moléculas pequeñas

El mercado francés experimenta un crecimiento constante debido al aumento de ingresos hospitalarios por enfermedades infecciosas, cardiovasculares y metabólicas. Las jeringas precargadas y los inyectables en viales son cada vez más preferidos para mejorar la precisión de la dosificación y reducir el tiempo de preparación de los profesionales sanitarios. El sólido marco regulatorio francés garantiza altos estándares de calidad y seguridad para todos los inyectables estériles. El mercado se ve respaldado además por inversiones en automatización hospitalaria, sistemas centralizados de gestión de farmacias e infraestructura de cadena de frío. La creciente concienciación de los pacientes y los programas gubernamentales que promueven el acceso a terapias esenciales también contribuyen a la expansión del mercado.

Análisis del mercado polaco de fármacos inyectables estériles de moléculas pequeñas

Se espera que el mercado polaco experimente el mayor crecimiento durante el período de pronóstico, impulsado por la expansión de la infraestructura hospitalaria, el aumento del gasto sanitario y el mayor acceso a terapias inyectables avanzadas. Las jeringas precargadas y los formatos de cartucho se están adoptando rápidamente para el tratamiento de enfermedades metabólicas, cardiovasculares e infecciosas, lo que mejora la seguridad y la adherencia del paciente. Los servicios de atención domiciliaria y las consultas externas contribuyen al aumento de la demanda, ya que los pacientes prefieren soluciones prácticas y listas para administrar. Las iniciativas gubernamentales para mejorar el acceso a medicamentos esenciales y las inversiones en la logística de la cadena de frío impulsan el crecimiento del mercado. El creciente enfoque en la modernización de la atención sanitaria y la expansión de las clínicas especializadas está acelerando la adopción de inyectables estériles. Además, la creciente concienciación entre los profesionales sanitarios sobre la manipulación aséptica y las prácticas de administración seguras está impulsando la penetración del mercado en Polonia.

Cuota de mercado de medicamentos inyectables estériles de moléculas pequeñas en Europa

La industria europea de medicamentos inyectables estériles de moléculas pequeñas está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Recipharm AB (Suecia)

- Vetter Pharma‑Fertigung GmbH & Co. KG (Alemania)

- Cenexi (Francia)

- Siegfried Holding AG (Suiza)

- Unither Pharmaceuticals (Francia)

- Grupo Famar (Grecia)

- Grupo Aenova (Alemania)

- Baxter (EE. UU.)

- Lonza Group AG (Suiza)

- Rentschler Biopharma SE (Alemania)

- Delpharm (Francia)

- CordenPharma GmbH (Alemania)

- NextPharma Technologies GmbH (Alemania)

- BAG Health Care GmbH (Alemania)

- Lyocontract GmbH (Alemania)

- Simtra BioPharma Solutions (Alemania)

- Servicios farmacéuticos PCI (EE. UU.)

- Fresenius Kabi AG (Alemania)

- Pfizer (EE. UU.)

¿Cuáles son los últimos avances en el mercado europeo de medicamentos inyectables estériles de moléculas pequeñas?

- En octubre de 2025, Polpharma Biologics lanzó el primer biosimilar de ranibizumab en Europa en formato de jeringa precargada para mejorar la atención oftalmológica. La compañía anunció que Ranivisio® PFS, un biosimilar de Lucentis® presentado en jeringa precargada, ya está disponible comercialmente en Francia. Ofrece una dosificación precisa y una administración más sencilla para la degeneración macular neovascular asociada a la edad y otras afecciones relacionadas, lo que representa una notable innovación en presentaciones de fármacos inyectables estériles.

- En junio de 2025, Simtra BioPharma Solutions finalizó la construcción de una nueva planta de fabricación de inyectables estériles. La ampliación añadió 1800 m² de espacio de producción, aumentando la superficie total de fabricación a casi 12 000 m², e introdujo la tecnología de jeringas precargadas y liofilizadores adicionales. Esta planta refuerza la capacidad de llenado y acabado estéril de la empresa para viales y jeringas, a fin de satisfacer la creciente demanda de terapias inyectables complejas.

- En febrero de 2025, Recipharm lanzó un sistema modular de llenado estéril totalmente operativo. Recipharm instaló una nueva línea de llenado aséptico modular, conforme a las normas GMP, en sus instalaciones de Wasserburg, que admite múltiples tipos de productos, como jeringas y viales. El sistema mejora la flexibilidad, reduce la pérdida de producto y amplía la capacidad de procesamiento estéril para satisfacer las necesidades clínicas y comerciales.

- En febrero de 2025, Sovereign Pharma obtuvo la aprobación de la UE para múltiples productos inyectables estériles. La compañía recibió la aprobación regulatoria de la Unión Europea para una gama de formatos asépticos y con esterilización terminal, incluyendo viales, ampollas, cartuchos y jeringas precargadas, lo que refuerza su capacidad para suministrar inyectables estériles en todos los mercados de la UE.

- En febrero de 2023, CARBOGEN AMCIS, con sede en Suiza, inauguró una nueva planta de fabricación de medicamentos inyectables estériles en Francia, ampliando así sus líneas de producción automatizadas para inyectables estériles líquidos y liofilizados. La nueva planta de 9500 m² incluye dos líneas totalmente automatizadas capaces de producir compuestos de alta potencia y terapias inyectables avanzadas, lo que impulsa la capacidad de llenado y acabado de Europa en un contexto de escasez de suministro global para la fabricación aséptica.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.