Europe Skin Packaging For Fresh Meat Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

216.04 Million

USD

300.25 Million

2025

2033

USD

216.04 Million

USD

300.25 Million

2025

2033

| 2026 –2033 | |

| USD 216.04 Million | |

| USD 300.25 Million | |

|

|

|

|

Segmentación del mercado europeo de envases skin para carne fresca, por tipo (envases skin termoformables con tarjeta, termoformables sin tarjeta y skin), material (plástico, papel y cartón, entre otros), recubrimiento de sellado térmico (base agua, base disolvente, entre otros), llenado de aire (al vacío y sin vacío), función (preservación y protección, idoneidad para el propósito, etiquetado reglamentario, presentación, entre otros), naturaleza (apto para microondas y no apto para microondas), uso final (carne, aves y mariscos): tendencias del sector y pronóstico hasta 2033.

¿Cuál es el tamaño y la tasa de crecimiento del mercado europeo de envases de piel para carne fresca?

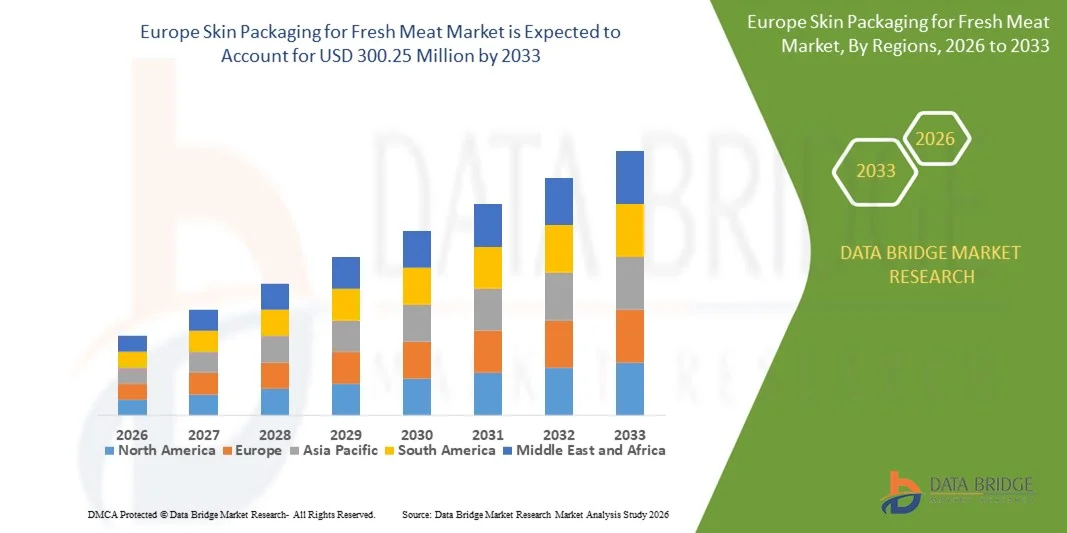

- El tamaño del mercado europeo de envases de piel para carne fresca se valoró en USD 216,04 millones en 2025 y se espera que alcance los USD 300,25 millones para 2033 , con una CAGR del 4,20 % durante el período de pronóstico.

- La tendencia reciente indica una creciente demanda de envases skin para carne fresca, a medida que las inversiones en las industrias alimentarias públicas y privadas siguen en aumento. Los factores que impulsan el crecimiento del mercado son la creciente concienciación sobre la salud entre la población general y los continuos avances tecnológicos en el envasado skin.

¿Cuáles son las principales conclusiones del envasado skin para el mercado de carne fresca?

- Con el rápido crecimiento de la globalización y el aumento de los mandatos para alimentos y bebidas por parte de varios países y regiones, el mercado de envases de piel para carne fresca experimentará una trayectoria incrementada en los próximos años.

- Los avances y las nuevas tendencias en tecnologías de envasado skin y el aumento del consumo de carne fresca con envases premium impulsarán aún más el crecimiento del mercado.

- Alemania dominó el mercado europeo de envasado skin para carne fresca con la mayor participación en los ingresos del 32,8 % en 2024, impulsada por una fuerte demanda de envasado de carne fresca de alta calidad, una infraestructura avanzada de procesamiento de alimentos y la adopción generalizada del envasado skin al vacío por parte de los principales minoristas y procesadores de carne.

- El mercado francés de envasado de piel para carne fresca está experimentando un crecimiento constante a una CAGR del 8,7 %, respaldado por el aumento del consumo de productos cárnicos frescos y de primera calidad, la expansión de los formatos minoristas modernos y el creciente enfoque en la reducción del desperdicio de alimentos.

- El segmento de envases termoformables skin sin cardar dominó el mercado con una participación estimada del 41,6 % en 2025, impulsado por su visibilidad superior del producto, la conformidad ajustada de la película y la capacidad de extender la vida útil sin materiales de soporte adicionales.

Alcance del informe y segmentación del mercado de envasado en piel para carne fresca

|

Atributos |

Envasado skin para carne fresca: Perspectivas clave del mercado |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Europa

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

¿Cuál es la tendencia clave en el mercado de envases de piel para carne fresca?

Adopción creciente de soluciones de envasado skin de alta barrera, sostenibles y que prolongan la vida útil

- El mercado de envasado de piel para carne fresca está experimentando un fuerte cambio hacia películas de piel de alta barrera, basadas en vacío y específicas para cada aplicación, diseñadas para extender la vida útil y preservar la frescura de la carne.

- Los fabricantes se centran cada vez más en películas multicapa, resistentes al oxígeno y con mayor claridad que mejoran la visibilidad del producto al tiempo que previenen la oxidación, la pérdida de humedad y el crecimiento microbiano.

- El creciente énfasis en los materiales de embalaje de piel reciclables, de menor espesor y de origen biológico está impulsando la innovación en respuesta al endurecimiento de las regulaciones de sostenibilidad y los compromisos de los minoristas.

- Por ejemplo, empresas como Amcor, Sealed Air, Berry Global, Winpak y Klöckner Pentaplast están invirtiendo en películas de piel reciclables y soluciones de envasado monomaterial para carne fresca.

- La creciente demanda de una vida útil más prolongada, una reducción del desperdicio de alimentos y una presentación de carne de primera calidad está acelerando la adopción de formatos avanzados de envasado skin.

- A medida que los estándares de venta minorista y de servicios de alimentación continúan evolucionando, el envasado en piel se está volviendo fundamental para mejorar la protección del producto, el atractivo visual y la eficiencia de la cadena de suministro.

¿Cuáles son los impulsores clave del mercado de envases de piel para carne fresca?

- El aumento del consumo de productos cárnicos frescos, refrigerados y de valor añadido en los canales minoristas y de servicios de alimentación es un importante motor de crecimiento.

- Por ejemplo, durante 2024-2025, los principales procesadores y minoristas de carne ampliaron el uso del envasado en piel para mejorar la estabilidad en los estantes y reducir las pérdidas por deterioro.

- El creciente enfoque en la seguridad alimentaria, la higiene y los ciclos de distribución extendidos en las cadenas de suministro de carne globales está acelerando la adopción del envasado skin.

- Los avances en la extrusión de películas, las tecnologías de sellado y los materiales de alta claridad están mejorando la integridad del paquete al tiempo que mantienen la estética del producto.

- La creciente preferencia por formatos de envases convenientes, a prueba de fugas y de manipulación entre los consumidores está apoyando la expansión del mercado.

- Con el respaldo de iniciativas de sostenibilidad, objetivos de reducción del desperdicio de alimentos y tendencias de premiumización, se espera que el mercado de envases de piel para carne fresca experimente un crecimiento constante a largo plazo.

¿Qué factor está obstaculizando el crecimiento del mercado de envases skin para carne fresca?

- Los altos costos de los materiales y los requisitos de equipos especializados asociados con las películas de envasado skin avanzado limitan su adopción entre los procesadores de carne de pequeña y mediana escala.

- Por ejemplo, durante 2024-2025, la fluctuación de los precios de la resina y el aumento de los costos de la energía aumentaron los gastos de producción de envases.

- Los problemas de compatibilidad entre películas de piel, bandejas y maquinaria de sellado pueden crear desafíos operativos para los procesadores.

- Las estrictas regulaciones de seguridad alimentaria, los estándares de cumplimiento de materiales y los requisitos de reciclabilidad aumentan los plazos de desarrollo y certificación.

- La infraestructura de reciclaje limitada para películas plásticas multicapa plantea desafíos regulatorios y de sostenibilidad.

- Para superar estas barreras, los fabricantes se están centrando en diseños monomateriales, estrategias de reducción de espesores e innovaciones de películas rentables, lo que apoya la penetración futura en el mercado.

¿Cómo está segmentado el mercado de envases skin para carne fresca?

El mercado está segmentado según el tipo, material, revestimiento de sellado térmico, llenado de aire, función, naturaleza y uso final .

- Por tipo

Según el tipo, el mercado de envasado skin para carne fresca se segmenta en envases skin termoformables con cartón, envases skin termoformables sin cartón y envases skin. El segmento de envases skin termoformables sin cartón dominó el mercado con una participación estimada del 41,6 % en 2025, gracias a su excelente visibilidad del producto, su firme conformidad con la película y su capacidad para prolongar la vida útil sin materiales de soporte adicionales. Este formato es ampliamente adoptado por grandes procesadores de carne y minoristas debido a su menor consumo de material, su mejor rendimiento de vacío y su compatibilidad con líneas de envasado automatizadas.

Se espera que el segmento de envases skin termoformables en cartón registre la tasa de crecimiento anual compuesta (TCAC) más alta entre 2026 y 2033, impulsado por la creciente demanda de presentaciones premium para carnes, espacio para la marca y envases minoristas de valor añadido. La creciente adopción de carnes especiales y envases orientados a la exportación está acelerando aún más el crecimiento.

- Por material

Según el material, el mercado se segmenta en plástico, papel, cartón y otros. El segmento de plásticos tuvo la mayor participación de mercado, con un 68,9%, en 2025, gracias a sus excelentes propiedades de barrera, flexibilidad, integridad del sellado y su idoneidad para aplicaciones de envasado al vacío. Materiales plásticos como el PET, el PE y las películas multicapa se utilizan ampliamente para prevenir la entrada de oxígeno, la pérdida de humedad y la contaminación, garantizando así una mayor vida útil de los productos cárnicos frescos.

Se proyecta que el segmento de papel y cartón crecerá a su tasa de crecimiento anual compuesta (TCAC) más alta entre 2026 y 2033, impulsado por el aumento de las iniciativas de sostenibilidad, el compromiso de los minoristas de reducir el uso de plástico y los avances en soluciones de papel estucado y con tratamiento de barrera. Se espera que las innovaciones en envases reciclables y de fibra fina impulsen su adopción a largo plazo.

- Por recubrimiento de sellado térmico

En cuanto al recubrimiento termosellable, el mercado de envases skin para carne fresca se segmenta en base agua, base solvente y otros. El segmento de recubrimiento termosellable a base de agua dominó el mercado con una participación del 45,3 % en los ingresos en 2025, gracias a sus bajas emisiones de COV, el cumplimiento de la normativa de seguridad alimentaria y la compatibilidad con iniciativas de envasado sostenible. Los recubrimientos a base de agua ofrecen un sellado fiable, a la vez que cumplen con los requisitos de reciclabilidad y regulatorios.

Se prevé que el segmento de productos a base de solventes experimente el mayor crecimiento entre 2026 y 2033, gracias a su superior fuerza de adhesión y rendimiento en operaciones de envasado a alta velocidad. A pesar de las preocupaciones ambientales, el uso continuo en aplicaciones exigentes y las mejoras en las tecnologías de control de emisiones impulsan el crecimiento del segmento.

- Por llenado de aire

Según el llenado con aire, el mercado se segmenta en envasado al vacío y envasado sin vacío. El segmento de envasado al vacío representó la mayor participación, con un 72,4 %, en 2025, ya que el envasado al vacío skin prolonga significativamente la vida útil, reduce el crecimiento microbiano y conserva la textura y el color de la carne. Este formato se utiliza ampliamente en la venta minorista de carne fresca, el envasado para exportación y las plantas de procesamiento centralizadas.

Se espera que el segmento de llenado sin vacío crezca a la tasa de crecimiento anual compuesta (TCAC) más alta durante el período de pronóstico, gracias a los menores costos de sus equipos y su idoneidad para aplicaciones de corta vida útil y distribución local. Los pequeños procesadores y los proveedores regionales de carne están adoptando cada vez más soluciones sin vacío para optimizar sus costos.

- Por función

Por función, el mercado se segmenta en Conservar y Proteger, Apto para su Uso, Etiquetado Regulatorio, Presentación y Otros. El segmento Conservar y Proteger dominó el mercado con una participación del 39,8 % en 2025, impulsado por la necesidad imperiosa de prolongar la vida útil, reducir el deterioro y mantener los estándares de seguridad alimentaria. El envasado skin minimiza eficazmente la exposición al oxígeno y la pérdida de humedad, lo que lo hace esencial para la conservación de la carne fresca.

Se proyecta que el segmento de Presentación crecerá a la tasa de crecimiento anual compuesta (TCAC) más alta entre 2026 y 2033, impulsado por la creciente preferencia de los consumidores por envases de carne premium visualmente atractivos. Los minoristas utilizan cada vez más los envases skin para mejorar la diferenciación del producto y la percepción de la marca.

- Por naturaleza

Por su naturaleza, el mercado de envasado skin para carne fresca se segmenta en envases aptos para microondas y no aptos para microondas. El segmento no apto para microondas mantuvo la cuota de mercado con un 63,7 % en 2025, ya que la mayoría de los productos cárnicos frescos se preparan para métodos de cocción convencionales. Este segmento se beneficia de una menor complejidad de los materiales y una amplia aceptación regulatoria.

Se prevé que el segmento de productos para microondas experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente demanda de alimentos preparados, productos cárnicos listos para cocinar y el estilo de vida urbano. Los avances en películas resistentes al calor y diseños de envases fáciles de usar están impulsando su adopción.

- Por uso final

Según el uso final, el mercado se segmenta en carne, aves y mariscos. El segmento de carnes dominó el mercado con una participación del 44,5 % en los ingresos en 2025, impulsado por el alto consumo mundial de carne de res, cerdo y cordero, junto con el amplio uso de envases de piel en los canales minoristas y de exportación.

Se proyecta que el segmento de mariscos crecerá a la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2026 y 2033, impulsado por la necesidad de mayor frescura, envases herméticos y presentaciones premium. El aumento de las exportaciones de mariscos y la expansión de la cadena de frío están acelerando aún más el crecimiento.

¿Qué región posee la mayor participación en el mercado de envases skin para carne fresca?

- Alemania dominó el mercado europeo de envasado skin para carne fresca con la mayor participación en los ingresos del 32,8 % en 2024, impulsada por una fuerte demanda de envasado de carne fresca de alta calidad, una infraestructura avanzada de procesamiento de alimentos y la adopción generalizada del envasado skin al vacío por parte de los principales minoristas y procesadores de carne.

- La industria de procesamiento de carne bien establecida del país, las estrictas normas de seguridad alimentaria y la alta penetración de productos cárnicos de primera calidad y de marca privada están acelerando la demanda de soluciones de envasado de piel de alta barrera que extienden la vida útil.

- Los principales actores del embalaje como MULTIVAC, Klöckner Pentaplast, Winpak y Schur Flexibles están invirtiendo activamente en películas reciclables, soluciones monomateriales y formatos de embalaje skin de alta transparencia, posicionando a Alemania como un centro de fabricación e innovación para el mercado europeo de embalajes skin para carne fresca.

Perspectiva del mercado francés de envases skin para carne fresca

El mercado francés de envasado al vacío para carne fresca registra un crecimiento sostenido con una tasa de crecimiento anual compuesta (TCAC) del 8,7%, impulsado por el aumento del consumo de productos cárnicos frescos y premium, la expansión de los formatos minoristas modernos y la mayor atención a la reducción del desperdicio de alimentos. Los procesadores de carne franceses adoptan cada vez más el envasado al vacío al vacío para prolongar la vida útil, mejorar la higiene y optimizar la presentación del producto. El fuerte énfasis regulatorio en el envasado sostenible, junto con las iniciativas impulsadas por los minoristas para reducir los residuos plásticos y mejorar la reciclabilidad, está impulsando la adopción de materiales de envasado al vacío de menor espesor y reciclables. Las inversiones en logística de la cadena de frío y la modernización del suministro de alimentos frescos están consolidando aún más la posición de Francia en el mercado europeo.

Perspectiva del mercado del envasado skin para carne fresca en el Reino Unido

El mercado británico de envasado skin para carne fresca está en constante expansión, impulsado por la creciente demanda de carne fresca lista para consumir, la creciente penetración de marcas blancas y la sólida apuesta de los minoristas por una mayor vida útil y la reducción del deterioro. La adopción de formatos de envasado skin al vacío y de alta transparencia está en aumento en las categorías de carne de vacuno, aves y mariscos. Minoristas y procesadores están priorizando el envasado skin reciclable y monomaterial para cumplir con los compromisos de sostenibilidad y los requisitos regulatorios en constante evolución. Las inversiones continuas en líneas de envasado automatizadas y la presentación premium de la carne están posicionando al Reino Unido como un factor clave para el crecimiento del mercado europeo de envasado skin para carne fresca.

¿Cuáles son las principales empresas en el mercado de envasado skin para carne fresca?

La industria del envasado skin para carne fresca está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Dow, Inc. (EE. UU.)

- Windmöller & Hölscher (Alemania)

- Sealed Air Corporation (EE. UU.)

- Klöckner Pentaplast (Luxemburgo)

- Berry Global Inc. (EE. UU.)

- Amcor plc (Suiza)

- Graphic Packaging International, LLC (EE. UU.)

- FLEXOPACK SA (Grecia)

- WINPAK LTD. (Canadá)

- Schur Flexibles Holding GesmbH (Austria)

- Paquete Mannok (Reino Unido)

- Spa G. Mondini (Italia)

- GRUPO CLONDALKIN (Países Bajos)

- PLASTOPIL (Israel)

- MULTIVAC (Alemania)

- ULMA Packaging (España)

- JASA Packaging Solutions (Países Bajos)

- Sealpac International bv (Países Bajos)

- KM Packaging Services Ltd (Reino Unido)

- Bliston Packaging BV (Países Bajos)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.