Europe Pulse Protein Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

4.50 Billion

USD

7.67 Billion

2025

2033

USD

4.50 Billion

USD

7.67 Billion

2025

2033

| 2026 –2033 | |

| USD 4.50 Billion | |

| USD 7.67 Billion | |

|

|

|

|

Segmentación del mercado europeo de proteínas de legumbres por fuentes (lentejas negras, lentejas verdes, guisantes, judías blancas, garbanzos, guisantes kaspa, judías negras, judías rojas, altramuces, habas, judías munga y otras), categoría (orgánica y convencional), proceso de extracción (procesamiento en seco y húmedo), forma (aislados, concentrados e hidrolizados), función (solubilidad, hidratación, emulsificación, formación de espuma y otras), aplicación (alimentos y bebidas, piensos, productos farmacéuticos y cosméticos), usuario final (uso doméstico, industria de snacks, industria de la harina y otras) - Tendencias y pronóstico del sector hasta 2033

Tamaño del mercado de proteínas de legumbres en Europa

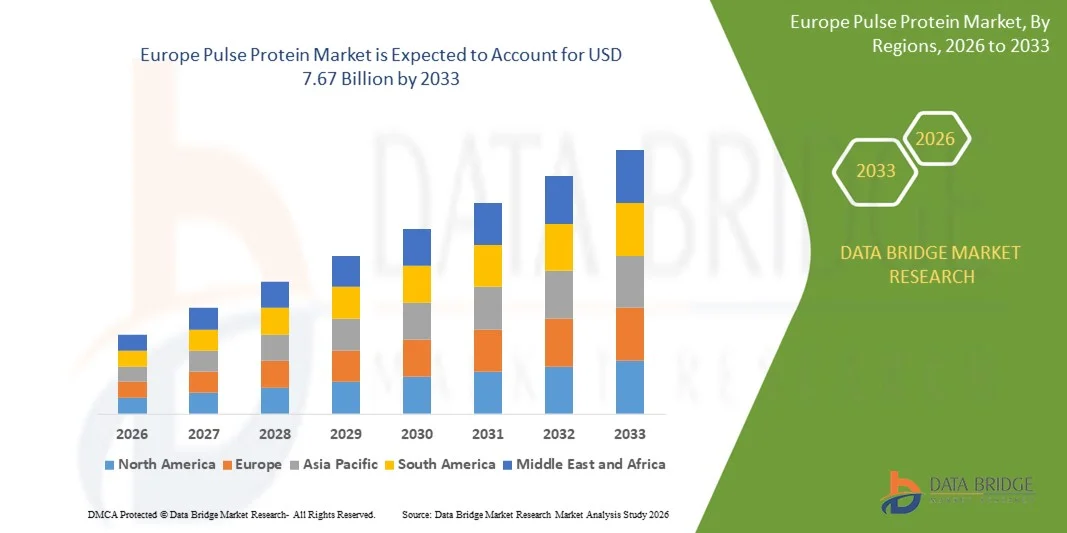

- El tamaño del mercado de proteínas de legumbres de Europa se valoró en 4.500 millones de dólares en 2025 y se espera que alcance los 7.670 millones de dólares en 2033 , con una CAGR del 6,9 % durante el período de pronóstico.

- El crecimiento del mercado se debe en gran medida a la creciente preferencia de los consumidores por dietas basadas en plantas y ricas en proteínas, impulsada por la conciencia de la salud, la creciente adopción de estilos de vida veganos y flexitarianos y la creciente demanda de productos alimenticios funcionales y de etiqueta limpia.

- Además, la expansión de las aplicaciones de la proteína de legumbres en panadería, bebidas, snacks y alternativas a la carne está generando nuevas oportunidades de ingresos para los fabricantes de alimentos. Estas tendencias convergentes están acelerando la adopción de las proteínas de legumbres, impulsando así significativamente el crecimiento de la industria.

Análisis del mercado europeo de proteínas de legumbres

- La proteína de legumbres es un ingrediente vegetal extraído de legumbres como guisantes, garbanzos, lentejas y frijoles, y se utiliza para mejorar el contenido proteico, la textura y la funcionalidad de alimentos y bebidas. Sirve como una alternativa sostenible y libre de alérgenos a las proteínas animales en diversas aplicaciones.

- La creciente demanda de proteínas de legumbres se debe principalmente a la creciente necesidad de soluciones alimentarias nutritivas, de origen vegetal y sostenibles, la expansión del sector de la salud y el bienestar y la creciente incorporación de proteínas en alimentos funcionales y fortificados en los mercados desarrollados y emergentes.

- Alemania dominó el mercado de proteínas de legumbres en 2025, debido a su sólida industria de procesamiento de alimentos, la alta conciencia de los consumidores sobre la salud y el bienestar y el ecosistema establecido de innovación de productos de origen vegetal.

- Se espera que el Reino Unido sea el país de más rápido crecimiento en el mercado de proteínas de legumbres durante el período de pronóstico debido al creciente énfasis en el consumo consciente de la salud, la sostenibilidad y el cumplimiento normativo en todo el sector alimentario.

- El segmento de guisantes dominó el mercado con una participación del 39,4 % en 2024, gracias a su abundante disponibilidad, alto rendimiento proteico y sabor neutro, lo que los hace aptos para múltiples aplicaciones alimentarias. La proteína de guisante se utiliza ampliamente en sustitutos de carne, nutrición deportiva y alternativas sin lácteos. Su menor alergenicidad en comparación con la soja y sus propiedades funcionales superiores, como la solubilidad y la emulsificación, la convierten en una opción preferida por los procesadores de alimentos. Su fuerte adopción en bebidas y carnes de origen vegetal refuerza aún más su dominio.

Alcance del informe y segmentación del mercado de proteínas de legumbres

|

Atributos |

Perspectivas clave del mercado de las proteínas de legumbres |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Europa

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de proteínas de legumbres en Europa

Creciente demanda de proteínas de origen vegetal

- El mercado de las proteínas de legumbres está experimentando una sólida expansión a medida que los consumidores optan por una nutrición de origen vegetal debido a la creciente preocupación por la salud, la sostenibilidad y la ética alimentaria. Los fabricantes de alimentos están aprovechando las proteínas de legumbres como el guisante, la lenteja y el garbanzo para formular alternativas a la carne, sustitutos lácteos y snacks enriquecidos con proteínas que atraen a un público amplio y consciente de la salud.

- Por ejemplo, importantes empresas como AGT Food and Ingredients e Ingredion han invertido en el desarrollo de aislados de proteína de legumbres versátiles para su uso en hamburguesas vegetales, barritas de proteína y leche vegetal. Puntos geográficos clave como Canadá y Australia lideran la producción, lo que apoya el movimiento global hacia el abastecimiento sostenible de proteínas.

- Las innovaciones en extracción y procesamiento impulsan su adopción, mejorando la solubilidad, la textura y el sabor de las proteínas de legumbres para su uso en una amplia gama de alimentos funcionales. El aumento de las poblaciones vegetarianas y veganas, así como la tendencia flexitariana, están ampliando la base global de clientes para aplicaciones de proteínas vegetales.

- Las proteínas de legumbres se promocionan como libres de OMG, hormonas y antibióticos, y respetuosas con el medio ambiente gracias a su menor consumo de recursos en comparación con las proteínas animales. Su aplicación en nutracéuticos y productos dietéticos especializados está impulsando nuevas entradas al mercado y lanzamientos de productos en todo el mundo.

- Se espera que el movimiento de productos de origen vegetal, junto con el creciente interés en las etiquetas limpias y la nutrición holística, mantenga el impulso del mercado de las proteínas de legumbres. A medida que evolucionan las normas regulatorias en torno al etiquetado y la sostenibilidad, los líderes del mercado se centran en la innovación y la participación del consumidor para mantener el crecimiento.

Dinámica del mercado europeo de proteínas de legumbres

Conductor

Aumentar la conciencia sobre la salud y el bienestar entre los consumidores

- La creciente conciencia sobre la salud y el bienestar entre los consumidores es un factor clave en la demanda de proteínas de legumbres. Estas proteínas son ricas en aminoácidos esenciales, fibra, vitaminas y minerales, y ofrecen alternativas bajas en grasa y sin alérgenos para quienes buscan evitar productos animales y alérgenos comunes como los lácteos y la soja.

- Por ejemplo, Beyond Meat promociona las proteínas de guisantes y lentejas en batidos sustitutivos de comidas, snacks y suplementos deportivos para los segmentos de consumidores que cuidan su salud y controlan su peso en Norteamérica y Europa. Los beneficios de las proteínas de legumbres para la salud cardiovascular y el control glucémico también se destacan en los lanzamientos de nuevos productos en los mercados asiáticos.

- La investigación nutricional que vincula las proteínas de las legumbres con beneficios a largo plazo, como la reducción del colesterol, la prevención de la diabetes y la recuperación muscular, está aumentando su atractivo general. El marketing de etiqueta limpia y la ausencia de aditivos o ingredientes artificiales refuerzan la confianza del consumidor e impulsan la repetición de compras.

- Las categorías de suplementos dietéticos y alimentos funcionales están experimentando una rápida adopción de las proteínas de legumbres como ingredientes principales, lo que impulsa una visión más amplia de un estilo de vida saludable en todos los grupos de edad. El mayor enfoque en enriquecer los alimentos cotidianos con proteínas naturales está acelerando su penetración en el mercado.

- Un cambio global hacia un consumo centrado en el bienestar, respaldado por iniciativas políticas, educación pública y reformulaciones de la industria alimentaria, continúa reforzando las perspectivas positivas del mercado de las proteínas de legumbres. Esto garantiza perspectivas de crecimiento constantes a medida que más consumidores integran ingredientes saludables de origen vegetal en sus dietas diarias.

Restricción/Desafío

Cadenas de suministro fluctuantes

- El mercado de las proteínas de legumbres se enfrenta a desafíos derivados de las fluctuaciones en las cadenas de suministro, que afectan la disponibilidad de materias primas, los costos de los insumos y la consistencia del producto. La volatilidad en la producción mundial de legumbres, las interrupciones del transporte y los cambios en las políticas comerciales ejercen influencias impredecibles sobre productores y marcas.

- Por ejemplo, Cargill experimentó inestabilidad en los precios de los insumos y escasez ocasional para los procesadores y fabricantes de alimentos debido a las tensiones comerciales y los aranceles sobre los guisantes partidos y otros productos de legumbres en mercados de exportación clave como América del Norte, Europa y Australia.

- Las malas cosechas causadas por el clima y los obstáculos agrícolas regionales, en particular en India y Australia, contribuyen a la desigualdad en el suministro y tienen consecuencias para los precios del mercado mundial. Los fabricantes se ven obligados a diversificar sus proveedores, invertir en almacenamiento o trasladar los costos a los consumidores, lo que dificulta la asequibilidad y la fiabilidad de los productos terminados.

- Las variaciones de calidad y las diferencias en la tecnología de procesamiento pueden perturbar aún más la uniformidad de la cadena de suministro, afectando la funcionalidad del producto y la satisfacción del cliente. Los cambios constantes en la sostenibilidad y la normativa, especialmente en materia de etiquetado y seguridad alimentaria, exigen una adaptación continua de los proveedores.

- En conclusión, la fluctuación de las cadenas de suministro sigue siendo un desafío crítico para el sector de las proteínas de legumbres. La inversión continua en estrategias de abastecimiento resilientes, la transparencia de la cadena de suministro y las prácticas agrícolas sostenibles serán esenciales para garantizar el crecimiento futuro y la estabilidad del mercado en este segmento dinámico.

Panorama del mercado de proteínas de legumbres en Europa

El mercado está segmentado en función de fuentes, categoría, proceso de extracción, forma, función, aplicación y usuario final.

- Por fuentes

Según las fuentes, el mercado se segmenta en lentejas negras, lentejas verdes, guisantes, frijoles blancos, garbanzos, guisantes kaspa, frijoles negros, frijoles rojos, altramuces, habas, frijoles munga y otros. Los guisantes representaron la mayor participación en los ingresos, con un 39,4 %, en 2024, gracias a su abundante disponibilidad, alto rendimiento proteico y sabor neutro, lo que los hace aptos para múltiples aplicaciones alimentarias. La proteína de guisante se utiliza ampliamente en sustitutos de carne, nutrición deportiva y alternativas sin lácteos. Su menor alergenicidad en comparación con la soja y sus propiedades funcionales superiores, como la solubilidad y la emulsificación, la convierten en una opción preferida por los procesadores de alimentos. Su fuerte adopción en bebidas y carnes de origen vegetal refuerza aún más su dominio.

Se espera que el segmento de los garbanzos registre la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, impulsado por su creciente popularidad en snacks ricos en proteínas, productos de panadería sin gluten y sustitutos de lácteos. Las proteínas de garbanzo ofrecen un alto valor nutricional y un atractivo sabor, lo que las hace atractivas para los consumidores que buscan la salud. Su integración en las dietas mediterráneas, junto con su creciente uso en mezclas de proteínas y en la fortificación de harinas, impulsa la demanda del mercado. Además, se espera que las innovaciones en curso en aislados y concentrados de proteína de garbanzo impulsen un crecimiento significativo.

- Por categoría

Según la categoría, el mercado se segmenta en orgánico y convencional. El segmento convencional dominó la mayor parte en 2024, principalmente debido a su amplia disponibilidad y rentabilidad, lo que lo convierte en la opción preferida para el procesamiento de alimentos a granel. Las proteínas de legumbres convencionales se utilizan ampliamente en aplicaciones de alimentos y bebidas convencionales, como panadería, snacks y alternativas lácteas. Su asequibilidad las hace ideales para los fabricantes que buscan abastecer al mercado masivo. Con cadenas de suministro consolidadas y una calidad constante, las proteínas convencionales siguen dominando las aplicaciones alimentarias a gran escala a nivel mundial.

Se proyecta que el segmento orgánico crecerá a su ritmo más rápido entre 2025 y 2032, a medida que la creciente concienciación de los consumidores sobre la salud, la sostenibilidad y la nutrición natural impulsa la preferencia por las proteínas sin químicos. Las proteínas de legumbres con certificación orgánica se están incorporando cada vez más en productos de salud premium, alimentos funcionales y bebidas de etiqueta limpia. Los consumidores de los mercados desarrollados muestran una mayor disposición a pagar más por las proteínas vegetales orgánicas. La creciente inversión en agricultura orgánica y la expansión de las líneas de productos orgánicos por parte de marcas globales de alimentos impulsarán significativamente el crecimiento de este segmento.

- Por proceso de extracción

Según el proceso de extracción, el mercado se divide en procesamiento en seco y procesamiento en húmedo. El segmento de procesamiento en seco dominó la cuota de mercado en 2024, principalmente debido a su rentabilidad, respeto al medio ambiente y capacidad para preservar el contenido natural de fibra y almidón de las legumbres. Este método se adopta ampliamente en las industrias de la harina y la panadería, donde la pureza funcional no es el requisito principal. El menor consumo de energía y agua también favorece la producción sostenible. Sigue siendo la opción preferida para aplicaciones a gran escala que requieren ingredientes proteicos asequibles.

Se prevé que el segmento de procesamiento húmedo experimente el mayor crecimiento entre 2025 y 2032, ya que produce aislados de proteínas de alta pureza con mayor solubilidad, digestibilidad y versatilidad funcional. La extracción húmeda permite adaptar las proteínas a bebidas, suplementos nutricionales y fórmulas infantiles, donde la pureza y la calidad son cruciales. La creciente demanda de aislados de proteínas en nutrición deportiva y bebidas vegetales está impulsando el crecimiento. Además, las innovaciones en la tecnología de procesamiento húmedo la hacen más eficiente y escalable, impulsando aún más su adopción.

- Por formulario

Según su presentación, el mercado se clasifica en aislados, concentrados e hidrolizados. El segmento de concentrados dominó la mayor participación en 2024, ya que ofrece un perfil proteico equilibrado, junto con fibra y almidón, lo que los hace ideales para panadería, snacks y piensos. Los concentrados de proteína de legumbres son rentables en comparación con los aislados, lo que garantiza un uso más amplio en las industrias alimentaria y de piensos. Su capacidad para conservar componentes naturales los hace atractivos para productos orientados a la nutrición holística. Además, su versatilidad en snacks extruidos y fortificación de harinas garantiza su dominio continuo.

Se prevé que el segmento de aislados registre el mayor crecimiento entre 2025 y 2032, impulsado por la creciente demanda de proteínas de alta pureza en bebidas vegetales, nutrición deportiva y alimentos funcionales. Los aislados ofrecen una solubilidad y digestibilidad superiores, lo que los hace ideales para formulaciones listas para beber y productos de alto rendimiento. Los consumidores que buscan dietas ricas en proteínas están impulsando la demanda de aislados tanto en los mercados desarrollados como en los emergentes. Se espera que las crecientes innovaciones en productos lácteos vegetales y suplementos nutricionales aceleren aún más la adopción de aislados.

- Por función

Según su función, el mercado se segmenta en solubilidad, hidratación, emulsificación, formación de espuma y otros. El segmento de emulsificación dominó el mercado en 2024, ya que las proteínas de legumbres se utilizan ampliamente para estabilizar mezclas de aceite y agua en carnes vegetales, alternativas lácteas, salsas y aderezos. Su capacidad para mejorar la textura, la consistencia y la sensación en boca las hace valiosas en las formulaciones de productos. Los fabricantes de alimentos prefieren las proteínas de legumbres para la emulsificación debido a su atractivo de etiqueta limpia y su naturaleza libre de alérgenos. La creciente demanda de estabilizantes naturales en los sistemas alimentarios respalda firmemente el dominio del segmento.

Se proyecta que la función de solubilidad crecerá a su ritmo más rápido entre 2025 y 2032, con un uso cada vez mayor en batidos de proteínas, smoothies y bebidas de nutrición clínica. Su alta solubilidad garantiza una dispersión uniforme y una mejor experiencia del consumidor en aplicaciones líquidas. A medida que aumenta la demanda de bebidas fortificadas y bebidas ricas en proteínas, las proteínas de legumbres solubles se están volviendo muy atractivas para los formuladores de alimentos. Además, los avances en las tecnologías de procesamiento están mejorando la solubilidad de los aislados, impulsando aún más el potencial de crecimiento de este segmento.

- Por aplicación

Según su aplicación, el mercado se segmenta en alimentos y bebidas, piensos y productos farmacéuticos, y cosméticos. El segmento de alimentos y bebidas dominó en 2024, a medida que las proteínas de legumbres se incorporan cada vez más a productos de panadería, alternativas lácteas, bebidas y sustitutos de la carne. El aumento de las poblaciones veganas y flexitarianas en todo el mundo está impulsando a los fabricantes de alimentos a incluir proteínas vegetales en sus ofertas principales. El fuerte crecimiento de los alimentos funcionales y las bebidas saludables también impulsa su adopción. Su amplia aplicabilidad en diferentes categorías de alimentos refuerza el liderazgo del segmento.

Se prevé que el segmento de cosméticos experimente el mayor crecimiento entre 2025 y 2032, debido a la creciente demanda de ingredientes vegetales y naturales para el cuidado personal. Las proteínas de legumbres están ganando popularidad en las fórmulas para el cuidado de la piel y el cabello por sus propiedades hidratantes, acondicionadoras y formadoras de película. Se utilizan cada vez más en productos antienvejecimiento y restauradores, donde se prefieren los ingredientes de etiqueta limpia. A medida que los consumidores optan por productos de belleza sostenibles, es probable que la adopción de las proteínas de legumbres en la industria cosmética se acelere.

- Por el usuario final

Según el usuario final, el mercado se segmenta en consumo doméstico, industria de snacks, industria de harinas, entre otros. Este segmento tuvo la mayor participación en 2024, impulsado por la creciente demanda de opciones de snacks saludables y ricos en proteínas. Las legumbres se utilizan ampliamente en barritas energéticas, snacks extruidos y patatas fritas horneadas, resultando atractivas para consumidores activos y centrados en el fitness. Su alto valor nutricional y versatilidad permiten a los fabricantes innovar en múltiples categorías de snacks. La creciente popularidad de la nutrición para llevar contribuye significativamente al dominio de este segmento.

Se prevé que el segmento de la industria de la harina crezca a su ritmo más rápido entre 2025 y 2032, a medida que las proteínas de legumbres se incorporan cada vez más a las harinas tradicionales para mejorar el contenido proteico y el valor nutricional. La creciente demanda de harinas fortificadas en panadería, alimentos funcionales y cocina doméstica está impulsando su adopción. Esta tendencia se ve impulsada por la creciente concienciación sobre la deficiencia de proteínas en las regiones en desarrollo. Los fabricantes de harina están ampliando el uso de proteínas de legumbres para satisfacer la demanda de los consumidores de alimentos básicos más saludables.

Análisis regional del mercado europeo de proteínas de legumbres

- Alemania dominó el mercado de proteínas de legumbres con la mayor participación en los ingresos en 2025, impulsada por su sólida industria de procesamiento de alimentos, la alta conciencia de los consumidores sobre la salud y el bienestar y un ecosistema establecido de innovación de productos de origen vegetal.

- La infraestructura de la cadena de suministro bien desarrollada del país, la I+D avanzada en alimentos funcionales y las estrictas normas de seguridad alimentaria siguen apoyando la adopción generalizada de proteínas de legumbres en suplementos dietéticos, reemplazos de comidas y productos alimenticios fortificados.

- El creciente enfoque en la nutrición vegetal, la fuerte demanda de alternativas ricas en proteínas y sin alérgenos, el aumento de las inversiones de las principales marcas de alimentación y la presencia de empresas como Rügenwalder Mühle refuerzan el liderazgo de Alemania. La innovación continua en formulaciones de proteínas de legumbres, la conformidad con las directivas de la UE sobre nutrición y etiquetado, y las alianzas estratégicas con fabricantes intermedios garantizan el dominio de Alemania en el mercado europeo de proteínas de legumbres.

Perspectivas del mercado de proteínas de legumbres del Reino Unido

Se proyecta que el Reino Unido registrará la tasa de crecimiento anual compuesta (TCAC) más rápida en el mercado europeo de proteínas de legumbres entre 2026 y 2033, gracias al creciente énfasis en el consumo responsable, la sostenibilidad y el cumplimiento normativo en todo el sector alimentario. Por ejemplo, marcas británicas como Marigold Health Foods incorporan cada vez más proteínas de guisantes y lentejas en alimentos funcionales, snacks y bebidas, lo que impulsa su adopción por parte de los consumidores. El creciente enfoque en productos de etiqueta limpia y sin alérgenos, la expansión de la nutrición deportiva y las ofertas de sustitutivos de comidas, y la creciente concienciación sobre las dietas basadas en plantas están acelerando el crecimiento del mercado. Una sólida supervisión regulatoria, las inversiones en formulaciones innovadoras de origen vegetal y la adaptación a las directrices nutricionales nacionales y de la UE en constante evolución consolidan la posición del Reino Unido como el mercado de mayor crecimiento de la región.

Perspectiva del mercado de proteínas de legumbres en Francia

Se prevé que Francia experimente un crecimiento sostenido entre 2026 y 2033, impulsado por el creciente interés de los consumidores por alimentos saludables de origen vegetal e ingredientes funcionales. El creciente énfasis en la calidad nutricional, la modernización de las técnicas de procesamiento de alimentos y la mayor adopción de proteínas de legumbres en productos de panadería, alternativas lácteas y snacks impulsan la expansión del mercado. La colaboración entre los fabricantes franceses de alimentos y los proveedores globales, junto con la preferencia por fuentes de proteínas sostenibles y de alta calidad, fomenta una adopción constante. El enfoque del país en la innovación de productos orientada al bienestar, las iniciativas de economía circular en la producción alimentaria y el cumplimiento de las normas nutricionales de la UE refuerzan el crecimiento estable de Francia en el mercado europeo de proteínas de legumbres.

Cuota de mercado de proteínas de legumbres en Europa

- Ingredion (EE. UU.)

- Cargill Incorporated (EE. UU.)

- AGT Alimentos e Ingredientes (Canadá)

- ADM (EE. UU.)

- ET-Chem (China)

- Grupo Shandong Jianyuan (China)

- Axiom Foods, Inc. (EE. UU.)

- Kerry Group plc. (Irlanda)

- Vestkorn (Noruega)

- Glanbia PLC (Irlanda)

- Roquette Frères (Francia)

- The Scoular Company (EE. UU.)

- Nutriati, Inc. (EE. UU.)

- DuPont (EE. UU.)

- Prolupin GmbH (Alemania)

- FENCHEM (China)

- PURIS (EE. UU.)

- Grupo Emsland (Alemania)

- Burcon (Canadá)

- SOTEXPRO (Francia)

- Yantai Shuangta Food Co. (China)

Últimos avances en el mercado europeo de proteínas de legumbres

- En junio de 2025, Roquette lanzó NUTRALYS T Pea 700XC, una proteína de guisante texturizada en trozos grandes con un 70 % de contenido proteico y alta resistencia térmica. Esta innovación responde a la creciente demanda de texturas sustanciosas y carnívoras en platos preparados, salsas y platos tradicionales de origen vegetal, facilitando a los fabricantes de alimentos la creación de alternativas atractivas y ricas en proteínas. Su mínimo requerimiento de hidratación y su proceso de formulación simplificado mejoran la eficiencia de la producción, a la vez que ofrecen a los consumidores una mejor experiencia sensorial. Con la introducción de este producto, Roquette reforzó su cartera en el mercado de proteínas de legumbres, respondiendo a la creciente tendencia de ingredientes vegetales sostenibles y versátiles.

- En febrero de 2024, Roquette amplió su gama de proteínas vegetales NUTRALYS con cuatro proteínas de guisante multifuncionales diseñadas para mejorar el sabor, la textura y la funcionalidad de los alimentos y productos nutricionales de origen vegetal. Esta expansión permite a los fabricantes de alimentos innovar y diversificar su oferta de productos, a la vez que satisface la creciente demanda de soluciones vegetales ricas en proteínas. Esta iniciativa refuerza el liderazgo de Roquette en el mercado de las proteínas de legumbres al ofrecer ingredientes versátiles aptos para bebidas, panadería y snacks enriquecidos con proteínas, respondiendo a la creciente preferencia de los consumidores por opciones de proteínas sostenibles y de etiqueta limpia.

- En octubre de 2022, Roquette presentó una nueva línea de ingredientes orgánicos de guisantes, que incluye almidón y proteína de guisantes orgánicos, producidos en su planta canadiense. Este lanzamiento satisfizo la creciente demanda de ingredientes orgánicos y de origen vegetal, ofreciendo a los fabricantes fuentes de proteínas sostenibles y de alta calidad. Al ofrecer alternativas orgánicas, Roquette fortaleció su posición competitiva en el mercado de proteínas de legumbres y apoyó la transición hacia productos alimenticios más saludables y respetuosos con el medio ambiente. Esta iniciativa también le permitió a la empresa dirigirse a mercados emergentes donde los ingredientes orgánicos y de etiqueta limpia cobran cada vez más importancia.

- En junio de 2022, Roquette lanzó la gama NUTRALYS, con proteínas texturizadas orgánicas derivadas de guisantes y habas. Esta introducción estratégica amplió la base de clientes de Roquette al ofrecer soluciones de etiqueta limpia, sostenibles y ricas en proteínas para fabricantes de alimentos. El lanzamiento respondió al creciente interés de los consumidores por las dietas vegetales y los alimentos funcionales, ayudando a las marcas a ofrecer productos ricos en proteínas con mejor textura y valor nutricional. Al reforzar su enfoque en la innovación vegetal, Roquette consolidó su presencia en el creciente mercado de las proteínas de legumbres.

- En junio de 2021, Roquette lanzó la proteína de guisante texturizada P6511C en FI Europe, posicionándose como una alternativa sostenible a la carne. El producto satisfizo la creciente preferencia de los consumidores por alimentos de origen vegetal con perfiles nutricionales robustos, lo que permitió a los fabricantes crear productos innovadores ricos en proteínas con mejor textura y versatilidad. Al entrar en este nicho, Roquette reforzó su competitividad en el mercado de las proteínas de legumbres y apoyó la transición de la industria hacia ingredientes sostenibles y funcionales.

- En julio de 2020, Ingredion Incorporated EMEA lanzó un almidón nativo funcional instantáneo orgánico para satisfacer la demanda de ingredientes vegetales versátiles y de alta calidad. Esta innovación proporcionó a los fabricantes de alimentos y bebidas almidones funcionales aptos para productos de etiqueta limpia y enfocados en la salud. El lanzamiento ayudó a Ingredion a anticipar un aumento de ventas y a fortalecer su presencia en el mercado de proteínas de legumbres e ingredientes vegetales, impulsando la tendencia general hacia soluciones alimentarias sostenibles y enriquecidas con proteínas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.