Europe Power Tools Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

13.47 Billion

USD

21.08 Billion

2024

2032

USD

13.47 Billion

USD

21.08 Billion

2024

2032

| 2025 –2032 | |

| USD 13.47 Billion | |

| USD 21.08 Billion | |

|

|

|

|

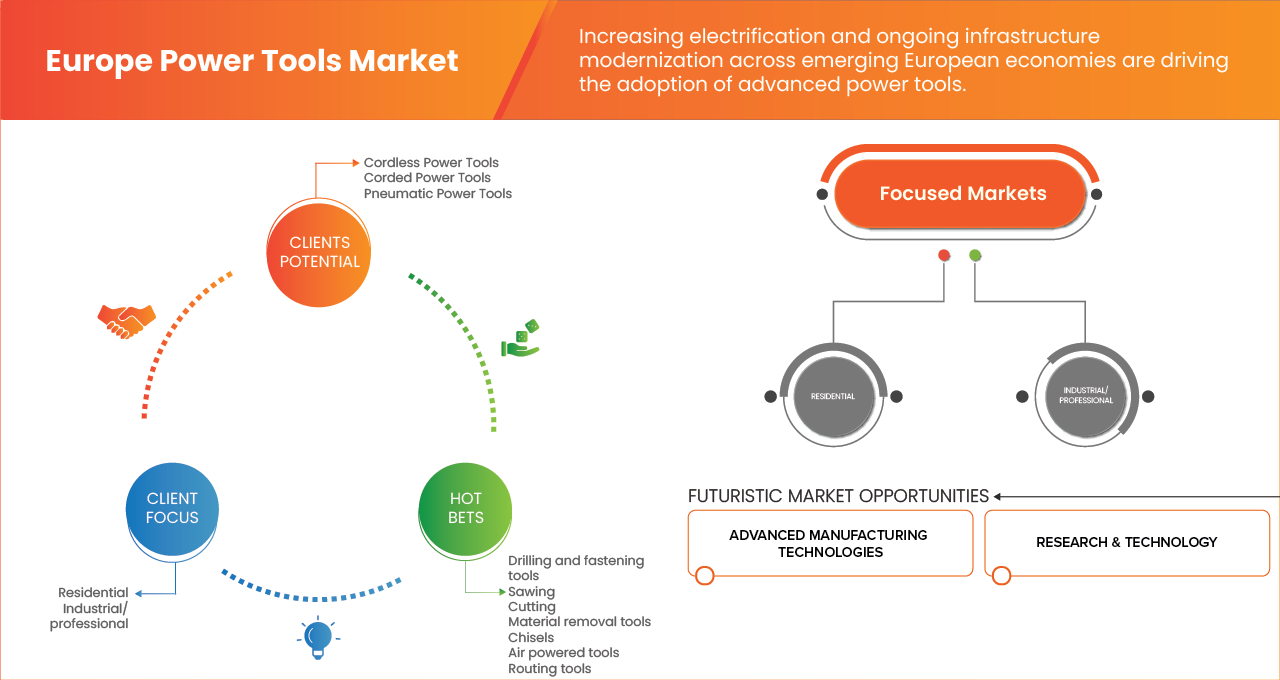

Por tipo (herramientas de perforación y fijación, serrado, corte, demolición, clavadoras, fresadoras, cizallas portátiles, herramientas neumáticas, herramientas para remover material, atornillado (puntas de destornillador), cinceles, accesorios), por modo de operación (eléctricas, de combustible líquido, hidráulicas, neumáticas, accionadas por pólvora), por aplicación (hormigón y construcción, carpintería, metalurgia, soldadura), por usuario final (industrial/profesional, residencial), por canal de venta (en línea, fuera de línea): tendencias y pronóstico del sector hasta 2032.

Tamaño del mercado europeo de herramientas eléctricas

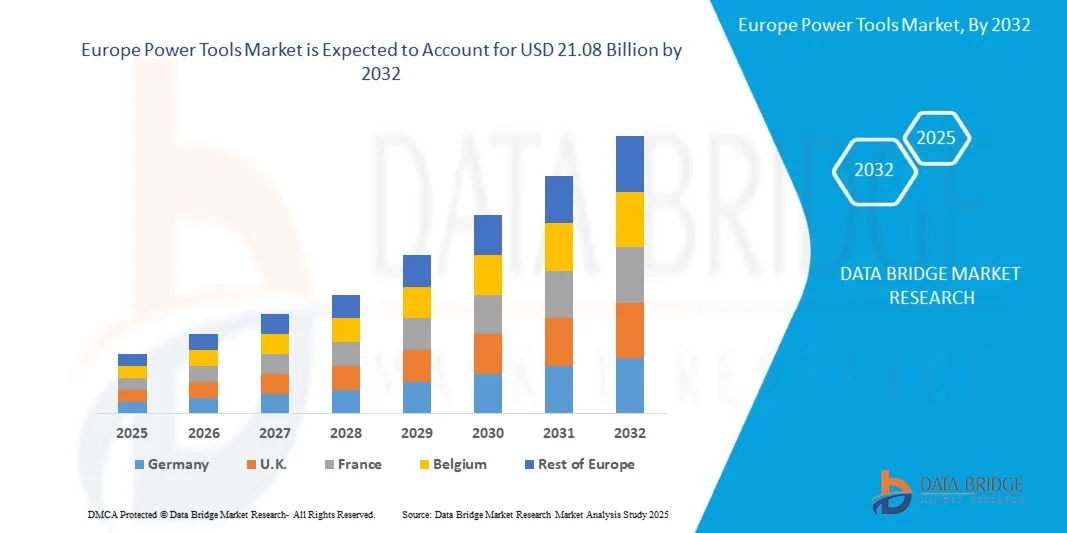

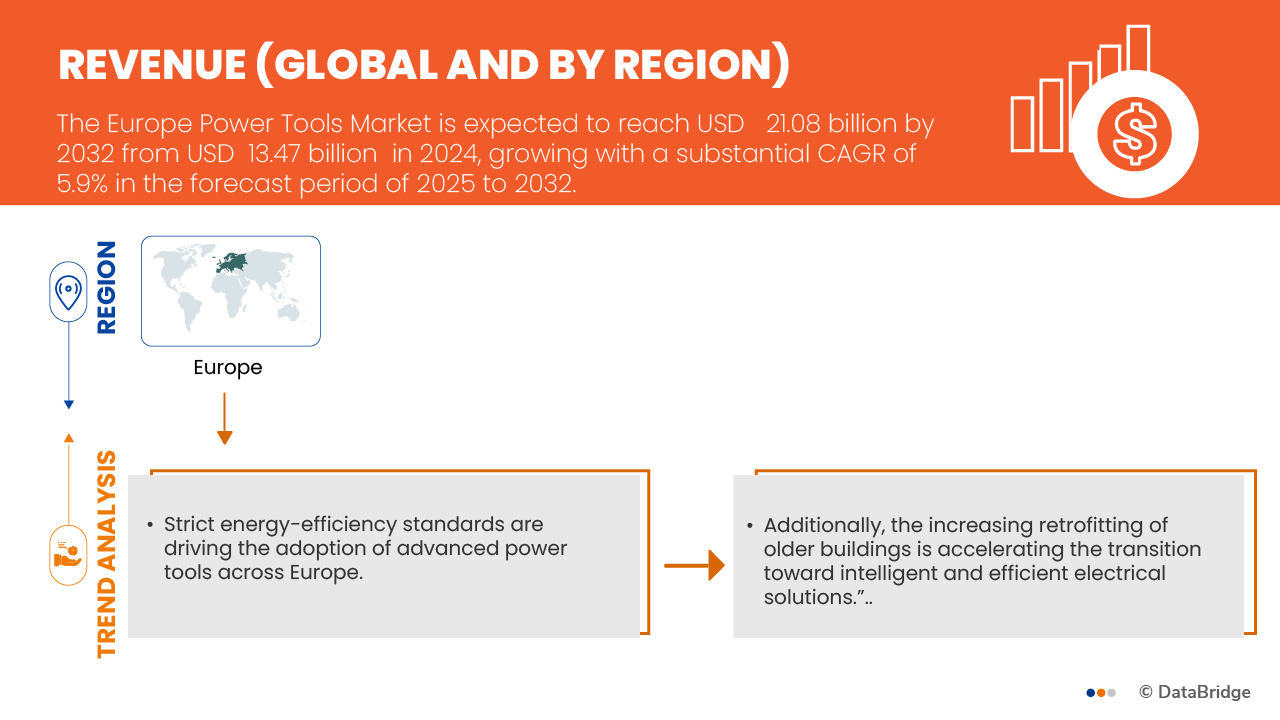

- El mercado europeo de herramientas eléctricas se valoró en 13.470 millones de dólares en 2024 y se prevé que alcance los 21.080 millones de dólares en 2032 , con una tasa de crecimiento anual compuesta (TCAC) del 5,5% durante el período de previsión.

- Las herramientas eléctricas son aquellas que requieren una fuente de energía adicional para su funcionamiento; constan de un motor que las impulsa. Estos motores pueden funcionar con electricidad, aire comprimido o mediante combustión interna con combustible. Se utilizan para diversas operaciones como taladrar, demoler, cortar, serrar, remover material, pulir, entre otras. Para estas operaciones se requieren diferentes tipos de herramientas, como taladros, martillos, sierras de calar y lijadoras.

Análisis del mercado europeo de herramientas eléctricas

- Las herramientas eléctricas se utilizan tanto en la industria como en el hogar para facilitar el trabajo. Ofrecen mayor precisión, facilidad de uso y productividad. El trabajo se simplifica y agiliza con herramientas eléctricas. Estas herramientas se utilizan principalmente en la construcción y la industria automotriz para trabajos con hormigón, madera y metal. La capacidad de producción de estas industrias aumenta con el uso de herramientas eléctricas. Son compactas y fáciles de transportar; además, las herramientas eléctricas inalámbricas que funcionan con baterías han hecho que el trabajo sea aún más flexible.

- Las industrias buscan constantemente formas de aumentar su productividad y precisión. El uso de herramientas eléctricas satisface esta necesidad, ya que reducen el tiempo y aumentan la eficiencia. Su uso se ha generalizado gracias a la creciente integración de tecnologías avanzadas. Las empresas están lanzando aplicaciones inteligentes que se integran con las herramientas, brindan información sobre ellas, permiten rastrear su ubicación y facilitan la gestión de inventario.

- Se prevé que Alemania domine el mercado europeo de herramientas eléctricas y que registre el crecimiento más rápido durante el período de pronóstico. El mercado alemán de herramientas eléctricas está impulsado por sus sectores manufactureros clave —automotriz, aeroespacial y de maquinaria— y por el impulso hacia la automatización y la Industria 4.0. Existe una fuerte demanda creciente de herramientas inalámbricas con baterías y motores sin escobillas.

- En 2024, las herramientas de perforación y fijación dominaron el mercado con una cuota de ingresos superior al 21,13 % y se prevé que experimenten el crecimiento más rápido durante el período de pronóstico. El segmento de herramientas de perforación y fijación está impulsado por el aumento de la actividad de la construcción y la fabricación en toda Europa, donde la precisión, la durabilidad y la eficiencia son fundamentales. La creciente adopción de tecnologías inalámbricas y con motores sin escobillas mejora la portabilidad y el rendimiento. La demanda de herramientas de fijación de alto par por parte de los sectores automotriz y aeroespacial respalda la expansión del mercado. Además, el auge de las tendencias de bricolaje y mejoras para el hogar, junto con los proyectos de renovación industrial, impulsan la penetración del producto. Innovaciones como la conectividad inteligente, los portabrocas de cambio rápido y los diseños ergonómicos ligeros fortalecen aún más el crecimiento del mercado en aplicaciones comerciales y residenciales.

Alcance del informe y segmentación del mercado europeo de herramientas eléctricas

|

Atributos |

Información clave del mercado europeo de herramientas eléctricas |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Europa

|

|

Principales actores del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de datos de valor añadido |

Además de información sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y principales actores, los informes de mercado elaborados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, producción y capacidad de las empresas representadas geográficamente, esquemas de red de distribuidores y socios, análisis detallado y actualizado de la tendencia de los precios y análisis de déficit de la cadena de suministro y la demanda. |

Tendencias del mercado europeo de herramientas eléctricas

“Conectividad inteligente en herramientas eléctricas”

- La integración de la conectividad inteligente, impulsada por los avances en tecnología digital e Internet de las Cosas (IoT), ha transformado el mercado europeo de herramientas eléctricas. Empresas de toda la región han lanzado herramientas equipadas con análisis de datos en tiempo real, monitorización remota y diagnósticos mediante aplicaciones, lo que permite a los usuarios gestionar el rendimiento, programar el mantenimiento predictivo y controlar los niveles de batería desde smartphones o plataformas empresariales. Estos avances facilitan la transición hacia fábricas inteligentes y centros de trabajo conectados en toda la región.

- Las herramientas conectadas digitalmente ofrecen una amplia gama de ventajas. Los usuarios pueden controlar el inventario y el uso de los dispositivos para prevenir robos, acceder a los registros operativos para optimizar su uso y recibir alertas sobre los niveles de carga o los programas de mantenimiento, lo que reduce el tiempo de inactividad. Empresas líderes del sector, como Bosch, Hilti Group y Makita, han presentado modelos con alertas de calibración automática y funciones de bloqueo remoto para garantizar el cumplimiento de las normativas y la seguridad en aplicaciones profesionales e industriales. En el ensamblaje de componentes para la industria automotriz y electrónica, las llaves y taladros inteligentes se han vuelto esenciales para el control del par y la trazabilidad de las operaciones de ensamblaje, en consonancia con la tendencia del sector hacia estándares de calidad y seguridad más estrictos.

- Tal y como anunció Bosch Power Tools en enero de 2025, la compañía presentó más de 30 herramientas inalámbricas, baterías y cargadores con funciones de conectividad inteligente. Estas herramientas están diseñadas para mejorar la experiencia del usuario mediante la integración con plataformas digitales, optimizando así el seguimiento del rendimiento y la planificación del mantenimiento. Esta iniciativa subraya el compromiso de Bosch con el avance de la tecnología inteligente en herramientas eléctricas para diversos sectores.

- En un comunicado de prensa de enero de 2025, Bosch Power Tools anunció el lanzamiento de más de 30 nuevas herramientas inalámbricas, baterías y cargadores, muchos de los cuales incorporan conectividad inteligente. Estas innovaciones buscan ofrecer a los usuarios un seguimiento del rendimiento mejorado, un mantenimiento predictivo y una gestión optimizada de las herramientas, reflejando la tendencia del sector hacia herramientas eléctricas más inteligentes y conectadas.

Dinámica del mercado europeo de herramientas eléctricas

Conductor

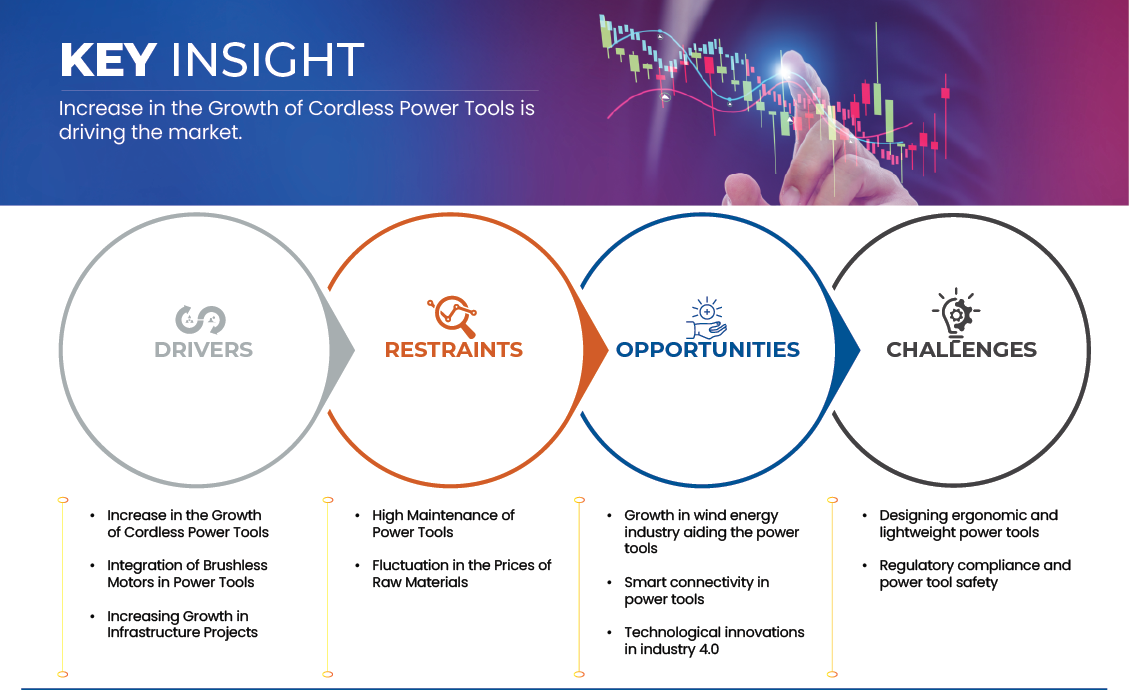

“Aumento en el crecimiento de las herramientas eléctricas inalámbricas”

- Las herramientas inalámbricas, con tecnología avanzada de iones de litio y motores sin escobillas, ofrecen mayor comodidad, portabilidad y eficiencia, características muy valoradas tanto en aplicaciones profesionales como de bricolaje. Los sectores de la construcción, la automoción y la fabricación en toda Europa están adoptando cada vez más los modelos inalámbricos debido a su mejor ergonomía y a su capacidad para funcionar sin fuentes de alimentación externas, lo que reduce el tiempo de inactividad y aumenta la productividad.

- Además, países como Alemania, Francia y el Reino Unido están experimentando una creciente demanda de herramientas sostenibles y energéticamente eficientes, lo que fomenta aún más la adopción de sistemas de baterías recargables. La integración de funciones inteligentes, como la conectividad Bluetooth, los indicadores de estado de la batería y los modos de control de energía, mejora la experiencia del usuario y la precisión operativa. El auge de los proyectos de renovación de viviendas y la cultura del bricolaje, especialmente tras la pandemia, también ha impulsado las ventas de dispositivos inalámbricos compactos y ligeros.

- En enero de 2022, según un comunicado de prensa de Europawire, Bosch lanzó cuatro nuevos modelos de taladros/atornilladores inalámbricos en su sistema “18V Power for All”, incluyendo EasyDrill 18V-40 y UniversalImpact 18V-60. Estos taladros comparten una única plataforma de batería y forman parte de un sistema que abarca 40 herramientas para bricolaje, jardinería y hogar, mejorando la comodidad del usuario y la fidelización al ecosistema.

- En diciembre de 2024, según un comunicado de prensa de Einhell Germany AG, la compañía inauguró una nueva planta de producción en Hungría (Nagykanizsa) dedicada a sus baterías y cargadores “Power X-Change”. La planta tiene como objetivo producir más de un millón de baterías y 500 000 cargadores al año, impulsando así la localización de la cadena de suministro y reforzando el crecimiento del mercado de herramientas inalámbricas a batería.

Restricción/Desafío

“Alto mantenimiento de herramientas eléctricas”

- Muchas herramientas eléctricas industriales y profesionales tienen un diseño complejo, con múltiples piezas móviles, componentes electrónicos y motores especializados. El mantenimiento regular, que incluye lubricación, calibración, reemplazo de componentes desgastados e inspecciones periódicas, es necesario para garantizar un rendimiento óptimo y una larga vida útil. Esta necesidad de mantenimiento incrementa los costos operativos para los usuarios finales, especialmente para las pequeñas y medianas empresas que pueden carecer de equipos de mantenimiento especializados.

- Además, la necesidad de conocimientos y herramientas especializadas para realizar reparaciones o mantenimiento preventivo a menudo obliga a los usuarios a recurrir a centros de servicio autorizados, lo que puede resultar costoso y consumir mucho tiempo. Los requisitos de mantenimiento frecuentes también pueden provocar tiempos de inactividad, reduciendo la productividad en entornos profesionales. Para los usuarios que realizan el mantenimiento por sí mismos, la alta complejidad del mantenimiento puede desalentar el uso frecuente o impulsar el cambio a alternativas que requieran menos mantenimiento, lo que afecta la adopción general en el mercado. Asimismo, las normativas medioambientales sobre la eliminación y el mantenimiento de herramientas que contienen componentes electrónicos o químicos específicos añaden otra capa de cumplimiento y coste. En conjunto, estos factores actúan como un freno al crecimiento del mercado europeo de herramientas eléctricas, influyendo en las decisiones de compra y ralentizando la expansión del mercado.

- En noviembre de 2024, según un artículo de National World Publishing Ltd, el aumento de los precios de las herramientas y los elevados costes de mantenimiento están obligando a muchos profesionales británicos a retrasar nuevas compras o a recurrir a las reparaciones por su cuenta. Alrededor de un tercio de los profesionales afirmó estar posponiendo la compra de herramientas nuevas debido a los gastos, mientras que el 13 % admitió seguir trabajando con herramientas que no están en óptimas condiciones porque las reparaciones son demasiado costosas. El artículo también destacó que los costes acumulados de reparación de herramientas de uso frecuente, como taladros percutores y sierras, pueden superar los costes de reposición tras varias reparaciones, lo que convierte el mantenimiento de las herramientas en una importante carga financiera.

- En julio de 2023, según un artículo de Insight Retail Group Ltd, los profesionales del sector de la construcción en el Reino Unido afrontaban gastos considerables en el mantenimiento de sus herramientas, con un promedio de 246 libras esterlinas anuales destinadas a reparaciones. Muchos admitían utilizar herramientas dañadas debido al elevado coste del mantenimiento, lo que pone de manifiesto una importante limitación en el uso práctico de las herramientas y en la demanda del mercado.

Oportunidad

“El crecimiento de la industria de la energía eólica beneficia a las herramientas eléctricas”

- La expansión del sector de la energía eólica se ha reconocido como un importante motor de nuevas oportunidades para el mercado europeo de herramientas eléctricas. El aumento de las inversiones en instalaciones de aerogeneradores ha conllevado un incremento paralelo de la demanda de herramientas de apriete especializadas, esenciales tanto para el montaje como para el mantenimiento. En este contexto, las llaves dinamométricas eléctricas se han adoptado cada vez más, ya que su rendimiento y precisión se consideran superiores a los de las llaves dinamométricas manuales.

- Estas herramientas se han valorado por su capacidad para garantizar una aplicación de par constante, reducir la fatiga del operario y mejorar la seguridad en entornos operativos exigentes. En la construcción de aerogeneradores, donde las conexiones atornilladas críticas deben fijarse según especificaciones exactas, una mayor precisión se ha considerado esencial para el rendimiento estructural general y la fiabilidad a largo plazo. Además, a medida que los objetivos de sostenibilidad siguen siendo una prioridad en toda Europa, las mejoras en la eficiencia que ofrece el par eléctrico avanzado resultan cruciales.

- Según informó WindEurope en septiembre de 2025, Europa instaló 16,4 GW de nueva capacidad eólica en 2024, de los cuales el 84 % se instaló en tierra firme. La UE se propone instalar 140 GW de nueva capacidad eólica para 2030, con un promedio de 23 GW anuales. Este importante crecimiento de los proyectos de energía eólica está incrementando la demanda de herramientas eléctricas especializadas utilizadas en la construcción y el mantenimiento de aerogeneradores.

- En septiembre de 2025, Reuters informó que los aerogeneradores europeos estaban a punto de convertirse en el principal motor del crecimiento del suministro de electricidad limpia durante el resto de 2025, gracias a las condiciones de viento más favorables. Se esperaba que este aumento en la generación eólica, a partir de mediados de septiembre, impulsara la demanda de herramientas eléctricas avanzadas diseñadas para la instalación y el mantenimiento de parques eólicos marinos, lo que ayudaría a la región a alcanzar nuevos récords en la producción de electricidad limpia.

Alcance del mercado europeo de herramientas eléctricas

El mercado de herramientas eléctricas se segmenta en cinco segmentos principales que se basan en el tipo, el modo de funcionamiento, la aplicación, el usuario final y el canal de ventas.

- Por tipo

Según su tipo, el mercado se segmenta en herramientas de perforación y fijación, serrado, corte, demolición, clavadoras, fresadoras, cizallas portátiles, herramientas neumáticas, herramientas para remover material, puntas de destornillador, cinceles, accesorios y otros. Se prevé que en 2025, el segmento de herramientas de perforación y fijación domine el mercado con una cuota de mercado del 21,43% y registre el crecimiento más rápido durante el período de pronóstico. Este segmento está impulsado por el auge de la construcción y la manufactura en toda Europa, donde la precisión, la durabilidad y la eficiencia son fundamentales. La creciente adopción de tecnologías inalámbricas y con motores sin escobillas mejora la portabilidad y el rendimiento. La demanda de herramientas de fijación de alto torque por parte de los sectores automotriz y aeroespacial respalda la expansión del mercado. Además, el auge de las mejoras en el hogar y el bricolaje, junto con los proyectos de renovación industrial, impulsan la penetración del producto. Innovaciones como la conectividad inteligente, los portabrocas de cambio rápido y los diseños ergonómicos ligeros fortalecen aún más el crecimiento del mercado en aplicaciones comerciales y residenciales.

- Por modo de funcionamiento

Según su modo de funcionamiento, el mercado se segmenta en herramientas eléctricas, de combustible líquido, hidráulicas, neumáticas y de pólvora. El segmento eléctrico se divide a su vez en herramientas con cable e inalámbricas. Se prevé que en 2025, el segmento eléctrico domine el mercado con una cuota del 35,98% y que experimente el crecimiento más rápido durante el período de pronóstico en el mercado europeo, debido al creciente desarrollo de infraestructuras y la automatización industrial. El cambio de equipos manuales a eléctricos mejora la productividad y la seguridad, reduciendo los plazos de los proyectos. El crecimiento de las soluciones energéticamente eficientes y a batería apoya las iniciativas de sostenibilidad. Los modelos eléctricos inalámbricos son cada vez más populares por su flexibilidad y movilidad en aplicaciones profesionales y de bricolaje. Los principales fabricantes se centran en integrar motores sin escobillas y controles inteligentes para un mejor rendimiento y una optimización energética. El auge de la construcción, la reparación de automóviles y las reformas impulsa aún más la demanda de herramientas eléctricas.

- Mediante solicitud

Según su aplicación, el mercado se segmenta en hormigón y construcción, carpintería, metalurgia, soldadura y otros. Se prevé que en 2025, el segmento de hormigón y construcción domine el mercado con una cuota del 35,89 % y que registre el crecimiento más rápido durante el período de pronóstico. Las herramientas eléctricas para hormigón y construcción experimentan una fuerte demanda en toda Europa, impulsada por la urbanización a gran escala, los proyectos de ciudades inteligentes y las inversiones en infraestructura pública. El mayor uso en la construcción de carreteras, puentes y viviendas impulsa las ventas de cortadoras de hormigón, martillos demoledores y martillos rotativos. Los avances en tecnologías de control de vibraciones y materiales duraderos mejoran la seguridad y la eficiencia del usuario. Las innovaciones inalámbricas y los sistemas integrados de gestión de polvo mejoran la productividad en la obra y el cumplimiento de las normas de seguridad de la UE. Además, la demanda de herramientas ligeras y de alto rendimiento por parte de contratistas y constructores sigue impulsando el crecimiento de este segmento.

- Por usuario final

Según el usuario final, el mercado se segmenta en industrial/profesional y residencial. Se prevé que en 2025, el segmento industrial/profesional domine el mercado con una cuota del 72,20 % y que registre el crecimiento más rápido durante el período de pronóstico. El segmento de herramientas eléctricas industriales y profesionales está impulsado por la expansión de las industrias manufactureras, automotrices y aeroespaciales en toda Europa. La creciente automatización, junto con la demanda de herramientas de ensamblaje de alta precisión, impulsa el crecimiento del mercado. Los profesionales prefieren cada vez más dispositivos ergonómicos, de alto torque y de bajo mantenimiento para lograr eficiencia y confiabilidad. Los fabricantes están integrando sistemas habilitados para IoT para el mantenimiento predictivo y la monitorización operativa. Además, el aumento de las inversiones en proyectos de energías renovables y construcción marítima incrementa la utilización de herramientas. El enfoque en el cumplimiento de las normas de seguridad, la eficiencia energética y la mejora de la productividad sigue fortaleciendo la adopción de herramientas profesionales.

- Por canal de ventas

Según el canal de ventas, el mercado se divide en online y offline. Se prevé que en 2025 el segmento offline domine el mercado con una cuota del 64,42 %. Las ventas offline predominan en el mercado europeo de herramientas eléctricas debido a la marcada preferencia de los clientes por la inspección física, los servicios posventa y la confianza en la marca. Las ferreterías, los distribuidores autorizados y las cadenas minoristas como Leroy Merlin y Würth desempeñan un papel fundamental en la accesibilidad a los productos. Las instalaciones de demostración, los descuentos por volumen y la disponibilidad inmediata de los productos atraen a los usuarios profesionales. Además, los canales offline ofrecen asistencia personalizada, crucial para los compradores de los sectores industrial y de la construcción. El aumento de las colaboraciones entre fabricantes y distribuidores regionales mejora la eficiencia de la distribución, impulsando el buen desempeño de este canal de ventas en toda Europa.

Se prevé que el segmento online experimente el crecimiento más rápido durante el período de pronóstico. Este segmento del mercado de herramientas eléctricas está impulsado por la rápida expansión de las plataformas de comercio electrónico, que ofrecen una amplia disponibilidad de productos, precios competitivos y la comodidad de la entrega a domicilio. La creciente digitalización, la preferencia de los consumidores por las compras sin contacto, las ventas online directas del fabricante y la facilidad para comparar productos impulsan aún más las ventas online de herramientas eléctricas tanto para usuarios residenciales como profesionales.

Análisis regional del mercado europeo de herramientas eléctricas

Alemania

- Alemania domina el mercado con la mayor cuota (23,52%) en 2025. El mercado alemán de herramientas eléctricas está impulsado por sus sectores manufactureros clave: automoción, aeroespacial y maquinaria, así como por el impulso hacia la automatización y la Industria 4.0. Existe una fuerte demanda de herramientas inalámbricas con baterías y motores sin escobillas. Las estrictas normativas de seguridad, medioambientales y de eficiencia energética fomentan la innovación en herramientas ergonómicas y de bajas emisiones. El sector de la construcción, junto con el desarrollo de infraestructuras y viviendas (incluida la construcción modular y prefabricada), impulsa la demanda de herramientas para atornillar, cortar y taladrar. Los canales online y el comercio electrónico facilitan el acceso a las herramientas. Las inversiones en I+D y la reputación de las marcas locales por su durabilidad y precisión también refuerzan el crecimiento del mercado.

Francia

Francia domina el mercado con la segunda mayor cuota (16,18%) en 2025. En Francia, el crecimiento se ve impulsado por la creciente popularidad de las herramientas inalámbricas (a batería), los diseños ligeros y la tecnología de motores sin escobillas. Los sectores de la construcción, la automoción, la industria aeroespacial y la fabricación demandan precisión y eficiencia. La cultura del bricolaje, impulsada por las redes sociales, las tendencias de renovación del hogar y las herramientas ergonómicas más ligeras, está ampliando la base de consumidores. La presión normativa en materia de sostenibilidad, eficiencia energética y seguridad está influyendo en el diseño de productos. El comercio electrónico ofrece a los consumidores mayor variedad y comodidad. A nivel regional, los centros de energías renovables, construcción naval e industria en el norte, el este y el sur de Francia incrementan la demanda de herramientas especializadas y duraderas. Las herramientas de perforación y fijación destacan por su relación calidad-precio.

Reino Unido

El Reino Unido domina el mercado con la tercera mayor cuota de mercado (10,07%) en 2025. El mercado británico de herramientas eléctricas se ve impulsado por la inversión en infraestructuras y la expansión de la construcción residencial y comercial. Existe un fuerte segmento de bricolaje: las tendencias de mejora y renovación del hogar están en auge, gracias a los tutoriales en línea y los canales de comercio electrónico que facilitan el acceso a las herramientas. Los usuarios profesionales (trabajadores de la construcción, contratistas) demandan herramientas inalámbricas, de alto rendimiento y ligeras, y se presta cada vez más atención a las características de seguridad (antivibración, apagado automático). Las políticas medioambientales y los objetivos de cero emisiones netas fomentan la adopción de herramientas energéticamente eficientes y con motores sin escobillas. Además, la diversificación de la cadena de suministro y la innovación de marca contribuyen a satisfacer las demandas cambiantes.

Cuota de mercado de herramientas eléctricas en Europa

La industria europea de herramientas eléctricas está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Husqvarna AB (Suecia)

- Robert Bosch GmbH (Alemania)

- Corporación Makita (Japón)

- Stanley Black & Decker, Inc. (EE. UU.)

- Hilti AG (Liechtenstein)

- Atlas Copco AB (Suecia)

- Corporación Delta de Equipos Eléctricos (EE. UU.)

- Apex Tool Group, LLC (EE. UU.)

- Ingersoll Rand (EE. UU.)

- Snap-on Incorporated (EE. UU.)

- Ferm International BV (Países Bajos)

- Compañía Eléctrica Emerson (EE. UU.)

- Corporación KYOCERA (Japón)

- Corporación Panasonic (Japón)

Últimos desarrollos en el mercado europeo de herramientas eléctricas

- En octubre de 2024, Husqvarna anunció el lanzamiento de cuatro nuevos robots cortacésped profesionales inalámbricos: el 580L EPOS, el 580 EPOS, el 560 EPOS y una versión actualizada del 535 AWD EPOS. Estos robots cuentan con navegación GPS, patrones de corte seleccionables y funciones de IA y energía solar preparadas para el futuro. Estos productos son relevantes para el mercado europeo de herramientas eléctricas, ya que se enmarcan dentro de las herramientas avanzadas para exteriores con batería, reflejando las tendencias en conectividad inteligente, innovación tecnológica y herramientas eléctricas sostenibles.

- En enero de 2025, Bosch Power Tools lanzó más de 15 productos nuevos, principalmente en la categoría de herramientas inalámbricas de 18 V, junto con 30 herramientas inalámbricas, baterías y cargadores dirigidos a profesionales, reforzando su compromiso con las soluciones inalámbricas.

- En octubre de 2025, Makita presentó la manguera de suministro de agua para cortadoras eléctricas (1915Y2-3), diseñada para conectar las pulverizadoras Makita con las cortadoras eléctricas. Este accesorio garantiza un flujo de agua constante para la supresión de polvo y la refrigeración de la cuchilla, cumpliendo con las normas de la OSHA y siendo compatible con los sistemas XGT® y LXT®.

- En noviembre, DEWALT presentó el sistema POWERSHIFT™, una alternativa sostenible a las herramientas tradicionales para hormigón que funcionan con gasolina. El sistema reduce las emisiones de CO₂ en casi un 60 % y fue reconocido por Popular Science como una de las «50 mayores innovaciones de 2024».

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE POWER TOOLS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES ANALYSIS

4.2 REGULATORY STANDARDS IN THE EUROPE POWER TOOLS MARKET

4.3 CASE STUDY: GROWTH DYNAMICS, CHALLENGES, AND STRATEGIC DEVELOPMENTS

4.4 PATENT ANALYSIS

4.4.1 MARKET CONTEXT

4.5 COMPETITIVE ANALYSIS FRAMEWORK

4.5.1 MARKET CONTEXT

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN THE GROWTH OF CORDLESS POWER TOOLS

5.1.2 INTEGRATION OF BRUSHLESS MOTORS IN POWER TOOLS

5.1.3 INCREASING GROWTH IN INFRASTRUCTURE PROJECTS

5.2 RESTRAINS

5.2.1 HIGH MAINTENANCE OF POWER TOOLS

5.2.2 FLUCTUATION IN THE PRICES OF RAW MATERIALS

5.3 OPPORTUNITIES

5.3.1 GROWTH IN WIND ENERGY INDUSTRY AIDING THE POWER TOOLS

5.3.2 SMART CONNECTIVITY IN POWER TOOLS

5.3.3 TECHNOLOGICAL INNOVATIONS IN INDUSTRY 4.0

5.4 CHALLENGES

5.4.1 DESIGNING ERGONOMIC AND LIGHTWEIGHT POWER TOOLS

5.4.2 REGULATORY COMPLIANCE AND POWER TOOL SAFETY

6 EUROPE POWER TOOLS MARKET, BY TYPE

6.1 OVERVIEW

6.2 DRILLING AND FASTENING TOOLS

6.2.1 DRILLING AND FASTENING TOOLS, BY TYPE

6.2.1.1 DRILLS

6.2.1.2 SCREWDRIVERS AND NUTRUNNERS

6.2.1.3 IMPACT WRENCHES

6.2.1.4 IMPACT DRIVERS

6.2.2 DRILLING AND FASTENING TOOLS, BY MATERIAL

6.2.2.1 CONCRETE

6.2.2.2 METAL

6.2.2.3 MULTI PURPOSE

6.2.2.4 WOODS

6.2.2.5 STONE

6.2.3 DRILLING AND FASTENING TOOLS, BY SALES CHANNEL

6.2.3.1 OFFLINE

6.2.3.1.1 OFFLINE, BY TYPE

6.2.3.1.1.1 DISTRIBUTORS

6.2.3.1.1.2 WHOLESALER

6.2.3.1.1.3 OTHERS

6.2.3.2 ONLINE

6.2.3.2.1 ONLINE, BY TYPE

6.2.3.2.1.1 COMPANY WEBSITE

6.2.3.2.1.2 E-COMMERCE WEBSITES

6.3 SAWING

6.3.1 SAWING, BY MATERIAL

6.3.1.1 CIRCULAR SAWS

6.3.1.2 JIG SAWS

6.3.1.3 MULTI-CUTTER SAWS

6.3.1.4 CHOP SAWS

6.3.1.5 BAND SAWS

6.3.1.6 HOLE SAWS

6.3.1.7 RECIPROCATING SAWS

6.3.1.8 SHEARS AND NIBBLERS

6.3.2 SAWING, BY SALES CHANNEL

6.3.2.1 OFFLINE

6.3.2.1.1 OFFLINE, BY TYPE

6.3.2.1.1.1 DISTRIBUTORS

6.3.2.1.1.2 WHOLESALER

6.3.2.1.1.3 OTHERS

6.3.2.2 ONLINE

6.3.2.2.1 ONLINE, BY TYPE

6.3.2.2.1.1 COMPANY WEBSITE

6.3.2.2.1.2 E-COMMERCE WEBSITES

6.4 CUTTING

6.4.1 CUTTING, BY TYPE

6.4.1.1 BONDED CUTTING

6.4.1.2 DIAMOND CUTTING

6.4.2 CUTTING, BY SALES CHANNEL

6.4.2.1 OFFLINE

6.4.2.1.1 OFFLINE, BY TYPE

6.4.2.1.1.1 DISTRIBUTORS

6.4.2.1.1.2 WHOLESALER

6.4.2.1.1.3 OTHERS

6.4.2.2 ONLINE

6.4.2.2.1 ONLINE, BY TYPE

6.4.2.2.1.1 COMPANY WEBSITE

6.4.2.2.1.2 E-COMMERCE WEBSITES

6.5 DEMOLITION TOOLS

6.5.1 DEMOLITION TOOLS, BY TYPE

6.5.1.1 DEMOLITION HAMMER

6.5.1.2 HAMMER DRILL

6.5.1.3 BREAKER

6.5.1.4 ROTARY HAMMER

6.5.1.5 OTHERS

6.5.2 DEMOLITION TOOLS, BY SALES CHANNEL

6.5.2.1 OFFLINE

6.5.2.1.1 OFFLINE, BY TYPE

6.5.2.1.1.1 DISTRIBUTORS

6.5.2.1.1.2 WHOLESALER

6.5.2.1.1.3 OTHERS

6.5.2.2 ONLINE

6.5.2.2.1 ONLINE, BY TYPE

6.5.2.2.1.1 COMPANY WEBSITE

6.5.2.2.1.2 E-COMMERCE WEBSITES

6.6 NAILERS

6.6.1 NAILERS, BY SALES CHANNEL

6.6.1.1 OFFLINE

6.6.1.1.1 OFFLINE, BY TYPE

6.6.1.1.1.1 DISTRIBUTORS

6.6.1.1.1.2 WHOLESALER

6.6.1.1.1.3 OTHERS

6.6.1.2 ONLINE

6.6.1.2.1 ONLINE, BY TYPE

6.6.1.2.1.1 COMPANY WEBSITE

6.6.1.2.1.2 E-COMMERCE WEBSITES

6.7 ROUTING TOOLS

6.7.1 ROUTING TOOLS, BY TYPE

6.7.1.1 ROUTERS/PLANER

6.7.1.2 JOINERS

6.7.2 ROUTING TOOLS, BY SALES CHANNEL

6.7.2.1 OFFLINE

6.7.2.1.1 OFFLINE, BY TYPE

6.7.2.1.1.1 DISTRIBUTORS

6.7.2.1.1.2 WHOLESALER

6.7.2.1.1.3 OTHERS

6.7.2.2 ONLINE

6.7.2.2.1 ONLINE, BY TYPE

6.7.2.2.1.1 COMPANY WEBSITE

6.7.2.2.1.2 E-COMMERCE WEBSITES

6.8 PORTABLE NIBBLERS

6.8.1 PORTABLE NIBBLERS, BY SALES CHANNEL

6.8.1.1 OFFLINE

6.8.1.1.1 OFFLINE, BY TYPE

6.8.1.1.1.1 DISTRIBUTORS

6.8.1.1.1.2 WHOLESALER

6.8.1.1.1.3 OTHERS

6.8.1.2 ONLINE

6.8.1.2.1 ONLINE, BY TYPE

6.8.1.2.1.1 COMPANY WEBSITE

6.8.1.2.1.2 E-COMMERCE WEBSITES

6.9 AIR-POWERED TOOLS

6.9.1 AIR-POWERED TOOLS, BY TYPE

6.9.1.1 AIR HOSES

6.9.1.2 AIR HAMMERS

6.9.1.3 AIR SCALERS

6.9.1.4 OTHERS

6.9.2 AIR-POWERED TOOLS, BY SALES CHANNEL

6.9.2.1 OFFLINE

6.9.2.1.1 OFFLINE, BY TYPE

6.9.2.1.1.1 DISTRIBUTORS

6.9.2.1.1.2 WHOLESALER

6.9.2.1.1.3 OTHERS

6.9.2.2 ONLINE

6.9.2.2.1 ONLINE, BY TYPE

6.9.2.2.1.1 COMPANY WEBSITE

6.9.2.2.1.2 E-COMMERCE WEBSITES

6.1 MATERIAL REMOVAL TOOLS

6.10.1 MATERIAL REMOVAL TOOLS, BY TYPE

6.10.1.1 GRINDERS

6.10.1.1.1 GRINDERS, BY TYPE

6.10.1.1.1.1 DIE AND STRAIGHT GRINDER

6.10.1.1.1.2 ANGLE GRINDER

6.10.1.1.1.3 ROTARY FILES

6.10.1.1.1.4 BENCH GRINDER

6.10.1.1.1.5 PENCIL GRINDERS

6.10.2 SANDERS

6.10.2.1 SANDERS, BY TYPE

6.10.2.1.1 WOOD SANDING

6.10.2.1.2 METAL SANDING

6.10.2.1.3 COMPOSITE SANDING

6.10.2.2 POLISHERS/BUFFERS

6.10.3 MATERIAL REMOVAL TOOLS, BY SALES CHANNEL

6.10.3.1 OFFLINE

6.10.3.1.1 OFFLINE, BY TYPE

6.10.3.1.1.1 DISTRIBUTORS

6.10.3.1.1.2 WHOLESALER

6.10.3.1.1.3 OTHERS

6.10.3.2 ONLINE

6.10.3.2.1 ONLINE, BY TYPE

6.10.3.2.1.1 COMPANY WEBSITE

6.10.3.2.1.2 E-COMMERCE WEBSITES

6.11 SCREWING (SCREWDRIVER BITS)

6.11.1 SCREWING (SCREWDRIVER BITS), BY SALES CHANNEL

6.11.1.1 OFFLINE

6.11.1.1.1 OFFLINE, BY TYPE

6.11.1.1.1.1 DISTRIBUTORS

6.11.1.1.1.2 WHOLESALER

6.11.1.1.1.3 OTHERS

6.11.1.2 ONLINE

6.11.1.2.1 ONLINE, BY TYPE

6.11.1.2.1.1 COMPANY WEBSITE

6.11.1.2.1.2 E-COMMERCE WEBSITES

6.12 CHISELS

6.12.1 CHISELS, BY SALES CHANNEL

6.12.1.1 OFFLINE

6.12.1.1.1 OFFLINE, BY TYPE

6.12.1.1.1.1 DISTRIBUTORS

6.12.1.1.1.2 WHOLESALER

6.12.1.1.1.3 OTHERS

6.12.1.2 ONLINE

6.12.1.2.1 ONLINE, BY TYPE

6.12.1.2.1.1 COMPANY WEBSITE

6.12.1.2.1.2 E-COMMERCE WEBSITES

6.13 ACCESSORIES

6.13.1 ACCESSORIES, BY SALES CHANNEL

6.13.1.1 OFFLINE

6.13.1.1.1 OFFLINE, BY TYPE

6.13.1.1.2 DISTRIBUTORS

6.13.1.1.3 WHOLESALER

6.13.1.1.4 OTHERS

6.13.1.2 ONLINE

6.13.1.2.1 ONLINE, BY TYPE

6.13.1.2.1.1 COMPANY WEBSITE

6.13.1.2.1.2 E-COMMERCE WEBSITES

6.14 OTHERS

6.14.1 OTHERS, BY SALES CHANNEL

6.14.1.1 OFFLINE

6.14.1.1.1 OFFLINE, BY TYPE

6.14.1.1.1.1 DISTRIBUTORS

6.14.1.1.1.2 WHOLESALER

6.14.1.1.1.3 OTHERS

6.14.1.2 ONLINE

6.14.1.2.1 ONLINE, BY TYPE

6.14.1.2.1.1 COMPANY WEBSITE

6.14.1.2.1.2 E-COMMERCE WEBSITES

7 EUROPE POWER TOOLS MARKET, BY MODE OF OPERATION

7.1 OVERVIEW

7.2 ELECTRIC

7.2.1 ELECTRIC, BY TYPE

7.2.1.1 CORDED TOOL

7.2.1.2 CORDLESS TOOL

7.3 LIQUID FUEL TOOL

7.4 HYDRAULIC

7.5 PNEUMATIC

7.6 POWDER-ACTUATED TOOLS

8 EUROPE POWER TOOLS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 CONCRETE AND CONSTRUCTION

8.3 WOODWORKING

8.4 METALWORKING

8.5 WELDING

8.6 OTHERS

9 EUROPE POWER TOOLS MARKET, BY END USER

9.1 OVERVIEW

9.2 INDUSTRIAL/PROFESSIONAL

9.2.1 INDUSTRIAL/PROFESSIONAL, BY TYPE

9.2.1.1 CONSTRUCTION

9.2.1.2 MANUFACTURING

9.2.1.3 AUTOMOTIVE

9.2.1.4 WOOD WORKING AND ART

9.2.1.5 ENERGY

9.2.1.6 AEROSPACE

9.2.1.7 SHIPBUILDING

9.2.1.8 CHEMICAL

9.2.1.9 OTHERS

9.2.2 INDUSTRIAL/PROFESSIONAL, BY TYPE

9.2.2.1 DRILLING AND FASTENING TOOLS

9.2.2.2 SAWING

9.2.2.3 CUTTING

9.2.2.4 DEMOLITION TOOLS

9.2.2.5 NAILERS

9.2.2.6 ROUTING TOOLS

9.2.2.7 PORTABLE NIBBLERS

9.2.2.8 AIR-POWERED TOOLS

9.2.2.9 MATERIAL REMOVAL TOOLS

9.2.2.10 SCREWING (SCREWDRIVER BITS)

9.2.2.11 CHISELS

9.2.2.12 ACCESSORIES

9.2.2.13 OTHERS

9.2.3 INDUSTRIAL/PROFESSIONAL, BY MODE OF OPERATION

9.2.3.1 ELECTRIC

9.2.3.2 LIQUID FUEL TOOL

9.2.3.3 HYDRAULIC

9.2.3.4 PNEUMATIC

9.2.3.5 POWDER-ACTUATED TOOLS

9.3 RESIDENTIAL

9.3.1 RESIDENTIAL, BY TYPE

9.3.1.1 SINGLE FAMILY HOME

9.3.1.2 DUPLEXES

9.3.1.3 APARTMENTS

9.3.1.4 OTHERS

9.3.2 RESIDENTIAL, BY TYPE

9.3.2.1 DRILLING AND FASTENING TOOLS

9.3.2.2 SAWING

9.3.2.3 CUTTING

9.3.2.4 DEMOLITION TOOLS

9.3.2.5 NAILERS

9.3.2.6 ROUTING TOOLS

9.3.2.7 PORTABLE NIBBLERS

9.3.2.8 AIR-POWERED TOOLS

9.3.2.9 MATERIAL REMOVAL TOOLS

9.3.2.10 SCREWING (SCREWDRIVER BITS)

9.3.2.11 CHISELS

9.3.2.12 ACCESSORIES

9.3.2.13 OTHERS

9.3.3 RESIDENTIAL, BY MODE OF OPERATION

9.3.3.1 ELECTRIC

9.3.3.2 LIQUID FUEL TOOL

9.3.3.3 HYDRAULIC

9.3.3.4 PNEUMATIC

9.3.3.5 POWDER-ACTUATED TOOLS

10 EUROPE POWER TOOLS MARKET, BY SALES CHANNEL

10.1 OVERVIEW

10.2 OFFLINE

10.2.1 OFFLINE, BY TYPE

10.2.1.1 WHOLESALER

10.2.1.2 DISTRIBUTORS

10.2.1.3 OTHERS

10.3 ONLINE

10.3.1 ONLINE, BY TYPE

10.3.1.1 COMPANY WEBSITE

10.3.1.2 E-COMMERCE WEBSITES

11 EUROPE POWER TOOLS MARKET BY COUNTRIES

11.1 EUROPE

11.1.1 GERMANY

11.1.2 FRANCE

11.1.3 U.K.

11.1.4 ITALY

11.1.5 SPAIN

11.1.6 POLAND

11.1.7 TURKEY

11.1.8 RUSSIA

11.1.9 NETHERLANDS

11.1.10 SWEDEN

11.1.11 BELGIUM

11.1.12 SWITZERLAND

11.1.13 DENMARK

11.1.14 NORWAY

11.1.15 FINLAND

11.1.16 REST OF EUROPE

12 EUROPE POWER TOOLS MARKET COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 HUSQVARNA GROUP

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 ROBERT BOSCH POWER TOOLS GMBH

14.2.1 COMPANY SNAPSHOT

14.2.2 PRODUCT PORTFOLIO

14.2.3 RECENT DEVELOPMENT

14.3 MAKITA CORPORATION

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 STANLEY BLACK & DECKER, INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 HILTI AKTIENGESELLSCHAFT

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENT

14.6 ATLAS COPCO GROUP

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 APEX TOOL GROUP, LLC

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 DELTA POWER EQUIPMENT CORPORATION

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 EMERSON ELECTRIC CO.

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.1 FERM INTERNATIONAL B.V.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 INGERSOLL RAND

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 KYOCERA CORPORATION

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENTS

14.13 PANASONIC CORPORATION

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 SNAP-ON INCORPORATED

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 OVERVIEW OF PATENT LANDSCAPE IN THE EUROPE POWER TOOLS MARKET

TABLE 2 COMPARATIVE ANALYSIS OF LEADING POWER TOOLS COMPANIES IN THE EUROPEAN MARKET (2025)

TABLE 3 EUROPE POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 EUROPE DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 EUROPE DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 6 EUROPE DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 7 EUROPE OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 EUROPE ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 EUROPE SAWING IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 EUROPE SAWING TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 11 EUROPE OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 EUROPE ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 EUROPE CUTING IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 EUROPE CUTING IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 15 EUROPE OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 EUROPE ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 EUROPE DEMOLITION TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 EUROPE DEMOLITION TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 19 EUROPE OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 EUROPE ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 EUROPE NAILERS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 22 EUROPE OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 EUROPE ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 EUROPE ROUTING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 EUROPE ROUTING TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 26 EUROPE OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 EUROPE ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 EUROPE PORTABLE NIBBLERS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 29 EUROPE OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 EUROPE ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 EUROPE AIR-POWERED TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 EUROPE AIR-POWERED TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 33 EUROPE OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 EUROPE ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 EUROPE MATERIAL REMOVAL TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 EUROPE GRINDERS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 EUROPE SANDERS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 EUROPE MATERIAL REMOVAL TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 39 EUROPE OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 EUROPE ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 EUROPE SCREWING (SCREWDRIVER BITS) IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 42 EUROPE OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 EUROPE ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 EUROPE CHISELS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 45 EUROPE OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 EUROPE ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 EUROPE ACCESSORIES IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 48 EUROPE OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 EUROPE ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 TABLE 49 EUROPE OTHERS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 51 EUROPE OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 EUROPE ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 EUROPE POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2032 (USD THOUSAND)

TABLE 54 EUROPE ELECTRIC IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 EUROPE POWER TOOLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 56 EUROPE POWER TOOLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 57 EUROPE INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 EUROPE INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 EUROPE INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2032 (USD THOUSAND)

TABLE 60 EUROPE RESIDENTIAL IN POWER TOOLS MARKET, BY RESIDENTIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 EUROPE RESIDENTIAL IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 EUROPE RESIDENTIAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2032 (USD THOUSAND)

TABLE 63 EUROPE POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 64 EUROPE OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 EUROPE ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 EUROPE POWER TOOLS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 67 GERMANY POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 GERMANY DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 GERMANY DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 70 GERMANY DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 71 GERMANY ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 GERMANY OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 GERMANY SAWING IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 GERMANY SAWING TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 75 GERMANY ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 GERMANY OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 GERMANY CUTING IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 GERMANY CUTING IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 79 GERMANY ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 GERMANY OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 GERMANY DEMOLITION TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 GERMANY DEMOLITION TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 83 GERMANY ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 GERMANY OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 GERMANY NAILERS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 86 GERMANY ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 GERMANY OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 GERMANY ROUTING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 GERMANY ROUTING TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 90 GERMANY ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 GERMANY OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 GERMANY PORTABLE NIBBLERS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 93 GERMANY ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 GERMANY OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 GERMANY AIR-POWERED TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 GERMANY AIR-POWERED TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 97 GERMANY ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 GERMANY OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 GERMANY MATERIAL REMOVAL TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 GERMANY GRINDERS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 GERMANY SANDERS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 GERMANY MATERIAL REMOVAL TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 103 GERMANY ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 GERMANY OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 GERMANY SCREWING (SCREWDRIVER BITS) IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 106 GERMANY ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 GERMANY OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 GERMANY CHISELS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 109 GERMANY ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 GERMANY OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 GERMANY ACCESSORIES IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 112 GERMANY ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 GERMANY OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 GERMANY OTHERS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 115 GERMANY ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 GERMANY OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 GERMANY POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2032 (USD THOUSAND)

TABLE 118 GERMANY ELECTRIC IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 GERMANY POWER TOOLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 120 GERMANY POWER TOOLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 121 GERMANY INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 GERMANY INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 GERMANY INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2032 (USD THOUSAND)

TABLE 124 GERMANY RESIDENTIAL IN POWER TOOLS MARKET, BY RESIDENTIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 GERMANY RESIDENTIAL IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 GERMANY RESIDENTIAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2032 (USD THOUSAND)

TABLE 127 GERMANY POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 128 GERMANY ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 GERMANY OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 FRANCE POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 FRANCE DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 FRANCE DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 133 FRANCE DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 134 FRANCE ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 FRANCE OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 FRANCE SAWING IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 FRANCE SAWING TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 138 FRANCE ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 FRANCE OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 FRANCE CUTING IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 FRANCE CUTING IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 142 FRANCE ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 FRANCE OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 FRANCE DEMOLITION TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 FRANCE DEMOLITION TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 146 FRANCE ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 FRANCE OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 FRANCE NAILERS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 149 FRANCE ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 FRANCE OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 FRANCE ROUTING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 FRANCE ROUTING TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 153 FRANCE ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 FRANCE OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 FRANCE PORTABLE NIBBLERS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 156 FRANCE ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 FRANCE OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 FRANCE AIR-POWERED TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 FRANCE AIR-POWERED TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 160 FRANCE ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 FRANCE OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 FRANCE MATERIAL REMOVAL TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 FRANCE GRINDERS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 FRANCE SANDERS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 FRANCE MATERIAL REMOVAL TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 166 FRANCE ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 FRANCE OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 FRANCE SCREWING (SCREWDRIVER BITS) IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 169 FRANCE ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 FRANCE OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 FRANCE CHISELS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 172 FRANCE ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 FRANCE OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 FRANCE ACCESSORIES IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 175 FRANCE ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 FRANCE OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 FRANCE OTHERS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 178 FRANCE ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 FRANCE OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 FRANCE POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2032 (USD THOUSAND)

TABLE 181 FRANCE ELECTRIC IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 FRANCE POWER TOOLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 183 FRANCE POWER TOOLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 184 FRANCE INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 FRANCE INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 FRANCE INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2032 (USD THOUSAND)

TABLE 187 FRANCE RESIDENTIAL IN POWER TOOLS MARKET, BY RESIDENTIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 FRANCE RESIDENTIAL IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 FRANCE RESIDENTIAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2032 (USD THOUSAND)

TABLE 190 FRANCE POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 191 FRANCE ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 FRANCE OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 U.K. POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 U.K. DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 U.K. DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 196 U.K. DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 197 U.K. ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 U.K. OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 U.K. SAWING IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 U.K. SAWING TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 201 U.K. ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 U.K. OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 U.K. CUTING IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 U.K. CUTING IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 205 U.K. ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 U.K. OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 U.K. DEMOLITION TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 U.K. DEMOLITION TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 209 U.K. ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 U.K. OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 U.K. NAILERS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 212 U.K. ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 U.K. OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 U.K. ROUTING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 U.K. ROUTING TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 216 U.K. ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 U.K. OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 U.K. PORTABLE NIBBLERS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 219 U.K. ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 U.K. OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 U.K. AIR-POWERED TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 U.K. AIR-POWERED TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 223 U.K. ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 U.K. OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 U.K. MATERIAL REMOVAL TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 U.K. GRINDERS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 U.K. SANDERS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 U.K. MATERIAL REMOVAL TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 229 U.K. ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 U.K. OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 U.K. SCREWING (SCREWDRIVER BITS) IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 232 U.K. ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 U.K. OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 U.K. CHISELS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 235 U.K. ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 U.K. OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 U.K. ACCESSORIES IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 238 U.K. ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 U.K. OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 U.K. OTHERS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 241 U.K. ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 U.K. OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 U.K. POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2032 (USD THOUSAND)

TABLE 244 U.K. ELECTRIC IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 U.K. POWER TOOLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 246 U.K. POWER TOOLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 247 U.K. INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 U.K. INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 U.K. INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2032 (USD THOUSAND)

TABLE 250 U.K. RESIDENTIAL IN POWER TOOLS MARKET, BY RESIDENTIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 U.K. RESIDENTIAL IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 U.K. RESIDENTIAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2032 (USD THOUSAND)

TABLE 253 U.K. POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 254 U.K. ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 U.K. OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 ITALY POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 ITALY DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 ITALY DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 259 ITALY DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 260 ITALY ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 ITALY OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 ITALY SAWING IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 ITALY SAWING TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 264 ITALY ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 ITALY OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 ITALY CUTING IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 ITALY CUTING IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 268 ITALY ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 ITALY OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 ITALY DEMOLITION TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 ITALY DEMOLITION TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 272 ITALY ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 ITALY OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 ITALY NAILERS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 275 ITALY ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 ITALY OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 ITALY ROUTING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 ITALY ROUTING TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 279 ITALY ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 280 ITALY OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 ITALY PORTABLE NIBBLERS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 282 ITALY ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 ITALY OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 ITALY AIR-POWERED TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 ITALY AIR-POWERED TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 286 ITALY ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 ITALY OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 ITALY MATERIAL REMOVAL TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 ITALY GRINDERS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 ITALY SANDERS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 ITALY MATERIAL REMOVAL TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 292 ITALY ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 293 ITALY OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 ITALY SCREWING (SCREWDRIVER BITS) IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 295 ITALY ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 ITALY OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 297 ITALY CHISELS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 298 ITALY ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 ITALY OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 ITALY ACCESSORIES IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 301 ITALY ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 302 ITALY OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 303 ITALY OTHERS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 304 ITALY ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 305 ITALY OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 306 ITALY POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2032 (USD THOUSAND)

TABLE 307 ITALY ELECTRIC IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 308 ITALY POWER TOOLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 309 ITALY POWER TOOLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 310 ITALY INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 311 ITALY INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 ITALY INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2032 (USD THOUSAND)

TABLE 313 ITALY RESIDENTIAL IN POWER TOOLS MARKET, BY RESIDENTIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 314 ITALY RESIDENTIAL IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 315 ITALY RESIDENTIAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2032 (USD THOUSAND)

TABLE 316 ITALY POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 317 ITALY ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 318 ITALY OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 319 SPAIN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 SPAIN DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 SPAIN DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 322 SPAIN DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 323 SPAIN ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 324 SPAIN OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 SPAIN SAWING IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 SPAIN SAWING TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 327 SPAIN ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 SPAIN OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 SPAIN CUTING IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 330 SPAIN CUTING IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 331 SPAIN ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 332 SPAIN OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 333 SPAIN DEMOLITION TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 334 SPAIN DEMOLITION TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 335 SPAIN ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 336 SPAIN OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 337 SPAIN NAILERS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 338 SPAIN ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 339 SPAIN OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 340 SPAIN ROUTING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 341 SPAIN ROUTING TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 342 SPAIN ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 343 SPAIN OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 344 SPAIN PORTABLE NIBBLERS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 345 SPAIN ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 346 SPAIN OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 347 SPAIN AIR-POWERED TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 348 SPAIN AIR-POWERED TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 349 SPAIN ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 350 SPAIN OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 351 SPAIN MATERIAL REMOVAL TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 352 SPAIN GRINDERS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 353 SPAIN SANDERS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 354 SPAIN MATERIAL REMOVAL TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 355 SPAIN ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 356 SPAIN OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 357 SPAIN SCREWING (SCREWDRIVER BITS) IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 358 SPAIN ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 359 SPAIN OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 360 SPAIN CHISELS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 361 SPAIN ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 362 SPAIN OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 363 SPAIN ACCESSORIES IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 364 SPAIN ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 365 SPAIN OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 366 SPAIN OTHERS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 367 SPAIN ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 368 SPAIN OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 369 SPAIN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2032 (USD THOUSAND)

TABLE 370 SPAIN ELECTRIC IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 371 SPAIN POWER TOOLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 372 SPAIN POWER TOOLS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 373 SPAIN INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 374 SPAIN INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 375 SPAIN INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2032 (USD THOUSAND)

TABLE 376 SPAIN RESIDENTIAL IN POWER TOOLS MARKET, BY RESIDENTIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 377 SPAIN RESIDENTIAL IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 378 SPAIN RESIDENTIAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2032 (USD THOUSAND)

TABLE 379 SPAIN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 380 SPAIN ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 381 SPAIN OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 382 POLAND POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 383 POLAND DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 384 POLAND DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 385 POLAND DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 386 POLAND ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 387 POLAND OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 388 POLAND SAWING IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 389 POLAND SAWING TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 390 POLAND ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 391 POLAND OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 392 POLAND CUTING IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 393 POLAND CUTING IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 394 POLAND ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 395 POLAND OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 396 POLAND DEMOLITION TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 397 POLAND DEMOLITION TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 398 POLAND ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 399 POLAND OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 400 POLAND NAILERS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 401 POLAND ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 402 POLAND OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 403 POLAND ROUTING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 404 POLAND ROUTING TOOLS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 405 POLAND ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 406 POLAND OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 407 POLAND PORTABLE NIBBLERS IN POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 408 POLAND ONLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 409 POLAND OFFLINE IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 410 POLAND AIR-POWERED TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)