Europe Phytogenic Feed Additives Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

211.76 Million

USD

426.87 Million

2022

2030

USD

211.76 Million

USD

426.87 Million

2022

2030

| 2023 –2030 | |

| USD 211.76 Million | |

| USD 426.87 Million | |

|

|

|

|

Mercado europeo de aditivos fitogénicos para piensos, por tipo ( aceites esenciales , flavonoides, saponinas, oleorresinas, taninos y otros), tipo de pienso (pienso para aves de corral, pienso para rumiantes, pienso para acuicultura, pienso para cerdos y otros), fuentes (hierbas y especias), forma (seca y líquida), función (mejoradores del rendimiento, propiedades antimicrobianas, mejoradores de la palatabilidad, mejoradores de la digestión y otros): tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de aditivos fitogénicos para piensos en Europa

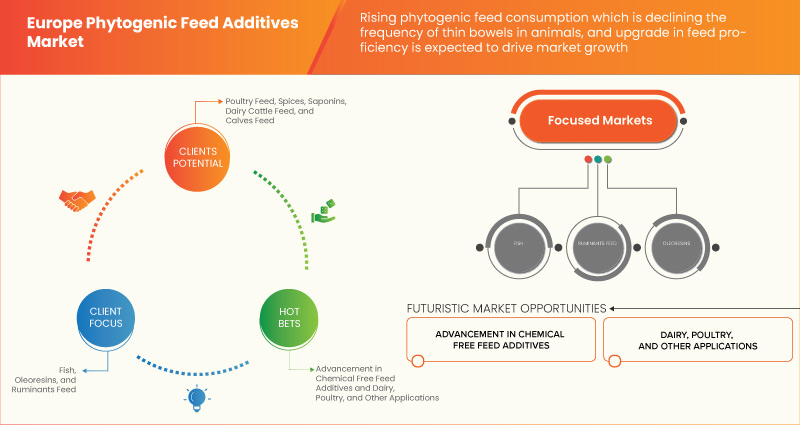

La creciente demanda de aditivos naturales para piensos, el aumento del consumo de proteínas animales, las estrictas normas sobre los aditivos antibióticos para piensos y la creciente preocupación por el bienestar animal son algunos de los factores que se espera que impulsen el crecimiento del mercado. Sin embargo, se espera que la disponibilidad de alternativas establecidas para los aditivos para piensos en el mercado frene el crecimiento del mercado.

El informe sobre el mercado de aditivos fitogénicos para piensos en Europa proporciona detalles sobre la cuota de mercado, los nuevos desarrollos y el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un informe de analista. Nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

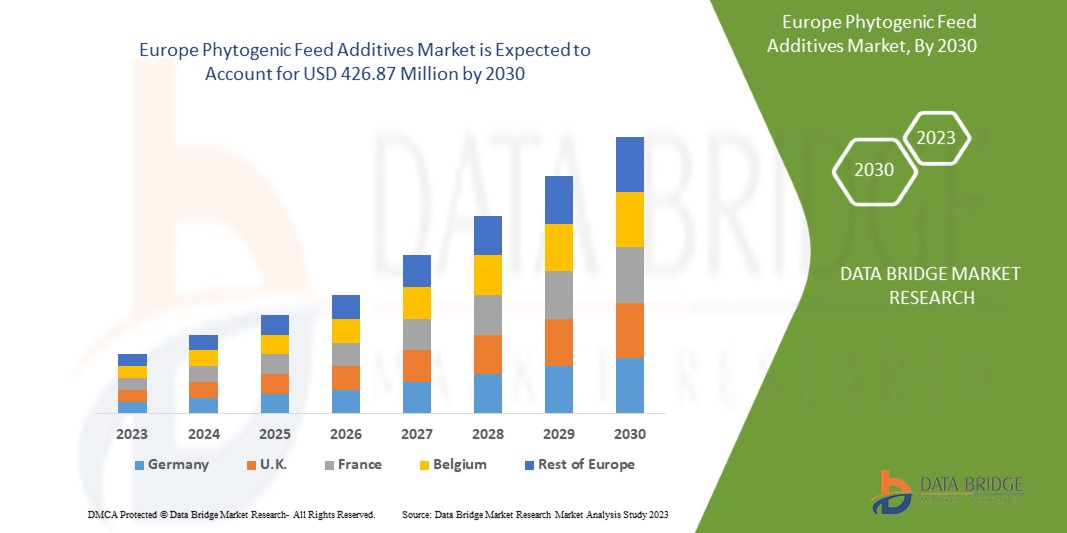

Se espera que el mercado europeo de aditivos fitogénicos para piensos crezca significativamente en el período de pronóstico de 2023 a 2030. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 9,3% en el período de pronóstico de 2023 a 2030 y se espera que alcance los 426,87 millones de dólares en 2030 desde los 211,76 millones de dólares en 2022.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Año histórico |

2021 (Personalizable para 2015 - 2020) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

Tipo (aceites esenciales, flavonoides, saponinas, oleorresinas, taninos y otros), tipo de alimento para animales (alimento para aves de corral, alimento para rumiantes, alimento para acuicultura, alimento para cerdos y otros), fuentes (hierbas y especias), forma (seca y líquida), función (mejoradores del rendimiento, propiedades antimicrobianas, mejoradores de la palatabilidad, mejoradores de la digestión y otros) |

|

Países cubiertos |

Alemania, Francia, Reino Unido, Países Bajos, Suiza, Bélgica, Rusia, Italia, España, Polonia, Dinamarca, Suecia, Turquía y resto de Europa. |

|

Actores del mercado cubiertos |

Cargill, Incorporated., DSM, Kemin Industries, Inc., ADM, Nutreco, Natural Remedies., Himalaya Wellness Company, Vinayak Ingredients. India, Silvateam Spa, Phytobiotics Futterzusatzstoffe GmbH, Tegasa, MIAVIT GMBH, Indian Herbs, Cliente DOSTOFARM GmbH, British Horse Feeds, Orffa, Igusol, Glamac International Private Limited. y Nor-Feed, entre otros. |

Definición de mercado

Los fitogénicos son una clase de promotores de crecimiento orgánicos que se utilizan como aditivos para piensos y que se derivan de hierbas, especias u otras plantas. La gama de aditivos fitogénicos para piensos es amplia e incluye aceites esenciales y clases de ingredientes activos como saponinas, flavonoides, mucílagos, taninos y sustancias amargas y picantes. Los aditivos fitogénicos para piensos son sustancias de origen vegetal que se añaden a las dietas de los animales en los niveles recomendados para mejorar el crecimiento y la nutrición de los animales.

Dinámica del mercado de aditivos fitogénicos para piensos en Europa

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- Normas estrictas sobre los aditivos antibióticos para piensos

Los antibióticos son una clase de compuestos orgánicos, semiorgánicos o sintéticos con actividad antimicrobiana que se utilizan ampliamente para tratar y prevenir enfermedades infecciosas en humanos y animales. También se pueden añadir a los alimentos como promotores del crecimiento para ayudar al desarrollo de los animales.

El uso de antibióticos en la producción avícola y ganadera es considerado ventajoso por los agricultores y la economía en su conjunto, ya que ha mejorado en general el rendimiento avícola de manera económica y eficaz. Sin embargo, la posible propagación de cepas de organismos patógenos y no patógenos resistentes a los antibióticos al medio ambiente y su posterior transmisión a los seres humanos a través de la cadena alimentaria podría afectar gravemente a la salud pública. En todo el mundo se están estableciendo leyes y otras restricciones sobre el uso de antibióticos en animales de granja debido a estas preocupaciones sanitarias.

Por ejemplo,

- En noviembre de 2017, la OMS publicó un artículo en contra de la administración frecuente de antibióticos para estimular el crecimiento y prevenir enfermedades en animales sanos. Al minimizar su uso innecesario en animales, las nuevas recomendaciones de la OMS buscan conservar la potencia de los antibióticos que son cruciales para la salud humana.

- Según la Comisión Europea, los antibióticos se han utilizado ampliamente en la ganadería en todo el mundo durante décadas. Estos mejoran el crecimiento de los animales de granja cuando se añaden en pequeñas dosis a su pienso. Sin embargo, la Comisión decidió eliminar gradualmente y, en última instancia, prohibir la comercialización y el uso de antibióticos como promotores del crecimiento en los piensos a partir de 2006 debido al aumento de la resistencia bacteriana a los antibióticos utilizados para tratar enfermedades humanas y animales.

Es poco probable que los antibióticos se eliminen alguna vez de la agricultura animal, ya que hacerlo dañaría al sector ganadero. Es crucial buscar promotores de crecimiento naturales, accesibles, asequibles y eficientes para reemplazar a los promotores de crecimiento antibióticos (AGP) en las dietas del ganado, especialmente en regiones donde los antibióticos están prohibidos. Como resultado, en aras de la sostenibilidad ambiental, la salud humana y la seguridad alimentaria, los investigadores se han centrado recientemente más en alternativas naturales que podrían reemplazar el uso de antibióticos en la producción ganadera. Esto conduce a alternativas efectivas llamadas aditivos alimentarios naturales, como los aditivos alimentarios fitogénicos. Se espera que estos factores impulsen el crecimiento del mercado.

Oportunidad

- Demanda creciente de aditivos fitogénicos para piensos en acuicultura y piensos para mascotas

El mercado de la acuicultura orgánica está en expansión, ya que tiende a proteger la salud de los consumidores mediante la reducción del uso de productos químicos sintéticos o nocivos. El crecimiento de la acuicultura orgánica conduce a una mayor participación de aditivos alimentarios orgánicos en la fabricación de piensos para acuicultura orgánica, como los aditivos alimentarios fitogénicos. Por lo tanto, se espera que el aumento de la acuicultura orgánica cree una oportunidad para el crecimiento del mercado.

Por ejemplo,

- En agosto de 2020, Delacon lanzó un producto llamado Syrena Boost. El producto es una premezcla de saponinas, especias y aceites esenciales que brinda soluciones fitogénicas completas para las prácticas de acuicultura modernas. Fue diseñado de manera que pudiera apuntar al rendimiento y la productividad intestinal. Viene en forma microencapsulada para mantener su estabilidad térmica y para la liberación intestinal gradual de los ingredientes sensibles involucrados.

- En diciembre de 2020, según el Philippines Journal of Fisheries, se utilizaron medicamentos para la quimioterapia con el fin de reducir, prevenir y tratar enfermedades en la acuicultura. Por lo tanto, la quimioterapia tiene algunos efectos negativos en la salud de los peces y de los seres humanos. Como sustituto, los alimentos fitogénicos han mostrado resultados excepcionales, como la estimulación del apetito y el aumento de peso. Además de eso, se dice que actúa como un inmunoestimulante que hereda propiedades antipatógenas en los peces.

El uso de aditivos fitogénicos en los piensos para acuicultura mejora el apetito de los peces y actúa como promotor orgánico del crecimiento. Además, se dice que las propiedades antimicrobianas y antifúngicas de los fitogénicos mejoran la salud de los peces al prevenir y curar diversas enfermedades.

En conclusión, el mercado de la acuicultura está creciendo debido al consumo de pescado por parte de los consumidores de carne y la participación en suplementos medicinales como los aceites de pescado. Como la acuicultura ahora se inclina hacia métodos orgánicos, el consumo de alimentos de base orgánica está aumentando. Debido a todas las razones mencionadas anteriormente, se espera que el uso de aditivos fitogénicos para alimentos en la acuicultura brinde una oportunidad para el crecimiento del mercado y para todos los fabricantes de aditivos fitogénicos para alimentos.

Restricción/Desafío

- Disponibilidad de alternativas establecidas para aditivos alimentarios

Los aditivos fitogénicos para piensos se utilizan en la cría de animales para mejorar la inmunidad, el rendimiento y la salud general. Para contrarrestar los efectos de los antibióticos y aumentar la producción, los aditivos fitogénicos para piensos introdujeron diversos componentes del pienso y los ajustes necesarios en el manejo de los animales.

Aunque los aditivos fitogénicos para piensos tienen diversos beneficios y mejoran el rendimiento y la salud de los animales, también se comercializan otros aditivos naturales para piensos, como prebióticos, probióticos, enzimas, ácidos orgánicos, sales, aceites esenciales y algas marinas. Estos aditivos se elaboran a partir de fuentes orgánicas, como minerales, plantas y microbios. Se emplean en la nutrición animal para mejorar el rendimiento, la salud y el bienestar de los animales. Además de los aditivos fitogénicos para piensos, numerosas empresas de aditivos para piensos han introducido recientemente nuevos productos para algunos aditivos naturales para piensos.

Por ejemplo,

- En noviembre de 2022, según el artículo publicado en Feed-lot Magazine Inc, los prebióticos son sustancias que se encuentran en los alimentos y que estimulan el desarrollo o la actividad de las bacterias y los hongos beneficiosos. En el sistema digestivo, los prebióticos pueden cambiar la composición de las bacterias del microbioma intestinal. El prebiótico de precisión Amaferm de BioZyme, Inc. está elaborado a partir de un producto de fermentación completo de una cepa particular de Aspergillus oryzae.

Por ello, otros aditivos naturales para piensos están ganando protagonismo en todo el mundo. Estos aditivos tienen beneficios casi iguales a los de los aditivos fitogénicos, que se espera que frenen el crecimiento del mercado.

Impacto posterior a la COVID-19 en el mercado europeo de aditivos fitogénicos para piensos

La incertidumbre causada por el brote de la pandemia de COVID-19 en el mundo ha afectado y cambiado la dinámica completa de las industrias europeas y ha tenido un impacto negativo en el crecimiento del mercado de las economías europeas. Los efectos se pueden ver en la intensidad y eficacia de los esfuerzos de contención, los cambios de comportamiento (como evitar la compra y la inversión), los cambios en los patrones de gasto, los esfuerzos de contención de las perturbaciones del suministro, las secuelas del ajuste dramático en el mercado, los precios volátiles de las materias primas y el aumento de la carga de la deuda. Debido a COVID-19, todos los países se han enfrentado a una crisis de múltiples capas que comprende perturbaciones económicas internas, caída de la demanda externa, colapso de los precios y colapso de la oferta y la demanda de productos.

Acontecimientos recientes

- En marzo de 2023, Indian Herbs anunció el lanzamiento de un nuevo producto llamado HEATBEAT para aves de corral. Este producto es una combinación de vitamina C natural, complejo de cromo orgánico y menta. Este lanzamiento ayudó a la empresa a ampliar su cartera de productos.

- En febrero de 2022, Orffa anunció un nuevo acuerdo de distribución con Eigenmann & Veronelli, un proveedor líder de soluciones en la industria de productos químicos especiales e ingredientes alimentarios en Rho (MI), Italia. Este acuerdo ayudaría a la empresa a promocionar sus productos en Italia.

Alcance del mercado de aditivos fitogénicos para piensos en Europa

El mercado europeo de aditivos fitogénicos para piensos se divide en cinco segmentos importantes según el tipo, el tipo de pienso para animales, las fuentes, la forma y la función. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Aceites esenciales

- Flavonoides

- Saponinas

- Oleorresinas

- Taninos

- Otros

Según el tipo, el mercado está segmentado en aceites esenciales, flavonoides, saponinas, oleorresinas, taninos y otros.

Tipo de alimento para animales

- Alimento para aves de corral

- Alimentación de rumiantes

- Alimento para acuicultura

- Alimento para cerdos

- Otros

Según el tipo de alimento animal, el mercado está segmentado en alimentos para aves de corral, alimentos para rumiantes, alimentos para acuicultura, alimentos para cerdos y otros.

Fuentes

- Hierbas

- Especias

Según las fuentes, el mercado está segmentado en hierbas y especias.

Forma

- Seco

- Líquido

En función de la forma, el mercado se segmenta en seco y líquido.

Función

- Mejoradores del rendimiento

- Propiedades antimicrobianas

- Mejoradores de la palatabilidad

- Mejoradores de la digestión

- Otros

Sobre la base de la función, el mercado está segmentado en mejoradores del rendimiento, propiedades antimicrobianas, mejoradores de la palatabilidad, mejoradores de la digestión y otros.

Análisis y perspectivas regionales del mercado de aditivos fitogénicos para piensos en Europa

El mercado europeo de aditivos alimentarios fitogénicos está segmentado en cinco segmentos notables según el tipo, tipo de alimento animal, fuentes, forma y función.

Los países cubiertos en este informe de mercado son Alemania, Francia, Reino Unido, Países Bajos, Suiza, Bélgica, Rusia, Italia, España, Polonia, Dinamarca, Suecia, Turquía y el resto de Europa.

Se espera que Alemania domine el mercado europeo de aditivos fitogénicos para alimentos debido a la creciente demanda de alimentos naturales en el país.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. El análisis de los puntos de datos de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para cada país. Además, se consideran la presencia y disponibilidad de marcas regionales y los desafíos que enfrentan debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de aditivos fitogénicos para piensos en Europa

The Europe phytogenic feed additives market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, and technology lifeline curve. The above data points provided are only related to the companies’ focus related to the market.

Some of the major market players operating in the Europe phytogenic feed additives market are Cargill, Incorporated., DSM, Kemin Industries, Inc., ADM, Nutreco, Natural Remedies., Himalaya Wellness Company, Vinayak Ingredients. India, Silvateam S.p.a., Phytobiotics Futterzusatzstoffe GmbH, Tegasa, MIAVIT GMBH, Indian Herbs, Customer DOSTOFARM GmbH, British Horse Feeds, Orffa, Igusol, Glamac International Private Limited., and Nor-Feed among others.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE PHYTOGENIC FEED ADDITIVES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TREATMENT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 FACTORS INFLUENCING PURCHASE DECISION

4.1.1 PRODUCT PRICING

4.1.2 INGREDIENTS

4.1.3 AUTHENTICITY OF PRODUCT

4.2 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.3 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.3.1 GROWING DEMAND FOR NATURAL ADDITIVES

4.3.2 MANUFACTURERS OFFERING CERTIFIED FEED SUPPLEMENTS

4.3.3 BUSINESS EXPANSIONS THROUGH DIFFERENT STRATEGIC DECISIONS

4.4 FUTURE PERSPECTIVE

4.5 PORTER’S FIVE FORCES ANALYSIS FOR THE EUROPE PHYTOGENIC FEED ADDITIVES MARKET

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 RAW MATERIAL PROCUREMENT & MANUFACTURING

4.6.2 DISTRIBUTION

4.6.3 END USERS

4.7 TECHNOLOGICAL ADVANCEMENT

4.8 VALUE CHAIN ANALYSIS: EUROPE PHYTOGENIC FEED ADDITIVES MARKET

5 PRICING INDEX

6 PRODUCTION CAPACITY OF KEY MANUFACTURERS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 IMPACT OF ECONOMIC SLOWDOWN ON THE MARKET

8.1 IMPACT ON PRICE

8.2 IMPACT ON SUPPLY CHAIN

8.3 IMPACT ON SHIPMENT

8.4 IMPACT ON COMPANY'S STRATEGIC DECISIONS

9 BRAND OUTLOOK

10 MARKET OVERVIEW

10.1 DRIVERS

10.1.1 SURGING DEMAND FOR NATURAL FEED ADDITIVES

10.1.2 INCREASE IN THE CONSUMPTION OF ANIMAL PROTEIN

10.1.3 STRINGENT REGULATIONS ON ANTIBIOTIC FEED ADDITIVES

10.1.4 ESCALATING CONCERN REGARDING ANIMAL WEALTH

10.2 RESTRAINTS

10.2.1 AVAILABILITY OF ESTABLISHED ALTERNATIVES FOR FEED ADDITIVES

10.2.2 HIGHER-END PRODUCT PRICES CAUSE LOW-PROFIT MARGIN

10.2.3 LIMITED R&D IN PHYTOGENIC FEED ADDITIVES

10.3 OPPORTUNITIES

10.3.1 RISING DEMAND FOR PHYTOGENIC FEED ADDITIVES IN AQUACULTURE AND PET FEEDS

10.3.2 MEDICINAL PROPERTIES OF HERBS AND SPICES

10.3.3 GROWING DEMAND FOR ORGANIC MEAT

10.4 CHALLENGES

10.4.1 AVAILABILITY AND VOLATILITY OF ORGANIC RAW MATERIALS

10.4.2 THE PREVALENCE OF ADULTERATION AND SIDE EFFECTS OF PHYTOGENIC MATERIALS

11 EUROPE PHYTOGENIC FEED ADDITIVES MARKET, BY REGION

11.1 EUROPE

11.1.1 GERMANY

11.1.2 RUSSIA

11.1.3 SPAIN

11.1.4 FRANCE

11.1.5 POLAND

11.1.6 TURKEY

11.1.7 U.K.

11.1.8 ITALY

11.1.9 NETHERLANDS

11.1.10 DENMARK

11.1.11 BELGIUM

11.1.12 SWEDEN

11.1.13 SWITZERLAND

11.1.14 REST OF EUROPE

12 COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 SWOT

14 COMPANY PROFILE

14.1 CARGILL, INCORPORATED

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 DSM

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 KEMIN INDUSTRIES, INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 ADM

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 NUTRECO

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 BRITISH HORSE FEEDS

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 CUSTOMER DOSTOFARM GMBH

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 GLAMAC INTERNATIONAL PRIVATE LIMITED

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 HIMALAYA WELLNESS COMPANY

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 IGUSOL

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 INDIAN HERBS

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 MIAVIT GMBH

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 NATURAL REMEDIES

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 NOR-FEED

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 ORFFA

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 PHYTOBIOTICS FUTTERZUSATZSTOFFE GMBH

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 SILVATEAM S.P.A.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 TEGASA

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 VINAYAK INGREDIENTS INDIA

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 EUROPE PHYTOGENIC FEED ADDITIVES MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 3 EUROPE PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 EUROPE PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE OF ANIMAL FEED, 2021-2030 (USD MILLION)

TABLE 5 EUROPE POULTRY FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 EUROPE RUMINANTS FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 EUROPE SWINE FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 EUROPE AQUA FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 EUROPE FISH IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 EUROPE MOLLUSKS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 EUROPE CRUSTACEANS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 EUROPE PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCES, 2021-2030 (USD MILLION)

TABLE 13 EUROPE HERBS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 14 EUROPE SPICES IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 EUROPE PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 16 EUROPE PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 17 GERMANY PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 GERMANY PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE OF ANIMAL FEED, 2021-2030 (USD MILLION)

TABLE 19 GERMANY POULTRY FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 20 GERMANY RUMINANTS FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 GERMANY SWINE FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 22 GERMANY AQUA FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 GERMANY FISH IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 24 GERMANY MOLLUSKS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 GERMANY CRUSTACEANS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 26 GERMANY PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCES, 2021-2030 (USD MILLION)

TABLE 27 GERMANY HERBS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 GERMANY SPICES IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 GERMANY PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 30 GERMANY PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 31 RUSSIA PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 RUSSIA PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE OF ANIMAL FEED, 2021-2030 (USD MILLION)

TABLE 33 RUSSIA POULTRY FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 RUSSIA RUMINANTS FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 RUSSIA SWINE FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 36 RUSSIA AQUA FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 RUSSIA FISH IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 38 RUSSIA MOLLUSKS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 RUSSIA CRUSTACEANS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 RUSSIA PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCES, 2021-2030 (USD MILLION)

TABLE 41 RUSSIA HERBS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 RUSSIA SPICES IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 RUSSIA PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 44 RUSSIA PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 45 SPAIN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 SPAIN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE OF ANIMAL FEED, 2021-2030 (USD MILLION)

TABLE 47 SPAIN POULTRY FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 SPAIN RUMINANTS FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 SPAIN SWINE FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 SPAIN AQUA FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 SPAIN FISH IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 SPAIN MOLLUSKS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 53 SPAIN CRUSTACEANS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 SPAIN PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCES, 2021-2030 (USD MILLION)

TABLE 55 SPAIN HERBS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 56 SPAIN SPICES IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 57 SPAIN PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 58 SPAIN PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 59 FRANCE PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 FRANCE PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE OF ANIMAL FEED, 2021-2030 (USD MILLION)

TABLE 61 FRANCE POULTRY FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 62 FRANCE RUMINANTS FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 63 FRANCE SWINE FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 FRANCE AQUA FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 FRANCE FISH IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 FRANCE MOLLUSKS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 FRANCE CRUSTACEANS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 FRANCE PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCES, 2021-2030 (USD MILLION)

TABLE 69 FRANCE HERBS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 FRANCE SPICES IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 FRANCE PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 72 FRANCE PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 73 POLAND PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 74 POLAND PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE OF ANIMAL FEED, 2021-2030 (USD MILLION)

TABLE 75 POLAND POULTRY FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 POLAND RUMINANTS FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 77 POLAND SWINE FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 POLAND AQUA FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 79 POLAND FISH IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 POLAND MOLLUSKS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 POLAND CRUSTACEANS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 POLAND PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCES, 2021-2030 (USD MILLION)

TABLE 83 POLAND HERBS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 84 POLAND SPICES IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 POLAND PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 86 POLAND PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 87 TURKEY PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 88 TURKEY PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE OF ANIMAL FEED, 2021-2030 (USD MILLION)

TABLE 89 TURKEY POULTRY FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 90 TURKEY RUMINANTS FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 91 TURKEY SWINE FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 92 TURKEY AQUA FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 93 TURKEY FISH IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 94 TURKEY MOLLUSKS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 95 TURKEY CRUSTACEANS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 TURKEY PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCES, 2021-2030 (USD MILLION)

TABLE 97 TURKEY HERBS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 TURKEY SPICES IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 TURKEY PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 100 TURKEY PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 101 U.K. PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 U.K. PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE OF ANIMAL FEED, 2021-2030 (USD MILLION)

TABLE 103 U.K. POULTRY FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 104 U.K. RUMINANTS FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 105 U.K. SWINE FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 106 U.K. AQUA FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 U.K. FISH IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 108 U.K. MOLLUSKS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 U.K. CRUSTACEANS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 110 U.K. PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCES, 2021-2030 (USD MILLION)

TABLE 111 U.K. HERBS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 112 U.K. SPICES IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 113 U.K. PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 114 U.K. PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 115 ITALY PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 116 ITALY PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE OF ANIMAL FEED, 2021-2030 (USD MILLION)

TABLE 117 ITALY POULTRY FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 118 ITALY RUMINANTS FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 119 ITALY SWINE FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 120 ITALY AQUA FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 121 ITALY FISH IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 122 ITALY MOLLUSKS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 123 ITALY CRUSTACEANS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 124 ITALY PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCES, 2021-2030 (USD MILLION)

TABLE 125 ITALY HERBS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 126 ITALY SPICES IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 127 ITALY PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 128 ITALY PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 129 NETHERLANDS PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 NETHERLANDS PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE OF ANIMAL FEED, 2021-2030 (USD MILLION)

TABLE 131 NETHERLANDS POULTRY FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 132 NETHERLANDS RUMINANTS FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 133 NETHERLANDS SWINE FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 134 NETHERLANDS AQUA FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 135 NETHERLANDS FISH IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 136 NETHERLANDS MOLLUSKS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 137 NETHERLANDS CRUSTACEANS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 138 NETHERLANDS PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCES, 2021-2030 (USD MILLION)

TABLE 139 NETHERLANDS HERBS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 140 NETHERLANDS SPICES IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 141 NETHERLANDS PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 142 NETHERLANDS PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 143 DENMARK PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 144 DENMARK PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE OF ANIMAL FEED, 2021-2030 (USD MILLION)

TABLE 145 DENMARK POULTRY FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 146 DENMARK RUMINANTS FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 147 DENMARK SWINE FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 148 DENMARK AQUA FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 149 DENMARK FISH IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 150 DENMARK MOLLUSKS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 151 DENMARK CRUSTACEANS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 152 DENMARK PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCES, 2021-2030 (USD MILLION)

TABLE 153 DENMARK HERBS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 154 DENMARK SPICES IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 155 DENMARK PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 156 DENMARK PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 157 BELGIUM PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 158 BELGIUM PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE OF ANIMAL FEED, 2021-2030 (USD MILLION)

TABLE 159 BELGIUM POULTRY FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 160 BELGIUM RUMINANTS FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 161 BELGIUM SWINE FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 162 BELGIUM AQUA FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 163 BELGIUM FISH IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 164 BELGIUM MOLLUSKS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 165 BELGIUM CRUSTACEANS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 166 BELGIUM PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCES, 2021-2030 (USD MILLION)

TABLE 167 BELGIUM HERBS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 168 BELGIUM SPICES IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 169 BELGIUM PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 170 BELGIUM PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 171 SWEDEN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 172 SWEDEN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE OF ANIMAL FEED, 2021-2030 (USD MILLION)

TABLE 173 SWEDEN POULTRY FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 174 SWEDEN RUMINANTS FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 175 SWEDEN SWINE FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 176 SWEDEN AQUA FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 177 SWEDEN FISH IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 178 SWEDEN MOLLUSKS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 179 SWEDEN CRUSTACEANS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 180 SWEDEN PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCES, 2021-2030 (USD MILLION)

TABLE 181 SWEDEN HERBS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 182 SWEDEN SPICES IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 183 SWEDEN PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 184 SWEDEN PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 185 SWITZERLAND PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 186 SWITZERLAND PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE OF ANIMAL FEED, 2021-2030 (USD MILLION)

TABLE 187 SWITZERLAND POULTRY FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 188 SWITZERLAND RUMINANTS FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 189 SWITZERLAND SWINE FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 190 SWITZERLAND AQUA FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 191 SWITZERLAND FISH IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 192 SWITZERLAND MOLLUSKS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 193 SWITZERLAND CRUSTACEANS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 194 SWITZERLAND PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCES, 2021-2030 (USD MILLION)

TABLE 195 SWITZERLAND HERBS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 196 SWITZERLAND SPICES IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 197 SWITZERLAND PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 198 SWITZERLAND PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 199 REST OF EUROPE PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 EUROPE PHYTOGENIC FEED ADDITIVES MARKET: SEGMENTATION

FIGURE 2 EUROPE PHYTOGENIC FEED ADDITIVES MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE PHYTOGENIC FEED ADDITIVES MARKET: DROC ANALYSIS

FIGURE 4 EUROPE PHYTOGENIC FEED ADDITIVES MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE PHYTOGENIC FEED ADDITIVES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE PHYTOGENIC FEED ADDITIVES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE PHYTOGENIC FEED ADDITIVES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE PHYTOGENIC FEED ADDITIVES MARKET: SEGMENTATION

FIGURE 9 SURGING DEMAND FOR NATURAL FEED ADDITIVES IS DRIVING THE GROWTH OF THE EUROPE PHYTOGENIC FEED ADDITIVES MARKET IN THE FORECAST PERIOD

FIGURE 10 THE ESSENTIAL OILS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE PHYTOGENIC FEED ADDITIVES MARKET IN 2023 AND 2030

FIGURE 11 SUPPLY CHAIN OF THE EUROPE PHYTOGENIC FEED ADDITIVES MARKET

FIGURE 12 VALUE CHAIN ANALYSIS OF THE EUROPE PHYTOGENIC FEED ADDITIVES MARKET

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE PHYTOGENIC FEED ADDITIVES MARKET

FIGURE 14 AUSTRALIAN PRODUCTION AND CONSUMPTION OF CHICKEN MEAT (IN KT/KG)

FIGURE 15 EUROPE PHYTOGENIC FEED ADDITIVES MARKET: SNAPSHOT (2022)

FIGURE 16 EUROPE PHYTOGENIC FEED ADDITIVES MARKET: BY COUNTRY (2022)

FIGURE 17 EUROPE PHYTOGENIC FEED ADDITIVES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 18 EUROPE PHYTOGENIC FEED ADDITIVES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 19 EUROPE PHYTOGENIC FEED ADDITIVES MARKET: BY TYPE (2023-2030)

FIGURE 20 EUROPE PHYTOGENIC FEED ADDITIVES MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.