Mercado europeo de barras de cereales y frutos secos, por tipo de producto (barras de cereales y barras de frutos secos), afirmación (normal, sin gluten, vegana, sin lactosa, sin colorantes ni conservantes artificiales y otros), categoría (normal, barra de reemplazo de comidas , barras pre-entrenamiento, barras post-entrenamiento, barras de yoga y otras), naturaleza (convencional y orgánica), sabor (normal y sabor), tipo de paquete (paquete individual, paquete familiar/multipaquete y otros), embalaje (envoltorio, bolsas, caja de cartón y otros), marca (de marca y privada), canal de distribución (minoristas en tiendas y minoristas fuera de tiendas) - Tendencias de la industria y pronóstico hasta 2029.

En la actualidad, en el mercado se encuentran disponibles diversas barritas de cereales y frutos secos en muchos sabores, como chocolate, caramelo, fresa, arándanos y otros. Se prevé que la creciente demanda de snacks sustitutivos de comidas y el aumento de la demanda de snacks para llevar y en porciones pequeñas entre los consumidores europeos impulsen la demanda del mercado europeo de barritas de cereales y frutos secos. Sin embargo, un aumento de la prevalencia de las alergias a los frutos secos y la presencia de herbicidas en los productos a base de granola pueden obstaculizar el crecimiento del mercado.

Varias empresas están tomando decisiones estratégicas, como lanzar innovadoras barras de cereales y frutos secos y adquirir otras empresas para mejorar su cuota de mercado. Como resultado, el mercado europeo de barras de cereales y frutos secos podría crecer a un ritmo rápido.

El informe sobre el mercado de barritas de cereales y frutos secos de Europa proporciona detalles sobre la cuota de mercado, los nuevos desarrollos y el análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un informe de analista; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado. Se espera que la creciente demanda de barritas sin azúcar entre los consumidores impulse el crecimiento del mercado en el período de pronóstico.

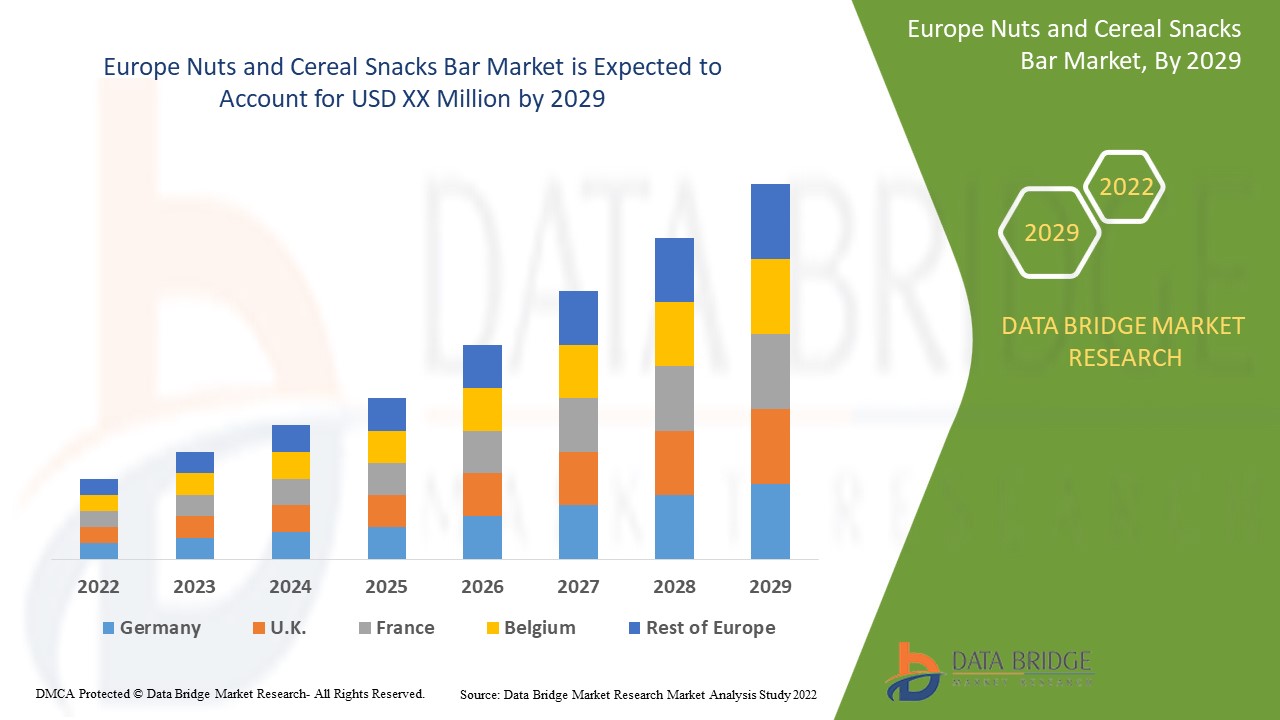

El mercado europeo de barritas de cereales y frutos secos es favorable y tiene como objetivo reducir la progresión de la enfermedad. Data Bridge Market Research analiza que se espera que el mercado europeo de barritas de cereales y frutos secos crezca a una tasa compuesta anual del 5,2 % durante el período de pronóstico de 2022 a 2029.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Tipo de producto (barritas de cereales y barritas de frutos secos), declaración (normal, sin gluten, vegana, sin lactosa, sin colorantes ni conservantes artificiales y otros), categoría (normal, barrita de sustitución de comidas, barritas para antes y después del entrenamiento, barritas para yoga y otras), naturaleza (convencional y orgánica ), sabor (normal y con sabor), tipo de envase (paquete individual, paquete familiar/paquete múltiple y otros), embalaje (envoltorio, bolsas, caja de cartón y otros), marca (de marca y de marca blanca), canal de distribución (minoristas con sede en tiendas y minoristas sin tiendas), país (Reino Unido, Alemania, Francia, Bélgica, Países Bajos, Italia, Dinamarca, Suecia, Rusia, España, Suiza, Polonia, Turquía y resto de Europa) |

|

Países cubiertos |

Reino Unido, Alemania, Francia, Bélgica, Países Bajos, Italia, Dinamarca, Suecia, Rusia, España, Suiza, Polonia, Turquía y el resto de Europa |

|

Actores del mercado cubiertos |

Mondelez International, General Mills Inc., Kellogg's Company, The Simply Good Foods Company, Associated British Foods plc, Nestlé, The Quaker Oats Company, Clif Bar and Company., Cerealto Siro Foods, Danone, Bühler, Mars, Incorporated y sus afiliadas, Eat Naturals, Healthy Bars, Hero Group, entre otras. |

Definición de mercado:

Las barritas de cereales o frutos secos son productos versátiles que suelen elaborarse con frutos secos, cereales y otros ingredientes para aportar nutrientes saludables y fibra dietética a los consumidores. Las barritas de cereales o frutos secos se pueden consumir como parte de una comida (como parte del almuerzo, el desayuno o la cena), como postre y como sustituto de una comida. Las barritas de cereales están diseñadas como barritas nutricionales para ofrecer nutrición a los consumidores. Son una alternativa saludable a los snacks convencionales, ya que son ricas en fibra, proteínas y otros ingredientes nutricionales. Además, los fabricantes ofrecen barritas bajas en calorías o con azúcar, barritas veganas, barritas sin lactosa o sin gluten, sin conservantes ni colorantes artificiales para atraer a los consumidores.

Dinámica del mercado de barritas de cereales y frutos secos en Europa

Conductores

- Creciente lanzamiento de una variedad de frutos secos y barritas de snacks con composición diversa

El estilo de vida cada vez más acelerado y ajetreado ha provocado muchos problemas de salud entre los consumidores en los últimos años. Por ello, las personas optan por un estilo de vida más saludable y mantienen el control de la ingesta de nutrientes como el azúcar, los carbohidratos y otros.

Los fabricantes de frutos secos y snacks han creado nuevos productos sin azúcar que reducen la absorción de azúcar del organismo. Muchas empresas están lanzando nuevos productos de barritas de frutos secos y snacks con composiciones muy diversas.

- Alta demanda de snacks y barritas de snack

La creciente conciencia sobre la salud y el cambio en el estilo de vida de los consumidores europeos son los principales factores que impulsan el crecimiento del mercado.

Varios países de Europa están optando por tendencias en alimentos y snacks saludables. Los consumidores del Reino Unido se centran más en las barritas de snacks de fácil preparación que ofrecen varios beneficios para la salud, mientras que Alemania es el gran mercado de snacks orgánicos. En Alemania, la cultura alimentaria se está volviendo más vegana. A medida que aumenta la conciencia de los consumidores sobre la nutrición, las industrias alimentarias se adaptan para producir snacks saludables.

En la mayoría de los países europeos, el ritmo de vida de los ciudadanos se ha vuelto muy agitado. En países como el Reino Unido, Alemania y los Países Bajos, la gente opta por el sarampión, que requiere menos tiempo y ofrece diversos beneficios nutricionales para la salud. Alrededor de una cuarta parte de los consumidores desayunan en menos de cinco minutos durante los días laborables. Esto aumenta la demanda de comida preparada e impulsa las ventas de snacks en toda Europa.

Oportunidad

- Gran demanda de barritas de snack sin azúcar o con bajo contenido de azúcar

El consumo excesivo de azúcar provoca diabetes y obesidad. Europa ya cuenta con una base de consumidores considerable de personas con diabetes que prefieren productos sin azúcar. Según la Asociación Británica de Diabéticos, la población con diagnóstico de diabetes en el Reino Unido aumentó de 3 millones de personas en 2012 a 3,9 millones en 2019.

Este factor está ayudando a los fabricantes de barritas de frutos secos sin azúcar a penetrar más en el mercado. Están posicionando y promocionando su producto como sin azúcar para atraer a los pacientes diabéticos. También se centran en aumentar la oferta de productos, de modo que los consumidores diabéticos no tengan una variedad limitada de productos.

En la actualidad, los consumidores, especialmente los jóvenes, se están volviendo extremadamente cautelosos con respecto a su salud. Son plenamente conscientes de los efectos nocivos de la obesidad, por lo que evitan los productos alimenticios a base de azúcar como medida de seguridad y precaución. Este factor también ha aumentado las oportunidades para que los fabricantes de frutos secos y barritas de snack atiendan no solo a los consumidores diabéticos, sino también a los no diabéticos. También se observan iniciativas gubernamentales para reducir el consumo de azúcar en Europa.

Restricciones/Desafíos

Muchos consumidores europeos sufren alergias a los cacahuetes y a los frutos secos. Entre los síntomas que provocan se encuentran goteo nasal, picor en la piel, erupciones cutáneas, problemas digestivos como dolor de estómago, calambres, náuseas o vómitos, hormigueo en la garganta y la boca, entre otros. Este factor puede obstaculizar el crecimiento del mercado, ya que los consumidores son escépticos antes de comprar los productos.

En Europa también se registra un elevado número de casos de enfermedad celíaca. En 2014, una amplia investigación basada en pruebas serológicas confirmó que entre el 0,5 y el 1 % de la población de la Unión Europea padece enfermedad celíaca no diagnosticada. Sin embargo, la estimación más alta de los estudios poblacionales relacionados con la enfermedad celíaca es de aproximadamente el 1 %. Además, al considerar los datos de varios períodos, la incidencia de la enfermedad celíaca parece oscilar entre 0,1 y 3,7/1000 nacidos vivos en la población infantil, mientras que en la población adulta es de 1,3 a 39/100 000/año.

Según el Comité de Negociación de Servicios Farmacéuticos de 2015, "alrededor del 1% de la población del Reino Unido padece celiaquía, pero solo el 24% de ellos está diagnosticado. Esto significa que aproximadamente 500.000 personas en el Reino Unido siguen sin diagnosticar". Este factor también afecta a las ventas del segmento de barritas de cereales y está frenando el crecimiento del mercado.

Además, este mercado está creciendo rápidamente. Con el aumento de la demanda de barritas de frutos secos y snacks, han surgido muchos nuevos fabricantes en el mercado europeo. Los fabricantes están desarrollando muchos productos nuevos para satisfacer la creciente demanda de barritas.

Estos fabricantes internacionales de frutos secos y barras de snack tienen una popularidad mundial por sus productos, lo que afecta a los fabricantes locales de frutos secos y barras de snack.

Debido a la gran demanda de barritas de snack, se han introducido en el mercado muchos fabricantes locales. Además, estos fabricantes locales ofrecen barritas de snack y frutos secos a un coste bajo en comparación con otros grandes fabricantes. Estos fabricantes locales pueden crear una gran competencia para los grandes fabricantes de barritas de snack y frutos secos, ya que las empresas obtienen los mismos productos de los fabricantes locales a precios muy bajos.

Entre los fabricantes locales de snacks se encuentran Gutschermühle Traismauer Gmbh, Pataza Pty Ltd, Skinni Snax, Levom Grup Gida Ürünler y muchos más. Sin embargo, debido al aumento del coste de los frutos secos y las barritas de snacks de las empresas internacionales, los fabricantes locales han reducido relativamente sus productos para obtener una ventaja competitiva en el mercado, lo que supone un reto para los fabricantes globales.

El COVID-19 tuvo un gran impacto en el mercado europeo de barritas de cereales y frutos secos

Durante la pandemia, la volátil demanda del mercado de productos finales a base de frutos secos pertenecientes a categorías como snacks, lácteos, panadería y confitería ha afectado negativamente a la cadena de suministro de productos de frutos secos. Se espera una proyección de crecimiento decente en la dinámica de consumo de productos de frutos secos como ingrediente principal. Los actores de la cadena de suministro en el mercado de productos de frutos secos se están preparando para atender picos inesperados tras la tibia demanda de frutos secos y sus productos de valor añadido. Durante el confinamiento por COVID-19 en todos los países, las interrupciones en la cadena de suministro supusieron un reto para el mercado. COVID-19 afectó a varias industrias manufactureras y prestadoras de servicios en el año 2020-2021, ya que provocó el cierre de lugares de trabajo, la interrupción de las cadenas de suministro y restricciones al transporte. El desequilibrio entre la demanda y la oferta y su impacto en los precios se considera de corto plazo y se espera que se recupere a medida que esta pandemia llegue a su fin. Debido al brote de COVID-19 en todo el mundo, la demanda de productos de desayuno saludables como barritas de cereales ha aumentado enormemente. Además, las personas infectadas necesitaban una dieta proteica natural y saludable, lo que ayudó a que el mercado europeo de barras de cereales y frutos secos creciera durante la pandemia.

El informe sobre el mercado de barras de cereales y nueces en Europa proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado por categoría, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de barras de cereales y nueces en Europa, comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Desarrollo reciente

- En diciembre de 2020, el Grupo Ferrero adquirió Eat Natural para ampliar su cartera global de snacks con 'Eat Natural'. Tiene previsto conservar la dirección y los empleados actuales de la empresa. Mantuvo la confidencialidad de los términos financieros. Es una apuesta estratégica para la empresa, ya que ampliará su presencia general en un mercado de snacks saludables. Mejorará la distribución y se expandirá a nuevos mercados en toda su serie de productos.

Mercado europeo de snacks de cereales y frutos secos

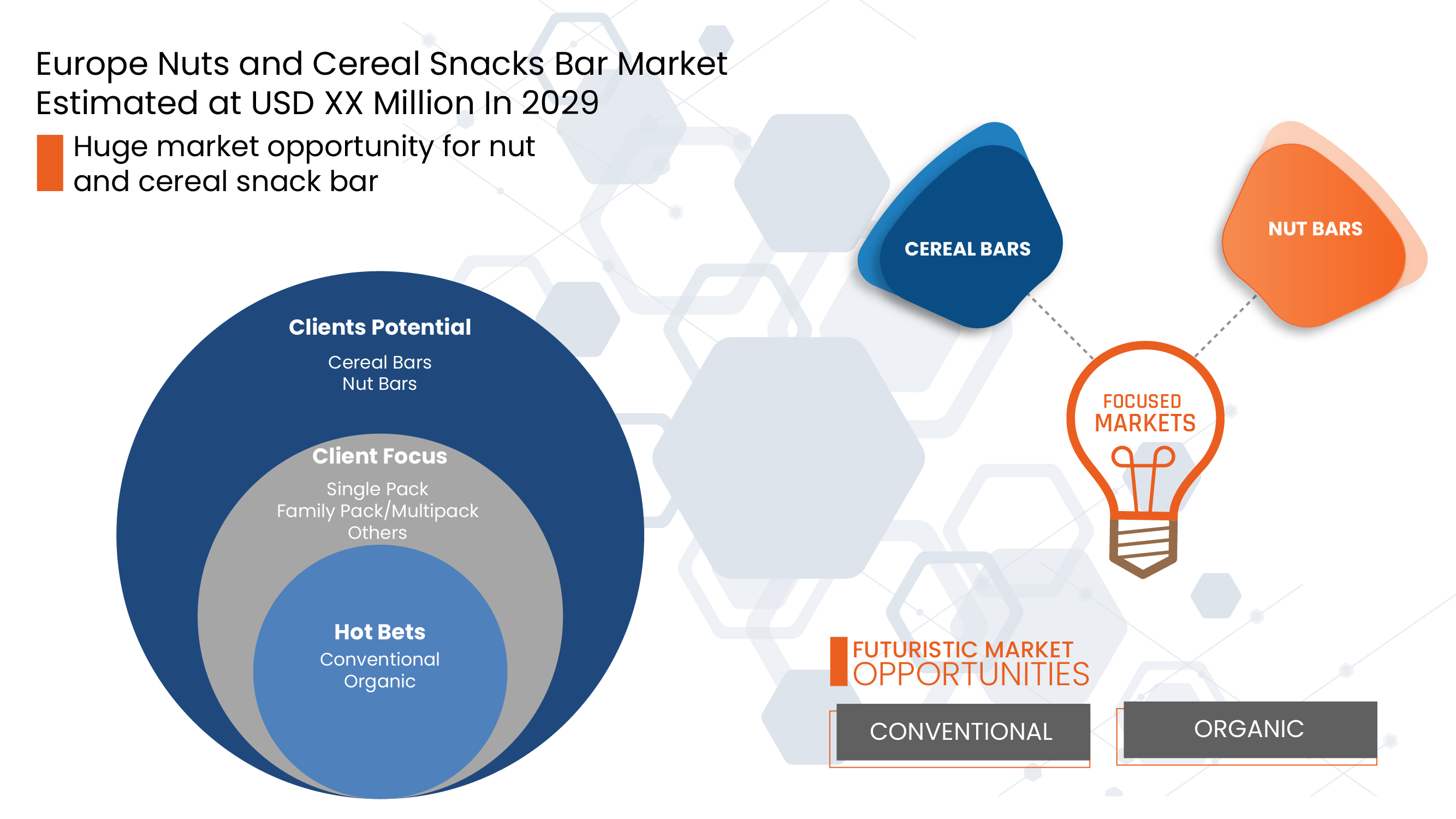

El mercado europeo de barritas de cereales y frutos secos está segmentado en nueve segmentos importantes según el tipo de producto, el reclamo, la categoría, la naturaleza, el sabor, el tipo de envase, el embalaje, la marca y el canal de distribución. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

Tipo de producto

- Barras de cereales

- Barras de nueces

Sobre la base del tipo de producto, el mercado europeo de barras de cereales y frutos secos se segmenta en barras de cereales y barras de frutos secos.

Afirmar

- Regular

- Sin gluten

- Vegano

- Sin lactosa

- Sin colorantes ni conservantes artificiales

- Otros

Sobre la base de un reclamo, el mercado europeo de barras de cereales y frutos secos se segmenta en regular, sin gluten, vegano, sin lactosa, sin colorantes ni conservantes artificiales y otros.

- Categoría

- Regular

- Barra sustitutiva de comidas

- Barras pre-entrenamiento

- Barras post entrenamiento

- Barras de yoga

- Otros

Sobre la base de la categoría, el mercado europeo de barras de cereales y frutos secos se segmenta en barras regulares, barras de reemplazo de comidas, barras pre-entrenamiento, barras post-entrenamiento, barras de yoga y otras.

- Naturaleza

- Convencional

- Orgánico

En función de la naturaleza, el mercado europeo de barras de cereales y frutos secos se segmenta en convencionales y orgánicos.

- Sabor

- Regular

- Sabor

En función del sabor, el mercado europeo de barras de cereales y frutos secos se segmenta en regulares y con sabor.

- Tipo de paquete

- Paquete individual

- Paquete familiar/Multipack

- Otros

Sobre la base del tipo de paquete, el mercado europeo de barras de cereales y frutos secos se segmenta en un solo paquete, un paquete familiar/multipaquete y otros.

- Embalaje

- Envolver en

- Caja de cartas

- Bolsas

- Otros

Sobre la base del embalaje, el mercado europeo de barras de cereales y frutos secos se segmenta en envoltorios, cajas de cartón, bolsas y otros.

- Marca

- De marca

- Marca privada

Sobre la base de la marca, el mercado europeo de barras de cereales y frutos secos se segmenta en marcas blancas y de marca.

- Canal de distribución

- Venta minorista en tiendas

- Venta minorista sin tiendas

Sobre la base del canal de distribución, el mercado europeo de barras de cereales y frutos secos se segmenta en minoristas con sede en tiendas y minoristas sin tienda.

Análisis y perspectivas del mercado de barras de cereales y frutos secos en Europa

Se analiza el mercado europeo de barras de snacks de cereales y frutos secos, y se proporcionan información y tendencias sobre el tamaño del mercado por país, tipo de producto, reclamo, categoría, naturaleza, sabor, tipo de paquete, embalaje, marca y canal de distribución, como se menciona anteriormente.

Algunos de los países cubiertos en el informe del mercado de barras de cereales y frutos secos de Europa son el Reino Unido, Alemania, Francia, Bélgica, Países Bajos, Italia, Dinamarca, Suecia, Rusia, España, Suiza, Polonia, Turquía y el resto de Europa.

Se espera que el mercado de barritas de cereales y frutos secos de Reino Unido crezca a un ritmo más prometedor en el período de previsión debido a la creciente demanda de productos orgánicos entre los consumidores. Alemania ocupa el segundo puesto debido a los lanzamientos de varios productos por parte de los fabricantes del país, y Francia es el tercer país de mayor crecimiento en el mercado de barritas de cereales y frutos secos de Europa, ya que existe una gran demanda de barritas de cereales y frutos secos fortificados.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas europeas y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de las barras de cereales y frutos secos en Europa

El panorama competitivo del mercado europeo de barritas de cereales y frutos secos proporciona información detallada de los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en el mercado europeo de barritas de cereales y frutos secos.

Algunos de los actores clave del mercado de barras de cereales y frutos secos en Europa son Mondelez International, General Mills Inc., Kellogg's Company, The Simply Good Foods Company, Associated British Foods plc, Nestlé, The Quaker Oats Company, Clif Bar and Company., Cerealto Siro Foods, Danone, Bühler, Mars, Incorporated y sus afiliadas, Eat Naturals, Healthy Bars, Hero Group, entre otros.

Metodología de la investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con tamaños de muestra grandes. Los datos del mercado se analizan y estiman utilizando modelos estadísticos y coherentes del mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Aparte de esto, los modelos de datos incluyen la cuadrícula de posicionamiento de proveedores, el análisis de la línea de tiempo del mercado, la descripción general y la guía del mercado, la cuadrícula de posicionamiento de la empresa, el análisis de la participación de mercado de la empresa, los estándares de medición, el análisis global frente al regional y el análisis de la participación de los proveedores. Solicite una llamada de un analista en caso de tener más consultas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE NUTS AND CEREAL SNACKS BAR MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 AVERAGE GROSS MARGINS

4.2 BRAND COMPETITIVE ANALYSIS

4.3 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

4.3.1 OVERVIEW

4.3.2 SOCIAL FACTORS

4.3.3 CULTURAL FACTORS

4.3.4 PSYCHOLOGICAL FACTORS

4.3.5 PERSONAL FACTORS

4.3.6 ECONOMIC FACTORS

4.3.7 PRODUCT TRAITS

4.3.8 MARKET ATTRIBUTES

4.4 EUROPEAN CONSUMERS DISPOSABLE INCOME/SPEND DYNAMICS

4.5 FASTEST GROWING NEW ENTRANTS

4.6 EUROPE NUTS AND CEREAL SNACKS BAR MARKET- IMPORT & EXPORT ANALYSIS OF RAW MATERIAL

4.6.1 IMPORT OF CASHEW NUTS

4.6.2 IMPORT OF ALMONDS IN EU-28 BY ORIGIN IN MT (SHELLED BASIS)

4.6.3 IMPORT OF NUTS, EDIBLE; ALMONDS, FRESH OR DRIED, IN SHELL IN EU- 2018

4.6.4 EU-28 IMPORTS OF WALNUTS BY ORIGIN IN METRIC TONS (IN-SHELL BASIS)

4.6.5 FRANCE IMPORT OF OATS BY COUNTRY- 2019

4.6.6 EU-28 EXPORTS OF ALMONDS BY DESTINATION IN METRIC TONS (SHELLED BASIS)

4.6.7 EU-28 EXPORT OF WALNUTS BY ORIGIN IN METRIC TONS (IN-SHELL BASIS)

4.7 MACROECONOMIC TRENDS AFFECTING THE MARKET GROWTH

4.7.1 INFLATION

4.7.2 DISPOSABLE INCOME

4.7.3 SOCIAL FACTORS

4.8 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: MARKETING STRATEGY

4.8.1 LAUNCHING ORGANIC AND PLANT-BASED PRODUCTS FOR THE VEGAN POPULATION

4.8.2 THOUGHTFUL PACKAGING AND CAMPAIGN

4.8.3 PARTNERSHIP WITH POPULAR BRANDS

4.8.4 A VAST NETWORK OF DISTRIBUTION

4.9 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, NEW PRODUCT LAUNCH STRATEGY

4.9.1 OVERVIEW

4.9.2 NUMBER OF PRODUCT LAUNCHES

4.9.3 LINE EXTENSION

4.9.4 NEW PACKAGING

4.9.5 RE-LAUNCHED

4.9.6 NEW FORMULATION

4.9.7 DIFFERENTIAL PRODUCT OFFERING

4.9.8 MEETING CONSUMER REQUIREMENT

4.9.9 PACKAGE DESIGNING

4.9.10 PRICING ANALYSIS

4.9.11 PRODUCT POSITIONING

4.9.12 CONCLUSION

4.1 PATENT ANALYSIS OF EUROPE NUTS AND CEREAL SNACKS BAR MARKET

4.10.1 PROMOTIONAL ACTIVITIES

4.10.2 PUBLIC RELATIONS

4.10.3 GEO-LOCATIONAL MARKETING

4.10.4 UNIQUE MARKETING CAMPAIGNS

4.11 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: SHOPPING BEHAVIOUR

4.11.1 BUYING STRATEGIES

4.11.1.1 RECOMMENDATIONS FROM FAMILY & FRIENDS

4.11.1.2 RESEARCH

4.11.1.3 IMPULSIVE

4.11.2 ADVERTISEMENT

4.11.2.1 TELEVISION ADVERTISEMENT

4.11.2.2 ONLINE ADVERTISEMENT

4.11.2.3 IN-STORE ADVERTISEMENT

4.11.2.4 OUTDOOR ADVERTISEMENT

4.12 SUPPLY CHAIN OF EUROPE NUTS AND CEREAL SNACKS BAR MARKET

4.12.1 RAW MATERIAL PROCUREMENT

4.12.2 CEREAL AND NUTS BAR PRODUCTION/PROCESSING

4.12.3 MARKETING AND DISTRIBUTION

4.12.4 END USERS

4.13 VALUE CHAIN OF NUTS AND CEREAL SNACK BARS MARKET

5 REGIONAL SUMMARY

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR MEAL REPLACEMENT SNACKS

6.1.2 SURGE IN DEMAND FOR ON-THE-GO AND SMALL-PORTION SNACKING

6.1.3 RISE IN NUMBER OF HEALTH-CONSCIOUS CONSUMERS AND CHANGING LIFESTYLE

6.1.4 INCREASE IN DISPOSABLE INCOME

6.2 RESTRAINTS

6.2.1 INCREASE IN PREVALENCE OF NUT ALLERGY

6.2.2 HIGH PRICES OF RAW MATERIAL

6.2.3 PRESENCE OF HERBICIDES IN GRANOLA-BASED PRODUCTS

6.3 OPPORTUNITIES

6.3.1 HIGH DEMAND FOR SUGAR-FREE AND LOW SUGAR SNACK BARS

6.3.2 INCREASING DEMAND FOR ORGANIC PRODUCTS FROM CONSUMERS

6.3.3 GROWING NUMBER OF NEW PRODUCT LAUNCH

6.3.4 HIGH DEMAND FOR FORTIFIED NUTS BARS AND CEREAL BARS

6.3.5 GROWING POPULARITY OF SPORTS AND ATHLETIC ACTIVITIES

6.4 CHALLENGES

6.4.1 AVAILABILITY OF ALTERNATIVE BARS

6.4.2 STRINGENT GOVERNMENT REGULATION

6.4.3 INCREASING PRODUCTION COST OF GLUTEN-FREE PRODUCTS

7 IMPACT OF COVID-19 PANDEMIC ON THE EUROPE NUTS AND CEREAL SNACKS BAR MARKET

7.1 COVID-19 IMPACT ON MARKET

7.2 IMPACT ON PRICE

7.3 IMPACT ON DEMAND

7.4 IMPACT ON SUPPLY CHAIN

7.5 STRATEGIC DECISIONS FOR MANUFACTURERS

7.6 CONCLUSION

8 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 CEREAL BAR

8.2.1 GRANOLA BAR

8.2.2 MIXED CEREAL BAR

8.2.3 OAT BAR

8.2.4 RICE BAR

8.2.5 OTHERS

8.3 NUTS BAR

8.3.1 ALMOND

8.3.2 PEANUT

8.3.3 CASHEW

8.3.4 HAZELNUT

8.3.5 OTHERS

9 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY CLAIM

9.1 OVERVIEW

9.2 REGULAR

9.3 GLUTEN FREE

9.4 VEGAN

9.5 ARTIFICIAL COLOR AND PRESERVATIVE FREE

9.6 LACTOSE FREE

9.7 OTHERS

10 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY CATEGORY

10.1 OVERVIEW

10.2 REGULAR

10.3 MEAL REPLACEMENT BAR

10.4 PRE WORK OUT BAR

10.5 POST WORK OUT BAR

10.6 YOGA BAR

10.7 OTHERS

11 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY NATURE

11.1 OVERVIEW

11.2 CONVENTIONAL

11.3 ORGANIC

12 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR

12.1 OVERVIEW

12.2 FLAVOR

12.2.1 CHOCOLATES

12.2.2 NUTS

12.2.3 BLUEBERRY

12.2.4 COCONUT

12.2.5 STRAWBERRY

12.2.6 BANANA

12.2.7 CARAMEL

12.2.8 VANILLA

12.2.9 BLACKBERRY

12.2.10 HONEY

12.2.11 PEPPERMINT

12.2.12 BLACK CURRENT

12.2.13 BLACK BERRY

12.2.14 BLUE BERRY

12.2.15 CHEERY

12.2.16 PEACH

12.2.17 MOCHA

12.2.18 AMARETTO

12.2.19 GREEN TEA

12.2.20 OTHERS

12.3 REGULAR

13 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY PACK TYPE

13.1 OVERVIEW

13.2 FAMILY PACK/MULTIPACK

13.3 SINGLE PACK

13.4 OTHERS

14 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY PACKAGING

14.1 OVERVIEW

14.2 WRAP IN

14.3 CARD BOX

14.4 POUCHES

14.5 OTHERS

15 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY BRAND

15.1 OVERVIEW

15.2 BRANDED

15.3 PRIVATE LABEL

16 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 STORE-BASED RETAILER

16.2.1 SUPERMARKETS/HYPERMARKETS

16.2.2 CONVENIENCE STORES

16.2.3 SPECIALTY RETAILERS

16.2.4 GROCERY RETAILERS

16.2.5 WHOLESALERS

16.2.6 OTHERS

16.3 NON-STORE RETAILER

16.3.1 ONLINE

16.3.2 VENDING MACHINE

17 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY COUNTRY

17.1 EUROPE

17.1.1 U.K.

17.1.2 GERMANY

17.1.3 FRANCE

17.1.4 BELGIUM

17.1.5 NETHERLANDS

17.1.6 ITALY

17.1.7 DENMARK

17.1.8 SWEDEN

17.1.9 RUSSIA

17.1.10 SPAIN

17.1.11 SWITZERLAND

17.1.12 POLAND

17.1.13 TURKEY

17.1.14 REST OF EUROPE

18 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: EUROPE

19 SWOT ANALYSIS

20 COMPANY PROFILE

20.1 KELLOGG'S COMPANY

20.1.1 COMPANY SNAPSHOT

20.1.2 RECENT FINANCIALS

20.1.3 PRODUCT PORTFOLIO

20.1.4 RECENT DEVELOPMENT

20.2 MONDELĒZ INTERNATIONAL

20.2.1 COMPANY SNAPSHOT

20.2.2 RECENT FINANCIALS

20.2.3 PRODUCT PORTFOLIO

20.2.4 RECENT DEVELOPMENTS

20.3 CLIF BAR & COMPANY.

20.3.1 COMPANY SNAPSHOT

20.3.2 PRODUCT PORTFOLIO

20.3.3 RECENT DEVELOPMENT

20.4 THE QUAKER OATS COMPANY

20.4.1 COMPANY SNAPSHOT

20.4.2 RECENT FINANCIALS

20.4.3 PRODUCT PORTFOLIO

20.4.4 RECENT DEVELOPMENTS

20.5 GENERAL MILLS INC.

20.5.1 COMPANY SNAPSHOT

20.5.2 RECENT FINANCIALS

20.5.3 PRODUCT PORTFOLIO

20.5.4 RECENT DEVELOPMENT

20.6 ASSOCIATED BRITISH FOODS PLC

20.6.1 COMPANY SNAPSHOT

20.6.2 RECENT FINANCIALS

20.6.3 PRODUCT PORTFOLIO

20.6.4 RECENT DEVELOPMENTS

20.7 BÜHLER

20.7.1 COMPANY SNAPSHOT

20.7.2 PRODUCT PORTFOLIO

20.7.3 RECENT DEVELOPMENTS

20.8 CEREALTO SIRO FOODS

20.8.1 COMPANY SNAPSHOT

20.8.2 RECENT FINANCIALS

20.8.3 PRODUCT PORTFOLIO

20.8.4 RECENT DEVELOPMENTS

20.9 DANONE

20.9.1 COMPANY SNAPSHOT

20.9.2 RECENT FINANCIALS

20.9.3 PRODUCT PORTFOLIO

20.9.4 RECENT DEVELOPMENTS

20.1 EAT NATURALS

20.10.1 COMPANY SNAPSHOT

20.10.2 PRODUCT PORTFOLIO

20.10.3 RECENT DEVELOPMENT

20.11 HEALTHY BAR

20.11.1 COMPANY SNAPSHOT

20.11.2 PRODUCT PORTFOLIO

20.11.3 RECENT DEVELOPMENTS

20.12 HERO GROUP

20.12.1 COMPANY SNAPSHOT

20.12.2 RECENT FINANCIALS

20.12.3 PRODUCT PORTFOLIO

20.12.4 RECENT DEVELOPMENT

20.13 MARS, INCORPORATED AND ITS AFFILIATES

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENTS

20.14 NESTLÉ

20.14.1 COMPANY SNAPSHOT

20.14.2 RECENT FINANCIALS

20.14.3 PRODUCT PORTFOLIO

20.14.4 RECENT DEVELOPMENTS

20.15 THE SIMPLY GOOD FOODS COMPANY

20.15.1 COMPANY SNAPSHOT

20.15.2 RECENT FINANCIALS

20.15.3 PRODUCT PORTFOLIO

20.15.4 RECENT DEVELOPMENTS

21 QUESTIONARE

22 RELATED REPORTS

Lista de Tablas

TABLE 1 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 EUROPE CEREAL BAR IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 3 EUROPE NUT BAR IN BAR IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY CLAIM, 2020-2029 (USD MILLION)

TABLE 5 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 6 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 7 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 8 EUROPE FLAVOR IN NUTS AND CEREAL SNACKS BAR MARKETS MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 9 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY PACK TYPE, 2020-2029 (USD MILLION)

TABLE 10 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 11 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 12 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 13 EUROPE STORE-BASED RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 14 EUROPE NON-STORE RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 15 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 16 U.K. NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 17 U.K. CEREAL BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 18 U.K. NUTS BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 19 U.K. NUTS AND CEREAL SNACKS BAR MARKET, BY CLAIM, 2020-2029 (USD MILLION)

TABLE 20 U.K. NUTS AND CEREAL SNACKS BAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 21 U.K. NUTS AND CEREAL SNACKS BAR MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 22 U.K. NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 23 U.K. FLAVOR IN NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 24 U.K. NUTS AND CEREAL SNACKS BAR MARKET, BY PACK TYPE, 2020-2029 (USD MILLION)

TABLE 25 U.K. NUTS AND CEREAL SNACKS BAR MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 26 U.K. NUTS AND CEREAL SNACKS BAR MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 27 U.K. NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 28 U.K. STORE-BASED RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 29 U.K. NON-STORE RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 30 GERMANY NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 31 GERMANY CEREAL BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 32 GERMANY NUTS BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 33 GERMANY NUTS AND CEREAL SNACKS BAR MARKET, BY CLAIM, 2020-2029 (USD MILLION)

TABLE 34 GERMANY NUTS AND CEREAL SNACKS BAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 35 GERMANY NUTS AND CEREAL SNACKS BAR MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 36 GERMANY NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 37 GERMANY FLAVOR IN NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 38 GERMANY NUTS AND CEREAL SNACKS BAR MARKET, BY PACK TYPE, 2020-2029 (USD MILLION)

TABLE 39 GERMANY NUTS AND CEREAL SNACKS BAR MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 40 GERMANY NUTS AND CEREAL SNACKS BAR MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 41 GERMANY NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 42 GERMANY STORE-BASED RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 43 GERMANY NON-STORE RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 44 FRANCE NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 45 FRANCE CEREAL BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 46 FRANCE NUTS BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 47 FRANCE NUTS AND CEREAL SNACKS BAR MARKET, BY CLAIM, 2020-2029 (USD MILLION)

TABLE 48 FRANCE NUTS AND CEREAL SNACKS BAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 49 FRANCE NUTS AND CEREAL SNACKS BAR MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 50 FRANCE NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 51 FRANCE FLAVOR IN NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 52 FRANCE NUTS AND CEREAL SNACKS BAR MARKET, BY PACK TYPE, 2020-2029 (USD MILLION)

TABLE 53 FRANCE NUTS AND CEREAL SNACKS BAR MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 54 FRANCE NUTS AND CEREAL SNACKS BAR MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 55 FRANCE NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 56 FRANCE STORE-BASED RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 57 FRANCE NON-STORE RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 58 BELGIUM NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 59 BELGIUM CEREAL BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 BELGIUM NUTS BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 61 BELGIUM NUTS AND CEREAL SNACKS BAR MARKET, BY CLAIM, 2020-2029 (USD MILLION)

TABLE 62 BELGIUM NUTS AND CEREAL SNACKS BAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 63 BELGIUM NUTS AND CEREAL SNACKS BAR MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 64 BELGIUM NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 65 BELGIUM FLAVOR IN NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 66 BELGIUM NUTS AND CEREAL SNACKS BAR MARKET, BY PACK TYPE, 2020-2029 (USD MILLION)

TABLE 67 BELGIUM NUTS AND CEREAL SNACKS BAR MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 68 BELGIUM NUTS AND CEREAL SNACKS BAR MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 69 BELGIUM NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 70 BELGIUM STORE-BASED RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 71 BELGIUM NON-STORE RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 72 NETHERLANDS NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 73 NETHERLANDS CEREAL BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 74 NETHERLANDS NUTS BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 75 NETHERLANDS NUTS AND CEREAL SNACKS BAR MARKET, BY CLAIM, 2020-2029 (USD MILLION)

TABLE 76 NETHERLANDS NUTS AND CEREAL SNACKS BAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 77 NETHERLANDS NUTS AND CEREAL SNACKS BAR MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 78 NETHERLANDS NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 79 NETHERLANDS FLAVOR IN NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 80 NETHERLANDS NUTS AND CEREAL SNACKS BAR MARKET, BY PACK TYPE, 2020-2029 (USD MILLION)

TABLE 81 NETHERLANDS NUTS AND CEREAL SNACKS BAR MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 82 NETHERLANDS NUTS AND CEREAL SNACKS BAR MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 83 NETHERLANDS NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 84 NETHERLANDS STORE-BASED RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 85 NETHERLANDS NON-STORE RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 86 ITALY NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 87 ITALY CEREAL BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 88 ITALY NUTS BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 89 ITALY NUTS AND CEREAL SNACKS BAR MARKET, BY CLAIM, 2020-2029 (USD MILLION)

TABLE 90 ITALY NUTS AND CEREAL SNACKS BAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 91 ITALY NUTS AND CEREAL SNACKS BAR MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 92 ITALY NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 93 ITALY FLAVOR IN NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 94 ITALY NUTS AND CEREAL SNACKS BAR MARKET, BY PACK TYPE, 2020-2029 (USD MILLION)

TABLE 95 ITALY NUTS AND CEREAL SNACKS BAR MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 96 ITALY NUTS AND CEREAL SNACKS BAR MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 97 ITALY NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 98 ITALY STORE-BASED RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 99 ITALY NON-STORE RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 100 DENMARK NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 101 DENMARK CEREAL BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 102 DENMARK NUTS BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 103 DENMARK NUTS AND CEREAL SNACKS BAR MARKET, BY CLAIM, 2020-2029 (USD MILLION)

TABLE 104 DENMARK NUTS AND CEREAL SNACKS BAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 105 DENMARK NUTS AND CEREAL SNACKS BAR MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 106 DENMARK NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 107 DENMARK FLAVOR IN NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 108 DENMARK NUTS AND CEREAL SNACKS BAR MARKET, BY PACK TYPE, 2020-2029 (USD MILLION)

TABLE 109 DENMARK NUTS AND CEREAL SNACKS BAR MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 110 DENMARK NUTS AND CEREAL SNACKS BAR MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 111 DENMARK NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 112 DENMARK STORE-BASED RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 113 DENMARK NON-STORE RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 114 SWEDEN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 115 SWEDEN CEREAL BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 116 SWEDEN NUTS BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 117 SWEDEN NUTS AND CEREAL SNACKS BAR MARKET, BY CLAIM, 2020-2029 (USD MILLION)

TABLE 118 SWEDEN NUTS AND CEREAL SNACKS BAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 119 SWEDEN NUTS AND CEREAL SNACKS BAR MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 120 SWEDEN NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 121 SWEDEN FLAVOR IN NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 122 SWEDEN NUTS AND CEREAL SNACKS BAR MARKET, BY PACK TYPE, 2020-2029 (USD MILLION)

TABLE 123 SWEDEN NUTS AND CEREAL SNACKS BAR MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 124 SWEDEN NUTS AND CEREAL SNACKS BAR MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 125 SWEDEN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 126 SWEDEN STORE-BASED RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 127 SWEDEN NON-STORE RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 128 RUSSIA NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 129 RUSSIA CEREAL BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 130 RUSSIA NUTS BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 131 RUSSIA NUTS AND CEREAL SNACKS BAR MARKET, BY CLAIM, 2020-2029 (USD MILLION)

TABLE 132 RUSSIA NUTS AND CEREAL SNACKS BAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 133 RUSSIA NUTS AND CEREAL SNACKS BAR MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 134 RUSSIA NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 135 RUSSIA FLAVOR IN NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 136 RUSSIA NUTS AND CEREAL SNACKS BAR MARKET, BY PACK TYPE, 2020-2029 (USD MILLION)

TABLE 137 RUSSIA NUTS AND CEREAL SNACKS BAR MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 138 RUSSIA NUTS AND CEREAL SNACKS BAR MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 139 RUSSIA NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 140 RUSSIA STORE-BASED RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 141 RUSSIA NON-STORE RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 142 SPAIN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 143 SPAIN CEREAL BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 144 SPAIN NUTS BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 145 SPAIN NUTS AND CEREAL SNACKS BAR MARKET, BY CLAIM, 2020-2029 (USD MILLION)

TABLE 146 SPAIN NUTS AND CEREAL SNACKS BAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 147 SPAIN NUTS AND CEREAL SNACKS BAR MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 148 SPAIN NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 149 SPAIN FLAVOR IN NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 150 SPAIN NUTS AND CEREAL SNACKS BAR MARKET, BY PACK TYPE, 2020-2029 (USD MILLION)

TABLE 151 SPAIN NUTS AND CEREAL SNACKS BAR MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 152 SPAIN NUTS AND CEREAL SNACKS BAR MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 153 SPAIN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 154 SPAIN STORE-BASED RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 155 SPAIN NON-STORE RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 156 SWITZERLAND NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 157 SWITZERLAND CEREAL BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 158 SWITZERLAND NUTS BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 159 SWITZERLAND NUTS AND CEREAL SNACKS BAR MARKET, BY CLAIM, 2020-2029 (USD MILLION)

TABLE 160 SWITZERLAND NUTS AND CEREAL SNACKS BAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 161 SWITZERLAND NUTS AND CEREAL SNACKS BAR MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 162 SWITZERLAND NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 163 SWITZERLAND FLAVOR IN NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 164 SWITZERLAND NUTS AND CEREAL SNACKS BAR MARKET, BY PACK TYPE, 2020-2029 (USD MILLION)

TABLE 165 SWITZERLAND NUTS AND CEREAL SNACKS BAR MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 166 SWITZERLAND NUTS AND CEREAL SNACKS BAR MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 167 SWITZERLAND NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 168 SWITZERLAND STORE-BASED RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 169 SWITZERLAND NON-STORE RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 170 POLAND NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 171 POLAND CEREAL BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 172 POLAND NUTS BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 173 POLAND NUTS AND CEREAL SNACKS BAR MARKET, BY CLAIM, 2020-2029 (USD MILLION)

TABLE 174 POLAND NUTS AND CEREAL SNACKS BAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 175 POLAND NUTS AND CEREAL SNACKS BAR MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 176 POLAND NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 177 POLAND FLAVOR IN NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 178 POLAND NUTS AND CEREAL SNACKS BAR MARKET, BY PACK TYPE, 2020-2029 (USD MILLION)

TABLE 179 POLAND NUTS AND CEREAL SNACKS BAR MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 180 POLAND NUTS AND CEREAL SNACKS BAR MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 181 POLAND NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 182 POLAND STORE-BASED RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 183 POLAND NON-STORE RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 184 TURKEY NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 185 TURKEY CEREAL BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 186 TURKEY NUTS BARS IN NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 187 TURKEY NUTS AND CEREAL SNACKS BAR MARKET, BY CLAIM, 2020-2029 (USD MILLION)

TABLE 188 TURKEY NUTS AND CEREAL SNACKS BAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 189 TURKEY NUTS AND CEREAL SNACKS BAR MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 190 TURKEY NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 191 TURKEY FLAVOR IN NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 192 TURKEY NUTS AND CEREAL SNACKS BAR MARKET, BY PACK TYPE, 2020-2029 (USD MILLION)

TABLE 193 TURKEY NUTS AND CEREAL SNACKS BAR MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 194 TURKEY NUTS AND CEREAL SNACKS BAR MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 195 TURKEY NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 196 TURKEY STORE-BASED RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 197 TURKEY NON-STORE RETAILER IN NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 198 REST OF EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: SEGMENTATION

FIGURE 2 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: DROC ANALYSIS

FIGURE 4 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: EUROPE VS COUNTRY MARKET ANALYSIS

FIGURE 5 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: SEGMENTATION

FIGURE 10 INCREASING DEMAND FOR MEAL REPLACEMENT SNACKS IS EXPECTED TO DRIVE THE EUROPE NUTS AND CEREAL SNACKS BAR MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 CEREAL BARS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE NUTS AND CEREAL SNACKS BAR MARKET IN 2022 & 2029

FIGURE 12 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: FACTORS AFFECTING DISPOSABLE INCOME OR SPEND DYNAMICS OF THE CONSUMERS

FIGURE 13 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: FACTORS AFFECTING NEW PRODUCT LAUNCHES STRATEGY

FIGURE 14 SUPPLY CHAIN OF EUROPE NUTS AND CEREAL SNACKS BAR MARKET

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE NUTS AND CEREAL SNACKS BAR MARKET

FIGURE 16 EUROPE: COUNTRIES WITH HIGHEST ORGANIC LAND IN 2019 (DATA IN PERCENTAGE)

FIGURE 17 EUROPE NUTS AND CEREAL SNACKS BAR, BY PRODUCT TYPE, 2021

FIGURE 18 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY CLAIM, 2021

FIGURE 19 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY CATEGORY, 2021

FIGURE 20 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY NATURE, 2021

FIGURE 21 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY FLAVOR, 2021

FIGURE 22 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, PACK TYPE, 2021

FIGURE 23 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY PACKAGING, 2021

FIGURE 24 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY BRAND, 2021

FIGURE 25 EUROPE NUTS AND CEREAL SNACKS BAR MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 26 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: SNAPSHOT (2021)

FIGURE 27 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: BY COUNTRY (2021)

FIGURE 28 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: BY COUNTRY (2022 & 2029)

FIGURE 30 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 31 EUROPE NUTS AND CEREAL SNACKS BAR MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.