Europe Next Generation Packaging Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1,766.07 Million

USD

2,800.02 Million

2021

2029

USD

1,766.07 Million

USD

2,800.02 Million

2021

2029

| 2022 –2029 | |

| USD 1,766.07 Million | |

| USD 2,800.02 Million | |

|

|

|

Mercado europeo de embalajes de próxima generación por tipo (embalaje activo, embalaje inteligente y embalaje en atmósfera modificada), función (control de humedad, indicadores de temperatura, detección de vida útil, seguimiento de productos y otros), tecnología (captadores y susceptores, etiquetas RFID, códigos QR, etiquetas NFC, codificación y marcado, sensores y dispositivos de salida y otros), material (plástico, papel, vidrio, cartón corrugado, metal y otros) y aplicación (alimentos, bebidas, cuidado personal, atención médica, logística y cadena de suministro, electrónica de consumo y otros), país (Alemania, Reino Unido, Italia, Francia, España, Rusia, Suiza, Turquía, Bélgica, Países Bajos, Luxemburgo y resto de Europa), tendencias de la industria y pronóstico hasta 2029

Análisis y perspectivas del mercado : mercado europeo de envases de próxima generación

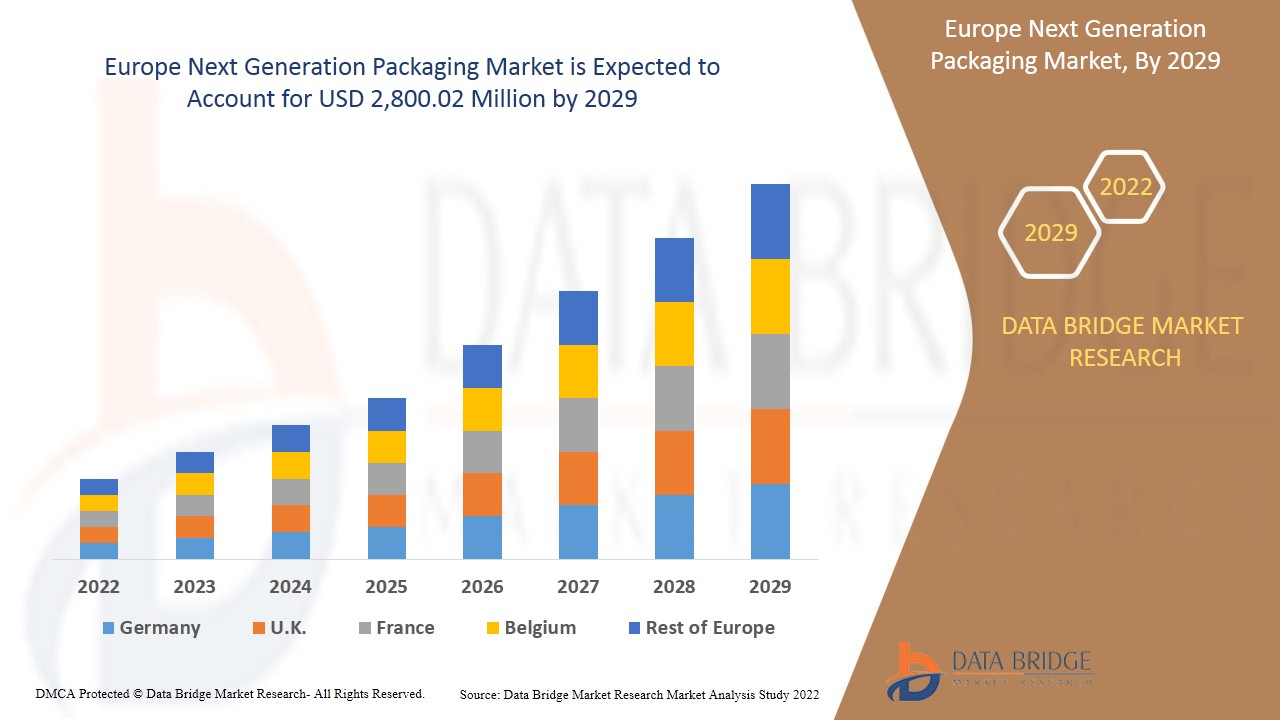

Se espera que el mercado europeo de envases de próxima generación gane un crecimiento significativo en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 5,9% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 2.800,02 millones para 2029 desde USD 1.766,07 millones en 2021.

El embalaje de próxima generación incluye el embalaje activo, inteligente y de atmósfera modificada. Básicamente, se trata de una tecnología de embalaje que posee diferentes características avanzadas, como la trazabilidad, ofrece diversos beneficios, como la extensión de la vida útil del producto y proporciona información sobre la calidad del producto. El término embalaje activo, embalaje inteligente, embalaje inteligente se refiere a los sistemas de embalaje utilizados para alimentos, productos farmacéuticos y varios otros tipos de productos. Ayudan a extender la vida útil, controlar la frescura, mostrar información sobre la calidad, mejorar la seguridad y mejorar la comodidad. Estos términos están estrechamente relacionados. Por ejemplo, el embalaje activo generalmente significa tener funciones activas más allá de la contención pasiva inerte y la protección del producto. El embalaje inteligente y activo generalmente implica la capacidad de detectar o medir un atributo del producto, la atmósfera interna del paquete o el entorno de envío. Esta información se puede comunicar a los usuarios o puede activar funciones de embalaje activo, materia programable y materiales inteligentes, entre otros.

La tendencia reciente indica una creciente demanda de envases de última generación a medida que aumentan las inversiones en las industrias de atención médica pública y privada. Los factores que impulsan el crecimiento del mercado son la creciente conciencia de la salud entre la población en general y los continuos avances tecnológicos en materia de envases. Con el rápido crecimiento de la globalización y el aumento de las exigencias para los alimentos y las bebidas en varios países y regiones, el mercado mundial de envases de última generación experimentará una trayectoria creciente en los próximos años. Sin embargo, el alto costo de los envases restringirá el crecimiento del mercado.

Varias empresas están tomando decisiones estratégicas, como la celebración de acuerdos con centros de investigación para lanzar nuevos productos, con el fin de mejorar su participación en el mercado. Como resultado, el mercado de envases de próxima generación está creciendo a un ritmo rápido.

Para comprender el análisis y el escenario del mercado de envases de próxima generación, comuníquese con Data Bridge Market Research para obtener un resumen analítico. Nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de envases de próxima generación en Europa

El mercado europeo de envases de próxima generación está segmentado en cinco segmentos según el tipo, la función, la tecnología, el material y la aplicación.

El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

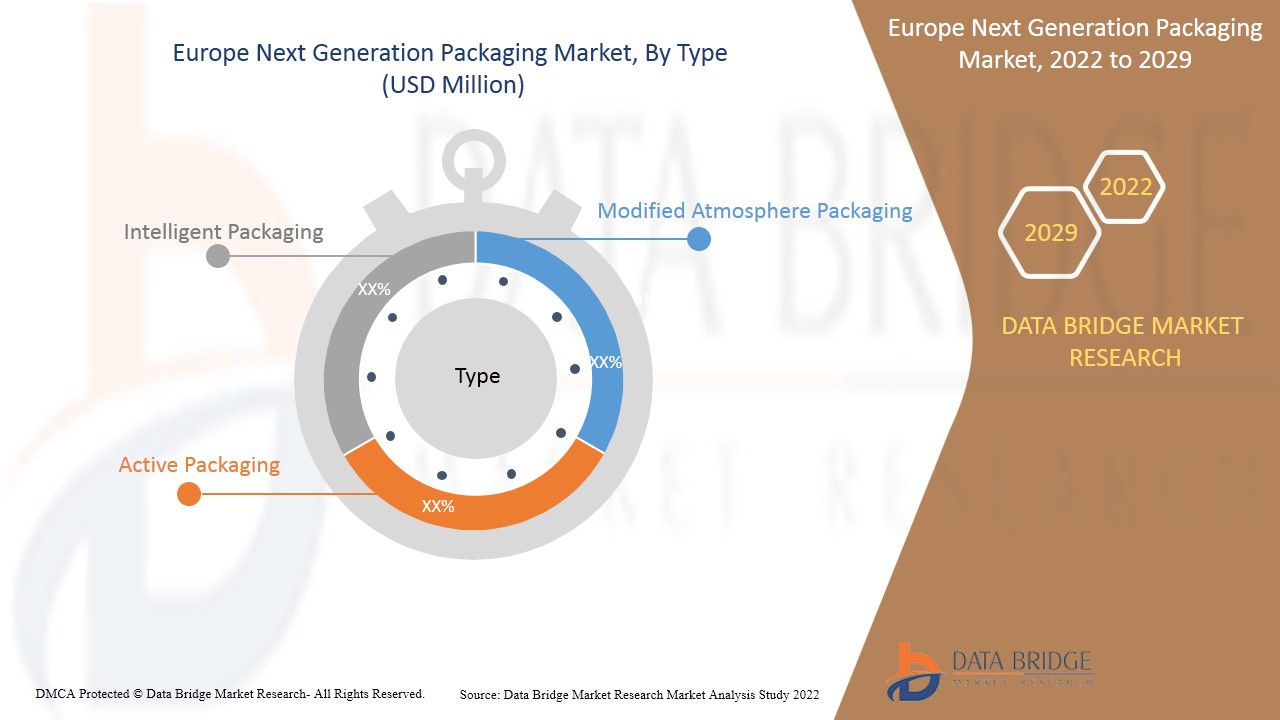

- En función del tipo, el mercado europeo de envases de próxima generación se segmenta en envases activos, envases inteligentes y envases en atmósfera modificada. En 2022, se espera que el segmento de envases activos domine el mercado debido a la gran cantidad de producción y la facilidad de uso de los envases activos.

- En función de la función, el mercado europeo de envases de próxima generación se segmenta en control de humedad, indicadores de temperatura, detección de vida útil, seguimiento del producto y otros. En 2022, se espera que el segmento de control de humedad domine el mercado, ya que es la función de envasado más demandada para extender la vida útil del producto.

- En términos de tecnología, el mercado europeo de envases de próxima generación se segmenta en captadores y susceptores, etiquetas RFID, códigos QR, etiquetas NFC, codificación y marcado, sensores y dispositivos de salida, entre otros. En 2022, se espera que el segmento de captadores y susceptores domine el mercado, ya que brinda un fácil acceso al producto a los consumidores.

- En función del material, el mercado europeo de envases de próxima generación se segmenta en plástico, papel, vidrio, cartón ondulado, metal y otros. En 2022, se espera que el segmento del plástico domine el mercado, ya que los consumidores están interesados en los envases de los productos debido a su asequibilidad.

- En función de la aplicación, el mercado europeo de envases de próxima generación se segmenta en alimentos, bebidas, cuidado personal, atención sanitaria, logística y cadena de suministro, electrónica de consumo y otros. En 2022, se espera que el segmento de alimentos domine el mercado, ya que la demanda de alimentos envasados está aumentando a nivel mundial debido al ajetreado estilo de vida de los consumidores.

El mercado europeo de envases de próxima generación está fragmentado y los principales actores han utilizado diversas estrategias, como lanzamientos de nuevos productos, expansiones, acuerdos, empresas conjuntas, asociaciones, adquisiciones y otras para aumentar su presencia en el mercado de envases de próxima generación.

Europa está segmentada por países en Alemania, Reino Unido, Italia, Francia, España, Rusia, Suiza, Turquía, Bélgica, Países Bajos, Luxemburgo y el resto de Europa. En 2022, se espera que Alemania domine el mercado europeo de envases de próxima generación, debido a la creciente aplicación de este mercado en la industria de alimentos y bebidas.

Las crecientes actividades estratégicas de los principales actores del mercado para mejorar el conocimiento sobre los envases de próxima generación están impulsando el crecimiento del mercado

El mercado europeo de envases de próxima generación también le ofrece un análisis detallado del mercado para el crecimiento de cada país en un mercado en particular. Además, proporciona información detallada sobre la estrategia de los actores del mercado y su presencia geográfica. Los datos están disponibles para el período histórico de 2010 a 2020.

Análisis del panorama competitivo y de la cuota de mercado de los envases de próxima generación en Europa

El panorama competitivo del mercado de envases de próxima generación de Europa ofrece detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de supervivencia de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de envases de próxima generación de Europa.

Entre los principales actores que operan en el mercado europeo de envases de próxima generación se encuentran LCR Hallcrest Ltd, Ampacet Corporation, WestRock Company, Tetra Pak, Scan and win, RR Donnelley & Sons Company, Sonoco Products Company, Smart Packaging, Amcor Plc, CONSTANTIA FLEXIBLES, Klöckner Pentaplast, Graham Packaging Company, Avery Dennison Corporation, DS Smith y Cryolog, entre otros. Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado.

Numerosos desarrollos se están llevando a cabo también en empresas de todo el mundo que están acelerando el mercado europeo de envases de próxima generación.

Por ejemplo,

- En octubre de 2021, RR Donnelley & Sons Company lanzó nuevas etiquetas inteligentes escaneables para señalización minorista, impresión comercial, embalajes, formularios y correo directo. Esto aumentará la base de clientes de la empresa.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE NEXT GENERATION PACKAGING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 SOURCE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 EUROPE NEXT GENERATION PACKAGING MARKET: APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 INDUSTRIAL INSIGHTS: EUROPE NEXT GENERATION PACKAGING MARKET

5.1 DEVELOPMENT OF ADVANCED SMART PACKAGING PRODUCT

5.2 TEMPERATURE BALANCING SMART PACKAGING:

5.3 SMART PACKAGING TO IMPROVE CONSUMER SAFETY:

5.4 CONCLUSION:

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR INTELLIGENT PACKAGING TO AVOID FOOD WASTAGE

6.1.2 INCREASING DISPOSABLE INCOME OF CONSUMERS

6.1.3 INCREASING CASES OF FOOD CONTAMINATION

6.1.4 INCREASE IN THE CONSUMPTION OF PACKAGED PRODUCTS

6.1.5 INCREASING HEALTH AWARENESS AMONG CONSUMERS

6.2 RESTRAINTS

6.2.1 COSTS ASSOCIATED WITH RESEARCH AND DEVELOPMENT ACTIVITIES

6.2.2 HIGH COMPETITION AMONG MARKET PLAYERS

6.3 OPPORTUNITIES

6.3.1 RECENT INNOVATIONS AND NEW PRODUCT LAUNCHES

6.3.2 GROWING ALCOHOLIC AND NON-ALCOHOLIC INDUSTRY WITH ACTIVE AND INTELLIGENT PACKAGING

6.4 CHALLENGES

6.4.1 AVAILABILITY OF ALTERNATIVES IN THE MARKET

6.4.2 SUPPLY CHAIN DISRUPTION DUE TO COVID-19

7 IMPACT OF COVID-19 ON THE EUROPE NEXT GENERATION PACKAGING MARKET

7.1 AWARENESS ABOUT FOOD SAFETY AND QUALITY INCREASED DUE TO THE COVID-19 PANDEMIC

7.2 COVID-19 IMPACT ON DEMAND & SUPPLY CHAIN OF NEXT GENERATION PACKAGING

7.3 IMPACT ON PRICE

7.4 INITIATIVES TAKEN BY MANUFACTURERS

7.5 CONCLUSION

8 EUROPE NEXT GENERATION PACKAGING MARKET, BY TYPE

8.1 OVERVIEW

8.2 ACTIVE PACKAGING

8.2.1 GAS SCAVENGERS/EMITTERS

8.2.2 MICROWAVE SUSCEPTORS

8.2.3 OTHERS

8.3 INTELLIGENT PACKAGING

8.4 MODIFIED ATMOSPHERE PACKAGING

9 EUROPE NEXT GENERATION PACKAGING MARKET, BY FUNCTION

9.1 OVERVIEW

9.2 MOISTURE CONTROL

9.3 TEMPERATURE INDICATORS

9.4 PRODUCT TRACKING

9.5 SHELF LIFE SENSING

9.6 OTHERS

10 EUROPE NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 SCAVENGERS AND SUSCEPTORS

10.3 RFID TAGS

10.4 NFC TAGS

10.5 QR CODES

10.6 SENSORS & OUTPUT DEVICES

10.7 CODING & MARKINGS

10.8 OTHERS

11 EUROPE NEXT GENERATION PACKAGING MARKET, BY MATERIAL

11.1 OVERVIEW

11.2 PLASTIC

11.3 PAPER

11.4 CORRUGATED BOARD

11.5 OTHERS

12 EUROPE NEXT GENERATION PACKAGING MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FOOD

12.2.1 PACKAGED FOOD

12.2.2 PROCESSED FOOD

12.2.2.1 CHILLED

12.2.2.2 DRIED

12.2.3 MEAT & POULTRY

12.2.4 DAIRY

12.2.5 BAKERY & CONFECTIONERY

12.2.6 FRUITS & VEGETABLES

12.2.7 FROZEN FOOD

12.2.8 OTHERS

12.3 BEVERAGES

12.3.1 NON- ALCOHOLIC

12.3.2 ALCOHOLIC

12.4 PERSONAL CARE

12.5 HEALTH CARE

12.6 LOGISTICS & SUPPLY CHAIN

12.7 CONSUMER ELECTRONICS

12.8 OTHERS

13 EUROPE NEXT GENERATION PACKAGING MARKET, BY REGION

13.1 EUROPE

13.1.1 GERMANY

13.1.2 FRANCE

13.1.3 U.K.

13.1.4 ITALY

13.1.5 SPAIN

13.1.6 RUSSIA

13.1.7 BELGIUM

13.1.8 NETHERLANDS

13.1.9 SWITZERLAND

13.1.10 TURKEY

13.1.11 LUXEMBURG

13.1.12 REST OF EUROPE

14 COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 AVERY DENNISON CORPORATION

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 DUPONT

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 BALL CORPORATION

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 GRAHAM PACKAGING COMPANY

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 R.R. DONNELLEY & SONS COMPANY

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ACTIVE PACKAGING

16.6.1 COMPANY SANPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 AMCOR PLC

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 AMERPLAST

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 AMERICAN THERMAL INSTRUMENTS

16.9.1 COMPANY SANPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 CORTEC PACKAGING

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 KLÖCKNER PENTAPLAST

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 MICROBEGUARD CORPORATION

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 MITSUBISHI GAS CHEMICAL COMPANY, INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 SAES GETTERS S.P.A.

16.14.1 COMPANY SANPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 SEALED AIR

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENT

16.16 TEMPTIME CORPORATION.

16.16.1 COMPANY SANPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 TOPPAN INC.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 VESTA

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 EUROPE NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 EUROPE ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 EUROPE ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 EUROPE INTELLIGENT PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE MODIFIED ATMOSPHERE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 EUROPE NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE MOISTURE CONTROL IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE TEMPERATURE INDICATORS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE PRODUCT TRACKING IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE SHELF LIFE SENSING IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE OTHERS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 13 EUROPE SCAVENGERS AND SUSCEPTORS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE RFID TAGS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE NFC TAGS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE QR CODES IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE SENSORS & OUTPUT DEVICES IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE CODING & MARKINGS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE OTHERS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 21 EUROPE PLASTIC IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE PAPER IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE CORRUGATED BOARD IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE OTHERS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE FOOD IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICTION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE PERSONAL CARE IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 EUROPE HEALTHCARE IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE LOGISTICS & SUPPLY CHAIN IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE CONSUMER ELECTRONICS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE OTHERS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 EUROPE NEXT GENERATION PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 37 EUROPE NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 EUROPE ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 EUROPE NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 40 EUROPE NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 41 EUROPE NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 42 EUROPE NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 43 EUROPE FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 EUROPE PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 EUROPE BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 GERMANY NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 GERMANY ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 GERMANY NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 49 GERMANY NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 50 GERMANY NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 51 GERMANY NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 GERMANY FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 GERMANY PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 GERMANY BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 FRANCE NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 FRANCE ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 FRANCE NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 58 FRANCE NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 59 FRANCE NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 60 FRANCE NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 FRANCE FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 FRANCE PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 FRANCE BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 U.K. NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 U.K. ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 U.K. NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 67 U.K. NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 68 U.K. NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 69 U.K. NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 U.K. FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 U.K. PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 72 U.K. BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 ITALY NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 ITALY ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 ITALY NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 76 ITALY NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 77 ITALY NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 78 ITALY NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 ITALY FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 ITALY PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 ITALY BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 SPAIN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 SPAIN ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 SPAIN NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 85 SPAIN NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 86 SPAIN NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 87 SPAIN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 88 SPAIN FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 89 SPAIN PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 SPAIN BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 91 RUSSIA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 RUSSIA ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 RUSSIA NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 94 RUSSIA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 95 RUSSIA NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 96 RUSSIA NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 RUSSIA FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 RUSSIA PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 99 RUSSIA BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 100 BELGIUM NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 BELGIUM ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 BELGIUM NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 103 BELGIUM NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 104 BELGIUM NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 105 BELGIUM NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 106 BELGIUM FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 107 BELGIUM PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 108 BELGIUM BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 NETHERLANDS NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 NETHERLANDS ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 NETHERLANDS NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 112 NETHERLANDS NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 113 NETHERLANDS NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 114 NETHERLANDS NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 115 NETHERLANDS FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 116 NETHERLANDS PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 117 NETHERLANDS BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 118 SWITZERLAND NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 SWITZERLAND ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 SWITZERLAND NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 121 SWITZERLAND NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 122 SWITZERLAND NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 123 SWITZERLAND NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 124 SWITZERLAND FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 125 SWITZERLAND PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 126 SWITZERLAND BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 127 TURKEY NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 TURKEY ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 TURKEY NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 130 TURKEY NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 131 TURKEY NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 132 TURKEY NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 133 TURKEY FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 TURKEY PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 TURKEY BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 LUXEMBURG NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 LUXEMBURG ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 LUXEMBURG NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 139 LUXEMBURG NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 140 LUXEMBURG NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 141 LUXEMBURG NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 142 LUXEMBURG FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 143 LUXEMBURG PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 144 LUXEMBURG BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 145 REST OF EUROPE NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 EUROPE NEXT GENERATION PACKAGING MARKET: SEGMENTATION

FIGURE 2 EUROPE NEXT GENERATION PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE NEXT GENERATION PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE NEXT GENERATION PACKAGING MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE NEXT GENERATION PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE NEXT GENERATION PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE NEXT GENERATION PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE NEXT GENERATION PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE NEXT GENERATION PACKAGING MARKET: SEGMENTATION

FIGURE 10 ASIA-PACIFIC IS EXPECTED TO DOMINATE EUROPE NEXT GENERATION PACKAGING MARKET AND IS EXPECTED TO GROW WITH HIGHEST CAGR IN FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 AN INCREASE IN CONSUMPTION OF BEVERAGES AND HEALTH AWARENESS AMONG CONSUMERS IS EXPECTED TO DRIVE EUROPE NEXT GENERATION PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 PACKAGING TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR LARGEST SHARE OF EUROPE NEXT GENERATION PACKAGING MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE NEXT GENERATION PACKAGING MARKET

FIGURE 14 EUROPE NEXT GENERATION PACKAGING MARKET, BY TYPE, 2021

FIGURE 15 EUROPE NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2021

FIGURE 16 EUROPE NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2021

FIGURE 17 EUROPE NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2021

FIGURE 18 EUROPE NEXT GENERATION MARKET, BY APPLICATION, 2021

FIGURE 19 EUROPE NEXT GENERATION PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 20 EUROPE NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 21 EUROPE NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 22 EUROPE NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 23 EUROPE NEXT GENERATION PACKAGING MARKET: BY TYPE (2022 & 2029)

FIGURE 24 EUROPE NEXT GENERATION PACKAGING MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.