Europe Mobility As A Service Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

71.97 Billion

USD

743.73 Billion

2025

2033

USD

71.97 Billion

USD

743.73 Billion

2025

2033

| 2026 –2033 | |

| USD 71.97 Billion | |

| USD 743.73 Billion | |

|

|

|

|

Mercado de movilidad como servicio en Europa, por tipo de servicio (automóvil compartido, autobús compartido, tren, viajes en taxi, bicicletas compartidas, automóviles autónomos y otros), solución (soluciones de navegación, soluciones de emisión de billetes, plataformas tecnológicas, servicios de seguros, proveedores de conectividad de telecomunicaciones y motores de pago), tipo de transporte (público y privado), tipo de vehículo (vehículos de cuatro ruedas, autobús, tren y micromovilidad), plataforma de aplicación (IOS, Android y otros), tipo de requisito (conectividad de primera y última milla, desplazamientos fuera de horas punta y al trabajo por turnos, desplazamientos diarios, viajes al aeropuerto o estaciones de transporte público, viajes entre ciudades y otros), tamaño de la organización (grandes empresas y pequeñas y medianas empresas (PYME)), uso (comercial y personal), país (Alemania, Francia, Reino Unido, Italia, España, Rusia, Turquía, Bélgica, Países Bajos, Suiza y resto de Europa), tendencias de la industria y pronóstico hasta 2028

Análisis y perspectivas del mercado: mercado europeo de la movilidad como servicio

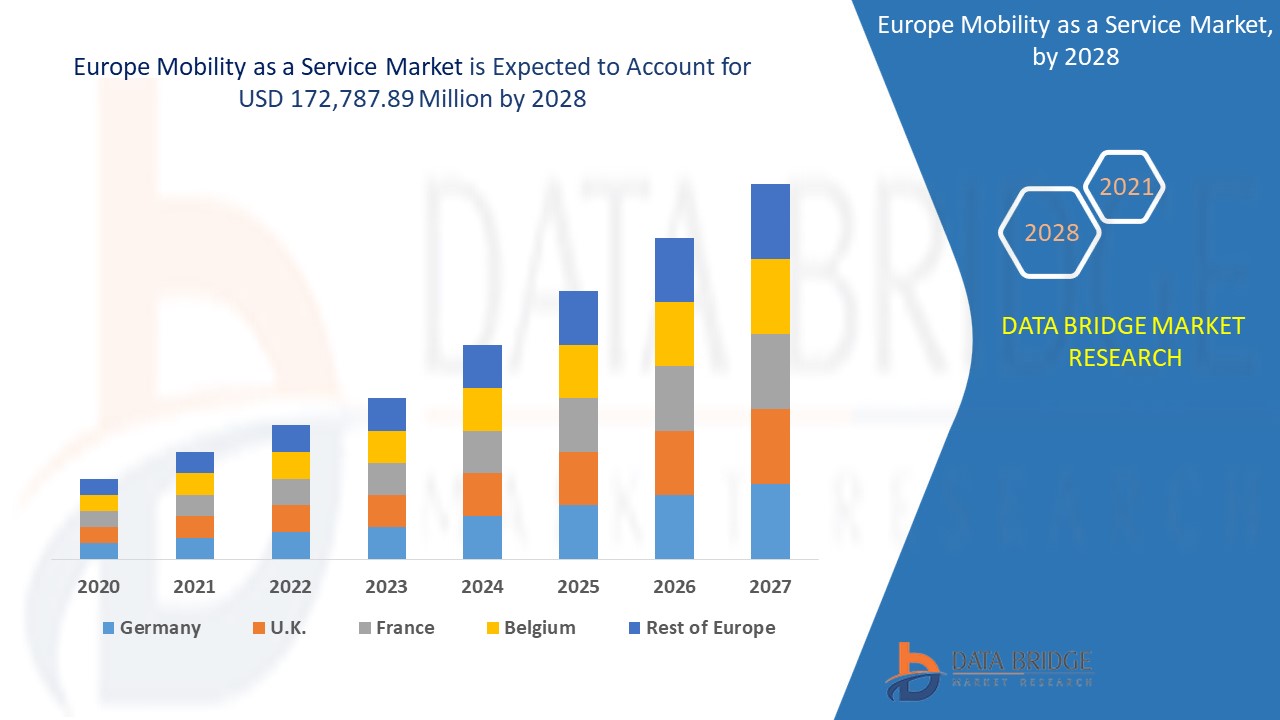

Se espera que el mercado de la movilidad como servicio gane crecimiento de mercado en el período de pronóstico de 2021 a 2028. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 33,9 % en el período de pronóstico de 2021 a 2028 y se espera que alcance los USD 172.787,89 millones para 2028. Las estrictas normas gubernamentales para controlar las emisiones de carbono en Europa están actuando como un factor importante para el crecimiento del mercado.

Las enormes inversiones realizadas por los actores del mercado en el desarrollo de vehículos ecológicos han impulsado el crecimiento de este mercado en Europa.

La movilidad como servicio es un modelo centrado en el consumidor para proporcionar transporte a las personas. La movilidad como servicio también se conoce como MaaS y, a veces, se la denomina transporte como servicio (TaaS). La movilidad como servicio es la integración de métodos de transporte, como el uso compartido de automóviles y bicicletas, los taxis y los alquileres/arrendamientos de automóviles a través de canales digitales que permiten a los consumidores planificar, reservar y pagar múltiples tipos de servicios de movilidad. El concepto principal del desarrollo de MaaS es ofrecer a los viajeros soluciones de movilidad basadas en sus necesidades de viaje.

La creciente urbanización y las iniciativas de ciudades inteligentes están impulsando el crecimiento del mercado de la movilidad como servicio, con una mayor demanda de productos avanzados que tengan una conectividad y un rendimiento mejorados. Los actores del mercado tienen que cumplir con los estándares regulatorios de cada país en el que venden sus productos, lo que limita el crecimiento del mercado de la movilidad como servicio. El crecimiento de los vehículos eléctricos para un transporte cómodo y limpio a un menor costo está creando oportunidades para el mercado de la movilidad como servicio. La poca conciencia del costo de vida útil de los vehículos privados y la propiedad de servicios va a ser un desafío importante para el mercado de la movilidad como servicio.

Este informe de mercado de movilidad como servicio proporciona detalles sobre la participación de mercado, los nuevos desarrollos y el análisis de la cartera de productos, el impacto de los actores del mercado local y nacional, analiza las oportunidades en términos de segmentos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, comuníquese con nosotros para obtener un resumen analítico; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de la movilidad como servicio en Europa

El mercado de la movilidad como servicio se segmenta en función del tipo de servicio, la solución, el tipo de transporte, el tipo de vehículo, la plataforma de aplicación, el tipo de requisito, el tamaño de la organización y el uso. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

- En función del tipo de servicio, el mercado de la movilidad como servicio se segmenta en coches compartidos, autobuses compartidos, trenes, viajes en taxi, bicicletas compartidas, coches autónomos y otros. En 2021, el segmento de viajes en taxi tuvo una mayor participación en el mercado de la movilidad como servicio debido a la creciente opción de reserva y comodidad que ha aumentado la demanda de servicios de transporte ferroviario.

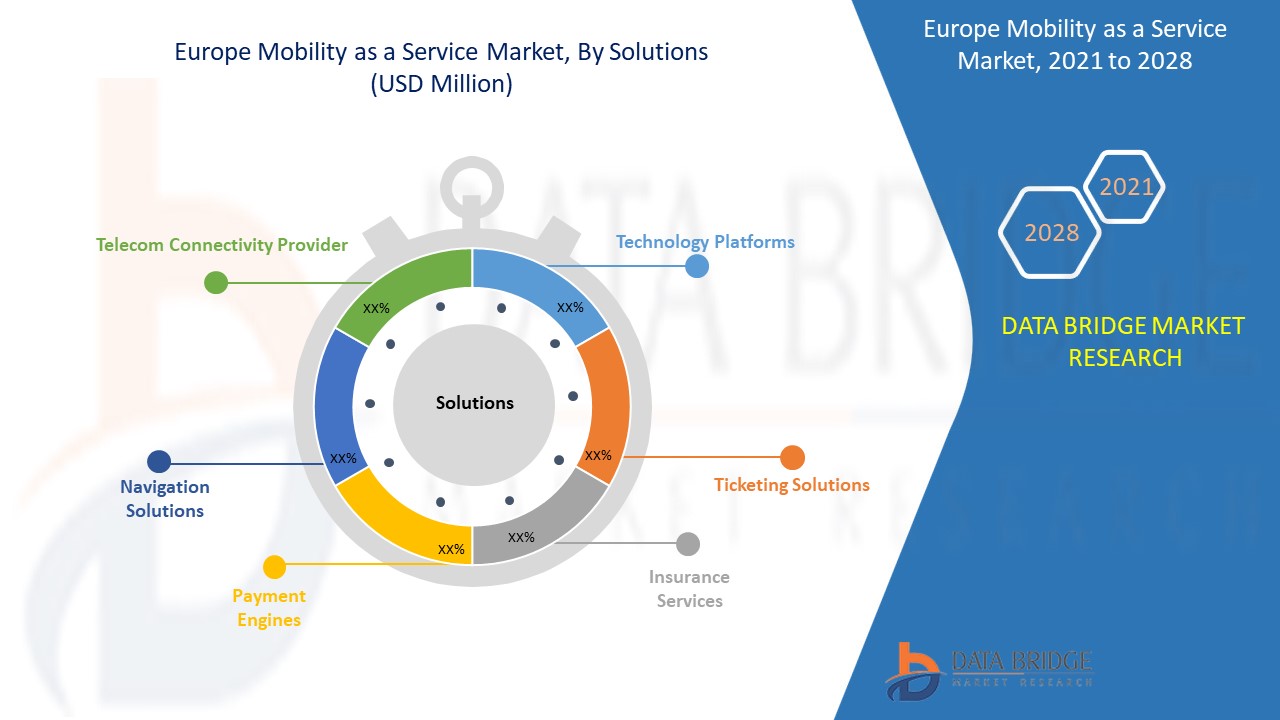

- En función de la solución, el mercado de la movilidad como servicio se segmenta en soluciones de navegación, soluciones de emisión de billetes, plataformas tecnológicas, servicios de seguros, proveedores de conectividad de telecomunicaciones y motores de pago. En 2021, la categoría de soluciones de navegación ha representado el tamaño máximo del mercado debido a la creciente importancia de la seguridad de los pasajeros y la creciente preocupación por minimizar el tiempo de viaje, lo que ha aumentado la demanda de soluciones de navegación.

- Según el tipo de transporte, el mercado de la movilidad como servicio se segmenta en público y privado. En 2021, la categoría pública representó el tamaño máximo del mercado debido al aumento del tráfico vehicular, que ha incrementado la demanda de servicios de movilidad.

- Según el tipo de vehículo, el mercado de la movilidad como servicio se segmenta en vehículos de cuatro ruedas, autobuses, trenes y micromovilidad. En 2021, el segmento de vehículos de cuatro ruedas tuvo la mayor participación en el mercado, lo que se atribuye principalmente a la creciente inversión en la infraestructura de transporte que ha impulsado la demanda de servicios de movilidad.

- En función de la plataforma de aplicación, el mercado de la movilidad como servicio se segmenta en iOS, Android y otros. En 2021, la categoría Android ha representado el tamaño máximo del mercado debido a la creciente penetración de Internet y al creciente uso de dispositivos móviles en las economías en desarrollo, lo que ha dado lugar a una mayor demanda de servicios de movilidad para la aplicación Android.

- En función del tipo de requisito, el mercado de la movilidad como servicio se segmenta en conectividad de primera y última milla, desplazamientos fuera de horas punta y en turnos de trabajo, desplazamientos diarios, viajes a aeropuertos o estaciones de transporte público, viajes interurbanos y otros. En 2021, la categoría de viajes interurbanos tuvo una mayor participación de mercado debido al aumento del tráfico de vehículos que ha incrementado la demanda de servicios de movilidad.

- En función del tamaño de la organización, el mercado de la movilidad como servicio se segmenta en grandes empresas y pequeñas y medianas empresas (PYMES). En 2021, el segmento de las grandes empresas tuvo una mayor participación de mercado debido a la creciente inversión de los diversos gigantes tecnológicos en infraestructura de transporte y uso compartido de automóviles que están haciendo su presencia en la industria del transporte.

- En función del uso, el mercado de la movilidad como servicio se segmenta en comercial y personal. En 2021, la categoría comercial tuvo una mayor participación de mercado debido a la creciente necesidad de opciones de transporte de bienes y materiales seguras, efectivas y económicas.

Análisis a nivel de país del mercado de movilidad como servicio

Se analiza el mercado de movilidad como servicio y se proporciona información sobre el tamaño del mercado por país, tipo de servicio, solución, tipo de transporte, tipo de vehículo, plataforma de aplicación, tipo de requisito, tamaño de la organización y uso como se mencionó anteriormente.

Los países cubiertos en el informe del mercado de movilidad como servicio son Alemania, Francia, Reino Unido, Suiza, Italia, Rusia, España, Países Bajos, Bélgica, Turquía y el resto de Europa.

Alemania está dominando la región europea en el mercado de movilidad como servicio debido a la creciente necesidad de MaaS entre las organizaciones comerciales de implementar soluciones holísticas como MaaS para abordar la congestión del tráfico y los problemas ambientales.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Demanda creciente de movilidad como servicio

El mercado de la movilidad como servicio también le ofrece un análisis detallado del mercado para cada país: crecimiento de la industria con ventas, ventas de componentes, impacto del desarrollo tecnológico en la movilidad como servicio y cambios en los escenarios regulatorios con su apoyo al mercado de la movilidad como servicio. Los datos están disponibles para el período histórico de 2010 a 2019.

Panorama competitivo y movilidad como análisis de participación de mercado

El panorama competitivo del mercado de la movilidad como servicio ofrece detalles por competidor. Los detalles incluidos son la descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la variedad de productos, el dominio de las aplicaciones y la curva de supervivencia de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de la movilidad como servicio.

Los principales actores cubiertos en el informe son Moovit Inc. (subsidiaria de Intel Corp.), UbiGo Innovation AB, MaaS Global Oy, SkedGo Pty Ltd, moovel Group GmbH (subsidiaria de Daimler AG), Communauto, Lyft, Inc., Uber Technologies, Inc., Citymapper Limited, Cubic Corporation, innovation in Traffic Systems SE, Mobilleo, MOTIONTAG GmbH, ANI Technologies Pvt. Ltd., Splyt Technologies Ltd., Lyft, Inc., Uber Technologies, Inc., EasyMile, entre otros. Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado.

Numerosas empresas de todo el mundo también están impulsando el desarrollo de productos que aceleran el crecimiento del mercado de la movilidad como servicio.

Por ejemplo,

- En noviembre de 2020, Lyft, Inc. agregó una nueva función de información de transporte público a la aplicación Lyft. A través de ella, los pasajeros pueden comparar sus opciones de transporte y elegir la mejor ruta. Esta nueva función de transporte en la aplicación Lyft también permite a los pasajeros ver las próximas salidas cercanas de cuatro agencias de transporte del GTA, incluidas TTC, GO Transit, UP Express y York Region Transit. Esto ha ayudado a la empresa a mejorar su cartera de productos y satisfacer mejor la demanda de los clientes.

- En noviembre de 2020, Uber Technologies Inc. lanzó los rickshaws eléctricos para la conectividad de primera y última milla. Estos rickshaws eléctricos estarán disponibles en 26 estaciones de la línea azul del metro de Delhi en India. Este producto ofrece a los pasajeros soluciones de movilidad para una mejor conectividad. A través de esto, la empresa puede mejorar su cartera de productos en el mercado.

Las asociaciones, las empresas conjuntas y otras estrategias mejoran la cuota de mercado de la empresa con una mayor cobertura y presencia. También ofrecen a las organizaciones la ventaja de mejorar su oferta de movilidad como servicio a través de una gama más amplia de tamaños.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.