Mercado europeo de colchones de látex, por tipo (mezcla combinada, natural y sintética), canal de distribución (en línea y fuera de línea), aplicación (residencial y comercial): tendencias de la industria y pronóstico hasta 2029.

Análisis y tamaño del mercado de colchones de látex en Europa

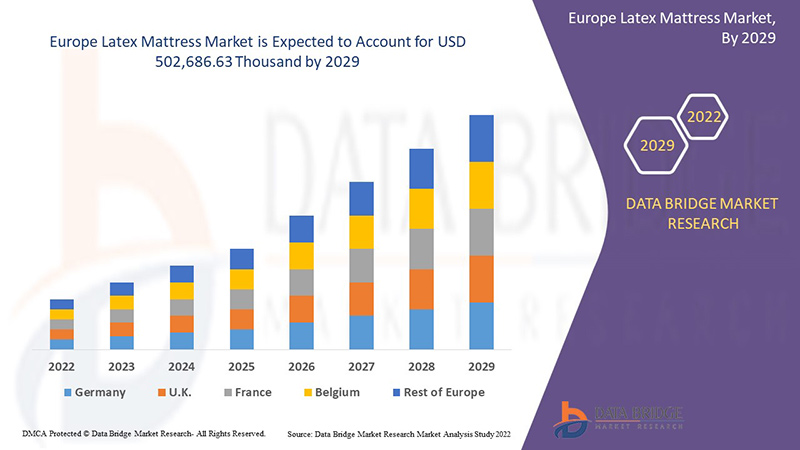

Se espera que el mercado de colchones de látex de Europa crezca significativamente en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 5,2% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 502.686,63 mil para 2029. El principal factor que impulsa el crecimiento del mercado de colchones de látex es la creciente tendencia de los colchones que alivian la presión en el sector residencial, la creciente popularidad de los productos de colchones en el sector residencial y comercial y la creciente conciencia sobre las propiedades del colchón.

Un colchón de látex crea una superficie firme y duradera para dormir al combinar espuma de látex con resortes o espuma reflex. El látex es un producto natural porque proviene de la savia de un árbol de caucho y parece el colchón natural perfecto. El colchón de látex se rellena con relleno natural para crear uno. La firmeza y la amortiguación de la superficie son las propiedades que ofrece el látex natural debido a su calidad flotante. Debido a la presión de las propiedades revitalizantes, los colchones impulsan ampliamente el mercado en los sectores comercial y residencial.

El informe sobre el mercado de colchones de látex en Europa proporciona detalles sobre la participación de mercado, los nuevos desarrollos y el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de segmentos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un informe de analista. Nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en miles de USD |

|

Segmentos cubiertos |

Por tipo (mezcla combinada, natural y sintética), canal de distribución (en línea y fuera de línea), aplicación (residencial y comercial) |

|

Países cubiertos |

Reino Unido, Rusia, Francia, España, Italia, Alemania, Turquía, Países Bajos, Suiza, Bélgica, Resto de Europa |

|

Actores del mercado cubiertos |

Spring Air International, Jinbaoma Furniture Manufacturer, Latexco, Avocado Mattress, LLC, Plush Beds, Brooklyn Bedding, Jiangsu Sleeptight Household Technology Co., Ltd., Foshan Aussie Hcl Furniture Co., Ltd., Foshan Golden Furniture Co., Ltd., Snoozer Bedding Limited, Saatva, Inc. y Kaneman Furniture Co., Ltd., entre otros. |

Definición de mercado

Los colchones de látex combinan espuma de látex con espuma reflexiva o de muelles para dar soporte y crear una superficie duradera para dormir. La savia de un árbol de caucho produce este material. Debido a sus propiedades ambientales, los colchones de látex se utilizan para diversas aplicaciones comerciales. El colchón de látex es utilizado principalmente por personas con problemas ortopédicos o dolores generales.

Dinámica del mercado de colchones de látex en Europa

Conductores

- Tendencia creciente de colchones antiescaras en residencias

El látex contiene algunas propiedades, como la elasticidad, que pueden responder rápidamente a los movimientos, el peso y la forma. Debido a la propiedad elástica, la parte más pesada del cuerpo obtiene un mayor alivio de la presión. En comparación con los poliuretanos, un colchón de látex hace maravillas al reducir la presión máxima del cuerpo. Debido a sus características mecánicas, los colchones de látex pueden distribuir la tensión de manera más uniforme y sutil sobre el cuerpo. El diseño del asiento cómodo para la amortiguación de látex es importante para cumplir con las cualidades deseadas. Las plantillas de látex pueden absorber un 35% más de energía de impacto que las plantillas de poliuretano, lo que enfatiza las capacidades de amortiguación del látex en escenarios de energía de bajo impacto. Además, debido a la gran capacidad de amortiguación del látex, la compresión del cuerpo se centra en un punto específico, por lo que es esencial garantizar que la concentración de tensión se distribuya uniformemente por todo el cuerpo.

- Expansión del comercio electrónico en todo el mundo

La expansión de la industria del comercio electrónico en todo el mundo y el creciente uso de teléfonos inteligentes e Internet tanto en los países desarrollados como en desarrollo son factores clave que impulsan el crecimiento del mercado de colchones de látex en Europa. Los proveedores y comerciantes están utilizando plataformas en línea para ampliar sus bases de clientes y su alcance geográfico. Y debido a la demanda de productos de primera calidad por parte de los clientes y la disponibilidad de colchones en la plataforma en línea, se volvió fácil para el consumidor comprar el producto. Tienen opciones para comprar directamente desde el sitio web de la empresa o comprar al proveedor para su comodidad. Pueden comprar en Europa a través del portal en línea con varias ofertas y descuentos. El comercio electrónico impulsa el crecimiento del mercado de colchones de látex durante el período de pronóstico.

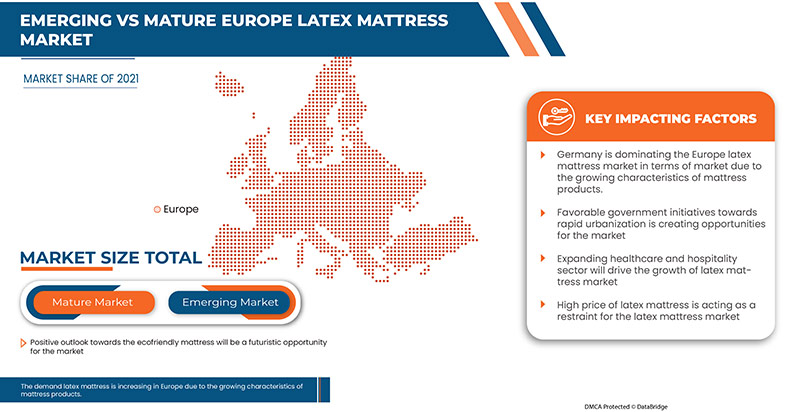

- Expansión del sector sanitario y hotelero

El crecimiento del sector de la atención sanitaria y la hostelería impulsará el mercado durante el período de previsión. La hostelería, como el sector de los albergues, exige colchones de primera calidad, lo que indica el crecimiento del sector de los colchones de látex. Los sectores de la hostelería y la atención sanitaria están cambiando rápidamente durante el período de previsión. El crecimiento del sector de la hostelería probablemente también se deba al turismo, ya que la mayoría de las personas visitan los lugares turísticos durante sus vacaciones, lo que muestra un ligero crecimiento hacia la construcción de hoteles. El sector de la atención sanitaria está aumentando considerablemente en todo el mundo después de la pandemia de COVID-19.

Oportunidades

- Perspectiva positiva hacia el colchón ecológico

La mayoría de las personas en la era actual se sienten atraídas por los productos ecológicos. La gente es más consciente de los productos no tóxicos. El látex 100% natural está hecho de caucho, y cada año, las plantas productoras de látex convierten casi 90 millones de toneladas de dióxido de carbono en oxígeno. Como resultado, el látex es uno de los rellenos de colchón naturales disponibles. Las personas que utilizan colchones ecológicos impulsan el crecimiento del mercado a medida que los clientes toman conciencia de los productos ecológicos. El látex natural contiene caucho puro, que proporciona una comodidad increíble y un colchón libre de polvo y antibacterias. Los colchones orgánicos no se calientan como otros colchones, se mantienen frescos incluso en verano, lo que los convierte en un gran producto entre otros colchones.

- Iniciativas gubernamentales favorables hacia una urbanización rápida

La construcción de sectores comerciales o residenciales impulsó el crecimiento del mercado, ya que ambos sectores de alguna manera utilizaron productos de colchones. El rápido desarrollo en áreas urbanas y rurales aumenta la demanda de colchones de látex durante el período de pronóstico. La demanda de colchones de látex puede ser una buena oportunidad en el mercado, ya que los inversores invierten en varios segmentos, como los sectores residencial, comercial y de infraestructura, lo que aumentará el uso de colchones en la próxima década.

Restricciones/Desafíos

- Alto precio del colchón de látex

El alto precio del caucho natural puede inhibir el crecimiento del producto en el mercado. La extracción del caucho natural mediante el método Dunlop y Talalay es un proceso lento y prolongado, por lo que el coste de los colchones de látex natural es elevado. Aun así, el consumidor busca un producto menos eficaz y de calidad asequible. El alto precio del colchón de látex natural puede frenar el mercado.

- Disponibilidad de productos alternativos

Las personas utilizan productos de espuma viscoelástica en colchones como alternativa a los colchones de látex porque son rentables y brindan el mismo nivel de comodidad que los colchones de látex. La espuma viscoelástica está hecha de un material sintético llamado poliuretano. La disponibilidad de productos alternativos es un gran desafío para que el actor se mantenga en el mercado, ya que las personas buscan productos de calidad a precios asequibles. El consumidor ahora usa colchones con memoria de forma como alternativa a los colchones de látex.

- Volatilidad de las materias primas

Durante el período proyectado, la volatilidad del precio de las materias primas será un obstáculo importante para la industria de los colchones de látex. Las fuentes naturales, sintéticas e híbridas son los tipos de látex más utilizados. La disponibilidad de materias primas difiere de una región a otra, ya que la cadena de suministro y el transporte, todos estos factores juegan un papel importante en la fluctuación del precio de las materias primas. La volatilidad de las materias primas para el látex se debe a la confiabilidad de la necesidad del mercado. El látex natural es mucho más caro porque su extracción también requiere mucho tiempo y se procesa mediante métodos Dunlop y Talalay. A veces, la hebra por la que se extrae no satisface la necesidad requerida por el mercado, por lo que el precio fluctúa.

Desarrollo reciente

- En julio de 2022, Jiangsu Sleeptight Household Technology Co., Ltd. presentó un nuevo diseño de colchón de espuma viscoelástica con gel frío. Este desarrollo ayudó a la empresa a aumentar su base de clientes.

Panorama del mercado de colchones de látex en Europa

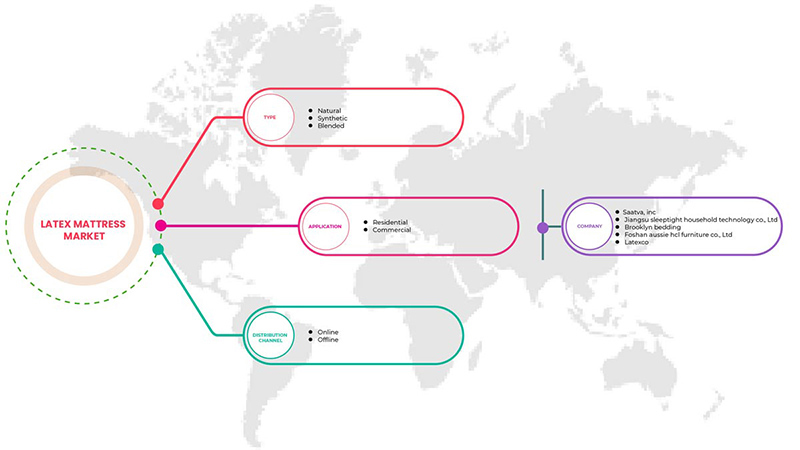

El mercado europeo de colchones de látex se clasifica en función del tipo, la aplicación y el canal de distribución. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas a fin de identificar las principales aplicaciones del mercado.

Tipo

- Mezcla combinada

- Natural

- Sintético

Según el tipo, el mercado europeo de colchones de látex se clasifica en dos segmentos: mezcla, natural y sintético.

Solicitud

- Residencial

- Comercial

Sobre la base de la aplicación, el mercado europeo de colchones de látex se clasifica en dos segmentos: residencial y comercial.

Canal de distribución

- En línea

- Desconectado

En función del usuario final, el mercado europeo de colchones de látex se clasifica en dos segmentos: en línea y fuera de línea.

Análisis y perspectivas regionales del mercado de colchones de látex en Europa

El mercado europeo de colchones de látex está segmentado según el tipo, la aplicación y el canal de distribución.

Los países que componen el mercado europeo de colchones de látex son el Reino Unido, Rusia, Francia, España, Italia, Alemania, Turquía, Países Bajos, Suiza, Bélgica y el resto de Europa. Alemania domina el mercado europeo de colchones de látex en términos de mercado debido a las características crecientes de los productos de colchones.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. El análisis de los puntos de datos de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas europeas y los desafíos que enfrentan debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los colchones de látex en Europa

El panorama competitivo del mercado de colchones de látex de Europa ofrece detalles por competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la profundidad de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en el mercado de colchones de látex de Europa.

Algunos de los participantes destacados que operan en el mercado de colchones de látex de Europa son Spring Air International, Jinbaoma Furniture Manufacturer, Latexco, Avocado Mattress, LLC, Plush Beds, Brooklyn Bedding, Jiangsu Sleeptight Household Technology Co., Ltd., Foshan Aussie Hcl Furniture Co., Ltd., Foshan Golden Furniture Co., Ltd., Snoozer Bedding Limited, Saatva, Inc. y Kaneman Furniture Co., Ltd., entre otros.

Metodología de la investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con tamaños de muestra grandes. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Aparte de esto, los modelos de datos incluyen cuadrículas de posicionamiento de proveedores, análisis de la línea de tiempo del mercado, descripción general y guía del mercado, cuadrículas de posicionamiento de la empresa, análisis de la participación de mercado de la empresa, estándares de medición, Europa frente a la región y análisis de la participación de los proveedores. Solicite una llamada de un analista en caso de tener más consultas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE LATEX MATTRESS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 COUNTRY ANALYSIS CHINA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING TREND OF PRESSURE RELIEVING MATTRESSES IN RESIDENTIAL

6.1.2 EXPANSION OF E-COMMERCE ACROSS THE GLOBE

6.1.3 EXPANDING HEALTHCARE AND HOSPITALITY SECTOR

6.1.4 SHIFT IN ' 'CONSUMER'S PREFERENCE TOWARDS LATEX MATTRESS PRODUCTS

6.2 RESTRAINTS

6.2.1 HIGH PRICE OF LATEX MATTRESS

6.2.2 AVAILABILITY OF ALTERNATIVE PRODUCTS

6.3 OPPORTUNITIES

6.3.1 POSITIVE OUTLOOK TOWARD THE ECO-FRIENDLY MATTRESS

6.3.2 FAVOURABLE GOVERNMENT INITIATIVES TOWARD RAPID URBANIZATION

6.4 CHALLENGES

6.4.1 VOLATILITY IN RAW MATERIAL

7 EUROPE LATEX MATTRESS MARKET, BY TYPE

7.1 OVERVIEW

7.2 NATURAL

7.3 SYNTHETIC

7.4 BLENDED

8 EUROPE LATEX MATTRESS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 COMMERCIAL

8.3 RESIDENTIAL

9 EUROPE LATEX MATTRESS MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.1.1 ONLINE

9.1.1.1 COMPANY-OWNED

9.1.1.2 THIRD PARTY

9.2 OFFLINE

9.2.1 SUPERMARKETS & HYPERMARKETS

9.2.1.1 CONVENIENCE STORES

9.2.1.2 SPECIALTY STORES

9.2.1.3 OTHERS

10 EUROPE LATEX MATTRESS MARKET, BY REGION

10.1 EUROPE

10.1.1 GERMANY

10.1.2 U.K.

10.1.3 FRANCE

10.1.4 ITALY

10.1.5 SPAIN

10.1.6 RUSSIA

10.1.7 SWITZERLAND

10.1.8 TURKEY

10.1.9 BELGIUM

10.1.10 NETHERLANDS

10.1.11 REST OF EUROPE

11 COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: EUROPE

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 SAATVA, INC.

13.1.1 COMPANY SNAPSHOT

13.1.2 COMPANY SHARE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT UPDATES

13.2 JIANGSU SLEEPTIGHT HOUSEHOLD TECHNOLOGY CO., LTD.

13.2.1 COMPANY SNAPSHOT

13.2.2 COMPANY SHARE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT UPDATES

13.3 BROOKLYN BEDDING

13.3.1 COMPANY SNAPSHOT

13.3.2 COMPANY SHARE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT UPDATES

13.4 FOSHAN AUSSIE HCL FURNITURE CO., LTD.

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT UPDATES

13.5 LATEXCO

13.5.1 COMPANY SNAPSHOT

13.5.2 COMPANY SHARE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT UPDATES

13.6 AVOCADO MATTRESS, LLC

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT UPDATES

13.7 FOSHAN GOLDEN FURNITURE CO., LTD.

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT UPDATES

13.8 JINBAOMA FURNITURE MANUFACTURER

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT UPDATES

13.9 KANEMAN FURNITURE CO., LTD.

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT UPDATES

13.1 PLUSH BEDS

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT UPDATE

13.11 SNOOZER BEDDING LIMITED

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT UPDATES

13.12 SPRING AIR INTERNATIONAL

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT UPDATE

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tablas

TABLE 1 IMPORT DATA OF SATURATED POLYESTERS IN PRIMARY FORMS (EXCLUDING POLYCARBONATES, ALKYD RESINS, POLYETHYLENE AND POLYLACTIC ACID); HS CODE – 390799 (USD THOUSAND)

TABLE 2 EXPORT DATA OF SATURATED POLYESTERS IN PRIMARY FORMS (EXCLUDING POLYCARBONATES, ALKYD RESINS, POLYETHYLENE AND POLYLACTIC ACID); HS CODE – 390799 (USD THOUSAND)

TABLE 3 EUROPE LATEX MATTRESS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 4 EUROPE LATEX MATTRESS MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 5 EUROPE NATURAL IN LATEX MATTRESS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 EUROPE SHORT CHAIN LENGTH IN LATEX MATTRESS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 7 EUROPE SYNTHETIC IN LATEX MATTRESS MARKET, BY REGION, 2020-2029 (TONS)

TABLE 8 EUROPE SYNTHETIC IN LATEX MATTRESS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 EUROPE BLENDED IN LATEX MATTRESS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 EUROPE BLENDED IN LATEX MATTRESS MARKET, BY REGION, 2020-2029 (TONS)

TABLE 11 EUROPE LATEX MATTRESS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 12 EUROPE COMMERCIAL IN LATEX MATTRESS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 EUROPE RESIDENTIAL IN LATEX MATTRESS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 EUROPE LATEX MATTRESS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 15 EUROPE ONLINE IN LATEX MATTRESS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 EUROPE ONLINE IN LATEX MATTRESS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 17 EUROPE OFFLINE IN LATEX MATTRESS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 EUROPE OFFLINE IN LATEX MATTRESS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 19 EUROPE LATEX MATTRESS MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 20 EUROPE LATEX MATTRESS MARKET, BY COUNTRY, 2020-2029 (THOUSAND UNITS)

TABLE 21 EUROPE LATEX MATTRESS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 22 EUROPE LATEX MATTRESS MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 23 EUROPE LATEX MATTRESS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 24 EUROPE LATEX MATTRESS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 25 EUROPE ONLINE IN LATEX MATTRESS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 26 EUROPE OFFLINE IN LATEX MATTRESS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 27 GERMANY LATEX MATTRESS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 28 GERMANY LATEX MATTRESS MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 29 GERMANY LATEX MATTRESS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 30 GERMANY LATEX MATTRESS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 31 GERMANY ONLINE IN LATEX MATTRESS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 32 GERMANY OFFLINE IN LATEX MATTRESS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 33 U.K LATEX MATTRESS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 34 U.K LATEX MATTRESS MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 35 U.K. LATEX MATTRESS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 36 U.K LATEX MATTRESS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 37 U.K ONLINE IN LATEX MATTRESS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 38 U.K OFFLINE IN LATEX MATTRESS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 39 FRANCE LATEX MATTRESS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 40 FRANCE LATEX MATTRESS MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 41 FRANCE LATEX MATTRESS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 42 FRANCE LATEX MATTRESS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 43 FRANCE ONLINE IN LATEX MATTRESS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 44 FRANCE OFFLINE IN LATEX MATTRESS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 45 ITALY LATEX MATTRESS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 46 ITALY LATEX MATTRESS MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 47 ITALY LATEX MATTRESS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 48 ITALY LATEX MATTRESS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 49 ITALY ONLINE IN LATEX MATTRESS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 50 ITALY OFFLINE IN LATEX MATTRESS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 51 SPAIN LATEX MATTRESS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 52 SPAIN LATEX MATTRESS MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 53 SPAIN LATEX MATTRESS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 54 SPAIN LATEX MATTRESS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 55 SPAIN OFFLINE IN LATEX MATTRESS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 56 RUSSIA LATEX MATTRESS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 RUSSIA LATEX MATTRESS MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 58 RUSSIA. LATEX MATTRESS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 59 RUSSIA LATEX MATTRESS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 60 RUSSIA ONLINE IN LATEX MATTRESS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 61 RUSSIA OFFLINE IN LATEX MATTRESS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 62 SWITZERLAND LATEX MATTRESS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 SWITZERLAND LATEX MATTRESS MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 64 SWITZERLAND. LATEX MATTRESS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 65 SWITZERLAND LATEX MATTRESS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 66 SWITZERLAND ONLINE IN LATEX MATTRESS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 67 SWITZERLAND OFFLINE IN LATEX MATTRESS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 68 TURKEY LATEX MATTRESS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 TURKEY LATEX MATTRESS MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 70 TURKEY. LATEX MATTRESS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 71 TURKEY LATEX MATTRESS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 72 TURKEY ONLINE IN LATEX MATTRESS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 73 TURKEY OFFLINE IN LATEX MATTRESS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 74 BELGIUM LATEX MATTRESS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 BELGIUM LATEX MATTRESS MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 76 BELGIUM. LATEX MATTRESS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 77 BELGIUM LATEX MATTRESS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 78 BELGIUM ONLINE IN LATEX MATTRESS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 79 BELGIUM OFFLINE IN LATEX MATTRESS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 80 NETHERLANDS LATEX MATTRESS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 81 NETHERLANDS LATEX MATTRESS MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 82 NETHERLANDS. LATEX MATTRESS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 83 NETHERLANDS LATEX MATTRESS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 84 NETHERLANDS ONLINE IN LATEX MATTRESS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 85 NETHERLANDS OFFLINE IN LATEX MATTRESS MARKET, BY CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 86 REST OF EUROPE LATEX MATTRESS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 87 REST OF EUROPE LATEX MATTRESS MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

Lista de figuras

FIGURE 1 EUROPE LATEX MATTRESS MARKET

FIGURE 2 EUROPE LATEX MATTRESS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE LATEX MATTRESS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE LATEX MATTRESS MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE LATEX MATTRESS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE LATEX MATTRESS MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 EUROPE LATEX MATTRESS MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE LATEX MATTRESS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE LATEX MATTRESS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE LATEX MATTRESS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 EUROPE LATEX MATTRESS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 EUROPE LATEX MATTRESS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE LATEX MATTRESS MARKET: SEGMENTATION

FIGURE 14 INCREASING DEMAND FOR NATURAL RUBBER MATERIALS IN THE COMMERCIAL INDUSTRIES IS EXPECTED TO DRIVE THE EUROPE LATEX MATTRESS MARKET IN THE FORECAST PERIOD

FIGURE 15 NATURAL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE LATEX MATTRESS MARKET IN 2022 & 2029

FIGURE 16 DRIVERS, RESTRAINT, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE LATEX MATTRESS MARKET

FIGURE 17 EUROPE LATEX MATTRESS MARKET: BY TYPE, 2021

FIGURE 18 EUROPE LATEX MATTRESS MARKET: BY APPLICATION, 2021

FIGURE 19 EUROPE LATEX MATTRESS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 20 EUROPE LATEX MATTRESS MARKET: SNAPSHOT (2021)

FIGURE 21 EUROPE LATEX MATTRESS MARKET: BY COUNTRY (2021)

FIGURE 22 EUROPE LATEX MATTRESS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 EUROPE LATEX MATTRESS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 EUROPE LATEX MATTRESS MARKET: BY TYPE (2022-2029)

FIGURE 25 EUROPE LATEX MATTRESS MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.