Mercado europeo de sistemas de gestión de información de laboratorio (LIMS), por componente (servicios, software), tipo de producto (amplio, específico de la industria), entrega (local, en la nube, alojado de forma remota), tipo de industria (industria de las ciencias de la vida, industria química/energética, industrias de alimentos y bebidas y agricultura, dispositivos médicos/de diagnóstico, organizaciones de investigación clínica/organizaciones de fabricación por contrato (CRO/CMO) y otras), canal de distribución (licitaciones directas, ventas minoristas), país (Alemania, Francia, Reino Unido, Italia, España, Rusia, Países Bajos, Suiza, Bélgica, Turquía y resto de Europa). Tendencias de la industria y pronóstico hasta 2029

Análisis y perspectivas del mercado: mercado europeo de sistemas de gestión de información de laboratorio (LIMS)

Análisis y perspectivas del mercado: mercado europeo de sistemas de gestión de información de laboratorio (LIMS)

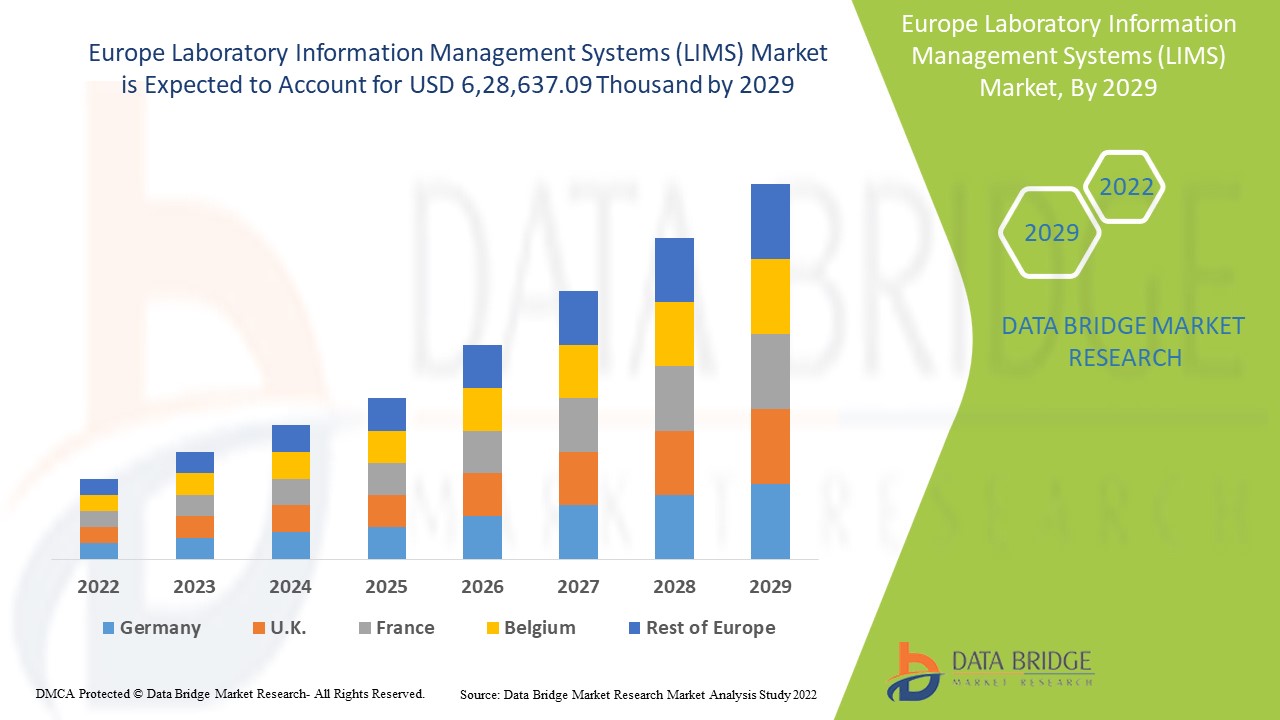

Se espera que el mercado europeo de sistemas de gestión de información de laboratorio (LIMS) gane un crecimiento significativo en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 8,9% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 6.28.637,09 mil para 2029. Se espera que los avances tecnológicos relacionados con los laboratorios farmacéuticos y la creciente demanda de automatización de laboratorios impulsen el crecimiento del mercado europeo de sistemas de gestión de información de laboratorio (LIMS).

Un software de sistemas de gestión de información de laboratorio (LIMS) ayuda a gestionar de forma eficaz las muestras y los datos asociados a ellas. Con la ayuda de LIMS, un laboratorio puede integrar instrumentos, gestionar muestras y automatizar los flujos de trabajo. El software LIMS también se utiliza en la genómica moderna . La cantidad sin precedentes de datos que se generan a partir de la genómica moderna se gestiona fácilmente con la ayuda del software LIMS. Debido a los mayores esfuerzos de los médicos e investigadores por mejorar las operaciones de laboratorio y al creciente número de muestras en los laboratorios, la demanda de software LIMS está aumentando, lo que contribuye aún más al crecimiento del mercado hasta cierto punto.

La integración de diversas tecnologías, como la inteligencia artificial y el aprendizaje automático, es el principal factor impulsor del mercado. La complejidad de los datos y la falta de herramientas fáciles de usar pueden resultar un desafío, sin embargo, el aumento de las decisiones estratégicas, como las asociaciones y colaboraciones, en el campo de la informática puede resultar una oportunidad. La limitación es el mayor costo de la gestión de datos y el software. Además, los desafíos a los que se enfrenta debido al impacto de COVID-19 en la cadena de suministro son uno de los principales factores restrictivos.

El informe de mercado de sistemas de gestión de información de laboratorio (LIMS) de Europa proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado de sistemas de gestión de información de laboratorio (LIMS), comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de los sistemas de gestión de información de laboratorio (LIMS)

Alcance y tamaño del mercado de los sistemas de gestión de información de laboratorio (LIMS)

El mercado europeo de sistemas de gestión de información de laboratorio (LIMS) está segmentado por componentes, tipos de productos, entregas, tipos de industria y canales de distribución. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

- En función de los componentes, el mercado europeo de sistemas de gestión de información de laboratorio (LIMS) se segmenta en software y servicios. En 2022, se espera que el segmento de servicios domine el mercado debido a la creciente necesidad de implementación, integración, mantenimiento, validación y soporte de LIMS.

- En función del tipo de producto, el mercado europeo de sistemas de gestión de información de laboratorio (LIMS) se segmenta en específico de la industria y basado en placa. En 2022, se espera que el segmento basado en placa domine el mercado, ya que los datos se pueden recopilar y compartir de forma segura e instantánea desde cualquier dispositivo en cualquier momento en este segmento. En función de la entrega, el mercado europeo de sistemas de gestión de información de laboratorio (LIMS) se segmenta en local, basado en la nube y alojado de forma remota. En 2022, se espera que el segmento basado en la nube domine el mercado, ya que se puede acceder a los datos desde múltiples ubicaciones, múltiples sistemas y desde múltiples sucursales.

- En función del tipo de industria, el mercado europeo de sistemas de gestión de información de laboratorio (LIMS) se segmenta en la industria de las ciencias de la vida, la química/energía, la alimentación y las bebidas y la agricultura, los dispositivos médicos/de diagnóstico, las organizaciones de investigación por contrato/organizaciones de fabricación por contrato (CRO/CMO) y otras. En 2022, se espera que el segmento de la industria de las ciencias de la vida domine el mercado debido a la creciente adopción de LIMS en los laboratorios farmacéuticos.

- En función del canal de distribución, el mercado europeo de sistemas de gestión de información de laboratorio (LIMS) se segmenta en licitaciones directas y ventas minoristas. En 2022, se espera que el segmento de licitaciones directas domine el mercado, ya que garantiza el pago y crea un negocio sostenible al asegurar una cantidad específica de ventas para la empresa.

Algunos de los principales actores que operan en el mercado de sistemas de gestión de información de laboratorio (LIMS) de Europa son Autoscribe Informatics, Novatek International, LabWare, STARLIMS Corporation, IBM, Eusoft Ltd., Infors AG, Siemens y LabVantage Solutions Inc., entre otros.

Análisis a nivel de país del mercado de sistemas de gestión de información de laboratorio (LIMS)

Se analiza el mercado de sistemas de gestión de información de laboratorio (LIMS) de Europa y se proporciona información sobre el tamaño del mercado según el país, el componente, el tipo de producto, la entrega, el tipo de industria y el canal de distribución como se mencionó anteriormente.

Los países incluidos en el informe sobre el mercado de sistemas de gestión de información de laboratorio (LIMS) de Europa son Alemania, Francia, Reino Unido, Italia, España, Rusia, Países Bajos, Suiza, Bélgica, Turquía y el resto de Europa. Alemania domina la región europea debido a las políticas de apoyo que facilitan la adopción de la automatización de laboratorios, como los programas de EHR.

La sección de países del informe también proporciona factores de impacto individuales en el mercado y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se considera la presencia y disponibilidad de marcas europeas y los desafíos que enfrentan debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

La creciente adopción de la automatización en los laboratorios está impulsando el crecimiento del mercado

El mercado europeo de sistemas de gestión de información de laboratorio (LIMS) también le ofrece un análisis detallado del mercado para el crecimiento de cada país en un mercado en particular. Además, proporciona información detallada sobre la estrategia de los actores del mercado y su presencia geográfica. Los datos están disponibles para el período histórico de 2010 a 2019.

Análisis del panorama competitivo y de la cuota de mercado de los sistemas de gestión de información de laboratorio (LIMS)

El panorama competitivo del mercado de sistemas de gestión de información de laboratorio (LIMS) proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la profundidad de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa relacionado con el mercado de sistemas de gestión de información de laboratorio (LIMS).

Algunos de los principales actores que operan en el mercado de sistemas de gestión de información de laboratorio (LIMS) son Autoscribe Informatics, Novatek International, LabWare, STARLIMS Corporation, IBM, Eusoft Ltd., Infors AG, Siemens y LabVantage Solutions Inc., entre otros.

Numerosas empresas de todo el mundo también han iniciado numerosos contratos y acuerdos que están acelerando también el mercado de los sistemas de gestión de información de laboratorio (LIMS).

Por ejemplo,

- En julio de 2021, Eusoft Ltd. lanzó la plataforma de comunicación de transición digital en el mundo B2B. Esta innovación ayudó a la empresa a atraer clientes durante la situación de pandemia y mejoró su interacción con los clientes.

- En junio de 2019, Eusoft Ltd. obtuvo la certificación ISO 27001 para SGSI. Esta certificación facilita a la empresa la explicación de su producto y mejora el valor de confianza para sus productos y servicios.

- En enero de 2021, Infors AG amplió su línea de producción para duplicar su capacidad. Esta expansión ayudará a la empresa a satisfacer la alta demanda del mercado, lo que dará como resultado plazos de entrega más cortos, mejorará la satisfacción del cliente y acelerará el valor de confianza de la empresa.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COMPONENT TYPE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 EXISTING LEGAL FRAMEWORK FOR LABORATORY INFORMATION MANAGEMENT SYSTEM

4.1.1 USP <1058> REGULATIONS

4.1.2 TITLE 21CFRPART 11

4.1.3 ISO 17025

4.1.4 ISO 15189

4.1.5 GOOD LABORATORY PRACTICE

4.2 MARKET VIEWPOINT OF KEY OPINION LEADERS

4.3 EXPERT OPINION SURVEY

4.4 EXPECTATION OF FUTURE MARKET SCENARIOS

4.5 FINDINGS AND REGIONAL TRENDS

4.6 LIMS INSTALLED BASE TOP PHARMA COMPANIES

5 MARKET OVERVIEW

5.1 DRIVER

5.1.1 INCREASE IN THE REQUIREMENT OF QUICK-DECISION MAKING PROCESS IN BIOTECHNOLOGY

5.1.2 RISING DEMAND FOR ADVANCED COMPUTATIONAL TOOLS IN RESEARCH LABORATORY

5.1.3 GROWING USAGE OF LIMS TO COMPLY IN LIFE SCIENCE FIELD REQUIREMENTS WITHOUT COMPROMISING PROCESS VERSATILITY

5.1.4 INTEGRATION OF ADVANCED TECHNOLOGIES SUCH AS AI, MACHINE LEARNING

5.2 RESTRAINTS

5.2.1 HIGHER COST OF DATA MANAGEMENT & SOFTWARE

5.2.2 LACK OF WELL-DEFINED STANDARD FORMAT FOR DATA INTEGRATION

5.2.3 STRINGENT REGULATION BY GOVERNMENT ENTITLES IN INFORMATICS DOMAIN

5.3 OPPORTUNITIES

5.3.1 INCREASE IN STRATEGIC DECISIONS, SUCH AS PARTNERSHIPS, PRODUCT LUANCH, AND COLLABORATIONS IN INFORMATICS FIELD

5.3.2 ADVANCEMENTS IN R&D LABS SPECIALLY IN PHARMACEUTICAL SECTOR

5.3.3 INCREASE IN VARIOUS INITIATIVES FROM GOVERNMENT AS WELL AS PRIVATE SECTORS

5.4 CHALLENGES

5.4.1 LACK OF SKILLED & TRAINED PROFESSIONALS TO USE THE COMPUTATIONAL TOOLS

5.4.2 DATA COMPLEXITY & LACK OF USER FRIENDLY TOOLS

6 IMPACT OF COVID-19 ON EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON DEMAND AND SUPPLY CHAIN

6.5 CONCLUSION

7 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 SERVICE

7.3 SOFTWARE

7.3.1 SAMPLE MANAGEMENT SOFTWARE

7.3.2 REPORTING SOFTWARE

7.3.3 WORKFLOW MANAGEMENT SOFTWARE

7.3.4 EMR/EHR SOFTWARE

7.3.5 OTHER SOFTWARE

8 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 BROAD-BASED

8.3 INDUSTRY-SPECIFIC

9 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY DELIVERY

9.1 OVERVIEW

9.2 CLOUD-BASED

9.3 REMOTELY-HOSTED

9.4 ON-PREMISE

10 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY INDUSTRY TYPE

10.1 OVERVIEW

10.2 LIFE SCIENCES INDUSTRY

10.2.1 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

10.2.2 BIOBANKS & BIOREPOSITORIES

10.2.3 BIOANALYTICAL DRUG DISCOVERY LABS

10.2.4 MOLECULAR DIAGNOSTICS & NGS LABORATORIES

10.2.5 CONTRACT SERVICE ORGANIZATIONS

10.2.6 TOXICOLOGY LABORATORIES

10.2.7 ACADEMIC RESEARCH INSTITUTES

10.2.8 OTHERS

10.3 CLINICAL RESEARCH ORGANIZATION / CONTRACT MANUFACTURING ORGANIZATIONS (CRO/CMO)

10.4 DIAGNOSTICS/MEDICAL DEVICE

10.5 CHEMICAL/ENERGY

10.6 FOOD AND BEVERAGE AND AGRICULTURE INDUSTRIES

10.7 OTHERS

11 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TENDERS

11.3 RETAIL SALES

12 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY REGION

12.1 EUROPE

12.1.1 EUROPE

12.1.2 GERMANY

12.1.3 FRANCE

12.1.4 U.K.

12.1.5 ITALY

12.1.6 SPAIN

12.1.7 RUSSIA

12.1.8 NETHERLANDS

12.1.9 SWITZERLAND

12.1.10 BELGIUM

12.1.11 TURKEY

12.1.12 REST OF EUROPE

13 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

14 COMPANY PROFILE

14.1 THERMO FISHER SCIENTIFIC INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 SWOT ANALYSIS

14.1.5 PRODUCT PORTFOLIO

14.1.6 RECENT DEVELOPMENTS

14.1.7 DBMR ANALYSIS

14.2 ROPER TECHNOLOGIES, INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 SWOT ANALYSIS

14.2.5 PRODUCT PORTFOLIO

14.2.6 RECENT DEVELOPMENTS

14.2.7 DBMR ANALYSIS

14.3 PERKINELMER INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 SWOT ANALYSIS

14.3.5 PRODUCT PORTFOLIO

14.3.6 RECENT DEVELOPMENTS

14.3.7 DBMR ANALYSIS

14.4 IBM CORPORATION

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 SWOT ANALYSIS

14.4.5 SERVICE PORTFOLIO

14.4.6 RECENT DEVELOPMENTS

14.4.7 IBM:

14.5 ILLUMINA, INC.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 SWOT ANALYSIS

14.5.4 COMPANY SHARE ANALYSIS

14.5.5 PRODUCT PORTFOLIO

14.5.6 RECENT DEVELOPMENTS

14.5.7 DBMR ANALYSIS

14.6 AGARAM TECHNOLOGIES PVT LTD

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 AGILENT TECHNOLOGIES, INC

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 AUTOSCRIBE INFORMATICS

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 BENCHLING

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 CLOUDLIMS.COM

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 EUSOFT LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 INFORS AG

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 LABVANTAGE SOLUTIONS INC.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 LABWARE

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 MCKESSON CORPORATION

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENTS

14.16 NOVATEK INTERNATIONAL

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 SHIMADZU CORPORATION

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENT

14.18 SIEMENS

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 SERVICE PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

14.19 STARLIMS CORPORATION (A SUBSIDIARY OF ABBOTT)

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENT

14.2 ZOHO CORPORATION PVT. LTD.

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 2 EUROPE SERVICE IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 3 EUROPE SOFTWARE IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 4 EUROPE SOFTWARE IN LABORATORY INFORMATION MANAGEMENT SYSTEMS, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 EUROPE BROAD-BASED IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 EUROPE INDUSTRY-SPECIFIC IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY DELIVERY, 2020-2029 (USD THOUSAND)

TABLE 9 EUROPE CLOUD-BASED IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 EUROPE REMOTELY-HOSTED IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 EUROPE ON-PREMISE IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY INDUSTRY TYPE, 2020-2029 (USD THOUSAND)

TABLE 13 EUROPE LIFE SCIENCES INDUSTRY IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 EUROPE LIFE SCIENCES INDUSTRY IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 15 EUROPE CLINICAL RESEARCH ORGANIZATION / CONTRACT MANUFACTURING ORGANIZATIONS (CRO/CMO) IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 EUROPE DIAGNOSTICS/MEDICAL DEVICE IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 EUROPE CHEMICAL/ENERGY IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 EUROPE FOOD AND BEVERAGE AND AGRICULTURE INDUSTRIES IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 EUROPE OTHERS IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 21 EUROPE DIRECT TENDERS IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 EUROPE RETAIL SALES IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 24 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 25 EUROPE SOFTWARE IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 26 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 27 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY DELIVERY, 2020-2029 (USD THOUSAND)

TABLE 28 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY INDUSTRY TYPE, 2020-2029 (USD THOUSAND)

TABLE 29 EUROPE LIFE SCIENCES INDUSTRY IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 30 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY DISTRIBUTIORN CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 31 GERMANY LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 32 GERMANY SOFTWARE IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 33 GERMANY LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 34 GERMANY LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY DELIVERY, 2020-2029 (USD THOUSAND)

TABLE 35 GERMANY LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY INDUSTRY TYPE, 2020-2029 (USD THOUSAND)

TABLE 36 GERMANY LIFE SCIENCES INDUSTRY IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 37 GERMANY LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY DISTRIBUTIORN CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 38 FRANCE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 39 FRANCE SOFTWARE IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 40 FRANCE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 41 FRANCE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY DELIVERY, 2020-2029 (USD THOUSAND)

TABLE 42 FRANCE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY INDUSTRY TYPE, 2020-2029 (USD THOUSAND)

TABLE 43 FRANCE LIFE SCIENCES INDUSTRY IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 44 FRANCE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY DISTRIBUTIORN CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 45 U.K. LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 46 U.K. SOFTWARE IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 U.K. LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 U.K. LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY DELIVERY, 2020-2029 (USD THOUSAND)

TABLE 49 U.K. LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY INDUSTRY TYPE, 2020-2029 (USD THOUSAND)

TABLE 50 U.K. LIFE SCIENCES INDUSTRY IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 U.K. LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY DISTRIBUTIORN CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 52 ITALY LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 53 ITALY SOFTWARE IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 ITALY LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 ITALY LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY DELIVERY, 2020-2029 (USD THOUSAND)

TABLE 56 ITALY LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY INDUSTRY TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 ITALY LIFE SCIENCES INDUSTRY IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 ITALY LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY DISTRIBUTIORN CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 59 SPAIN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 60 SPAIN SOFTWARE IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 SPAIN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 62 SPAIN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY DELIVERY, 2020-2029 (USD THOUSAND)

TABLE 63 SPAIN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY INDUSTRY TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 SPAIN LIFE SCIENCES INDUSTRY IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 SPAIN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY DISTRIBUTIORN CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 66 RUSSIA LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 67 RUSSIA SOFTWARE IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 68 RUSSIA LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 RUSSIA LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY DELIVERY, 2020-2029 (USD THOUSAND)

TABLE 70 RUSSIA LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY INDUSTRY TYPE, 2020-2029 (USD THOUSAND)

TABLE 71 RUSSIA LIFE SCIENCES INDUSTRY IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 72 RUSSIA LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY DISTRIBUTIORN CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 73 NETHERLANDS LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 74 NETHERLANDS SOFTWARE IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 NETHERLANDS LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 76 NETHERLANDS LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY DELIVERY, 2020-2029 (USD THOUSAND)

TABLE 77 NETHERLANDS LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY INDUSTRY TYPE, 2020-2029 (USD THOUSAND)

TABLE 78 NETHERLANDS LIFE SCIENCES INDUSTRY IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 79 NETHERLANDS LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY DISTRIBUTIORN CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 80 SWITZERLAND LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 81 SWITZERLAND SOFTWARE IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 82 SWITZERLAND LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 83 SWITZERLAND LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY DELIVERY, 2020-2029 (USD THOUSAND)

TABLE 84 SWITZERLAND LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY INDUSTRY TYPE, 2020-2029 (USD THOUSAND)

TABLE 85 SWITZERLAND LIFE SCIENCES INDUSTRY IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 86 SWITZERLAND LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY DISTRIBUTIORN CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 87 BELGIUM LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 88 BELGIUM SOFTWARE IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 89 BELGIUM LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 90 BELGIUM LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY DELIVERY, 2020-2029 (USD THOUSAND)

TABLE 91 BELGIUM LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY INDUSTRY TYPE, 2020-2029 (USD THOUSAND)

TABLE 92 BELGIUM LIFE SCIENCES INDUSTRY IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 93 BELGIUM LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY DISTRIBUTIORN CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 94 TURKEY LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 95 TURKEY SOFTWARE IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 96 TURKEY LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 97 TURKEY LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY DELIVERY, 2020-2029 (USD THOUSAND)

TABLE 98 TURKEY LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY INDUSTRY TYPE, 2020-2029 (USD THOUSAND)

TABLE 99 TURKEY LIFE SCIENCES INDUSTRY IN LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 100 TURKEY LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY DISTRIBUTIORN CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 101 REST OF EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

Lista de figuras

FIGURE 1 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET: SEGMENTATION

FIGURE 2 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET: DROC ANALYSIS

FIGURE 4 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET: SEGMENTATION

FIGURE 10 GROWING DEMAND FOR VEHICLE WIRING HARNESS FOR AUTOMOTIVE SAFETY SYSTEMS IS EXPECTED TO DRIVE EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET IN THE FORECAST PERIOD OF 2022 -2029

FIGURE 11 COMPONENT TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET IN 2022 & 2029

FIGURE 12 NORTH AMERICA IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 DRIVERS, RESTRAINT, OPPORTUNITIES, CHALLENGES FOR EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET

FIGURE 14 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET: BY COMPONENT, 2021

FIGURE 15 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET: BY PRODUCT TYPE, 2021

FIGURE 16 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET: BY DELIVERY, 2021

FIGURE 17 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET: BY INDUSTRY TYPE, 2021

FIGURE 18 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 19 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET: SNAPSHOT (2021)

FIGURE 20 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET: BY COUNTRY (2021)

FIGURE 21 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 22 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 23 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET: BY COMPONENT (2022-2029)

FIGURE 24 EUROPE LABORATORY INFORMATION MANAGEMENT SYSTEMS (LIMS) MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.