Europe Laboratory Hoods And Enclosure Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

168.86 Million

USD

265.70 Million

2025

2033

USD

168.86 Million

USD

265.70 Million

2025

2033

| 2026 –2033 | |

| USD 168.86 Million | |

| USD 265.70 Million | |

|

|

|

|

Segmentación del mercado europeo de campanas extractoras y recintos de laboratorio, por producto (Cámaras de equilibrio ventiladas (VBE), Cabinas de seguridad biológica, Cabinas de flujo laminar, recintos, campanas extractoras y otros), modularidad (de sobremesa y portátiles), material (PVC, acero inoxidable y otros), usuario final (empresas farmacéuticas, institutos de investigación, centros académicos y otros): tendencias del sector y pronóstico hasta 2033.

Tamaño del mercado europeo de campanas extractoras y envolventes de laboratorio

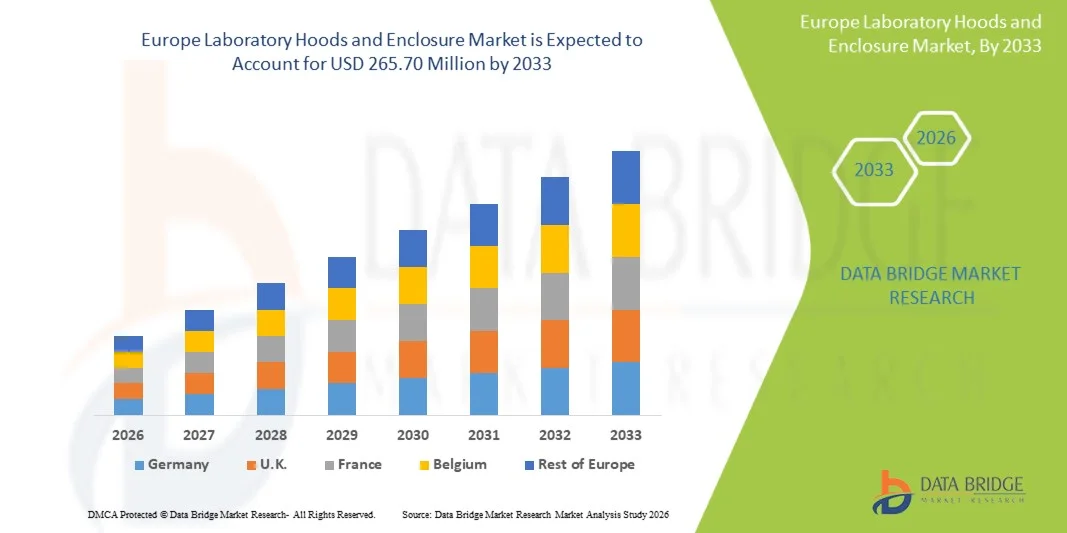

- El tamaño del mercado de campanas y envolventes de laboratorio de Europa se valoró en USD 168,86 millones en 2025 y se espera que alcance los USD 265,70 millones para 2033 , con una CAGR del 5,70 % durante el período de pronóstico.

- El crecimiento del mercado se debe en gran medida a la creciente necesidad de seguridad, control de la contaminación y cumplimiento de las normas regulatorias en laboratorios, instalaciones de investigación y unidades de fabricación farmacéutica, lo que lleva a una mayor adopción de campanas y recintos de laboratorio para garantizar el manejo seguro de productos químicos, muestras biológicas y sustancias peligrosas.

- Además, el aumento de las inversiones en investigación en ciencias de la vida, biotecnología e industrias farmacéuticas, junto con la creciente concienciación sobre la seguridad laboral y las buenas prácticas de laboratorio (BPL), están consolidando las campanas y los recintos de laboratorio como equipos esenciales en los laboratorios modernos. Estos factores convergentes están acelerando la adopción de soluciones de campanas y recintos de laboratorio, impulsando así significativamente el crecimiento de la industria.

Análisis del mercado europeo de campanas extractoras y envolventes de laboratorio

- Las campanas y los recintos de laboratorio, diseñados para proporcionar entornos seguros y controlados para el manejo de productos químicos peligrosos, muestras biológicas y materiales sensibles, son componentes cada vez más vitales en los laboratorios de investigación, unidades de producción farmacéutica e instalaciones de pruebas clínicas debido a su capacidad para prevenir la contaminación y garantizar el cumplimiento de las normas de seguridad.

- La creciente demanda de campanas y recintos de laboratorio se debe principalmente a la creciente inversión en ciencias de la vida, biotecnología e investigación farmacéutica, la creciente concienciación sobre las normas de seguridad en el laboratorio y la mayor atención al cumplimiento normativo. Estos factores convergentes están acelerando la adopción de soluciones de campanas y recintos de laboratorio, impulsando así significativamente el crecimiento del sector.

- El Reino Unido dominó el mercado europeo de campanas y recintos de laboratorio con la mayor participación en los ingresos del 36,9 % en 2025, respaldado por fuertes inversiones gubernamentales y privadas en infraestructura de investigación, expansión de laboratorios especializados y terciarios, creciente adopción de equipos de seguridad avanzados e iniciativas para fortalecer las capacidades de investigación en ciencias de la vida y atención médica.

- Se espera que Alemania sea la región de más rápido crecimiento en el mercado europeo de campanas y recintos de laboratorio, registrando una CAGR del 11,2 % durante el período de pronóstico, impulsada por el rápido desarrollo de laboratorios de investigación públicos y privados, los crecientes sectores farmacéutico y biotecnológico, la creciente adopción de equipos de seguridad de laboratorio avanzados y programas gubernamentales que promueven la innovación en investigación clínica e I+D industrial.

- El segmento de sobremesa dominó con una participación de ingresos del 57,3 % en 2025, impulsado por su alta adopción en laboratorios que requieren configuraciones estacionarias y estables para trabajos de precisión.

Alcance del informe y segmentación del mercado europeo de campanas extractoras y envolventes de laboratorio

|

Atributos |

Perspectivas clave del mercado de campanas extractoras y envolventes de laboratorio |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Europa

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis en profundidad de expertos, epidemiología de pacientes, análisis de la cartera de productos, análisis de precios y marco regulatorio. |

Tendencias del mercado europeo de campanas extractoras y envolventes de laboratorio

Mayor seguridad y eficiencia operativa en entornos de laboratorio

- Una tendencia importante y en aceleración en el mercado europeo de campanas y recintos de laboratorio es la adopción de soluciones de laboratorio de alto rendimiento, ergonómicas y energéticamente eficientes, diseñadas para mejorar la seguridad, la eficiencia del flujo de trabajo y el cumplimiento de las normas internacionales.

- Por ejemplo, en las principales universidades de Arabia Saudita, las cabinas de bioseguridad y las campanas extractoras de gases químicos modernizadas ahora cuentan con diseños modulares, sistemas de flujo de aire ajustables y sensores integrados para monitoreo en tiempo real, lo que garantiza tanto la protección del personal como condiciones experimentales consistentes.

- La adopción de mecanismos avanzados de control de la contaminación, como la filtración HEPA y ULPA, está aumentando, particularmente en los laboratorios de investigación farmacéutica y biotecnológica, para minimizar la contaminación cruzada y mantener entornos estériles.

- Se están priorizando los diseños ergonómicos y que ahorran espacio para optimizar los diseños de los laboratorios, lo que permite que varios usuarios operen de forma segura en entornos de investigación de alta densidad.

- Fabricantes como Labconco, Thermo Fisher Scientific y Esco están ampliando sus ofertas en la región con campanas modulares, configuraciones flexibles y controles de flujo de aire inteligentes que mejoran la eficiencia del laboratorio y cumplen con estrictos estándares de seguridad.

- También está aumentando la demanda de campanas capaces de manejar diversas aplicaciones de investigación química, biológica y molecular, lo que respalda el creciente énfasis de la región en la biotecnología, la genómica y la investigación clínica.

Dinámica del mercado europeo de campanas extractoras y envolventes para laboratorios

Conductor

“Ampliación de la infraestructura de investigación y estrictas normas de seguridad”

- Las rápidas inversiones gubernamentales en infraestructura de atención médica, investigación y biotecnología están impulsando significativamente la demanda de campanas y recintos de laboratorio avanzados en la región.

- Por ejemplo, en 2025, varios hospitales e institutos de investigación en Riad actualizaron sus cabinas de bioseguridad a clase II con alarmas de flujo de aire y esterilización UV, lo que permitió el manejo seguro de materiales peligrosos.

- El creciente establecimiento de laboratorios privados y terciarios en países como Arabia Saudita y Egipto está creando un fuerte mercado para campanas extractoras de alto rendimiento que garantizan el cumplimiento de las normas internacionales de seguridad.

- La estricta adhesión a los protocolos de manipulación de productos químicos y biológicos por parte de los reguladores en Oriente Medio está obligando a los centros de investigación a adoptar campanas y recintos con capacidades avanzadas de filtración y contención.

- La creciente colaboración con instituciones de investigación internacionales está impulsando a los laboratorios locales a cumplir con los estándares globales de seguridad de laboratorio, lo que impulsa aún más la adopción.

- La creciente conciencia sobre la seguridad de los trabajadores de laboratorio y la mitigación de riesgos está alentando a los hospitales, las compañías farmacéuticas y las universidades a reemplazar las configuraciones obsoletas con sistemas de contención modernos y certificados.

Restricción/Desafío

“ Altos costos de inversión de capital y operativos ”

- Las campanas y los recintos de laboratorio avanzados tienen costos iniciales significativos, que pueden resultar prohibitivos para laboratorios y centros de investigación más pequeños.

- Por ejemplo, se informó que la instalación de cabinas de bioseguridad modulares de clase II con monitoreo de flujo de aire en tiempo real y filtración HEPA en laboratorios privados de Abu Dhabi costaba más del triple que las campanas extractoras mecánicas estándar, lo que ralentizaba las decisiones de adquisición.

- Los requisitos regulares de mantenimiento, calibración y certificación periódica se suman a los gastos operativos constantes, lo que puede afectar los presupuestos en las regiones en desarrollo.

- La disponibilidad limitada de técnicos capacitados para la instalación, calibración y mantenimiento en ciertos países es otro factor que restringe la adopción.

- El consumo de energía de las campanas y los gabinetes de alto rendimiento también puede aumentar los costos operativos, en particular en instalaciones de investigación a gran escala.

- Abordar estos desafíos mediante opciones de arrendamiento, incentivos gubernamentales, diseños modulares y programas de capacitación regional para técnicos es fundamental para ampliar la adopción en el mercado.

Alcance del mercado europeo de campanas extractoras y envolventes de laboratorio

El mercado de campanas y recintos de laboratorio de África y Europa está segmentado en función del producto, la modularidad, el material y el usuario final.

• Por producto

Según el producto, el mercado se segmenta en cabinas de equilibrio ventiladas (VBE), cabinas de seguridad biológica, cabinas de flujo laminar, cabinas, campanas extractoras y otros. El segmento de las cabinas de seguridad biológica (BSC) dominó el mercado con una participación en los ingresos del 42,5 % en 2025, impulsado por la creciente adopción en la producción farmacéutica, la investigación académica y los laboratorios clínicos en toda África. Las BSC garantizan la seguridad del operador y del medio ambiente durante la manipulación de materiales biopeligrosos, lo que las hace esenciales en aplicaciones de virología, microbiología y cultivo celular. El segmento se beneficia de las estrictas regulaciones de bioseguridad en países como Sudáfrica, Egipto y Nigeria, lo que impulsa a los laboratorios a actualizar o reemplazar unidades obsoletas. Los hospitales, centros de investigación y empresas farmacéuticas priorizan las BSC debido a su fiabilidad y cumplimiento de las normas ISO y de la OMS. El aumento de las inversiones en investigación de vacunas, pruebas de enfermedades infecciosas y biotecnología impulsa aún más la demanda. La pandemia de COVID-19 amplificó la necesidad de BSC en laboratorios de diagnóstico e institutos de investigación. Los avances tecnológicos, como la filtración HEPA, el funcionamiento energéticamente eficiente y los diseños ergonómicos, impulsan su adopción. El segmento también se beneficia de su alta durabilidad y larga vida útil, lo que convierte a las BSC en la opción preferida para laboratorios con un gran volumen de trabajo. Las iniciativas de bioseguridad financiadas por el gobierno y las colaboraciones público-privadas impulsan la penetración en el mercado. Los sectores farmacéutico y de ciencias de la vida en crecimiento en África siguen impulsando un crecimiento constante de los ingresos.

Se prevé que el segmento de las Cajas de Balanza Ventiladas (VBE) experimente la tasa de crecimiento anual compuesta (TCAC) más rápida, del 9,8 %, entre 2026 y 2033, impulsada por su creciente uso en laboratorios analíticos para la manipulación de polvos, productos químicos y compuestos sensibles. Las VBE ofrecen un flujo de aire controlado, un diseño ergonómico y estaciones de pesaje integradas, lo que las hace ideales para flujos de trabajo farmacéuticos y de investigación de alta precisión. El auge de la fabricación farmacéutica y las pruebas de control de calidad en África impulsa el crecimiento del segmento. Las VBE se adoptan cada vez más en universidades e institutos de investigación para la química analítica y la investigación biofarmacéutica. Los modelos compactos de VBE de sobremesa facilitan su adopción en laboratorios con espacio limitado. Los fabricantes están lanzando VBE energéticamente eficientes y de bajo mantenimiento para atraer nuevos clientes. La tendencia hacia la automatización y la integración digital en los equipos de laboratorio aumenta su atractivo. La expansión de las organizaciones de investigación por contrato (CRO) y los laboratorios privados acelera aún más su adopción. Los programas gubernamentales que promueven las capacidades industriales y de investigación en ciencias de la vida impulsan la demanda de VBE. Las características mejoradas de seguridad y control de la contaminación impulsan la adquisición. La necesidad de cumplir con las normas ISO y GLP también impulsa el crecimiento del mercado.

• Por modularidad

Debido a su modularidad, el mercado se segmenta en equipos de sobremesa y portátiles. El segmento de sobremesa dominó con una participación en los ingresos del 57,3 % en 2025, impulsado por su alta adopción en laboratorios que requieren configuraciones estacionarias y estables para trabajos de precisión. Los modelos de sobremesa son los preferidos en laboratorios farmacéuticos, institutos de investigación y centros académicos debido a su robustez, fiabilidad y compatibilidad con una amplia gama de instrumentos de laboratorio. Permiten configuraciones integradas de flujo de trabajo, incluyendo conexiones con sensores, sistemas de ventilación y unidades de filtración. El segmento se beneficia de una fuerte adopción en países como Sudáfrica, Egipto y Kenia, donde la infraestructura de laboratorio está en expansión. Las normas regulatorias y de seguridad exigen configuraciones estacionarias para la manipulación de productos químicos y materiales biológicos, lo que aumenta la adopción de equipos de sobremesa. Las continuas mejoras en el diseño ergonómico y la eficiencia energética impulsan aún más el crecimiento de los ingresos. Las unidades de sobremesa ofrecen una larga vida útil y suelen ser seleccionadas para laboratorios de alto rendimiento. La pandemia de COVID-19 puso de relieve su importancia en los laboratorios de diagnóstico e investigación. La expansión de la I+D farmacéutica en África continúa fortaleciendo el segmento. Las actualizaciones tecnológicas, incluyendo sistemas automatizados de flujo de aire y monitorización, impulsan su adopción.

Se espera que el segmento portátil experimente la tasa de crecimiento anual compuesta (TCAC) más rápida del 10,2 % entre 2026 y 2033, impulsada por la creciente demanda de configuraciones de laboratorio flexibles y móviles en institutos de investigación más pequeños, laboratorios de campo e instalaciones sanitarias emergentes. Las unidades portátiles permiten realizar pruebas in situ, una rápida implementación y su uso en laboratorios móviles para aplicaciones ambientales, clínicas e industriales. Los materiales ligeros, como el PVC y el aluminio, mejoran la portabilidad sin comprometer la seguridad. Los modelos portátiles se adoptan cada vez más para la investigación de campo, la recogida de muestras y las pruebas en el punto de atención en zonas remotas. Los fabricantes están integrando la monitorización digital del flujo de aire y diseños modulares para mejorar la usabilidad. La expansión de los programas móviles de investigación y divulgación en países africanos impulsa aún más el crecimiento. La demanda de configuraciones de laboratorio temporales durante epidemias, pruebas ambientales y estudios de campo farmacéuticos impulsa su adopción. Su fácil mantenimiento y la eficiencia energética hacen que las unidades portátiles sean atractivas para laboratorios con bajos recursos. La tendencia hacia la descentralización de la investigación y las pruebas mejora el potencial de crecimiento.

• Por material

Según el material, el mercado se segmenta en PVC, acero inoxidable y otros. El segmento de acero inoxidable dominó con una participación de ingresos del 49,6 % en 2025, gracias a su durabilidad, resistencia química y facilidad de esterilización. Las campanas y recintos de laboratorio de acero inoxidable son los preferidos para cabinas de bioseguridad, campanas extractoras de gases químicos e investigación farmacéutica debido a su larga vida útil y al cumplimiento de las normas de bioseguridad e ISO. Hospitales, centros de investigación y laboratorios académicos invierten en unidades de acero inoxidable para pruebas de alto rendimiento y la manipulación de materiales peligrosos. La pandemia de COVID-19 puso de relieve la necesidad de materiales fiables y fáciles de limpiar en los laboratorios de diagnóstico e investigación. La resistencia a la corrosión, el bajo mantenimiento y la estética impulsan aún más su adopción. La expansión de los sectores biotecnológico y farmacéutico en Sudáfrica, Nigeria y Egipto impulsa el crecimiento del segmento de acero inoxidable. La integración con sistemas de control de flujo de aire, filtración HEPA y diseños ergonómicos aumenta el valor del producto. Las regulaciones gubernamentales que exigen estándares de seguridad y calidad impulsan las compras. Las prácticas de fabricación estandarizadas garantizan el cumplimiento de las certificaciones internacionales de seguridad. Este segmento sigue siendo crucial para los laboratorios de alto rendimiento.

Se espera que el segmento de PVC experimente la tasa de crecimiento anual compuesta (TCAC) más rápida, del 9,5 %, entre 2026 y 2033, impulsada por su rentabilidad, construcción ligera y resistencia química, ideal para laboratorios de campo, centros educativos y entornos de investigación más pequeños. Las carcasas de PVC se utilizan cada vez más en modelos portátiles y soluciones de sobremesa. Su adopción está creciendo en las regiones africanas, donde las instituciones con presupuestos ajustados buscan equipos de laboratorio flexibles y de bajo mantenimiento. La fácil personalización, la modularidad y la rápida instalación hacen que las unidades de PVC sean atractivas para los laboratorios emergentes. Los programas gubernamentales que apoyan el desarrollo de capacidades en laboratorios de investigación y atención médica fomentan la adquisición. Las unidades de PVC ofrecen resistencia a ácidos y reactivos básicos, lo que reduce los costes de mantenimiento. Su construcción ligera facilita su reubicación dentro de los laboratorios. La integración con los sistemas de flujo de aire y ventilación garantiza el cumplimiento de las normas de seguridad. Los bajos requisitos de inversión de capital aceleran aún más su adopción.

• Por el usuario final

Según el usuario final, el mercado se segmenta en compañías farmacéuticas, institutos de investigación, centros académicos y otros. El segmento de compañías farmacéuticas dominó con una participación en los ingresos del 46,7 % en 2025, impulsado por el aumento de las actividades de I+D, las pruebas de control de calidad y el cumplimiento normativo en el desarrollo y la producción de fármacos. Los laboratorios farmacéuticos dependen en gran medida de cabinas de seguridad biológica, recintos ventilados y campanas de flujo laminar para la manipulación segura de productos químicos, la preparación estéril y los flujos de trabajo analíticos. El crecimiento se ve respaldado por la expansión de los centros de fabricación farmacéutica en Sudáfrica, Egipto y Marruecos. La adopción se ve impulsada por las iniciativas gubernamentales que promueven los sectores biotecnológico y farmacéutico. La innovación continua en equipos de laboratorio mejora la eficiencia del flujo de trabajo, la seguridad y el control de la contaminación. Las empresas invierten en sistemas automatizados de bajo consumo energético para reducir los costes operativos. Los requisitos reglamentarios de bioseguridad y la certificación ISO fortalecen la demanda. El aumento de los ensayos clínicos, la producción de vacunas y las actividades de investigación por contrato impulsan aún más la adopción. La integración con instrumentos de laboratorio automatizados aumenta la fiabilidad. Las asociaciones a largo plazo con los fabricantes respaldan el crecimiento sostenido.

Se espera que el segmento de Centros Académicos experimente la tasa de crecimiento anual compuesta (TCAC) más rápida, del 10,0 %, entre 2026 y 2033, impulsada por la creciente inversión en infraestructura de educación superior e investigación en África. Las universidades y centros de educación superior adoptan campanas y recintos de laboratorio para la docencia, la investigación estudiantil y los programas de I+D dirigidos por el profesorado. Las unidades portátiles y de sobremesa permiten la formación práctica en laboratorio, manteniendo al mismo tiempo el cumplimiento de las normas de bioseguridad. La financiación procedente de programas gubernamentales, colaboraciones internacionales y subvenciones respalda la expansión de las instalaciones de laboratorio. La adopción de modelos de PVC rentables para laboratorios educativos acelera el crecimiento. La integración con programas de investigación en biotecnología, biología molecular y productos farmacéuticos impulsa las adquisiciones. La tendencia hacia configuraciones de laboratorio modulares y flexibles fomenta la innovación en el diseño de mobiliario y recintos de laboratorio. El mayor enfoque en la educación STEM en África fortalece la demanda. Los centros académicos suelen buscar soluciones ligeras, ergonómicas y energéticamente eficientes. Las iniciativas de investigación colaborativa entre universidades y laboratorios privados impulsan aún más la adopción.

Análisis regional del mercado europeo de campanas extractoras y envolventes de laboratorio

- El mercado europeo de campanas y envolventes de laboratorio está experimentando un sólido crecimiento, impulsado por el aumento de las inversiones en infraestructura de investigación y atención sanitaria en toda la región.

- El mercado dominó el mercado europeo con la mayor cuota de ingresos, un 36,9 % en 2025, gracias a una sólida financiación pública y privada para la investigación académica, las ciencias de la vida y los laboratorios clínicos. La expansión de los laboratorios especializados y terciarios, junto con las iniciativas para fortalecer las capacidades de investigación sanitaria, ha generado una importante demanda de campanas y recintos de laboratorio avanzados.

- En Londres y Cambridge, por ejemplo, los centros de investigación académica y clínica han adoptado cabinas de balanza ventiladas y cabinas de bioseguridad modulares con características de eficiencia energética para cumplir con las normas internacionales de seguridad e higiene. Los diseños de laboratorio modernos, que priorizan la ergonomía, la sostenibilidad y la eficiencia operativa, están impulsando aún más la modernización de los laboratorios con campanas y cabinas avanzadas.

Perspectiva del mercado de campanas extractoras y recintos de laboratorio en Europa del Reino Unido

El mercado de campanas y recintos de laboratorio en el Reino Unido y Europa dominó Europa en 2025, con la mayor participación en los ingresos, un 36,9 %, impulsado por importantes inversiones gubernamentales y privadas en infraestructura de investigación, atención médica y ciencias de la vida. La expansión de los laboratorios especializados y terciarios, junto con la creciente adopción de equipos de seguridad avanzados, ha impulsado la demanda de campanas y recintos de laboratorio modernos. Los principales centros de investigación académica y clínica de Londres, Oxford y Cambridge han implementado recintos de equilibrio ventilados, cabinas de bioseguridad y campanas de flujo laminar equipadas con filtración HEPA y monitorización del flujo de aire en tiempo real para cumplir con las normas internacionales de bioseguridad. El creciente énfasis en la ergonomía, la eficiencia energética y la sostenibilidad de las operaciones de laboratorio ha impulsado a los laboratorios a adoptar sistemas de recintos modulares y personalizables, lo que permite optimizar el flujo de trabajo y reducir los costes operativos, manteniendo al mismo tiempo altos estándares de seguridad e higiene. El creciente número de iniciativas de investigación farmacéutica, biotecnológica y clínica respalda el crecimiento constante del mercado en el Reino Unido, lo que garantiza una demanda continua de soluciones avanzadas de seguridad en el laboratorio.

Análisis del mercado de campanas extractoras y envolventes de laboratorio en Alemania y Europa

Se prevé que el mercado europeo de campanas y recintos de laboratorio en Alemania y Europa sea el de mayor crecimiento, registrando una tasa de crecimiento anual compuesta (TCAC) del 11,2 % durante el período de pronóstico. Este crecimiento se debe al rápido desarrollo de laboratorios de investigación públicos y privados, la expansión de los sectores farmacéutico y biotecnológico, y los programas gubernamentales que promueven la innovación en la investigación clínica y la I+D industrial. Los institutos de investigación de Berlín y Múnich, por ejemplo, instalan cada vez más cabinas de flujo laminar y campanas de extracción de gases químicos equipadas con filtración HEPA, monitorización del flujo de aire y sistemas de ahorro energético para apoyar la investigación farmacéutica y biotecnológica de alta precisión. El enfoque en la eficiencia energética, la sostenibilidad y el diseño ergonómico está configurando las inversiones en laboratorios de toda Alemania, garantizando una mayor eficiencia operativa y cumpliendo al mismo tiempo con las estrictas normativas de seguridad.

Cuota de mercado de campanas extractoras y envolventes de laboratorio en Europa

La industria de campanas y envolventes de laboratorio está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Thermo Fisher Scientific Inc. (EE. UU.)

- Esco Lifesciences Group (Singapur)

- Labconco Corporation (EE. UU.)

- NuAire, Inc. (EE. UU.)

- The Baker Company (EE. UU.)

- Ciencias del aire (EE. UU.)

- Haier Biomedical (China)

- Avantor, Inc. (EE. UU.)

- BINDER GmbH (Alemania)

- Germfree Laboratories, Inc. (EE. UU.)

- NuAire, Inc. (EE. UU.)

- Corporación Científica Kewaunee (EE. UU.)

- AB Sciex (EE. UU.)

- Sakura Finetek (Japón)

- Thermo Electron Corporation (EE. UU.)

- Instrumentos científicos Labgene (China)

- Esco Global Pte Ltd. (Singapur)

- Corporación HEMCO (EE. UU.)

- Flow Sciences, Inc. (EE. UU.)

- BioAir (Italia)

Últimos avances en el mercado europeo de campanas extractoras y envolventes de laboratorio

- En julio de 2023, Labconco Corporation presentó la campana de flujo laminar horizontal Nexus, la primera campana de flujo laminar con inteligencia integrada. Esta avanzada campana de flujo laminar proporciona un ambiente de aire limpio ISO Clase 4 con una interfaz de pantalla táctil de 5 pulgadas, capacidad de registro de datos y tecnología de perfil de flujo de aire constante, lo que mejora el control de la contaminación, la trazabilidad y la usabilidad para flujos de trabajo de laboratorio sin riesgos.

- En agosto de 2023, Esco Lifesciences lanzó la cabina de seguridad biológica Labculture G4 Clase II, con gestión mejorada del flujo de aire, espacio de trabajo ergonómico, control táctil Centurion y registro remoto de datos. Esta innovación mejoró el rendimiento de la contención del laboratorio y la comodidad del operador en aplicaciones de investigación biológica y diagnóstico, lo que refleja las continuas mejoras de productos en el segmento de cabinas de bioseguridad.

- En noviembre de 2023, Esco Micro Pte. Ltd. anunció una nueva cabina de seguridad biológica de Clase II en ARABLAB 2023, reforzando su compromiso con la bioseguridad y la educación. El lanzamiento respaldó los estándares globales de seguridad en laboratorios al ofrecer soluciones de contención mejoradas y demostrar el papel de Esco en la promoción de prácticas seguras de laboratorio.

- En septiembre de 2023, la cabina de seguridad biológica AS-AHA-193 Purair BIO de Air Science USA LLC se incluyó oficialmente entre los modelos con certificación NSF/ANSI 49, lo que refleja un cumplimiento más amplio de la industria con estrictos estándares de seguridad para contención y protección del operador en laboratorios.

- En abril de 2023, AZBIL TELSTAR, SLU amplió sus capacidades de servicio con unas nuevas instalaciones en Lainate (Italia), con el objetivo de reforzar su presencia en el mercado de cabinas de seguridad biológica y su servicio posventa. La expansión tenía como objetivo mejorar el servicio al cliente y la asistencia técnica en toda Europa.

- En febrero de 2024, Yamato Scientific Co., Ltd. anunció el desarrollo de una nueva serie de cabinas de flujo laminar diseñadas para un funcionamiento silencioso y una mejor visibilidad, satisfaciendo así las necesidades de las industrias de la electrónica y los dispositivos médicos, donde el control de partículas es fundamental. Este lanzamiento demostró la diversificación del mercado más allá de los sectores tradicionales de las biociencias.

- En marzo de 2024, AirClean Systems, Inc. presentó en la Conferencia y Exposición Pittcon sus gabinetes actualizados para estaciones de trabajo de PCR, con esterilización UV integrada, controles táctiles y filtración HEPA para facilitar los flujos de trabajo de genómica y biología molecular. Este desarrollo destacó la creciente importancia de los gabinetes con control de contaminación en entornos de investigación de vanguardia.

- En abril de 2024, WALDNER Holding GmbH & Co. KG lanzó su sistema modular de campanas extractoras de laboratorio ScienLab, diseñado para una integración flexible en infraestructuras de laboratorio nuevas y existentes, con una mayor eficiencia del flujo de aire y un menor consumo de energía, dirigido a laboratorios farmacéuticos y químicos. Esta innovación favoreció la flexibilidad de configuración del laboratorio y los objetivos de sostenibilidad.

- En mayo de 2024, Thermo Fisher Scientific Inc. anunció el lanzamiento de cabinas de seguridad biológica de nueva generación y eficiencia energética de la serie Heracell, diseñadas con filtración HEPA avanzada, controles ergonómicos y sistemas de monitoreo digital para satisfacer la demanda de los laboratorios académicos y farmacéuticos. Esto representó una mejora significativa en la seguridad y sostenibilidad de los equipos de contención.

- En enero de 2024, Mott Manufacturing Ltd. se asoció con un instituto de investigación líder de América del Norte para suministrar recintos de balanzas ventiladas (VBE) personalizados, diseñados para el pesaje de alta precisión de materiales peligrosos, lo que refleja la creciente necesidad de soluciones de contención especializadas en entornos de investigación complejos.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.