Europe Industrial Machine Vision Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

3.16 Billion

USD

5.48 Billion

2024

2032

USD

3.16 Billion

USD

5.48 Billion

2024

2032

| 2025 –2032 | |

| USD 3.16 Billion | |

| USD 5.48 Billion | |

|

|

|

|

Segmentación del mercado europeo de visión artificial industrial por componente (hardware y software), producto (sistema de visión con cámara inteligente y sensor inteligente, sistema de visión híbrido con cámara inteligente y basado en PC), tipo (sistemas de visión 2D, 3D y 1D), implementación (célula robótica y general), aplicaciones (detección de defectos, inspección de productos, inspección de superficies, inspección de embalajes, identificación, OCR/OCV, reconocimiento de patrones, calibración, guiado y seguimiento de piezas, inspección de bandas y otros), usuario final (automoción, electrónica de consumo, alimentación y embalajes, farmacéutica, metalurgia, impresión, aeroespacial, vidrio, caucho y plásticos, minería, textiles, madera y papel, maquinaria, fabricación de paneles solares y otros): tendencias y pronóstico del sector hasta 2032.

Tamaño del mercado de visión artificial industrial

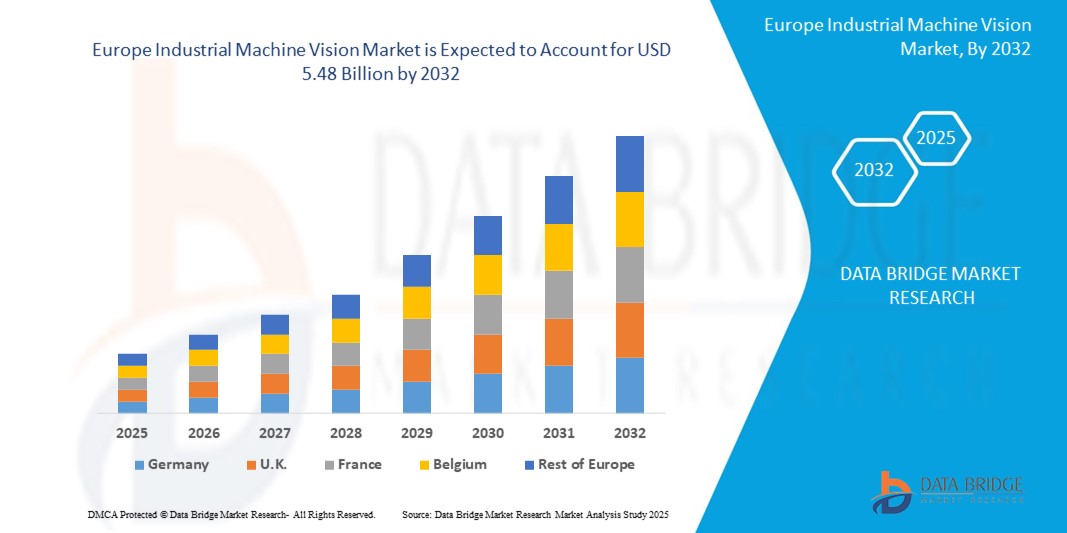

- El tamaño del mercado de visión artificial industrial de Europa se valoró en USD 3.16 mil millones en 2024 y se espera que alcance los USD 5.48 mil millones para 2032 , con una CAGR del 7,09% durante el período de pronóstico.

- Este crecimiento está impulsado por factores como la creciente adopción de la automatización en las industrias manufactureras, la creciente demanda de inspección de calidad y detección de defectos, y los avances tecnológicos en el aprendizaje automático y el procesamiento de imágenes.

Análisis del mercado de visión artificial industrial

- Los sistemas de visión artificial industrial son tecnologías críticas que se utilizan en entornos de fabricación para la inspección automatizada, el control de calidad y el guiado robótico, ofreciendo precisión y eficiencia en diversas industrias, incluidas la automotriz, la electrónica, la farmacéutica y la de alimentos y bebidas.

- La demanda de estos sistemas está impulsada significativamente por la creciente necesidad de automatización, precisión en la detección de defectos y avances en tecnologías de imágenes integradas con IA.

- Alemania es el país dominante en el mercado de visión artificial industrial de Europa, con una participación del 35%, gracias a su liderazgo en ingeniería avanzada, producción automotriz y adopción temprana de prácticas de la Industria 4.0.

- Francia, que se proyecta que registre la CAGR más alta en el mercado de visión artificial industrial de Europa, tiene una participación del 15%, impulsada por el crecimiento en los sectores farmacéutico y de procesamiento de alimentos y las crecientes inversiones en automatización.

- Se prevé que el segmento de fabricación de automóviles domine el mercado de la visión artificial industrial, con la mayor cuota de mercado (48,75 %) en 2025, debido a su alta demanda de automatización y control de calidad en las líneas de producción. Como componente fundamental de la fabricación de automóviles moderna, los sistemas de visión artificial mejoran la precisión en procesos como la inspección, el ensamblaje y la identificación de piezas.

Alcance del informe y segmentación del mercado de visión artificial industrial

|

Atributos |

Perspectivas clave del mercado de la visión artificial industrial |

|

Segmentos cubiertos |

|

|

Países cubiertos |

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de visión artificial industrial

Integración de IA, aprendizaje profundo y sistemas de visión 3D en la automatización industrial

- Una tendencia destacada en el mercado de visión artificial industrial es la creciente integración de inteligencia artificial (IA), algoritmos de aprendizaje profundo y sistemas de visión 3D para la toma de decisiones en tiempo real y la automatización de precisión en los procesos de fabricación.

- Estas innovaciones mejoran significativamente el rendimiento de la visión artificial al permitir que los sistemas detecten patrones complejos, clasifiquen defectos y se adapten a condiciones variables que los sistemas tradicionales basados en reglas no pueden manejar de manera efectiva.

- Por ejemplo, las modernas tecnologías de visión 3D ofrecen percepción de profundidad y análisis volumétrico, lo que permite aplicaciones como selección de contenedores, guiado de robots y control de calidad de objetos de forma irregular con alta precisión.

- Estos avances están transformando el panorama de la automatización industrial, reduciendo las tasas de error, aumentando la eficiencia de la producción e impulsando la demanda de sistemas de visión inteligente en las industrias automotriz, electrónica, de embalaje y logística.

Dinámica del mercado de visión artificial industrial

Conductor

Creciente demanda de inspección de calidad y automatización en la fabricación

- El creciente énfasis en el aseguramiento de la calidad, la optimización de procesos y la detección de defectos en la fabricación moderna está contribuyendo significativamente a la mayor demanda de sistemas de visión artificial industrial.

- A medida que las industrias adoptan la automatización, la visión artificial desempeña un papel fundamental al permitir la inspección en tiempo real, la medición de precisión y el guiado robótico, lo que garantiza la consistencia y la confiabilidad en las líneas de producción.

- Industrias como la automotriz, la electrónica, la farmacéutica y la de alimentos y bebidas dependen en gran medida de los sistemas de visión artificial para cumplir con estrictos estándares regulatorios y de calidad.

Por ejemplo,

- En octubre de 2023, Cognex Corporation informó un aumento en la demanda de sistemas de visión en los sectores de electrónica y logística, impulsado por las crecientes expectativas de los consumidores en cuanto a la confiabilidad de los productos y el cumplimiento rápido de los pedidos.

- Como resultado de este creciente enfoque en el control de calidad automatizado, hay un aumento sustancial en la adopción de sistemas de visión artificial industrial para mejorar la productividad, minimizar errores y reducir los costos laborales en los ecosistemas de fabricación globales.

Oportunidad

Impulsando la visión artificial industrial con la integración de inteligencia artificial

- Los sistemas de visión artificial industrial impulsados por IA pueden mejorar la detección de objetos, la automatización y el control de calidad en los procesos de fabricación, mejorando la eficiencia operativa y la precisión.

- Los algoritmos de IA pueden analizar imágenes en tiempo real para identificar defectos, monitorear líneas de producción y rastrear la calidad del producto, brindando retroalimentación inmediata para que los fabricantes aborden los problemas antes de que se agraven.

- Los sistemas de visión impulsados por IA también pueden ayudar en el mantenimiento predictivo al analizar el rendimiento del equipo e identificar posibles fallas, lo que reduce el tiempo de inactividad y los costos de mantenimiento.

Por ejemplo,

- En diciembre de 2024, la colaboración entre Siemens y una empresa de software de IA dio lugar a la integración de la visión artificial industrial impulsada por IA en las plantas de fabricación de Siemens. El sistema de IA proporciona control de calidad en tiempo real mediante la identificación de defectos en los productos y el ajuste automático de los parámetros de producción para mantener una calidad constante. Esta integración ha resultado en un aumento del 15 % en la eficiencia de la producción y una reducción del 20 % en los defectos de los productos.

- La integración de la IA en los sistemas de visión artificial industrial también puede conducir a una mejor utilización de los recursos, ciclos de producción más rápidos y una reducción de los residuos. Al aprovechar la capacidad de la IA para analizar grandes cantidades de datos visuales, los fabricantes pueden optimizar las líneas de producción, reducir los errores humanos y garantizar una mayor consistencia en la calidad del producto.

Restricción/Desafío

Los altos costos de los equipos dificultan la penetración en el mercado

- El alto costo de los sistemas de visión artificial industrial representa una barrera importante para su adopción generalizada, en particular para las pequeñas y medianas empresas (PYME) con presupuestos limitados.

- Estos sistemas de visión avanzados, que son esenciales para automatizar el control de calidad y mejorar los procesos de fabricación, pueden costar desde decenas de miles hasta varios cientos de miles de dólares, dependiendo de la complejidad y las capacidades del sistema.

- La importante inversión financiera requerida para estos sistemas puede disuadir a las empresas más pequeñas de actualizar sus equipos, lo que lleva a una dependencia de la inspección manual o de soluciones de visión artificial obsoletas.

Por ejemplo,

- En octubre de 2024, un informe de la Sociedad Internacional de Automatización (ISA) destacó el desafío que enfrentan las pequeñas empresas manufactureras al considerar la adopción de sistemas de visión artificial industrial basados en IA. El informe enfatizó que, si bien las grandes corporaciones pueden afrontar la elevada inversión inicial, muchas pymes enfrentan dificultades para integrar sistemas basados en IA en sus operaciones, lo que ralentiza la tasa de adopción en todo el sector.

- Como resultado, este obstáculo financiero puede conducir a un crecimiento más lento del mercado y evitar una adopción más amplia de sistemas avanzados de visión artificial, en particular en industrias sensibles a los costos, como la fabricación a pequeña escala o las empresas en mercados emergentes.

Alcance del mercado de la visión artificial industrial

El mercado está segmentado en función del componente, producto, tipo, implementación, aplicaciones y usuario final.

|

Segmentación |

Subsegmentación |

|

Por componente |

|

|

Por producto |

|

|

Por tipo |

|

|

Por implementación |

|

|

Por aplicaciones |

|

|

Por el usuario final |

|

Se proyecta que en 2025, el segmento de fabricación de automóviles dominará el mercado con la mayor participación en el segmento de usuarios finales.

Se prevé que el segmento de fabricación de automóviles domine el mercado de la visión artificial industrial, con la mayor cuota de mercado (48,75 %) en 2025, debido a la alta demanda de automatización y control de calidad en las líneas de producción. Como componente fundamental de la fabricación de automóviles moderna, los sistemas de visión artificial mejoran la precisión en procesos como la inspección, el montaje y la identificación de piezas. La creciente demanda de características de seguridad para vehículos, sumada a los avances en las tecnologías de visión artificial, impulsa la adopción de estos sistemas en la producción automotriz. El aumento de la automatización en las fábricas de automóviles y la creciente complejidad de los diseños de vehículos contribuyen aún más al dominio de este segmento en el mercado de la visión artificial industrial.

Se espera que el reconocimiento de patrones represente la mayor participación durante el período de pronóstico en los segmentos de aplicación.

En 2025, se prevé que el segmento de reconocimiento de patrones domine el mercado de la visión artificial industrial, con la mayor cuota de mercado, un 50,62 %, gracias a su capacidad para optimizar el control de calidad, la inspección y la automatización de los procesos de fabricación. Los sistemas de reconocimiento de patrones son fundamentales para identificar y clasificar objetos, defectos y anomalías en tiempo real, lo que permite a los fabricantes mantener una calidad constante del producto y optimizar la eficiencia de la producción. A medida que las industrias exigen mayores niveles de precisión y velocidad, los sistemas de reconocimiento de patrones, especialmente en combinación con IA y tecnologías de aprendizaje profundo, impulsan el crecimiento del mercado. La creciente complejidad de los productos y la necesidad de altos estándares de calidad en sectores como la automoción, la electrónica y la industria farmacéutica contribuyen aún más al dominio de los sistemas de visión artificial basados en el reconocimiento de patrones en el mercado.

Análisis regional del mercado de visión artificial industrial

Alemania posee la mayor participación en el mercado europeo de visión artificial industrial.

- Alemania es el país dominante en el mercado de visión artificial industrial de Europa, con una participación del 35%, gracias a su liderazgo en ingeniería avanzada, producción automotriz y adopción temprana de prácticas de la Industria 4.0.

- La implementación generalizada de la Industria 4.0 en el país y la integración de la automatización en las líneas de producción respaldan el uso extensivo de sistemas de visión artificial para el control de calidad y la fabricación de precisión.

- La alta demanda de detección de defectos, validación de ensamblajes y guiado robótico en las industrias automotriz, electrónica y de maquinaria de Alemania está impulsando la adopción de tecnologías IMV.

- El fuerte respaldo gubernamental a la digitalización industrial, junto con una importante inversión en I+D y un sólido ecosistema de proveedores de tecnología, refuerza el liderazgo de Alemania en el mercado europeo de visión artificial industrial.

Se proyecta que Francia registre la tasa de crecimiento anual compuesta (TCAC) más alta del mercado europeo de visión artificial industrial .

- Francia, que se proyecta que registre la CAGR más alta en el mercado de visión artificial industrial de Europa, tiene una participación del 15%, impulsada por el crecimiento en los sectores farmacéutico y de procesamiento de alimentos y las crecientes inversiones en automatización.

- Las iniciativas lideradas por el gobierno, como “France Relance” y el apoyo a la transformación de la Industria 4.0, están acelerando la integración de sistemas avanzados de automatización y visión en la fabricación.

- La creciente necesidad de estándares de alta calidad e inspección automatizada en sectores como el farmacéutico, el de alimentos y bebidas y el automotriz está impulsando la demanda de visión artificial industrial en toda Francia.

- Las inversiones continuas de los sectores público y privado en transformación digital y automatización industrial están impulsando la rápida expansión de las aplicaciones de visión artificial en todo el país.

Cuota de mercado de la visión artificial industrial

El panorama competitivo del mercado ofrece detalles por competidor. Se incluye información general de la empresa, sus estados financieros, ingresos generados, potencial de mercado, inversión en investigación y desarrollo, nuevas iniciativas de mercado, presencia global, plantas de producción, capacidad de producción, fortalezas y debilidades de la empresa, lanzamiento de productos, alcance y variedad de productos, y dominio de las aplicaciones. Los datos anteriores se refieren únicamente al enfoque de mercado de las empresas.

Los principales líderes del mercado que operan en el mercado son:

- KEYENCE CORPORATION (Japón)

- Corporación OMRON (Japón)

- Sony Semiconductor Solutions Corporation (Japón)

- Cognex Corporation (EE. UU.)

- SICK AG (EE. UU.)

- Teledyne FLIR LLC (EE. UU.)

- CORPORACIÓN NACIONAL DE INSTRUMENTOS (EE. UU.)

- BASLER AG (Alemania)

- ISRA VISION (Alemania)

- Intel Corporation (EE. UU.)

- Texas Instruments Incorporated (EE. UU.)

- Cadence Design Systems, Inc. (EE. UU.)

- Sistemas de identificación automática (Reino Unido) Limited (Reino Unido)

- MV ASIA Infomatrix Pte Ltd (Singapur)

- Ceva Inc. (EE. UU.)

- Soda Vision (Singapur),

- The Imaging Source, LLC (EE. UU.)

- Kalypso: una empresa de Rockwell Automation (EE. UU.)

- Qualitas Technologies (India)

- Integro Technologies Corp. (EE. UU.)

Últimos avances en el mercado europeo de visión artificial industrial

- En julio de 2024, OMRON Corporation presentó una actualización de software para su sistema de visión FH y su cámara inteligente FHV7, que integra la tecnología de decodificación Digimarc para mejorar la identificación digital de productos. Esta actualización permite la verificación de envases a alta velocidad mediante marcas de agua digitales, alcanzando más de 2000 piezas por minuto. La integración mejora la precisión de detección, la velocidad de procesamiento, la flexibilidad de la cámara, la redundancia y las capacidades de inspección, lo que refuerza el compromiso de OMRON con la innovación en automatización industrial. Diseñado para fabricantes de bienes de consumo, este avance mejora el control de calidad y la eficiencia en la producción.

- El 6 de mayo de 2025, AMETEK anunció la adquisición de FARO Technologies por aproximadamente 920 millones de dólares. FARO, líder en soluciones de medición e imagen 3D, registró ventas por 340 millones de dólares en 2024. Esta estrategia busca expandir la división de instrumentos electrónicos de AMETEK y fortalecer su presencia en los mercados aeroespacial, médico, de investigación, energético e industrial. La adquisición enriquece la cartera de AMETEK con soluciones de fabricación de precisión y realidad digital, complementando su negocio actual con Creaform.

- En abril de 2024, Cognex Corporation presentó el sistema de visión 3D In-Sight L38, el primer sistema de visión 3D del mundo con tecnología de IA, diseñado para una implementación rápida y unas inspecciones fiables en la automatización de la fabricación. Este sistema integra tecnologías de IA, visión 2D y 3D, generando imágenes de proyección únicas que simplifican el entrenamiento y revelan características invisibles para las imágenes 2D tradicionales. Con herramientas de IA integradas, mejora la precisión de la inspección, la precisión de la medición y la eficiencia operativa, estableciendo nuevos estándares en la automatización industrial.

- En mayo de 2023, Teledyne DALSA inició la producción de la cámara de escaneo lineal multiespectral 4k de 5 GigE Linea 2, un avance en la tecnología de sistemas de visión. Esta avanzada cámara cuenta con una interfaz de 5 GigE, que ofrece cinco veces más ancho de banda que su predecesora, la cámara Linea GigE. Con imágenes multiespectrales RGB e infrarrojo cercano (NIR) de alta resolución, optimiza la detección de defectos, la clasificación de materiales y la clasificación óptica en aplicaciones industriales. El sensor CMOS cuatrilineal garantiza una diafonía espectral mínima, lo que mejora la precisión de la inspección.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.