Europe Herpes Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

381.52 Million

USD

612.68 Million

2025

2033

USD

381.52 Million

USD

612.68 Million

2025

2033

| 2026 –2033 | |

| USD 381.52 Million | |

| USD 612.68 Million | |

|

|

|

|

Segmentación del mercado europeo del herpes por tipo de virus (herpes simple y herpes zóster), producto (aciclovir, docosanol, valaciclovir, famciclovir y otros), tipo de fármaco (con receta y sin receta), edad (adultos y niños), vía de administración (tópica, oral y parenteral), canal de distribución (hospitales, farmacias, farmacias minoristas, droguerías, farmacias en línea y otros), usuarios finales (hospitales, clínicas especializadas y otros): tendencias del sector y pronóstico hasta 2033.

Tamaño del mercado del herpes en Europa

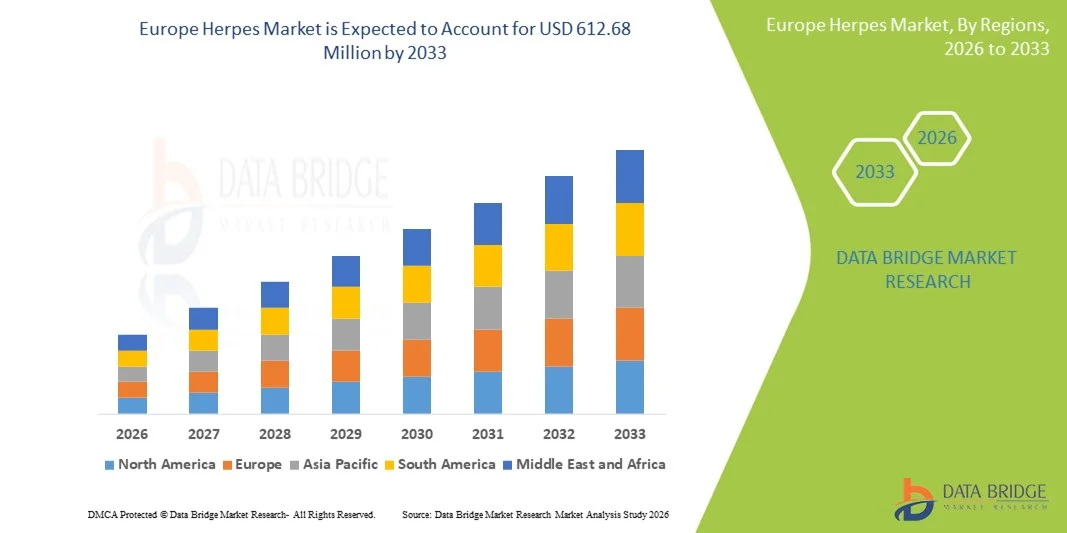

- El tamaño del mercado europeo del herpes se valoró en USD 381,52 millones en 2025 y se espera que alcance los USD 612,68 millones para 2033 , con una CAGR del 6,1 % durante el período de pronóstico.

- El crecimiento del mercado se debe en gran medida a la creciente prevalencia de infecciones por herpes en toda Europa, el aumento del gasto sanitario y la expansión de tratamientos farmacológicos antivirales eficaces que están mejorando los resultados de los pacientes y la adopción del tratamiento.

- Además, la creciente conciencia de las infecciones de transmisión sexual (ITS), las iniciativas de salud pública de apoyo y los avances en soluciones diagnósticas y terapéuticas están impulsando la demanda de una atención del herpes más accesible e integrada, lo que consolida el papel de la región como un mercado clave para la terapéutica del herpes.

Análisis del mercado del herpes en Europa

- Los tratamientos contra el herpes, incluidas las terapias antivirales para las infecciones por HSV-1 y HSV-2, son componentes cada vez más vitales del panorama sanitario europeo debido a su eficacia para controlar los síntomas, prevenir brotes y reducir los riesgos de transmisión tanto en entornos residenciales como clínicos.

- La creciente demanda de tratamientos para el herpes se debe principalmente a la creciente prevalencia de infecciones por herpes, la creciente conciencia sobre las infecciones de transmisión sexual (ITS) y la preferencia por medicamentos antivirales eficaces y de fácil acceso.

- Alemania dominó el mercado del herpes con la mayor participación en los ingresos del 28,5 % en 2025, impulsada por una infraestructura de atención médica bien establecida, un alto gasto en atención médica y una fuerte presencia de compañías farmacéuticas líderes que ofrecen terapias antivirales, respaldadas por campañas de salud pública y la adopción temprana de protocolos de tratamiento avanzados.

- Se espera que Polonia sea el país de más rápido crecimiento en el mercado del herpes durante el período de pronóstico debido al aumento del acceso a la atención médica, la creciente conciencia sobre las ITS y la expansión de la disponibilidad de medicamentos antivirales.

- El segmento de aciclovir dominó el mercado del herpes con una participación de mercado del 42,9 % en 2025, impulsado por su larga reputación de eficacia, uso clínico generalizado e inclusión en las pautas de tratamiento en los países europeos.

Alcance del informe y segmentación del mercado del herpes en Europa

|

Atributos |

Perspectivas clave del mercado del herpes en Europa |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Europa

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, epidemiología de pacientes, análisis de canalización, análisis de precios y marco regulatorio. |

Tendencias del mercado del herpes en Europa

Avances en terapias antivirales y concientización sobre salud digital

- Una tendencia significativa y en auge en el mercado europeo del herpes es el desarrollo de terapias antivirales más eficaces y la integración de herramientas de salud digital, como plataformas de telemedicina, aplicaciones móviles para el seguimiento de brotes y la gestión de recetas en línea. Esta combinación está mejorando la adherencia del paciente, la comodidad y el manejo general de la enfermedad.

- Por ejemplo, las tabletas de Valaciclovir de Liberación Prolongada, lanzadas en Alemania, ofrecen pautas de dosificación simplificadas, lo que mejora el cumplimiento terapéutico en pacientes con infecciones recurrentes por VHS-1 y VHS-2. De igual manera, algunas plataformas de telesalud en el Reino Unido permiten a los pacientes consultar con dermatólogos y obtener recetas de antivirales a distancia, lo que reduce las barreras para acceder a la atención médica.

- Las herramientas de salud digital y las terapias avanzadas permiten funciones como recordatorios personalizados de brotes, monitoreo de la efectividad del tratamiento y detección temprana de síntomas, lo que ayuda a reducir las complicaciones.

- La integración fluida de las terapias antivirales con las plataformas de monitorización digital facilita la gestión centralizada de la salud del paciente, permitiendo a los profesionales sanitarios supervisar la adherencia al tratamiento y los resultados del paciente de forma remota. Los pacientes pueden gestionar sus medicamentos, registrar sus síntomas y recibir orientación a través de una única interfaz.

- Esta tendencia hacia una atención del herpes más intuitiva, centrada en el paciente e integrada digitalmente está transformando las expectativas sobre el tratamiento y el manejo de la enfermedad. En consecuencia, compañías farmacéuticas como GlaxoSmithKline están desarrollando programas de apoyo al paciente con herramientas digitales y funciones de adherencia al tratamiento.

- La demanda de tratamientos para el herpes combinados con apoyo de salud digital está creciendo rápidamente tanto en entornos clínicos como de atención domiciliaria, ya que los pacientes priorizan cada vez más la conveniencia, el cumplimiento y las soluciones de atención médica integradas.

- La integración de dispositivos portátiles para la monitorización de síntomas en tiempo real en países como España también está ganando terreno, lo que permite a los profesionales sanitarios y a los pacientes detectar signos tempranos de brotes y optimizar los programas de tratamiento.

Dinámica del mercado del herpes en Europa

Conductor

Aumento de la prevalencia del herpes y mayor concienciación

- La creciente prevalencia de infecciones por HSV-1 y HSV-2, junto con una mayor conciencia de las infecciones de transmisión sexual, es un factor importante para la mayor demanda de tratamientos efectivos contra el herpes.

- Por ejemplo, en marzo de 2025, el Ministerio de Salud de Alemania lanzó una campaña nacional de concienciación para mejorar el diagnóstico temprano y el tratamiento de las infecciones por VHS, con el objetivo de reducir la transmisión y las complicaciones. Se espera que estas iniciativas, en países clave, impulsen el crecimiento del mercado del herpes durante el período de pronóstico.

- A medida que los pacientes y los proveedores de atención médica se vuelven más conscientes de los riesgos de infección y la necesidad de un tratamiento oportuno, las terapias antivirales ofrecen control de los síntomas, prevención de recurrencias y reducción de la transmisión, lo que proporciona una alternativa convincente a las infecciones no tratadas.

- Además, la creciente disponibilidad de servicios de telemedicina y farmacia en línea está haciendo que el tratamiento sea más accesible, permitiendo a los pacientes obtener recetas y hacer un seguimiento de la atención de manera conveniente.

- La facilidad de adherencia al tratamiento, la mejor accesibilidad y los programas de apoyo al paciente son factores clave que impulsan la adopción de terapias contra el herpes en toda Europa. Las iniciativas de concienciación pública, las consultas de telesalud y la educación del paciente contribuyen aún más al crecimiento del mercado.

- Por ejemplo, las campañas de salud pública en Italia centradas en la educación sobre salud sexual han aumentado significativamente las tasas de diagnóstico temprano y la adopción de tratamiento antiviral entre los adultos jóvenes.

- La creciente cobertura de seguros y las políticas de reembolso en países como los Países Bajos están permitiendo un acceso más amplio a los medicamentos antivirales, lo que impulsa aún más la expansión del mercado.

Restricción/Desafío

Efectos secundarios y obstáculos regulatorios

- Las preocupaciones en torno a los posibles efectos secundarios de las terapias antivirales, como náuseas, dolor de cabeza y reacciones cutáneas leves, plantean un desafío importante para una adopción más amplia en el mercado, ya que los pacientes pueden interrumpir el tratamiento prematuramente.

- Por ejemplo, los informes de efectos secundarios relacionados con los riñones en algunos usuarios de aciclovir a largo plazo han hecho que algunos pacientes duden en adherirse a los regímenes antivirales prescritos.

- Abordar estas preocupaciones de seguridad mediante una mejor educación del paciente, la optimización de las dosis y los protocolos de monitorización es crucial para generar confianza. Empresas como GlaxoSmithKline y Viatris enfatizan los perfiles de seguridad y ofrecen orientación a los médicos para tranquilizar a los pacientes. Además, el cumplimiento normativo y los requisitos de aprobación para nuevas formulaciones antivirales pueden retrasar la entrada al mercado, especialmente para terapias innovadoras o combinadas.

- Si bien los medicamentos antivirales genéricos están ampliamente disponibles y son asequibles, las terapias premium o recientemente desarrolladas a menudo tienen un costo más alto, lo que puede ser una barrera para los pacientes sensibles a los precios en ciertos países.

- Superar estos desafíos mediante un mejor apoyo al paciente, educación sobre la seguridad de la terapia y el desarrollo de opciones antivirales rentables será vital para el crecimiento sostenido del mercado del herpes en toda Europa.

- Por ejemplo, los complejos procesos de aprobación de terapias antivirales combinadas en Francia y Alemania pueden retrasar el lanzamiento de tratamientos innovadores, limitando la disponibilidad para los pacientes que los necesitan.

- Las altas tasas de interrupción del tratamiento debido a efectos adversos leves informados en estudios clínicos también representan un desafío, que requiere esfuerzos constantes en la educación y el monitoreo del paciente para mantener la adherencia a la terapia.

Análisis del mercado del herpes en Europa

El mercado está segmentado según el tipo de virus, producto, tipo de fármaco, edad, vía de administración, canal de distribución y usuarios finales.

- Por tipo de virus

Según el tipo de virus, el mercado europeo del herpes se segmenta en herpes simple y herpes zóster. El segmento del herpes simple dominó el mercado en 2025, representando la mayor participación en los ingresos debido a su mayor prevalencia tanto en la población adulta como pediátrica en toda Europa. Los pacientes con infecciones por VHS-1 y VHS-2 a menudo requieren terapia antiviral recurrente, lo que garantiza una demanda constante. El segmento se beneficia de una amplia concienciación clínica, pruebas de rutina y programas de diagnóstico temprano que mejoran el inicio del tratamiento. Las sólidas líneas de investigación para terapias dirigidas y el manejo a largo plazo también respaldan el dominio del segmento. Los proveedores de atención médica en países como Alemania y Francia priorizan el manejo del herpes simple debido a su potencial de brotes recurrentes y la prevención de la transmisión. Además, la cobertura de seguros para tratamientos antivirales en Europa Occidental mejora la accesibilidad y la adopción de este tipo de virus.

Se espera que el segmento de herpes zóster experimente el mayor crecimiento durante el período de pronóstico, impulsado por la creciente incidencia de herpes zóster en las poblaciones mayores. Los programas de concientización sobre la vacunación en el Reino Unido e Italia y el aumento del gasto en atención médica para adultos mayores son factores clave. El herpes zóster suele provocar complicaciones graves, como la neuralgia posherpética, lo que requiere una intervención antiviral temprana. El creciente enfoque en la atención preventiva, las campañas de inmunización y la educación del paciente contribuye a la rápida adopción de tratamientos. Además, el segmento se ve respaldado por la innovación farmacéutica en formulaciones antivirales más efectivas y terapias combinadas específicas para el manejo del herpes zóster.

- Por producto

Según el producto, el mercado se segmenta en aciclovir, docosanol, valaciclovir, famciclovir y otros. El segmento de aciclovir dominó el mercado en 2025 con la mayor cuota de mercado, un 42,9%, gracias a su prolongada eficacia clínica y a su amplio uso en Europa. El aciclovir se considera un tratamiento de primera línea para las infecciones por VHS-1 y VHS-2 y está incluido en numerosas guías de tratamiento europeas. Su disponibilidad en formato genérico lo hace asequible para una amplia base de pacientes, lo que refuerza aún más su dominio. La alta confianza de los médicos, las pautas posológicas establecidas y la sólida adherencia del paciente contribuyen a una cuota de mercado estable. Hospitales, clínicas y farmacias minoristas mantienen un stock regular de aciclovir, lo que garantiza una distribución estable y una accesibilidad accesible. La demanda del mercado se ve reforzada por las continuas campañas de concienciación y la inclusión en programas de salud pública en toda Europa Occidental.

Se espera que el segmento de Valaciclovir experimente el mayor crecimiento gracias a su perfil farmacocinético mejorado, que permite una dosificación menos frecuente y un mayor cumplimiento terapéutico por parte del paciente. Este producto es especialmente popular entre adultos que trabajan y viajeros debido a su comodidad. Su eficacia para reducir la frecuencia de recurrencias y el riesgo de transmisión impulsa la preferencia de los médicos. Las compañías farmacéuticas están promoviendo activamente Valaciclovir mediante iniciativas de educación al paciente en Alemania, Francia y el Reino Unido. La creciente adopción de plataformas de telemedicina para la gestión remota de recetas también impulsa un rápido crecimiento. El segmento se beneficia de un sólido reconocimiento de marca y de la continua evidencia clínica que respalda resultados superiores para los pacientes.

- Por tipo de fármaco

Según el tipo de fármaco, el mercado se segmenta en medicamentos con receta y medicamentos de venta libre (OTC). El segmento de medicamentos con receta dominó el mercado en 2025, impulsado por los requisitos regulatorios para terapias antivirales como aciclovir, valaciclovir y famciclovir en la mayoría de los países europeos. Los medicamentos con receta garantizan el acceso controlado, el cumplimiento de la dosis y la monitorización adecuada de los efectos adversos. Hospitales, clínicas y farmacias especializadas prefieren los medicamentos con receta para controlar tanto los brotes agudos como la terapia de supresión a largo plazo. Las guías clínicas recomiendan la terapia antiviral con receta como tratamiento de primera línea, lo que respalda el dominio del mercado. El segmento se ve reforzado por las mayores tasas de reembolso de seguros para medicamentos con receta. La confianza de los pacientes y de los médicos en los antivirales con receta también fortalece la demanda sostenida.

Se espera que el segmento de medicamentos de venta libre experimente el mayor crecimiento durante el período de pronóstico debido a la mayor concienciación sobre el manejo de brotes leves de herpes en adultos. Los tratamientos tópicos de venta libre, como cremas y geles, ofrecen opciones accesibles para el autocuidado y el alivio de los síntomas. Este crecimiento se ve impulsado por farmacias en línea y puntos de venta minorista que ofrecen un acceso conveniente a productos de venta libre. Los consumidores buscan cada vez más tratamientos rápidos y económicos para el herpes labial recurrente o brotes leves. Las campañas educativas que destacan el uso adecuado de las opciones de venta libre y las medidas preventivas están impulsando su adopción. Países como Francia y España muestran un crecimiento significativo en las ventas de medicamentos de venta libre a través de farmacias y plataformas de comercio electrónico.

- Por edad

Según la edad, el mercado se segmenta en adultos y niños. El segmento de adultos dominó el mercado con la mayor participación en los ingresos en 2025 debido a la mayor prevalencia de infecciones por VHS-1 y VHS-2 en adultos y a los brotes recurrentes que requieren tratamiento. Los adultos también impulsan la demanda de terapia de supresión crónica, antivirales recetados y servicios de atención médica basados en telemedicina. El segmento se beneficia de una sólida cobertura de seguros, monitoreo proactivo de la atención médica y campañas de concienciación para los pacientes. Los adultos también son más propensos a invertir en tratamientos preventivos y estrategias de gestión del estilo de vida para minimizar los brotes. Los hospitales y clínicas priorizan la atención a adultos debido al mayor volumen de casos y la asignación de recursos clínicos. Los programas de apoyo al paciente centrados en adultos mejoran aún más la adherencia al tratamiento y la demanda sostenida del mercado.

Se espera que el segmento de Pediatría experimente el mayor crecimiento durante el período de pronóstico debido al aumento del diagnóstico temprano y la adopción del tratamiento antiviral pediátrico. Las iniciativas de salud pública en Alemania e Italia fomentan la detección temprana del VHS en niños para prevenir complicaciones. Las plataformas de telemedicina y las clínicas pediátricas especializadas facilitan el acceso al tratamiento. El segmento se beneficia de la creciente concienciación parental, la asesoría preventiva y los programas de vacunación contra el herpes zóster en adolescentes. El creciente enfoque en formulaciones aptas para niños, como suspensiones y geles tópicos, impulsa la adopción. La mejora del cumplimiento y las medidas de seguridad en el tratamiento pediátrico también impulsan la expansión del mercado.

- Por vía de administración

Según la vía de administración, el mercado se segmenta en tópico, oral y parenteral. El segmento oral dominó el mercado en 2025, con la mayor participación gracias a la conveniencia, eficacia y preferencia por el tratamiento sistémico de las infecciones por VHS. Los antivirales orales, como las tabletas de valaciclovir y aciclovir, permiten la supresión de brotes recurrentes y la reducción del riesgo de transmisión. Hospitales, clínicas y farmacias priorizan las formulaciones orales debido a su facilidad de administración y al cumplimiento terapéutico del paciente. Los medicamentos orales están ampliamente disponibles, son asequibles e incluidos en las guías clínicas, lo que sustenta una demanda constante. Las plataformas de telemedicina también promueven la terapia oral para el manejo domiciliario. Este segmento se ve reforzado por la fuerte preferencia de los médicos y los sólidos sistemas de seguimiento de la adherencia del paciente.

Se espera que el segmento de productos tópicos experimente el mayor crecimiento durante el período de pronóstico debido a la creciente preferencia de los consumidores por el manejo localizado de los síntomas y la accesibilidad a los medicamentos sin receta. Se utilizan cremas, geles y ungüentos para aliviar las molestias del herpes labial y lesiones menores. Este crecimiento se ve impulsado por farmacias en línea y puntos de venta minorista que ofrecen un cómodo acceso a medicamentos sin receta. Los tratamientos tópicos son atractivos tanto para adultos como para niños para brotes leves. Las campañas educativas sobre el uso correcto de los productos tópicos están aumentando su adopción. Las innovaciones en la formulación para una absorción más rápida y el alivio de los síntomas impulsan aún más el segmento.

- Por canal de distribución

Según el canal de distribución, el mercado se segmenta en farmacias hospitalarias, farmacias minoristas, droguerías, farmacias en línea y otras. El segmento de farmacias hospitalarias dominó el mercado con la mayor participación en 2025 debido al alto volumen de antivirales con receta dispensados a través de las redes hospitalarias. Los hospitales gestionan casos agudos y crónicos, garantizando un acceso confiable a los pacientes y el monitoreo de la adherencia. El segmento se beneficia de la supervisión clínica, el reembolso de seguros y una afluencia constante de pacientes. Los hospitales suelen tener en stock antivirales de primera línea como aciclovir, valaciclovir y famciclovir para el inicio inmediato del tratamiento. Los protocolos clínicos y las redes de farmacias establecidas refuerzan su dominio. La sólida confianza de los médicos en la dispensación hospitalaria también impulsa la participación de mercado.

Se espera que el segmento de Farmacias Online experimente el mayor crecimiento durante el período de pronóstico debido a la creciente penetración del comercio electrónico y la adopción de la telemedicina en toda Europa. Cada vez más pacientes solicitan antivirales con receta y de venta libre en línea para mayor comodidad y entrega a domicilio. Las plataformas online ofrecen acceso a consultas remotas, gestión de recetas y entrega puntual. La COVID-19 aceleró la adopción de canales de atención médica digitales, impulsando el crecimiento de las farmacias online. El marketing digital, los programas de suscripción y las aplicaciones móviles contribuyen a la expansión del segmento. Países como el Reino Unido, Alemania y Francia muestran una rápida adopción de los servicios farmacéuticos online.

- Por los usuarios finales

En función de los usuarios finales, el mercado se segmenta en hospitales, clínicas especializadas y otros. El segmento Hospitales dominó el mercado con la mayor participación en 2025 debido al alto volumen de pacientes, la disponibilidad de medicamentos recetados y la capacidad de monitorizar el tratamiento. Los hospitales prestan servicios tanto para el manejo de brotes agudos como para terapia supresora a largo plazo, lo que los convierte en puntos de distribución clave. También ofrecen asesoramiento al paciente, apoyo a la adherencia terapéutica y seguimiento clínico. Las redes hospitalarias consolidadas en Alemania, Francia y el Reino Unido fortalecen su penetración en el mercado. Las farmacias hospitalarias mantienen un stock constante de antivirales para el inicio inmediato del tratamiento. La confianza de los médicos y la supervisión regulatoria en los entornos hospitalarios refuerzan su dominio.

Se espera que el segmento de Clínicas Especializadas experimente el mayor crecimiento durante el período de pronóstico debido al mayor enfoque en clínicas de salud sexual y dermatología especializadas en el manejo del VHS. Las clínicas ofrecen planes de tratamiento personalizados, asesoramiento y terapias avanzadas. Las campañas de concienciación y diagnóstico temprano impulsan las visitas de pacientes. La integración de la telemedicina en las clínicas especializadas facilita el seguimiento remoto y la gestión de recetas. Clínicas en países como Italia, España y Polonia están ampliando sus servicios para abordar la prevalencia del herpes. La comodidad, la atención personalizada y la experiencia especializada contribuyen al crecimiento del segmento.

Análisis regional del mercado europeo del herpes

- Alemania dominó el mercado del herpes con la mayor participación en los ingresos del 28,5 % en 2025, impulsada por una infraestructura de atención médica bien establecida, un alto gasto en atención médica y una fuerte presencia de compañías farmacéuticas líderes que ofrecen terapias antivirales, respaldadas por campañas de salud pública y la adopción temprana de protocolos de tratamiento avanzados.

- Los pacientes y los proveedores de atención médica en Alemania valoran mucho el acceso oportuno a terapias antivirales, protocolos de tratamiento establecidos y programas integrados de apoyo al paciente, que ayudan a gestionar brotes recurrentes y reducir el riesgo de transmisión.

- Esta adopción generalizada se ve respaldada además por el alto gasto en atención médica, la amplia cobertura de seguros y la presencia de compañías farmacéuticas líderes, que establecen las terapias antivirales recetadas como la solución preferida para el tratamiento del herpes agudo y a largo plazo en Alemania.

Perspectiva del mercado del herpes en Alemania

Se espera que el mercado alemán del herpes se expanda a una tasa de crecimiento anual compuesta (TCAC) considerable durante el período de pronóstico, impulsado por una alta concienciación sobre las infecciones de transmisión sexual (ITS), una infraestructura sanitaria avanzada y una sólida cobertura de seguros. El énfasis de Alemania en la innovación en la atención médica y el tratamiento preventivo respalda la adopción de terapias antivirales, en particular medicamentos con receta como el aciclovir y el valaciclovir. Pacientes y médicos prefieren tratamientos que ofrezcan la supresión a largo plazo de los brotes, y las plataformas de telemedicina mejoran aún más el acceso a la atención. Las campañas de salud pública y las herramientas de salud digital para el seguimiento de síntomas son cada vez más frecuentes, en consonancia con las expectativas de los pacientes locales de una terapia oportuna, eficaz y monitorizada. La integración de terapias antivirales en las redes de hospitales, clínicas y farmacias garantiza una amplia disponibilidad y una adherencia constante a los protocolos de tratamiento.

Perspectivas del mercado del herpes en Francia

Se prevé que el mercado francés del herpes crezca a una CAGR notable durante el período de pronóstico, impulsado por los programas gubernamentales de concienciación, el sólido gasto en salud y el aumento del conocimiento de los pacientes sobre las ITS. Los pacientes y profesionales de la salud franceses valoran las terapias antivirales eficaces combinadas con apoyo digital en salud, como aplicaciones móviles para el seguimiento de brotes y la consulta remota. Los antivirales con receta predominan, respaldados por una sólida cobertura de seguros y redes de farmacias. La creciente urbanización y el mayor acceso a clínicas especializadas fomentan el diagnóstico temprano y el tratamiento preventivo. El enfoque del país en la educación sobre salud sexual y los programas de pruebas rutinarias continúa impulsando el crecimiento del mercado.

Perspectivas del mercado del herpes en el Reino Unido

Se espera que el mercado del herpes en el Reino Unido se expanda a una tasa de crecimiento anual compuesta (TCAC) considerable durante el período de pronóstico, impulsado por la creciente prevalencia de infecciones por herpes, la adopción de la telemedicina y la demanda de los pacientes de un acceso conveniente a terapias antivirales. Los centros de atención domiciliaria y de tratamiento ambulatorio incorporan cada vez más antivirales con receta a la atención estándar. La consolidada infraestructura de salud digital del Reino Unido, que incluye farmacias en línea y plataformas de consulta remota, está impulsando la adopción. Los pacientes también se sienten motivados por las campañas de concienciación y los programas de prevención de ITS, que fomentan el diagnóstico precoz y la gestión de terapias a largo plazo. Las redes hospitalarias, clínicas y farmacias desempeñan un papel fundamental para garantizar el suministro continuo y la adherencia a los protocolos de tratamiento antiviral.

Perspectivas del mercado del herpes en Polonia

Se espera que el mercado polaco del herpes crezca a una tasa de crecimiento anual compuesta (TCAC) notable durante el período de pronóstico, impulsado por una mayor concienciación sobre las infecciones de transmisión sexual (ITS), un mayor acceso a la atención médica y una mayor adopción de terapias antivirales. Los pacientes en Polonia buscan cada vez más tratamientos eficaces para las infecciones por VHS-1 y VHS-2, incluyendo antivirales con receta como aciclovir y valaciclovir. Las plataformas de telemedicina y las farmacias en línea están mejorando la accesibilidad, especialmente en zonas urbanas, mientras que las clínicas especializadas ofrecen atención específica para brotes recurrentes. Las campañas de salud pública que promueven el diagnóstico temprano, las medidas preventivas y la adherencia a los protocolos de tratamiento están contribuyendo a la expansión del mercado. Además, la disponibilidad de opciones antivirales asequibles y las iniciativas de atención médica apoyadas por el gobierno fomentan una mayor adopción de terapias.

Cuota de mercado del herpes en Europa

La industria del herpes en Europa está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- GSK plc (Reino Unido)

- Merck & Co. Inc. (EE. UU.)

- Pfizer Inc. (EE. UU.)

- Novartis AG (Suiza)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Viatris Inc. (EE. UU.)

- Sanofi (Francia)

- Abbott (EE. UU.)

- Fresenius Kabi AG (Alemania)

- Glenmark Pharmaceuticals Ltd. (India)

- Zydus Lifesciences Ltd. (India)

- Emcure Pharmaceuticals Ltd. (India)

- Apotex Inc. (Canadá)

- Aurobindo Pharma Ltd. (India)

- Sun Pharmaceutical Industries Ltd. (India)

- Agenus Inc. (EE. UU.)

- Gilead Sciences, Inc. (EE. UU.)

- Bausch Health (Canadá)

¿Cuáles son los desarrollos recientes en el mercado del herpes en Europa?

- En octubre de 2025, la nueva presentación de jeringa precargada Shingrix de GSK recibió una opinión positiva del CHMP, lo que agilizó la administración de la vacuna recombinante contra el herpes zóster en la Unión Europea y facilitó su uso por parte de los profesionales sanitarios. Esta aprobación refleja los esfuerzos continuos para mejorar la atención preventiva contra el herpes zóster y sus complicaciones.

- En septiembre de 2025, investigadores alemanes publicaron la generación de un nanoanticuerpo altamente potente contra el virus del herpes, capaz de neutralizar la infección por VHS-1 en una etapa temprana al actuar sobre proteínas de fusión viral esenciales. Este descubrimiento promete nuevos enfoques terapéuticos y preventivos para las infecciones graves por herpes.

- En agosto de 2025, los investigadores presentaron nuevos hallazgos en el Congreso de la Sociedad Europea de Cardiología de 2025 que muestran que la vacunación contra el herpes zóster (culebrilla) está asociada con un riesgo estadísticamente significativo menor de ataque cardíaco y accidente cerebrovascular.

- En junio de 2025, la Comisión Europea retiró la autorización de comercialización de Zostavax, la vacuna viva atenuada contra el herpes zóster, tras su suspensión por razones comerciales y el cese de su comercialización en la UE. Este cambio marcó el fin de la disponibilidad de Zostavax en favor de vacunas más eficaces como Shingrix.

- En septiembre de 2024, GSK interrumpió públicamente el desarrollo de su candidata a vacuna terapéutica contra el VHS (GSK3943104) después de que el ensayo de fase 1/2 no cumpliera con los criterios de valoración de eficacia primarios, lo que subrayó la dificultad de desarrollar una vacuna eficaz contra el herpes e impactó el enfoque de la I+D en Europa.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.