Mercado europeo de terapia génica, por tipo de vector (vector viral y vector no viral), método (ex vivo e in vivo), aplicación (trastornos oncológicos, enfermedades cardiovasculares, enfermedades infecciosas , enfermedades raras, trastornos neurológicos y otras enfermedades), usuario final (institutos de cáncer, hospitales, institutos de investigación y otros): tendencias de la industria y pronóstico hasta 2030.

Análisis y perspectivas del mercado de terapia génica en Europa

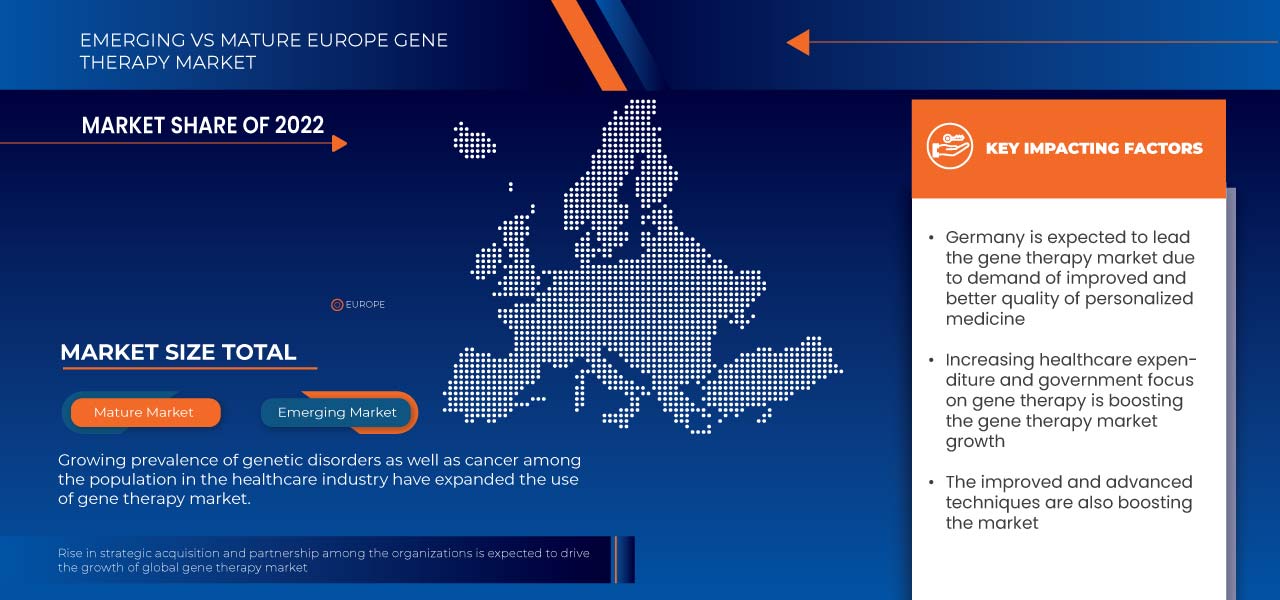

Se espera que el mercado europeo de terapia génica crezca en el año de pronóstico debido al aumento de los participantes del mercado y la disponibilidad de servicios y productos avanzados. Junto con esto, los fabricantes están involucrados en actividades de I+D para lanzar productos novedosos al mercado.

Se espera que la creciente investigación en terapia génica y sus técnicas y desarrollo impulse aún más el crecimiento del mercado. Sin embargo, se espera que las preocupaciones éticas y de seguridad al realizar el método obstaculicen el crecimiento del mercado europeo de terapia génica en el período de pronóstico. Se espera que la creciente demanda de terapia génica, un campo emergente y avanzado en ingeniería genética y atención médica, brinde oportunidades al mercado para mejorar los enfoques de tratamiento y diagnóstico.

Se espera que la creciente demanda de una atención sanitaria de mejor calidad para el cáncer y los trastornos genéticos impulse el crecimiento del mercado. Sin embargo, se espera que el alto coste de los diagnósticos y la falta de profesionales cualificados y certificados supongan un reto para el crecimiento del mercado.

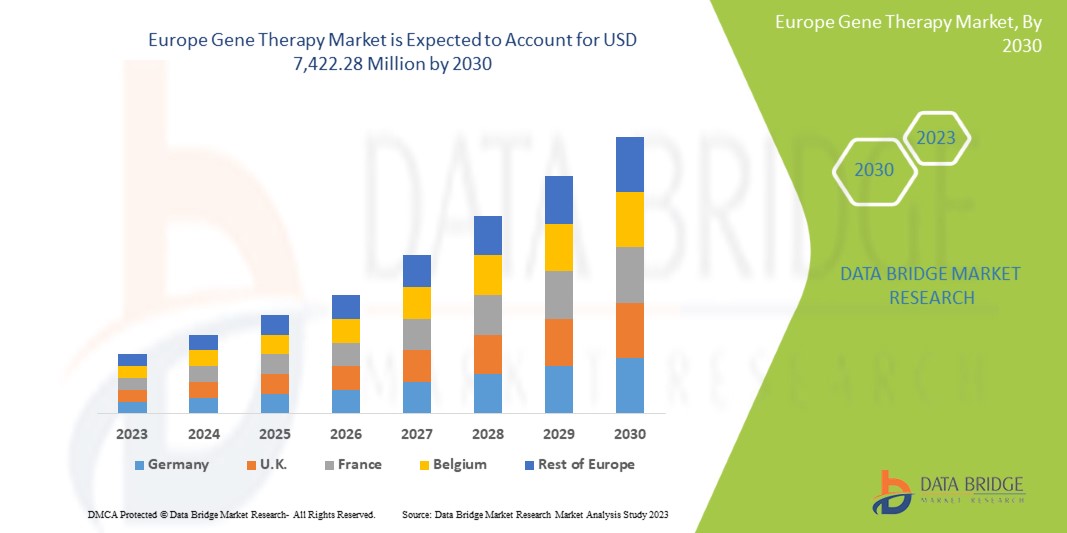

Data Bridge Market Research analiza que se espera que el mercado europeo de terapia génica alcance los 7.422,28 millones de dólares en 2030, con una tasa de crecimiento anual compuesta (CAGR) del 17,6 % durante el período de pronóstico. Los productos representan el segmento de tipo más importante en el mercado debido al creciente uso de productos de investigación de exosomas en diagnósticos y terapias.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2015-2020) |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Por tipo de vector (vector viral y vector no viral), método (ex vivo e in vivo), aplicación (trastornos oncológicos, enfermedades cardiovasculares, enfermedades infecciosas, enfermedades raras, trastornos neurológicos y otras enfermedades), usuario final (institutos oncológicos, hospitales, institutos de investigación y otros) |

|

Países cubiertos |

Alemania, Francia, Reino Unido, Italia, Rusia, España, Países Bajos, Suiza, Bélgica, Turquía, Resto de Europa |

|

Actores del mercado cubiertos |

Novartis AG, Kite Pharma (una subsidiaria de Gilead Sciences, Inc.), uniQure NV., Oxford Biomedica, Spark Therapeutics, Inc., SIBONO, bluebird bio, Inc., Shanghai Sunway Biotech Co., Ltd., Biogen, Dendreon Pharmaceuticals LLC., Amgen Inc., AnGes, Inc. y Enzyvant Therapeutics GmbH, entre otros. |

Definición del mercado europeo de terapia génica

La terapia génica es una estrategia médica que aborda el problema genético subyacente para tratar o prevenir una enfermedad. En lugar de utilizar medicamentos o cirugía, los procedimientos de terapia génica permiten a los médicos tratar un problema modificando la composición genética de una persona. Unos pocos trastornos seleccionados, entre ellos una afección ocular llamada amaurosis congénita de Leber y una afección muscular llamada atrofia muscular espinal, se están tratando con terapia génica. Para garantizar que sean seguras y eficaces, se están estudiando muchas otras terapias génicas. Los profesionales médicos aspiran a aplicar pronto la prometedora técnica de edición genómica para curar enfermedades humanas.

La capacidad de transportar con éxito un gen terapéutico a una célula diana es el requisito previo más importante para que la terapia génica tenga éxito. Una vez transportado, ese gen debe ir al núcleo de la pared celular, donde servirá como modelo para la fabricación de moléculas de proteína. La proteína produce entonces la principal acción terapéutica. Por ejemplo, la destrucción celular podría utilizarse en el tratamiento de tumores, mientras que la conservación celular podría utilizarse en el caso de enfermedades neurodegenerativas. Sin embargo, se espera que las estrictas regulaciones y normas para la aprobación y comercialización de productos limiten el crecimiento del mercado.

Dinámica del mercado de la terapia génica en Europa

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- Nuevos enfoques de la terapia génica

La terapia génica ha permitido curar de forma permanente enfermedades que antes eran meros tratamientos temporales. Durante mucho tiempo, la terapia génica no funcionó; sin embargo, en los últimos años se han registrado casos de tratamiento eficaz y duradero. Se han obtenido resultados prometedores para una amplia gama de enfermedades hereditarias, incluidas anomalías sanguíneas, deficiencias inmunológicas, problemas de visión, regeneración de células nerviosas, trastornos metabólicos y diferentes tipos de cáncer.

Con mayor especificidad y menos efectos secundarios, la terapia génica tiene el potencial de ser una medicina personalizada que puede "curar" una variedad de enfermedades. La terapia génica generalmente se refiere a la transferencia de material genético para tratar una enfermedad o, al menos, para mejorar el estado clínico de un paciente. El uso de virus como vectores genéticos para entregar el gen deseado a las células objetivo es un método de cómo funciona la terapia génica. Estos vectores se clasifican como vectores virales basados en ARN o basados en ADN según el tipo de genoma que contengan.

La mayoría de los expertos coinciden en que la terapia génica tiene el potencial de ser el uso más interesante de la investigación del ADN hasta la fecha. Una simple inyección intravenosa de un agente de transferencia génica podría algún día utilizarse para administrar genes como medicina, buscando células diana para la integración cromosómica estable y específica del sitio y la posterior expresión génica. Se prevé que existirá una necesidad de terapia génica que utilice técnicas revolucionarias que están siendo probadas por investigadores de todo el mundo e incorporadas al tratamiento convencional y se espera que actúen como impulsor del crecimiento del mercado de terapia génica en Europa.

- Aumento de la prevalencia de trastornos genéticos

En varios países de la región, una parte considerable de la mortalidad prenatal y neonatal se debe a enfermedades genéticas y congénitas. Muchas enfermedades multifactoriales también suelen tener su origen en factores genéticos. Las alteraciones genéticas que están presentes en casi todas las células del cuerpo causan muchas enfermedades hereditarias. Por lo tanto, estas enfermedades afectan con frecuencia a muchos sistemas corporales y la mayoría de ellas no pueden tratarse.

Por ejemplo,

- El Departamento de Salud indicó que aproximadamente seis de cada diez personas se verán afectadas por una enfermedad que tiene algún vínculo genético, según el Gobierno de Australia Occidental. Los trastornos genéticos pueden variar de leves a muy graves. Entre el 3 y el 5% de los recién nacidos en Australia Occidental tienen trastornos genéticos o anomalías congénitas.

Las mutaciones, la exposición a sustancias químicas y la radiación, entre otras cosas, pueden provocar trastornos genéticos. Aunque algunas enfermedades se han tratado con terapia génica, la mayoría de los planes de tratamiento para trastornos genéticos no modifican la anomalía genética subyacente. Por ello, la prevalencia de anomalías genéticas está aumentando significativamente en todos los grupos de edad y se espera que prácticamente todas las áreas geográficas actúen como impulsores del crecimiento del mercado de terapia génica en Europa.

Restricción

- El alto coste de la terapia genética

Una nueva línea de tratamientos médicos llamada terapia génica implica reemplazar, eliminar o introducir información genética en el genoma de un paciente para tratar una enfermedad. Aunque todavía está en sus inicios, la terapia génica ya ha demostrado ser muy prometedora para el tratamiento e incluso la cura de enfermedades que antes eran intratables. El precio de la terapia génica todavía está muy descontrolado y se determina caso por caso en muchos países, centrándose con frecuencia en un único pago inicial.

Por ejemplo,

- Según un artículo de noticias publicado en Web MD en febrero de 2023, Hemgenix está batiendo récords, pero no es una anomalía. En septiembre de 2022, Skysona, un medicamento para una enfermedad neurológica poco común, salió a la venta por 3 millones de dólares. Tan solo un mes antes, Zynteglo, un tratamiento genético para una enfermedad sanguínea genética, debutó en el mercado por 2,8 millones de dólares. Una cura para la atrofia muscular espinal, una enfermedad genética que mata a bebés y niños pequeños, llamada Zolgensma, costó 2,1 millones de dólares en 2019.

Aunque no siempre sean totalmente curativas, las terapias génicas pueden ser realmente transformadoras. La principal barrera para acceder a la terapia génica es el costo. El panorama de tratamiento de muchas enfermedades genéticas raras experimentará cambios significativos a medida que estén disponibles más productos de terapia génica, brindando a los pacientes alternativas potencialmente curativas por primera vez. La dificultad de garantizar que todos los pacientes, no solo un pequeño grupo con medios financieros y acceso privilegiado a la tecnología, puedan beneficiarse de estas terapias de vanguardia debe ser abordada por los sistemas de atención médica de todo el mundo. Sin embargo, debido al alto costo de los tratamientos,

Oportunidad

- Aumento de las adquisiciones estratégicas y las asociaciones entre organizaciones

Recientemente, diferentes organizaciones están dando un paso adelante para asociarse y colaborar con el fin de desarrollar diversos productos de terapia génica que son esenciales para detectar trastornos genéticos. No solo eso, con la ayuda de asociaciones y acuerdos, ambas empresas pueden desarrollar un nuevo conjunto de tecnologías y plataformas que ayudarán a detectar enfermedades.

Gracias a un acuerdo a largo plazo, ambas empresas pueden ofrecer precios dimensionales para los productos de terapia génica en respuesta a la demanda de los consumidores en el mercado. Esta asociación y este acuerdo mutuo no solo benefician a ambas empresas, sino que también crean muchas oportunidades para que el mercado crezca.

Por ejemplo,

- En julio de 2022, Novartis Pharmaceuticals UK anuncia el lanzamiento de Novartis Biome UK Heart Health Catalyst 2022, en una asociación de inversores pionera a nivel mundial con Medtronic Ltd, RYSE Asset Management y Chelsea and Westminster Hospital NHS Foundation Trust y su organización benéfica oficial CW+.

Por lo tanto, se espera que un aumento en la colaboración y las asociaciones genere muchas oportunidades para que el mercado crezca.

Desafío

- Normas estrictas para los productos de terapia genética

El uso de la terapia génica está aumentando rápidamente en todo el mundo, debido al aumento de la población envejecida y a varias enfermedades crónicas que se pueden prevenir mediante un diagnóstico temprano y tratamientos oportunos. Al mismo tiempo, los actores de la terapia génica en el mercado deben cumplir ciertas regulaciones para obtener la aprobación de las autoridades superiores para el lanzamiento del producto en una región. Estas estrictas pautas deben cumplirse y esta es una de las tareas más difíciles entre todos los pasos. La aprobación previa a la comercialización de varios productos de terapia génica varía de un país a otro.

Por ejemplo,

- En 2022, según la información proporcionada por la Administración de Alimentos y Medicamentos (FDA), el Centro de Evaluación e Investigación Biológica (CBER) regula los productos de terapia celular, los productos de terapia génica humana y ciertos dispositivos relacionados con la terapia celular y génica. El CBER utiliza tanto la Ley del Servicio de Salud Pública como la Ley Federal de Alimentos, Medicamentos y Cosméticos como estatutos habilitantes para la supervisión.

Por lo tanto, las regulaciones estrictas para los productos de terapia genética varían según los distintos países, lo que se espera que represente un desafío para el crecimiento del mercado.

Acontecimientos recientes

- En diciembre de 2022, Kite Pharma, Inc. y Daiichi Sankyo Co., Ltd. anunciaron que el Ministerio de Salud, Trabajo y Bienestar de Japón (MHLW) había aprobado Yescarta (axicabtagene ciloleucel), una terapia de células T con receptor de antígeno quimérico (CAR), para el tratamiento inicial de pacientes con linfoma de células B grandes recidivante/refractario (LBCL R/R): linfoma difuso de células B grandes, linfoma mediastínico primario de células B grandes, linfoma folicular transformado y linfoma de células B de alto grado. Solo los pacientes que no hayan recibido previamente una transfusión de células T CAR dirigidas contra el antígeno CD19 deben ser tratados con Yescarta.

- En diciembre, Ferring Pharmaceuticals anunció que la Administración de Alimentos y Medicamentos de los Estados Unidos (FDA) había aprobado Adstiladrin (nadofaragene firadenovec-vncg), una nueva terapia génica basada en un vector de adenovirus, para el tratamiento de pacientes adultos con cáncer de vejiga no músculo invasivo (NMIBC) de alto riesgo que no responde al bacilo de Calmette-Guérin (BCG) y que presenta carcinoma in situ (CIS) con o sin tumores papilares. Esto ha ayudado a la empresa a ampliar su cartera de productos.

Alcance del mercado de terapia génica en Europa

El mercado europeo de terapia génica se divide en cuatro segmentos importantes según el tipo de vector, el método, la aplicación y el usuario final. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

POR TIPO DE VECTOR

- Vector viral

- Vector no viral

Según el tipo de vector, el mercado europeo de terapia génica está segmentado en vectores virales y no virales.

POR MÉTODO

- Ex vivo

- In vivo

Sobre la base del método, el mercado europeo de terapia génica está segmentado en ex vivo e in vivo.

POR APLICACIÓN

- Trastornos oncológicos

- Enfermedades cardiovasculares

- Enfermedad infecciosa

- Enfermedades raras

- Trastornos neurológicos

- Otras enfermedades

Sobre la base de la aplicación, el mercado europeo de terapia génica está segmentado en trastornos oncológicos, enfermedades cardiovasculares, enfermedades infecciosas, enfermedades raras, trastornos neurológicos y otras enfermedades.

POR USUARIO FINAL

- Institutos del cáncer

- Hospitales

- Institutos de investigación

- Otros

Sobre la base del usuario final, el mercado europeo de terapia génica está segmentado en institutos de cáncer, hospitales, institutos de investigación y otros.

Análisis y perspectivas regionales del mercado de terapia génica en Europa

El mercado europeo de terapia génica está segmentado en cuatro segmentos notables según el tipo de vector, el método, la aplicación y el usuario final.

Los países cubiertos en este informe de mercado son Alemania, Francia, Reino Unido, Italia, Rusia, España, Países Bajos, Suiza, Bélgica, Turquía y el resto de Europa.

Alemania domina debido a la presencia de actores clave en el mayor mercado de consumo con un alto PIB. Se espera que Estados Unidos crezca debido al aumento de los avances tecnológicos en el mercado de productos de terapia génica.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas europeas y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, y el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de la terapia génica en Europa

El panorama competitivo del mercado de terapia génica en Europa ofrece detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en I+D, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las aprobaciones de productos, la amplitud y el alcance de los productos, el dominio de las aplicaciones y la curva de supervivencia de los tipos de productos. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa en el mercado de terapia génica en Europa.

Algunos de los principales actores que operan en el mercado de terapia génica en Europa son: Novartis AG, Kite Pharma (una subsidiaria de Gilead Sciences, Inc.), uniQure NV, Oxford Biomedica, Spark Therapeutics, Inc., SIBONO, bluebird bio, Inc., Shanghai Sunway Biotech Co. Ltd., Biogen, Dendreon Pharmaceuticals LLC., Amgen Inc., AnGes, Inc. y Enzyvant Therapeutics GmbHAudubon Bioscience, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE GENE THERAPY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET END USER COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER FIVE ANALYSIS

5 UPDATE ON GERMLINE GENE THERAPY

5.1 GERMLINE GENE THERAPY

6 EUROPE GENE THERAPY MARKET, MO

6.1 DRIVERS

6.1.1 NOVEL APPROACHES TO GENE THERAPY

6.1.2 INCREASING PREVALENCE OF GENETIC DISORDERS

6.1.3 THE GROWING INVESTMENT BY BIOTECHNOLOGY & PHARMACEUTICAL COMPANIES

6.1.4 GROWING DEMAND FOR PERSONALIZED MEDICINE

6.2 RESTRAINTS

6.2.1 HIGH COST OF GENE THERAPY

6.2.2 ETHICAL AND SAFETY CONCERNS

6.2.3 COMPLEXITY OF GENE THERAPY

6.3 OPPORTUNITIES

6.3.1 RISE IN STRATEGIC ACQUISITION AND PARTNERSHIP AMONG ORGANIZATIONS

6.3.2 RISING APPROVAL FOR GENE THERAPY PRODUCTS

6.4 CHALLENGES

6.4.1 STRINGENT REGULATIONS FOR GENE THERAPY PRODUCTS

6.4.2 LONG-TERM SAFETY AND EFFICACY

7 EUROPE GENE THERAPY MARKET, BY VECTOR TYPE

7.1 OVERVIEW

7.2 VIRAL VECTOR

7.2.1 ADENOVIRUS

7.2.2 RETROVIRUS

7.2.3 LENTIVIRUS

7.2.4 ADENO-ASSOCIATED VIRUS

7.2.5 VACCINIA VIRUS

7.2.6 HERPES SIMPLEX VIRUS

7.2.7 OTHERS

7.3 NON-VIRAL VECTOR

7.3.1 LIPOFECTION

7.3.2 INJECTION OF NAKED DNA

8 EUROPE GENE THERAPY MARKET, BY METHOD

8.1 OVERVIEW

8.2 EX-VIVO

8.3 IN-VIVO

9 EUROPE GENE THERAPY MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 ONCOLOGICAL DISORDERS

9.3 CARDIOVASCULAR DISEASES

9.4 INFECTIOUS DISEASES

9.5 RARE DISEASES

9.6 NUEROLOGICAL DISORDERS

9.7 OTHER DISEASES

10 EUROPE GENE THERAPY MARKET, BY END USER

10.1 OVERVIEW

10.2 CANCER INSTITUTES

10.3 HOSPITALS

10.4 RESEARCH INSTITUTES

10.5 OTHERS

11 EUROPE GENE THERAPY MARKET, BY REGION

11.1 EUROPE

11.1.1 GERMANY

11.1.2 FRANCE

11.1.3 U.K.

11.1.4 ITALY

11.1.5 SPAIN

11.1.6 RUSSIA

11.1.7 TURKEY

11.1.8 NETHERLANDS

11.1.9 BELGIUM

11.1.10 SWITZERLAND

11.1.11 REST OF EUROPE

12 EUROPE GENE THERAPY MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 COMPANY PROFILES

13.1 BIOGEN

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 SWOT ANALYSIS

13.1.5 PRODUCT PORTFOLIO

13.1.6 RECENT DEVELOPMENT

13.2 KITE PHARMA

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 SWOT ANALYSIS

13.2.5 PRODUCT PORTFOLIO

13.2.6 RECENT DEVELOPMENT

13.3 NOVARTIS AG

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 SWOT ANALYSIS

13.3.5 PRODUCT PORTFOLIO

13.3.6 RECENT DEVELOPMENTS

13.4 BRISTOL-MYERS SQUIBB COMPANY.

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 SWOT ANALYSIS

13.4.5 PRODUCT PORTFOLIO

13.4.6 RECENT DEVELOPMENT

13.5 OXFORD BIOMEDICA

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 SWOT ANALYSIS

13.5.5 PRODUCT PORTFOLIO

13.5.6 RECENT DEVELOPMENTS

13.6 AGC BIOLOGICS

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 ANGES, INC

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENT

13.8 AMGEN INC.

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENT

13.9 BLUEBIRD BIO, INC.

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 CHIESI FARMACEUTICI S.P.A

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENT

13.11 DENDREON PHARMACEUTICALS LLC

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 ENZYVANT THERAPEUTICS GMBH

13.12.1 COMPANY SNAPSHOT

13.12.2 RODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 FERRING B.V.

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 JANSSEN PHARMACEUTICALS, INC.

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 MALLINCKRODT.

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENT

13.16 ORCHARD THERAPEUTICS PLC.

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENT

13.17 SHANGHAI SUNWAY BIOTECH CO., LTD.

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 SIBONO

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENT

13.19 SPARK THERAPEUTICS, INC.

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 UNIQURE NV.

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tablas

TABLE 1 EUROPE GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 2 EUROPE VIRAL VECTOR IN GENE THERAPY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 EUROPE VIRAL VECTOR IN GENE THERAPY MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 EUROPE NON-VIRAL VECTOR IN GENE THERAPY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 EUROPE NON-VIRAL VECTOR IN GENE THERAPY MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 EUROPE GENE THERAPY MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 7 EUROPE EX-VIVO IN GENE THERAPY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 EUROPE IN –VIVO IN GENE THERAPY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 EUROPE GENE THERAPY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 10 EUROPE ONCOLOGICAL DISORDERS IN GENE THERAPY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 EUROPE CARDIOVASCULAR DISEASES IN GENE THERAPY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 EUROPE INFECTIOUS DISEASES IN GENE THERAPY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 EUROPE RARE DISEASES IN GENE THERAPY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 EUROPE NEUROLOGICAL DISORDERS IN GENE THERAPY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 EUROPE OTHER DISEASES IN GENE THERAPY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 EUROPE GENE THERAPY MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 17 EUROPE CANCER INSTITUTES IN GENE THERAPY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 EUROPE HOSPITALS IN GENE THERAPY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 EUROPE RESEARCH INSTITUTES IN GENE THERAPY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 EUROPE OTHERS IN GENE THERAPY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 EUROPE GENE THERAPY MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 22 EUROPE GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 23 EUROPE VIRAL VECTOR IN GENE THERAPY MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 24 EUROPE NON-VIRAL VECTOR IN GENE THERAPY MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 EUROPE GENE THERAPY MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 26 EUROPE GENE THERAPY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 27 EUROPE GENE THERAPY MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 28 GERMANY GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 29 GERMANY VIRAL VECTOR IN GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 30 GERMANY NON-VIRAL VECTOR IN GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 31 GERMANY GENE THERAPY MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 32 GERMANY GENE THERAPY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 33 GERMANY GENE THERAPY MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 34 FRANCE GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 35 FRANCE VIRAL VECTOR IN GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 36 FRANCE NON-VIRAL VECTOR IN GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 37 FRANCE GENE THERAPY MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 38 FRANCE GENE THERAPY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 39 FRANCE GENE THERAPY MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 40 U.K. GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 41 U.K. VIRAL VECTOR IN GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 42 U.K. NON-VIRAL VECTOR IN GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 43 U.K. GENE THERAPY MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 44 U.K. GENE THERAPY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 45 U.K. GENE THERAPY MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 46 ITALY GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 47 ITALY VIRAL VECTOR IN GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 48 ITALY NON-VIRAL VECTOR IN GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 49 ITALY GENE THERAPY MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 50 ITALY GENE THERAPY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 51 ITALY GENE THERAPY MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 52 SPAIN GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 53 SPAIN VIRAL VECTOR IN GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 54 SPAIN NON-VIRAL VECTOR IN GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 55 SPAIN GENE THERAPY MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 56 SPAIN GENE THERAPY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 57 SPAIN GENE THERAPY MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 58 RUSSIA GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 59 RUSSIA VIRAL VECTOR IN GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 60 RUSSIA NON-VIRAL VECTOR IN GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 61 RUSSIA GENE THERAPY MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 62 RUSSIA GENE THERAPY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 63 RUSSIA GENE THERAPY MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 64 TURKEY GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 65 TURKEY VIRAL VECTOR IN GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 66 TURKEY NON-VIRAL VECTOR IN GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 67 TURKEY GENE THERAPY MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 68 TURKEY GENE THERAPY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 69 TURKEY GENE THERAPY MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 70 NETHERLANDS GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 71 NETHERLANDS VIRAL VECTOR IN GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 72 NETHERLANDS NON-VIRAL VECTOR IN GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 73 NETHERLANDS GENE THERAPY MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 74 NETHERLANDS GENE THERAPY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 75 NETHERLANDS GENE THERAPY MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 76 BELGIUM GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 77 BELGIUM VIRAL VECTOR IN GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 78 BELGIUM NON-VIRAL VECTOR IN GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 79 BELGIUM GENE THERAPY MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 80 BELGIUM GENE THERAPY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 81 BELGIUM GENE THERAPY MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 82 SWITZERLAND GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 83 SWITZERLAND VIRAL VECTOR IN GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 84 SWITZERLAND NON-VIRAL VECTOR IN GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

TABLE 85 SWITZERLAND GENE THERAPY MARKET, BY METHOD, 2021-2030 (USD MILLION)

TABLE 86 SWITZERLAND GENE THERAPY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 87 SWITZERLAND GENE THERAPY MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 88 REST OF EUROPE GENE THERAPY MARKET, BY VECTOR TYPE, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 EUROPE GENE THERAPY MARKET: SEGMENTATION

FIGURE 2 EUROPE GENE THERAPY MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE GENE THERAPY MARKET: DROC ANALYSIS

FIGURE 4 EUROPE GENE THERAPY MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE GENE THERAPY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE GENE THERAPY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE GENE THERAPY MARKET: MARKET END USER COVERAGE GRID

FIGURE 8 EUROPE GENE THERAPY MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE GENE THERAPY MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE GENE THERAPY MARKET: SEGMENTATION

FIGURE 11 THE INCREASING PREVALENCE OF GENETIC DISORDERS AND GROWING DEMAND FOR PERSONALIZED MEDICINE ARE EXPECTED TO DRIVE THE GROWTH OF THE EUROPE GENE THERAPY MARKET FROM 2023 TO 2030

FIGURE 12 THE VIRAL VECTOR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE GENE THERAPY MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE GENE THERAPY MARKET

FIGURE 14 EUROPE GENE THERAPY MARKET: BY VECTOR TYPE, 2022

FIGURE 15 EUROPE GENE THERAPY MARKET: BY VECTOR TYPE, 2023-2030 (USD MILLION)

FIGURE 16 EUROPE GENE THERAPY MARKET: BY VECTOR TYPE, CAGR (2023-2030)

FIGURE 17 EUROPE GENE THERAPY MARKET: BY VECTOR TYPE, LIFELINE CURVE

FIGURE 18 EUROPE GENE THERAPY MARKET: BY METHOD, 2022

FIGURE 19 EUROPE GENE THERAPY MARKET: BY METHOD, 2023-2030 (USD MILLION)

FIGURE 20 EUROPE GENE THERAPY MARKET: BY METHOD, CAGR (2023-2030)

FIGURE 21 EUROPE GENE THERAPY MARKET: BY METHOD, LIFELINE CURVE

FIGURE 22 EUROPE GENE THERAPY MARKET: BY APPLICATION, 2022

FIGURE 23 EUROPE GENE THERAPY MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 24 EUROPE GENE THERAPY MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 25 EUROPE GENE THERAPY MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 26 EUROPE GENE THERAPY MARKET: BY END USER, 2022

FIGURE 27 EUROPE GENE THERAPY MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 28 EUROPE GENE THERAPY MARKET: BY END USER, CAGR (2023-2030)

FIGURE 29 EUROPE GENE THERAPY MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 EUROPE GENE THERAPY MARKET: SNAPSHOT (2022)

FIGURE 31 EUROPE GENE THERAPY MARKET: BY COUNTRY (2022)

FIGURE 32 EUROPE GENE THERAPY MARKET: BY COUNTRY (2023 & 2030)

FIGURE 33 EUROPE GENE THERAPY MARKET: BY COUNTRY (2022 & 2030)

FIGURE 34 EUROPE GENE THERAPY MARKET: VECTOR TYPE (2023-2030)

FIGURE 35 EUROPE GENE THERAPY MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.